Professional Documents

Culture Documents

EFTAnnualReview2008 2009

Uploaded by

Georgi TerziyskiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EFTAnnualReview2008 2009

Uploaded by

Georgi TerziyskiCopyright:

Available Formats

EFT Group Annual Review 2008/2009

is the premier energy trading and investment group specialising in western, central ____ and south-east Europe.

____ The Energy Financing Team Group

EFT Group Annual Review 2008/2009

01

EFT is leading the development of the south-east European electricity market through energy trading and investment in new production units.

CONTENTS

A brief look at 2008 Results Analysis Group structure Products & Services Reserve Energy feature Expansion Exchanges Innovation Ulog HPP Stanari mine TPP Stanari Fatnic Polje tunnel ko Summary of Group activities UCTE transmission network P02 P04 P06 P08 P10 P12 P14 P16 P18 P20 P22 P24 P26 P28 P40

02

EFT Group Annual Review 2008/2009

01.

A brief look at 2008

A BRIEF LOOK AT 2008

After a remarkable performance in 2007, the EFT Group set itself conservative goals for 2008 and managed to achieve highly creditable results. With declining economic activity resulting in the falling industrial use of electricity, as well as reduced wholesale power prices, it should not be surprising that some headline numbers for the Group show reductions. Total energy delivered amounted to 13.3 TWh, while consolidated turnover advanced from EUR 810 million in 2007 to EUR 975 million in 2008. Economic factors were the key drivers in the drop in volume of power delivered, but towards the end of the year the increase in water reserves for some customers also decreased their requirements for imported energy well below long-term averages. The Groups trading business has been carefully expanded over the years, and is not subject to the transitory nature of the financial markets. Each year the mix of countries that form the principal sources of supply, and to which the Group in turn supplies energy, changes. In 2008 over half of all sales were to customers based in EU countries, while deliveries in Croatia, Macedonia and Montenegro were also significant. Group sales in any single country did not exceed 15 per cent of total volumes delivered, a testament to the robust diversity of EFTs client portfolio. Cross border capacity (CBC) remains a key focus of the Groups business, with significant effort placed in both reducing the absolute level of cost to a minimum, whilst exploiting the maximum gain to be had from trading success. CBC costs increased overall by more than 140 per cent over the previous year, indicative of substantially increased regional competition. That said, this level of cost will tend to reduce over 2009 as overall consumption and regional flows decline. An important development has been the expansion of the Groups business into Turkey, where a new joint-venture company has been formed with local partners. This new departure forms part of a long-term vision the Group has developed for the gradual integration of Turkey within the UCTE framework, and the possibilities for significant business both within the country and across its borders ahead of that integration. The Turkish venture also allows EFT to plan for the development of the Groups business towards Central Asia in due course.

EFT Group Annual Review 2008/2009

03

staying power something the EFT Group ____ possesses in abundance.

____ Our theme this year is clear

On the investment front, the Group continued to make strong strides forward. The granting of the concession to build and operate HPP Ulog in Bosnia and Herzegovina brings EFT a major step closer to achieving its strategic goal of becoming the premier independent energy producer in south-east Europe. This 35 MW hydro capacity will in tandem with the Stanari thermal power plant form an increasingly optimal base for future trading activities. While it has become clear that the general world economic framework has not made the task of building a major state-of-theart power station any easier in South-East Europe indeed quite the reverse the first phase of the Stanari project has been successfully completed in 2008. The Stanari TPP is widely acknowledged to be one of the best developed and most prospective energy projects anywhere within an enormous radius of Bosnia and Herzegovina. Whilst the process of securing both an equity partner and of negotiating an acceptable EPC contract for the plant will have to run

at a slower pace in the present circumstances, the Group has not relaxed its commitment to ensure that every element of the project that can be completed is finalised. With that in mind, the development and implementation of all environmental and social action plans has continued apace, with the continued and welcome guidance and support of the EBRD in London. In the shifting sands of the modern economic world, it is those with the deepest and most secure foundations, founded on the bedrock of careful organisational design and prudent operating principles, that will endure and continue to prosper. Our theme this year is clear staying power something the EFT Group possesses in abundance and on which its clients and customers worldwide can rely.

04

EFT Group Annual Review 2008/2009

02.

Results

RESULTS

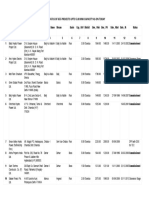

EFT Group deliveries in 2008 amounted to TWh 13.3, while consolidated turnover advanced from EUR 810 million in 2007 to EUR 975 million. Each year the mix of countries that form the principal sources of supply, and to which the Group in turn supplies energy, changes. In 2008 over half of all sales were to customers based in EU countries.

EFT Group Annual Review 2008/2009

05

16 14 12 10 8 6 4 2 0

2002

2003

2004

2005

2006

2007

2008

OCT JUL APR JAN OCT JUL APR JAN OCT JUL APR JAN OCT JUL APR JAN OCT JUL APR JAN OCT JUL APR JAN OCT JUL APR JAN Energy supplied contracted - MWh (millions) ALBANIA MACEDONIA MONTENEGRO KOSOVO SERBIA BOSNIA AND HERZEGOVINA CROATIA 3 14 7 2 0.5 3 9 15.5 GERMANY 2 AUSTRIA 9 ITALY 2.5 SLOVENIA 3 CZECH REPUBLIC 3 SLOVAKIA 2.5 HUNGARY 11 ROMANIA 5 BULGARIA 8 GREECE EFT sales in 2008 % MONTENEGRO ALBANIA SERBIA BOSNIA AND HERZEGOVINA CROATIA 0.5 0.5 2 5 1.5 13 GERMANY 2 AUSTRIA 1 ITALY 1 SLOVENIA 15 CZECH REPUBLIC 5 SLOVAKIA 9 HUNGARY 25 ROMANIA 19 BULGARIA 0.5 GREECE EFT purchases in 2008 %

06

EFT Group Annual Review 2008/2009

03.

Analysis Outlook for 2009

ANAL YSIS

Energy underpins all economic activity. As south-east Europe is no exception in suffering the knock-on effects of the world-wide financial crisis (several countries will exhibit technical recessions in 2009), there is a serious danger that the investment required in the energy sector will be further deferred, storing up problems for future generations.

EFT Group Annual Review 2008/2009

07

The collapse of several global investment banks in 2008 unleashed a domino series of events. International commodities have collapsed in price. South-east Europe has a long history of extraction or processing energy intensive metals, and this industry is threatened. In the spotlight are the aluminium smelters, steel mills, metallurgy complexes and the automotive, chemicals and construction industries. These exportoriented industries (which are coincidentally among the key drivers of economic growth in the region and also among the largest energy consumers) have either drastically reduced output or ceased production entirely.

If electricity prices have collapsed, no corresponding downward trend has emerged for the price of generation plant and equipment. The cost of technology for thermal generation plant has actually risen by 4.3 per cent to EUR 1200/kW, for hydro generation plants by 19 per cent to EUR 3700/kW, for CCGT plants by 2.1 per cent to EUR 650/kW and for off-shore wind parks by 10.7 per cent to EUR 2300/kW.

Investment in new capacity has become less attractive as costs and perceived risks increase. The assumptions on which projects have been modelled and forecast are in question. Further, the regional energy sector With reduced industrial demand for electricity, still faces the problems of transition from the regional energy balance has shifted radically state control to being market-based, a lack in 2009. Pre-crisis there was an energy deficit of developed market mechanisms, a poor legal and institutional framework and an outdated and power flowed into the region. The fall transmission network. in demand (approximately 15 per cent in 1Q 2009) creates unexpected surpluses, Compounding the problem are (i) the poor leading inevitably to sharp falls in prices. financial standing of many state-run power Wholesale electricity sold at over EUR 80/ utilities, and (ii) the curtailment of international MWh in October 2008, yet just five months energy company expansion strategies, as the later, in March 2009, it had fallen below EUR focus moves away from aggressive acquisitions 40/MWh. toward consolidation. Equally critical for the energy sector In terms of critical investment in new energy is a contraction in available capital and the generation in the region, the overriding issues increasing debt costs. Six leading European are clear who will invest in new power plants energy companies saw their cost of financing and how? If the pace of new development rise on average by 1.2 per cent in 1Q 2009 looked painfully slow before 2008, how much alone. When available, comparable data for slower will it be now? south-east Europe will doubtless reveal a significantly worse picture, as markets price Unexpected surpluses and price drops send in higher overall regional risk factors. wrong and potentially dangerous signals vs-a-vs the need for investment and continued (albeit painful) reform. Without these, energy prices will rise sharply once demand adjusts, creating further obstacles for economic growth and development.

The response of the multilaterals (above all the European Bank for Reconstruction and Development, and the European Investment Bank) will be a crucial determining factor. At a time when short-termism might lead to the suspension of projects and reform efforts, there is a risk that investment in new power generation will stall. What is needed instead is a re-affirmed commitment to the longer-term, to secure the growth and future prosperity of south-east Europe. The prevention of conflict and the settled growth of south-east Europe are goals that must be achieved a vision shared with the Marshall Plan, a vision that implies strengthened commitments to development, not retrenchment. In trading, market participants will focus heavily on predicting demand and price trends, this year and beyond. The signals are equivocal. Many point to prolonged economic crisis and continued downward pressure on electricity prices, but conversely oil prices can be predicted to rise again, following OPEC action, leading to higher gas prices and eventually to higher wholesale regional power prices. With conflicting signals and the volatility these will engender, constructing the right trading strategy is challenging. Those with an ability to manage their portfolios dynamically and with years of in-depth local knowledge will best navigate a safe course between the Scylla and Charybdis of the regions energy markets the intricate subtleties and highly specific regional risks, of payment, performance and moral hazard for the less well-equipped travellers, troubled waters lie ahead.

