Professional Documents

Culture Documents

Mergers Book and Case Digest#1

Uploaded by

Katrina MuliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mergers Book and Case Digest#1

Uploaded by

Katrina MuliCopyright:

Available Formats

CORPORATE ACQUISITIONS, MERGERS, & CONSOLIDATIONS

The 3 Levels of Acquisition / Transfer Assets Only Level The purchaser is only interested in the raw assets of the enterprise purchaser is not interested in the entity of the corporate owner, nor the goodwill or other factors relating to the business The transferee is not liable for the debts and liabilities of the transferor except where there is fraud or express (or implied) assumption of liability There is no privity of contract between the transferee and the creditors of the transferor Covered by the Bulk Sales Law; non-compliance makes the transfer null and void But where a corporation takes over the assets of another corporation that is dissolved, then the transferee is liable for the debts of the dissolved corporation to the extent of the value of the assets acquired Business Enterprise Level Purchasers interest goes beyond the mere assets or properties, but extends to the going concern and the earning capability of the venture, including goodwill, the customers, the stock-in-trade, etc. DD: This contemplates a sale or transfer of all or substantially all of the assets of the corporation the goodwill, or the ability to do business and make money. No interest in purchasing the juridical entity itself and in fact purchases the business or going concern from the said entity The transferee is responsible for the debts and liabilities of the predecessor, this is for the purpose of protecting the creditors of the transferor corporation (it is as if there is a lien in favor of the creditors that follows the enterprise) Fraud is not an essential element for applying the business-enterprise level doctrine in making the transferee liable for the transferors debts; its application has been linked w/ the piercing doctrine If a partnership (or sole proprietorship) is later incorporated and the corporation merely continued the business of the old partnership, then the subsequent corporation is prima facie liable for the predecessors debts (Quimson vs. Alaminor Cooperative) A free and harmless clause where the transferor agrees to hold the transferee harmless from all claims is binding only as between them and cannot prejudice creditors who were not parties thereto (remember relativity of contracts); the creditors may still go after the transferee DD: The business remains the same; only the medium changes.

Equity Level The purchaser takes control of the business by purchasing the shareholdings of the corporation The corporate owner remains the direct owner of the business, and what the purchasing corporation has actually secured is the ability to elect members of the Board The transferee is not liable for the debts and liabilities of the transferor except if there is express assumption of liability (their separate personalities remain) The purchasing corporation as a stockholder is still protected by the limited liability feature as well as the separate juridical personality MERGER & CONSOLIDATION The power to merge or consolidate is not inherent and is merely granted by law (Sec. 76) Consolidation Two or more existing corporations unite to form a new corporation called the Consolidated Corporation, composed generally though not necessarily of the stockholders of the old corporations. All the constituent corporations are dissolved and absorbed by the consolidated corporation. Merger One or more existing corporations are absorbed by another corporation w/c survives and continues the business. All constituent corporations except the surviving corporation are dissolved.

In both cases, there is no liquidation of assets, and the surviving or consolidated corporation becomes ipso jure liable for the debts of the constituent corporations Procedure The Board of Directors or Trustees of each constituent corporation may vote to consolidate or merge Affirmative vote of at least 2/3 of the outstanding capital stock or members is needed in a meeting duly called for the purpose There must be due notice of the meeting to the stockholders or members In non-stock corporations, although generally allowed in other cases, voting by mail is not allowed in case of merger or consolidation Appraisal Right is available to dissenting members or stockholders; the appraisal right is extinguished if the Board decides to abandon the plan of merger or consolidation. Amendments to the plan of merger or consolidation also require majority approval of the respective Boards as well as 2/3 vote of stockholders / members. Articles of Merger and Consolidation are executed by each constituent corporation signed by the President or VP and certified by the Secretary or Asst. Secretary and submitted to the SEC for approval SEC may issue Certificate of Merger or Consolidation at w/c time the merger/consolidation shall become effective If SEC has reason to believe that the merger or consolidation is contrary to law, it shall set a hearing and opportunity to be heard will be afforded Effects of Merger or Consolidation The constituent corporations shall become a single corporation Separate existence of the constituent corporations shall cease, except the surviving corporation in case of merger Surviving or consolidated corporation shall possess all rights, privileges, immunities, and franchise of each corporation All properties and interests shall ipso facto be vested in the surviving or consolidated corporation Surviving or consolidated corporation shall be responsible for the debts and liabilities of the constituent corporations Claims (even those pending) against the constituent corporations may be prosecuted against the surviving or consolidated corporation No rights or liens of creditors are impaired Advantages of Merger or Consolidation There is a continuous flow in the juridical personalities; the surviving or consolidated corporations are not even transferees per se There are certain statutory prohibitions against transfers w/c are not applicable to merger or consolidation There are tax advantages as transfers are usually covered by gains tax and not applicable to mergers or consolidation De Facto Merger They are recognized in Philippine Corporate Law. A de facto merger can be pursued by one corporation acquiring all or substantially all of the properties of another corporation in exchange of shares of stock of the acquiring corporation. The so-called target corporation is left w/ no other assets other than shares of stock of the acquiring corporation. ***simply put: assets in exchange for stocks Separate juridical personality subsists, but liabilities are transmitted under business-enterprise transfers. The acquiring corporation assumes the liabilities of the target corporation. De facto merger may be done by the acquiring corporation w/o the required 2/3 stockholders vote. But for the target corporation, 2/3 ratificatory vote is required and may trigger the exercise of appraisal right. DD: Observe that this involves a disposition of all or substantially all of the business of the target corporation; hence

