Professional Documents

Culture Documents

Profit Planning

Uploaded by

Chaudhry Umair YounisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit Planning

Uploaded by

Chaudhry Umair YounisCopyright:

Available Formats

Profit Planning

Learning Objectives

1. Understand why organizations budget and the processes they use to create budgets.

2. Prepare a sales budget, including a schedule oI expected cash receipts.

3. Prepare a production budget.

4. Prepare a direct materials budget, including a schedule oI expected cash

disbursements.

5. Prepare a direct labor budget.

6. Prepare a manuIacturing overhead budget.

7. Prepare an ending Iinished goods inventory budget.

8.Prepare a selling and administrative expense budget.

9. Prepare a cash budget.

10. Prepare a budgeted income statement and a budgeted balance sheet.

Lecture Notes

A. The Basic Budgeting Framework. A budget is a detailed plan outlining the

acquisition and use oI Iinancial and other resources over a speciIied time period.

1. Planning and control. A good budgeting system must provide Ior both planning

and control. Planning involves developing objectives and preparing various budgets to

achieve those objectives. Control involves the steps taken by management to ensure

that the objectives set down at the planning stage are attained and that all parts oI the

organization work together towards those objectives.

2.Advantages of budgeting. There are many advantages to budgeting, including:

O udgeting provides managers with a vehicle Ior communicating their

plans in an orderly way throughout the entire organization.

O udgeting requires managers to give planning top priority.

O udgeting provides a means oI allocating resources to those parts oI the

organization where they can be most eIIectively used.

O udgeting uncovers potential bottlenecks beIore they occur.

O udgeting coordinates the activities oI the entire organization by

integrating the plans and objectives oI the various parts.

O udgets provide benchmarks Ior evaluating subsequent perIormance.

. Responsibility accounting. A manager should be held responsible Ior those items

oI revenues and costs-and only those items-that the manager can actually control to a

signiIicant extent. The manager who is held responsible Ior a speciIic cost should

have a budget speciIying a limit on how much can be spent. This limit may be

adjusted, depending upon the activity during the period. This idea will be developed

in later chapters.

. Choosing a budget period. udget periods vary in length. Some may be as short

as a month, whereas others may cover many years. The most common budgeting

period, however, is a year.

O perating budgets ordinarily cover a one-year period. Additionally,

many companies divide their operating budgets into quarterly or monthly

periods.

O A continuous or perpetual budget is one that covers a 12-month period

but which adds a new month on the end as the current month is

completed. This approach stabilizes the planning horizon at one year.

. Self-imposed participative budget. The most successIul budget programs involve

lower-level managers in preparing their own budgets. There are two basic reasons: 1)

lower-level managers are more Iamiliar with the details oI their own operations than

top managers and 2) managers tend to be more committed to budgets that they have

been able to inIluence.

6. Human relations. Management must keep clearly in mind that budgeting involves

coordinating and motivating people and the human dimension is oI primary

importance.

O Top managers must clearly convey the message in actions as well as in

words that budgeting is important. II top management appears to be

ambivalent about the beneIits oI budgeting, others in the organization

will be reluctant to commit their own time and energy to the budgeting

process.

O II there is a preoccupation with getting every dollar and cent right or

with placing blame, the budgeting process will be resented and managers

will attempt to "game the system." udgets should not be used as a club.

They should be a way oI ensuring that everyone understands what is

expected. SigniIicant deviations Irom the budget should be investigated

so that managers understand changing conditions and their implications

Ior the organization. Managers should not ordinarily be punished Ior

deviations Irom the budget.

B. Preparing the Master Budget. The master budget consists oI a number oI

separate, but interrelated budgets. The interrelationships among these various budgets

are illustrated in Exhibit 9-2 in the text. Schedules 1 through 10 in the text present a

comprehensive example oI a master budget.

%. Budgets in large organi:ations can be very complex. The budgets in the text

are substantially simplified. Even so, these simplified budgets are quite intricate and

the level of detail may appear overwhelming. Each step in the process is fairly simple,

but the budgets must fit together. Return to Exhibit 9-2 from time to time to provide

the context for each of the separate budgets making up the master budget.

1. The Sales Budget (Schedule 1 in the text). The sales budget is a detailed schedule

showing the expected sales Ior the coming period. It is typically expressed in both

dollars and units oI the product. The sales budget is usually accompanied by a

schedule oI expected cash receipts. The schedule oI expected cash collections should

take into account delays in collecting credit sales.

