Professional Documents

Culture Documents

Stock Reco 01112011

Uploaded by

Nikhil PendharkarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Reco 01112011

Uploaded by

Nikhil PendharkarCopyright:

Available Formats

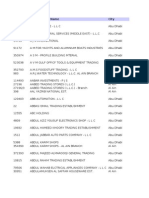

PRIVATE CLIENT RESEARCH

STOCK RECOMMENDATIONS

NOVEMBER 1, 2011

Stock Recommendations

Name of the Company

Mkt

Cap

(Rs mn)

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

Latest

Reco

Price

as on

1-Nov

(Rs)

Upside/

(Downside)

(%)

EPS (Rs)

PE (x)

RoE (%)

P/ABV (x)

FY11

FY12E

FY11

FY12E

FY11E

FY12E

FY11E

FY12E

Banking

Allahabad Bank

66,536

25-Jul-11

218

248

BUY

149

66.5

29.9

37.1

5.0

4.0

21.3

21.8

0.9

0.8

Andhra Bank

58,467

1-Aug-11

135

167

BUY

121

38.5

22.6

26.2

5.3

4.6

23.2

21.3

1.1

1.0

Axis Bank

462,831

24-Oct-11

1,124

1,500

BUY

1,136

32.0

82.5

99.4

13.8

11.4

19.3

19.8

2.5

2.1

Bank of Baroda

291,819

1-Nov-11

771

1,050

BUY

798

31.5

108.3

120.1

7.4

6.6

25.3

21.7

1.6

1.4

1,121,878

20-Oct-11

492

575

BUY

482

19.2

16.9

21.5

28.5

22.4

16.7

18.4

4.5

3.9

997,836

1-Nov-11

930

1,336

BUY

895

49.3

45.5

51.9

19.7

17.2

9.7

10.4

2.0

1.8

Indian Bank

93,067

1-Aug-11

225

305

BUY

217

40.8

39.9

44.4

5.4

4.9

22.4

20.8

1.2

1.1

Indian Overseas Bank

54,208

31-Oct-11

98

105

ACCUMULATE

100

5.5

17.3

13.9

5.8

7.2

14.8

10.2

0.9

0.9

Jammu & Kashmir Bank

39,848

2-Aug-11

887

1,060

BUY

822

29.0

126.9

143.9

6.5

5.7

19.0

18.6

1.2

1.0

319,291

29-Jul-11

1,100

1,400

BUY

1,013

38.3

139.9

163.0

7.2

6.2

23.0

22.1

1.8

1.5

29-Aug-11

BUY

HDFC Bank

ICICI Bank

Punjab National Bank

State Bank of India

Union Bank of India

1,207,161

1,889

2,545

1,901

33.8

130.2

159.1

14.6

12.0

12.6

14.7

2.3

2.0

111,707

25-Oct-11

212

275

ACCUMULATE

221

24.3

39.7

35.6

5.6

6.2

18.9

15.8

1.2

1.2

1,005,926

NBFCs

HDFC Ltd

18-Oct-11

672

720

ACCUMULATE

684

5.2

24.1

26.8

28.4

25.5

21.7

21.7

6.1

5.6

IDFC

170,815

29-Jul-11

129

175

BUY

132

32.9

8.8

8.3

15.0

15.9

14.1

10.4

1.7

1.6

LIC Housing Finance

111,435

21-Jul-11

217

240

ACCUMULATE

235

2.3

20.5

23.9

11.4

9.8

26.0

25.1

2.7

2.3

Mahindra & Mahindra Financial Services 63,138

25-Oct-11

638

810

BUY

660

22.8

45.2

54.0

14.6

12.2

21.9

20.4

2.8

2.4

Shriram Transport Finance Co

28-Jul-11

667

760

ACCUMULATE

608

25.0

54.4

62.4

11.2

9.7

29.0

27.2

3.0

2.4

136,170

STOCK RECOMMENDATIONS

November 1, 2011

Stock Recommendations

Name of the Company

Mkt

Cap

(Rs mn)

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

Latest

Reco

Price

as on

1-Nov

(Rs)

Upside/

(Downside)

(%)

EPS (Rs)

FY11

PE (x)

RoE (%)

EV/EBIDTA (x)

FY12E

FY11

FY12E

FY11E

FY12E

FY11E

FY12E

Automobiles

Ashok Leyland

69,692

21-Jul-11

25

23

26

(12.2)

2.4

2.1

11.1

12.5

16.6

13.5

7.7

8.3

Bajaj Auto

496,915

21-Oct-11

1,614

1,666

ACCUMULATE

1,714

(2.8)

