Professional Documents

Culture Documents

Reporting 1

Uploaded by

Mohsin AliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reporting 1

Uploaded by

Mohsin AliCopyright:

Available Formats

Unit

Islamic Perspective of Accounting

Topics in This Unit

1. 2. 3. 4. Introduction Meaning of Islamic Accounting Religion and Accounting An Explosive Mix ? A Prima-facie case for Islamic Accounting

Learning Outcomes

By the end of this unit, you should be able to:

Define and explain the concept of Islamic Accounting Argue that a separate accounting philosophy is required for Islamic Banking due to differences in worldviews. Differentiate between the Accounting for Islamic Institutions and Islamic Accounting Define and Differentiate the differences between conventional and Islamic Accounting

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting Unit 1|2

Key Terms

Capitalism

is an economic system in which the means of production are privately owned and operated for a private profit; decisions regarding supply, demand, price, distribution, and investments are made by private actors in the market

Worldview

fundamental cognitive orientation of an individual or society encompassing natural philosophy; fundamental existential and normative postulates; or themes, values, emotions, and ethics

Sharia AAOIFI Value free

Islamic Law Accounting and Auditing Organization for Islamic Financial Institutions Not altered by value judgements

Hence, O my people, [always] give full measure and weight, with equity, and do not deprive people of what is rightfully theirs, and do not act wickedly on earth by spreading corruption. That which rests with God is best for you, if you but believe [in Him]! However, I am not your keeper." (Hud, 11:8586)

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting Unit 1|3

Need for Islamic Accounting

All accounting activities will have an impact on the welfare of society in one way or another, i.e. having socioeconomic consequences. The emergence of Islamic banks as a significant force in several countries in the late-1970s has prompted researchers to consider the accounting implications. Islamic accounting was almost unheard of until Abdel-Magid (1981) in his seminal paper highlighted the need for accounting practices based on sharia principles to cater for Islamic banks that began to emerge at that time. The growth of Islamic banking in the early 1990s resulted in more scholarly research into Islamic accounting but they are either not written in English, and the English-language literature tends to be published in nonmainstream accounting journals (Napier and Haniffa, 2010)or the internet.

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting Unit 1|4

1.1

INTRODUCTION

To professional accountants and those who have received a conventional accounting education and who have been brought-up on the idea of accounting as an objective, technical and value-free discipline, the idea of attaching a religious adjective to accounting may seem to be embarrassing and unprofessional. On the other hand, the development of Islamic banking and finance now embraced even by ardent capitalist institutions such as Citibank, HSBC and ANZ banks may interest accountants and other job seekers to the possibility of new opportunities in this new discipline. Perhaps, the Enron affair has rekindled an interest in having a more honest profession who truly care about the public interest in addition to their pockets. Whatever the interest or curiosity, we hope readers will find this chapter (and hopefully the entire book) interesting, informative, and profitable and yes we hope it may even lead to a bit of soul searching. In this chapter, what is meant by the term Islamic accounting is explained, together with a discussion of the main differences between Islamic and conventional accounting. Justifications for the addition of the world Islamic, to the word accounting is provided, along with a prima facie case for Islamic accounting. Finally the distinction between accounting for Islamic banks and Islamic accounting, which is presently thought of by many people as synonymous, is made.

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting Unit 1|5

accounting for Islamic banks is a subset of Islamic accounting . The latter covers a wider scope including accounting for takaful,sukuk, waqf, zakat and Islamic businesses.

1.2

MEANING OF ISLAMIC ACCOUNTING

Islamic accounting can be defined as the accounting process which provides appropriate information (not necessarily limited to financial data) to stakeholders of an entity which will enable them to ensure that the entity is continuously operating within the bounds of the Islamic Sharia and delivering on its socioeconomic objectives. Islamic accounting is also a tool, which enables Muslims to evaluate their own accountabilities to God (in respect of inter-human/environmental transactions).

Figure 1.1

Islamic Accounting and Accountability

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting Unit 1|6

The diagram illustrates the purpose of Islamic accounting. Muslims believe in the hereafter. All business activities should be in line with the sharia or Islamic law, including business. In life, people transact through institutions such as business. These activities are classified, recorded and summarized using a philosophic filter (sharia standards) and to Islamic produce accounting accounting

Islamic Accounting The system of accounting which enableMuslims to discharge their accountabilities to Allah, by providing relevant information on the compliance of the company to shariah principles.

statements, which people act on. If the information produced is useful and

appropriate to make economic or social decisions through a moral framework, then the users will act in ways to correct their sins and increase good behaviour

leading to Gods pleasure in the hereafter. If the accounting information system misinforms or does not provide appropriate information, the business might be undertaking sinful activities, the responsibility for which will be borne by the investor as he is a participant. This may lead him to Hell. The meaning of Islamic accounting would be clearer if we compare this with the definition of conventional accounting. (Conventional)

accounting as we know is defined to be the identification, recording, classification, interpreting and communication economic events to permit users to make informed decisions (AAA, 1966). From this, it can be seen that both Islamic and conventional accounting is in the business of providing information. The differences lie in the following: The objectives of providing the information

