Professional Documents

Culture Documents

Exercise WACC

Uploaded by

Siri LogeswarenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise WACC

Uploaded by

Siri LogeswarenCopyright:

Available Formats

Exercises on WACC Question 1 Nuqman Industries is considering using weighted average cost of capital (WACC) to discount cash flows

in their capital budgeting analyses. The company is seeking your expertise in determining its WACC. It has provided the following information to assist you in your computation: The capital structure comprises long-term debts and equity. Long-term debt of Nuqman Industries comprises two bond issues, both with a RM1,000 face value. The first issue comprises 600,000 bonds with a 13 percent coupon rate, which is currently selling at RM1,097. The bonds pay semi-annually coupon and have 4 years to maturity. The second issue consist of 400,000 zero coupon bonds with 10 years left to maturity. The bonds sell for 45.64 percent of par.

Since no information was given on the equity capital of Nuqman Industries, you surfed the website and managed to get some information on relevant companys key ratios and statistics as shown below:

From your estimation, the beta of Nuqmans equity is 1.2, the T-bills yield 6 percent per year, and the expected return on the market portfolio is 14 percent. The corporate tax rate is 30 percent.

Question 2 Sayong Industries is an established company that has utilised a variety of sources of financing. In addition to common shares outstanding, the company has also issued preferred stocks and bonds to the investing public. The management of Sayong Industries is interested to know their cost of capital so that they can analyse proposals on capital spending in a more prudent manner. Sayong Industries is seeking your expertise in determining its WACC. The market portfolio has a risk premium of 8%, and the risk-free rate is 6%. Corporate tax rate is 30%. Information on the various sources of long-term financing is provided below: Preferred stock: Sayong Industries issued 70,000 preference shares of 6.27 percent 12 years ago. The current price of this RM100 par value share is RM112. Long-term debts: Sayong Industries has two long-term bond issues, both with a RM1,000 face value. The first issue comprises 20,000 bonds with 8% coupon rate. Currently, this bond sells at RM911.33. The bonds pay semi-annual coupon and have 6 years to maturity. The second issue consist of 60,000 bonds with 10 years left to maturity. The bonds sell for 45.64 percent of par. This bond has a debt beta of 0.4.

Common stock: From your estimation, the equity beta of Sayong Industries is 20 percent above that of the market. The most recent figure on the companys market capitalization is RM70,000,000.

A. Calculate the after-tax cost of debt for Sayong Industries. B. Calculate the cost of equity and the cost of preferred stock. C. Compute the WACC of Sayong Industries.

)

You might also like

- Welcome To Our Presentation On: Capital Structure and Profitability AnalysisDocument19 pagesWelcome To Our Presentation On: Capital Structure and Profitability Analysisrohanfyaz00No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaamitmdeshpandeNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentIsyfi SyifaaNo ratings yet

- Cost of CapitalDocument3 pagesCost of Capitalkedar211No ratings yet

- Tutorial 8 Questions (Chapter 5Document2 pagesTutorial 8 Questions (Chapter 5tan JiayeeNo ratings yet

- Mini Case of Cost of CapitalDocument13 pagesMini Case of Cost of Capitalpoooja2850% (4)

- Impact of Liquidity on Banking Sector Profitability in PakistanDocument9 pagesImpact of Liquidity on Banking Sector Profitability in PakistanAbdussalam gillNo ratings yet

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Npa 119610079679343 5Document46 pagesNpa 119610079679343 5Teju AshuNo ratings yet

- File MB0045 Financial Management SolvedDocument28 pagesFile MB0045 Financial Management SolvedSebastian TaraoNo ratings yet

- Final Exam Review W21 Questions OnlyDocument14 pagesFinal Exam Review W21 Questions Only費長威No ratings yet

- Asset-Liability Management in Banking SectorDocument7 pagesAsset-Liability Management in Banking SectorsukanyaNo ratings yet

- Financial Analysis of Singer (Sri Lanka) PLC For The Financial Years From 2012-2016Document22 pagesFinancial Analysis of Singer (Sri Lanka) PLC For The Financial Years From 2012-2016Shyamila RathnayakaNo ratings yet

- A PROJECT REPORT On On The Working Capital Management in Karnataka State Finance CorporationDocument80 pagesA PROJECT REPORT On On The Working Capital Management in Karnataka State Finance CorporationBabasab Patil (Karrisatte)No ratings yet

- WACC CALCULATIONSDocument4 pagesWACC CALCULATIONSshan50% (2)

- Easy Guide to SME Asaan Finance SchemeDocument16 pagesEasy Guide to SME Asaan Finance SchemeRakesh KumarNo ratings yet

- Introduction of SmedaDocument5 pagesIntroduction of SmedaTƛyyƛb ƛliNo ratings yet

