Professional Documents

Culture Documents

Eco Assignment (p10108)

Uploaded by

Saurabh TiwariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eco Assignment (p10108)

Uploaded by

Saurabh TiwariCopyright:

Available Formats

DILEMMA OF A XLER/OPPORTUNITY COSTS VISA-VIS GAME THEORY.

Mr Rajiv after getting a good percentile in XAT, and clearing the rest processes, makes his way to study at XLRI. On the first day of classes, each of his professors distributes a course syllabus and explains that the final exam will be graded on a curve. As a result, performance on the final exam will be measured relative to the others in the class. If Rajiv outperforms most of his peers, he will earn a good grade. If he studies about the same amount, he will get an average grade, and if he doesnt study much, he is sure that he will fail the course. Rajiv considers himself about average relative to his peers. As a result, good grades will give him a strong sense of accomplishment and bolster his grade point average. However, Rajiv knows, it will take a lot of studying to perform well in the course. On a 0 to 10 scale, Rajiv rates receiving an A in any course as a 10, an average grade as 5 and a failing grade as 0. On the other hand, the costs (in terms of money spent at XLRI and free time) of studying on the same 0-to-10 scale are 4 for studying a little and 7 for studying a lot. Rajiv assumes that the rest of the class (at least on average) faces a similar set of decisions and has similar costs and benefits. If Rajivs assumptions are correct and if he makes his decision without observing the choice of his classmates (and vice versa), how much should he study per week: a lot or a little? ANALYSIS: The case in the normal form is set up as follows: THE AVERAGE PERSON IN THE CLASS. STUDY A LITTLE STUDY A LITTLE STUDY A LOT LOT (1;1) (3;-4) (-4;3) (-2;-2) STUDY A

RAJIV

There is a single pure strategy Nash equilibrium where everyone studies a lot and the payoffs are average grades with a lot of work, yielding net benefits of 2 for everyone. This simple example allows us to illustrate several key economic concepts. For example, the concept of rational decision-making can be conveyed by defining the alternatives of each of the decision-makers as well as through the use of net benefit calculations as payoffs. The process of determining the Nash Equilibrium also requires evaluating opportunity costs and utilizing marginal analysis. As an example, considering the scenario where the average person in the class studies a little, Rajiv must choose the option with the highest marginal benefit, which in this case is to study a lot, since the marginal net benefit of this alternative, is 2 (or 3-1). But, by definition, marginal analysis also incorporates opportunity cost. In this scenario the opportunity cost of studying a lot is the net benefit of studying a little, which is 1. Using a game theoretic approach to present and discuss rational, marginal analysis has several advantages over the traditional approach. First, to find the Nash Equilibrium, we must evaluate several scenarios and complete several marginal analyses. This forces us to calculate opportunity costs and apply marginal analysis several times before arriving at a solution, which necessarily increases the likelihood that we understand and master the concept. Additionally, in each scenario the opportunity costs and net benefits change. That is, even though Rajiv has a dominant strategy to study a lot (i.e., there is a positive marginal net benefit to studying a lot regardless of what the other he do), the magnitude of this marginal net benefit changes across scenarios. This underscores a central tenant of economics, namely that opportunity costs

are subjective and vary by time the decision being made and the characteristics of the decision-maker.

You might also like

- LSAT PrepTest 75 Unlocked: Exclusive Data, Analysis & Explanations for the June 2015 LSATFrom EverandLSAT PrepTest 75 Unlocked: Exclusive Data, Analysis & Explanations for the June 2015 LSATNo ratings yet

- Modules 1-10: Volver A La Semana 6Document10 pagesModules 1-10: Volver A La Semana 6Juan ToralNo ratings yet

- Assessment That Works: How Do You Know How Much They Know? a Guide to Asking the Right QuestionsFrom EverandAssessment That Works: How Do You Know How Much They Know? a Guide to Asking the Right QuestionsNo ratings yet

- Modules 1-10: Revisar Lección RelacionadaDocument9 pagesModules 1-10: Revisar Lección RelacionadaJuan ToralNo ratings yet

- Efficient Frontier HomeworkDocument5 pagesEfficient Frontier Homeworkgfdrvlyod100% (1)

- Item analysis approachDocument7 pagesItem analysis approachAKSHITA MISHRANo ratings yet