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting Unit 1|7

What type of information is identified, and how is it measured and valued, recorded and communicated, and To whom is it communicated (the users)

Conventional accounting aims to permit informed decisions by users, whose ultimate purpose is to efficiently allocate scarce resources available to their most efficient (and profitable) uses by providing information efficiency in the market (FASB, 1978). Apparently this is achieved by the user making the appropriate, buy, sell or hold decisions on their investments. Islamic Accounting, on the other hand, hopes to enable users to ensure that Islamic organisations (whether business, government or NFP) abide by the principles of the Sharia or Islamic Law in its dealings and enables the assessment of whether the objectives of the organisation are being met. At the very basic level, it can be said that Islamic organisations (whether business or otherwise) differ from their conventional counterparts by having to adhere to certain Sharia principles and rules and also try to achieve certain socio-economic objectives encouraged by Islam. Following from the above, the type of information which Islamic accounting identifies and measures is different. Conventional accounting concentrates on identifying economic events and transactions, while Islamic accounting must identify socio-economic and religious events and transactions. Older accountants may still remember when they first learnt accounting. They had to prepare final accounts (i.e. balance sheet and profit and loss account). However, Americanization of the curriculum has popularised the term financial statements. Hence, the concentration of accounting has moved from stewardship based

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting Unit 1|8

manorial accounts to accounting for money (accentuated by the monetary measurement concept). This is not to say that Islamic accounting is not concerned with money (especially when accounting for businesses). On the contrary due to prohibition of interest-based income or expense, profit determination is more important in Islamic accounting than conventional accounting. However, Islamic accounting must be holistic in its reporting. Hence, both financial and non-financial measures regarding the economic, social, environmental and religious events and transactions are measured and reported. Conventional accounting mainly uses historic cost (or lower) to measure and values assets and liabilities (although the new IFRS seeks to introduce fair value measurements). The profession is well aware of the limitations of the stable unit of measure assumption of the monetary unit and to its credit has tried in the past in its inflation accounting initiatives. However, despite recommendation from its own research efforts (True blood committee?), the idea of using current values was given up due to its complexity and presumed lack of verifiability. From an Islamic point of view, at least for the purpose of computation of Zakat, current valuation is obligatory (see for example, Clarke et al, 1996) prompting calls for a current value Balance Sheet (Baydoun and Willet, 2000). A further difference is, Islamic accounting may require a different statement altogether to deemphasize the focus on profits by the income statement provided by conventional accounting. Baydoun and Willlet (2000) have suggested a Value Added Statement to replace the Income Statement in Islamic Corporate Reports. They argue that this shows and

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting Unit 1|9

encourages a cooperative environment in business as opposed to a destructive competitive environment. The third category of differences is in the users of the information. Although the profession has recognised various stakeholders as users of accounting information (see for example, the Corporate Report, 1975), the users which it focuses on are shareholders and creditors (i.e. Financiers those who provide the funds). This is obvious from the fact the FASBs SFAC 1 dismisses a whole range of stakeholders by the term and others. From recent developments in finance and financial markets, accounting seems to be serving an elite group of financiers market players and banks and other financial institutions. It has been accused of helping a group of rich people get richer (Gray et al., 1996)- a grave charge since the profession always justifies its monopoly on audit services by virtue of the public interest. Islamic accounting serves the whole gamut of stakeholders. Society as a whole can make corporations accountable for their actions and ensure they comply with Sharia principles and do not harm others while making money ethically and achieve an equitable allocation and distribution of wealth among members of society especially the stakeholders of the concerned corporation.

1.3

RELIGION AND ACCOUNTING- AN EXPLOSIVE MIX?

Now we come to the question, is it wise to add the adjective Islamic to accounting? Why not accounting for Islamic organisations or accounting

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 10

from the Islamic perspective? The worry is that the addition of any religious adjective may compromise the objectivity of the discipline as religion is mostly seen as an unchanging dogma and code not subject to pragmatic or logical considerations. We will take this matter in two stages:

a) Is conventional accounting value free and objective as it portrayed to be or is there a hidden adjective attached to it? b) The problem of epistemology- the nature and sources of knowledge

What are the implicit assumptions behind the theory and practice of conventional accounting, in other words what is the worldview behind conventional accounting? Some years back, European and communist states adopted different systems of accounting. In a centrally planned or a socialist state, there is a lack of profit motive or not too much of it. Hence, the conventional accounting i.e. profit and loss account, balance sheet did not make much sense in that economic system. This is why the accounting profession never developed in the communist countries. It is only after liberalisation i.e. conversion to capitalism that these states are trying to catch up with the West. A little more reflection and we come to the conclusion that the conventional accounting system in which many of us were educated and work in is in fact Capitalist Accounting. The adjective capitalist is not used before the word accounting, because it would then not appear neutral as capitalism is a philosophy and many ways a religion. Its sacred symbols are private property, the hudud (literal meaning the definitive borders) of the market and its God- wealth, for the creation of which,

