Professional Documents

Culture Documents

NTBCL Q1 FY2012 Financial Results

Uploaded by

Alok SinghalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NTBCL Q1 FY2012 Financial Results

Uploaded by

Alok SinghalCopyright:

Available Formats

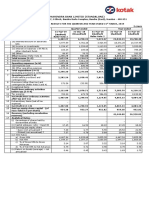

NOIDA TOLL BRIDGE COMPANY LIMITED

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED JUNE 30, 2011

(Rs. in Lacs)

SI.No.

ParticuIars

Quarter ended Quarter ended Year ended

30.06.2011 30.06.2010 31.03.2011

(Unaudited) (Unaudited) (Audited)

(1) (2) (3) (4) (5)

1 Net Sales / ncome from operations 2,121.96 2,105.79 8,431.18

TotaI Revenue 2,121.96 2,105.79 8,431.18

2 Total Expenditure

a) O & M Expenses 193.35 180.23 713.08

b) Consumption of Cards/On

Board units

1.72 3.92 15.26

c) Staff cost 94.62 143.41 492.38

d) Legal and Professional Charges 55.47 44.31 222.02

e) Advertisement and Business

promotion

4.25 3.44 16.58

f) Rates & Taxes 90.92 72.93 580.96

g) Other expenditure 27.48 36.09 165.82

h) Overlay 20.58 82.55

i) Depreciation/Amortisation 109.65 124.13 447.73

TotaI Expenditure 577.46 629.04 2,736.38

3

Profit (+) / Loss (-) from Operations

before Other ncome, nterest &

Exceptional items Activities before tax

(1-2)

1,544.50 1,476.75 5,694.80

4 Other ncome 68.27 32.81 300.69

5

Profit (+) / Loss (-) from before nterest

& Exceptional items Activities before

tax (3+4)

1,612.77 1,509.56 5,995.49

6 nterest 338.73 363.58 1,729.17

7

Profit (+) / Loss (-) after nterest &

before Exceptional items Activities

before tax (5-6)

1,274.04 1,145.98 4,266.32

8 Exceptional items - - -

9

Profit (+) / Loss (-) from Ordinary

Activities before tax (7-8)

1,274.04 1,145.98 4,266.32

10 Tax Expenses

- ncome Tax 262.07 228.40 928.48

- MAT Credit (242.32) (206.28) (829.69)

- Deferred Tax 109.00 116.50 418.23

11

Net Profit(+)/Loss(-) from Ordinary

Activities after tax (9-10)

1,145.29 1,007.36 3,749.30

12 Extraordinary items (Net of tax - - -

expense)

13

Net Profit (+) / Loss (-) for the period

(11-12)

1,145.29 1,007.36 3,749.30

14

Paid-up equity share capital

(Face Value Rs 10) 18,619.50 18,619.50 18,619.50

15 Paid-up Debt Capital 13,237.28 16,860.56 13,866.31

16

Reserves excluding Revaluation

Reserves as per balance sheet of

previous accounting year

26,989.06 24,187.49 25,843.77

17 Debenture Redemption Reserve 223.63 162.18 206.47

18 Earning Per Share (EPS)

a

Basic and diluted EPS before

extraordinary items for the period, for

the year to date and for the previous

year (not to be annualized)

0.62 0.54 2.01

b

Basic and diluted EPS after

extraordinary items for the period, for

the year to date and for the previous

year (not to be annualized)

0.62 0.54 2.01

19 Debt Equity Ratio 0.29 0.39 0.31

20 Debt Service Coverage Ratio (DSCR) 1.61 3.49 1.23

21

nterest Service Coverage Ratio

(SCR)

4.76 4.15 3.47

22 Public Shareholding

- Number of Shares 137,054,920 135,485,495 137,054,920

- Percentage of Shareholding 73.61% 72.77% 73.61%

23

Promoters and promoter group

Shareholding

a Pledged/Encumbered

- Number of Shares NL NL NL

- Percentage of Shares (as a % of

the total shareholding of promoter and

promoter group)

N/A N/A N/A

- Percentage of Shares (as a % of

the total share capital of the company)

N/A N/A N/A

b Non-encumbered

- Number of Shares 49095007 49095007 49095007

- Percentage of Shares (as a % of

the total shareholding of promoter and

promoter group)

100.00% 100.00% 100.00%

- Percentage of Shares (as a % of

the total share capital of the company)

26.37% 26.37% 26.37%

Notes:

1

The above results have been taken on record by the Board of Directors at a meeting held on July

21, 2011.