2. The Production Budget (Schedule 2 in the text). The budgeted production Ior each

period can be determined by adding together the budgeted sales and the desired

ending inventory and then subtracting the beginning inventory. The desired ending

inventory in units Ior each period is usually a predetermined percentage oI budgeted

unit sales Ior the Iollowing period. The production budget is typically expressed in

terms oI physical units rather than in dollars.

In a merchandising Iirm, a merchandise purchases budget would replace the

production budget. The merchandise purchases budget shows the amount oI goods to

be purchased Irom suppliers each period. This can be determined by adding together

the budgeted sales and the desired ending inventory and then subtracting the

beginning inventory. As in a manuIacturing Iirm, the desired ending inventory in units

is usually some predetermined percentage oI the unit sales Ior the Iollowing period.

. The Direct Materials Budget (Schedule 3 in the text). nce production needs

have been determined, a direct materials budget should be prepared. This budget

details the materials that will be required to IulIill the production budget and to ensure

adequate inventory levels. SuIIicient amounts oI raw material must be acquired to

meet both production needs and to provide Ior desired ending inventories. Materials

purchases can be determined by adding together the materials required Ior production

needs and the desired ending materials inventories and then subtracting the beginning

inventory. The desired ending inventory in units is usually a predetermined percentage

oI the number oI units that are expected to be used in production the Iollowing period.

The direct materials budget is usually accompanied by a schedule oI expected cash

disbursements Ior raw materials. This schedule should take into account any delays

that are anticipated in paying Ior materials.

. The Direct Labor Budget (Schedule 4 in the text). nce production needs are

known, the direct labor budget must be prepared so that the company will know

whether suIIicient labor time is available to meet those needs. The direct labor budget

is typically expressed in both direct labor-hours and in dollars. Translating the direct-

labor requirements into spending can lead to complications iI there is overtime or iI

there is some sort oI guaranteed employment policy.

. The Manufacturing Overhead Budget (Schedule 5 in the text). The

manuIacturing overhead budget lists all production costs other than direct materials

and direct labor. ManuIacturing overhead costs should be broken down by cost

behavior Ior budgeting purposes. Typically, the variable portion oI manuIacturing

overhead is assumed to be proportional to budgeted activity and the Iixed portion is

assumed to be constant in total. Under the assumption that depreciation is the only

signiIicant non-cash manuIacturing overhead expense, the manuIacturing overhead

expense can be converted to a cash Ilow basis by backing out oI the total any

depreciation charges.

6. Ending Finished Goods Inventory Budget (Schedule 6 in the text). This budget

details the amount and value oI ending inventory on the budgeted balance sheet. The

unit product cost Irom this budget is also used to compute the cost oI goods sold Ior

the budgeted income statement. The details oI the computations will depend upon

whether variable or absorption costing is used. Managers oIten want budgets on an

absorption costing basis since that is the basis that will ordinarily be used to report

results to outsiders. Data Ior the computations in this schedule are Iound in the direct

materials, direct labor, and manuIacturing overhead budgets.

7. The Selling and Administrative Expense Budget (Schedule 7 in the text). The

selling and administrative budget lists the anticipated non-manuIacturing expenses Ior

the budget period. In practice this budget is usually made up oI many smaller

individual budgets negotiated with various managers having sales and administrative

responsibilities. Setting appropriate budget limits Ior selling and administrative

Iunctions is one oI the most diIIicult problems in management accounting and is just

beginning to be understood.

8. The Cash Budget (Schedule 8 in the text). The cash budget should be broken

down into time periods that are as short as Ieasible in order to alert management to

problems that may occur due to Iluctuations in cash Ilows. As anyone with a checking

account knows, it is quite possible to have a positive overall cash Ilow during a period

and yet be overdrawn at some point during the period. The cash budget is composed

oI Iour major sections:

a. The receipts section.

b. The disbursements section.

c. Cash receipts, plus the beginning cash balance, less cash disbursements results in

cash excess or deIiciency. II a deIiciency exists, additional Iunds must be arranged

Ior. II an excess exists, previous borrowing can be repaid or short-term investments

made.

d. The Iinancing section oI the cash budget provides a detailed account oI the

borrowing and repayments projected to take place during the budget period. It also

includes a detailing oI interest payments.

