Professional Documents

Culture Documents

1118 Top 10

Uploaded by

Steve CouncilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1118 Top 10

Uploaded by

Steve CouncilCopyright:

Available Formats

FACT SHEET

South Carolina Policy Council

1323 Pendleton St., Columbia, SC 29201 803-779-5022 scpolicycouncil.com

10 Reforms for the S.C. Retirement System

By Simon Wong and Dr. Jameson Taylor As the S.C. Retirement System Investment Commission meets at Wampee this week, its our hope the commission is taking a long, hard look at the states pension plan and considering positive reforms that could make the system more sustainable moving forward. According to a recent actuarial valuation analysis performed for the state Budget & Control Board, South Carolinas retirement system is carrying a $12 billion unfunded liability. These conclusions are similar to those found by an April 2009 SCPC study ($11 billion in unfunded liabilities as of July 2008), as well as a recent report by the Manhattan Institute for Policy Research. Official projections, based on an 8 percent rate of return, show the S.C. Retirement System (SCRS) is 31 percent underfunded. The Manhattan Institute, using the more conservative projections required of private retirement fund managers, found that the SCRS is 59 percent underfunded.

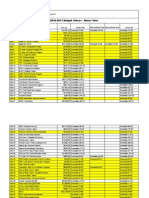

S.C. Retirement System (SCRS) $35,663,419,000 $24,699,678,000 $10,963,741,000 30.7% Police Officers (PORS) $4,318,955,000 $3,363,136,000 $955,819,000 22.1% General Assembly (GARS) $69,122,000 $47,189,000 $21,933,000 31.7% Judges & Solicitors (JSRS) $213,406,000 $138,323,000 $75,083,000 35.2% National Guard (NGRS) $53,534,000 $17,426,000 $36,108,000 67.4%

Retirement System Actuarial Accrued Liability Actuarial Value of Assets (based on 8 percent return) Unfunded Actuarial Accrued Liability Percentage Underfunded Number of Active, Inactive and Retired Members Unfunded Actuarial Accrued Liability Per Member

TOTAL $40,318,436,000 $28,265,752,000 $12,052,684,000 29.9%

452,380 $24,236

49,271 $19,399

580 $37,816

327 $229,612

18,993 $1,901

521,551 $23,109

In short, our April 2009 report concluded that South Carolinas retirement system is significantly underfunded. This liability has several important implications: More spending and higher taxes. According to Bob Borden, CEO/CIO of the S.C. Retirement System (SCRS), South Carolinas pension plan has historically performed very poorly, resulting in an excess burden on taxpayers to fund the unfunded liability. Currently, the SCRS is assuming an 8 percent return on investments. Yet the plan produced negative returns of 19 percent for FY2009. Taxpayers will have to and already are making up the difference. This is especially true for the National Guard Retirement System (NGRS), the lowest funded public retirement system in South Carolina. From FY2005 through FY2011, lawmakers allocated $22.875 million in General Fund revenue for

FACT SHEET 10 Reforms for SCRS

S.C. Policy Council

the retired National Guard pension plan, which seems to be funded entirely (at least according to the FY2009 SCRS Comprehensive Annual Financial Report) by taxpayers. Higher credit costs. Pension liabilities are an important factor in calculating credit worthiness and borrowing costs. For instance, Standard & Poors, one of the big three bond rating agencies, recently cut Chicagos credit rating from AA- to A+. According to Helen Samuelson, an analyst at S&P, a primary reason for the downgrade is that [the citys unfunded pension liabilities] will place a substantial and increasing burden on its future budgets. Chicagos municipal bonds were demoted from a high grade investment to an upper medium grade investment because of the citys large unfunded pension liabilities. This downgrade will increase borrowing costs. Similarly, if South Carolinas unfunded liability ratio continues to grow, it is likely bond rating agencies will decrease South Carolinas credit ratings a change that would cost taxpayers millions in higher interest payments. More risk for retirees. In a worst case scenario, the S.C. Retirement System could default on its obligations. This could mean reducing payments to retirees (not to mention subsequent and lengthy lawsuits in response). Currently, seven states (which also are assuming an unrealistic return on investment of 8 percent) are expected to deplete their pension assets over the next 10 years. Given current assumptions, South Carolinas plan will run dry by 2024, according to a May 2010 paper published by the National Bureau of Economic Research (NBER). Concludes the NBER report, There seems to be a high likelihood that future generations will have to bear the substantial burden of making up pension benefits for previous generations of state employees. Ten Recommendations for Reform What follows are 10 reforms that would facilitate funding the SCRS at 100 percent, keeping it solvent beyond 2024. The first nine ideas would streamline the existing system and provide for greater transparency. Adopting these reforms would not require a major overhaul of the existing plan. Reform # 10 looks to long-term changes that must be made to sustain the states retirement system. 1. Using more realistic investment return assumptions. In July 2008, the state revised annual investment return assumptions upward from 7.25 percent to 8 percent. Administrators also adopted a 10-year averaging method to estimate asset values. Both of these changes understate potential liabilities especially in the event of an extended economic downturn. In particular, the 8 percent rate of return permits all five major state retirement accounts to overestimate returns from current employee/employer contributions and, in turn, continue to claim their plans are funded at 100 percent. If investments dont yield 8 percent and it is very unlikely they will as based on historical trends taxpayers will be required to make up the difference. A more realistic assumption would be about 4.5 percent (based on GASB estimates using expected returns from high-quality municipal bonds) to 6 percent (based on actual earnings growth of the S&P 500 over the last 25 years). Likewise, most public funds employ a smoothing period of five years or less. 2. Implementing a closed amortization period no longer than 15 years. Taxpayers and lawmakers need an accurate and predictable means of assessing retirement system liabilities. Specific reforms aimed at meeting this goal include reducing the amortization period of unfunded liabilities. Currently, the five state retirement accounts have a remaining amortization period ranging from 16 to 30 years. According to a May 2010 paper issued by the Society of Actuaries, the leading professionals in the modeling and

