Professional Documents

Culture Documents

Timothy J Savage Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Timothy J Savage Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

,~o to

~ev. l/.OtO

[

[

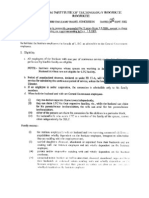

FINANCIAL DISCLOSURE REPORT

FOR CALENDAR YEAR 2009

2. Court or Organization F.aslern Dist. of Pennsylvania

5a. Report Type (check appropriote type) [] Nomination, ~ Initial l)ate ~ Anr, ual [---I Final

R,,port Required b), the Ethics

in Government Act of I978

O u.s.C. ~,pp. ~" ~o~-t~)

3. Date of Report 05/04/2010

; 6. Reporling Period 01/01/2009 to 12/3112009

1. Person Reporting (last name, first, middle initial) Savage, Timothy J.

4. Title (Article III judges indicate active or senior slams: m~gist~te judges indicate full- or part-time) U. S. District Judge- Active

5b. [] Amended Report 7. Chambers ~r Office Addrts~ 96 ] 4 UP.ited States Courthouse 601 Market Street Philadelphia, PA 19106 8. On the basis of the in~ormation eontMned in this Rep~rt and any nlodifieati~n~ pertaining thereto, it is, in my opinion, in eomplianee with applicable la,vs and regulations. Reviewing Officer Date

IMPORTANT :VOTES: The instructions accompanying tbis farm must be f!,llowed. Cvmplete all parts, checking the NONE box fi~r each part where )au have no reportable information. Sigtt un last page.

[~]

NONE (No reportable positions.) POSITION NAME OF ORGANIZATIONiENlqTY

Timothy J. Savage. P.C.

I.

Sole Officer, Director, Shareholder

2. 3. 4.

Partner Custodian Custod inn

Savage & Savage (Real Estate Investment) Trust # 1 Trust

II. AGREEM ENTS. (Reporting individnal only; see pp. 14-16 ,~.liling instructiotts.)

[~ NONE (No reportable agreements.) DATF,

I. 1977

.PARTIES AND TERMS

State Employees Retirement System (SF.RS), Pension

2. 2002

Lawrence J. Roberts, Esquire - sale of former law practice, no control

Savage, Timothy J.

FINANCIAL DISCLOSURE REPORT N .......fP~r~o. Report~.~

O~,..fa,port

Page 2 of 7

s.~.~, Timothy S.

05/04/2010

I11. NON-INVESTMENT INCOME. meporting indlvldual andsp .....

A. Filers Non-Investment Income ~ NONE (No reportable non-investment income.) DATE

I. 2009 2. 2009 3. Timolhy J. Savage. P.C. Commonwealth of Pennsylvania SERS

: see pp. 17-24 of]itlng instructi,,ns.)

SOURCE AND TYPE

INCOME

(yours, not spouses) 5;6,000.00 $28,990

B. S p ou ses No n-I n vest inen t I n co m e - If you .,ere married during any portion oft/,e re/,vrtl.g),ear, complete this secth~n.

(Dollar am ount not required except for honorat is.)

NONE ~Vo reportable non-investment income.) DATE

I. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS-tran.~-p~rtath~n. lodging, food. entergainment. NONE (No reportable reimbursements.) ~

I. 2. 3.

4.

DATES

LOCATION

PURPOSE

ITEMS PAID O~ pROVIDED

5.

FINANCIAL DISCLOSURE REPORT Page 3 of 7

N .... t~ .....R~por,~,,~ sa,,~, Timothy J.

D.t~fR.por, 05,04,~2010

[~

NONE (No reportable gifts.) SOURCE DESCRIPTION

1. 2. 3. 4. 5.

VI. I JA B1 L ITIE S. a,~,~ ,~,,~ o.c,~ ...... a aetwttdent children; see pp. 32-33 oflfillrtll it,struttlons.)

NONE (Aro reportable liabililies.) CREDITOR

1.

DESCRIPTION

VALUE CODE

3.

4.

5.