- Module 5 - Ordinal RegressionDocument55 pagesModule 5 - Ordinal RegressionMy Hanh DoNo ratings yet

- Boboiboy Informatics LRT1 3209672.PdDocument5 pagesBoboiboy Informatics LRT1 3209672.PdInformatics BoboiboyNo ratings yet

- Module 7 Weeks 14 15Document9 pagesModule 7 Weeks 14 15Shīrêllë Êllézè Rīvâs SmïthNo ratings yet

- EDUC 75 Module 7revised Measures of Central Tendency.Document14 pagesEDUC 75 Module 7revised Measures of Central Tendency.Cielo DasalNo ratings yet

- MCQ SettingtheStandardDocument26 pagesMCQ SettingtheStandardNazia EnayetNo ratings yet

- Business Report SMDM BhushanDocument18 pagesBusiness Report SMDM BhushanRaibhushNo ratings yet

- Stat Ess Mod 3 Ses 1Document29 pagesStat Ess Mod 3 Ses 1Akila100% (1)

- S7E3 Estimation HandoutDocument3 pagesS7E3 Estimation Handoutjayann.anonuevoNo ratings yet

- Random Sampling Techniques ThesisDocument5 pagesRandom Sampling Techniques Thesislodyicxff100% (2)

- Core Vocab ExpertDocument6 pagesCore Vocab Expertapi-510718006No ratings yet

- Literature Review On Measures of Central TendencyDocument6 pagesLiterature Review On Measures of Central Tendencyea0xbk19No ratings yet

- Studymanual PDFDocument34 pagesStudymanual PDFRoger SalamancaNo ratings yet

- EducationDocument31 pagesEducationAmmar IbrahimNo ratings yet

- Evaluate Homework and PracticeDocument4 pagesEvaluate Homework and Practicecampsxek100% (1)

- An Alternative Solution To The Analytic Hierarchy Process: Maria Teresa LamataDocument17 pagesAn Alternative Solution To The Analytic Hierarchy Process: Maria Teresa LamataGopala KrishnanNo ratings yet

- Fundamentals of Data Analysis by Srilakshminarayana G (FDA)Document7 pagesFundamentals of Data Analysis by Srilakshminarayana G (FDA)Shyamanth R KavimaneNo ratings yet

- Statistical Analysis Tools for Improved Marketing DecisionsDocument2 pagesStatistical Analysis Tools for Improved Marketing DecisionsJoshua CabinasNo ratings yet

- Level of AspirationDocument13 pagesLevel of AspirationShivani Marathe100% (4)

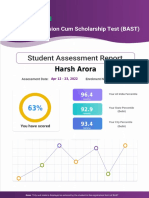

- Xam Idea - X - 2022-23Document9 pagesXam Idea - X - 2022-23Harsh AroraNo ratings yet

- 8614-2 Unique 2Document20 pages8614-2 Unique 2Ms AimaNo ratings yet

- Module Assessment1 C7.Document15 pagesModule Assessment1 C7.maria elaine melo colesioNo ratings yet

- Huawei H12-211 PRACTICE EXAM HCNA-HNTD HDocument117 pagesHuawei H12-211 PRACTICE EXAM HCNA-HNTD HCarolina MontañoNo ratings yet

- Term Paper LogicDocument7 pagesTerm Paper Logicafmzwasolldhwb100% (1)

- 8614 1Document21 pages8614 1anees kakarNo ratings yet

- Ainemanzi Barungi LRT1 3670756Document5 pagesAinemanzi Barungi LRT1 3670756sigmapowerugNo ratings yet

- Level 1 Review Quantitative Methods: Study Session 2Document4 pagesLevel 1 Review Quantitative Methods: Study Session 2Matheus AugustoNo ratings yet

- Episode3 170705080726Document8 pagesEpisode3 170705080726Jan-Jan A. ValidorNo ratings yet

- Reinforcement Learning: States, Algorithms, and FactorsDocument5 pagesReinforcement Learning: States, Algorithms, and FactorsSudharshan VenkateshNo ratings yet

- Homework Questions and AnswersDocument4 pagesHomework Questions and Answersg3v3q3ng100% (1)