- Objective of The Report: LimitationsDocument15 pagesObjective of The Report: LimitationsNelly NaimaNo ratings yet

- Cost of Capital Question BankDocument4 pagesCost of Capital Question BankQuestionscastle Friend100% (1)

- Risk Management Process of Askari BankDocument21 pagesRisk Management Process of Askari BankMamoona Chauhdry100% (3)

- Adjusted Present Value Method of Project AppraisalDocument7 pagesAdjusted Present Value Method of Project AppraisalAhmed RazaNo ratings yet

- Management Accounting and Finance 3B..3.11Document5 pagesManagement Accounting and Finance 3B..3.11MphoyaBadimo MphoyaBadimoNo ratings yet

- 57b2e7d35a4d40b8b460abe4914d711a.docxDocument6 pages57b2e7d35a4d40b8b460abe4914d711a.docxZohaib HajizubairNo ratings yet

- Workbased Assignment - Financial ManagementDocument2 pagesWorkbased Assignment - Financial Managementsuemwinza0% (1)

- IGNOU MBA MS - 04 Solved Assignment 2011Document12 pagesIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNo ratings yet

- 6 Financial Markets Institutions and Services - Prof. Vinay DuttaDocument3 pages6 Financial Markets Institutions and Services - Prof. Vinay DuttaParas KhuranaNo ratings yet

- Instructions For CandidatesDocument3 pagesInstructions For Candidatesshubham jagtapNo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Report of Summit Power Ltd.Document64 pagesReport of Summit Power Ltd.Shaheen Mahmud50% (2)

- IGNOU MBA MS - 04 Solved Assignment 2011Document16 pagesIGNOU MBA MS - 04 Solved Assignment 2011Kiran PattnaikNo ratings yet

- HO No. 3 - Working Capital ManagementDocument2 pagesHO No. 3 - Working Capital ManagementGrace Chavez ManaliliNo ratings yet

- 16 - Rahul Mundada - Mudita MathurDocument8 pages16 - Rahul Mundada - Mudita MathurRahul MundadaNo ratings yet

- Performance Dynamics One BankDocument8 pagesPerformance Dynamics One BankZabed HussainNo ratings yet

- Cash and Marketable Securities Seatworks PDFDocument3 pagesCash and Marketable Securities Seatworks PDFGirl Lang AkoNo ratings yet

- Products and Practices in Investment Management Industry in BangladeshDocument26 pagesProducts and Practices in Investment Management Industry in BangladeshRedwan Hossain ShovonNo ratings yet

- Ratio Analysis of The Annual Report On Standard BankDocument15 pagesRatio Analysis of The Annual Report On Standard BankShopno Konna Sarah80% (5)

- Igarashi MotorsDocument4 pagesIgarashi MotorsDynamic LevelsNo ratings yet

- K-Electric business finance risk return valuationDocument5 pagesK-Electric business finance risk return valuationMusaddeq KirigayaNo ratings yet

- IMT 61 Corporate Finance M1Document5 pagesIMT 61 Corporate Finance M1solvedcareNo ratings yet

- Problem Set Capital StructureDocument2 pagesProblem Set Capital StructureBaba Nyonya0% (1)

- OPTIONS ANALYSISDocument10 pagesOPTIONS ANALYSISWaleed MinhasNo ratings yet

- Liberalisation 1991Document5 pagesLiberalisation 1991ROKOV ZHASANo ratings yet

- Commentary On Q3 FY19 Financial Results IDFCFIRST BankDocument8 pagesCommentary On Q3 FY19 Financial Results IDFCFIRST BankHimanshu GuptaNo ratings yet

- A Comparison of The Finance Companies in BangladeshDocument27 pagesA Comparison of The Finance Companies in BangladeshAnik MuidNo ratings yet

- Assignment Working Capital MGMT SP 2015Document2 pagesAssignment Working Capital MGMT SP 2015JustinHallNo ratings yet

- Strategic Management AssingmentDocument33 pagesStrategic Management AssingmentIsanka AttanayakeNo ratings yet

- Receivables Management Policy Options for Maximizing ProfitsDocument2 pagesReceivables Management Policy Options for Maximizing Profitssamegroup4No ratings yet

- BBA-V 551 Subjective Dec 2016Document2 pagesBBA-V 551 Subjective Dec 2016Saif ali KhanNo ratings yet

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraNo ratings yet

- NIB BankDocument19 pagesNIB BankSohail KhanNo ratings yet

- Financial Management Strategy Nov 2007Document4 pagesFinancial Management Strategy Nov 2007samuel_dwumfourNo ratings yet

- Soal Latihan UASDocument2 pagesSoal Latihan UASGistima Putra JavandaNo ratings yet