FINANCIAL DISCLOSURE REPORT

~ ...... fP ..... Reporting

Page 4 of 7

VII. INVESTMENTS and TRUSTS - i ......... t.., , ....... a,,.s tl.ctuae~

Savage, Timothy J"

DateotRcpart

I

Transactions during reporting period buy sell. rede,npGon) mm/dd/yy ] Code 2 ! Code I l" ] (J-P) I(AII) t [ ..... buyer/seller (if private tran~ction)

NONE (No reportable income, assets, or transactions.) Descriplion of Assets (in,eluding trust assets) Income during ] reporting period i Codel ! div ...... t, ! (A-H) tw int,) Gross vahle at end of reporting period

..... ptfrompri~rdisel ..... .............................................. I. 2.

3.

Code2 (J-P)

: lvlehod : Code ~ i (Q-"v) T U

T

Lawrence J. Roberts, Esquire-Mortgage Mortgage - Edward & Deborah Bednarz

CMCSK - Common Stock

lnlcrest None

None

K J

J

4. 5. 6. 7. 8. 9. 10. I 1.

12. 13.

AXA - Commnn Stock Bank of America - Cotnmon Stock Joseph Manley - Commodity Investment Pool ALSAX -Alger Mutual Fund-Small Cap AIM Constellation - Mutual Fund Replaced AIM Weingarten Federal Capital flk/a Righttime - Blue Chip Mutual Fund A A A

None Dividend None None Dividend Dividend None None

D A Dividend Interest

J J J J J J M

T T T T T T T Sold 1 1113109

10113/09

(2)

Nationwide - Best of America - Annuities

PYI)S

VGR - Common Stock Ocean City tlomc Bank - Accounts

J

J A

M J

T T

Sold (part)

14,

15.

Citizens Bank - Accounts

Raylnond James

13

A

Interest

Interesl

M

J

T

T

16.

PBSO - Point Blank Solutions Common Stock EACFX (Evergreen) Trust #1 A

None

17.

Dividend

and D4)

1" =$50,00 t - $ [ 00 I~,0

G -$ I~0.0111 - $1.090.0n0

II I =$1.000,001 - $ 5.000.(~)0

112 -More than

FINANCIAL DISCLOSURE REPORT Page 5 of 7

NameofP ...... Reporting

Daleol Repnr! [

sa,ag~, Timothy J.

/

Transaction~ during re~ing period Type (.g.. buy. sell. redemplion) Dale Value [ Gain n~m/d~ Code 2 I Code 1 " 0-P) : ,A-ll) , ,

05/04/2010

VI I. 1NVESTMENTS an d TRUSTS ..tn ....... i,,,., ........ ,io,~ (Inctude~ those of sp ...... d dependent children; s~e pp. 34-60 offiling instructi

NONE (No reportable income, assets, or transactions.)

Description of Assets (inc luding ta~t assels] Place "(X)" after each asset excn~pt from prior disclosore Income during reposing period Amount T~e (.g.. : Code I div.. rent. ~ (A-,I)or iat.) ] Gross value at end of reporting period Value Code 2 (J-P) ~ Value Method C@e3 (Q-W~

Ideati~ of buyer/sell~ (if private I~ansactio n)

FINANCIAl, DISCLOSURE REPORT Page 6 of 7

r~ ....t~~r~o. ,~po,,i~ s,,~ge, Timothy J.

05,04/2010

V1 ii. ADDITIONAL INFORMATION OR EXPLANATIONS.

Part III. Non-lnvestrnenl Income The gross income figure on line 1 was generated front residual fee payments for services rendered prior to appointment to a professional corporation solely owned by Ihe reporter. Payments to Timothy J. Savage, P.C., a Subchapter S corporation, for sale of assets of law practice were passed through Io reporter for tax purposes.

FINAN CIAL DISCLOSURE REPORT Page 7 of 7

IX. CERTIFICATION.

N ..... f P ..... Reporting

Date of Report

Savage, Timothy J.

05/04!2010

i certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true. and complete In the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and lhe acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature_

NOTE: ANY INDIVIDUAL WilO KNOWINGLY AND WILFULLY FALSIFIE.: OR FALLS TO FILE Tills REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

FILING INSTRUCTIONS Mail signed original and 3 additional copies to: Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- Opinion - JW V NavyDocument7 pagesOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Gitmo Water Test ReportDocument2 pagesGitmo Water Test ReportJudicial Watch, Inc.No ratings yet