%. For simplicity, all of the interest calculations in the text, transparencies, and

problems assume simple interest is used with no compounding.

. Budgeted Financial Statements (Schedule 9 in the text). The last components oI

the master budget consist oI the budgeted income statement and the budgeted

statement oI Iinancial position. The balance sheet is perhaps the most diIIicult oI the

statements to construct in the examples we use. It requires pulling together data Irom

a variety oI schedules and sources.

%. After reviewing the makeup of each budget within the master budget, return to

Exhibit 9-2 and think of how the order in which the various budgets are prepared

could be altered. This process helps to clarify in your mind the interrelationships of

these various budgets.

You might also like

- IPSAS Explained: A Summary of International Public Sector Accounting StandardsFrom EverandIPSAS Explained: A Summary of International Public Sector Accounting StandardsNo ratings yet

- Module 3 - BudgetingDocument24 pagesModule 3 - Budgetinganalyst7788No ratings yet

- Bab IiDocument16 pagesBab IiAmelia SembiringNo ratings yet

- Hitachi Energy Annual-Report 2022-23 Web-VersionDocument212 pagesHitachi Energy Annual-Report 2022-23 Web-VersionMan MohanNo ratings yet

- Chapter No:-1 1.1: Introduction of Audit: Stakeholders Material Legal PersonDocument31 pagesChapter No:-1 1.1: Introduction of Audit: Stakeholders Material Legal PersonmadhuriNo ratings yet

- AUDIT BAB 7 FixDocument10 pagesAUDIT BAB 7 FixGusNo ratings yet

- CH 14Document20 pagesCH 14sumihosaNo ratings yet

- Usefulness of Accounting Information To Investors and CreditorsDocument20 pagesUsefulness of Accounting Information To Investors and CreditorsAnis A'yadi DaswirNo ratings yet

- 07 - Positive Accounting TheoryDocument15 pages07 - Positive Accounting TheoryMohammad AlfianNo ratings yet

- Resume: Cost Management and StrategyDocument4 pagesResume: Cost Management and StrategyAniya SaburoNo ratings yet

- Profit PlanningDocument10 pagesProfit Planningsanjay parmarNo ratings yet

- Strategic Financial Management GLIM GURGAON 2012-13Document11 pagesStrategic Financial Management GLIM GURGAON 2012-13Yeshwanth Babu100% (1)

- Internal Audit Independence and ObjectivityDocument38 pagesInternal Audit Independence and ObjectivityMd Sifat KhanNo ratings yet

- F2.1 Notes & PPDocument220 pagesF2.1 Notes & PPjbah saimon baptiste100% (2)

- Amazon's Main Business Units Analyzed Using BCG MatrixDocument11 pagesAmazon's Main Business Units Analyzed Using BCG MatrixManhNo ratings yet

- Assignment On Accounting TheoryDocument20 pagesAssignment On Accounting TheoryASHIMA MEHTANo ratings yet

- Accounting Theory 7th Edition GodfreyDocument7 pagesAccounting Theory 7th Edition GodfreySamir Raihan ChowdhuryNo ratings yet

- Accounting Research and Trust A Literature Review PDFDocument43 pagesAccounting Research and Trust A Literature Review PDFsailendrNo ratings yet

- Paper On E-AccountingDocument6 pagesPaper On E-AccountingPriyang RavalNo ratings yet

- Group 5 Weekly Task Accounting Theory 11th Meeting A Brief Review of Cost Allocation MethodDocument6 pagesGroup 5 Weekly Task Accounting Theory 11th Meeting A Brief Review of Cost Allocation MethodEggie Auliya HusnaNo ratings yet

- Strategic Management AccountingDocument32 pagesStrategic Management AccountingAlvinaNo ratings yet

- The Evolution of Accounting Theory and Its Role in SocietyDocument36 pagesThe Evolution of Accounting Theory and Its Role in SocietyAhmadYaseen100% (2)

- Reporting Standards Impact Company AssetsDocument8 pagesReporting Standards Impact Company AssetsAqsa ButtNo ratings yet

- Case Chapter 12Document3 pagesCase Chapter 12rika kartikaNo ratings yet

- Lie Dharma Putra-Audit EngagementDocument3 pagesLie Dharma Putra-Audit EngagementDarma SparrowNo ratings yet

- Control and Accounting Information System - CH 7 RomneyDocument21 pagesControl and Accounting Information System - CH 7 RomneyTamara SaraswatiNo ratings yet