EFT Territory

Italy Germany Austria Czech Republic Slovakia Hungary Slovenia Croatia Bosnia & Herzegovina Serbia Kosovo Romania Bulgaria Macedonia Albania Greece Montenegro

08

EFT Investments Limited

CYPRUS

04.

EFT (Holdings) ApS

DENMARK

EFT Group Annual Review 2008/2009

Group Structure

GROUP STRUCTURE

Energy Financing Team d.o.o. Trebinje

BiH

EFT Group Rudnik i Termoelektrana Stanari d.o.o.

BiH

EFT Bulgaria E.A.D.

BULGARIA

EFT Hrvatska d.o.o.

CROATIA

EFT Cesko a.s.

CZECH REPUBLIC

EFT (Hellas) S.A.

GREECE

Trading Licence

POLAND

EFT Budapest Zrt

HUNGARY

EFT Makedonija DOOEL

MACEDONIA

EFT Group Annual Review 2008/2009

09

Energy Financing Team d.o.o. Herceg-Novi

Energy Financing Team (Switzerland) AG

Energy Financing Team Romania S.R.L.

Energy Financing Team Limited

Energy Financing Team d.o.o.

Elektric Financ Tim d.o.o. ni ni

EFT Slovakia s.r.o.

EFT (Turkey) A.S.

EFT Ukraine

MONTENEGRO

SWITZERLAND

Under formation

SLOVENIA

SLOVAKIA

ROMANIA

TURKEY

SERBIA

UK

Notes.

Trading Licence

i: ii: Energy Financing Team (Switzerland) AG is the Groups principal energy trading company. The main activity of all companies within EFT Group is energy trading, with the exception of: EFT Investments Limited holding company. EFT (Holdings) ApS holding company. EFT Rudnik i Termoelektrana Stanari d.o.o. Mine and Thermal Power Plant iii: All companies are 100% owned with the exception of EFT (Turkey) AS. iv: EFT (Turkey) AS is a Joint Venture. EFT (Holdings) ApS owns 50.9999%, Energy Financing Team (Switzerland) AG owns 0.0001%

EFT Albania Sh.p.k

ALBANIA

KOSOVO

10

EFT Group Annual Review 2008/2009

05.

Products & Services

EFTs products and services are constantly improved to meet the ever changing needs of our clients. In addition to standard base and peak energy, the Group can also offer weekly base or peak, workday base, peak or offpeak, weekend energy, scheduled and full delivery from hourly, daily, monthly, to quarterly, yearly and longer term periods.

The flexibility of the EFTs portfolio allows the Group to offer a number of tailor-made derivative products. These include: Extendable delivery purchase and sales contracts These contracts typically have an above or below market unit price but with an embedded option permitting the holder the right but not the obligation to extend the contract term quantity and price for a pre-agreed period. Interruptible delivery purchase and sales contracts The buyer has the right to interrupt, stop or postpone the delivery of energy. Emergency delivery of energy on short and long term notice The flexible nature of EFTs portfolio, and its skill in securing greater access to cross border rights, allows EFT the opportunity to market reserve energy services to several transmission system operators. Unlike a stand-alone power plant, EFT is able to optimise its entire portfolio to provide the most efficient and finest priced reserve energy service. For more information see page 12. Upward reserve power Delivery of reserve power on a tertiary reserve basis with activation on minute and hourly notice. Downward reserve power EFT is able to guarantee energy off-take for its partners at times of unexpected surpluses in their portfolios. Physical location and time swaps These swaps aim to circumvent congested borders by swapping like-for-like quantities of physical energy in different countries at some fixed or floating formula agreed by the parties. Fixed-for-floating, with or without cap or floor These structures permit the customer to conclude a contract now at a price slightly away from the real market price, in return for securing the ability to earn a better price in the future. To earn this price improvement a contract specifies that on the day the contract is signed an observation is made of the prevailing price in Germany. This first observation date is then compared with a second observation date, which must be before the commencement of the deliveries. The difference between the two observation dates is measured and then applied to the originally agreed contract price. In the event the customer wishes to protect himself against an adverse change between the two observation dates, EFT can provide a cap or floor, subject to the inclusion of a co-efficient that limits any positive benefit in the event of a favourable move between the two observation periods (i.e. EUR 1 real move might only alter the unit price by EUR 0.50).

PRODUCTS & SERVICES

allows the Group to offer a number of tailor-made ____ derivative products.

____ The flexibility of EFTs portfolio

EFT Group Annual Review 2008/2009

11

12

EFT Group Annual Review 2008/2009

06.

Virtual Power Reserve

VIRTUAL POWER RESERVE

EFTs portfolio of energy products confers a remarkable degree of flexibility, allowing EFT to compete highly effectively against traditional (physical unit-based) suppliers of minute and hourly reserve energy.

to fit the precise reserve energy requirements ____ of a given TSO.

____ EFT prepares tailor-made solutions

EFT Group Annual Review 2008/2009

13

Contracted power reserve sales 2009 ELES

145 MW on 15-minute demand, for up to 16 hours duration.

MAVIR

280 MW on 2-hour demand, for up to 8 hours duration.

Why should a TSO buy Virtual Power Reserve? In comparison with the traditional auxiliary power reserve, VPR is cheaper, more reliable, encourages Rather than maintaining a physical efficient utilization of generation, production unit in reserve, EFT and optimises cross-border is able to fine-tune its export schedule transmission capacities. to accommodate interruption at very short notice. In principle, a modification EFT prepares tailor-made solutions to fit the precise reserve energy is made to the intra-day schedule, leaving the incumbent transmission requirements of a given TSO. For example, we can specifically system operator (TSO) with energy design a reserve energy proposal in its network that was originally to meet a TSOs seasonal demands, planned as an EFT export. enabling the client to avoid Simultaneously, in real time, EFT contracting excess capacities. secures its missing energy from other sources within its portfolio. EFT can accommodate almost any schedule and can even offer multiple activations per day, variable response times and flexible supply duration. What is the Virtual Power Reserve? Virtual Power Reserve (VPR) is a product pioneered by EFT in the south-east Europe energy market.

EFT power reserve references For the past 5 years, EFT has been the contracted supplier of minutenotice reserve energy for the Slovenian and Hungarian system operators, ELES and MAVIR. Over this period, EFT has maintained availability on every day. Each and every request for activation was fulfilled in accordance with the demand of the requesting TSO. The duration of those activations ranged from 1 hour to 15 hours. The largest hourly change in the demanded intraday schedule was 200 MW a figure not easily replicated by a physical unit at the relevant pricing.

14

EFT Group Annual Review 2008/2009

07.

Exchanges

EXCHANGES

The introduction of the BSP South Pool platform in Slovenia has increased the number of energy exchanges on which EFT is present. The Group now trades daily in spot and energy derivative products on seven international energy exchanges. These are:

www.eex.de

EEX Leipzig, Germany

EXAA Vienna, Austria

www.exaa.at

GME Rome, Italy

www.mercatoelettrico.org

PXE Prague, Czech Republic

www.pxe.cz

OPCOM Bucharest, Romania

www.opcom.ro

POOL Athens, Greece

www.desmie.gr

BSP South Pool Ljubljana, Slovenia

www.bsp-southpool.com

At a glance.

For an example of exchange rules and regulations visit: www.eex.com

EFT Group Annual Review 2008/2009

15

Trading on these exchanges provides EFT with a valuable tool in balancing its portfolio. The participants on these exchanges trade via open and cost-effective electronic access on equal terms. All traders undergo a rigorous licensing procedure. The exchanges are governed by stringent rules and regulations.

16

EFT Group Annual Review 2008/2009

08.

Expansion

EXPANSION

EFT has expanded the frontiers of its operation to include Turkey, marking the beginning of an exciting new venture for the Group.

EFT Group Annual Review 2008/2009

17

Turkeys electricity consumption has grown ____ at 7% per annum.

____ Over the last decade

Turkeys eventual accession into the EU and the countrys expected assimilation into the UCTE in 2010/2011 introduces a growing new market within EFTs sphere of interest and operation. Over the last decade Turkeys electricity consumption has grown at 7% per annum. The countrys total electricity generation was 199 TWh in 2008, 80% of which was covered by the national power utility EUAS. On balance, Turkey has an energy deficit. In terms of energy flows, Turkey is very much a gateway between Europe and the Middle East, given the borders with Bulgaria, Greece, Armenia, Georgia, Azerbaijan, Iran, Iraq and Syria. It generally imports energy from Turkmenistan

(via Iran), Azerbaijan, Georgia and Greece, and at certain times of year energy flows out to Greece, Georgia, Syria and Iraq. At present, all energy trading inside Turkey is regulated through TETAS, a public institution. A market price is paid for off-take from the independent power producers, while the price at which energy is sold to distribution companies is set by the government. The privatization process is however underway, and the expected liberalization of the market is first expected to affect the operation of the distribution companies. The present barriers to imports and the tight regulation of the retail market are also expected to be eased through the liberalization process. EFTs local joint-venture subsidiary received its trading licence in October 2008. The Group is already exploring opportunities for crossborder trading. Once Turkeys energy sector is liberalized, EFT will bring its unrivalled knowledge and experience of the traded energy markets to the local scene.