90.4

107.4

19.0

16.0

66.7

50.7

13.5

11.7

Hero MotoCorp Ltd

427,470

20-Oct-11

2,067

1,838

REDUCE

2,137

(14.0)

96.5

112.0

22.1

19.1

60.0

68.2

14.5

11.0

TVS Motors

Maruti Suzuki India Ltd

Escorts Ltd

REDUCE

31,357

14-Sep-11

59

70

327,582

1-Nov-11

1,125

1,112

BUY

8,123

8-Aug-11

88

157

BUY

REDUCE

66

6.1

4.1

5.2

16.1

12.7

21.2

22.5

9.3

7.9

1,134

(1.9)

79.2

64.0

14.3

17.7

17.8

12.6

8.4

11.5

85

84.4

15.2

13.9

5.6

6.1

8.1

6.8

5.9

3.8

Capital Goods & Engineering

ABB #

145,762

10-Aug-11

806

623

REDUCE

688

(9.4)

2.8

16.6

245.7

41.4

2.6

13.7

22.7

18.7

AIA Engineering

29,582

15-Sep-11

313

355

ACCUMULATE

315

12.8

19.4

21.0

16.2

15.0

18.8

17.6

12.3

11.5

Areva T&D India Ltd #

49,652

16-Aug-11

223

245

REDUCE

208

17.9

7.2

7.6

28.9

27.3

18.5

17.1

13.3

12.7

6.4

Bajaj Electricals

19,310

29-Jul-11

216

285

BUY

195

45.8

14.7

16.5

13.3

11.8

26.3

24.0

7.6

127,116

31-Oct-11

1,562

1,913

BUY

1,589

20.4

108.8

119.9

14.6

13.3

18.7

17.9

8.8

7.5

Blue Star

18,295

31-Oct-11

211

227

REDUCE

204

11.5

17.1

8.6

11.9

23.7

28.9

13.1

8.9

11.8

Crompton Greaves

89,022

20-Oct-11

144

130

REDUCE

139

(6.3)

14.3

9.7

9.7

14.3

28.6

16.6

6.3

7.8

Bharat Electronics

Cummins India

108,870

8-Aug-11

439

507

BUY

393

29.1

29.8

32.9

13.2

11.9

35.1

32.3

12.9

11.4

Diamond Power Infrastructure

4,096

8-Sep-11

110

173

BUY

110

57.3

29.6

24.1

3.7

4.6

26.4

15.8

4.4

4.8

Everest Kanto Cylinder

6,384

2-Aug-11

92

106

ACCUMULATE

60

75.5

6.3

9.0

9.6

6.7

10.4

12.2

7.2

5.0

21,204

25-Oct-11

89

110

BUY

87

26.7

4.9

7.1

17.7

12.2

25.0

30.0

10.3

7.2

2,107

11-Oct-11

131

195

BUY

133

46.2

20.8

17.9

6.4

7.4

20.4

15.8

3.1

3.3

45,812

1-Nov-11

ACCUMULATE

Greaves Cotton **

Gujarat Apollo Industries

Havells India Ltd

358

395

381

3.8

25.2

25.4

15.1

15.0

57.6

37.9

9.4

8.5

2,678

17-Aug-11

38

52

BUY

37

39.0

6.1

4.5

6.1

8.3

17.7

11.5

5.1

5.8

16,793

25-Oct-11

99

140

BUY

109

28.0

12.5

12.5

8.8

8.8

17.8

15.4

4.6

5.2

Larsen & Toubro

811,789

24-Oct-11

1,336

1,500

ACCUMULATE

1,390

7.9

69.9

80.5

19.9

17.3

18.6

18.9

12.8

11.7

Siemens India (Sept end)

ACCUMULATE

845

2.4

28.2

33.7

30.0

25.1

24.2

23.8

17.4

14.2

37

15.4

2.6

14.3

7.1

17.7

7.3

Hindustan Dorr-Oliver

Kalpataru Power Transmission

279,579

2-Aug-11

922

865

Suzlon Energy

55,760

24-Oct-11

37

43

Thermax

54,544

21-Oct-11

424

483

ACCUMULATE

458

5.4

31.7

35.8

14.5

12.8

24.5

22.0

8.1

7.5

Time Technoplast Ltd

12,801

10-Aug-11

65

72

ACCUMULATE

61

17.6

5.1

5.5

12.0

11.1

16.4

14.8

7.5

6.6

Tractors India Ltd

3,997

28-Oct-11

406

560

BUY

400

40.1

60.0

53.2

6.7

7.5

20.0

15.0

4.5

4.6

Voltamp Ltd

4,951

16-Aug-11

472

519

ACCUMULATE

490

5.9

51.0

43.0

9.6

11.4

15.0

11.0

5.2

7.0

32,637

22-Sep-11

121

150

BUY

99

51.9

9.6

8.6

10.3

11.5

25.9

19.5

5.4

5.5

Voltas Ltd

Kotak Securities - Private Client Research

REDUCE

For Private Circulation

STOCK RECOMMENDATIONS

November 1, 2011

Stock Recommendations

Mkt

Cap

(Rs mn)