FACT SHEET 10 Reforms for SCRS

S.C. Policy Council

management of financial risk, this current amortization practice can lead to perpetual negative amortization in which payments are never sufficient to pay the interest on the [unfunded actuarial accrued liability]. Two changes are needed. First, instead of an open or remaining amortization, the state should adopt a closed and fixed amortization. Second, the amortization period should be shortened to no more than 15 years, perhaps with the aim of achieving a long-term employer cost of 5 percent to 7 percent of payroll. 3. Prefunding retiree medical liabilities. The state is currently liable for nearly $9 billion in retiree medical benefit plans. Yet, the S.C. Retiree Health Insurance Trust Funds account is only 3 percent funded. Thats another $9 billion in liabilities taxpayers are on the hook for. Clearly, the existing medical benefits program is not financially sustainable. Aside from current/retired members who are already vested or have accrued retiree medical benefits, shouldnt state employees be responsible for paying these costs, instead of shifting the burden to other (in particular, future) taxpayers? 4. Eliminating TERI. The Teacher and Employee Retention Incentive Program (TERI) allows state workers to retire five years before they actually stop working and then collect a salary even as they accumulate retirement benefits in a tax-deferred account. The fact that state employees can enroll in TERI at a relatively young age (conceivably prior to turning 50) makes this early retirement benefit very generous. The General Assembly came close to eliminating the program in 2010, but the reform was struck out of the budget in conference committee. 5. Employing independent actuarial analysis. Including medical benefit liabilities, the states retirement system liability is at least $21 billion. But additional liabilities for instance, arising from TERI and the recent recession are not fully quantified. In particular, current practice treats TERI as a pay-asyou-go program that obscures true costs and does not inform policymakers if there are enough funds to fulfill future obligations. Instead, TERI should be analyzed by an independent accounting firm using actuarial projected accrued liabilities corresponding to reporting standards used in pension and OPEB (Other Post-retirement Employee Benefit) plans. 6. Eliminating pension COLAs. Our review of nine major S.C. private sector employers ranging in size from 4,500 to 17,700 employees found that only five sponsored a defined-benefit plan, and none of the plans included cost-of-living increases (COLAs). In the private sector, such provisions are considered unaffordable, and thus even less justifiable in the public sector. At the very least, COLA increases should be eliminated for new retiree program participants. (In spite of legal challenges, some states are also eliminating COLAs for existing participants). Another option is to make COLA increases dependent upon a formula based on the ratio of assets to liabilities. 7. Requiring more transparency on pension liability at the county/municipal level. Currently, South Carolina state and local government employee pension plans are aggregated into the S.C. Retirement System a cost-sharing pension plan. This means local entities are not required to report actuarial information in their financial statements. This practice masks the true liability of each county/city. Each South Carolina governmental entity should report their pension liability using at least as much detail as the states annual financial statement. 8. Requiring timely reporting of total pension liability. Current pension reporting regarding unfunded liabilities seems to be one year behind fiscal year reporting for the state as a whole. For example, South Carolinas FY2009 Comprehensive Annual Financial Statement only includes up to FY2008s