18

EFT Group Annual Review 2008/2009

09.

Innovation

mathematical models and simulation the information ____ is translated into usable forecasts.

____ Through application of various analytical tools,

INNOVATION

Innovative trading for tomorrow As traded volumes continue to grow and market competition intensifies market correlation, price transparency and market liquidity all improve. Such market developments help foster and encourage new ideas and innovative product development. Constantly thinking of new ways to meet customers needs has been at the heart of EFTs business philosophy and this approach has yielded impressive results for the Group. Innovative transactions and options such as location and time swaps, fixed for floating contracts, virtual cross-border capacity transactions and long term correlated hedging strategies linked to the forward curves on the EEX or one of the other European energy exchanges have all been pioneered in the region by EFT. As one of the major traders and suppliers of energy and ancillary services throughout the entire region, the Group is able to leverage its flexible portfolio and make the best use of its progressive attitude to new trends and markets.

EFT Group Annual Review 2008/2009

19

Power where you need it, when you need it The EFT Group manages its scheduling through a centralized Trading Floor, located in the Belgrade office. From here the Group optimises its entire portfolio, ensuring that clients demands are met at all times. The trading floor also enables EFT to respond to the ever changing circumstances in the regions transmission grid and production capacities. The organization of the Trading Floor is traditional. The trading department deals with spot and longer term arrangements. The Scheduling department makes schedules, takes care of cross border capacity allocations and helps optimise the whole portfolio managing different energy sources, customers in different countries and cross border energy flows and costs. State of the art scheduling Within the Trading Floor, is EFTs innovative 24-hour Scheduling Center This unique centre enables EFT to meet the needs of a huge array of clients any time during a day, with intraday trading.

EFTs documentary support department is tasked with invoicing, preparation of deal confirmations and statistics. In addition the whole trading floor structure is supported by EFTs customdesigned software system, EPOX. This software enables EFT to adapt quickly to the changing demands of clients and transmission system operators. In-depth market analysis EFTs trading activity is supported by an in-house analytical team, which continually collects information relevant to the electricity market. Through application of various analytical tools, mathematical models and simulation the information is translated into usable forecasts for the trading department. These include forecasts on electricity consumption, price of electricity and other fuels, per country and industry energy balances etc Analysis of the various relevant regulations and legislation, such as that related to CO2 policies, also falls within the scope of the analytical teams activities.

20

EFT Group Annual Review 2008/2009

10.

Ulog Hydro Power Plant

to begin in 2011, while completion is planned ____ for mid-2014.

____ Construction works are expected

ULOG HYDRO POWER PLANT

In March 2009 the authorities of Republika Srpska began the process of granting EFT a concession to build and operate the Ulog hydro power plant on the river Neretva in eastern Herzegovina.

EFT Group Annual Review 2008/2009

21

At a glance.

Location: Bosnia and Herzegovina Cost: Circa EUR 100 million Energy Production: 75 GWh per year

Development of HPP Ulog on the upper part of river Neretva dates back to the early 1960s, at a time when the development of the existing HPPs on the Neretva also commenced. At present, there are six operating units: HPP Jablanica, HPP Grabovica, HPP Salakovac, HPP Mostar and HPP Rama operated by the Bosnian state power utility EPBiH. Given the topographical, geological, geotechnical and hydro-geological conditions, and the need for maximum preservation of the existing infrastructure and maximum utilization of the existing head of water, the design of the new HPP Ulog unit will consist of the following fundamental structures: __ A new Nedavic dam with a back water level of 641 meters above sea level; __ A new water-supply system running from Nedavic to Grad; __ A secondary HPP Nedavic further downstream. , The preliminary feasibility study for the unit, prepared for EFT by the water management Institute Jaroslav Cerni, sets out the following energy parameters for the proposed object:

__ Installed system capacity __ Average electricity generation __ Peak-load energy __ Base-load energy

33 MW 75 GWh/yr 53 GWh/yr 22 GWh/yr

EFT has already commenced detailed elements of the project. These include the collection of all the relevant data for the preparation of full technical and environmental studies, commissioning of the final feasibility study, the drafting of tender procedures and the drawing up of applications for planning permission. In water-management terms, the planned development has been designed to ensure full compliance with local regulations and international standards with regards an ecologically acceptable outfall. From a social aspect, the location of the dam and the area which will in any way be affected by its construction and operation is remote and conveniently not populated. Construction works are expected to begin in 2011, while completion is planned for mid-2014. The estimated total project value is in the region of EUR 100 million.

22

EFT Group Annual Review 2008/2009

11.

Stanari Energy Complex Stanari Mine

as one of the best examples of successful ____ privatisations in the entire region.

____ Today, the Stanari mine is seen

EFT Group Annual Review 2008/2009

23

2008 was the year in which the first phase of the development of the Stanari mine and thermal power plant was successfully completed. The Stanari energy complex is now recognized as one of the best developed and most prospective energy projects not only in Bosnia and Herzegovina but the whole region.

STANARI MINE

The Stanari coal basin is located approximately 70 km to the east of Banja Luka in Republika Srpska, Bosnia and Herzegovina. EFT took over the control of the mine following an international tender in May 2005. The Group immediately set out a clear goal of overcoming the mines incessant production and debt problems, as well as expanding its capacity to enable it to meet the demands of the new 420 MW Stanari TPP. New management was put in place and since then over EUR 20 million has been invested in the complete rehabilitation and modernization of the mine. Record coal production was achieved successively in 2007 and 2008, while the operation at the mine has merited the international ISO 9001-Quality Management System, ISO14001-Environmental Management System and OHSAS 18001-Safety Management certification. Over 150 new jobs have been created and the Stanari mine is today seen as one of the best examples of successful privatization in the entire region. Project development In terms of increasing the annual coal production capacity to the 3.2 million tons required for the operation of the planned TPP, the following activities have been completed: __ Independent lignite coal reserves assessment and classification according to JORC Code (2004) by Dargo Associates; __ Feasibility Study for the Development of Stanari Mine by C&E Consulting wwand Engineering (www.cue-chemnitz.de); __ The Stanari basin geological lignite coal reserves have been classified in accordance with JORC Code (2004). Proven reserves are 108 million tonnes, with further measured reserves of 15 million tonnes; __ The tender process for the purchase of the new overburden excavation machinery and coal supply system to the TPP has been successfully implemented.

At a glance.

Location: Central Bosnia Employees: 416 EFT investment: circa EUR 30 million Coal production in 2008: 620,000 tonnes

24

EFT Group Annual Review 2008/2009

11.

Stanari Energy Complex Stanari TPP

STANARI THERMAL POWER PLANT

The feasibility study and the preliminary design of the Stanari TPP, as well as the EPC tender documents, outline the following technical concept: __ The power plant design is based on a state of the art once-through pulverised-coal-fired steam generator with supercritical parameters (275 bar/580 C; RH 60 bar/600 C) and a modern 3-stage turbine; __ The generation unit has an installed Project development In terms of increasing the annual coal production capacity to the 3.2 million tonnes required for the operation of the planned TPP, the following activities have been completed. Feasibility and design studies __ Preliminary Feasibility Study with Conceptual Design prepared by Institute for Construction Banja Luka; __ Feasibility Study with Preliminary Eco monitoring and social impact studies __ Detailed one-year ecological monitoring of air quality, water, soil, noise and vibration and meteorological data at the Stanari location, including the monitoring of air quality and meteorological data in five surrounding towns; __ Stanari Environmental Impact Assessment (EIA) Study prepared by IPSA Institute - Sarajevo. The EIA was submitted to the Ministry of Ecology of Republic Srpska for approval. capacity of 410 MW and a gross efficiency Design prepared by the international After public consultation and review consortium of Colenco Power Engineering above 44 %; by an independent licensed consultancy __ Complete flue gas treatment, including and Steinmuller Engineering. company, the study was approved in February 2008. The Ecology Permit Explorations works desulphurisation and dust removal; __ Exploration works at the site of TPP for TPP Stanari was awarded by the __ Indirect dry-cooling system with dry Ministry of Ecology of Republic Srpska Stanari including geo-mechanical, natural-draft cooling tower; in May 2008. An independent evaluation geophysical, geotechnical, seismic and __ Ash and residue disposal within and verification of the EIA study hydrological exploration. to international standards including the excavated areas of the Stanari mine. Water supply studies Equator Principles was completed by __ Water Supply Study prepared The grid connection for the TPP Stanari Mott Macdonald; by Institute for Water Resources to the power transmission network __ Review of land acquisition and social Development Jaroslav Cerni. will be at the 400 kV level, with a direct impacts of the Stanari project performed connection to the Banja Luka-Tuzla by an independent international consultant; transmission line, situated only __ Regional Electricity Market Study 1.5 kilometers from the plant site. The Stanari TPP will be the first energy generation unit in Bosnia and Herzegovina to fully abide by the EU directives (2001/80/EC) on protection of the environment. The plant will set new standards in south east Europe not only for energy efficiency, but also for minimizing any harmful impact on the environment. for South East Europe by Poyry Energy Consulting; __ Study for the connection of TPP Stanari to the transmission network system of Bosnia and Herzegovina by the Electricity Coordinating CentreBelgrade (www.ekc-ltd.com).