Name of the Company

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

Latest

Reco

Price

as on

1-Nov

(Rs)

Upside/

(Downside)

(%)

EPS (Rs)

FY11

PE (x)

RoE (%)

EV/EBIDTA (x)

FY12E

FY11

FY12E

FY11E

FY12E

FY11E

FY12E

Cement

ACC #

222,419

5-Oct-11

1,101

1,081

REDUCE

1,184

(8.7)

59.6

62.9

19.9

18.8

17.9

17.3

13.6

10.3

Grasim Industries

228,429

25-Oct-11

2,358

2,763

BUY

2,491

10.9

246.9

257.2

10.1

9.7

16.7

15.1

4.5

3.9

India Cements

24,192

16-Aug-11

72

78

REDUCE

79

(1.0)

2.2

6.2

35.8

12.7

1.6

4.5

9.9

6.3

Shree Cement

66,947

2-Aug-11

1,791

1,784

REDUCE

1,922

(7.2)

60.2

58.7

31.9

32.7

10.7

9.6

7.9

7.0

313,223

21-Oct-11

1,111

1,174

ACCUMULATE

1,143

2.7

51.2

61.6

22.3

18.6

18.4

14.8

13.0

9.9

BGR Energy Systems

23,389

16-Sep-11

367

520

BUY

325

60.1

45.0

43.3

7.2

7.5

35.9

25.9

5.2

4.9

IRB Infrastructure Developers

54,175

21-Jul-11

186

246

BUY

163

50.9

13.6

14.3

12.0

11.4

20.3

18.2

7.6

7.2

IVRCL Infrastructure

BUY

UltraTech Cement

Construction

10,360

17-Aug-11

40

76

J Kumar Infraprojects

4,296

10-Aug-11

106

135

39

95.9

5.9

5.5

6.6

7.1

8.2

7.1

5.3

5.5

155

(12.6)

25.7

26.7

6.0

5.8

20.8

18.1

2.9

Jaiprakash Associates

166,863

17-Aug-11

59

90

2.6

BUY

76

18.4

3.0

3.4

25.3

22.4

11.5

6.8

9.8

5,303

2-Aug-11

86

9.6

130

BUY

68

90.5

6.9

7.0

9.9

9.8

8.5

7.9

6.6

13,329

16-Aug-11

6.4

63

90

BUY

52

73.2

6.4

6.7

8.1

7.8

7.1

7.0

7.6

7.2

Patel Engineering

6,777

Pratibha Industries Ltd

4,250

18-Aug-11

102

118

REDUCE

97

21.7

14.3

10.8

6.8

9.0

7.4

5.2

6.1

6.0

25-Oct-11

43

70

BUY

44

57.5

7.1

8.7

6.3

5.1

18.7

16.7

3.9

Punj Lloyd Ltd

3.3

18,685

17-Aug-11

56

60

REDUCE

56

6.4

6.6

8.5

7.1

16.1

Simplex Infrastructures

7.0

10,403

16-Aug-11

280

260

REDUCE

209

24.1

24.8

27.4

8.4

7.6

12.0

11.9

4.7

4.4

2,923

13-Sep-11

49

86

39

118.0

12.7

13.3

3.1

3.0

15.5

14.2

3.3

3.5

136,587

24-Oct-11

402

446

ACCUMULATE

422

5.7

14.9

16.6

28.3

25.4

35.9

29.0

24.0

18.5

1,611,825

25-Oct-11

207

220

ACCUMULATE

208

5.6

6.4

7.7

32.5

27.1

33.8

35.9

21.9

17.6

Madhucon Projects

Nagarjuna Construction

Unity Infraprojects

ACCUMULATE

BUY

FMCG

Godrej Consumer Products Ltd

ITC Ltd

Kotak Securities - Private Client Research

For Private Circulation

STOCK RECOMMENDATIONS

November 1, 2011

Stock Recommendations

Mkt

Cap

(Rs mn)

