Professional Documents

Culture Documents

Nashville State Community College Payroll Accounting - ACCT 2200

Uploaded by

Bryan Derick Rivad RafananOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nashville State Community College Payroll Accounting - ACCT 2200

Uploaded by

Bryan Derick Rivad RafananCopyright:

Available Formats

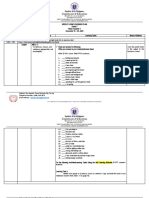

Nashville State Community College Payroll Accounting - ACCT 2200

Instructor Information:

Name: E-mail: Phone: Office Location: Cathy Gray cathy.gray@nscc.edu 353-3420 C-202F Monday: Tuesday: Wednesday: Thursday: Friday: 12:00-3:00 p.m. 12:00-2:00 p.m. 12:00-2:00 p.m. 12:00-1:00 p.m. 9:00-11:00 a.m.

Office Hours:

Course Description and Prerequisites or Co-Requisites:

ACCT 2200 is an upper division course designed to cover the payroll procedures and laws that affect payroll operations and employment practices. Students are required to complete all payroll operations for a business including payroll tax returns. Students will also complete a payroll project using payroll software. Prerequisites: ACCT 1104 and AIS 1181 with a grade of "C" or higher Because payroll accounting is an area that requires knowledge of payroll tax laws and the critical need for accurate information, you will not receive a passing grade in this course unless you can demonstrate mastery of the tax laws and demonstrate that you can accurately calculate payroll amounts and correctly complete payroll tax forms.

Textbook and Other Required Materials:

2011 Payroll Accounting by Bernard J. Bieg/ Judith A. Toland, South-Western Cengage Learning, bundled with CengageNow Homework Grader Software. The ISBN for the bundle is as follows: ISBN-111170449X. It is suggested that you purchase this text bundle NEW through the NSCC Bookstore. When you purchase the bundle through our bookstore, you are receiving a large discount on the access code to CengageNow, the homework grader software. You will not be able to complete your homework assignments without this access code. If you have a used book or if you rent a book, you will have to purchase this access code separately, and you will not receive the benefit of buying them as a bundle. The access code will be quite expensive to purchase alone. Also, please note that a new edition of this textbook is printed at the beginning of each year. Buying the book new from the NSCC Bookstore will ensure that you have the most current edition. The Payroll Accounting software for the computerized payroll project will be packaged with the book as a CD. Again, to make sure you have the most current software, you should purchase your book at the campus bookstore.

Mission of the Division of Business and Applied Arts:

To help our students become ethical and competent professionals in their chosen fields by providing a learner-centered environment. The Business and Applied Arts Division provides programs of study consistent with students goals which are intended to develop appropriate skills that our faculty and advisory committees have identified as critical to success. To accomplish this we focus on academic excellence, best practices in teaching and learning, technological competence, and the practical application of disciplinespecific principles.

Mission of the Computer Accounting Program:

The mission of the Computer Accounting Program is to provide a quality education in computerized accounting that enables students to succeed in a career now and in the future.

Course Outcomes:

Upon successful completion of this course, students should be able to: 1. Identify the various state and federal laws that affect payroll operations, describe and utilize records used to collect payroll data. 2. Calculate regular and overtime rates of pay using various acceptable methods. 3. Know the FICA tax laws and be able to define wages, apply current FICA and SECA tax rates, know FICA reporting requirements, and prepare Form 941 and Form 8109. 4. Know the state and federal income tax withholding laws and reporting requirements; be able to compute FIT using percentage and wage bracket methods for various payroll periods; be able to complete Form 941, Form W2, and other information returns. 5. Know the FUTA tax laws, be able compute the FUTA tax and credits against the tax; be able to calculate and apply an experience-rating system to determine tax rates; be able to complete Form 940 and state unemployment tax returns. 6. Calculate and record payrolls in registers, post to employees earnings records; journalize all payroll and payroll liability transactions and post to the general ledger; understand and prepare end-of-period adjustments.

Course Competencies:

The following are detailed course competencies intended to support the course outcomes: 1. Without the use of notes or other materials, identify the various laws that affect employers in their payroll operations and know the recordkeeping requirements of these laws. 2. Without the use of notes or other materials, describe employment procedures followed by the Human Resources Department and recognize the various personnel records used by businesses. 3. Without the use of notes or other materials, identify the major provisions of the Fair Labor Standards Act and be able to distinguish between employees principal activities and their preliminary and postliminary activities.