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 11

business and finance exists. Capitalism is not only the economic system which allows choices and opportunities but a philosophy and religion which forsakes equity for efficiency and the wants of a few for the needs of the many. It can be said to be the dominant religion of the world (both in Muslim and Non-Muslim countries). Hence, to call a spade, a spade, accounting should be renamed capitalist accounting, economics as capitalist economics and so forth. Hence, faculty of economics in our universities should be renamed faculty of capitalist economics. However, we do not do so because it is unnecessary as it is assumed and implicit. Due to the non-explicitness of this

assumption, we sometime forget that accounting is not objective, neutral and value-free as it is portrayed to be. Secondly, we discuss the problem of epistemology which is the theory of the nature and sources of knowledge. Ever since the enlightenment period in European history, science has gained the upper hand and has replaced religion as the authority in defining what is knowledge. Modern research emphasises positivism i.e. what is. Knowledge is only what is perceptible through our senses through observation and experiment or what appears logical to our mind. Revelation is not considered a source of knowledge as religious truths cannot be verified by our senses. Accounting is considered a science (many US and UK universities use MS or MSc not MA for post graduate accounting programs) and as such mixing religion with accounting may be considered unprofessional. However, as Chapra (2000) argues science and religion deals with different levels of reality. While sciences deal with the physical universe perceptible by the senses, religion deals with a higher level of reality which is transcendental and beyond the sense of perception. The sources

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 12

of scientific knowledge are reason and its method observation and experiment. It describes and analyzes what is and tries to predict what will happen in the future (e.g. forecast earnings from models). When dealing with the physical universe, it is exact in its description and analysis and more accurate in its predictive power (e.g. in Physics or Chemistry). However, when it deals with human beings who do not behave in a consistent manner, unlike the revolution of the planets above, its analysis is less precise and its predictions less accurate. The recent move by the Malaysian Securities Commission on insistence of a +/-10% accuracy level on profit forecasts reports by accountants has given a headache for accountants as forecasting market prices is not an accurate science as it deals with behaviour of human beings in the marketplace. Unlike science, religion depends on Revelation as well as reason for its knowledge. Its objective is to help transform the human condition from what is (e.g. Enron, WorldCom) to what should be (perhaps, Johnson & Johnson under Burke). It should bring about individual and social change to conform to its worldview, values and institutions that it provides. The ultimate objective of both science and religion is to bring about the well-being of human beings. One addresses the physical and material while the other addresses the social, mental, emotional and the spiritual. Chapra (2000) further argues that if both of these are important, then both science and religion can better serve mankind by greater cooperation and coordination between them. Religion can help science by reminding it of its ultimate objectives and limitations, to use the power and mastery over the universe for well-being rather than

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 13

destruction. Science can help religion by helping it realise what ought to be by providing a better description of what is , facilitating prediction and providing better technology for a more efficient use of all available resources. It can thus be seen that rather then becoming an explosive mix, the mixing of science and religion can be fruitful and in fact serve to stabilise society from the instability of a world dominated either by science or religion alone. Hence, we conclude that the addition of the adjective Islamic before accounting will not affect the objectivity of accounting.

1.4

A PRIMA-FACIE CASE FOR ISLAMIC ACCOUNTING

Accounting is a tool to achieve certain objectives. In order to be useful, it must be relevant to its purpose. The purpose of accounting has been extended by the American Accounting Association in 1975 (presumably concerned to promote the public interest responsibility of the profession) which defined the purpose of accounting thus: to permit informed decisions which will enable scarce resources to be allocated efficiently thereby achieving social welfare. Hence, like it or not, the accounting profession is entrusted with the responsibility of helping to achieve social welfare by providing its services.

It is common sense, that one must use the right tool for the right job. If one were to use a sledgehammer to crack a nut, the end result would be

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 14

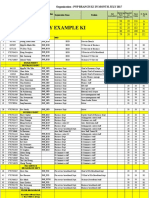

paste instead of nuts! Hence, Islamic accounting may be more appropriate to achieve the socio-economic and religions objectives of Islamic institutions and Muslim users. The diagram below (Shahul, 2001) shows the situation of match and mismatch.