- Financial AccountingDocument159 pagesFinancial AccountingTRINI100% (2)

- Conceptual Framework: MKF 4083 Accounting Theory & PracticeDocument25 pagesConceptual Framework: MKF 4083 Accounting Theory & PracticeMohamad SolihinNo ratings yet

- Romney Ais13 PPT 22Document10 pagesRomney Ais13 PPT 22Justin StraubNo ratings yet

- The Decision Usefulness Approach to Financial ReportingDocument27 pagesThe Decision Usefulness Approach to Financial ReportingAyu PuspitasariNo ratings yet

- Jurnal Akuntansi Dan Keuangan Vol 14 No 2Document146 pagesJurnal Akuntansi Dan Keuangan Vol 14 No 2Benedicts100% (5)

- Porter's Generic Strategies As Applied Toward E-Tailers Post-LeeginDocument7 pagesPorter's Generic Strategies As Applied Toward E-Tailers Post-LeeginAleem KhanNo ratings yet

- International Accounting Choi SMDocument11 pagesInternational Accounting Choi SMelfishsamurai147No ratings yet

- Complete Revision Notes Auditing 1Document90 pagesComplete Revision Notes Auditing 1Marwin Ace100% (1)

- Final Handbook On Accounting Treatment Under GST (20-6-19) PDFDocument146 pagesFinal Handbook On Accounting Treatment Under GST (20-6-19) PDFAdi Sam100% (3)

- Business CombinationDocument47 pagesBusiness CombinationHeliani sajaNo ratings yet

- Syllabus 2014 NbaaDocument104 pagesSyllabus 2014 NbaaFred Raphael Ilomo50% (2)

- Accounting Standards SummaryDocument5 pagesAccounting Standards SummaryVinesh MoilyNo ratings yet

- 2011 Accounting Standards in NigeriaDocument70 pages2011 Accounting Standards in Nigeriaoluomo1100% (1)

- Accounting Measurement SystemDocument7 pagesAccounting Measurement SystemDionysius Ivan Hertanto100% (1)

- Accounting Theory Construction PDFDocument23 pagesAccounting Theory Construction PDFPriyathasini ChandranNo ratings yet

- Banking Fundamentals: Types, Definitions and OriginsDocument209 pagesBanking Fundamentals: Types, Definitions and OriginsSasi Devi RamakrishnanNo ratings yet

- Chapter 7Document14 pagesChapter 7marwanNo ratings yet

- Financial ManagementDocument11 pagesFinancial ManagementMadhusudhan GowdaNo ratings yet

- Key Audit Matters Aug 2019Document20 pagesKey Audit Matters Aug 2019ahmed naseerNo ratings yet

- Chapter 15Document22 pagesChapter 15Ivan BliminseNo ratings yet

- IPSAS in Your Pocket - January 2021Document61 pagesIPSAS in Your Pocket - January 2021Megha AgarwalNo ratings yet

- Tax AuditDocument16 pagesTax AuditArifin FuNo ratings yet

- Modern Auditing Ch11Document31 pagesModern Auditing Ch11astoeti_sriNo ratings yet

- CTP BooksDocument3 pagesCTP BooksuzernaamNo ratings yet

- Process CostingDocument4 pagesProcess CostingAhsaan KhanNo ratings yet

- Family Economic Education Financial Literacy and Financial Inclusion Among University Students in IndonesiaDocument4 pagesFamily Economic Education Financial Literacy and Financial Inclusion Among University Students in IndonesiaLmj75 ntNo ratings yet

- Financial Audit ManualDocument162 pagesFinancial Audit Manualshane natividadNo ratings yet

- IFRS 1 Practice Handout on IAS 36 Impairment of AssetsDocument5 pagesIFRS 1 Practice Handout on IAS 36 Impairment of Assetsnoor ul anumNo ratings yet

- CH - 2 Master Budget - Ahmed With Illustration and SolutionDocument15 pagesCH - 2 Master Budget - Ahmed With Illustration and SolutionYohannes MeridNo ratings yet

- CH - 3 Master Budget - With Illustration and SolutionDocument16 pagesCH - 3 Master Budget - With Illustration and SolutionMelat TNo ratings yet

- Cost II-Ch - 3 Master BudgetDocument14 pagesCost II-Ch - 3 Master BudgetYitera SisayNo ratings yet