2

The Company had only one business segment and therefore reporting of segment wise

information under Clause 41 of the Listing Agreement is not applicable.

3

There was no complaint pending at the beginning of the quarter. The Company has received and

redressed seventeen complaints during the quarter and there were no complaints pending at the

end of the quarter.

4

No provision for overlay has been made during the quarter as provision for first overlay (which

was estimated to be performed during the year ended March 31, 2011) has already been made as

per independent consultant's report. The Company has appointed another consultant to evaluate

suitable method for carrying out overlay and advise on current estimate of the expenditure to be

incurred. Necessary adjustment, if any, will be made on completion of the overlay.

5

Permission to display advertisement was renewed by MCD subject to payment of monthly license

fee @ Rs 115/- per Sft. of the total display area or 25% of the gross revenue generated out of

display whichever is higher.

The Company contested the aforesaid imposition @ Rs.115 on the ground that same was not

permitted by the 2008 Outdoor Advertisement policy. On cancellation of the permission by

MCD for non payment @ Rs 115, Company has filed a writ petition before the High Court. The

Hon'ble High Court stayed the operation of the impungned order subject to NTBCL depositing

50% of License fee of Rs. 115/- per sqft.

Though the matter is sub judice the Company as an abundant caution, has decided to provide for

license fee as demanded by MCD in full. Necessary adjustment, if any, would be made on the

disposal of writ petition.

6 Coverage Ratios has been Calculated as under ;

a)

Debt Equity Ratio = Total Debt/(Paid-up Equity Share Capital+Reserves excluding Revaluation

Reserve)

b)

Debt Service Coverage Ratio= Profit before nterest,Exceptional tems & tax / (nterest+Principal

Repayment)

c)

nterest Service Coverage Ratio= Profit before nterest,Exceptional tems & tax / nterest

Expenses

7 Previous period figures have been regrouped / reclassified wherever necessary.

As per our separate report of even date

attached

For and on behaIf of the

Board of Directors

R.K.Bhargava

Chairman

Noida

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Cash Flows Statement - Two ExamplesDocument4 pagesCash Flows Statement - Two Examplesakash srivastavaNo ratings yet

- Seminar on Accounting Theory and PracticeDocument13 pagesSeminar on Accounting Theory and PracticeDEEPALI ANANDNo ratings yet

- Jamna Auto Industries Limited Unaudited ResultsDocument4 pagesJamna Auto Industries Limited Unaudited ResultspoloNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- UntitledDocument357 pagesUntitledAlexNo ratings yet

- Summer Internship ProjectDocument16 pagesSummer Internship ProjectpalakNo ratings yet

- Annual Report Highlights FY 2017-18Document40 pagesAnnual Report Highlights FY 2017-18shakeelahmadjsrNo ratings yet

- ATGL interim report analysisDocument11 pagesATGL interim report analysisparidhiNo ratings yet

- Unaudited Financial Results For The Quarter Ended 30Th June, 2011Document1 pageUnaudited Financial Results For The Quarter Ended 30Th June, 2011Ayush JainNo ratings yet

- 2000 5000 Corp Action 20220525Document62 pages2000 5000 Corp Action 20220525Contra Value BetsNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Finance Department Analysis of Dabur LimitedDocument15 pagesFinance Department Analysis of Dabur LimitedradhikaNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Ecobank GhanaDocument8 pagesEcobank GhanaFuaad DodooNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- Taxation: MD Mashiur Rahaman Robin KPMG-RRHDocument12 pagesTaxation: MD Mashiur Rahaman Robin KPMG-RRHZidan ZaifNo ratings yet