Briefly, Islamic institutions (1) such as Islamic banks or the Lembaga Tabung Haji in Malaysia etc. are established to meet the socio-economic objectives of the Sharia (Islamic Law) through the implementation of an Islamic economic and financial system. Hence, these institutions should logically use Islamic accounting (2), especially for monitoring these institutions to achieve their objectives which are different from capitalist institutions. If such a system is used, then Muslim users (as homeo Islamicus) will make decisions in a manner congruent with Islamic values (3) and will inshaAllah achieve the socioeconomic objectives of the sharia (4), thereby strengthening the Islamic economic and financial system (5). However, if conventional accounting which developed to meet the needs of a capitalist economy is used instead in these institutions (2A), a mismatch is likely. This will lead to the institutions not meeting the Shariate socio-economic objectives and even worse may turn these Islamic institutions into capitalist institutions (4A) by providing materialist profit-focused information instead of the holistic information provided by Islamic accounting. This will lead to Muslim users making decisions incongruent with Islamic values but congruent with capitalist values (3A) and thus it is the socio-economic objectives of the capitalist system (5A) which will be achieved, not the socioeconomic objectives of the sharia.

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 15

5A. THE SOCIO-ECONOMIC OBJECTIVES OF THE SECULAR CAPITALIST ECONOMIC SYSTEM

4 .THE SOCIO -ECONOMIC OBJECTIVES OF THE SHARIA

4A. CAPITALIST ECONOMIC INSTITUTIONS

5. THE ISLAMIC ECONOMIC SYSTEM & FINANCIAL SYSTEM

1. ESTABLISHMENT OF ISLAMIC SOCIOECONOMIC INSTITUTIONS 2A. USE OF CONVENTIONAL ACCOUNTING BASED ON SECULAR PHILOSOPHICAL VALUES INCONSISTENT WITH ISLAMIC VALUES

2. USE OF ISLAMIC ACCOUNTING CONSISTENT WITH ISLAMIC VALUES

3A. INCONSISTENT OR DEVIANT DECISION MAKING OF MUSLIM USERS (HOMEO ECONOMICUS)

3. CONSISTENT DECISION MAKING IN LINE WITH ISLAMIC NORMS (HOMEO ISLAMICUS)

Figure 1.1 RESULT OF INCONGRUENCY BETWEEN ECONOMIC SYSTEM AND ACCOUNTING SYSTEM SSYSTEMSYSTEMSYSTEM(Source; shahul, 2001)

It can thus be seen that it is not at all unscientific or objectionable, to use Islamic accounting and would in fact be more logical to use it as it would result in an ethical based accounting system which measures not only profits but social, environmental and religious performance.

Finally, it must be borne in mind that accounting for Islamic banks and financial institutions is not Islamic Accounting but only a subset of it. Although the efforts of AAOFI must be commended for developing standards for Islamic Financial Institutions, not all Islamic Institutions

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 16

are Financial Institutions. Islamic accounting is not the just technicalities of accounting for Islamic financial instruments employed by Islamic banks but much more requiring whole new areas of performance measurement including the social, environmental, economic and the Shariate.

Figure 1.2

Components of Islamic Accounting

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 17

Summary

Summary Point 1: It is contended that Islamic banks require a different accounting system to meet the objectives for which they were established. Failure to use an appropriate Islamic accounting system may result in their not achieving their socio- economic objectives as envisaged by their founders, and in fact may result in Islamic banks becoming completely capitalistic institutions.

Summary Point 2: The concept of Islamic accountability is a dual accountability concept, where in a situation where investors endow resources to a company run by professional managers who are contracted to run the company, the managers do not only have an accountability relationship to the investors but also to other stakeholders including the community and the environment. In effect by discharging these dual accountabilities they are in fact discharging their accountability to Allah or God.

Summary Point 3: It is contended that there is no danger in adding the adjective Islamic to accounting, as accounting is not value free or objective as generally propounded by its priests , the professional accountants. It in fact reflects the values of the socio-economic system it is developed and used.

Summary Point 4: Islamic accounting is sometimes used interchangeably with accounting for Islamic banks. This is strictly not true it covers a broader scope of institutions and practices such as takaful, Islamic businesses, waqf and zakat institutions and Islamic government.

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 18

Multiple Choice

1. What kind of standards are issued by the Accounting & Auditing Organization for Islamic Financial Institutions (AAOIFI)? A. Accounting and Auditing.

B. Accounting, Auditing and Governance.

C. Accounting, Auditing, Governance and Ethics and Sharia.

D. Accounting, Auditing, Governance and Sharia

2. How is Accounting for Islamic banks related to Islamic Accounting?

A. The same Accounting

as

Islamic

B. Subset of Accounting

Islamic

C. The same as accounting for Islamic financial institutions

D. The same as reporting for Islamic financial transactions.

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 19

3. Identify the main pull factor for the A. The establishment of development of Islamic accounting. Islamic financial institutions

B. The establishment Islamic republics

of

C. The establishment of Islamic business organizations

D. The establishment zakat

of

4. What is NOT a difference between Islamic A. The objectives of And Conventional Accounting. providing the information

B. What type of information is identified, and how is it measured and valued, recorded and communicated

C. The people who prepare the accounting reports.

D. To

whom

is

it

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 20

communicated 5. Identify the category which does NOT fall A. Accounting for Takaful under Islamic Accounting. B. Accounting for Waqfs

C. Accounting Trading

for

Debt

D. Accounting for Islamic Banking and Financial Institutions 6. The need for separate a separate field of A. Different Business models Islamic Accounting is based on being used by Islamic and Conventional Institutions

B. Different Target Market of Customers

C. Difference in Worldview on which business practices and instruments are based

D. Difference in the users and investors in an Islamic Bank. 7. Which is of the following is a specific A. Balance Sheet accounting report for Islamic Banks only.