Name of the Company

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

Latest

Reco

Price

as on

1-Nov

(Rs)

Upside/

(Downside)

(%)

EPS (Rs)

FY11

PE (x)

FY12E

FY11

RoE (%)

EV/EBIDTA (x)

FY12E

FY11E

FY12E

FY11E

FY12E

3.4

Information Technology

Geometric Ltd

7-Sep-11

40

61

46

33.6

9.2

8.5

5.0

5.4

28.4

22.0

3.6

296,847

2,785

19-Oct-11

400

496

BUY

430

15.4

22.9

30.8

18.8

14.0

13.6

15.0

10.7

8.3

1,622,523

13-Oct-11

2,680

2,993

BUY

2,837

5.5

119.4

142.0

23.8

20.0

27.1

27.0

18.0

14.7

Infotech Enterpises

13,132

20-Oct-11

115

155

BUY

118

31.1

12.6

13.1

9.4

9.0

14.4

13.4

5.2

3.5

KPIT Cummins Infosystems

13,605

24-Oct-11

167

211

BUY

161

31.1

10.8

15.5

14.9

10.4

19.1

20.5

8.3

5.9

Mphasis BFL (Oct 10)

71,751

7-Sep-11

356

378

ACCUMULATE

344

10.0

37.7

33.2

9.1

10.4

21.7

16.3

5.8

5.2

7,930

24-Oct-11

46

63

BUY

48

30.8

5.6

5.1

8.6

9.4

17.2

14.5

6.6

5.8

13,246

19-Oct-11

227

300

BUY

226

32.8

30.7

31.6

7.4

7.1

27.4

23.0

4.9

3.8

176,096

7-Sep-11

1,819

2,110

BUY

2,103

0.3

132.3

115.5

15.9

18.2

22.9

16.5

13.1

12.2

43,956

20-Oct-11

331

378

ACCUMULATE

330

14.5

45.4

29.7

7.3

11.1

18.4

7.3

4.5

3.1

REDUCE

HCL Technologies (June end)

Infosys Technologies

NIIT LTD

NIIT Technologies

Oracle Financial Services Software

Patni Computer

R Systems International

ACCUMULATE

1,336

7-Sep-11

105

119

110

8.7

14.0

13.9

7.8

7.9

9.9

9.1

1.8

2.1

47,331

7-Sep-11

74

76

ACCUMULATE

70

7.9

4.2

6.5

16.8

10.8

27.4

34.9

2.4

4,024

1-Nov-11

42

47

SELL

41

14.4

12.1

11.4

3.4

3.6

29.9

22.4

7.2

4.9

2,169,680

18-Oct-11

1,120

1,240

BUY

1,108

11.9

44.4

54.7

25.0

20.3

37.6

42.3

18.9

14.9

Wipro Technologies

910,295

1-Nov-11

368

422

BUY

372

13.4

21.6

22.7

17.2

16.4

24.3

21.5

12.6

10.2

Zensar Technologies

5,577

25-Oct-11

126

195

BUY

129

50.8

30.4

33.4

4.3

3.9

34.0

28.6

4.5

2.9

Mahindra Satyam Ltd

Subex Azure Ltd

Tata Consultancy Services (TCS)

Logistics

Allcargo Global Logistics

19,701

18-Aug-11

167

195

ACCUMULATE

144

35.6

13.0

15.0

11.1

9.6

14.7

15.3

7.2

5.9

127,608

28-Oct-11

975

950

REDUCE

982

(3.2)

63.9

66.7

15.4

14.7

16.4

15.4

10.0

9.3

15,946

17-Oct-11

145

160

ACCUMULATE

148

8.4

8.9

9.5

16.6

15.5

13.6

13.6

11.4

9.7

320,760

19-Oct-11

153

166

ACCUMULATE

160

3.7

4.5

5.4

35.6

29.6

21.7

22.3

27.8

21.4

DB Corp

40,676

24-Oct-11

222

288

BUY

224

28.5

14.2

13.2

15.8

17.0

35.4

26.7

10.0

9.7

Entertainment Network (ENIL)

12,423

25-Jul-11

265

264

REDUCE

260

1.4

11.0

11.0

23.7

23.7

11.4

9.5

12.4

10.0

HT Media

33,237

25-Oct-11

140

200

BUY

142

40.9

7.7

9.3

18.4

15.3

14.9

14.2

8.5

6.7

TV18 Broadcast

16,236

12-Aug-11

63

78

45

73.9

1.0

44.9

5.3

42.1

12.9

Jagran Prakashan

32,990

25-Oct-11

107

140

BUY

110

27.7

6.6

7.3

16.6

15.0

32.0

31.4

9.2

8.6

Sun TV Network

100,825

2-Sep-11

303

391

BUY

256

52.8

19.5

22.2

13.1

11.5

36.0

32.8

6.0

5.4

Zee Entertainment Ent

115,453

18-Oct-11

113

97

SELL

118

(17.8)