EFT Group Annual Review 2008/2009

25

At a glance.

Total value of investment: circa EUR 1 billion Energy production: 3000 GWh per year Environmental standards: according to EU directives Phase 1 of the project completed

Tender documentation and negotiations __ EPC tender documentation prepared by the international consortium of Colenco Power Engineering and Steinmuller Engineering; __ EPC prequalification process in conformity with EBRD guidelines; __ Negotiations with EPC contractors; __ Agreement for the preparation of the final technical and commercial EPC proposal for TPP Stanari with SNC Lavalin. Zone planning and land acquisitions __ Stanari Zone Regulation Plan developed by Space Planning Institute of Republic Srpska and adopted by the authorities of Doboj Municipality. Zone planning permit for TPP Stanari awarded by the Ministry for Space Planning, Construction and Ecology; __ Land acquisition for the TPP Stanari site has been completed.

Site works __ TPP site preparation works including site levelling, fencing, road connection, securing electricity and water supply to be completed by end-2009. Concession and Construction permits __ The concession contract for construction and operation of the TPP Stanari has been signed with the Government of Republic Srpska; __ Construction permit for the TPP Stanari has been issued by the Regulatory Commission for Energy of Republika Srpska; __ The agreement with Elektroprenos BiH (Power Transmission Company of BiH) for the connection of TPP Stanari to the 400 kV network has been signed. Plans for 2009 Phase 2 of the project began in 2009. The main aims for the year will be: __ The completion of the TPP site preparation; __ The arranging of project finance; __ Completion of negotiations with the EPC contractor and signing of the EPC contract for TPP Stanari; __ Procurement of the necessary overburden excavation machinery and TPP coal supply system.

26

EFT Group Annual Review 2008/2009

12.

Fatnic Polje-Bilec accumulation tunnel ko a

At a glance.

Location: Eastern Herzegovina Built: 2006 Cost: EUR 26 million Energy Production: 150 GWh per year

EFT Group Annual Review 2008/2009

27

FATNICKO POLJE-BILECA TUNNEL

The largest infrastructural project in Herzegovina for decades In November 2008, rights to the energy generated as a result of additional flows of water through the Fatnic Polje-Bilec accumulation tunnel ko a within the Trebisnica hydro-system in eastern Herzegovina finally transferred from EFT to the local power utility EPRS. This change marked the successful conclusion of a seven-year contract between EFT and EPRS, under which the Group financed the successful completion of the largest modern infrastructural project in Herzegovina, financed entirely through energy off-take. History The Fatnic Polje-Bilec accumulation tunnel ko a is an integral part of the Upper Horizons hydro-system in eastern Herzegovina. The basic concept of the system is to accumulate waters in the fields of eastern Herzegovina during rainy periods and later move it through a system of tunnels, thereby producing energy and creating drained arable land. The building of the Upper Horizons hydro-system began in 1969 but was not completed owing to building problems and later conflicts in the region. Among the unfinished parts of the system was the Fatnic Polje-Bilec accumulation tunnel. ko a

In 2001 the authorities in Bosnia and Herzegovina called an international tenderl for the completion of the tunnel. EFTs bid in consortium with Bosnias Hidrogradnja was by far the best. The company committed to investing EUR 26 million in the digging of the remaining part of the tunnel, the completion of its concrete lining and the installation of control mechanisms and infrastructure. In August 2007, the Fatnic Polje-Bilec accumulation ko a tunnel was officially put into use, at the completion of the largest civil engineering project in Herzegovina commissioned in many decades. The tunnel now produces some 150 GWh of energy per year through channelling flood waters from upper levels through the mountains to existing lower level hydro-electric power plants in eastern Herzegovina. The project directly employed some 400 people during construction, and several hundred more indirectly. It is environmentally sound and sustainable, and has no adverse effects on the surroundings. Financing through energy off-take Because of the inability of the local power utility to directly finance the project, the completion of the tunnel was financed through the off-take by EFT of the energy produced by the operation of the tunnel, over a period of seven years. Ownership of the tunnel and accompanying infrastructure remained with EPRS throughout the life of the project. Upon the expiry of the seven year period, in November 2008, the surplus energy produced by the tunnel reverted to EPRS as part of its portfolio.

28

EFT Group Annual Review 2008/2009

13.

Summary of Group Activities

SUMMARY OF GROUP ACTIVITIES

EFT Group Annual Review 2008/2009

29

CH

Switzerland

Energy Financing Team AG (Switzerland) is the principal operating company within the EFT Group.

EFT AG has the strongest balance sheet of all the Group trading companies and generates most of the Groups income. The Swiss company is responsible for a large percentage of EFTs client business and also covers tasks related to Group risk management, treasury, controlling and marketing. The Swiss office is managed and supported by professional staff with extensive experience in energy trading, risk management, financing, accounting and legal.

UK

United Kingdom

The London office provides the Group companies with a wide range of support services, including financial modelling, legal and treasury advice, documentation control and public relations.

These EFT professionals have decades of experience in the management of all kinds of financial risks, built through careers in commercial and investment banking, the capital markets, the trade finance and forfait markets, as well as accountancy and law. In terms of documentation support, EFT London has a strong in-house legal capacity and a team with extensive experience in structured finance and commodity trading. Alongside the Swiss office, London looks after documentary standards and risk control through adequate contractual protection for the Group in all its businesses. The London office is also in charge of legal aspects related to company formation within the Group. The financial experience of the London team supports the treasury work carried out in the Swiss unit. EFT London also undertakes the tasks of financial modelling for various Group investment projects.

Switzerland

Energy Financing Team (Switzerland) AG Pestalozzistrasse 2 CH-9000 St Gallen Switzerland Tel: + 41 71 226 1030

United Kingdom

Energy Financing Team Limited Cavendish Court 11-15 Wigmore Street London W1U 1PF UK Tel: + 44 207 518 9250

30

EFT Group Annual Review 2008/2009

13.

Summary of Group Activities

DE

Germany

The unrivalled liquidity, as well as the presence of the EEX energy exchange, underlines the importance of the German market to EFTs trading operation.

EFT traded electricity with 12 partners in Germany during 2008. Among these was the EEX energy exchange in Leipzig. In 2008 EFT delivered MWh 679,856 in the German - E.ON Grid, achieving a EUR 44 million turnover in the process. Group deliveries to the RWE grid in Germany during 2008 were MWh 1,374,613 and accounted for EUR 92 million. On the VET grid, EFT delivered MWh 3,120 during 2008.

3

AT

Austria

EFT delivered MWh 264,364 in Austria during 2008 and achieved a turnover of EUR 15 million.

On the Austrian energy exchange, EFT traded MWh 112,788 in total during 2008. The result represents 4.53% of the total volume of energy traded on EXAA during the year. EFT traded with 10 partners in Austria in 2008. Apart from the EXAA energy exchange in Vienna, these included Rtia Energie, Essent NV, Korlea Invest, ATEL, Ezpada, CEZ Trading and BKW FMB Energy. Industrial demand for energy in Germany fell by 10% in the first quarter of 2009. Energy intensive industries have been worst affected. Steel production has fallen by 50%, while machine orders are 40% less compared to the same period in 2007. In 2009 - 2010 the main objective for EFT in Germany will be to maintain its current position.

19

386

19

E.ON RWE VAT

261

1377

680

572

1375

2006 2007 2008 EFT deliveries in Germany GWh

OTHERS 95 EFT 5 EFT share in volume traded on EXAA 2008 %

Germany & Austria

Elektric Financ Tim d.o.o. ni ni Titova cesta 2a (IV) 2000 Maribor Slovenia Tel: + 386 2 620 9782

EFT Group Annual Review 2008/2009

31

IT

Italy

EFT delivered MWh 1,244,129 of energy in Italy during 2008 and achieved a turnover of EUR 101 million in the process. The result represents a 524% rise on the EUR 19 million achieved in 2007.

EFT had 5 trading partners in Italy during 2008, including the Italian energy exchange GME. These were also the multi-utility company A2A, the countrys largest energy producer ENEL, the BURGO paper mill and the owner of Italys transmission grid TERNA. The Italian energy sector has been severely affected by the economic crisis, which began with the collapse of the national air-carrier Alitalia, several big banks and insurance groups. This has created a dominoeffect, which has most impacted the energy intensive industries in the country. Steel production was particularly affected, with a 40% downturn being recorded in the first quarter of 2009 only. EFTs main goal in 2009 will be to consolidate and enlarge its position on the Italian market, and to create a platform from which to eventually take advantage of opportunities in the retail market.

CZ

Czech Republic

2008 was the first year in which EFT traded electricity in the Czech Republic. In total MWh 700,000 of energy was traded in the country during 2008, of which MWh 625,000 was exported. A total turnover of EUR 44.5 million was achieved.

EFT has 10 trading partners in the Czech Republic, including PEAS, CEZ, E.ON, Ezpada, ATEL, OTE, MVM Adwest. EFT also trades on the Czech energy exchange PXE. Of all the central European countries, the Czech economy seems best suited to overcome the economic slowdown. EFT expects to significantly increase the volume of energy purchased in the country during 2009.