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 21

B. Statement of Sources and Uses of Zakat

C. Profit & Loss Statement

D. Statement of Changes in Shareholders Equity E.

Questions and Problems

Question 1 a) Discuss the concept of Allahs bottom line as enunciated by Shahul and Karbhari (2007)

b) What Islamic accounting/auditing concepts can be inferred from the verse 2:282 from the Al-Quran translated below:

O ye who believe! When ye deal with each other, in transactions involving future obligations in a fixed period of time, reduce them to writing Let a scribe write down faithfully as between the parties: let not the scribe refuse to write: as Allah Has taught him, so let him write. Let him who incurs the liability dictate, but let him fear His Lord Allah, and not diminish aught of what he owes. If they party liable is mentally deficient, or weak, or unable Himself to dictate, Let his guardian dictate faithfully, and get two witnesses, out of your own men, and if there are not two men, then a man and

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 22

two women, such as ye choose, for witnesses, so that if one of them errs, the other can remind her. The witnesses should not refuse when they are called on (For evidence). Disdain not to reduce to writing (your contract) for a future period, whether it be small or big: it is juster in the sight of Allah, More suitable as evidence, and more convenient to prevent doubts among yourselves but if it be a transaction which ye carry out on the spot among yourselves, there is no blame on you if ye reduce it not to writing. But take witness whenever ye make a commercial contract; and let neither scribe nor witness suffer harm. If ye do (such harm), it would be wickedness in you. So fear Allah. For it is God that teaches you. And Allah is well acquainted with all things. (Al Baqarah 2:282) (INCEIF, MIF, May 2009)

Question 2 Is Islamic accounting and Accounting for islamic banks the same? Explain. (INCEIF, CIFP, Jan2009)

Question 3 i. Explain the accounting principles enunciated in the Quranic verses 2:282 (AL BAQARAH) and verses 11:85-86(Hud), reproduced below in relation to the primary financial statements i.e. the Balance Sheet and Income Statement.

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 23

2:282 O ye who believe! When ye deal with each other, in transactions involving future obligations in a fixed period of time, reduce them to writing Let a scribe write down faithfully as between the parties: let not the scribe refuse to write: as Allah Has taught him, so let him write. Let him who incurs the liability dictate, but let him fear His Lord Allah, and not diminish aught of what he owes. If they party liable is mentally deficient, or weak, or unable Himself to dictate, Let his guardian dictate faithfully, and get two witnesses, out of your own men, and if there are not two men, then a man and two

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 24

women, such as ye choose, for witnesses, so that if one of them errs, the other can remind her. The witnesses should not refuse when they are called on (For evidence). Disdain not to reduce to writing (your contract) for a future period, whether it be small or big: it is juster in the sight of Allah, More suitable as evidence, and more convenient to prevent doubts among yourselves but if it be a transaction which ye carry out on the spot among yourselves, there is no blame on you if ye reduce it not to writing. But take witness whenever ye make a commercial contract; and let neither scribe nor witness suffer harm. If ye do (such harm), it would be wickedness in you. So fear Allah. For it is God that teaches you. And Allah is well acquainted with all things.

)88:11( )88:11(

Hence, O my people, [always] give full measure and weight, with equity, and do not deprive people of what is rightfully theirs, [118] and do not act wickedly on earth by spreading corruption. That which rests with God [119] is best for you, if you but believe [in Him]! However, I am not your keeper." (Hud, 11:85-86)

(INCEIF, CIFP, Jan 2009)

Question 4 Islamic Banks face unique accounting problems both from a technical and philosophical point of view. Describe ANY FOUR (4) of these (INCEIF, CIFP, Jan 2010)

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

Islamic Perspective of Accounting U n i t 1 | 25

Shahul Hameed(2000b), Nurtured by Kufr: The underlying philosophic assumptions of conventional accounting, International Journal of Islamic Financial Services, Vol 2, No.2, Sept 2000. Shahul (2002) : Islamic Accounting- Accounting for the new Millenium, paper presented at the IIUM International Accounting Conference I, Kota Bahru, Kelantan, 2001. Haniffa, R. (2002), Social Reporting Disclosure: An Islamic Perspective, Indonesian Management and Accounting Research, Vol 1. No.2. Shahul Hameed (2000), The need for Islamic Accounting. Unpublished Phd Dissertation, University of Dundee. Shahul Hameed and Yusuf Karbhari (2006),Allahs bottom line: Reorienting Accounting for Islamic Finance, Paper presented at the Islamic Law Symposium, School of Oriental and African Studies, University of London. AAOIFI (2011), Statement of Financial Accounting 1 Objectives of Financial Accounting for Islamic Banks.