6.3

6.0

18.7

19.7

17.9

18.3

12.7

13.8

Container Corporation of India

Gateway Distriparks Ltd

Mundra Port & Special Economic Zone

Media

Kotak Securities - Private Client Research

ACCUMULATE

For Private Circulation

STOCK RECOMMENDATIONS

November 1, 2011

Stock Recommendations

Mkt

Cap

(Rs mn)

Name of the Company

Latest

Report

Date

Price as

on latest

Report

(Rs)

Latest

price

target*

(Rs)

Latest

Reco

Price

as on

1-Nov

(Rs)

Upside/

(Downside)

(%)

EPS (Rs)

PE (x)

RoE (%)

EV/EBIDTA (x)

FY11

FY12E

FY11

FY12E

FY11E

FY12E

FY11E

FY12E

Metals & Mining

SAIL

480,095

4-Nov-10

193

215

ACCUMULATE

111

94.2

15.4

19.6

7.2

5.6

17.7

19.4

4.6

3.8

Sesa Goa

185,325

28-Oct-11

205

232

ACCUMULATE

208

11.4

48.6

43.0

4.3

4.8

40.7

26.3

1.9

5.4

570,380

21-Oct-11

294

310

REDUCE

300

3.4

33.3

35.8

9.0

8.4

17.1

15.5

6.6

4.9

119,115

1-Nov-11

493

470

REDUCE

482

(2.4)

19.7

19.2

24.5

25.1

65.8

60.0

15.4

15.5

55,259

10-Aug-11

102

105

SELL

99

6.6

8.6

9.8

11.5

10.1

26.7

24.1

7.0

6.3

Oil & Gas

Cairn India Ltd

Castrol India Limited

Gujarat State Petronet (GSPL)

Indraprastha Gas (IGL)

58,464

20-Oct-11

398

450

BUY

418

7.8

18.4

21.9

22.7

19.1

27.0

26.5

12.7

10.2

122,063

19-Oct-11

161

175

ACCUMULATE

163

7.5

8.1

13.9

20.1

11.7

23.9

32.6

12.4

8.0

1,462,428

28-Oct-11

174

220

BUY

177

24.0

11.0

12.1

16.1

14.7

14.0

14.1

10.2

11.6

35,234

27-Sep-11

250

315

ACCUMULATE

232

35.9

31.0

22.3

7.5

10.4

7.9

5.4

6.7

7.3

6,157

19-Sep-11

27

48

BUY

26

83.2

3.0

3.6

8.7

7.3

3.0

3.6

2.9

3.7

30,450

16-Aug-11

73

86

REDUCE

72

19.6

12.2

6.1

5.9

11.8

8.8

4.3

7.8

9.7

Petronet LNG

Power

NTPC

Shipping

GE Shipping Company

Mercator Line

Shipping Corporation of India

Source: Kotak Securities - Private Client Research

* All recommendations are with a 9-12 month perspective from the date of the report/update. Investors are requested to use their discretion while deciding the timing,

quantity of investment as well as the exit.