SLO GR A

98 67

7 4

1245

1262

2922

2006 2007 2008 EFT deliveries per border GWh

2006 2007 2008 EFT deliveries GWh

Italy

Energy Financing Team (Switzerland) AG Pestalozzistrasse 2 CH-9000 St Gallen Switzerland Tel: + 41 71 226 1030

Czech Republic

EFT Cesko a.s. Ovocn trh 572/11 110 00 Prague 1 Czech Republic Tel: + 36 1 301 8724

2022

233

32

EFT Group Annual Review 2008/2009

13.

Summary of Group Activities

SK

Slovakia

EFT deliveries in Slovakia doubled in 2008 compared with previous year. In total MWh 1,209,000 of energy was delivered and a turnover of EUR 77 million was achieved.

EFT trading partners in Slovakia included the three major distribution companies ZSE, SSE and VSE, as well as the leading traders operating in the country. The introduction of the EURO to Slovakia in 2008 had a strong stabilising effect on the countrys economy. Slovakia was able to weather the first wave of economic crisis better than most of its neighbours. The automotive and associated service and supply industries have been most affected, including the VW, KIA and PSA assembly plants. Revenues of Slovakian companies have on average fallen by 19% in the first quarter of 2009. Energy consumption in 2009 is expected to fall. However, it is the decommissioning of the second, 440 MW block at the NPP Jaslovske Bohunice V1 that will most impact the Slovakian energy balance during the year. The resulting energy deficit will certainly provide opportunities for the strengthening of EFTs position and expansion into the retail market.

HU

Hungary

Hungary remains one of the key markets for EFT. In 2008 the Group delivered MWh 3,243,000 of energy, with a total value of EUR 210 million. The result represents a 44% increase compared with the previous year.

EFT traded with 15 partners in Hungary during the year. These included MVM, the Hungarian distribution companies, E.ON, the Vrtesi TPP, the Mtrai TPP and the AES TPP. In addition, EFT supplied MAVIR with MW 280 short-notice upward power reserve. Of all the central European countries, Hungary has been worst affected by the economic crisis. All the export oriented industries have been severely affected, including automotive, cement, fertiliser, steel and consumer electronics. Industrial output fell by 25% in the first quarter of 2009 alone, while GDP is expected to shrink by 6% in 2009. This will undoubtedly affect energy consumption, which is expected to be MWh 2,000,000 less than the previous year. EFTs goal in Hungary during 2009 will be to maintain its market-maker position.

135

463

785

18

2006 2007 2008 EFT sales GWh

2006 2007 2008 EFT share in wholesale market %

Slovakia

EFT Slovakia s.r.o. Karadzicova 8/A (CBC I) 821 08 Bratislava Slovakia Tel: + 421 2 5939 6154

Hungary

EFT Budapest Zrt Sas utca 10 12 Budapest HU 1051 Hungary Tel: + 36 1301 8724

22

17

EFT Group Annual Review 2008/2009

33

PL

Poland

The Polish wholesale market operates according to a specific set of rules, which could be compared with an island mode. Market entry for new participants in Poland is thus fraught with more difficulties than in other central European countries, like the Czech Republic or Slovakia.

2008 was the year for setting up the infrastructure for the trading operation, and for evaluating opportunities and risks in the local market. EFT concluded its first trading transaction in Poland in 2009. The trading license in Poland is owned by the Groups Hungarian company, EFT Budapest Zrt.

SI

Slovenia

In 2008 EFT left the retail market in Slovenia and delivered MWh 305,000 of energy in total. A turnover of EUR 23.5 million was achieved in the process.

The Group traded in electricity with the 5 Slovenian distribution companies, as well as with HSE, GEN-I, TE-TOL, ATEL, Ezpada and Korlea. The Group also supplied the Slovenian TSO ELES with 15-minute power reserve services. The Slovenian economy has been significantly impacted by the crisis. The metal processing and automotive industries have bared the brunt of the initial phase of the crisis, and further job losses are expected. The consumption of energy was down by 7.5% in January, compared with the same period the previous year. It is expected that in 2009 overall energy consumption in Slovenia will drop by 9%. The planned overhauls of NPP Krsko in April, TPP Trbovlje in May and Unit 4 of TPP Sostanj in August and September will ensure that Slovenia remains a country with an energy deficit. This could however be lessened by favourable hydrology and record production from hydro units. Overall, in 2009 the Slovenian energy deficit is expected to drop from 20% to 10% of total energy consumption.

2020

258

2006 2007 2008 EFT deliveries GWh

Poland

EFT Budapest Zrt Sas utca 10 12 Budapest HU 1051 Hungary Tel: + 36 1301 8724

Slovenia

Elektric Financ Tim d.o.o. ni ni Opekarska 5 Ljubljana 1000 Slovenia Tel: + 386 1 565 44 88

290

34

EFT Group Annual Review 2008/2009

13.

Summary of Group Activities

HR

Croatia

Unusually low winter temperatures resulted in a 13.3% increase in energy consumption in Croatia during 2008. The country remained one of the key markets for the EFT Group in 2008.

In total the Group delivered MWh 1,166,906 of energy in Croatia and achieved a turnover of EUR 82 million during the year. In the same period, EFT bought MWh 151,728 of energy in Croatia for the total value of EUR 9 million. The Group company in Croatia has begun the process of acquiring a licence to trade on the internal market. The economic downturn has considerably impacted the Croatian economy. In thefirst quarter of 2009 the manufacturing sector has recorded an abrupt Owing subsidized price decline in production output. of energy, both for industry The tobacco industry output and household segments, fell by 56%, automotive there is still no functioning industry by 43.9% while the internal energy market in Croatia. Asa result, the state remainder of manufacturing by as much as 63%. power utility HEP remains the dominant trading partner for EFT.

BA

Bosnia and Herzegovina

With subsidized prices for energy and no functioning internal electricity market, EFTs trading transactions in Bosnia and Herzegovina in 2008 were executed with the three state owned power utilities.

pursuing the Ulog HPP project on the river Neretva (see page 16). So far, EFT has successfully realised the Fatnic Polje-Bilec ko a accumulation tunnel project On the investment front, (see page 22) and privatized Bosnia and Herzegovina the Stanari mine (see page is by far the most important 18). With over EUR 50 million country for the EFT Group. already invested in Bosnia Apart from the Groups and Herzegovina, EFT is the flagship project, the Stanari leading foreign investor thermal power plant (see page in the countrys energy sector. 20), the Group is also EFT delivered MWh 382,319, with a financial turnover of EUR 28 million. The Group will aim to better this result in 2009 by 25%.

6 7

1659

1017

-974

-664

-204

1178

SALES PURCHASES

2006 2007 2008 EFT sales and purchase GWh

ERS EPBiH EPHZHB

87

70

26

2006 2007 2008 EFT purchases %

Croatia

EFT Hrvatska d.o.o. Trnjanska 37 5th Floor 10000 Zagreb Croatia Tel: + 385 1 619 4748

Bosnia and Herzegovina

Energy Financing Team d.o.o. Trebinje Obala Luke Vukalovic b.b. a Trebinje 89 101 Republika Srpska Bosnia and Herzegovina Tel: + 387 59 270 410

76

22

EFT Group Annual Review 2008/2009

35

RS

Serbia

While there is still no real functioning electricity market in Serbia, owing to its geographic position the country remains one of the key transit destinations for EFT Group.

2008 saw a moderate continuation of the rising trend in volume of traded electricity in Serbia. In total, MWh 4,843,000 was traded during the year, a 4.32% rise on 2007. A lions share of this energy (78.95%) was transited through Serbia to other final destinations. Transactions on the domestic market accounted for 5.59%, while purchases accounted for the rest. These outstripped sales by 6.1 times.

KV

Kosovo

The KEK power utility remains the sole buyer of energy in Kosovo. EFT delivered MWh 196,153 of energy to KEK during 2008, with a total value of EUR 32 million.

Owing to a lack of meaningful industrial activity, the consumption of electricity in Kosovo is dictated by household consumers. As a result, the economic crisis is not expected to significantly impact KEKs import needs in 2009. EFTs goal will be to maintain its position as one of KEKs key suppliers of energy.

IMPORTS 2,188,895 EXPORTS 2,383,360 PURCHASES 232,592 SALES 38,127 Traded volume in 2008 MWh

Serbia

Energy Financing Team d.o.o. Bulevar Mihaila Pupina 10b/II 11070 Belgrade Republic of Serbia Tel: + 381 11 30 11 021

Kosovo

Energy Financing Team (Switzerland) AG Pestalozzistrasse 2 CH-9000 St Gallen Switzerland Tel: + 41 71 226 1030

36

EFT Group Annual Review 2008/2009

13.

Summary of Group Activities

RO

Romania

In comparison with the previous year, the volume of EFT sales in Romania nearly tripled during 2008. The Group delivered MWh 2,462,300 of energy and achieved a turnover of EUR 122 million.

EFT was also the leading private exporter of energy from Romania in 2008. The upward trend is a result of increased activity on the wholesale market, dictated by the needs of the Group portfolio. EFT traded with all the leading traders in Romania, including E.ON, ATEL and CEZ. The Group was also present on the Romanian energy exchange OPCOM, which was effectively used for balancing of the Group portfolio. The economic crisis has brought with it a considerable drop in electricity consumption in Romania. A 10% drop was recorded in the first quarter of 2009 only, and the yearly consumption is expected to reach 2002 levels. Industrial output has also fallen in the first quarter and is 15% lower compared with the same period the previous year. As with other countries in the region, energy intensive industries have been worst affected, above all steel mills, the metallurgy complexes and the construction industry.

