Professional Documents

Culture Documents

Directions: This Material Is Confidential Until The End of August 1999

Uploaded by

Epic WinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Directions: This Material Is Confidential Until The End of August 1999

Uploaded by

Epic WinCopyright:

Available Formats

Np MaC vt 1998

This material is confidential until the end of August 1999.

Directions

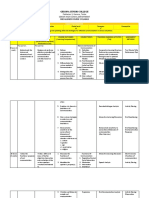

Test period Test time Resources Test material

Weeks 5-23 1998. According to decision at the school, but at least 120 minutes. According to local decision at the school. The material should be handed in together with your solutions. Write your name, the name of your education programme / adult education, and your date of birth on all the sheets you hand in.

The test

The open-solutions part consists of two problems, of which you should choose only one. The questions in the problem may be of such kind that you have to decide on the possible interpretations. You should present the assumptions which form the basis for your computations and conclusions. Even a partial solution may be a basis for the teachers evaluation of your work. A description of what the teacher may consider when evaluating your work is attached to the problem. If anything is unclear, ask your teacher.

Working methods

Your teacher will inform you about the working methods concerning the Open-Solutions part of the test.

Np MaC vt 1998

1. A STATISTICAL SURVEY

Authorities, organisations and companies often want to find out about the opinions of different groups in society. The opinions and values of the public, the members or the customers are mapped out in different kinds of statistical surveys. TV, radio and newspapers show great interest in the result of opinion polls, market analyses and consumer surveys. Choose an issue that is of interest to you. State which population the issue refers to. Plan, carry out, analyse and report a statistical sample random survey, where the aim is to give answer to the chosen issue If you need inspiration for issues, please read the attached newspaper quotations.

When evaluating your work, the teacher will consider the following: what knowledge you show of how to plan, carry out, analyse and report a statistical sample random survey how you comment and evaluate your method and the result of your survey how you report your survey

Np MaC vt 1998

Np MaC vt 1998

2. ETHICAL SAVING

For anyone interested in long-term money saving and at the same time help people in need there are several possibilities. You are going to compare two of them.

1)

Each year, you deposit equal amounts of money into a bank account. Your saved capital grows since the money yields interest. You must also give money to a relief organisation, and you decide by yourself how much and when you give away the money. The tax on bank savings is 30% of the annual interest and it is taken from your capital at the end of each year. Each year, you deposit equal amounts of money into a so-called ethical unit trust. The value of the savings in a unit trust depends on the growth of the shares. At the end of each year, 2% of your money in the ethical unit trust is given to the relief organisation that you have chosen. No tax is paid on the money you give to the relief organisation. The tax is not paid until you withdraw money from the unit trust. The tax is then 30% on the appreciation. (The appreciation is the difference between the value of the capital at the withdrawal and the value of the whole capital deposited.)

2)

Np MaC vt 1998

For both ways of saving, you can assume that the percentage appreciation is equally large for each year during the time for the saving. For the ethical unit trust, this is true for the appreciation before the money is given to the relief organisation. You may use the table below as a help when evaluating what may be reasonable appreciation for each way of saving.

Table: Appreciation of saved capital on a bank account and in an ethical unit trust during the 1990s. For the ethical unit trust this is true for the appreciation before the money is given to the relief organisation.

Appreciation in % 1991 11 6 1992 10 41 1993 7 64 1994 6 9 1995 7 17 1996 4 39

Bank account Ethical unit trust

Compare the amount you can save up with each way of saving. Do also compare how much money any relief organisation receives from you. You do not have to consider the taxes in your comparison. Make another comparison where you consider the taxes too.