- Managerial Accounting Asiacareer College/Cparcenter Operational and Financial Budgeting DWM - Reyno, Cpa, DbaDocument3 pagesManagerial Accounting Asiacareer College/Cparcenter Operational and Financial Budgeting DWM - Reyno, Cpa, DbaCertified Public AccountantNo ratings yet

- 10) BudgetingDocument5 pages10) BudgetingAlbert Krohn SandahlNo ratings yet

- Prisons We Choose To Live InsideDocument4 pagesPrisons We Choose To Live InsideLucas ValdezNo ratings yet

- Software Project Sign-Off DocumentDocument7 pagesSoftware Project Sign-Off DocumentVocika MusixNo ratings yet

- Winny Chepwogen CVDocument16 pagesWinny Chepwogen CVjeff liwaliNo ratings yet

- 11 Days Banner Advertising Plan for Prothom AloDocument4 pages11 Days Banner Advertising Plan for Prothom AloC. M. Omar FaruqNo ratings yet

- Subject and Object Questions WorksheetDocument3 pagesSubject and Object Questions WorksheetLucas jofreNo ratings yet

- Disaster Drilling Land RigsDocument21 pagesDisaster Drilling Land Rigsmohanned salahNo ratings yet

- The Princess AhmadeeDocument6 pagesThe Princess AhmadeeAnnette EdwardsNo ratings yet

- Sana Engineering CollegeDocument2 pagesSana Engineering CollegeandhracollegesNo ratings yet

- Battle of Qadisiyyah: Muslims defeat Sassanid PersiansDocument22 pagesBattle of Qadisiyyah: Muslims defeat Sassanid PersiansMustafeez TaranNo ratings yet

- Stann Creek PDFDocument199 pagesStann Creek PDFSeinsu ManNo ratings yet

- ACC WagesDocument4 pagesACC WagesAshish NandaNo ratings yet

- Meeting Consumers ' Connectivity Needs: A Report From Frontier EconomicsDocument74 pagesMeeting Consumers ' Connectivity Needs: A Report From Frontier EconomicsjkbuckwalterNo ratings yet

- Mixed 14Document2 pagesMixed 14Rafi AzamNo ratings yet

- Cost of DebtDocument3 pagesCost of DebtGonzalo De CorralNo ratings yet

- Everything You Need to Know About DiamondsDocument194 pagesEverything You Need to Know About Diamondsmassimo100% (1)

- The Catholic Encyclopedia, Volume 2 PDFDocument890 pagesThe Catholic Encyclopedia, Volume 2 PDFChristus vincit SV67% (3)

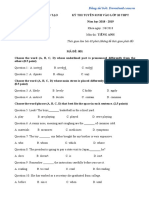

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangDocument5 pagesĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiNo ratings yet

- Chaitanya Candra KaumudiDocument768 pagesChaitanya Candra KaumudiGiriraja Gopal DasaNo ratings yet

- EAR Policy KhedaDocument40 pagesEAR Policy KhedaArvind SahaniNo ratings yet

- The Witch of Kings CrossDocument11 pagesThe Witch of Kings CrossMarguerite and Leni Johnson100% (1)

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesDocument24 pagesJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareNo ratings yet

- 5 8 Pe Ola) CSL, E Quranic WondersDocument280 pages5 8 Pe Ola) CSL, E Quranic WondersMuhammad Faizan Raza Attari QadriNo ratings yet

- Account statement for Rinku MeherDocument24 pagesAccount statement for Rinku MeherRinku MeherNo ratings yet

- Personal Values: Definitions & TypesDocument1 pagePersonal Values: Definitions & TypesGermaeGonzalesNo ratings yet

- Influencing Decisions: Analyzing Persuasion TacticsDocument10 pagesInfluencing Decisions: Analyzing Persuasion TacticsCarl Mariel BurdeosNo ratings yet

- New Wordpad DocumentDocument2 pagesNew Wordpad DocumentJia JehangirNo ratings yet

- Ncaa Financial Report Fy19 AlcornDocument79 pagesNcaa Financial Report Fy19 AlcornMatt BrownNo ratings yet

- Understanding Culture, Society and PoliticsDocument3 pagesUnderstanding Culture, Society and PoliticsแซคNo ratings yet

- Marketing, Advertising and Product SafetyDocument15 pagesMarketing, Advertising and Product SafetySmriti MehtaNo ratings yet

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDocument40 pagesPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshNo ratings yet