4. Given the total number of hours worked in one pay period, be able to calculate regular and overtime pay. 5. Given salary amounts for weekly, biweekly, semimonthly, or monthly pay periods be able to convert to hourly rates, calculate the overtime rate, and calculate total gross earnings for each of the pay periods. 6. Given overtime piece rates and number of pieces produced, compute overtime payments for pieceworkers using two different methods. 7. Given sales and percentage incentive rates, compute earnings under incentive and commission plans. 8. Without the use of notes or other materials, identify persons covered under social security and services that constitute employment for social security purposes. 9. Without the use of notes or other materials, identify the types of compensation that are defined as wages. 10. Given the current wage base and tax rates, apply the rates and wage base to calculate the amount of social security taxes to be deducted from gross wages. 11. Without the use of notes or other materials, describe how to obtain an Employer Identification Number and what it is used for. 12. Without the use of notes or other materials, describe how to obtain and the importance of obtaining an employees Social Security Number. 13. Given selected payroll data, calculate the amount of the FICA tax deposit and describe the different procedures for depositing the FICA tax liability. 14. Given selected payroll data, complete Form 941, Employers Quarterly Federal Tax Return and Form 8109, Federal Tax Deposit Coupon. 15. Given selected payroll deposit and liability data, identify the types of civil and criminal penalties that employers may be subject to and calculate the amount of penalty and interest if in violation. 16. Without the use of notes or other materials, identify who and what types of remuneration are covered under the federal income tax withholding laws. 17. Without the use of notes or other materials, identify the types of withholding allowances that may be claimed by employees for income tax withholding purposes. 18. Without the use of notes or other materials, explain the purpose of Form W-4 and list the proper procedures for using the information on the form. 19. Given selected payroll data and tax tables, compute the amount of federal income tax to be withheld using the percentage method and the wage-bracket method. 20. Given selected payroll data and tax tables, compute the amount of federal income tax using alternative methods such as quarterly averaging and annualizing of wages. 21. Given selected payroll data and supplemental payment data, compute FIT on supplementary wage payments using the acceptable methods. 22. Without the use of notes or other materials, explain what advance earned income credit is and given payroll data, tax tables and taxable wages, compute the amount of EIC. 23. Given year-to-date data on employees, complete Form W-2 forms, and be able to prepare other wage and tax statements. 24. Without the use of notes or other materials, describe the major types of information returns. 25. Given selected payroll data and tax rates, compute state and local income taxes to be withheld and identify reporting requirements for these taxes.

26. Without the use of notes or other materials, identify what is defined as taxable wages by the Federal Unemployment Tax Act and who is covered. 27. Given selected payroll data, compute the federal unemployment tax and the credit against this tax. 28. Given selected payroll data and an experience rating table, compute the contribution rate for an employer for the next year, compute the amount of additional contribution that could be made to lower the rate, and calculate the savings to the employer if the contribution is made. 29. Given selected payroll data, complete the Form 940, Employer Annual Federal Unemployment Tax Return. 30. Given selected payroll data, complete a state unemployment tax return. 31. Given selected payroll data, record payrolls in payroll registers and post to employees earnings records. 32. Given selected payroll data, journalize the entries to record the payroll, payroll taxes, and payment of payroll-related liabilities; post the entries to the various general ledger payroll accounts. 33. Given selected year-end payroll adjustment data, explain the need for end-of-period adjustments and record the journal entry for the adjustment. The following are general education competencies intended to support the course outcomes: 34. Given an accounting problem or project, locate, evaluate, and use multiple sources of information to determine and substantiate your decision. 35. Given an accounting problem, apply basic mathematical concepts to arrive at a solution to the problem. 36. Given a business accounting problem, apply critical thinking skills to determine and support a solution. 37. Given a business or accounting assignment, use and adapt current technologies to increase efficiency and effectiveness in performing routine business applications. 38. Given a business or accounting problem, apply scientific thought processes to a range of situations.

