Professional Documents

Culture Documents

PepsiCo and Coca Cola - Financial Analysis

Uploaded by

ashishkumar14Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PepsiCo and Coca Cola - Financial Analysis

Uploaded by

ashishkumar14Copyright:

Available Formats

PepsiCo & Coca Cola Financial Analysis 1

PepsiCo & Coca Cola Financial Analysis

The report presented below is the financial analysis of Coca Cola and Pepsi Inc. In the

beginning a brief overview of both the companies is given ,followed by a detailed view of

each of the companys financial health , comprising of the horizontal and vertical analysis of

the balance sheet and income statement and finally key ratios are calculated to observe the

trends and make recommendations. The financial data is taken from MSN Money Central

website referenced below.

Coca Cola

Coca Cola was invented by a pharmacist in the year 1886 when he was experimenting for a

recipe for headache and an energizer. Nowadays Coke serves as one of the number one

recognized brands of the world with a unit sales close to 3200 servings. Coke followed a path

of being known as a tonic and a healer with caffeines in late 1890s to being number one

beverage in 1900 till present. Subsequently Coca Cola rose its domination under the

leadership of various intelligent minds. By the time World War two started Coca Cola was

already introduced and expanded in forty four countries. Today Coca cola has the credit of

being one of the top most brands with a huge net worth and brand value.(Kulaiwik,2009)

Pepsi

Pepsi Cola has a long a rich history starting from 1898. Similar to the story of Coca Cola

,Pepsi was also developed by a pharmacist who was experimenting with spices and different

herbs . After developing this new taste he applied for Patent trademark. The business finally

started to grow and finally Pepsi was registered in 1903 by the US Patent office. In addition

to this a strong franchise system was also built which was mainly responsible for Pepsis

PepsiCo & Coca Cola Financial Analysis 2

success worldover. Moreover different marketing campaigns helped Peps built it brand name

worldover.(Andrew ,2002)

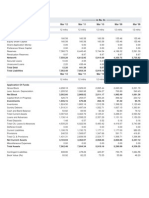

Vertical Analysis

A detailed Vertical Analysis of Income Statement and Balance Sheet of both companies is given .

(Day,2008)

Income Statement

Vertical Analysis

PepsiCo Inc

2009

2008

2009

2008

43,232

43,251

100%

100%

43,232

43,251

100%

100%

20,099

20,351

46.49%

47.05%

23,133

22,900

53.51%

52.95%

14,612

15,489

33.80%

35.81%

414

388

0.96%

0.90%

63

64

0.15%

0.15%

Operating Income

8,044

6,959

18.61%

16.09%

Income Before Tax

8,079

7,045

18.69%

16.29%

Income Tax Total

2,100

1,879

4.86%

4.34%

Income After Tax

5,979

5,166

13.83%

11.94%

-33

-24

-0.08%

-0.06%

0.00%

0.00%

5,946

5,142

13.75%

11.89%

5,946

5,142

13.75%

11.89%

Revenue

Total Revenue

Cost of Revenue, Total

Gross Profit

Selling Expense

Research & Development

Depreciation/Amortization

Minority Interest

U.S. GAAP Adjustment

Net Income Before

Extra. Items

Net Income

PepsiCo & Coca Cola Financial Analysis 3

Income Statement

Analysis

Coca Cola

Vertical

2009

2008

2009

2008

30,990.0

0

30,990.0

0

11,088.0

0

19,902.0

0

11,358.0

0

31,944.0

0

31,944.0

0

11,374.0

0

20,570.0

0

11,774.0

0

100.0%

100.0%

100.0%

100.0%

35.8%

35.6%

64.2%

64.4%

36.7%

36.9%

313

350

1.0%

1.1%

8,231.00

8,446.00

26.6%

26.4%

40

39

0.1%

0.1%

8,946.00

7,506.00

28.9%

23.5%

Income Tax Total

2,040.00

1,632.00

6.6%

5.1%

Income After Tax

6,906.00

5,874.00

22.3%

18.4%

-82

-67

-0.3%

-0.2%

6,824.00

5,807.00

22.0%

18.2%

6,824.00

5,807.00

22.0%

18.2%

Revenue

Total Revenue

Cost of Revenue, Total

Gross Profit

Selling Expenses

Unusual Expense

(Income)

Operating Income

Other, Net

Income Before Tax

Minority Interest

Net Income Before

Extra. Items

Net Income

PepsiCo & Coca Cola Financial Analysis 4

Balance Sheet

2009

2008

Cash and Short Term Investments

4,135.00

2,277.00

10.38%

6.33%

Total Receivables, Net

4,624.00

4,683.00

11.60%

13.01%

Total Inventory

2,618.00

2,522.00

6.57%

7.01%

Prepaid Expenses

1,194.00

1,324.00

3.00%

3.68%

12,571.0

0

12,671.0

0

10,806.0

0

11,663.00

31.55%

30.02%

31.80%

32.40%

Goodwill, Net

6,534.00

5,124.00

16.40%

14.24%

Intangibles, Net

2,623.00

1,860.00

6.58%

5.17%

Long Term Investments

4,484.00

3,883.00

11.25%

10.79%

Note Receivable - Long Term

118

115

0.30%

0.32%

Other Long Term Assets, Total

847

2,543.00

2.13%

7.07%

39,848.0

0

35,994.0

0

100.00%

100.00%

Liabilities and Shareholders'

Equity

Accounts Payable

2,881.00

2,846.00

7.23%

7.91%

Accrued Expenses

2,947.00

2,843.00

7.40%

7.90%

PepsiCo Inc.