the rules are the same the liabilities are transmitted, 2/3 vote is required. SPIN-OFFS They produce the opposite effect of merger or consolidation. Here, a department or division of the corporate business is sold off to a new corporation by the process where it will become a subsidiary of the original corporation in exchange for all the capital stock of the subsidiary. Spin-offs are not regulated by any specific provision of the Code the nearest in application being Sec. 40. EFFECTS OF TRANSFERS ON EMPLOYEES Assets Only Transfers The transferee is not bound to retain the employees of the transferor, even if the result is the shutting down of the former business Labor contracts are in personam and binding only as between the parties thereto, and an employer has the right to choose who his employees are going to be But the transferor and transferee can be held liable in case there is bad faith Business Enterprise Transfers As a rule, the transferee should be generally bound to retain the employees of the acquired business But the transferee is not liable for violations by the transferor of labor laws, the latter being solely liable Change of management or ownership of a business is not similar to cessation for purposes of exempting the transferor from payment of separation pay Jurisprudentially, however, there have been instances where the assets-only level was applied to a business-enterprise transfer. The transferee is not obligated to absorb the employees of the acquired business; an employees contractual relation is personal and only w/ the original employer The transferee can be held liable to the employees of the transferor if there are grounds to pierce the corporate veil where there is substantial continuity of the old business by the same owners using the corporate fiction as a shield Avon Dale Garments vs. NLRC For a new enterprise to take over the business concerns of another and at the same time not be liable for the labor claims of the predecessor, there must be a formal and substantial termination or break from the operations of the predecessor as to leave no doubts that the transferee is a separate entity. Equity Transfer The purchaser does not assume personal liability to the employees of the acquired corporation under the principle of separate juridical personality The original corporate employer remains as the party liable to its own employees In Case of Mergers or Consolidation By express provision of law (Sec. 80) the surviving or consolidated corporation assumes the liabilities of the constituent corporations including labor obligations and collective bargaining agreements Commentary: But the rulings of the SC (once again) run against the natural grain such as in the case of Filipinas Port v. NLRC, but this case was again overturned by a later case of the same name. DD: Labor cases have the tendency to distort the rules. In Case of Spin-Offs If the spin-off is done for a valid purpose and in good faith, then the employees of the spun-off corporation will no longer form part of the bargaining unit of the original corporation and are to be deemed as new bargaining units

Edward J. Nell Company vs. Pacific Farms, Inc. | Concepcion G.R. No. L-20850, November 29, 1965 | 15 SCRA 415

FACTS

In a previous case, Edward J. Nell Co. secured a judgment against Insular Farms, Inc. for a sum of money, representing the unpaid balance of the price of a pump sold by Edward to Insular Farms, including interest plus attorneys fees. A writ of execution was returned unsatisfied, stating that Insular Farms had no leviable property. Edward filed the present action against Pacific Farms, Inc., which it alleges to be an alter ego of Insular Farms. The municipal court, CFI, and CA dismissed the complaint. Hence this petition.

