Professional Documents

Culture Documents

DU B.com (H) First Year (Financial Acc.) - Q Paper 2010

Uploaded by

mouryastudypointOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DU B.com (H) First Year (Financial Acc.) - Q Paper 2010

Uploaded by

mouryastudypointCopyright:

Available Formats

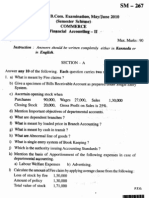

B.COM (H) 1st Year.

ARUN BAJAJ CLASSES

B.Com. (Hons.) / I-NS

Paper II Financial Accounting 2010

Time : Part A 2 Hrs. Time : Part B 30 Min. Max. Marks : Part A 45 Max. Marks : Part B 10

General Instruction : This questions paper has 2 parts. Part A is compulsory for all examines. Part B is meant only for those examinees who have not offered Computerised Accounts. Applicable for students of Regular College). Student of SOL have to Attempt Part A & B. Part A and B are to be answered on separate answer books. PART - A 1. State with reasons whether the following statements are True or False. (i) A business entity can keep its accounts on accural basis of accounting. (ii) Legal Fees paid to acquire a property is capital expenditure. (iii) Higher depreciation will not affect cash profit of the business. (iv) Receipts and Payments Account highlights total income and expenditure. (v) Deferred revenue expenditure is current years revenue expenditure to be paid in later years. 2. (a) Define depreciation. What are the contributory factors for decline in the value of fixed assets ? 4 (b) Mayur Traders, which depreciates its machinery at 10% p.a. according to Diminishing balance method, had on 1-1-2009 4,86,000 balance in Machinery Account. Part of the machinery purchased on 1-12007 for 60,000 was sold for 40,000 on 1st July, 2009 and a new machinery at a cost of 70,000 was purchased and installed on the same date, installation charges being 5,000. Mayur Traders wanted to change its method of depreciation on 1-1-2009 from Diminishing balance method to Straight line method with effect from 1-1-2007. The rate of depreciation remains the same as before. Show Machinery Account for the year 2009. Also show your working clearly. OR The following are the details of material of Sai Mills : 01-01-2009 01-01-2009 15-01-2009 01-02-2009 15-02-2009 20-02-2009 01-03-2009 Opening Stock Purchases Issued for consumption Purchases Issued for consumption Issued for consumption Purchases 100 units @ 25 per unit 200 units @ 30 per unit 100 units 400 units @ 40 per unit 200 units 300 units @ 50 per unit 200 units

w w w. m o r y as t u d y po i n t . we e b l y.c o m

10

B.COM (H) 1st Year.2

15-03-2009 (i)

Issued for consumption

200 units

Find out the cost of closing stock as on 31-3-2009 according to : First in first out basis and (ii) Weighted average price basis, using perpetual inventory system. Also calculate cost of closing inventory on LIFO basis under periodic system. 3. A trader keeps his books of account under Single entry system. On 31st March, 2009, his Statement of Affairs stood as follows : Liabilities Capital Trade Creditors Bills Payable Outstanding Expenses

Assets

1,00,000 6,10,000 1,48,000 60,000 2,000 80,000 10,00,000

2,50,000 Furniture (cost Rs. 1,50,000) 5,80,000 Stock 1,25,000 Trade Debtors 45,000 Bills Receivable Unexpired Insurance Cash and bank 10,00,000

The following was the summary of Cash Book for the year ended 31st March 2010 : Receipts To Balance To Cash Sales To Receipts from Trade Debtors To Receipts from Bills Receivables

Payments

75,07,000 8,15,000 6,20,700 2,40,000 1,27,300 93,10,000

80,000 By Trade Creditors 73,80,000 By Bills Payable met 15,10,000 By Sundry Debtors 3,40,000 By Drawings By Balance c/d 93,10,000

Discount allowed to trade debtors and received from trade creditors amounted to 36,000 and 28,000 respectively. Bills endorsed amounted to 15,000. Annual Fire Insurance Premium of 6,000 was paid every year on 1st August for renewal of the policy. Furniture was subject to depreciation @ 15% per annum on reducing balance. You are also informed about the following balance as on 31st March, 2010 :