Topics to Be Covered:

Chapter 1: Laws that affect employers in their payroll operations, recordkeeping for these laws, employment procedures followed by Human Resources Department, personnel records used, procedures employed in a typical payroll accounting system, payroll register and employee's earnings record Chapter 2: Fair Labor Standards Act; types of records used to collect payroll data; calculation of regular and overtime pay; conversion of weekly, monthly and annual salary rates to hourly rates; calculation of regular and overtime payments for piecework, calculation of earnings under incentive and commission plans Chapter 3: Federal Insurance Contributions Act and persons and services covered under the law, types of compensation defined as wages, application of current tax rates and wage base for FICA and SECA purposes, employer's identification and employee's identification numbers, completion of Form 941 and Form 8109, civil and criminal penalties for noncompliance

Chapter 4: Federal income tax withholding law, withholding allowances, Form W-4, computation of federal income tax to be withheld from regular and supplementary payments, advance earned income credit, Form W-2, completion of Form 941 and information returns, impact of state and local incomes taxes Chapter 5: Federal Unemployment Tax Act (FUTA), coverage of interstate employees, definition of wages, computation of FUTA tax and credits against the tax, experience-rating system and employer's contributions, completion of Form 940, reporting for state unemployment Chapter 6: Completing payroll registers and posting to employees' earnings records; journalizing entries to record the payroll, payroll taxes, and payment of payroll-related liabilities; posting to general ledger accounts, payment and recording of the payroll tax deposits; general ledger accounts for payroll transactions; end-of-period payroll adjusting entries Chapter 7: A simulation for payroll accounting that will apply the knowledge acquired in the previous chapters to practical payroll situations using Microsoft Excel Chapter 8: A simulation for payroll accounting that will apply the knowledge acquired in the previous chapters to practical payroll situations using a computerized payroll package that is supplied with the textbook

Grading Criteria:

Grading Scale: A 90 - 100 B C F 80 - 89 70 - 79 under 70 Evaluation: Homework Projects Examinations Total 10% 30% 60% 100%

Attendance and Make-up Exam Policy Traditional Class Meetings:

Students are expected to attend each class session, to arrive on time, and to remain for the entire class period. Students are also responsible for explaining absences and lateness directly to the instructor. Instructors may lower the students grade for excessive absences or lateness. Excessive absence is more than four hours of missed class time. If the student is absent, it is the students responsibility to find out about missed work and class announcements, etc. during their absence.

Attendance in this course is critical to success. There are specific due dates set for homework assignments and exams. Homework due dates and test dates will be strictly adhered to and will not be extended. Failure to complete homework and exams by the due dates will result in a grade of zero for that assessment. For students that have attended during the semester, if the student does not have an average of 70 or greater, a grade of F will be assigned. A student that stops attending during the semester and does not withdraw will be assigned a grade of FA. FA means failure, attendance related. A student that never attends class and does not withdraw will be assigned a grade of FN. FN means failure, never attended class (unofficial withdrawal).

Attendance and Make-up Exam Policy for Web Sections:

Students are expected to log into the online course at least twice per week. Students are expected to submit homework, quizzes, exams, and online discussions by the due date. Attendance for this course is based on the student logging in to the course, reviewing the current lesson, and completing lessons and exams as scheduled. A successful outcome to this course requires students to complete and submit assignments and exams as outlined by the instructor. Late work will not be accepted. Since web students have a great amount of flexibility in scheduling their work, make-up exams are usually not given. Exams may be taken early but must be taken no later than the exam deadline. Students are expected to manage their schedules in order to be prepared for the exam by the exam deadline.

ADA Policy:

Nashville State complies with the Americans with Disabilities Act. If you require any accommodation(s) for this class, please notify Student Disabilities Services as soon as possible. The Student Disability Services office is located in D-26 and their phone is 353-3721. Notify the instructor about the accommodation that you seek.

Academic Dishonesty and Classroom Conduct Policy:

Cheating is prohibited and will result in a grade of zero for homework or tests where a student is determined to have cheated. Cheating includes, but is not limited to copying information from a solutions manual, another student or purchasing material to be presented as ones own work, taking an exam for another student or copying an exam of another student, providing others with information and/or answers regarding exams, quizzes, homework, or other classroom assignments unless explicitly authorized by the instructor. If a student is caught cheating on an exam, the student will be asked to turn in the exam, leave the room, and a grade of -0- will be recorded for that exam. No one will be allowed to leave the room during an exam until the exam is turned in to the instructor. Plagiarism, cheating, and other forms of academic dishonestly are prohibited. Students guilty of academic dishonesty, either directly or indirectly through participation or assistance, are immediately responsible to the instructor of the class. In addition to other possible disciplinary sanctions that may be imposed through the regular institutional procedures as result of academic misconduct, the instructor has the authority to assign an "F" or a "zero" for the exercise or examination or to assign an "F" in the course. Please see Student Handbook. For information about plagiarism, please see http://www.nscc.edu/library/help.html Disruptive behavior in the classroom is prohibited and may be defined as, but not limited to, behavior that obstructs or disrupts the learning environment (e.g., offensive language, offensive body odor, harassment of students and instructors, repeated outbursts from a student which disrupt the flow of