- Kotak Mahindra Bank Q4 FY19 standalone resultsDocument9 pagesKotak Mahindra Bank Q4 FY19 standalone resultsSumit SharmaNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- Ecobank Ghana Limited: Un-Audited Financial Statements For The Three-Month Period Ended 31 March 2022Document8 pagesEcobank Ghana Limited: Un-Audited Financial Statements For The Three-Month Period Ended 31 March 2022Fuaad DodooNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Paytm Annual Report-2021Document200 pagesPaytm Annual Report-2021PRANJAL GUPTANo ratings yet

- ACAPL - Outcome of BM - Finnancials - Asset Cover CertificateDocument23 pagesACAPL - Outcome of BM - Finnancials - Asset Cover CertificateShashi Bhushan PrinceNo ratings yet

- Reliance Infrastructure Limited Consolidated Segment-wise Revenue ResultsDocument2 pagesReliance Infrastructure Limited Consolidated Segment-wise Revenue ResultsShambhavi MishraNo ratings yet

- Ramco Annual Report 2014Document2 pagesRamco Annual Report 2014nithinNo ratings yet

- HCL Technologies: PrintDocument2 pagesHCL Technologies: PrintSachin SinghNo ratings yet

- National Alcohol & Liquor Factory Financial Statements for FY 2021Document74 pagesNational Alcohol & Liquor Factory Financial Statements for FY 2021Amanuel TewoldeNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- (A) Nature of Business of Cepatwawasan Group BerhadDocument16 pages(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingNo ratings yet

- UnauditedDocument30 pagesUnauditedSanjay KumarNo ratings yet

- Financial Results Q1 August 2018Document13 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- Statement of Profit and Losss Account For The Year Ended 31 ST March 2019Document9 pagesStatement of Profit and Losss Account For The Year Ended 31 ST March 2019Chirag SinghNo ratings yet

- D.M. Textile Mills Directors' Report Highlights Profits, ChallengesDocument3 pagesD.M. Textile Mills Directors' Report Highlights Profits, ChallengesZeeshan AzizNo ratings yet

- Discounted Cash FlowDocument9 pagesDiscounted Cash FlowAditya JandialNo ratings yet

- Financial Overview and Regulation G Disclosure Q2 2014Document10 pagesFinancial Overview and Regulation G Disclosure Q2 2014Christopher TownsendNo ratings yet

- History of The CompanyDocument5 pagesHistory of The CompanyAkshata HadimaniNo ratings yet

- Bharti Airtel's Financial PerformanceDocument14 pagesBharti Airtel's Financial PerformanceSuresh PandaNo ratings yet

- Hindalco Industries FY19-20 Financial ReportDocument14 pagesHindalco Industries FY19-20 Financial ReportJaydeep SolankiNo ratings yet

- Aimco Pesticides Limited Unaudited Financial Results for Year Ended June 2008Document3 pagesAimco Pesticides Limited Unaudited Financial Results for Year Ended June 2008manish_khabarNo ratings yet

- United Bank Limited and Its Subsidiary CompaniesDocument15 pagesUnited Bank Limited and Its Subsidiary Companieszaighum sultanNo ratings yet

- Blue Cloud Softech Solutions Limited: Bse LTDDocument3 pagesBlue Cloud Softech Solutions Limited: Bse LTDShyam SunderNo ratings yet

- Bajaj Aut1Document2 pagesBajaj Aut1Rinku RajpootNo ratings yet

- ACC Limited Reports 21% Rise in Consolidated SalesDocument12 pagesACC Limited Reports 21% Rise in Consolidated SalesKKVSBNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Global Auto PartsDocument33 pagesGlobal Auto Partssantosh pandeyNo ratings yet

- Devyani International Q3 ResultsDocument9 pagesDevyani International Q3 ResultsSaurabh AggarwalNo ratings yet

- Company Analysis On Force MotorsDocument16 pagesCompany Analysis On Force Motorskarna.sahithireddy21No ratings yet

- Panda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)Document172 pagesPanda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)geniuskkNo ratings yet

- Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)Document1 pageResubmission of Standalone Financial Results For December 31, 2014 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- KFin Technologies - Flash Note - 12 Dec 23Document6 pagesKFin Technologies - Flash Note - 12 Dec 23palakNo ratings yet

- Can Press Release Jun 2008Document5 pagesCan Press Release Jun 2008pranav5950No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CaseDocument3 pagesCaseAnawin FamadicoNo ratings yet

- Satin Creditcare Network Limited: Deepankshi Singla & Mallika YadavDocument18 pagesSatin Creditcare Network Limited: Deepankshi Singla & Mallika YadavMallikaNo ratings yet

- SBLC Format HSBC HKDocument2 pagesSBLC Format HSBC HKWinengku50% (8)

- 2 LetterDocument9 pages2 LetterSaif AzmanNo ratings yet

- Statement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Document2 pagesStatement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Sayan SarkarNo ratings yet

- Proximate CauseDocument4 pagesProximate CauseDavid GattNo ratings yet

- MAS16Document12 pagesMAS16Kyaw Htin Win50% (2)

- Truth About Imperial RussiaDocument3 pagesTruth About Imperial RussiaareliabijahNo ratings yet

- Financial PlanningDocument18 pagesFinancial PlanningckzeoNo ratings yet

- Suite Talk Web Services Records GuideDocument194 pagesSuite Talk Web Services Records GuideZettoX0% (1)

- App QDocument11 pagesApp Qkasi_raghav50% (2)

- Feasibility Report on Establishing Microfinance in Port MoresbyDocument164 pagesFeasibility Report on Establishing Microfinance in Port MoresbyterrancekuNo ratings yet

- Employees in BankDocument41 pagesEmployees in BankKasturiNo ratings yet

- Audit Glossary of TermsDocument37 pagesAudit Glossary of Termsiwona_lang1968No ratings yet

- Clinical Trials Insurance Proposal FormDocument8 pagesClinical Trials Insurance Proposal FormNamrathaNo ratings yet

- The Economics of Money Banking and Financial Markets 6th Canadian Edition by Mishkin - Test BankDocument34 pagesThe Economics of Money Banking and Financial Markets 6th Canadian Edition by Mishkin - Test BankerisalogicNo ratings yet

- Pengetahuan Cargo 2016Document121 pagesPengetahuan Cargo 2016danu yp100% (3)

- Edi - 20689603 - 20689603-Broker-Mrs Febylyn Rodrigue-07 - 04 - 2018-pdx35439512 PDFDocument6 pagesEdi - 20689603 - 20689603-Broker-Mrs Febylyn Rodrigue-07 - 04 - 2018-pdx35439512 PDFVenis ManahanNo ratings yet

- LienVietPostBank Profile 2018Document16 pagesLienVietPostBank Profile 2018Hoàng Tuấn LinhNo ratings yet

- Annual Report 2008Document83 pagesAnnual Report 2008Dhivya SivananthamNo ratings yet

- AudprobDocument3 pagesAudprobJonalyn MoralesNo ratings yet

- DV For MOOEDocument10 pagesDV For MOOELex AmarieNo ratings yet

- AICPA Released Questions AUD 2015 DifficultDocument26 pagesAICPA Released Questions AUD 2015 DifficultTavan ShethNo ratings yet

- Customer Satisfaction IndexDocument25 pagesCustomer Satisfaction IndexPrateek DeepNo ratings yet

- Información de Trading de Acciones - CysecDocument57 pagesInformación de Trading de Acciones - CysecMarcos CenturionNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument7 pagesInstitute of Actuaries of India: ExaminationsStranger SinhaNo ratings yet

- Fdd-1q-Deposit Kyckyc Final PrintDocument11 pagesFdd-1q-Deposit Kyckyc Final PrintBablu PrasadNo ratings yet

- Central Bank Names of Different CountriesDocument6 pagesCentral Bank Names of Different CountrieskalasriNo ratings yet

- US Internal Revenue Service: I1099ltc 07Document2 pagesUS Internal Revenue Service: I1099ltc 07IRSNo ratings yet

- Liability Insurance.Document62 pagesLiability Insurance.pankajgupta80% (5)