- EPI0003-Assignment #3Document16 pagesEPI0003-Assignment #3G. B.No ratings yet

- Thesis Using Multiple Linear RegressionDocument7 pagesThesis Using Multiple Linear Regressiontmexyhikd100% (2)

- Homework Help Probability StatisticsDocument4 pagesHomework Help Probability Statisticscfp2bs8r100% (2)

- Interpreting Standardized Test Scores Book ChapterDocument4 pagesInterpreting Standardized Test Scores Book Chapterapi-301935239No ratings yet

- Name: Darakhshan Nigar Roll No: 2020-1104 Instructor Name: Dr. Abaidullah Semester: 2nd Subject: Theories of Test DevelopmentDocument9 pagesName: Darakhshan Nigar Roll No: 2020-1104 Instructor Name: Dr. Abaidullah Semester: 2nd Subject: Theories of Test DevelopmentShoaib GondalNo ratings yet

- Managerial Decision Making Course SyllabusDocument10 pagesManagerial Decision Making Course SyllabusAbhijeet SinghNo ratings yet

- Maths Statistics Coursework SampleDocument7 pagesMaths Statistics Coursework Samplef5dq3ch5100% (2)

- Thesis Reinforcement LearningDocument5 pagesThesis Reinforcement Learningkmxrffugg100% (1)

- IV-Day 39Document6 pagesIV-Day 39Ivan Rey Porras VerdeflorNo ratings yet

- Crack CAT DI & LR with Skills DevelopmentDocument2 pagesCrack CAT DI & LR with Skills Developmentnikhil0123456789No ratings yet

- Hypothesis TestingDocument84 pagesHypothesis TestingDiana Rose Bagui LatayanNo ratings yet

- List of Attempted Questions and Answers (Security Analysis & Portfolio Management - 2)Document3 pagesList of Attempted Questions and Answers (Security Analysis & Portfolio Management - 2)api-3745584No ratings yet

- Given My Knowledge On These Topics, These Information That I Am Going To Present Under Each Question Might Help You A Lot. Thank You. RegardsDocument2 pagesGiven My Knowledge On These Topics, These Information That I Am Going To Present Under Each Question Might Help You A Lot. Thank You. RegardsJimbo J. AntipoloNo ratings yet

- NPV IRR ExplainedDocument8 pagesNPV IRR ExplainedkumarnramNo ratings yet

- Subject:Theories of Test Development: Final Term ExaminationDocument9 pagesSubject:Theories of Test Development: Final Term ExaminationShoaib GondalNo ratings yet

- Lecture 1 Introduction(2)Document43 pagesLecture 1 Introduction(2)1621995944No ratings yet

- Data AnalyticsDocument32 pagesData Analyticsprathamesh patilNo ratings yet

- Assignment No. 1Document30 pagesAssignment No. 1Ammar IbrahimNo ratings yet

- Statistics For The Behavioral Sciences 4th Edition Nolan Solutions ManualDocument12 pagesStatistics For The Behavioral Sciences 4th Edition Nolan Solutions Manualkhuehang4k0deo100% (16)

- English For Specific Purposes (ESP) : Stephen Van Vlack Sookmyung Women S University Graduate School of TESOLDocument11 pagesEnglish For Specific Purposes (ESP) : Stephen Van Vlack Sookmyung Women S University Graduate School of TESOLNovianti ArifNo ratings yet

- What Is Reinforcement LearningDocument12 pagesWhat Is Reinforcement LearningranamzeeshanNo ratings yet

- Aptitude TestDocument27 pagesAptitude TestPhát Phạm Trần HồngNo ratings yet

- Chat Session With Acca F9 TutorDocument4 pagesChat Session With Acca F9 TutorRana Salman AwaisNo ratings yet

- Norm-Referenced InstrumentsDocument10 pagesNorm-Referenced InstrumentsRatiey Sidraa100% (1)

- How To Handle The Problem of Near Zero Determinant in Computing Reliability Using SPSSDocument7 pagesHow To Handle The Problem of Near Zero Determinant in Computing Reliability Using SPSSMr. BatesNo ratings yet

- Assignment 1: Marketing ManagementDocument37 pagesAssignment 1: Marketing ManagementHimanshu Verma100% (2)

- Unit 3 Assignment: A Simple BudgetDocument5 pagesUnit 3 Assignment: A Simple BudgetNguyên KhánhNo ratings yet