Property/Plant/Equipment, Total

Net

Total Assets

Notes Payable/Short Term Debt

2008

Vertical Analysis

Assets

Total Current Assets

2009

464

369

1.16%

1.03%

2,464.00

2,729.00

6.18%

7.58%

8,756.00

8,787.00

21.97%

24.41%

7,400.00

7,858.00

18.57%

21.83%

Deferred Income Tax

659

226

1.65%

0.63%

Minority Interest

638

476

1.60%

1.32%

5,591.00

6,541.00

14.03%

18.17%

23,044.0

0

-104.00

23,888.0

0

-97.00

57.83%

66.37%

-0.26%

-0.27%

Other Current Liabilities, Total

Total Current Liabilities

Total Long Term Debt

Other Liabilities, Total

Total Liabilities

Preferred Stock - Non Redeemable,

Net

Common Stock

Additional Paid-In Capital

Retained Earnings (Accumulated

Deficit)

Treasury Stock Common

Other Equity, Total

Total Equity

Total Liabilities & Shareholders

Equity

30.00

30.00

0.08%

0.08%

250.00

351.00

0.63%

0.98%

33,805.0

0

13,383.0

0

-3,794.00

30,638.00

84.83%

85.12%

14,122.00

-33.59%

-39.23%

-4,694.00

-9.52%

-13.04%

16,804.0

0

39,848.0

0

12,106.00

42.17%

33.63%

35,994.0

0

100.00%

100.00%

PepsiCo & Coca Cola Financial Analysis 5

Coca Cola

2009

2008

Cash and Short term

Investment

Total Receivables, Net

Total Inventory

Prepaid Expenses

Total Current Assets

Property/Plant/Equipment,

Total Net

Goodwill, Net

Intangibles, Net

Long Term Investments

Other Long Term Assets,

Total

Total Assets

Total Current Liabilities

Total Long Term Debt

Deferred Income Tax

Minority Interest

Other Liabilities, Total

Total Liabilities

Common Stock

Additional Paid-In Capital

Retained Earnings

(Accumulated Deficit)

Treasury Stock - Common

Other Equity, Total

Total Equity

Total Liabilities &

Shareholders Equity

2008

9,213.00

4,979.00

18.93%

12.29%

3,758.00

3,090.00

7.72%

7.63%

2,354.00

2,187.00

4.84%

5.40%

2,226.00

1,920.00

4.57%

4.74%

17,551.0

0

9,561.00

12,176.0

0

8,326.00

36.06%

30.05%

19.64%

20.55%

4,224.00

4,029.00

8.68%

9.94%

8,604.00

8,476.00

17.68%

20.92%

6,755.00

5,779.00

13.88%

14.26%

1,976.00

1,733.00

4.06%

4.28%

48,671.0

0

40,519.0

0

100.00%

100.00%

0.00%

0.00%

Liabilities and Shareholders'

Equity

Accounts Payable

Accrued Expenses

Notes Payable/Short Term

Debt

Current Port. of LT

Debt/Capital Leases

Other Current Liabilities,

Total

2009

Vertical Analysis

Assets

1,410.00

1,370.00

2.90%

3.38%

5,247.00

4,835.00

10.78%

11.93%

6,749.00

6,066.00

13.87%

14.97%

51

465

0.10%

1.15%

264

252

0.54%

0.62%

13,721.0

0

5,059.00

12,988.0

0

2,781.00

28.19%

32.05%

10.39%

6.86%

1,580.00

877

3.25%

2.16%

547

390

1.12%

0.96%

2,965.00

3,011.00

6.09%

7.43%

23,872.0

0

880

20,047.0

0

880

49.05%

49.48%

1.81%

2.17%

8,537.00

7,966.00

17.54%

19.66%

41,537.00

38,513.00

85.34%

95.05%

-25,398.00

-52.18%

-59.76%

-757

24,213.00

-2,674.00

-1.56%

-6.60%

24,799.0

0

48,671.0

0

20,472.0

0

40,519.0

0

50.95%

50.52%

100.00%

100.00%

PepsiCo & Coca Cola Financial Analysis 6

PepsiCo & Coca Cola Financial Analysis 7

Horizontal Analysis

A detailed Horizontal Analysis of Income Statement and Balance Sheet of both companies is given.

The base year for both companies is taken as 2008.