ISSUES & ARGUMENTS W/N Pacific Farms, Inc. may be held liable for Insular Farms debt to Edward, on the theory that the former is an alter ego of the latter. HOLDING & RATIO DECIDENDI PACIFIC FARMS, INC. NOT LIABLE FOR INSULARS DEBT. The theory of Edward that Pacific is an alter ego of Insular is based on the fact that 1) Pacific had purchased all or substantially all of Insulars shares of stock, as well as its real and personal properties, including the pumping equipment; and 2) that Pacific sold the shares to certain individuals, who forthwith reorganized the corporation. These facts do not prove that Pacific is an alter ego of Insular Farms, or is liable for its debts. Generally where one corporation sells or otherwise transfers all of its assets to another corporation, the latter is not liable for the debts and liabilities of the transferor, except: 1) where the purchaser expressly or impliedly agrees to assume such debts; 2) where the transaction amounts to a consolidation or merger of the corporations; 3) where the purchasing corporation is merely a continuation of the selling corporation; and 4) where the transaction is entered into fraudulently in order to escape liability for such debts. There is neither proof nor allegation by Edward of these facts. Moreover, the sale of the shares took place 6 months before final judgment in the original case, and 1 month before the complaint was filed by Edward. Neither is it claimed that there has been a merger or consolidation of Insular and Pacific. In fact, Edwards theory negates such consolidation or merger, for a corporation cannot be its own alter ego. Decision affirmed.

Gonzales v. SRA | Feliciano G.R. No. 84606, June 28, 1989

FACTS

Spouses Gonzales filed a complaint seeking cancellation of a mortgage and recovery of a sum of money against the Republic Planters Bank (RPB), the Philippine Sugar Commission (Philsucom) and the Sugar Regulatory Administration (SRA). The complaint alleged the Gonzaleses obtained a loan secured by a real estate mortgage from RPB. RPB was collecting from the spouses but based on the latters computation, they had paid off the loan already. The loan was payable from the proceeds of the spouses sugar with Philsucom. Philsucom deducted from the petitioners export sugar proceeds the amount of P421,517.32 in favor of RPB without their authority and consent resulting in the overpayment of the RPB. Petitioners prayed that the real estate mortgage be cancelled, and that Philsucom and SRA be required jointly and severally to reimburse the petitioners the amount of P 289,260.88.

SRA moved to dismiss the complaint upon the ground of lack of cause of action. o SRA noted that while the deductions complained of were made by the Philsucom during the period from 1980 to 1984, the SRA itself had been created by Executive Order No. 18 only in 1986 and that it was not a party to the real estate mortgage between petitioners and the RPB.

ISSUES & ARGUMENTS W/N Spouses Gonzales may claim against SRA o Petitioners: abolition of the Philsucom by Executive Order No. 18 in effect destroyed the petitioners right to recover from Philsucom. Petitioners deprived of property without due process of law and that the abolition of Philsucom and the transfer of assets from Philsucom to respondent SRA are unconstitutional and ineffective. The implicit theory of petitioners is that they have a right to follow Philsucom's assets in the hands of the SRA. HOLDING & RATIO DECIDENDI SPOUSES MAY CLAIM AGAINST SRA, BUT TO A LIMITED EXTENT ONLY One who asserts a claim against a juridical entity has co constitutional rightt to the perpetual existence of such entity. Juridical persons, whether incorporated or not, whether owned by the government or the private sector, may come to an end at one time or another for a variety of reasons. Thus, the Corporation Code provides for termination of corporate life, the dissolution of the corporation, the winding up of its operations, the liquidation of its assets, the payment of its obligations and distribution of any residual assets to its stockholders. The termination of the life of a juridical entity does not by itself imply the diminution or extinction of rights demandable against such juridical entity. EO 18 did not provide for universal succession of SRA to Philsucom, or more specifically to the assets and liabilities of Philsucom. The succession of the SRA to the assets and records of the Philsucom is thus limited in nature; the extent of such succession is left to the discretionary determination of the SRA itself. More importantly, EO 18 is silent as to the liabilities of Philsucom; it does not speak of assumption of such liabilities by the SRA. HOWEVER, Section 13 of EO 18 is not to be interpreted as authorizing respondent SRA to disable Philsucom from paying Philsucom's demandable obligations by simply taking over Philsucom's assets and immunizing them from legitimate claims igainst Philsucom. The right of those who have previously contracted with or otherwise acquired lawful claims against, Philsucom, to have the assets of Philsucom applied to the satisfaction of those claims, is a substantive right and not merely a procedural remedy. Section 13 cannot be read as permitting the SRA to destroy that substantive right. To avoid such a result, it is held that should the assets of Philsucom remaining in Philsucom at the time of its abolition not be adequate to pay for all lawful claims against Philsucom, respondent SRA must be held liable for such claims against Phflsucom to the extent of the fair value of assets actually taken over by the SRA from Philsucom, if any. To this extent, claimants against Philsucom do have a right to follow Philsucom's assets in the hands of SRA or any other agency for that matter. Petitioners have a cause of action against SRA to the extent that they are able to prove lawful claims against Philsucom, which claims Philsucom is or may be unable to satisfy, and to the extent respondent SRA did, or does, in fact take over all or some of the assets of Philsucom.