BG

Bulgaria

During 2008 EFT delivered MWh 221,634 of energy in Bulgaria and achieved a turnover of EUR 8 million. These were to the local power utilities CEZ Bulgaria, Enemona Utilities and E.ON Bulgaria, as well as the lead and zinc producer OCK.

EFTs plans in 2009 will focus on expanding its eligible customer base by a further 25%. Since the closure of the two MW 400 units at the Kozloduy NPP, Bulgaria has steadily lost its position as the dominant exporter of energy in the south-east European region. The competitiveness of the Bulgarian energy sector has since then depended on hydrology and the price of imported coal, gas and oil. Bulgarian exports in the future will also depend on the market prices in the region. Bulgarias dominant position could be reaffirmed with the completion of the Belene NPP.

Romania

Energy Financing Team Romania S.R.L. European Business Center 2nd Floor 24 Blvd Mircea Voda CP 030667 Bucharest 3 Romania Tel: + 40 21 302 3623

Bulgaria

EFT Bulgaria A.D. 1A Sekvoya Boyana Sofia 1616 Bulgaria Tel: + 359 2 8159 300

EFT Group Annual Review 2008/2009

37

MK

Macedonia

EFT covered circa 75% of all energy imports into Macedonia during 2009. The Group delivered MWh 1,865,511 of energy to 10 clients and achieved a turnover of EUR 160 million.

EFTs clients included the state system operator MEPSO, the national power utility ELEM, the leading distribution company EVN and major industrial consumers such as FENI, Silmak, Bucim, Makstil, Arcelor Mital, Skopski Leguri and Titan Cementara. EFTs aim in Macedonia in 2009 will be to maintain and improve its current market position, and to be a dependable supplier of energy to its partners. This will be an especially difficult task, with the changing economic circumstances and the expected drop in industrial consumption. Apart from trading, EFT is evaluating several investment opportunities in the Macedonian energy sector.

ME

Montenegro

EFT delivered MWh 969,877 of energy to Montenegro in 2008, with a total value of EUR 79 million.

The Group was the leading supplier of the national power utility Elektroprivreda Crne Gore (EPCG) and the KAP Aluminium smelter in Podgorica. KAP is part of the Central European Aluminum Company (CEAC), which was created to manage the assets of the EN + Group in Central-Eastern Europe. It is the powerhouse of the Montenegrin economy, accounting for 51% of the countrys exports. With the collapse of the price of aluminium, the smelter has fallen on hard times in 2009. Production output has been more than halved, and the plants long term prospects remain in doubt. KAP also accounted for over 30% of Montenegros energy consumption. Its possible closure in 2009, coupled with favourable hydrology could lead to Montenegro becoming an energy exporter in the coming period.

EFT 24 OTHERS 76

EFT 36 OTHERS 64

EFT 75 OTHERS 25

900 800 700 600 500 400 300 200 100 0

2006

2007 EFT sales - %

2008

EPCG KAP

2005

2006

2007

2008

EFT deliveries to EPCG and KAP - GWh

Macedonia

EFT Makedonija DOOEL Majakovski 3 / M2 1000 Skopje Makedonija Tel: + 389 23 215 062

Montenegro

Energy Financing Team d.o.o. Herceg Novi (Montenegro) Sitnica bb 85340 Herceg Novi Montenegro Tel: + 382 31 353 700

38

EFT Group Annual Review 2008/2009

13.

Summary of Group Activities

GR

Greece

EFT delivered MWh 1,025,558 of energy in the Greek grid during 2008 and achieved a financial turnover of EUR 76 million. The Group served the needs of two clients: the Hellenic transmission system operator HTSO and the national power utility PPC.

The Greek economy has been impacted much like the rest of the region. Energy intensive industries, above all the metallurgy complex, have borne the brunt of the slowdown. Aggregate electricity consumption fell by 4.6% in the first quarter of 2009, and for the year is expected to be 20% less than in 2008. EFTs aim in Greece in 2009 will be to consolidate its position and to explore opportunities with eligible consumers in the medium and low voltage market segments.

AL

Albania

Albania is the only country in the region which is expecting an increase in energy consumption in 2009. As there are no heavy industries in the country, no negative impact of the economic crisis on electricity consumption in Albania is expected. Indeed, as the household sector accounts for nearly all of the total electricity consumption in the country, an increase of up to 5% is expected during the year.

EFT maintained its position as one of the leading suppliers of energy to the state power utility KESH, as well as the biggest distribution company OSSH. In total, the Group delivered MWh 456,202 during the year and achieved a turnover of EUR 36 million. The Group is actively evaluating several investment opportunities in Albania. In the beginning of 2009, a local company, EFT Albania, was registered in line with new legislation.

1015

1758

1752

2006 2007 2008 EFT sales GWh

KESH OSSH

79 21 EFT deliveries in 2008 %

Greece

EFT (Hellas) S.A. 151 Kifisias Avenue 15124 Maroussi Athens Greece Tel: + 30 210 80 67500

Albania

EFT Albania Sh.p.k Gjergji Centre Murat Toptani Street Tirana Albania Tel: + 355 4 2235 104

EFT Group Annual Review 2008/2009

39

TR

Turkey

In October 2008 EFTs local company in Turkey was licensed to trade in electricity on the local market. EFT Elektrik Enerjisi thalat hracat ve Toptan Sat A.. aims to be the leading energy trader in the country, once the market liberalizes in line with the EU accession process. Turkeys UCTE membership is expected in 2011.

Turkey is a country of 74 million people. Its economy has been rapidly expanding over the last decade. With it, electricity consumption has grown, on average at 7% per annum. In 2008 it totalled TWh 199. Of this amount, around 80% is generated by the state power utility EUAS. The remaining deficit is covered by energy imports from Turkmenistan, Azerbaijan, Georgia and Greece. To the last two, as well as to Iraq and Syria, Turkey exports energy at times of seasonal surplus.

Turkey

EFT Elektrik Enerjisi thalat hracat ve Toptan Sat A.. Toprakkale S. No:2 Etiler, Istanbul 34337 Turkey Tel: + 90 212 265 1177

40

EFT Group Annual Review 2008/2009

14.

UCTE Transmission Network

Eindhoven Mol Langerlo Awirs Urfort Ohligs Van Eyck Neurath Siersdorf Witten Arpe Unna Bren Sd Wrgassen Twistetal Wolkramshausen Gttingen Sandershausen Bergshausen Nehden Schkopau Lippendorf Taucha Pulgar Grodalzig Eula Schwarze Brwalde Pumpe Strumen Schmlln Boxberg Mikulowa Czarna Pasikurowice Klecina Biskupice wiebodzice Wroclaw