# Figures for CY10 & CY11

** Financials for FY11 are for 9 months - Jun 2010 - Mar-2011 due to change in acounting year

Kotak Securities - Private Client Research

For Private Circulation

STOCK RECOMMENDATIONS

November 1, 2011

Fundamental Research Team

Dipen Shah

IT, Media

dipen.shah@kotak.com

+91 22 6621 6301

Saurabh Agrawal

Metals, Mining

agrawal.saurabh@kotak.com

+91 22 6621 6309

Ruchir Khare

Capital Goods, Engineering

ruchir.khare@kotak.com

+91 22 6621 6448

Amit Agarwal

Logistics, Transportation

agarwal.amit@kotak.com

+91 22 6621 6222

Sanjeev Zarbade

Capital Goods, Engineering

sanjeev.zarbade@kotak.com

+91 22 6621 6305

Saday Sinha

Banking, NBFC, Economy

saday.sinha@kotak.com

+91 22 6621 6312

Ritwik Rai

FMCG, Media

ritwik.rai@kotak.com

+91 22 6621 6310

Jayesh Kumar

Economy

kumar.jayesh@kotak.com

+91 22 6652 9172

Teena Virmani

Construction, Cement, Mid Cap

teena.virmani@kotak.com

+91 22 6621 6302

Arun Agarwal

Automobiles

arun.agarwal@kotak.com

+91 22 6621 6143

Sumit Pokharna

Oil and Gas

sumit.pokharna@kotak.com

+91 22 6621 6313

K. Kathirvelu

Production

k.kathirvelu@kotak.com

+91 22 6621 6311

Amol Athawale

amol.athawale@kotak.com

+91 20 6620 3350

Premshankar Ladha

premshankar.ladha@kotak.com

+91 22 6621 6261

Rahul Sharma

sharma.rahul@kotak.com

+91 22 6621 6198

Malay Gandhi

malay.gandhi@kotak.com

+91 22 6621 6350

Technical Research Team

Shrikant Chouhan

shrikant.chouhan@kotak.com

+91 22 6621 6360

Derivatives Research Team

Sahaj Agrawal

sahaj.agrawal@kotak.com

+91 22 6621 6343

Prashanth Lalu

prashanth.lalu@kotak.com

+91 22 6621 6110

Disclaimer

This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe

these restrictions.

This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where

such an offer or solicitation would be illegal. It is for the general information of clients of Kotak Securities Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs

of individual clients.

We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Kotak Securities Limited, nor any person connected with it,

accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or

down. Past performance is not a guide for future performance. Transactions involving futures, options and other derivatives involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts

of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals.

Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment

decisions that are inconsistent with the recommendations expressed herein. Kotak Securities has two independent equity research groups: Institutional Equities and Private Client Group. This report has been prepared by the Private Client Group. The

views and opinions expressed in this document may or may not match or may be contrary with the views, estimates, ratings, and target price of the Institutional Equity Research Group of Kotak Securities Limited.

Kotak Securities Limited is also a Portfolio Manager. Portfolio Management Team (PMS) takes its investment decisions independent of the PCG research and accordingly PMS may have positions contrary to the PCG research recommendation.

We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction

involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender I borrower to such company (ies) or have other potential

conflict of interest with respect to any recommendation and related information and opinions.

Kotak Securities Limited generally prohibits its analysts from maintaining financial interest in the securities or derivatives of any of the companies that the analysts cover. The analyst for this report certifies that all of the views expressed in this report

accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed

in this report.

No part of this material may be duplicated in any form and/or redistributed without Kotak Securities' prior written consent.

Kotak Securities

Registered

Office: -Kotak

Private

Securities

Client Limited,

Research

Bakhtawar, 1st floor, 229 Nariman Point, Mumbai 400021 India. For Private Circulation

You might also like

- Private Client Stock Recommendations for October 12, 2012Document6 pagesPrivate Client Stock Recommendations for October 12, 2012Prashanto MukherjeeNo ratings yet

- Daily Currency Report: Market RecapDocument6 pagesDaily Currency Report: Market Recapdreamz_blogsNo ratings yet

- Currency Daily Report October 10Document4 pagesCurrency Daily Report October 10Angel BrokingNo ratings yet

- Currency Daily Report November 9Document4 pagesCurrency Daily Report November 9Angel BrokingNo ratings yet

- Currency Daily Report October 12Document4 pagesCurrency Daily Report October 12Angel BrokingNo ratings yet

- Currency Daily Report November 8Document4 pagesCurrency Daily Report November 8Angel BrokingNo ratings yet

- Currency Daily Report August 23Document4 pagesCurrency Daily Report August 23Angel BrokingNo ratings yet

- Currency Daily Report August 10Document4 pagesCurrency Daily Report August 10Angel BrokingNo ratings yet

- Currency Daily Report November 21Document4 pagesCurrency Daily Report November 21Angel BrokingNo ratings yet

- Currency Daily Report November 22Document4 pagesCurrency Daily Report November 22Angel BrokingNo ratings yet

- Currency Daily Report October 30Document4 pagesCurrency Daily Report October 30Angel BrokingNo ratings yet

- Currency Daily Report August 22Document4 pagesCurrency Daily Report August 22Angel BrokingNo ratings yet

- Currency Daily Report November 6Document4 pagesCurrency Daily Report November 6Angel BrokingNo ratings yet

- Currency Daily Report October 25Document4 pagesCurrency Daily Report October 25Angel BrokingNo ratings yet

- Currency Daily Report November 16Document4 pagesCurrency Daily Report November 16Angel BrokingNo ratings yet

- Currency Daily Report November 5Document4 pagesCurrency Daily Report November 5Angel BrokingNo ratings yet