instruction or prevent concentration on the subject taught, failure to cooperate in maintaining classroom decorum, etc.), and the continued use of any electronic or other noise or light emitting device which disrupts others (e.g., noises from beepers, cell phones, palm pilots, lap-top computers, games, etc.).

Student Resources:

Nashville State offers several additional resources which may be of benefit to you, including accounting tutoring. Contact the Learning Center at 353-3551, or their website at http://www.nscc.edu/lc/index.html for additional information.

Study Plan:

To learn accounting, it is very important that you immerse yourself in the subject. This course does require a lot of work for successful completion. Do not get behind in the work assigned. It is extremely difficult to catch up on back work at the same time current work needs to be completed. Successful students: Read materials and prepare for the course. Ask questions and actively participate in the course. Complete all assignments prior to due dates. Are self-motivated and take responsibility for their own level of success. Recognize the power of determination and hard work. Allow the instructor to help them become better students. Set goals and stick to them. Carefully manage time and priorities. Carefully follow written instructions. Never think about cheating.

ACCT 2200 Payroll Accounting Chapters and Assignments

Specific course competencies that expand on the overall course outcomes are given at the beginning of each chapter and also on the instruction sheet for each Lesson. The outcomes and competencies should be read before beginning each chapter.

Chapter 1 - The Need for Payroll and Personnel Records

Assignment: Questions for Review 1 through 20 (create Word document and submit through NSOnline)

Chapter 2 - Computing Wages and Salaries

Assignment: Complete the assignment for Chapter 2 in CengageNow. The problems assigned in CengageNow correspond with the following A-problems in your book: 2-1, 2-2, 2-4, 2-5, 2-6, 2-7, 2-8, 2-9, 2-10, 2-12, 2-13, 2-15, 2-16,2-17, 2-18, 2-19, 2-20

Test on Chapters 1 and 2 Chapter 3 - Social Security Taxes

Assignment: Complete the assignment for Chapter 3 in CengageNow. The problems assigned in CengageNow correspond with the following A-problems in your book: 3-2, 3-4, 3-5, 3-6, 3-8, 3-10, 3-13, 3-14, 3-15, 3-16, 3-17

Chapter 4 - Income Tax Withholding

Assignment: Complete the assignment for Chapter 4 in CengageNow. The problems assigned in CengageNow correspond with the following A-problems in your book: 4-1, 4-3, 4-6, 4-7, 4-8, 4-10, 4-11, 4-12, 4-13

Test on Chapters 3 and 4 Chapter 5 - Unemployment Compensation Taxes

Assignment: Complete the assignment for Chapter 5 in CengageNow. The problems assigned in CengageNow correspond with the following A-problems in your book: 5-3, 5-4, 5-6, 5-7, 5-8, 5-9, 5-10, 5-11, 5-12, 5-13, 5-15, 5-16, 5-17

Chapter 6 - Analyzing and Journalizing Payroll Transactions

Assignment: Complete the assignment for Chapter 6 in CengageNow. The problems assigned in CengageNow correspond with the following A-problems in your book: 6-1, 6-2, 6-5, 6-7, 6-8, 6-9, 6-10, 6-11, 6-12, 6-13, 6-14, 6-15, 6-16

Test on Chapters 5 and 6 Chapter 7 - Payroll Project

Chapter 7 is a last quarter payroll project that should be completed prior to the deadline established by the instructor. Students will complete the project manually with the assistance of Excel spreadsheets. (This project will be 20% of the final grade.) Due date will be established by the instructor and published on the Assignment Due Dates form.

Appendix A Computerized Payroll Project

Students will complete the same project as in Chapter 7, but using the payroll software that comes packaged with the text. (This project will be 10% of the final grade.) Due date will be established by the instructor and published on the Assignment Due Dates form.