Waldeck Niederwartha Erfurt-Nord Turow Nauerbau Opladen Vieselbach Cieplice Graetheide Niederwiesa Dresden-Sd Opole Sechtem Borken Boguszw Eisenach Bressoux Dillenburg Groschwabhausen Siegburg Rhrsdorf Mecklar Weida Zbkowice Lixhe Bezdin Crossen Oberzier Angleur Poii Chotejovice Lieem Dauersberg Zwnitz Hohenwarte Jupille Babylon Gieen/Nord K. Zdroj Alar Chomutov Pocerady Neuwied Romse Tuimice Remptendorf Markersbach Dipperz Mlnik Pa endorf Brume Altenfeld Limburg Nchod Dlouh Strn Gramme Rimire Weienthurm Neznov Vykov Prunerov Drnigheim Achne Coo Dahlem Ems Goldisthal Mechlenreuth Kerben Vesov Tynec Koblenz Marcourt Vitkov F.-West Malesice Hradec Redwitz Staudinger Schweinfurt NiederHou alize Vchod eporyje H. ivotice Frankfurt Opoinek Tisov Hradec stedem Grokrotzenburg Grafenrheinfeld Chvaletice Villeroux Wengerohr Chodov Zpad Kriftel Marxheim Eltmann Krasikov Kelsterbach Vianden Bauler . Sted Wrgau Heinsch Mainz Flebour Aubange Chrast Urberach Niederhausen Oberhaid Roost Latour Quint Biblis Saint-Mard Heisdorf Etzenricht Trennfeld Bischofsheim Orlik Trier Kriegenbrunn Mirovka Uchtelfangen Brstadt Milin Happurg Mt.-St.ebin Saarwellingen Weinheim Bexbach Reisach Pretice Martin Hp ngen BASF Catlenom Tabor Beerfelden Sokolnice GKM Temelin Ludersheim Schwandorf Otrok Landres Neurott Obringheim Raitersaich Moulaine Ensdorf Htte Weiher Daleice Philippsburg Montois Kupferzell Koin La Maxe Slavtice Heilbronn Hodonin Rele Vigy Daxlanden Grogartach Saargemnd Dukovany Neckarwestheim Vantires St. Holi Tvrdonice PetiteHoheneck Dasny Avold Rosselle Dettwiller PulverBlenod Regensburg I ezheim Senica Mhlhauses Bezaumont dingen Greifenstein Sittling Winnenden Ingolstadt Suisse Sarrebourg Lipno Metz Irsching Goldshfe Isar Pleinting Void KuppenEndersbach Korneuburg Donaustadt heim Birkenfeld Altenwrth Custines Rotensohl Laneuveville Grundrem- Meitingen Gambsheim Zohor Bnzwangen Neuves-Maisons Jochenstein Altheim Marlenheim mingen Wendlingen Bhl OberZolling Aschach Abwinden-Asten Thei Passau Stupava jettingen Ottensheim Wallsee Matzinger Schrding Bisamberg Houdreville Etival Oberbachern Weier MelkDrnrohr Ering Eggl ng Niedestotzingen Ybbs-P. Sarasdorf Vincey Lechhausen Freudenau Laichingen H.Linz P. Ottenhofen Pirach Anould Menzing Simmering Engstlatt Jeuxey Wien Freudenau Lac Noir Etzersdorf Vittel OberottmarsEichstetten Trossingen Vhringen Fhring Tging Sdost Braunau St. Peter hausen Herbertingen Neusiedl Villingen Hausruck Sattledt Rolampont Ybbsfeld Pottenbrunn St.Nabord Riedersbach Ernsthofen Logelbach Oberbrunn Marienberg Vogelgrun Salzach Timelkam Guebwiller Memmingen Groramming Leitzachwerk Ternitz La Thur Muhlbach Fessenheim Hirsingue Klaus Lutterbach Wehr Pyhrn WalchenseeSierentz Argiesans Grnkraut Leupolz Pusy ObermooKhmoos Tiengen werk Weienbach Oberaudolf weiler Etupes Eglisau Hie au Krn Asphard Achensee Kirchbichl Pernegg Langenegg Strass Mambelin Tauern Breite Szombathely Hessenberg Slk Zell/Ziller Palente Westtirol Werben Sdburhenland Thaur Schwarzach Zeltweg Meiningen Imst Bassecourt Kaprun Champvans Gerlos Walgau -Hauptstufe Mayrhofen Silz Brs -Oberstufe Bickingen Khtai Lnersee Mellach Malta Siebnen Innerfragrant Rodund Hviz Rohag Werndorf -Oberstufe MhlebergGiswil Pontarlier Kops I+II Kainachtal Auerfragrant Husling Kaunertal -Hauptstufe M. Otok Pradella Mathod Koralpe Champagnole Lenti Amlach Schwabeck St. Andr Vermunt Reieck Vuhred Ozbalt Lienz Pymont Oberrsielach Zlatolije Romanel Ova Spin Vaux Sils Rosegg Ferlach Lana Handeck Formin Banlieue-Ouest Vuzenica Fala Varadin Dravograd Maribor akovec Cardano Mrel Edling Premadio St. Triphon Somplago otanj Moste Lavorno Chamoson Mavie Edolo Nedeljanec C.E.R.N. Dubra Floriano Soazza Okroglo Podlog Grosio Gabi Ponte Doblar Buia Cirkovce Mese Bois-Tollot Robbia Avce Medvode Bostanj Cornier Izernore Lanzada Trbovlje Soverzene S. Fiorano Udine Verampio Laviz Verbois Fadalto Plave Blanca Brestanica Riddes Gondo Serra Klece Pordenone Gorduno Sondrio Solkan Vrhovo TOL Vallorcine Manno Zagreb erjavinec Chavanod Krko Conegliano Musignano Pallanzeno Mandrisio Cordignano Serrires Ugine Passy Valpelline Redipuglia Roncovalgrande Magadino Bulciago P. Camuno Bugey Mraclin Berievo La Bathie Creys MantagnyGorlago Cagno Tumbri Divaa Torbole Vellai Oderzo Salgareda Planais Bussolengo Verderio Les-Lanches Cislago Nave Mercallo Sandrigo Torviscosa Padriciano La Marnise Albertville Trav. Ospiate I.Bistrica Malgovert Bovisio Cassano Meduri Monfalcone Turbigo Scorzi Lonato Koper Baggio Aoste Randens Sisak Pehlin Biella CiseranoChiari Sandri Les Brevieres Venezia N. Brugherio Grande-lle Monteviale Flero La Coche Magenta Tavazzano Fusina Buje Matulji Melina Villarodin Crolles Le Cheylas Rondissone Dugale Malcontenta Gojak Longefan Mincio Camin Trino N. Lacchiarella Leyni Praz Mantova Froges Plomin Ferrera La Casella Cremona Nogarole Rijeka Villarodin Chivasso Ostiglia Lancey Vaujany Erbognone Pieve Marcaria Albignola Venaus Prije Saussaz Trino Caorso Brinje Adria S. Bissorte Piacenza Biha Vinodol St.Guillerme Voghera S. Rocco Senj Porto Tolle Castelnuovo Casanova Cordeau Ferrara Sermide Colorno K. Vakuf Focomorto Piossasco Le Sautet Vignole Bistagno Grisolles Parma V. S. Damaso Morigallo Porto Corsini Velebit Curbans Savona Rubiera Serre-Poncon Magliano Graac Enipower Colunga Martignone B. Grahovo Erzelli Genova Ravenna Sisteron Bargi S. Colombano Salignac Vado Ligure Knin Forli Entrancque Oraziana St. Auban La Spezia Perua St. Tulle Oraison San Marino Avenza Le Broc-Carros Poggio Campochiesa Fano Bilice Konjsko Manosque Calenzano Lingostiere Trinite-Victor Camporosso Marginone Tore-Supra St.Croix Orlo Menton Casellina Boutre Quinson Tavarnuzze Zakuac La Palun Livorno Biancon Acciaiolo S. Barbara Tour-Lascaris Mougins Candia Enco Vins Kra Arezzo Digue-des-Francais Trans Frjus P.D. Speranza Cagnes sur Mer Neoules Rosen Plan de Grasse Le Coudon Larderello Le Garde L`Escaillon Pietra ta Suvereto Rosara Piombino Seraing

UCTE TRANSMISSION NETWORK

LUX.

ESK REPUBLIKA

DEUTSCHLAND

STERREICH

S C H W E I Z

SLOVENIJA

HRV

B HER

FRANCE

SAN MARINO

MONACO

Bastia Lucciana Montalto Aurelia S. Lucia

Villavalle

S. Giacomo Providenza

Teramo Villanova Montorio Popoli Larino Termoli Energia

Corse

Torvaldaliga Nord Torvaldaliga Sud Civitavecchia Roma/O. S. Paolo Roma/S.

I TA L I A

Roma/N. Roma/E. Valmontone

Ceprano Latina Garigliano

Capriati Presenzano Candela Maddaloni Benevento S. So a

Foggia

Bonifacio S. Teresa Fiume Santo

Andria

S. Maria Frattamaggiore Patria Giugliano Levante Condrongianus

Torre

Montecorvino

Sardegna

Ottana

Legend

Plants and stations:

S. Valentino Salerno

Pis

Lines 750 kV transmission line

Laino

Enichem Taloro

Hydro Power Plant Wind Farm Thermal Power Plant

500 kV transmission line 380-400 kV transmission line 300-330 kV transmission line 220 kV transmission line 132-150 kV transmission line DC-line Interconnection for voltage<220 kV One circuit (di . colours) Under construction (di . colours) Double circuit (di . colours) Double circuit with 1 circuit mounted >=3 circuit (di . colours)

Bellolampo Particino Trapani Ciminna Termini Caracoli S. F. Mela Corriolo Sorgente

Rotond

Oristano

Busachi

Altomonte

Villasor Selarguis Portoscuso Sulcis Rumianca Sarlux

Substation Substations + power plants Converter station Under construction

Feroleto

Scale 1 : 2 500 000

Partanna

Sicilia

Favara

Paterno Misterbianco

Trbaczew Aniolw Huta Czstochowa Dobrze Wryosowa Groszowice Lagisza

Kielce Joachimw Lonice

Kielce Piaski Ratkowice

Ostrowiec Dobrotvirska St. Wola Chmielw Radziviliv Lviv 2 Rzeszw Azoty Tarnow Krosno-Iskrzynia Drogobych Boryslav Stryi Kalush GPP-1 Vol'a Velk Kapuany Volovets Mukachevo Kisvrda Khust Bogorodchanyi Bursthtyn TPP Kalushska CHPP Ivano Frankivsk Boguchwala Javoriv Lviv Zakhidna Rosdil

Khmelnitskaya AES Shepetivka

Zhitomir

Bilotserkivska

Polyana

Kremenchug WDGMK

Dnipropetrovska Dniprodzergynska Promet DDZ

Kozyatyn

Polaniec

Rokitnica Tucznawa Kopanina Halemba 1 Koksochemia Blachownia 2 Lubocza Laziska 9 Kopanina Klikowa Siersza Kdzierzyn 4 Skawina Wanda 3 11 Wielopole 10 4 Rybnik 6 5 Bujakw 8 Dtmarovice Pogwizdow Albrechtice Darkov Mnisztwo Porbka ar Liskovec Trinec Ustron Noovice Ropice K.N.Mesto adca Varin irok Liptovsk Mara ierny Vah Suany Medzibrod Rimavska Sobota

Lviv Pivd Ternopil Zakhidnoukrainska

U K R A I N A

Vinnitsa 750 Khmelnitski Bar Vinnitsa 330 Ladyzhinska TPP

Dniprovska Taine Ukrainka Pivdennoukrainska NPP Quarzit Pivdenna Ferosplavna Kryvorizka TPP Rudna Pershotravneva Kirova Nikopol Zaporizka Dnipro HPP