FACT SHEET 10 Reforms for SCRS

S.C. Policy Council

pension information, instead of up to FY2009. Pension obligations should be reported in as timely a manner as possible so policymakers and citizens can make more informed decisions about the states financial health. 9. Advocating for better accounting and financial reporting methods. The Governmental Accounting Standards Board (GASB) is a nongovernmental organization that provides generally accepted accounting principles (GAAP) used by state and local governments. GASB is currently deliberating an overhaul in pension accounting requirements and is expected to issue final statements on pension accounting changes in June 2012. Prior to that between July and September 2011 GASB will have an open public comment period on the changes. This means think tanks, governmental officers and activists can use this opportunity to submit their concerns and comments about the pension rule change. 10. Switching from a defined-benefit pension plan to a defined-contribution pension plan for new employees. The most fundamental reform the SCRS could make would be to require new employees to switch to a defined-contribution plan (i.e., a 401k) instead of the current defined-benefit plan. Doing so would give public employees more investment choices, but also require them to take responsibility for their own investment decisions. If that sounds like a radical idea, its how most private sector companies treat retirement benefits. But most private sector companies dont have pension plans supplemented by taxpayer dollars. More than anything, the states retirement system should be self-sustaining. This requires funding the SCRS at a 100 percent ratio of assets to accrued liabilities so that pension obligations are fully funded. Currently, the plan seems to be fully funded only because of overly optimistic investment returns that simply will not materialize. As a result, the SCRS is facing insolvency within the next 15 years. Instead of waiting on a bailout from state and federal taxpayers, plan administrators should act now to reform the system and provide more transparency regarding the states pension obligations.

Nothing in the foregoing should be construed as an attempt to aid or hinder passage of any legislation. Copyright 2010 South Carolina Policy Council

South Carolina Policy Council 1323 Pendleton St., Columbia, SC 29201 803-779-5022 scpolicycouncil.com

You might also like

- Exec Summ Recorded Votes 082610Document1 pageExec Summ Recorded Votes 082610Steve CouncilNo ratings yet

- Fact Sheet: Which Counties Spend The Most of Your Tax Dollars?Document7 pagesFact Sheet: Which Counties Spend The Most of Your Tax Dollars?Steve CouncilNo ratings yet

- Exec Summ Shorten The Session 082610Document1 pageExec Summ Shorten The Session 082610Steve CouncilNo ratings yet

- Workforce Development Requires Educational Reform: by L. Brooke ConawayDocument14 pagesWorkforce Development Requires Educational Reform: by L. Brooke ConawaySteve CouncilNo ratings yet

- Mployment Security Organization of Southern StatesDocument6 pagesMployment Security Organization of Southern StatesSteve CouncilNo ratings yet

- Chapter 7Document20 pagesChapter 7Steve CouncilNo ratings yet

- Chapter 8Document22 pagesChapter 8Steve CouncilNo ratings yet

- Chapter 3Document22 pagesChapter 3Steve CouncilNo ratings yet

- Chapter 5Document21 pagesChapter 5Steve CouncilNo ratings yet

- Chapter 10Document24 pagesChapter 10Steve CouncilNo ratings yet

- Chapter 6Document19 pagesChapter 6Steve CouncilNo ratings yet

- Chapter 2Document28 pagesChapter 2Steve CouncilNo ratings yet

- Sat Scores Report 091010Document5 pagesSat Scores Report 091010Steve CouncilNo ratings yet

- Best Worst 2011Document20 pagesBest Worst 2011Steve CouncilNo ratings yet

- Best/Worst of 2010: South Carolina Policy CouncilDocument47 pagesBest/Worst of 2010: South Carolina Policy CouncilSteve CouncilNo ratings yet

- Chapter 1Document14 pagesChapter 1Steve CouncilNo ratings yet

- BudgetWatchObesityMandate 052710Document2 pagesBudgetWatchObesityMandate 052710Steve CouncilNo ratings yet

- Budget Watch I95 052510Document3 pagesBudget Watch I95 052510Steve CouncilNo ratings yet

- The $21 Billion State Budget: South Carolina's Three Spending CategoriesDocument25 pagesThe $21 Billion State Budget: South Carolina's Three Spending CategoriesSteve CouncilNo ratings yet

- Aiken Fact SheetDocument2 pagesAiken Fact SheetSteve CouncilNo ratings yet

- 4478 Fact Sheet 061010Document4 pages4478 Fact Sheet 061010Steve CouncilNo ratings yet

- Senate Budget Veto VotingDocument2 pagesSenate Budget Veto VotingSteve CouncilNo ratings yet

- House Budget Veto VotingDocument3 pagesHouse Budget Veto VotingSteve CouncilNo ratings yet