Final Exam

The final exam will be comprehensive and will be included on the list of due dates.

You might also like

- Principles of Corporate TaxationDocument253 pagesPrinciples of Corporate TaxationRakeshBhaskarNo ratings yet

- 1500 Act English and Reading Questions To Know by Test DayDocument233 pages1500 Act English and Reading Questions To Know by Test DayTianna1337100% (2)

- Introduction to Payroll Management SystemDocument49 pagesIntroduction to Payroll Management Systemnikhil_jbpNo ratings yet

- Exam Article Series 1040 Exam PrepDocument17 pagesExam Article Series 1040 Exam PrepNorma WahnonNo ratings yet

- Payroll Payment and Distributions: Qadri KhanDocument9 pagesPayroll Payment and Distributions: Qadri KhanQadri Khan100% (1)

- QuickBooks 2014 Payroll User GuideDocument32 pagesQuickBooks 2014 Payroll User GuideHaplucky100% (1)

- Family Life EducationDocument39 pagesFamily Life Educationapi-236516264100% (1)

- The Romanian Education SystemDocument32 pagesThe Romanian Education SystemFlorentina SpinareNo ratings yet

- List The Country Specific Payroll InfotypesDocument15 pagesList The Country Specific Payroll InfotypesPradeep KumarNo ratings yet

- Payroll - Overtime Supplemental PayDocument6 pagesPayroll - Overtime Supplemental PaymanuelaristotleNo ratings yet

- Greyhound Tragedy Lesson PlanDocument9 pagesGreyhound Tragedy Lesson Planapi-609136962No ratings yet

- Is storytelling and drama powerful tools in teachingDocument17 pagesIs storytelling and drama powerful tools in teachingummiweewee100% (1)

- Payroll ObjectivesDocument9 pagesPayroll ObjectivesfiredevilNo ratings yet

- Phonics Cards: A Subscriber FREEBIE!Document12 pagesPhonics Cards: A Subscriber FREEBIE!daniel keng100% (1)

- Accountant Job DescriptionDocument2 pagesAccountant Job DescriptionPavan SinghNo ratings yet

- New Century Clinic Chapter1Document4 pagesNew Century Clinic Chapter1chandini100% (2)

- ACCO 20133 Income TaxationDocument113 pagesACCO 20133 Income Taxationrhoshelle beleganio100% (1)

- Tax Laws and Practice (Module I Paper 4)Document778 pagesTax Laws and Practice (Module I Paper 4)sonamkhanchandaniNo ratings yet

- Business Free Talk Lesson 5Document9 pagesBusiness Free Talk Lesson 5McJay CharitoNo ratings yet

- BSBFIN601 Project Portfolio 1Document21 pagesBSBFIN601 Project Portfolio 1Zumer FatimaNo ratings yet

- Brigada Certificate-of-AppearanceDocument43 pagesBrigada Certificate-of-AppearanceAnacel FaustinoNo ratings yet

- Observation Notes Form: Classroom Observation Tool (Cot) - RpmsDocument9 pagesObservation Notes Form: Classroom Observation Tool (Cot) - RpmsRica Tano100% (1)

- BSBFIN601 MANAGE ORGANISATIONAL FINANCES - Question Task 2Document4 pagesBSBFIN601 MANAGE ORGANISATIONAL FINANCES - Question Task 2Gabriel Jay Lasam50% (2)

- Senior Accountant - Job DescriptionDocument3 pagesSenior Accountant - Job DescriptionShaikha S ADNo ratings yet

- Responsibilities of TaxpayersDocument10 pagesResponsibilities of Taxpayers'Aisyah Roselan0% (1)

- A Graduate at Curtis Mclean Will Receive Experience in The Following Areas Throughout Their Initial Three Years of TrainingDocument4 pagesA Graduate at Curtis Mclean Will Receive Experience in The Following Areas Throughout Their Initial Three Years of TrainingAbhishek P BenjaminNo ratings yet

- 1 01accountantDocument2 pages1 01accountantvishal9patel-63No ratings yet

- 1.0 Accountant Job DescriptionDocument2 pages1.0 Accountant Job Descriptionvishal9patel-63No ratings yet

- Control de Lectura 01Document2 pagesControl de Lectura 01Addicto LikeNo ratings yet