POLSKA

Nemiya Dnistrovska HPP K. Podilsk Nelypivtsy Chernivtsy Larga Shahta Brich Otaci

Dnistrovska HPSPP

Pobuzhzya Tashlyk HPSPP

Gomaya

Prosenice Steln kovice

SLOVENSKO

Lemeany Spisk Nova Ves Moldava USSK Vojany

Poroghi Kakhovska GPP Soroca Bli Rbnai CET Nord Kotovsk Kr. Okny Primorska-750 Trihaty Kakhovska HPP Mikolaiv Berzan Rozdilna Komintern Centrolit Usatovo Cioara Husi Bacu Sud Munteni HBK CERS Moldova Belyaevka Starokazachye N. Odeska Zakhidnokrymska Maryanivka Elevatorna Donuzlav Borzeti Chervonoperekopska Ostrivska Kherson Kakhovska-750 Titan Soda

Ocnia

Povask Bystrica

Costeti Stnca Suceava

Boca Novaky Bystriany Jaslovsk H. daa Bohunice Mochovce Kriovany ala Velik r

M O L D O VA

Ungheni Straeni Chiinu uora Iai Roman Nord

Sajivnka Felszsolca Tisza II Tiszalk Veti Sajszged Roiori Baia Mare

Vasilevk DGES CET-1 CET-2

Levice Mtra Gd Zugl Albertfalva Dunameti csa Albertirsa Detk

P. Biskupice

Gabikovo Gny Gyr Oroszlny Martonvsr Litr

R O M N I A

Debrecen Slaj Tihu Oradea Munteni Remei Bkscsaba Gdlin Cluj Est Cmpia Turzii Ungheni Fntnele Iernut Gheorghieni Stejaru

Dumbrava Vaduri Racova Lilieci

Szolnok

Cluj Floresti Gilau

Gutina

Siret Vulcneti Fileti Smrdan Galai Etulija Reni Bolgrad Kosa Budzhak

Artsyz

Simferopolska CHPP

Dunajvros

Mrielu Somesul Tarnita Cald Ndab

M A G YA R O R S Z G

Paks Sndorfalva Szeged Subotica Pcs Sikls B. Manastir Sombor Apatin Kikinda Srbobran Novi Sad Nijemci upanja Bosanski Brod Gradaac Banja Luka Oraje Ugljevik Zvornik Tuzla B.Bata aak id Mitrovica Beograd 3 Mladost Bijeljina TENT B Lesnica abac Valjevo Panevo Bgd 20 Smederevo Beograd 8 Obrenovac TENT A Morava Zrenjanin Jimbolia Sclaz Timioara Toponr

Alba Iulia Arad Mintia Pesti Hdat Rul Mare Iaz Reia Ruieni

Arpastu

Focani Vest Brasov

ava

AT S K A

D.Miholjac Ernestinovo akovo

Slavonski Brod 2

Drmno

Porile de Fier 1 Gura Vii

Sibiu Drste Lacu Isaccea ugag Barboi Nehoia Scoreiu Srat Buzu aval Cornetu Glceag Brila Totesti Cirnesti Stlpu Vidraru Lotru Orlea Arefu Baru Mare Brdior Clbucet Teleajen Oiesti Turnu Doiceti G.Ialomitei Paroeni Albesi Govora Noaptes Rureni Brazi Vest Motru Stuprei Trgu Jiu Targoviste Brazi Bradu Tismana Cernavoda Ionesti Urecheti Piteti Sud Fundeni Zavideni Grozavesti Rovinari Pelicanu Medgidia Tnreni Srdneti Dragasani Bucureti Mostistea Sud Drobeta Sud Turceni Domneti Slatina Tr. Sip Severin Craiova Nord Isalnita Drgneti Olt Gradite Frunzaru Rusneti Tr. Mgurele Bucureti Vest Ghizdaru Progresu Giurgiu

Tulcea

Constanta Nord Palas

edor

BOSNA I RCEGOVINA

Jajce Zenica

Porile de Fier 2 Ostrovu erdap Mare Kusjak Cetate Bor Zajear Kragujevac Vidin Kula

Obraztsow Chi ik Varna Dobrudzha

Kolubara

Izbiceni Calafat Kozloduy

Pleven Gorna Oryakhovitsa

Madara

Kakanj

Poega Vardite Bistrica Potpec Zamrsten

Varna

Rama B. Blato Grabovica

B.B. Sarajevo 10 Sarajevo 20 Viegrad Jablanica Salakovac Mostar

Jagodina Kruevac Kraljevo Ni

Boychinovtsi Kremikovtsi So a Metalurgichna Pirot So a-Zapad Breznik Ch. Mogila So a-Yug Bobov dol Skakavica Vrla Mizia

Tsarevets Balkan

SRBIJA

Leskovac

Tvarditsa

Karnobat

Burgas Baptin

ovac

B U LG A R I A Stolnik

Zlatitsa Kazichene Sestrimo Aleko Vetren Plovdiv Peshtera Orfey Devin Teshel Chudomir

Stara Zagora

Maritsa 2 Ereli Maritsa 3 Maritsa

aljevac Imotski

Grude apljina Opuzen Neum Ston

Pljevlja Gacko Niki Trebinje Piva Ribarevina Mojkovac Podujevo

Maritsa 1

Bilea

CRNA GORA

Peruica

Kosovo B Kosovo A Glogovac

Stomana Vranje K. Palanka

Belmeken

Blagoevgrad

Chaira

Uzundzhovo

Babaeski

Hamitabat Habibler

Alibey

Paaky Adapazari mtaniye Teperen Izmit Seka Aslanbey Akyazi DG

Osmanca

Komolac Dubrovnik

H.Novi

Podgorica

Fierze Koman

Pritina Prizren Skopje 1 Skopje 5

Ikitelli

Skopje 4 tip

Akyazi Sant

Vau i Dejes Ulza Burrel Vrutok

Negotino Dubrovo FYR MAKEDONIJA Bitola Suica

Doal Gaz Petrich Thissavros Filippi Platanovrisi N. Santa Komotini Ida Bursa B. Sanayi

Cayirhan Yenice Saricakay Gokekaya

Shkopet Tirana 2 Durres Tirana 1 1 Elbasan Bari Fier 2

Edessos Enthes Ag. Dimitrios Lagadas Thessaloniki Can Balikesir

SHQIPERIA

Brindisi P. Matera Brindisi /S. Taranto 1 Bistrice 2 Brindisi /N. Vlore

Florina Amyndeo

Agras Ptolemaida Kardia

Zemblak

Assomata S kia Polyphyto

Limnos

T R K I Y E

Soma

Tutes alt

Seyitmer

Afyon

sticci Galatina Piges

H E L L A S

Messochora Pournari Mourtos Louros Arachthos

Larissa Trikala

Lesvos

Aliaa

Haba

da

Kerkyra

Rossano Mucone

Jeotermal Iiklar Denizli Germencik

N. Plastiras Lamia Kremasta Larymna Distomo Aluuminio Patra Koumoundourou Ag. Georgios Argyroupoli Lavrio Heron Aliveri

Chios

Ghiona

Res

U. Dere

Kastraki Scandale Stratos

Acheloos

Acharnes

Varsak Ag. Stefanos Pallini Yenikoy Yataan

Peloponnisos

Ladonas Megalopoli

Korinthos

Kemerkoy

Rizzioni

Kos

Rodos Soroni

Rodos

www.eft-group.net enquiries@eft-group.net London +44 20 7518 9250 St Gallen +41 71 226 1030 Belgrade +381 11 301 1021 London Cavendish Court 11-15 Wigmore Street London W1U 1PF UK Copenhagen Dampfrgevej 3 1st Floor DK-2100 Copenhagen Denmark St Gallen Pestalozzistrasse 2 CH-9000 St Gallen Switzerland Athens 151 Kifisias Avenue 15124 Maroussi Athens Greece Belgrade Bulevar Mihaila Pupina 10b/II 11070 Belgrade Republic of Serbia Bratislava Karadzicova 8/A (CBC I) 821 08 Bratislava Slovakia Bucharest European Business Center 2nd Floor 24 Blvd Mircea Voda CP 030667 Bucharest 3 Romania Budapest Sas utca 10-12 HU1051 Budapest Hungary Herceg Novi Sitnica bb 85340 Herceg Novi Montenegro Istanbul Toprakkale S. No:2 Etiler, Istanbul 34337 Turkey Ljubljana Opekarska 5 1000 Ljubljana Slovenia Maribor Titova cesta 2a (IV) 2000 Maribor Slovenia Nicosia EFT Investments Ltd c/o Cyproman Services Limited 12 Esperidon Street 4th Floor 1087 Nicosia Cyprus Prague Ovocn trh 572/11 110 00 Prague 1 Czech Republic Skopje Majakovski 3/M2 1000 Skopje Macedonia Sofia 1A Sekvoya Boyana Sofia 1616 Bulgaria Stanari Stanari bb 74208 Stanari Republika Srpska Bosnia & Herzegovina Tirana Gjergji Centre Murat Toptani Street Tirana Albania Trebinje Obala Luke Vukalovica b.b. Trebinje 89 101 Republika Srpska Bosnia & Herzegovina Zagreb Trnjanska 37 10000 Zagreb Croatia

Designed & Produced by Jory&Co. Printed by Ripping Image.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)