Blesilo & Florencio Buan, Jr. v. Alcantara & Paras-Nisce

Melencio-Herrera | G.R. No. L-59592, February 29, 1984 | 127 SCRA 834 FACTS Petitioners are 2 of the heirs of Florencio & Rizalina Buan, owners of Philippine Rabbit Bus Lines and other properties, who died in a motor vehicle accident. Intestate estate proceedings started in 1953, and named co-administrators of their estate were Florencios brother Bienvenido Buan and Rizalinas sister Natividad Paras-Nisce (respondent). As administrators, Buan & Paras-Nisce successfully sought court approval for various transactions, including the incorporation of the Philippine Rabbit Bus Lines (where the estate was majority owner with 99.67%) and the increase of its capital stock. When the corporations capital stock was increased, the administrators successfully asked the court to have the estate waive its preemptive rights to subscribe to new shares, subscribing to the newly-issued shares themselves. This resulted in the estates share being diluted to 35%. On February, 1981, petitioners filed a motion praying for the closure of the intestate proceedings (already going on for almost 30 years), having been long deprived of their inheritance. They also asked for precautionary remedies against administratrix Paras-Nisce. Paras-Nisce opposed the motion, stating that the delay in the closure of the estate proceedings was not caused by her, but was due to the pendency of actions for damages filed against the administrators of the estate, which have remained pending over the years. Judge Alcantara denied the motion, so the Buans filed a petition with the SC. ISSUES & ARGUMENTS W/N the intestate proceedings should be closed even while actions for damages against the administrators were pending. HOLDING & RATIO DECIDENDI INTESTATE PROCEEDINGS SHOULD BE TERMINATED, PROPERTY DISTRIBUTED. The proposition that the damage suits prevent the closure of the proceedings is not meritorious. Account must be taken of the fact that Philippine Rabbit had been incorporated. Since the estate became the owner of practically all of the shares of stock, the damage suits should have also become the responsibility of the corporation. At the time of the incorporation, the administrators and the corporation technically became alter egos with respect to each other. The administrators would still be liable for obligations of the corporation. Similarly, the corporation would have to be liable for the debts of the administrators. As between the estate and the corporation, the intention of incorporation was to make the corporation liable for past and pending obligations of the estate as the transportation business itself was being transferred to and placed in the name of the corporation. That liability on the part of the corporation, vis--vis the estate, should continue to remain with it even after the percentage of the estates shares of stock in the corporation should be diluted. Where the administrator of the estate of a decedent incorporated the assets of the estate and continued the business of the latter, the administrator and the corporation formed are alter egos with respect to each other, so that the administrators would still be liable for obligations of the corporation, just as the corporation would have to be liable for the debts of the administrators. Waiting for all damage suits to terminate before closing the intestate proceedings is absurd. Given the inherent risk of accidents in Philippine

Rabbits business, suits will invariably result wrapping all these up before ending the estate will place the latter in perpetual administration. Philippine Veterans Investment Development Corporation vs. CA | Cruz G.R. No. 85266, January 30, 1990 | 181 SCRA 669 FACTS

March 1979, Violeta Borres got injuredin an accident that was later held by the RTC and the CA to be due to the negligence of Phividec Railways, Inc. (PRI) May 1979, petitioner Philippine Veterans Investment Development Corporation (PHIVIDEC) sold all its rights and interests in the PRI to the Philippine Sugar Commission (PHILSUCOM). Two days later, PHILSUCOM caused the creation of a wholly-owned subsidiary, the Panay Railways, Inc., to operate the railway assets acquired from PHIVIDEC. January 1980 - Borres filed a complaint for damages against PRI and Panay Railways Inc. (Panay ), whereupon the PANAY filed with leave of court a third-party complaint against PHIVIDEC. PANAY disclaimed liability on the ground that in the Agreement concluded between PHIVIDEC and PHILSUCOM, it was provided that: o D. With the exception of the Liabilities and Contracts specified in Annexes 4 and 5 of the preceding paragraph, PHIVIDEC hereby holds PHILSUCOM harmless from and against any action, claim or liability that may arise out of or result from acts or omissions, contracts or transactions prior to the turn-over. RTC held that PRI was negligent and liable for damages and that as PRI was a wholly owned subsidiary of PHIVIDEC, PHIVIDEC should answer for PRIs liability.