- Currency Daily Report October 16Document4 pagesCurrency Daily Report October 16Angel BrokingNo ratings yet

- Currency Daily Report August 27Document4 pagesCurrency Daily Report August 27Angel BrokingNo ratings yet

- Currency Daily Report November 7Document4 pagesCurrency Daily Report November 7Angel BrokingNo ratings yet

- Currency Daily Report August 29Document4 pagesCurrency Daily Report August 29Angel BrokingNo ratings yet

- Currency Daily Report November 12Document4 pagesCurrency Daily Report November 12Angel BrokingNo ratings yet

- Currency Daily Report August 31Document4 pagesCurrency Daily Report August 31Angel BrokingNo ratings yet

- Currency Daily Report August 13Document4 pagesCurrency Daily Report August 13Angel BrokingNo ratings yet

- Focus: Colombo Stock ExchangeDocument24 pagesFocus: Colombo Stock ExchangeLBTodayNo ratings yet

- Currency Daily Report October 18Document4 pagesCurrency Daily Report October 18Angel BrokingNo ratings yet

- MarketDocument1 pageMarketabdulmateencomNo ratings yet

- Currency Daily Report October 22Document4 pagesCurrency Daily Report October 22Angel BrokingNo ratings yet

- Currency Daily Report November 20Document4 pagesCurrency Daily Report November 20Angel BrokingNo ratings yet

- Currency Daily Report October 23Document4 pagesCurrency Daily Report October 23Angel BrokingNo ratings yet

- Currency Daily Report November 19Document4 pagesCurrency Daily Report November 19Angel BrokingNo ratings yet

- International Commodities Evening Update November 8Document3 pagesInternational Commodities Evening Update November 8Angel BrokingNo ratings yet

- Currency Daily Report August 21Document4 pagesCurrency Daily Report August 21Angel BrokingNo ratings yet

- Currency Daily Report September 27Document4 pagesCurrency Daily Report September 27Angel BrokingNo ratings yet

- Currency Daily Report September 17Document4 pagesCurrency Daily Report September 17Angel BrokingNo ratings yet

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Currency Daily Report August 17Document4 pagesCurrency Daily Report August 17Angel BrokingNo ratings yet

- CMM Project 3 FinalDocument19 pagesCMM Project 3 FinalMithilesh SinghNo ratings yet

- International Commodities Evening Update December 5Document3 pagesInternational Commodities Evening Update December 5Angel BrokingNo ratings yet

- Currency Daily Report November 1Document4 pagesCurrency Daily Report November 1Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report August 14Document4 pagesCurrency Daily Report August 14Angel BrokingNo ratings yet

- 57 BBNP Bank Nusantara Parahyangan TBKDocument3 pages57 BBNP Bank Nusantara Parahyangan TBKDjohan HarijonoNo ratings yet

- Fiscal EPS ($) Market Cap Price Top Pick LastDocument6 pagesFiscal EPS ($) Market Cap Price Top Pick LastOladipupo Mayowa PaulNo ratings yet

- 071 Sti110311fDocument3 pages071 Sti110311fPrem LalNo ratings yet

- Growth of ETFs in IndiaDocument4 pagesGrowth of ETFs in IndiautkarshupsNo ratings yet

- Ebbs & Flows: EM Maiden Funds Outflow in 15 WeeksDocument9 pagesEbbs & Flows: EM Maiden Funds Outflow in 15 WeeksNgọcThủy100% (1)

- Daily Metals and Energy Report November 5Document6 pagesDaily Metals and Energy Report November 5Angel BrokingNo ratings yet

- Central Bank of Sri Lanka: Selected Weekly Economic IndicatorsDocument12 pagesCentral Bank of Sri Lanka: Selected Weekly Economic IndicatorsLBTodayNo ratings yet

- Central Bank of Sri Lanka: Selected Weekly Economic IndicatorsDocument12 pagesCentral Bank of Sri Lanka: Selected Weekly Economic IndicatorsLBTodayNo ratings yet

- Currency Daily Report December 04Document4 pagesCurrency Daily Report December 04Angel BrokingNo ratings yet

- Daily Metals and Energy Report October 10Document6 pagesDaily Metals and Energy Report October 10Angel BrokingNo ratings yet

- Content: US Dollar Euro GBP JPY Economic IndicatorsDocument4 pagesContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNo ratings yet

- Currency Daily Report November 15Document4 pagesCurrency Daily Report November 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 01Document6 pagesDaily Metals and Energy Report, April 01Angel BrokingNo ratings yet

- Currency Daily Report September 11Document4 pagesCurrency Daily Report September 11Angel BrokingNo ratings yet