Income Statement

Horizontal

Analysis

(base year 08)

Pepsi Co

2009

2008

2009

2008

43,232

43,251

-0.04%

0.00%

43,232

43,251

-0.04%

0.00%

20,099

20,351

-1.24%

0.00%

23,133

22,900

1.02%

0.00%

14,612

15,489

-5.66%

0.00%

414

388

6.70%

0.00%

63

64

-1.56%

0.00%

Operating Income

8,044

6,959

15.59%

0.00%

Income Before Tax

8,079

7,045

14.68%

0.00%

Income Tax Total

2,100

1,879

11.76%

0.00%

Income After Tax

5,979

5,166

15.74%

0.00%

-33

-24

37.50%

0.00%

5,946

5,142

15.64%

0.00%

5,946

5,142

15.64%

0.00%

Revenue

Total Revenue

Cost of Revenue, Total

Gross Profit

Selling Expenses

Research & Development

Depreciation/Amortization

Minority Interest

U.S. GAAP Adjustment

Net Income Before

Extra. Items

Net Income

Horizontal

Analysis

(base year

08)

Coca Cola

Revenue

Total Revenue

Cost of Revenue, Total

Gross Profit

Selling Expenses

Unusual Expense

(Income)

2009

2008

2009

2008

30,990.0

0

30,990.0

0

11,088.0

0

19,902.0

0

11,358.0

0

31,944.0

0

31,944.0

0

11,374.0

0

20,570.0

0

11,774.0

0

-2.99%

0.00%

-2.99%

0.00%

-2.51%

0.00%

-3.25%

0.00%

-3.53%

0.00%

313

350

-10.57%

0.00%

PepsiCo & Coca Cola Financial Analysis 8

Operating Income

Other, Net

Income Before Tax

Income Tax Total

Income After Tax

Minority Interest

Net Income Before

Extra. Items

Net Income

8,231.00

8,446.00

-2.55%

0.00%

40

39

2.56%

0.00%

8,946.00

7,506.00

19.18%

0.00%

2,040.00

1,632.00

25.00%

0.00%

6,906.00

5,874.00

17.57%

0.00%

-82

-67

-0.3%

-0.2%

6,824.00

5,807.00

22.0%

18.2%

6,824.00

5,807.00

22.0%

18.2%

Balance Sheet

Pepsi Co

2009

2008

Assets

Cash and Short term

Investments

Total Receivables, Net

Total Inventory

Prepaid Expenses

Total Current Assets

Property/Plant/Equipment,

Total - Net

Goodwill, Net

Intangibles, Net

Long Term Investments

Note Receivable - Long Term

Other Long Term Assets,

Total

Total Assets

Liabilities and

Shareholders' Equity

Accounts Payable

Accrued Expenses

Notes Payable/Short Term

Debt

Other Current Liabilities,

Total

Total Current Liabilities

Total Long Term Debt

Deferred Income Tax

Minority Interest

Other Liabilities, Total

Total Liabilities

Preferred Stock - Non

Redeemable, Net

Common Stock

Additional Paid-In Capital

2009

2008

Horizontal Analysis base

year 08

4,135.00

2,277.00

81.60%

0.00%

4,624.00

4,683.00

-1.26%

0.00%

2,618.00

2,522.00

3.81%

0.00%

1,194.00

1,324.00

-9.82%

0.00%

12,571.0

0

12,671.0

0

10,806.0

0

11,663.00

16.33%

0.00%

8.64%

0.00%

6,534.00

5,124.00

27.52%

0.00%

2,623.00

1,860.00

41.02%

0.00%

4,484.00

3,883.00

15.48%

0.00%

118

115

2.61%

0.00%

847

2,543.00

-66.69%

0.00%

39,848.0

0

35,994.0

0

10.71%

0.00%

2,881.00

2,846.00

1.23%

0.00%

2,947.00

2,843.00

3.66%

0.00%

464

369

25.75%

0.00%

2,464.00

2,729.00

-9.71%

0.00%

8,756.00

8,787.00

-0.35%

0.00%

7,400.00

7,858.00

-5.83%

0.00%

659

226

191.59%

0.00%

638

476

34.03%

0.00%

5,591.00

6,541.00

-14.52%

0.00%

23,044.0

0

-104.00

23,888.0

0

-97.00

-3.53%

0.00%

7.22%

0.00%

30.00

30.00

0.00%

0.00%

250.00

351.00

-28.77%

0.00%

PepsiCo & Coca Cola Financial Analysis 9

Retained Earnings

(Accumulated Deficit)

Treasury Stock - Common

Other Equity, Total

Total Equity

Total Liabilities &

Shareholders Equity

33,805.0

0

30,638.00

10.34%

0.00%

13,383.0

0

-3,794.00

14,122.00

-5.23%

0.00%

-4,694.00

-19.17%

0.00%

16,804.0

0

39,848.0

0

12,106.0

0

35,994.0

0

38.81%

0.00%

10.71%

0.00%

2008

2009

2008

2009

Coca Cola

Horizontal Analysis

(base year 08)