ISSUE W/N when PRI was sold by PHIVIDEC to PHILSUCOM on May 1979, the legal fiction of PRI as a separate corporate entity from PHIVIDEC disappeared pursuant to and in view of the representations and warranties contained in the agreement of sale between PHIVIDEC and PHILSUCOM, particularly the stipulation already quoted above, by virtue of which PHIVIDEC held PHILSUCOM harmless from any claim or liability arising out of any act or transaction "prior to the turn-over." W/N the veil of corporate fiction may be pierced. HOLDING & RATIO DECIDENDI No, PRIs legal fiction as a separate corporate entity from PHIVIDEC did not disappear and in the interest of justice and equity, and to prevent the veil of corporate fiction from denying Borres the reparation to which she is entitled, that veil must be pierced and PHIVIDEC and PRI regarded as one and the same entity. The CA held that PHIVIDEC'S act of selling PRI to PHILSUCOM shows that PHVIDEC had complete control of PRI's business. This circumstance renders applicable the rule cited that if a parent- holding company (PHIVIDEC in the present case) assumes complete control of the operations of its subsidiary's business, the separate corporate existence of the subsidiary must be disregarded, such that the holding company will be responsible for the negligence of the employees of the subsidiary as if it were the holding company's own employees. It is clear from the evidence of record that by virtue of the agreement between PHIVIDEC and PHILSUCOM, particularly the stipulation exempting the latter from any "claim or liability arising out of any act or transaction" prior to the turn-over, PHIVIDEC had expressly assumed liability for any

claim against PRI. Since the accident happened before that agreement and PRI ceased to exist after the turn-over, it should follow that PHIVIDEC cannot evade its liability for the injuries sustained by Borres. Important doctrines from the case:

According to Abney vs. Belmont Country Club Properties: o The rule is that: Where it appears that two business enterprises are owned, conducted and controlled by the same parties, both law and equity will, when necessary to protect the rights of third persons, disregard the legal fiction that two corporations are distinct entities, and treat them as identical.

Yutivo Sons Hardware Co. v. Court of Tax Appeals o It is an elementary and fundamental principle of corporation law that a corporation is an entity separate and distinct from its stockholders and from other corporations to which it may be connected. However, "when the notion of legal entity is used to defeat public convenience, justify wrong, protect fraud or defend crime," the law will regard the corporation as an association of persons, or in the case of two corporations merge them into one. ... Another rule is that, when the corporation is the "mere alter ego or business conduit of a person, it may be disregarded. Nell Case o Generally where one corporation sells or otherwise transfers all of its assets to another corporation, the latter is not liable for the debts and liabilities of the transferor, except: (1) where the purchaser expressly or impliedly agrees to assume such debts; (2) where the transaction amounts to a consolidation or merger of the corporations; (3) where the purchasing corporation is merely a continuation of the selling corporation; and (4) where the transaction is entered into fraudulently in order to escape liability for such debts.

You might also like

- Understanding Corporation LawDocument36 pagesUnderstanding Corporation LawJanus Mari100% (1)

- Company LawDocument18 pagesCompany LawPriya SaxenaNo ratings yet

- Corporation Law NotesDocument38 pagesCorporation Law NotesToshirouHitsugaya100% (2)

- Corporate Law PDFDocument11 pagesCorporate Law PDFAnna MahmudNo ratings yet

- Retainer ContractDocument5 pagesRetainer ContractKatrina MuliNo ratings yet

- Powers of The CorporationDocument7 pagesPowers of The CorporationMon RamNo ratings yet

- Essex Competency ToolkitDocument26 pagesEssex Competency ToolkitFathia Rofifah100% (1)

- Corporations - Loewenstein - Spring 2007 - Alexande - Grade 97Document45 pagesCorporations - Loewenstein - Spring 2007 - Alexande - Grade 97a thaynNo ratings yet

- Continuation (Corp and Corporate Rehabilitation) Combination of The Two (2) TestsDocument5 pagesContinuation (Corp and Corporate Rehabilitation) Combination of The Two (2) TestsAdam SmithNo ratings yet

- Kslu Unit 5 Q & A Company LawDocument30 pagesKslu Unit 5 Q & A Company LawMG MaheshBabuNo ratings yet

- Reyes 1968Document460 pagesReyes 1968Katrina Muli100% (1)

- Mergers ReviewerDocument3 pagesMergers ReviewerAices SalvadorNo ratings yet

- Close and Special CorporationsDocument145 pagesClose and Special Corporationsjed_nurNo ratings yet

- Case DoctrinesDocument4 pagesCase DoctrinesZaira Gem GonzalesNo ratings yet

- Transfer and Other Dealings of Share SEC 62Document6 pagesTransfer and Other Dealings of Share SEC 62Weddanever CornelNo ratings yet

- NetApp The Day-to-Day of A District ManagerDocument24 pagesNetApp The Day-to-Day of A District ManagerHari ChandanaNo ratings yet