- Currency Daily Report December 10Document4 pagesCurrency Daily Report December 10Angel BrokingNo ratings yet

- Currency Daily Report September 10Document4 pagesCurrency Daily Report September 10Angel BrokingNo ratings yet

- Currency Daily Report, April 10Document4 pagesCurrency Daily Report, April 10Angel BrokingNo ratings yet

- Currency Daily Report October 15Document4 pagesCurrency Daily Report October 15Angel BrokingNo ratings yet

- Botswana Etssp 2015-2020Document174 pagesBotswana Etssp 2015-2020sellojkNo ratings yet

- Integration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025Document587 pagesIntegration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025tdropulicNo ratings yet

- Print - Udyam Registration Certificate AnnexureDocument2 pagesPrint - Udyam Registration Certificate AnnexureTrupti GhadiNo ratings yet

- Project 1Document20 pagesProject 1pandurang parkarNo ratings yet

- JVA JuryDocument22 pagesJVA JuryYogesh SharmaNo ratings yet

- CH 07 Hull Fundamentals 8 The DDocument47 pagesCH 07 Hull Fundamentals 8 The DjlosamNo ratings yet

- Types of CooperativesDocument11 pagesTypes of CooperativesbeedeetooNo ratings yet

- Rapaport Diamond ReportDocument2 pagesRapaport Diamond ReportMorries100% (1)

- SWOT Analysis for Reet in QatarDocument3 pagesSWOT Analysis for Reet in QatarMahrosh BhattiNo ratings yet

- Cobrapost II - Expose On Banks Full TextDocument13 pagesCobrapost II - Expose On Banks Full TextFirstpost100% (1)

- Quiz 523Document17 pagesQuiz 523Haris NoonNo ratings yet

- Ficha Tecnica y Certificado de Bituminoso MartinDocument2 pagesFicha Tecnica y Certificado de Bituminoso MartinPasion Argentina EliuNo ratings yet

- AE 5 Midterm TopicDocument9 pagesAE 5 Midterm TopicMary Ann GurreaNo ratings yet

- Fingal Housing Strategy AppendixDocument156 pagesFingal Housing Strategy Appendixdi TalapaniniNo ratings yet

- Vertical DifferentiationDocument8 pagesVertical DifferentiationAidanNo ratings yet

- Manual Book Vibro Ca 25Document6 pagesManual Book Vibro Ca 25Muhammad feri HamdaniNo ratings yet

- CareEdge Ratings Update On Tyre IndustryDocument5 pagesCareEdge Ratings Update On Tyre IndustryIshan GuptaNo ratings yet

- Aec 2101 Production Economics - 0Document4 pagesAec 2101 Production Economics - 0Kelvin MagiriNo ratings yet

- Total Amount Due: P1,799.00: BIR CAS Permit No. 0415-126-00187 SOA Number: I000051735833Document2 pagesTotal Amount Due: P1,799.00: BIR CAS Permit No. 0415-126-00187 SOA Number: I000051735833Pia Ber-Ber BernardoNo ratings yet

- Industrial Visit ReportDocument6 pagesIndustrial Visit ReportgaureshraoNo ratings yet

- Jia Chen - Development of Chinese Small and Medium-Sized EnterprisesDocument8 pagesJia Chen - Development of Chinese Small and Medium-Sized EnterprisesAzwinNo ratings yet

- Cover NoteDocument1 pageCover NoteSheera IsmawiNo ratings yet

- Act 51 Public Acts 1951Document61 pagesAct 51 Public Acts 1951Clickon DetroitNo ratings yet

- AUH DataDocument702 pagesAUH DataParag Babar33% (3)

- Nepal submits TFA ratification documents to WTODocument1 pageNepal submits TFA ratification documents to WTOrajendrakumarNo ratings yet

- Spence's (1973) Job Market Signalling GameDocument3 pagesSpence's (1973) Job Market Signalling GameKhanh LuuNo ratings yet

- INKP - Annual Report - 2018 PDFDocument225 pagesINKP - Annual Report - 2018 PDFKhairani NisaNo ratings yet

- Pi MorchemDocument1 pagePi MorchemMd Kamruzzaman MonirNo ratings yet

- Hong Leong Bank auction of 5 Kuala Lumpur propertiesDocument1 pageHong Leong Bank auction of 5 Kuala Lumpur propertieschek86351No ratings yet

- Public Finance Exam A2 JHWVLDocument3 pagesPublic Finance Exam A2 JHWVLKhalid El SikhilyNo ratings yet