- Holder Travel Records CombinedDocument854 pagesHolder Travel Records CombinedJudicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Visitor Tent DescriptionDocument3 pagesVisitor Tent DescriptionJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Navy Water Safety ProductionDocument114 pagesNavy Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JW Cross Motion v. NavyDocument10 pagesJW Cross Motion v. NavyJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- May 2007 BulletinDocument7 pagesMay 2007 BulletinJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- Schoolboard PowerpointDocument2 pagesSchoolboard PowerpointJudicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 8 Edsa Shangri-La Hotel Vs BF CorpDocument21 pages8 Edsa Shangri-La Hotel Vs BF CorpKyla Ellen CalelaoNo ratings yet

- DPTC CMF C P16995 Client 31052023 MonDocument8 pagesDPTC CMF C P16995 Client 31052023 Monsiddhant jainNo ratings yet

- NDRRMF GuidebookDocument126 pagesNDRRMF GuidebookS B100% (1)

- Purnama RT Sinaga - MB-4D - Developing Skiils Before Graduating From PolmedDocument2 pagesPurnama RT Sinaga - MB-4D - Developing Skiils Before Graduating From PolmedPurnamaNo ratings yet

- What Is A Pitch BookDocument4 pagesWhat Is A Pitch Bookdonjaguar50No ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document3 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09gary hays100% (1)

- Hippo 3 Use 2020 V1.EDocument2 pagesHippo 3 Use 2020 V1.ECherry BushNo ratings yet

- Invitation to Kids Camp in Sta. Maria, BulacanDocument2 pagesInvitation to Kids Camp in Sta. Maria, BulacanLeuan Javighn BucadNo ratings yet

- Developer Extensibility For SAP S4HANA Cloud On The SAP API Business HubDocument8 pagesDeveloper Extensibility For SAP S4HANA Cloud On The SAP API Business Hubkoizak3No ratings yet

- The Boy in PajamasDocument6 pagesThe Boy in PajamasKennedy NgNo ratings yet

- Leave Travel Concession PDFDocument7 pagesLeave Travel Concession PDFMagesssNo ratings yet

- Ar2022 en wb1Document3 pagesAr2022 en wb1peach sehuneeNo ratings yet

- University of ST Andrews 2009 ArticleDocument156 pagesUniversity of ST Andrews 2009 ArticleAlexandra SelejanNo ratings yet

- Ch9A Resource Allocation 2006Document31 pagesCh9A Resource Allocation 2006daNo ratings yet

- Organized Crime in Central America The Northern Triangle, Report On The Americas #29 DRAFTDocument125 pagesOrganized Crime in Central America The Northern Triangle, Report On The Americas #29 DRAFTLa GringaNo ratings yet

- James Tucker - Teaching Resume 1Document3 pagesJames Tucker - Teaching Resume 1api-723079887No ratings yet

- Weekly Mass Toolbox Talk - 23rd Feb' 20Document3 pagesWeekly Mass Toolbox Talk - 23rd Feb' 20AnwarulNo ratings yet

- Abyip MagcagongDocument10 pagesAbyip MagcagongJhon TutorNo ratings yet

- Slip Form ConstructionDocument10 pagesSlip Form ConstructionAkshay JangidNo ratings yet

- UntitledDocument1,422 pagesUntitledKarinNo ratings yet

- BCM 304Document5 pagesBCM 304SHIVAM SANTOSHNo ratings yet

- TaclobanCity2017 Audit Report PDFDocument170 pagesTaclobanCity2017 Audit Report PDFJulPadayaoNo ratings yet

- The Sanctuary Made Simple Lawrence NelsonDocument101 pagesThe Sanctuary Made Simple Lawrence NelsonSulphur92% (12)

- The Paradox ChurchDocument15 pagesThe Paradox ChurchThe Paradox Church - Ft. WorthNo ratings yet

- Jack Mierzejewski 04-09 A4Document7 pagesJack Mierzejewski 04-09 A4nine7tNo ratings yet

- Makato and The Cowrie ShellDocument3 pagesMakato and The Cowrie ShellMhay Serna80% (5)

- Appreciative SystemsDocument7 pagesAppreciative SystemsSaNo ratings yet

- MEP Civil Clearance 15-July-2017Document4 pagesMEP Civil Clearance 15-July-2017Mario R. KallabNo ratings yet

- Lawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NiDocument4 pagesLawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NibawihpuiapaNo ratings yet

- Da Vinci CodeDocument2 pagesDa Vinci CodeUnmay Lad0% (2)