- Commercial Law - Atty. RondezDocument50 pagesCommercial Law - Atty. RondezJenMarlon Corpuz AquinoNo ratings yet

- Project Report MBA H RDocument107 pagesProject Report MBA H RgoswamiphotostatNo ratings yet

- NOTES ON CORPORATION LAWDocument10 pagesNOTES ON CORPORATION LAWCarlos JamesNo ratings yet

- Political Law - PALMERA v. CSCDocument3 pagesPolitical Law - PALMERA v. CSCMaestro LazaroNo ratings yet

- Iso 37001 Anti Bribery MssDocument8 pagesIso 37001 Anti Bribery MssDisha Shah0% (1)

- Offer LetterDocument20 pagesOffer Lettersuman sheikhNo ratings yet

- Pound Ridge Library Director Marilyn Tinter's Disciplinary ChargesDocument7 pagesPound Ridge Library Director Marilyn Tinter's Disciplinary ChargestauchterlonieDVNo ratings yet

- Group Assignment Office Business Layout ASM553Document8 pagesGroup Assignment Office Business Layout ASM553MS MKNo ratings yet

- Deed of Absolute Sale ParkingDocument3 pagesDeed of Absolute Sale ParkingKatrina MuliNo ratings yet

- Doctrines (Finals) Corp LawDocument16 pagesDoctrines (Finals) Corp LawAngel Grace PeraltaNo ratings yet

- Titles 9, 11, 12, 13, 14Document4 pagesTitles 9, 11, 12, 13, 14Jeanne Pearce VirayNo ratings yet

- Corporation Sec.95 132Document46 pagesCorporation Sec.95 132iseonggyeong302No ratings yet

- Winding Up of CompaniesDocument18 pagesWinding Up of CompaniesEMONNo ratings yet

- Notes On Online LecturesDocument10 pagesNotes On Online LecturesJustice PajarilloNo ratings yet

- Questions To Ponder: What Is The Concept of Separate Legal Entity?Document4 pagesQuestions To Ponder: What Is The Concept of Separate Legal Entity?Kot SoonthronsukNo ratings yet

- Rules Directors Duties Contracts Dividends Corporate GovernanceDocument4 pagesRules Directors Duties Contracts Dividends Corporate GovernanceFerb CruzadaNo ratings yet

- 2023 Week 12 Winding Up of CompaniesDocument13 pages2023 Week 12 Winding Up of CompaniesJoshua OnckerNo ratings yet

- Reconstruction and AmalgamationDocument17 pagesReconstruction and AmalgamationTanmay PatilNo ratings yet

- Baroperations2014 141201230103 Conversion Gate02 PDFDocument286 pagesBaroperations2014 141201230103 Conversion Gate02 PDFDela Cruz Kenneth JuneNo ratings yet

- Irish Company LawDocument6 pagesIrish Company LawDionneNo ratings yet

- Section 33. Disloyalty of A Director. - Where A Director, by Virtue of Such OfficeDocument19 pagesSection 33. Disloyalty of A Director. - Where A Director, by Virtue of Such OfficeKhimie PadillaNo ratings yet

- Corpo NotesDocument20 pagesCorpo NotesWarly PabloNo ratings yet

- Directors' Liability IndiaDocument7 pagesDirectors' Liability IndiaAmit GroverNo ratings yet

- Corporate Combinations in 40 CharactersDocument4 pagesCorporate Combinations in 40 CharactersDJ ULRICHNo ratings yet

- Mergers and Consolidations ExplainedDocument15 pagesMergers and Consolidations ExplainedMohammad Raffe GuroNo ratings yet

- CorpoReport Dissolution REPORTDocument48 pagesCorpoReport Dissolution REPORTMarinel June PalerNo ratings yet

- Amalgamation ChecklistDocument101 pagesAmalgamation ChecklistSabeena KhanNo ratings yet

- Company Law Reconstruction and AmalgamationDocument50 pagesCompany Law Reconstruction and Amalgamationzeerak jabeenNo ratings yet

- CORPORATION MERGER LAWDocument80 pagesCORPORATION MERGER LAWJamie Rose AragonesNo ratings yet

- ReviewerDocument3 pagesReviewerPrince Jheremias Ravina AbrencilloNo ratings yet

- Apply For A Revival of Its Corporate ExistenceDocument7 pagesApply For A Revival of Its Corporate Existencedarwin polidoNo ratings yet

- RCC Allows One Person CorpDocument9 pagesRCC Allows One Person CorpDel Rosario MarianNo ratings yet