References

www.iium.edu.my/iaw http://sites.google.com/site/islamicaccountingweb/Home/introduction www.aaoifi.com

Web References

INTERNATIONAL CENTRE FOR EDUCATION IN ISLAMIC FINANCE 2011/1432 AH IE 1002 Reporting of Islamic Financial Transactions

CIFP

You might also like

- Spare Part PhilosophyDocument27 pagesSpare Part Philosophyavaisharma50% (2)

- The Objectives of Islamic AccountingDocument3 pagesThe Objectives of Islamic AccountingNur Rasyidah Ab HalimNo ratings yet

- CP-104 Accounting For ManagersDocument662 pagesCP-104 Accounting For ManagersRenjith Ranganadhan100% (1)

- Islamic Accounting-Article 3Document7 pagesIslamic Accounting-Article 3Mohd Firdaus Abd LatifNo ratings yet

- Accounting Science or ArtDocument10 pagesAccounting Science or ArtMandeep Batra100% (8)

- The Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceFrom EverandThe Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceNo ratings yet

- Meaning of Islamic AccountingDocument19 pagesMeaning of Islamic Accountingturk66650% (2)

- CHP 1 Abdur Rahman Abdur Raheem Introduction To Islamic Accounting Practice and Theory 9 32Document24 pagesCHP 1 Abdur Rahman Abdur Raheem Introduction To Islamic Accounting Practice and Theory 9 32Asfa AsfiaNo ratings yet

- Islamic Accounting Vs Conventional Accounting - Assigment 2Document3 pagesIslamic Accounting Vs Conventional Accounting - Assigment 2ahmedNo ratings yet

- Islamic Accounting Vs Conventional Accounting - Assigment 2Document3 pagesIslamic Accounting Vs Conventional Accounting - Assigment 2ahmedNo ratings yet

- The Objectives of Providing The Information: Tutorial 2 Q7Document2 pagesThe Objectives of Providing The Information: Tutorial 2 Q7Dira AlwanNo ratings yet

- An Introduction To Islamic Accounting Theory and Practice PDFDocument256 pagesAn Introduction To Islamic Accounting Theory and Practice PDFArif Witjaksoeno100% (6)

- Islamic Accounting Case StudyDocument9 pagesIslamic Accounting Case StudyRabeeka SiddiquiNo ratings yet

- Financial Accounting For Islamic Banking Products: Learning ObjectivesDocument21 pagesFinancial Accounting For Islamic Banking Products: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- 28890cpt Fa SM Cp1 Part1Document0 pages28890cpt Fa SM Cp1 Part1Vikas ZurmureNo ratings yet

- Financial Accounting Topic: Case Study Case Name: Islamic Accouting DATE: 22.FEB.2021Document4 pagesFinancial Accounting Topic: Case Study Case Name: Islamic Accouting DATE: 22.FEB.2021fatima waqarNo ratings yet

- The Disclosure of Islamic Values - Annual Report The Analysis of Bank Muamalat Indonesia'S Annual ReportDocument12 pagesThe Disclosure of Islamic Values - Annual Report The Analysis of Bank Muamalat Indonesia'S Annual ReportSiska AgustiNo ratings yet

- Branches of AccountingDocument3 pagesBranches of Accountinglorealla anjela diazonNo ratings yet

- Application of Sharia Accounting Principles in Sharia Financial InstitutionsDocument7 pagesApplication of Sharia Accounting Principles in Sharia Financial InstitutionsThe IjbmtNo ratings yet

- Islamic Financial and Accounting ConceptsDocument22 pagesIslamic Financial and Accounting Conceptsvishiran sathyasalanNo ratings yet

- Lecture 7Document44 pagesLecture 7Amran Bin Ismail RunsNo ratings yet

- Islamic Finance and Their Financial Growth Verses Their Maqasid Al-ShariahDocument54 pagesIslamic Finance and Their Financial Growth Verses Their Maqasid Al-Shariahmughees100% (1)

- Islamic Finance and Their Financial Growth Verses Their Maqasid Al ShariahDocument54 pagesIslamic Finance and Their Financial Growth Verses Their Maqasid Al ShariahNader MehdawiNo ratings yet

- Compare The Characteristic of Islamic Accounting Versus ConventionalDocument13 pagesCompare The Characteristic of Islamic Accounting Versus ConventionalHafiz BajauNo ratings yet

- Introduction To AccountingDocument20 pagesIntroduction To AccountingJosh ChuaNo ratings yet

- Basic Accounting PrincipleDocument17 pagesBasic Accounting PrincipleGilbert LimNo ratings yet

- Accounting For ManagementDocument662 pagesAccounting For Managementdorababu2007100% (1)