Assets

Cash and Short Term

Investments

Total Receivables, Net

Total Inventory

Prepaid Expenses

Total Current Assets

Property/Plant/Equipment,

Total - Net

Goodwill, Net

Intangibles, Net

Long Term Investments

Other Long Term Assets,

Total

Total Assets

9,213.00

4,979.00

85.04%

0.00%

3,758.00

3,090.00

21.62%

0.00%

2,354.00

2,187.00

7.64%

0.00%

2,226.00

1,920.00

15.94%

0.00%

17,551.0

0

9,561.00

12,176.0

0

8,326.00

44.14%

0.00%

14.83%

0.00%

4,224.00

4,029.00

4.84%

0.00%

8,604.00

8,476.00

1.51%

0.00%

6,755.00

5,779.00

16.89%

0.00%

1,976.00

1,733.00

14.02%

0.00%

48,671.0

0

40,519.0

0

20.12%

0.00%

1,410.00

1,370.00

2.92%

0.00%

5,247.00

4,835.00

8.52%

0.00%

6,749.00

6,066.00

11.26%

0.00%

51

465

-89.03%

0.00%

264

252

4.76%

0.00%

13,721.0

0

5,059.00

12,988.0

0

2,781.00

5.64%

0.00%

81.91%

0.00%

1,580.00

877

80.16%

0.00%

547

390

40.26%

0.00%

2,965.00

3,011.00

-1.53%

0.00%

Liabilities and Shareholders'

Equity

Accounts Payable

Accrued Expenses

Notes Payable/Short Term

Debt

Current Port. of LT

Debt/Capital Leases

Other Current Liabilities

Total Current Liabilities

Total Long Term Debt

Deferred Income Tax

Minority Interest

Other Liabilities, Total

PepsiCo & Coca Cola Financial Analysis 10

Total Liabilities

Common Stock

Additional Paid-In Capital

Retained Earnings

(Accumulated Deficit)

Treasury Stock - Common

Other Equity, Total

Total Equity

Total Liabilities &

Shareholders Equity

23,872.0

0

880

20,047.0

0

880

19.08%

0.00%

0.00%

0.00%

8,537.00

7,966.00

7.17%

0.00%

41,537.0

0

38,513.00

7.85%

0.00%

25,398.0

0

-757

24,213.00

4.89%

0.00%

-2,674.00

-71.69%

0.00%

24,799.0

0

48,671.0

0

20,472.0

0

40,519.0

0

21.14%

0.00%

20.12%

0.00%

Ratio Calculation

The financial data is taken from MSN Money central website ,referenced below. The found out ratios

are then interpreted to see the trends. (Gattis,2009)

Liquidity Ratio

Current Ratio = Current Assets/Current Liabilities

Coca Cola

Year

(000)

Current

Assets

Current

Liabilities

Current

Ratio

Pepsi

Year (000)

Current

Assets

Current

Liabilities

Current

Ratio

2008

2009

12,176 17,551

12,988 13,721

0.94

2008

1.28

2009

10,806

12,571

8,787

8,756

1.23

1.44

Quick Ratio =Current Assets Inventory/Current Liabilities

PepsiCo & Coca Cola Financial Analysis 11

Coca Cola

Year

(000)

2008

Current

Assets

Inventory

2009

12,176 17,551

4,224 4,029

Current

Liabilities

Current

Ratio

12,988 13,721

0.61

0.99

Pepsi

Year (000)

2008

Current

Assets

Current

Liabilities

Inventory

Quick Ratio

2009

10,806

12,571

8,787

2,522

0.94

8,756

2,618

1.14

Liquidity ratios deal with the companys ability to deal with its short term obligations. As far

as the current ratio is concerned both the companies have improved with an increase in

current assets and current liabilities. Similar is the case with quick ratio ,both the companies

have shown an increased trend in this ratio which is a good signal. However inventory level

for Coca Cola is decreasing and inventory level for Pepsi is increasing , this indicates that

Coca Cola is efficiently managing its inventory levels.

Profitability Ratio

Gross Profit Margin= Gross Profit/Sales

Coca Cola

Year (000)

Gross Profit

Revenue

Gross Profit

Margin

2008

19,902

31,944

2009

20,570

30,990

62.30%

66.38%

PepsiCo & Coca Cola Financial Analysis 12

Pepsi

Year (000)

Gross Profit

Revenue

2008

Gross Profit

Margin

22,900

43,251

2009

23,133

43,232

52.95%

53.51%

Return on Assets = Net income/Total Assets

Coca Cola

Year (000)

Net Income

Total Assets

ROA

2008

5,807

35,994

16.13%

2009

6,824

39,848

17.13%

Pepsi

Year (000)

Net Income

Total Assets

ROA

2008

5,142

35,994

14.29%

2009

5,946

39,848

14.92%

Profitability ratio deals with whether the company is making sufficient profit or not .Gross

Profit is assed as a percentage of Sales . In this scenario both the companies are showing an

increased trend as compared to past year. For Coca Cola the gross profit is increasing but the

revenue is showing a decreased trend ,however for Pepsi there is an increase in both the gross

profit and revenue. Coca Cola on the other hand is showing a greater increase for the profit

margin, this is because of access to large variety of market a greater likeness for the brand.