- Company LawDocument10 pagesCompany LawVaishnavi SharmaNo ratings yet

- Amalgamation: Example:-Existing Companies A and B Are Wound Up and A New Company C IsDocument5 pagesAmalgamation: Example:-Existing Companies A and B Are Wound Up and A New Company C Isnikhilesh kumarNo ratings yet

- Winding Up of CompaniesDocument18 pagesWinding Up of CompaniesAbbas HaiderNo ratings yet

- COMPANY Law - Business Law NotesDocument28 pagesCOMPANY Law - Business Law NotesDiana FaridaNo ratings yet

- Corporation: Governing LawDocument10 pagesCorporation: Governing LawAnonymous wLsYUICZe100% (1)

- Mergers, Consolidations, Dissolutions, and Affiliations: Legal Issues For Community-Based OrganizationsDocument10 pagesMergers, Consolidations, Dissolutions, and Affiliations: Legal Issues For Community-Based OrganizationskashokmbaNo ratings yet

- Atty. Castro - Commercial Law - RCC (Part 2)Document257 pagesAtty. Castro - Commercial Law - RCC (Part 2)Jiezel Flores-EbreoNo ratings yet

- Corp (D)Document9 pagesCorp (D)Moress JarieNo ratings yet

- Corporate Veil:: Concept of Limited LiabilityDocument9 pagesCorporate Veil:: Concept of Limited LiabilityRohan PatelNo ratings yet

- Malawi College Accountancy Guide to Winding Up CompaniesDocument8 pagesMalawi College Accountancy Guide to Winding Up CompaniesInnocent Pboy Kim MekeNo ratings yet

- Corporation Final Exam AnswersDocument3 pagesCorporation Final Exam AnswersSharah Del T. TudeNo ratings yet

- Corporation Sec.75 85Document37 pagesCorporation Sec.75 85iseonggyeong302No ratings yet

- Corporation Code Part 4 - Title IV Powers of A CorporationDocument11 pagesCorporation Code Part 4 - Title IV Powers of A CorporationJynxNo ratings yet

- Unit 8Document35 pagesUnit 8Hemanta PahariNo ratings yet

- Bar Q&A ComDocument13 pagesBar Q&A CompawsmasonNo ratings yet

- Title V & IV Additional InformationDocument7 pagesTitle V & IV Additional InformationAsdfghjkl qwertyuiopNo ratings yet

- Doctrine of Lifting of or Piercing The Corporate VeilDocument5 pagesDoctrine of Lifting of or Piercing The Corporate VeilNiraj Dhar DubeyNo ratings yet

- Derivative Action in IndiaDocument26 pagesDerivative Action in IndiaabbishekNo ratings yet

- Project ON AccountingDocument22 pagesProject ON AccountingHammad Bin Azam HashmiNo ratings yet

- Company Law ExamDocument15 pagesCompany Law ExamHärîsh KûmärNo ratings yet

- CONSEQUENCES (Effects) OF SEPARATE LEGAL PERSONALITYDocument16 pagesCONSEQUENCES (Effects) OF SEPARATE LEGAL PERSONALITYFrst-Ngwazi Prince Christopher Manda75% (4)

- Legal - Borrowing Powers, Majority Powers and Minority RightsDocument21 pagesLegal - Borrowing Powers, Majority Powers and Minority RightsSailesh NallapothuNo ratings yet

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringFrom EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo ratings yet

- Affidavit of DiscrepancyDocument1 pageAffidavit of DiscrepancyKatrina MuliNo ratings yet

- Cruz v. AntonioDocument15 pagesCruz v. AntonioKatrina MuliNo ratings yet

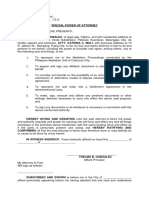

- Spa - GonzalezDocument2 pagesSpa - GonzalezKatrina MuliNo ratings yet

- Com Res 10468Document8 pagesCom Res 10468Katrina MuliNo ratings yet

- RDO No. 43 - Pasig CityDocument374 pagesRDO No. 43 - Pasig CityCherry Chao100% (2)

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptKatrina MuliNo ratings yet

- Acknowledgement ReceiptDocument1 pageAcknowledgement ReceiptKatrina MuliNo ratings yet

- Motion To Avail Plea Bargainig: Regional Trial CourtDocument3 pagesMotion To Avail Plea Bargainig: Regional Trial CourtKatrina MuliNo ratings yet

- Lease ContractDocument11 pagesLease ContractKatrina MuliNo ratings yet

- SubmissionDocument2 pagesSubmissionKatrina MuliNo ratings yet

- ScriptDocument2 pagesScriptKatrina MuliNo ratings yet

- Franchise Inquiry Form for Robinsons Convenience StoresDocument1 pageFranchise Inquiry Form for Robinsons Convenience StoresKatrina MuliNo ratings yet