- FUNACC MIDTERM WPS Office 2Document9 pagesFUNACC MIDTERM WPS Office 2Althea Anne AcaboNo ratings yet

- Conventional Accounting Versus Sharia Accounting: Reconciliation of Perception To Achieve Spiritual MeaningDocument6 pagesConventional Accounting Versus Sharia Accounting: Reconciliation of Perception To Achieve Spiritual Meaninggrizzly hereNo ratings yet

- Accounting For ManagersDocument289 pagesAccounting For ManagersEliecer Campos Cárdenas100% (2)

- Notes For MBA 2Document254 pagesNotes For MBA 2Pramod Vasudev100% (1)

- 1-Compare The Characteristic of Islamic Accounting Versus ConventionalDocument13 pages1-Compare The Characteristic of Islamic Accounting Versus ConventionalHafiz BajauNo ratings yet

- TKM Institute of Management, Kollam Study Notes, Semester I Accounting For ManagersDocument28 pagesTKM Institute of Management, Kollam Study Notes, Semester I Accounting For ManagersAhsan DileepNo ratings yet

- Unit 1 Accounting Meaning Scope and PrinciplesDocument32 pagesUnit 1 Accounting Meaning Scope and Principlesmohammed1abdul1ale_1100% (1)

- Accounting SystemsDocument1 pageAccounting SystemsHafij UllahNo ratings yet

- Islamic IndividualDocument1 pageIslamic IndividualFatin Amo LorghNo ratings yet

- Islamic Accounting StandardsDocument64 pagesIslamic Accounting StandardsDawood Mohmand50% (2)

- Module Sample ShsDocument8 pagesModule Sample ShsJoke JoNo ratings yet

- Napier Haniffa Introduction To Islamic Accounting 2011Document14 pagesNapier Haniffa Introduction To Islamic Accounting 2011OwlNo ratings yet

- ASL FahrudinDocument5 pagesASL FahrudinIwan FakhruddinNo ratings yet

- Islamic Accounting Need or FormalityDocument24 pagesIslamic Accounting Need or Formalityoma1100No ratings yet

- ABM - 1 Fundamentals of Accounting Part 2Document39 pagesABM - 1 Fundamentals of Accounting Part 2Manny HermosaNo ratings yet

- Accounting For ManagersDocument287 pagesAccounting For ManagersmenakaNo ratings yet

- Fabm 1 - Week 1Document5 pagesFabm 1 - Week 1FERNANDO TAMZ2003No ratings yet

- Accounting Standards and Islamic Financial Institutions: The Malaysian ExperienceDocument6 pagesAccounting Standards and Islamic Financial Institutions: The Malaysian ExperienceDev Indran MuniandyNo ratings yet

- Notes in ACCTG 11 Lesson 1Document10 pagesNotes in ACCTG 11 Lesson 1Jeasa LapizNo ratings yet

- ACCOUNTING Full Module PDFDocument61 pagesACCOUNTING Full Module PDFmariel suingNo ratings yet

- Islamic Accounting in Indonesia: A Review From Current Global SituationDocument24 pagesIslamic Accounting in Indonesia: A Review From Current Global SituationAgus ArwaniNo ratings yet

- 1 Fundamentals of Islamic AccountingDocument14 pages1 Fundamentals of Islamic Accountingfidha Pa100% (1)

- Islamic Accounting: Introduction To IA: Foundation & DevelopmentDocument52 pagesIslamic Accounting: Introduction To IA: Foundation & DevelopmentNuranis QhaleedaNo ratings yet

- Financial Accounting Part IDocument18 pagesFinancial Accounting Part Idannydoly100% (1)

- AFM - MBA-1ST SemDocument440 pagesAFM - MBA-1ST SemSunny Mittal50% (2)

- Atp T4 Q2Document1 pageAtp T4 Q2Ling Xuan ChinNo ratings yet

- Tuto IADocument7 pagesTuto IAShangita Suvarna GangarajNo ratings yet

- Accounting For ManagersDocument286 pagesAccounting For ManagersSatyam Rastogi100% (1)

- Principles of Islamic Finance: New Issues and Steps ForwardFrom EverandPrinciples of Islamic Finance: New Issues and Steps ForwardNo ratings yet

- The Simplified Guide to Not-for-Profit Accounting, Formation, and ReportingFrom EverandThe Simplified Guide to Not-for-Profit Accounting, Formation, and ReportingNo ratings yet

- Group 5Document25 pagesGroup 5Mohsin AliNo ratings yet

- Re Engineering Structural ProceduresDocument22 pagesRe Engineering Structural ProceduresMohsin AliNo ratings yet

- DEPOSITSMOBILAZATIONDocument226 pagesDEPOSITSMOBILAZATIONMohsin AliNo ratings yet

- IB1005 TableofcontentDocument1 pageIB1005 TableofcontentMohsin AliNo ratings yet