When evaluating your work, the teacher will consider the following: how clear and complete your presentation is how you justify your assumptions and comment your results if you carry out your calculations correctly what mathematical knowledge you present

You might also like

- IGCSEBusinessStudiesTG Pp265 292 CroppedDocument28 pagesIGCSEBusinessStudiesTG Pp265 292 CroppeddefNo ratings yet

- bsp1703 Project Sample - CompressDocument8 pagesbsp1703 Project Sample - CompressYorinNo ratings yet

- Consumer Math: Ledyard High School Math CurriculumDocument24 pagesConsumer Math: Ledyard High School Math CurriculumYAP JIN LING MoeNo ratings yet

- V372 Take-Home Exam 1 Budget Tables and QuestionsDocument4 pagesV372 Take-Home Exam 1 Budget Tables and QuestionsJared ReillyNo ratings yet

- 8 Intro To Engineering EconomyDocument40 pages8 Intro To Engineering EconomyMohammed Abdul-MananNo ratings yet

- Accounting The Monopoly WayDocument5 pagesAccounting The Monopoly Wayfrieda20093835No ratings yet

- Chapter OneDocument37 pagesChapter Onehamdi abdrhmanNo ratings yet

- 16 FinancialmanagementDocument30 pages16 FinancialmanagementAbhijeet SinghNo ratings yet

- Folio Add MathDocument32 pagesFolio Add MathHazwan ArasyNo ratings yet

- Engineering EconomicsDocument43 pagesEngineering EconomicsBeverly Paman100% (3)

- 3.1 - Decision MakingDocument6 pages3.1 - Decision MakingRavi RavalNo ratings yet

- Ass1 PST311L-1 PDFDocument5 pagesAss1 PST311L-1 PDFAnonymous s8D66xTNo ratings yet

- Application of Engineering or Mathematical Analysis and Synthesis To Decision Making in EconomicsDocument6 pagesApplication of Engineering or Mathematical Analysis and Synthesis To Decision Making in EconomicsmizaelledNo ratings yet

- GuesstimatesDocument35 pagesGuesstimatesMADDALA KALYANNo ratings yet

- Engineering Economy AnalysisDocument6 pagesEngineering Economy AnalysisNC College of Geodetic EngineeringNo ratings yet

- Study Case 1Document4 pagesStudy Case 1Rodrigo Corrales-MejíasNo ratings yet

- Unit 5 Instructor Graded AssignmentDocument3 pagesUnit 5 Instructor Graded Assignmentrosalindcsr_64842985No ratings yet

- HW1 MepDocument4 pagesHW1 MepsivaNo ratings yet

- Chapter 9 - Budget PreparationDocument30 pagesChapter 9 - Budget PreparationvdhienNo ratings yet

- Pay Equity and Remmuneration Policies. Group ProjectDocument29 pagesPay Equity and Remmuneration Policies. Group Projectmaria morenoNo ratings yet

- Report WritingDocument41 pagesReport WritingFazle RabbiNo ratings yet

- A Not So Helpful Reviewer For Bam 040Document34 pagesA Not So Helpful Reviewer For Bam 040rago.cachero.auNo ratings yet

- Accounting and Audit for Financial Sector - Understanding Bank Interest and its CalculationsDocument19 pagesAccounting and Audit for Financial Sector - Understanding Bank Interest and its CalculationsTanay ShahNo ratings yet

- BCO126 Mathematics of Finance: 3 Ects Spring Semester 2022Document35 pagesBCO126 Mathematics of Finance: 3 Ects Spring Semester 2022summerNo ratings yet

- A Not So Helpful Reviewer For Bam 040Document27 pagesA Not So Helpful Reviewer For Bam 040rago.cachero.auNo ratings yet

- MGT 3078 Exam 1Document2 pagesMGT 3078 Exam 18009438387No ratings yet

- Macroeconomics: A Mathematical Approach: ECO 311 - Spring 2018Document4 pagesMacroeconomics: A Mathematical Approach: ECO 311 - Spring 2018Gabriel RoblesNo ratings yet

- Final Project Outline Fall 2022 SemesterDocument5 pagesFinal Project Outline Fall 2022 SemesterMana PlanetNo ratings yet

- AP Economics Homework AnswersDocument8 pagesAP Economics Homework Answersafetadcpf100% (1)

- IGCSE Economics (Summary Updated)Document91 pagesIGCSE Economics (Summary Updated)CRITICAL GAMERNo ratings yet