- UpdateDocument1 pageUpdateSteve CouncilNo ratings yet

- Budget Veto HouseDocument4 pagesBudget Veto HouseSteve CouncilNo ratings yet

- BudgetDocument2 pagesBudgetSteve CouncilNo ratings yet

- HealthcareDocument2 pagesHealthcareSteve CouncilNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Table of ContentsDocument6 pagesTable of ContentsRakeshKumarNo ratings yet

- Institutional Investor - 07 JUL 2009Document72 pagesInstitutional Investor - 07 JUL 2009jumanleeNo ratings yet

- Bill 1.1Document2 pagesBill 1.1Александр ТимофеевNo ratings yet

- The Racist Roots of Welfare Reform - The New RepublicDocument6 pagesThe Racist Roots of Welfare Reform - The New Republicadr1969No ratings yet

- Swine Breeder Farms Sbfap November 29 2021Document2 pagesSwine Breeder Farms Sbfap November 29 2021IsaacNo ratings yet

- Metro Manila, Philippines: by Junio M RagragioDocument21 pagesMetro Manila, Philippines: by Junio M RagragiofrancisNo ratings yet

- Informal Childcare Has Negative Effects On Child DevelopmentDocument3 pagesInformal Childcare Has Negative Effects On Child DevelopmentJotham DiggaNo ratings yet

- Impact of The Tax System On The Financial Activity of Business EntitiesDocument6 pagesImpact of The Tax System On The Financial Activity of Business EntitiesOpen Access JournalNo ratings yet

- Pye, D.-1968-The Nature and Art of WorkmanshipDocument22 pagesPye, D.-1968-The Nature and Art of WorkmanshipecoaletNo ratings yet

- Life Cycle AssessmentDocument11 pagesLife Cycle Assessmentrslapena100% (1)

- ISO Hole Limits TolerancesDocument6 pagesISO Hole Limits ToleranceskumarNo ratings yet

- Technology and Industrial RelationsDocument13 pagesTechnology and Industrial RelationsAdityaNo ratings yet

- SWIFT Trade Finance Messages and Anticipated Changes 2015Document20 pagesSWIFT Trade Finance Messages and Anticipated Changes 2015Zayd Iskandar Dzolkarnain Al-HadramiNo ratings yet

- Rasanga Curriculum VitaeDocument5 pagesRasanga Curriculum VitaeKevo NdaiNo ratings yet

- Economic Development Complete NotesDocument36 pagesEconomic Development Complete Notessajad ahmadNo ratings yet

- Lack of Modern Technology in Agriculture System in PakistanDocument4 pagesLack of Modern Technology in Agriculture System in PakistanBahiNo ratings yet

- Company Analysis - Applied Valuation by Rajat JhinganDocument13 pagesCompany Analysis - Applied Valuation by Rajat Jhinganrajat_marsNo ratings yet

- HI 5001 Accounting For Business DecisionsDocument5 pagesHI 5001 Accounting For Business Decisionsalka murarkaNo ratings yet

- Hhse - JSJ Ozark Bank GarnishmentDocument38 pagesHhse - JSJ Ozark Bank GarnishmentYTOLeaderNo ratings yet

- Report On Brick - 1Document6 pagesReport On Brick - 1Meghashree100% (1)

- SBI Clerk Prelims Previous Year Paper 2018Document14 pagesSBI Clerk Prelims Previous Year Paper 2018Caroline JuliyatNo ratings yet

- No. 3 CambodiaDocument2 pagesNo. 3 CambodiaKhot SovietMrNo ratings yet

- TerraCycle Investment GuideDocument21 pagesTerraCycle Investment GuideMaria KennedyNo ratings yet

- Highways and Minor Ports Department: Government of Tamil Nadu 2018Document25 pagesHighways and Minor Ports Department: Government of Tamil Nadu 2018Vijay KumarNo ratings yet

- Internal Audit Checklist Sample PDFDocument3 pagesInternal Audit Checklist Sample PDFFernando AguilarNo ratings yet

- AOW2 2018 Post Show ReportDocument3 pagesAOW2 2018 Post Show ReportEmekaVictorOnyekwereNo ratings yet

- Wec12 01 Que 20240120Document32 pagesWec12 01 Que 20240120Hatim RampurwalaNo ratings yet

- Attacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep DevkarDocument14 pagesAttacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep Devkarsim4misNo ratings yet

- Bank - A Financial Institution Licensed To Receive Deposits and Make Loans. Banks May AlsoDocument3 pagesBank - A Financial Institution Licensed To Receive Deposits and Make Loans. Banks May AlsoKyle PanlaquiNo ratings yet

- Superstocks Final Advance Reviewer'sDocument250 pagesSuperstocks Final Advance Reviewer'sbanman8796% (24)