As far as ROA is concerned both the companies are showing an increased trend. This is a

good signal for investors for both companies.

PepsiCo & Coca Cola Financial Analysis 13

Solvency

Debt to Equity =Total Debt/Owners Equity

Coca Cola

Year (000)

Total Debt

Owners

Equity

D/E

2008

20,047

2009

23,872

20,472

97.92%

24,799

96.26%

Pepsi

Year (000)

Total Debt

Owners

Equity

D/E

2008

23,888

2009

23,044

12,106

197.32%

16,804

137.13%

Debt to Asset= Total Debt/Total Assets

Coca Cola

Year (000)

Total Debt

Total Assets

D/A

2008

20,047

40,519

49.48%

2009

23,872

48,671

49.05%

Pepsi

Year (000)

Total Debt

Total Assets

D/A

2008

23,888

35,994

66.37%

2009

23,044

39,848

57.83%

Solvency Ratios are used to assess the companies abilities to fulfil it long term obligations.

The factors such as total debt ,owners equity are used to find out these ratios.

Total Debt to Total Equity ratio for both companies is decreasing ,for Coca Cola the debt and

equity both are increasing and for Pepsi total debt is decreasing and equity is increasing

PepsiCo & Coca Cola Financial Analysis 14

which is a very good signal for Pepsi. As far as total debt to total assets ratio is concerned

total assets for both the companies is increasing which is resulting in a decrease in D/A for

both the companies. This is a good signal as assets are being properly managed.

Recommendations

Coca Cola and Pepsi ,both companies are financially looking sound with good profit margins.

Recommendations for both companies is given below.

Coca Cola although is showing increased profit margin but the revenue is showing a

decreased trend which is a cause of concern .It needs to work on methods to increase its

revenue. Coca Cola also need to work on reducing its debt. Other factors are increasing

which a good signal for the company. Pepsi firstly is showing a slight decrease in current

liabilities, which is good needs to work more on it . Likewise Coca Cola the revenue for

Pepsi is also decreasing but with a very slight number. Pepsi needs to work on increasing the

revenue . The total debt for Pepsi is also decreasing which is a very good signal for the

company . (Brigham,2005)

Conclusion

Overall both the companies are doing good financially , the decreasing trend for revenue is

mainly due to the current global economic crises which has affected the profit margins , but a

consistency is observed in all the ratios which indicates that the companies according to each

ones capability is doing good despite the current economic situation.

References

Books

PepsiCo & Coca Cola Financial Analysis 15

Brigham, E,F , Erhhardth ,M ,C (2005) .Financial Management Theory and Practice.

Eleventh Edition. South Western Publishers

Thomas ,A,(2002).Introduction to Financial Accounting. Fourth Edition. McGraw Hill.

Website

Kulawik, A (2009),The development of Coca Cola Advertising Campaigns, retrieved on

November 29th,2010 from,

http://images.nexto.pl/upload/publisher/All%20Free

%20Media/public/the_development_of_coca-cola_advertising_campaigns_(18862007)_demo.pdf

Andrew (2002),A brief Pepsi History retrieved on November 29th 2010 from,

<http://www.sirpepsi.com/pepsi11.htm>

Day, J (2008), Theme: Analyzing Financial Statements, retrieved on 30th November 2010

from

<http://www.reallifeaccounting.com/pubs/Article_Theme_Analyzing_Financial_Statements.p

df>

Gattis ,C,G.(2009).Using Financial Ratios

< http://bluepointstrategies.com/uploads/White_Paper_-_Using_Financial_Ratios.pdf> [30th

November 2010]

MSN Money (2010),Pepsi Co Financial Statements, retrieved on 30th November 2010 from

<http://moneycentral.msn.com/investor/invsub/results/statemnt.aspx?symbol=pep>

MSN Money (2010),Coca Cola Financial Statements, retrieved on 30th November 2010 from

<http://moneycentral.msn.com/investor/invsub/results/statemnt.aspx?symbol=ko>

You might also like

- Foundations of Financial Management 16th Edition by Block TB Testbank and Solution ManualDocument25 pagesFoundations of Financial Management 16th Edition by Block TB Testbank and Solution ManualIbrahim Khalil Ullah0% (1)

- FM11 CH 11 Mini CaseDocument13 pagesFM11 CH 11 Mini CasesushmanthqrewrerNo ratings yet

- Capital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachDocument4 pagesCapital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachAnshuman AggarwalNo ratings yet

- Assignment 2Document1 pageAssignment 2Sumbal JameelNo ratings yet

- TMV Solved ProblemDocument27 pagesTMV Solved ProblemIdrisNo ratings yet

- Apple Design-1111Document5 pagesApple Design-1111Sharad KumarNo ratings yet

- On Comparative Analysis of Financial Statement of Pepsi Co & Coca Cola.Document7 pagesOn Comparative Analysis of Financial Statement of Pepsi Co & Coca Cola.Saikat BhattacharjeeNo ratings yet

- Ch.3 13ed Analysis of Fin Stmts MiniC SolsDocument7 pagesCh.3 13ed Analysis of Fin Stmts MiniC SolsAhmed SaeedNo ratings yet