- Taxation 0816 Extra NotesDocument15 pagesTaxation 0816 Extra NotesDani MotaNo ratings yet

- Icaew Cfab Pot 2019 SyllabusDocument10 pagesIcaew Cfab Pot 2019 SyllabusAnonymous ulFku1vNo ratings yet

- Tax CourseworkDocument7 pagesTax Courseworkxdkankjbf100% (2)

- BSBFIN 601 Task 2 V0357Document9 pagesBSBFIN 601 Task 2 V0357Catalina Devia CastiblancoNo ratings yet

- Ebook PDF Fundamentals of Taxation 2018 Edition 11th Edition by Ana CruzDocument41 pagesEbook PDF Fundamentals of Taxation 2018 Edition 11th Edition by Ana Cruzfrank.kuan506No ratings yet

- Accounts AssistantDocument4 pagesAccounts Assistantburn3deathNo ratings yet

- Accounts AssistantDocument4 pagesAccounts Assistantburn3deathNo ratings yet

- Payroll Records and Security ProceduresDocument19 pagesPayroll Records and Security ProceduresNiomi Golrai100% (1)

- Human Resources Audit Objectives and Procedures, Stage 1 Date Dd/mm/yyDocument12 pagesHuman Resources Audit Objectives and Procedures, Stage 1 Date Dd/mm/yyNaveen Kumar NaiduNo ratings yet

- Job Description: Paterson Board of EducationDocument5 pagesJob Description: Paterson Board of EducationAik MusafirNo ratings yet

- Professional Auditing Assignment PlanDocument5 pagesProfessional Auditing Assignment PlanBrijesh GajjarNo ratings yet

- Agumentik Task 19 (Blog Writing On Various Topics) by Deep VyasDocument14 pagesAgumentik Task 19 (Blog Writing On Various Topics) by Deep VyasBUNDELKHAND TALENT HUNTNo ratings yet

- General ResponsibilitiesDocument3 pagesGeneral ResponsibilitieszakNo ratings yet

- Digital Literacy Training Partner RegistrationDocument12 pagesDigital Literacy Training Partner RegistrationDinesh HiresNo ratings yet

- Instructional Materials For Income TaxationDocument126 pagesInstructional Materials For Income TaxationNadi HoodNo ratings yet

- Tax Intern ResumeDocument7 pagesTax Intern Resumegbfcseajd100% (1)

- Payroll In-ChargeDocument2 pagesPayroll In-ChargeCherryNo ratings yet

- Connect Accounting Homework Answers Chapter 4Document6 pagesConnect Accounting Homework Answers Chapter 4afmtnlckk100% (1)

- CUAC 408 Advanced Taxation Practical Assignments PresentationsDocument5 pagesCUAC 408 Advanced Taxation Practical Assignments PresentationsnsnhemachenaNo ratings yet

- Final Project Proposal9Document2 pagesFinal Project Proposal9Jericho LlagasNo ratings yet

- Research Paper On Tax PlanningDocument9 pagesResearch Paper On Tax Planningjwuajdcnd100% (1)

- Registered Tax Return PreparerDocument17 pagesRegistered Tax Return PreparerNorma WahnonNo ratings yet

- Tax Tips Newsline - February 2015Document20 pagesTax Tips Newsline - February 2015Frank ZerjavNo ratings yet

- BSBFIA412 - AssessmentPi 2Document25 pagesBSBFIA412 - AssessmentPi 2Pattaniya KosayothinNo ratings yet

- Bookkeeping Skills ResumeDocument5 pagesBookkeeping Skills Resumec2yv821v100% (1)

- Summary & Career Objective:: Curriculum VitaeDocument3 pagesSummary & Career Objective:: Curriculum VitaeJnanamNo ratings yet

- 2006 - TAX101 - Phil Tax System & Income TaxDocument7 pages2006 - TAX101 - Phil Tax System & Income Taxhappiness12340% (1)

- Job PostingDocument3 pagesJob Postingapi-514930447No ratings yet

- Business Tax Assignment-1Document15 pagesBusiness Tax Assignment-1ashikaNo ratings yet

- Priyanka Summer Training Report 2015Document83 pagesPriyanka Summer Training Report 2015Tushar JainNo ratings yet