- Challenges Facing Islamic BankingDocument92 pagesChallenges Facing Islamic BankingMohamed Elgazwi88% (8)

- Shariah Aspects AssignmentDocument21 pagesShariah Aspects AssignmentMohsin AliNo ratings yet

- SH 1003-Shariah Rules AssignmentDocument36 pagesSH 1003-Shariah Rules AssignmentMohsin AliNo ratings yet

- SecurityFund PPT 1.1Document13 pagesSecurityFund PPT 1.1Fmunoz MunozNo ratings yet

- Verniers Micrometers and Measurement Uncertainty and Digital2Document30 pagesVerniers Micrometers and Measurement Uncertainty and Digital2Raymond ScottNo ratings yet

- CRISTIAN COLCERIU - PERSONALITATI CLUJENE Prof - Dr.ing - POMPILIU MANEADocument21 pagesCRISTIAN COLCERIU - PERSONALITATI CLUJENE Prof - Dr.ing - POMPILIU MANEAcristian colceriu100% (2)

- Aribah Ahmed CertificateDocument2 pagesAribah Ahmed CertificateBahadur AliNo ratings yet

- Crisis of The World Split Apart: Solzhenitsyn On The WestDocument52 pagesCrisis of The World Split Apart: Solzhenitsyn On The WestdodnkaNo ratings yet

- 1 PBDocument7 pages1 PBIndah Purnama TaraNo ratings yet

- Lesser Known Homoeopathic Medicines of Alopecia Areata.20200718115446Document9 pagesLesser Known Homoeopathic Medicines of Alopecia Areata.20200718115446BruntNo ratings yet

- Low Voltage Switchgear Specification: 1. ScopeDocument6 pagesLow Voltage Switchgear Specification: 1. ScopejendrikoNo ratings yet

- Hw10 SolutionsDocument4 pagesHw10 Solutionsbernandaz123No ratings yet

- Case 3 SectionC Group 1 (Repaired)Document3 pagesCase 3 SectionC Group 1 (Repaired)SANDEEP AGRAWALNo ratings yet

- Operator'S Manual Diesel Engine: 2L41C - 2M41 - 2M41ZDocument110 pagesOperator'S Manual Diesel Engine: 2L41C - 2M41 - 2M41ZMauricio OlayaNo ratings yet

- Designing and Drawing PropellerDocument4 pagesDesigning and Drawing Propellercumpio425428100% (1)

- Green Dot ExtractDocument25 pagesGreen Dot ExtractAllen & UnwinNo ratings yet

- Ismb ItpDocument3 pagesIsmb ItpKumar AbhishekNo ratings yet

- Aero Ebook - Choosing The Design of Your Aircraft - Chris Heintz PDFDocument6 pagesAero Ebook - Choosing The Design of Your Aircraft - Chris Heintz PDFGana tp100% (1)

- PNP Ki in July-2017 AdminDocument21 pagesPNP Ki in July-2017 AdminSina NeouNo ratings yet

- Nfpa 1126 PDFDocument24 pagesNfpa 1126 PDFL LNo ratings yet

- Alphabetic KnowledgeDocument8 pagesAlphabetic KnowledgejsdgjdNo ratings yet

- On Animal Language in The Medieval Classification of Signs PDFDocument24 pagesOn Animal Language in The Medieval Classification of Signs PDFDearNoodlesNo ratings yet

- Low Speed Aerators PDFDocument13 pagesLow Speed Aerators PDFDgk RajuNo ratings yet

- Spectacle Blinds - Closed Blinds Open Blinds (Ring Spacer)Document2 pagesSpectacle Blinds - Closed Blinds Open Blinds (Ring Spacer)Widiyanto WiwidNo ratings yet

- Riqas Ri RQ9142 11aDocument6 pagesRiqas Ri RQ9142 11aGrescia Ramos VegaNo ratings yet

- DCN Dte-Dce and ModemsDocument5 pagesDCN Dte-Dce and ModemsSathish BabuNo ratings yet

- March For Our LivesDocument22 pagesMarch For Our LivesLucy HanNo ratings yet

- Advertisement: National Institute of Technology, Tiruchirappalli - 620 015 TEL: 0431 - 2503365, FAX: 0431 - 2500133Document4 pagesAdvertisement: National Institute of Technology, Tiruchirappalli - 620 015 TEL: 0431 - 2503365, FAX: 0431 - 2500133dineshNo ratings yet

- Consent Form: Republic of The Philippines Province of - Municipality ofDocument1 pageConsent Form: Republic of The Philippines Province of - Municipality ofLucette Legaspi EstrellaNo ratings yet

- Amritsar Police StationDocument5 pagesAmritsar Police StationRashmi KbNo ratings yet

- Motivation Theories Description and CriticismDocument14 pagesMotivation Theories Description and CriticismAhmed Elgazzar89% (18)

- CUBE Dealer Book 2009Document280 pagesCUBE Dealer Book 2009maikruetzNo ratings yet