- Testbank Opmen For UTSDocument67 pagesTestbank Opmen For UTSPaskalis KrisnaaNo ratings yet

- Latihan Budget 20142015Document48 pagesLatihan Budget 20142015AnnaNo ratings yet

- MBA641 Managerial Accounting Case Study #3Document3 pagesMBA641 Managerial Accounting Case Study #3risvana rahimNo ratings yet

- AF 325 Homework # 1Document3 pagesAF 325 Homework # 1Kunhong ZhouNo ratings yet

- Hacking With Experts 3 (Facebook Hacking) by Anurag DwivediDocument88 pagesHacking With Experts 3 (Facebook Hacking) by Anurag Dwivediashishkumar1479% (14)

- DGKC Research ReportDocument34 pagesDGKC Research Reportgbqzsa100% (1)

- Forensic Accounting Ambit 22dec2014Document39 pagesForensic Accounting Ambit 22dec2014suksesNo ratings yet

- Coca-Cola Financial AnalysisDocument9 pagesCoca-Cola Financial AnalysisKrissi EbbensNo ratings yet

- Delta Airlines Baggage Loading Cost SavingsDocument37 pagesDelta Airlines Baggage Loading Cost SavingsenergizerabbyNo ratings yet

- Mportance OF Apital UdgetingDocument16 pagesMportance OF Apital UdgetingtsayuriNo ratings yet

- Information Systems Study Questions AnsweredDocument7 pagesInformation Systems Study Questions Answeredjawangi unedoNo ratings yet

- Strategy and The Master BugdetDocument38 pagesStrategy and The Master BugdetPhearl Anjeyllie PilotonNo ratings yet

- The Cost of Capital (WACC)Document3 pagesThe Cost of Capital (WACC)hira shaikhNo ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument7 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- Final Exam Review Questions - SolvedDocument6 pagesFinal Exam Review Questions - SolvedHemabhimanyu MaddineniNo ratings yet

- DMP3e CH12 Solutions 05.17.10 RevisedDocument41 pagesDMP3e CH12 Solutions 05.17.10 Revisedmichaelkwok1No ratings yet

- Valuing StocksDocument39 pagesValuing StocksANITAAZHARNED0% (3)

- Financial Management Assignment 1Document8 pagesFinancial Management Assignment 1Puspita RamadhaniaNo ratings yet

- Industry Analysis (6-Force) Worksheet: Horizontal RelationshipsDocument4 pagesIndustry Analysis (6-Force) Worksheet: Horizontal RelationshipsJulia ValentineNo ratings yet

- Excel Solution - Extruder Capital Budgeting Case StudyDocument15 pagesExcel Solution - Extruder Capital Budgeting Case Studyalka murarkaNo ratings yet

- Coba BDocument4 pagesCoba BCesar Felipe UauyNo ratings yet

- Capital Structure For SFADDocument10 pagesCapital Structure For SFADMadeeha KhanNo ratings yet

- Coca-Cola Financial AnalysisDocument6 pagesCoca-Cola Financial AnalysisAditya Pal Singh Mertia RMNo ratings yet

- Apple Inc. Financial Statements AnalysisDocument15 pagesApple Inc. Financial Statements AnalysisDOWLA KHANNo ratings yet

- C 13Document416 pagesC 13Arun Victor Paulraj50% (2)

- Financial Analysis of Coca Cola CompanyDocument22 pagesFinancial Analysis of Coca Cola CompanyCedric AjodhiaNo ratings yet

- Capital budgeting decisions and project evaluation techniquesDocument5 pagesCapital budgeting decisions and project evaluation techniquesOrko AbirNo ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingshafiqul84No ratings yet

- FM - Chapter 9Document5 pagesFM - Chapter 9sam989898No ratings yet

- Analyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsDocument46 pagesAnalyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsHana NadhifaNo ratings yet

- Cost of Capital Excel Temple-Free CH 10Document10 pagesCost of Capital Excel Temple-Free CH 10Mohiuddin AshrafiNo ratings yet

- Ques 1Document2 pagesQues 1Renuka SharmaNo ratings yet

- FM11 CH 13 Mini-Case Old3Document14 pagesFM11 CH 13 Mini-Case Old3Wu Tian WenNo ratings yet

- Finance: CH 15 Capital Structure DecisionDocument50 pagesFinance: CH 15 Capital Structure DecisionSarah A ANo ratings yet

- The Cost of Goods Manufactured ScheduleDocument7 pagesThe Cost of Goods Manufactured ScheduleM Jamal KhanNo ratings yet

- Midland Energy's Cost of Capital CalculationsDocument5 pagesMidland Energy's Cost of Capital CalculationsOmar ChaudhryNo ratings yet

- Group-01 Niche and Mainstream (PBME)Document15 pagesGroup-01 Niche and Mainstream (PBME)tejay356No ratings yet

- Cost Accounting Reviewer Chapter 1: Introduction To Cost AccountingDocument38 pagesCost Accounting Reviewer Chapter 1: Introduction To Cost AccountingJoyce MacatangayNo ratings yet