- Request For Release With Undertaking - HaleyDocument1 pageRequest For Release With Undertaking - HaleyKatrina MuliNo ratings yet

- Affidavit - TeofiloDocument1 pageAffidavit - TeofiloKatrina MuliNo ratings yet

- Withdraw Lost Title AffidavitDocument1 pageWithdraw Lost Title AffidavitKatrina MuliNo ratings yet

- AffidavitDocument2 pagesAffidavitKatrina MuliNo ratings yet

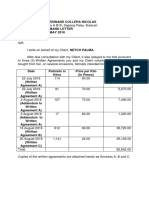

- Netch PalmaDocument3 pagesNetch PalmaKatrina MuliNo ratings yet

- Notice To VacateDocument1 pageNotice To VacateKatrina MuliNo ratings yet

- Affidavit ManuelDocument2 pagesAffidavit ManuelKatrina MuliNo ratings yet

- Withdraw Lost Title AffidavitDocument1 pageWithdraw Lost Title AffidavitKatrina MuliNo ratings yet

- Withdraw Lost Title AffidavitDocument1 pageWithdraw Lost Title AffidavitKatrina MuliNo ratings yet

- 2.0 Organizational Analysis 2.1 Swot AnalysisDocument9 pages2.0 Organizational Analysis 2.1 Swot Analysisathirah jamaludinNo ratings yet

- Analyst or Associate or Investment Analyst or Research AnalystDocument2 pagesAnalyst or Associate or Investment Analyst or Research Analystapi-78345443No ratings yet

- Intro NotesDocument6 pagesIntro NotesDanielle DuranNo ratings yet

- Chapter 2: Rights and Conditions of MembershipsDocument4 pagesChapter 2: Rights and Conditions of MembershipsBerNo ratings yet

- May 2016 1463558230 152 PDFDocument2 pagesMay 2016 1463558230 152 PDFDR K DHAMODHARANNo ratings yet

- Cambridge University CV and Cover Letter Guide 1690127645Document43 pagesCambridge University CV and Cover Letter Guide 1690127645SaranyaNo ratings yet

- Case Study On Compensation AdministrationDocument2 pagesCase Study On Compensation AdministrationCathy Joyce SumandeNo ratings yet

- Aron Smith CV AssistantDocument2 pagesAron Smith CV Assistantdwiud33% (3)

- PART 2 (D) : Employment Information: OccupationDocument1 pagePART 2 (D) : Employment Information: OccupationAnwarNo ratings yet

- PwC's Corporate Values Plan Unifies Practices & Improves ClimateDocument4 pagesPwC's Corporate Values Plan Unifies Practices & Improves ClimatekarinaNo ratings yet

- Croma Electronics Megastore Ties-up with Microsoft for Connected HomesDocument11 pagesCroma Electronics Megastore Ties-up with Microsoft for Connected HomesShamshad ShaikhNo ratings yet

- Abhishek Mishra IHRM Models of Staffing AssignmentDocument5 pagesAbhishek Mishra IHRM Models of Staffing AssignmentAbhishek MishraNo ratings yet

- Case 6 Hewlett-Packard Company in VietnamDocument25 pagesCase 6 Hewlett-Packard Company in Vietnamrasha_fayez100% (7)

- Assignment 2 - Recruitment in A Changing Internal Labor MarketDocument8 pagesAssignment 2 - Recruitment in A Changing Internal Labor MarketMeriem DaoudiNo ratings yet

- Final Project of Rayeen SteelsDocument56 pagesFinal Project of Rayeen SteelsShiva PrasannaNo ratings yet

- Chapter 4: Creativity and The Product ConceptDocument3 pagesChapter 4: Creativity and The Product ConceptAngelica SolisNo ratings yet

- Fmla Cfra OutlineDocument44 pagesFmla Cfra OutlineRichNo ratings yet

- EXHIBIT 1 - HBMA Model Billing ContractDocument18 pagesEXHIBIT 1 - HBMA Model Billing Contractjhanine davidNo ratings yet

- Construction Project Management Thesis PDFDocument8 pagesConstruction Project Management Thesis PDFbsqkr4kn100% (2)

- Running a Successful Construction BusinessDocument14 pagesRunning a Successful Construction BusinessPrasanna S KulkarniNo ratings yet

- Roco, Ryan Jermon R. Corporation Law Block BDocument31 pagesRoco, Ryan Jermon R. Corporation Law Block BRyan RocoNo ratings yet

- BibliographyDocument5 pagesBibliographyPramod KrNo ratings yet