- Savings and Interest RatesDocument8 pagesSavings and Interest RatesAgui S. T. PadNo ratings yet

- Money Math WorkbookDocument109 pagesMoney Math WorkbookIamangel1080% (10)

- Competency 2 AdditionalDocument13 pagesCompetency 2 AdditionalDan Jave Dumpa100% (1)

- Assess Two Doll Projects' NPV, IRR for RecommendationDocument4 pagesAssess Two Doll Projects' NPV, IRR for RecommendationTushar Gupta100% (1)

- SmithsonDocument9 pagesSmithsonNan DongdongNo ratings yet

- Economics IAL Exam Technique Essay SkillsDocument4 pagesEconomics IAL Exam Technique Essay SkillsSHAKEELNo ratings yet

- BSBMGT803 QuestionsDocument4 pagesBSBMGT803 QuestionsMuhammad Mubeen0% (1)

- A Master Budget Case (Project-2)Document16 pagesA Master Budget Case (Project-2)Shaikh Junaid50% (2)

- 10 Retirement PlanningDocument11 pages10 Retirement PlanningayraNo ratings yet

- Economic Decision Making GuideDocument32 pagesEconomic Decision Making GuideAnindhytaNo ratings yet

- Finance - Self Study Guide For Staff of Micro Finance InstitutionsDocument7 pagesFinance - Self Study Guide For Staff of Micro Finance InstitutionsmhussainNo ratings yet

- CH 7 - Financial Literacy ProjectDocument5 pagesCH 7 - Financial Literacy ProjectNd 03No ratings yet

- Lec 2 Final Eng - EcoDocument16 pagesLec 2 Final Eng - EcoSoundhar RajanNo ratings yet

- Actg 321 Gill Syllabus Fall 2013Document11 pagesActg 321 Gill Syllabus Fall 2013marx marolinaNo ratings yet

- Psychology and Economics of Consumer FinanceDocument4 pagesPsychology and Economics of Consumer FinanceMaxwell LongNo ratings yet

- BA 190 Course Outline 0120Document9 pagesBA 190 Course Outline 0120Sophia TayagNo ratings yet

- 2784 PDFDocument90 pages2784 PDFemraan KhanNo ratings yet

- Introduction To StatisticsDocument21 pagesIntroduction To StatisticsSai KrishnaNo ratings yet

- Creating A Personal Household AssignmentDocument5 pagesCreating A Personal Household AssignmentmrmclauchlinNo ratings yet

- Lam Q4 Week 1Document15 pagesLam Q4 Week 1Chrisjon Gabriel EspinasNo ratings yet

- Guide To Budgeting For NGOsDocument20 pagesGuide To Budgeting For NGOssanjuanaomi100% (1)

- Mathematical Economics Homework SolutionsDocument8 pagesMathematical Economics Homework Solutionsg3whfrjw100% (1)

- Guide For Case AnalysisDocument26 pagesGuide For Case AnalysisSubhankar Bera100% (1)

- The Financial Planning Workbook: A Comprehensive Guide to Building a Successful Financial Plan (2023 Edition)From EverandThe Financial Planning Workbook: A Comprehensive Guide to Building a Successful Financial Plan (2023 Edition)Rating: 4 out of 5 stars4/5 (9)

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesFrom EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNo ratings yet

- ECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsFrom EverandECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsNo ratings yet

- ECON 101 Notes + Study Guide - Gold Version: Introduction to Microeconomics at the University of AlbertaFrom EverandECON 101 Notes + Study Guide - Gold Version: Introduction to Microeconomics at the University of AlbertaNo ratings yet

- Finance for Qualitative Thinkers: How to Use Logical Math Intelligence in Financial Problem SolvingFrom EverandFinance for Qualitative Thinkers: How to Use Logical Math Intelligence in Financial Problem SolvingNo ratings yet

- InequalitiesDocument192 pagesInequalitiesEpic Win100% (2)

- Warning Signs of A Possible Collapse of Contemporary MathematicsDocument12 pagesWarning Signs of A Possible Collapse of Contemporary MathematicsEpic WinNo ratings yet