- Kotler Mm14e Im 08 GEDocument14 pagesKotler Mm14e Im 08 GEmohammad kitali0% (1)

- MOF Homework 1Document1 pageMOF Homework 1Adjanni Arbon DoceNo ratings yet

- Capital Rationing: Reporter: Celestial C. AndradaDocument13 pagesCapital Rationing: Reporter: Celestial C. AndradaCelestial Manikan Cangayda-AndradaNo ratings yet

- Activity Based CostingDocument52 pagesActivity Based CostingAfrina AfsarNo ratings yet

- TVM Activity 4 SolutionsDocument2 pagesTVM Activity 4 SolutionsAstrid BuenacosaNo ratings yet

- 2009-10 Term 2 Assign 1 - CokeDocument5 pages2009-10 Term 2 Assign 1 - CokePia Angela ElemosNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument17 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The Questionawesome bloggersNo ratings yet

- Bond Valuation Formulas in ExcelDocument22 pagesBond Valuation Formulas in Excelrameessalam852569No ratings yet

- Incremental AnalysisDocument18 pagesIncremental AnalysisMary Joy BalangcadNo ratings yet

- FIN 550 Chapter 14Document29 pagesFIN 550 Chapter 14Kesarapu Venkata ApparaoNo ratings yet

- Dupont AnalysisDocument5 pagesDupont AnalysisNoraminah IsmailNo ratings yet

- Chapter 1 - Statistics and Its ApplicationDocument52 pagesChapter 1 - Statistics and Its ApplicationAngel TamondongNo ratings yet

- Group 4 Home DepotDocument2 pagesGroup 4 Home DepotnikhilNo ratings yet

- Cumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowDocument173 pagesCumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowAditi OholNo ratings yet

- Chapter 14. The Cost of CapitalDocument15 pagesChapter 14. The Cost of Capitalmy backup1No ratings yet

- Coca Cola: Presented byDocument25 pagesCoca Cola: Presented byKeshav KalaniNo ratings yet

- AnmoljamwalDocument44 pagesAnmoljamwalAnmol JamwalNo ratings yet

- Notification Intelligence Bureau Security Assistant Executive PostsDocument17 pagesNotification Intelligence Bureau Security Assistant Executive Postsashishkumar14No ratings yet

- NEWSDocument183 pagesNEWSSebastian BaqueroNo ratings yet

- Sri Venkateswara College National Symposium Registration FormDocument1 pageSri Venkateswara College National Symposium Registration Formashishkumar14No ratings yet

- Marketing Mix - Wikipedia, The Free EncyclopediaDocument6 pagesMarketing Mix - Wikipedia, The Free Encyclopediaashishkumar14No ratings yet

- Subnetting Problem 1Document36 pagesSubnetting Problem 1ashishkumar14No ratings yet

- Approved Annual Programme 2014Document1 pageApproved Annual Programme 2014Kiran KumarNo ratings yet

- PythonDoc&Start16DEC2010 PDFDocument22 pagesPythonDoc&Start16DEC2010 PDFGyurme YesheNo ratings yet

- ADVT No - DMRC O M 1 2014Document5 pagesADVT No - DMRC O M 1 2014Er Ashish BahetiNo ratings yet

- ReadmeDocument21 pagesReadmeAntonio FrontadoNo ratings yet

- 1460 102 Impact of Aircel On The Other Competitors of Telecom IndustryDocument79 pages1460 102 Impact of Aircel On The Other Competitors of Telecom Industryashishkumar14No ratings yet

- Du PG ProspectusDocument19 pagesDu PG Prospectusashishkumar14No ratings yet

- Amits ResumeDocument1 pageAmits Resumeashishkumarsharma123No ratings yet

- Bba 303Document218 pagesBba 303ashishkumarsharma123No ratings yet

- International Business Management TopicsDocument8 pagesInternational Business Management Topicsashishkumarsharma123No ratings yet

- Battery Voltage Stability Effects On Small Wind Turbine Energy CaptureDocument12 pagesBattery Voltage Stability Effects On Small Wind Turbine Energy Captureashishkumar14No ratings yet

- Abstracts of Some JournalsDocument11 pagesAbstracts of Some Journalsashishkumar14No ratings yet

- Technical Specifications of Carrier Midea Air ConditionersDocument2 pagesTechnical Specifications of Carrier Midea Air Conditionersashishkumar14No ratings yet

- Four Year Undergraduate Programme With Multiple Degree OptionDocument2 pagesFour Year Undergraduate Programme With Multiple Degree Optionashishkumar14No ratings yet

- Unit - 1 Nature of Business PolicyDocument44 pagesUnit - 1 Nature of Business Policyashishkumar14No ratings yet

- The Domain Name System: Abdul Gafoor KV Big Leap Software Solution PVT LTDDocument21 pagesThe Domain Name System: Abdul Gafoor KV Big Leap Software Solution PVT LTDashishkumar14No ratings yet