- Retail ManagementDocument40 pagesRetail Managementij 1009No ratings yet

- HDFC Life Guaranteed Wealth Plus BrochureDocument23 pagesHDFC Life Guaranteed Wealth Plus BrochureMichael GloverNo ratings yet

- Week 2 Assignment Apex ChemicalsDocument4 pagesWeek 2 Assignment Apex ChemicalsSunita Chaudhary0% (1)

- Commercial Law New (Updated)Document95 pagesCommercial Law New (Updated)Ahmad Hamed AsekzayNo ratings yet

- Retailing: by Shraddha KocharDocument45 pagesRetailing: by Shraddha KocharShraddha KocharNo ratings yet

- Street Food V/S Restaurant FoodDocument15 pagesStreet Food V/S Restaurant FoodSakthi SaravananNo ratings yet

- Montenegro Taxation Chapter 16 PresentationDocument16 pagesMontenegro Taxation Chapter 16 PresentationAngus DoijNo ratings yet

- ISM - PrimarkDocument17 pagesISM - PrimarkRatri Ika PratiwiNo ratings yet

- Indian Economy 1950-1990 - Question BankDocument5 pagesIndian Economy 1950-1990 - Question BankHari prakarsh NimiNo ratings yet

- Deed of Conditional Sale of Motor VehicleDocument1 pageDeed of Conditional Sale of Motor Vehicle4geniecivilNo ratings yet

- ECON0109 - ECON3229 Topics in MacroeconomicsDocument3 pagesECON0109 - ECON3229 Topics in MacroeconomicsLee Man Kit AydenNo ratings yet

- Number of Months Number of Brownouts Per Month: Correct!Document6 pagesNumber of Months Number of Brownouts Per Month: Correct!Hey BeshywapNo ratings yet

- The Optimal Choice of Index-Linked Gics: Some Canadian EvidenceDocument14 pagesThe Optimal Choice of Index-Linked Gics: Some Canadian EvidenceKevin DiebaNo ratings yet

- Accenture Service Design Tale Two Coffee Shops TranscriptDocument2 pagesAccenture Service Design Tale Two Coffee Shops TranscriptAmilcar Alvarez de LeonNo ratings yet

- 2001 Financial Risk Manager ExaminationDocument47 pages2001 Financial Risk Manager ExaminationbondbondNo ratings yet

- ReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDocument21 pagesReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- Annual Report: Petrochina Company LimitedDocument276 pagesAnnual Report: Petrochina Company LimitedDư Trần HưngNo ratings yet

- Aviation Leasing & Finance: Diploma inDocument9 pagesAviation Leasing & Finance: Diploma inAustein NetoNo ratings yet

- MCQ Corporate FinanceDocument13 pagesMCQ Corporate FinancesubyraoNo ratings yet

- Brand Management Assignment (Project)Document9 pagesBrand Management Assignment (Project)Haider AliNo ratings yet

- Exercise 2 - CVP Analysis Part 1Document5 pagesExercise 2 - CVP Analysis Part 1Vincent PanisalesNo ratings yet

- Online Banking and E-Crm Initiatives A Case Study of Icici BankDocument4 pagesOnline Banking and E-Crm Initiatives A Case Study of Icici BankMani KrishNo ratings yet

- Valuation of BondsDocument7 pagesValuation of BondsHannah Louise Gutang PortilloNo ratings yet

- Chapter 3 & 4 Banking An Operations 2Document15 pagesChapter 3 & 4 Banking An Operations 2ManavAgarwalNo ratings yet

- 20 Important Uses of PLR Rights Material PDFDocument21 pages20 Important Uses of PLR Rights Material PDFRavitNo ratings yet

- Liability - Is A Present Obligation Arising From Past Event, The Settlement of WhichDocument5 pagesLiability - Is A Present Obligation Arising From Past Event, The Settlement of Whichbobo kaNo ratings yet

- Inventory Policy Decisions: "Every Management Mistake Ends Up in Inventory." Michael C. BergeracDocument105 pagesInventory Policy Decisions: "Every Management Mistake Ends Up in Inventory." Michael C. Bergeracsurury100% (1)

- 9 Public FacilitiesDocument2 pages9 Public FacilitiesSAI SRI VLOGSNo ratings yet