- The Mystery of Stochastic MechanicsDocument18 pagesThe Mystery of Stochastic MechanicsEpic WinNo ratings yet

- RomeDocument7 pagesRomeEpic WinNo ratings yet

- Hilbert's Mistake: Edward Nelson Department of Mathematics Princeton UniversityDocument27 pagesHilbert's Mistake: Edward Nelson Department of Mathematics Princeton UniversityEpic WinNo ratings yet

- New 18Document5 pagesNew 18Epic WinNo ratings yet

- IstDocument34 pagesIstEpic WinNo ratings yet

- Mathematics and The Mind: Nelson/papers - HTMLDocument6 pagesMathematics and The Mind: Nelson/papers - HTMLEpic WinNo ratings yet

- Syntax and Semantics: WWW - Math.princeton - Edu Nelson Papers - HTMLDocument7 pagesSyntax and Semantics: WWW - Math.princeton - Edu Nelson Papers - HTMLEpic WinNo ratings yet

- Ram RecDocument8 pagesRam RecEpic WinNo ratings yet

- HopeDocument4 pagesHopeEpic WinNo ratings yet

- FogDocument5 pagesFogEpic WinNo ratings yet

- OutlineDocument7 pagesOutlineEpic WinNo ratings yet

- Understanding Intuitionism: WWW - Math.princeton - Edu Nelson Papers - HTMLDocument20 pagesUnderstanding Intuitionism: WWW - Math.princeton - Edu Nelson Papers - HTMLEpic WinNo ratings yet

- Nelson BibDocument5 pagesNelson BibEpic WinNo ratings yet

- ElemDocument101 pagesElemEpic WinNo ratings yet

- Edward NelsonDocument1 pageEdward NelsonEpic WinNo ratings yet

- FaithDocument8 pagesFaithceceph354No ratings yet

- EDocument9 pagesEEpic WinNo ratings yet

- J. P. MayDocument17 pagesJ. P. MayEpic WinNo ratings yet

- Zhang QDocument15 pagesZhang QEpic WinNo ratings yet

- Internal Set TheoryDocument26 pagesInternal Set TheoryEpic WinNo ratings yet

- WoolfDocument9 pagesWoolfEpic WinNo ratings yet

- Zhang TDocument4 pagesZhang TEpic WinNo ratings yet

- WalijiDocument6 pagesWalijiEpic WinNo ratings yet

- Probability Theory: 1 Heuristic IntroductionDocument17 pagesProbability Theory: 1 Heuristic IntroductionEpic WinNo ratings yet

- J-Spectra For A Quotient Group J of G. That Context Gives An Interesting SituationDocument9 pagesJ-Spectra For A Quotient Group J of G. That Context Gives An Interesting SituationEpic WinNo ratings yet

- WeinerDocument6 pagesWeinerEpic WinNo ratings yet

- VParticipantsDocument1 pageVParticipantsEpic WinNo ratings yet

- WaddleDocument10 pagesWaddleEpic WinNo ratings yet

- Jhonalyn Individual Learning Plan-1Document15 pagesJhonalyn Individual Learning Plan-1Jhonalyn Toren-Tizon LongosNo ratings yet

- Factors Influencing Academic Track ChoicesDocument8 pagesFactors Influencing Academic Track ChoicesAerish Trisha ReblezaNo ratings yet

- The Biofuel Project: Creating Biodiesel: EnergyDocument36 pagesThe Biofuel Project: Creating Biodiesel: EnergyGNag R'VarmaNo ratings yet

- Rusu, Mihai Stelian. 2015. From The Will To Memory To The Right To Be ForgottenDocument29 pagesRusu, Mihai Stelian. 2015. From The Will To Memory To The Right To Be ForgottenMihai RusuNo ratings yet

- No IELTS Canada GuideDocument4 pagesNo IELTS Canada GuideOluwadamilola Shitta-beyNo ratings yet