- TCP IPModelDocument23 pagesTCP IPModelmukeshntNo ratings yet

- Businesspolicystrategicmanagement Notes 2011-12-111001044206 Phpapp02Document428 pagesBusinesspolicystrategicmanagement Notes 2011-12-111001044206 Phpapp02ashishkumar14No ratings yet

- Application Layer: FTP & Email: Notes Derived From "Document11 pagesApplication Layer: FTP & Email: Notes Derived From "ashishkumar14No ratings yet

- List of Ministers of India, List of Minister's PortfoliosDocument12 pagesList of Ministers of India, List of Minister's Portfoliosashishkumar14No ratings yet

- 8413 BSC H NotDocument17 pages8413 BSC H Notashishkumar14No ratings yet

- User Datagram Protocol: ObjectivesDocument32 pagesUser Datagram Protocol: Objectivesashishkumar14No ratings yet

- Unit - 1 Nature of Business PolicyDocument44 pagesUnit - 1 Nature of Business Policyashishkumar14No ratings yet

- Solar Storage BatteriesDocument2 pagesSolar Storage Batteriesashishkumar14No ratings yet

- McDonald's Stock Clearly Benefits From Its Large Buybacks - Here Is Why (NYSE - MCD) - Seeking AlphaDocument12 pagesMcDonald's Stock Clearly Benefits From Its Large Buybacks - Here Is Why (NYSE - MCD) - Seeking AlphaWaleed TariqNo ratings yet

- VGI Investor Letter 1.29.2019Document30 pagesVGI Investor Letter 1.29.2019stockenfraudNo ratings yet

- Option StrategiesDocument67 pagesOption StrategiesPradeep Singha100% (8)

- Ponzi SchemesDocument4 pagesPonzi SchemesNisa Hajja Qadri HarahapNo ratings yet

- Chapter 8 StudentDocument15 pagesChapter 8 Studentmaha aleneziNo ratings yet

- Feed The Future, Tanzania Land Tenure Assistance: DAI GlobalDocument57 pagesFeed The Future, Tanzania Land Tenure Assistance: DAI GlobalJacob PeterNo ratings yet

- Year-to-Date Revenues and Income Analysis for Period Ending Dec 2010Document35 pagesYear-to-Date Revenues and Income Analysis for Period Ending Dec 2010Kalenga CyrilleNo ratings yet

- High Probability Trading Setups For The Currency Market PDFDocument100 pagesHigh Probability Trading Setups For The Currency Market PDFDavid VenancioNo ratings yet

- Novus OverlapDocument8 pagesNovus OverlaptabbforumNo ratings yet

- An Analysis of Demat Account and Online TradingDocument90 pagesAn Analysis of Demat Account and Online TradingNITIKESH GORIWALENo ratings yet

- Maurece Schiller - StubsDocument15 pagesMaurece Schiller - StubsMihir ShahNo ratings yet

- 83UCinLRev413 PDFDocument33 pages83UCinLRev413 PDFrishikaNo ratings yet

- ASsignmentDocument10 pagesASsignmenthu mirzaNo ratings yet

- Agam Sastrowibowo IRRDocument6 pagesAgam Sastrowibowo IRRHendra YudisaputroNo ratings yet

- MS-04 Accounting and Finance for Managers Assignment 1-5Document3 pagesMS-04 Accounting and Finance for Managers Assignment 1-5Sanjay SanariyaNo ratings yet

- Commerce Guru: AccountancyDocument1 pageCommerce Guru: AccountancyHEMMU SAHU INSTITUTENo ratings yet

- Yaqeen Product Brochure enDocument29 pagesYaqeen Product Brochure enovifinNo ratings yet

- BUS227Document70 pagesBUS227Dauda AdijatNo ratings yet

- EF Lecture 5 2024Document42 pagesEF Lecture 5 2024donNo ratings yet

- All Schemes Half Yearly Portfolio - As On 31 March 2020Document1,458 pagesAll Schemes Half Yearly Portfolio - As On 31 March 2020anjuNo ratings yet

- Management ProjectDocument7 pagesManagement ProjectAanchal NarulaNo ratings yet

- HEDGING STRATEGIESDocument5 pagesHEDGING STRATEGIESasmaagartoum20No ratings yet

- Cases Optimal CapitalDocument2 pagesCases Optimal CapitalRiya PandeyNo ratings yet

- CDP Darbhanga PDFDocument16 pagesCDP Darbhanga PDFSanatNo ratings yet

- Camposol Holding 4q 2019 PresentationDocument24 pagesCamposol Holding 4q 2019 Presentationkaren ramosNo ratings yet

- Direct Lenders First Real Test: Deloitte Alternative Lender Deal Tracker Spring 2020Document56 pagesDirect Lenders First Real Test: Deloitte Alternative Lender Deal Tracker Spring 2020fjdglf klfdNo ratings yet

- Balance Sheet and P&L of CiplaDocument2 pagesBalance Sheet and P&L of CiplaPratik AhluwaliaNo ratings yet

- BB BBB BBBBBBDocument24 pagesBB BBB BBBBBBNaomi Pizaña AmpoloquioNo ratings yet