- Axis Bank Aug. 2012Document13 pagesAxis Bank Aug. 2012Deepankar MitraNo ratings yet

- Bajaj Finance Limited Q2 FY15 Presentation: 14 October 2014Document33 pagesBajaj Finance Limited Q2 FY15 Presentation: 14 October 2014adi99123No ratings yet

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- MAF603 COC - StudentsDocument12 pagesMAF603 COC - StudentsZoe McKenzieNo ratings yet

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- Business PlanDocument33 pagesBusiness PlanMarxy PanaguitonNo ratings yet

- Corporate 22Document9 pagesCorporate 22prathmesh agrawalNo ratings yet

- Week 3 Tutorial Solutions - Fiancial AcountingDocument13 pagesWeek 3 Tutorial Solutions - Fiancial AcountingMi ThaiNo ratings yet

- Company AccountsDocument26 pagesCompany AccountsSaleh AbubakarNo ratings yet

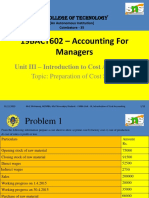

- 19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingDocument12 pages19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingReetaNo ratings yet

- Econ F212 1120Document6 pagesEcon F212 1120rohit BindNo ratings yet

- Weighted Average Cost of Capital (WACCDocument19 pagesWeighted Average Cost of Capital (WACCFahad AliNo ratings yet

- Student Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalDocument19 pagesStudent Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalSavithri NandadasaNo ratings yet

- Muhammad Thoriq Nabawi Tugas 3 Chapter 1 BusinessDocument9 pagesMuhammad Thoriq Nabawi Tugas 3 Chapter 1 BusinessThoriq NabawiNo ratings yet

- SBM Due Deligency Report by CADocument34 pagesSBM Due Deligency Report by CASURANA1973No ratings yet

- Ittefaq 2018 PDFDocument103 pagesIttefaq 2018 PDFSyed Ali DebajNo ratings yet

- 93-A China Banking Corporation v. Court of AppealsDocument2 pages93-A China Banking Corporation v. Court of AppealsAdi CruzNo ratings yet

- Bank Capital RegulationDocument57 pagesBank Capital RegulationAshenafiNo ratings yet

- Fraud Chapter 17Document6 pagesFraud Chapter 17Jeffrey O'LearyNo ratings yet

- Kristel Faye A.Cruz BA122 Bsa Iii A 1. History of The Philippine Corporate LawDocument10 pagesKristel Faye A.Cruz BA122 Bsa Iii A 1. History of The Philippine Corporate LawAsdfghjkl qwertyuiopNo ratings yet

- Revenue RecognitionDocument8 pagesRevenue RecognitionSedrick ChiongNo ratings yet

- Humpuss Trading - Eng - 31 - Des - 2018 - ReleasedDocument42 pagesHumpuss Trading - Eng - 31 - Des - 2018 - ReleasedDaffa DarwisNo ratings yet

- Option Chain (Equity Derivatives)Document2 pagesOption Chain (Equity Derivatives)sudhakarrrrrrNo ratings yet

- Unilever Nepal's Financial Health CheckDocument4 pagesUnilever Nepal's Financial Health CheckKusum GopalNo ratings yet

- Ipo ReportDocument94 pagesIpo Reportbindiya sharma71% (7)

- Winding Up of A CompanyDocument14 pagesWinding Up of A CompanyUday KiranNo ratings yet

- Crash Landing On You Company Financial StatementsDocument6 pagesCrash Landing On You Company Financial StatementsEmar KimNo ratings yet

- Cost of The Project: M/S Sarala Fly Ash BricksDocument6 pagesCost of The Project: M/S Sarala Fly Ash BricksGOUTAM GOSWAMINo ratings yet

- Capital & Derivatives MarketDocument12 pagesCapital & Derivatives Marketvikas_bhatia2007No ratings yet

- Financial Statements, Taxes and Cash Flow: Prepared by Jason Wong, MBA, CPA, CMADocument34 pagesFinancial Statements, Taxes and Cash Flow: Prepared by Jason Wong, MBA, CPA, CMASukh MakkarNo ratings yet

- TMS Boutique Profit Loss 2020Document2 pagesTMS Boutique Profit Loss 2020Syaza AisyahNo ratings yet

- Chapter 4 Financial Management IV BbaDocument3 pagesChapter 4 Financial Management IV BbaSuchetana AnthonyNo ratings yet

- FIN254 Project NSU (Excel File)Document6 pagesFIN254 Project NSU (Excel File)Sirazum SaadNo ratings yet

- MBA 533 Lecture 2 Introduction To Financial Accounting BasicsDocument59 pagesMBA 533 Lecture 2 Introduction To Financial Accounting BasicsGlentonNo ratings yet