- Canada-Document Student VISA ChecklistDocument2 pagesCanada-Document Student VISA ChecklistChris Daniel MangoleNo ratings yet

- TTL 2 SS Lesson 8Document29 pagesTTL 2 SS Lesson 8Hanie QsqnNo ratings yet

- Social Studies Major - Set B - Part 3Document3 pagesSocial Studies Major - Set B - Part 3Jane Uranza CadagueNo ratings yet

- Public Sector Org Application Form PDFDocument3 pagesPublic Sector Org Application Form PDFAsif Ullah KhanNo ratings yet

- Story ElementsDocument3 pagesStory ElementsnrblackmanNo ratings yet

- Without Slang and IdiomsDocument6 pagesWithout Slang and Idiomsluciferinchaos0% (1)

- Cognitive Learning TheoryDocument3 pagesCognitive Learning TheoryMark neil a. GalutNo ratings yet

- SMEA.1st Quarter.2019Document49 pagesSMEA.1st Quarter.2019Anonymous asInEYaZQNo ratings yet

- Problem Solving Barriers and Its ApproachesDocument22 pagesProblem Solving Barriers and Its Approachesvasu mittalNo ratings yet

- Poblacion 3, Gerona, Tarlac Senior High School DepartmentDocument6 pagesPoblacion 3, Gerona, Tarlac Senior High School DepartmentMarvin Dagdag MoralesNo ratings yet

- Detailed Lesson Plan For Grade 2 Math March 27, 2023 (Monday) I. Objectives at The End of The Lesson The Pupils Should Be Able ToDocument6 pagesDetailed Lesson Plan For Grade 2 Math March 27, 2023 (Monday) I. Objectives at The End of The Lesson The Pupils Should Be Able ToMaria Erlynn DumasigNo ratings yet

- NovardokDocument4 pagesNovardokRudolph C. KleinNo ratings yet

- Postgraduate Institute of Medical Education & Research ChandigarhDocument45 pagesPostgraduate Institute of Medical Education & Research ChandigarhDMnDLNo ratings yet

- Blog Synthesis Example 1Document3 pagesBlog Synthesis Example 1lucymanleyNo ratings yet

- 2 - Science and Religion PDFDocument10 pages2 - Science and Religion PDFRojdaNo ratings yet

- Perfume Making Training ReportDocument7 pagesPerfume Making Training ReportGhulam Nabi NizamaniNo ratings yet

- Journal On The Impact of Nursing Informatics To Clinical PracticeDocument2 pagesJournal On The Impact of Nursing Informatics To Clinical PracticeLhara Vhaneza CuetoNo ratings yet

- Facts Versus OpinionDocument20 pagesFacts Versus OpinionIrish Ga-aNo ratings yet

- Interview Questions, Study Materials For Computer ScienceDocument2 pagesInterview Questions, Study Materials For Computer ScienceInstitute of Engineering Studies (IES)No ratings yet

- Advantages and Disadvantages of Regression AnalysisDocument9 pagesAdvantages and Disadvantages of Regression AnalysisAPOORVA PANDEYNo ratings yet

- Aesthetic Factor Analysis of Interior SpaceDocument14 pagesAesthetic Factor Analysis of Interior SpaceImpact JournalsNo ratings yet

- Estudio Social e Intercultural Del Lenguaje, La Personalidad y La Medición Del Sistema (Motivacional) A-R-D HumanoDocument90 pagesEstudio Social e Intercultural Del Lenguaje, La Personalidad y La Medición Del Sistema (Motivacional) A-R-D HumanoWilliam Montgomery UrdayNo ratings yet

- Easyclass - Create Your Digital Classroom For Free...Document9 pagesEasyclass - Create Your Digital Classroom For Free...mohamad1010No ratings yet

- Sternberg's WICS Model Explains Successful IntelligenceDocument6 pagesSternberg's WICS Model Explains Successful IntelligenceRafael TianzonNo ratings yet

- AYC Application Form 2017: I. Background InformationDocument6 pagesAYC Application Form 2017: I. Background InformationyuoryNo ratings yet