- Payroll Officer Resume Saudi Arabia, Payroll Officer, Accountant, Compensation and Benefit Officer, Payroll AccountantDocument7 pagesPayroll Officer Resume Saudi Arabia, Payroll Officer, Accountant, Compensation and Benefit Officer, Payroll Accountantkhan mohdNo ratings yet

- 1 & 2 CorrectedDocument19 pages1 & 2 CorrectedAnonymous VPLA503ZCNo ratings yet

- Project Synopsis: Payroll ManagementDocument2 pagesProject Synopsis: Payroll ManagementAbhilash KsNo ratings yet

- Self-Assessment Explained for Individuals and CompaniesDocument12 pagesSelf-Assessment Explained for Individuals and CompaniesRaihan ShaheedNo ratings yet

- Job Description Accounts Officer ExpenditureDocument2 pagesJob Description Accounts Officer ExpenditureKevinNo ratings yet

- X. Accounting Processes: A. OverviewDocument7 pagesX. Accounting Processes: A. OverviewUmmu DevyNo ratings yet

- Pantaloons Employee Satisfaction Towards CompensationDocument61 pagesPantaloons Employee Satisfaction Towards CompensationkaurArshpreet57% (7)

- Assignment Taxation 2Document13 pagesAssignment Taxation 2afiq hisyamNo ratings yet

- Healthcare Staffing Payroll and Billing Process GuideFrom EverandHealthcare Staffing Payroll and Billing Process GuideNo ratings yet

- CLASS PLAN FOR COOKING DISHESDocument9 pagesCLASS PLAN FOR COOKING DISHESJhuli Elizabeth CNo ratings yet

- T-TESS Appraiser Sample Conferencing QuesionsDocument4 pagesT-TESS Appraiser Sample Conferencing QuesionsAndrea BrownleeNo ratings yet

- AP Polycet 2015 Application FormDocument2 pagesAP Polycet 2015 Application FormNeepur GargNo ratings yet

- Class ViiiDocument1 pageClass ViiiInnovate With AnweshaNo ratings yet

- An Ecocritics MacbethDocument47 pagesAn Ecocritics MacbethRakhiparna GhoshNo ratings yet

- Lp2 (Tle7) CssDocument4 pagesLp2 (Tle7) CssShiela Mae Abay-abayNo ratings yet

- An Overview of AssessmentDocument10 pagesAn Overview of AssessmentnikjadhavNo ratings yet

- Homeo Summer CampDocument12 pagesHomeo Summer CampsillymindsNo ratings yet

- Equivalents Record Form: I. Educational Attainment & Civil Service EligibilityDocument2 pagesEquivalents Record Form: I. Educational Attainment & Civil Service EligibilityGrace StraceNo ratings yet

- College Education AffordabilityDocument3 pagesCollege Education AffordabilityRiaz H. Rana100% (1)

- Ong Ku 0099M 11633 DATA 1Document94 pagesOng Ku 0099M 11633 DATA 1elka prielaNo ratings yet

- English Online Notebook A2Document10 pagesEnglish Online Notebook A2Mayra ChicaizaNo ratings yet

- Information Sheet BojaDocument1 pageInformation Sheet BojaKenneth Dwight BojaNo ratings yet

- Practicle of DbmsDocument40 pagesPracticle of Dbmsprofessor_manojNo ratings yet

- Department of Education: Republic of The PhilippinesDocument4 pagesDepartment of Education: Republic of The PhilippinesGlaiza OcampoNo ratings yet

- Personal Info and CVDocument5 pagesPersonal Info and CVRóbert TothNo ratings yet

- Supporting Students Who Need More Help (Excerpt From Boosting Executive Skills in The Classroom)Document6 pagesSupporting Students Who Need More Help (Excerpt From Boosting Executive Skills in The Classroom)Jossey-Bass EducationNo ratings yet

- My Children Have Faces: by Carol Campbell Student GuideDocument5 pagesMy Children Have Faces: by Carol Campbell Student Guideapi-293957469No ratings yet

- Grading Rubric for BrochuresDocument1 pageGrading Rubric for BrochuresMarilyn RonquilloNo ratings yet

- Why we need philosophy - for document on the meaning and importance of philosophyDocument2 pagesWhy we need philosophy - for document on the meaning and importance of philosophyRazzele Loraine AyadNo ratings yet

- Prevalence of Mental Health Problems and Sleep DiDocument1 pagePrevalence of Mental Health Problems and Sleep DiqinadeanazNo ratings yet