Stock Trade Debtors Bills Receivables Bills Payable O/s Expenses 6,50,000 1,52,000 75,000 1,40,000 5,000

The trader maintains a gross profit ratio of 10% on sales. Prepare Trading and Profit & Loss Account for the year ended 31st March, 2010 and Balance Sheet as on that date. 14 OR (a) What is a contingent liability ? Give three examples of contingent liabilities. (b) Given below is the Trial Balance of Mr. Ramesh as on 31st December, 2009 :

w w w. m o r y as t u d y po i n t . we e b l y.c o m

B.COM (H) 1st Year.3

Land and Building Office Machinery Furniture and Fittings Stock on 1-1-20089 Purchases and Sales Salaries Bad Debts Debtors and Creditors Sales Tax Rent, Rates and Taxes Advertisement Drawings Loan to Ashok @ 16% p.a. on 1-7-2009 Wages Interest on Loan to Ashok Bills Receivables Trade Mark Discount Wages Payable Capital Bank Overdraft Additional Information : (i) The Value of Stock on 31-12-2009, 30,000 1,20,000 70,000 20,000 16,000 90,000 20,000 10,000 35,000 10,000 15,000 18,000 5,000 20,000 33,000 10,000 8,000 1,000 5,01,000

2,20,000

40,000

1,000

2,000 1,98,000 40,000 5,01,000

(ii) Sales include 5,000 for the goods sold on approval to Hemant. Goods are sold at a profit of 25% on cost. Approval was not received till 31st December. (iii) Furniture purchased during the year for 5,000 was wrongly debited to Purchase Book. (iv) A Cheque of 8,000 received from customers was deposited in the bank in the last week of December. It was reported to have been dishonoured. (v) Free samples worth 4,000 were distributed during the year. (vi) Write off further bad debts 2,000. Also create a provision for doubtful debts at 10% on debtors. (vii) Depreciate furniture by 10% and office machinery by 5%. Prepare Trading and Profit & Loss Account for the year ended 31st December, 2009 and a Balance Sheet as on that date. 10 4. X Co. Ltd. purchased on 1-1-2008 from M/s R.V. traders four machines having cash price 80,000 each on hire purchase basis. The payment was to be made as follows : 10% of cash price down, and 25% of cash price at the end of each of the following four year. X Co. Ltd. paid the first instalment but failed to pay the second instalment due on 31-12-2009. M/s R.V. Traders repossessed three machines leaving remaining one machine with the buyer. The value of three

w w w. m o r y as t u d y po i n t . we e b l y.c o m

B.COM (H) 1st Year.4

machines was taken at cost less depreciation @ 20% p.a. on reducing balance method. M/s X Co. Ltd. charges depreciation at 10% p.a. on reducing balance method on 31st December of each year. M/s R.V. Traders spent 42,000 on overhauling of the machines repossessed and sold two of the repossessed machines for 1,20,000. Prepare necessary Ledger Accounts in the books of both the parties. OR From the follwoing Income and Expenditure Account of Mayur Club for the year ended 31st December, 2009, prepare Receipts and Payment Account for the year ended 31st December, 2009 and a Balance Sheet as on that date Income and Expenditure Account (for the year ended 31-12-2009) Expenditure To Salaries To Stationery To Postage and Telephone To Rates and Taxes To Repairs To Table Tennis Balls To Printing of Magazines To Electricity Charges To Billiard Room Expenses To Unkeep of Ground To Depreciation on Assets To Excess of Income over Exp. 14

Income

1,56,000 16,000 14,000 24,000 5,400

48,000 By Subscriptions 3,200 By Donations 6,400 By Billard Room Collections 12,000 By Entrance Fees 16,000 By Interest from Investments 2,400 4,000 12,000 6,000 18,800 4,000 82,600 2,15,400 As on 1-1-2009

2,15,400 31-12-2009

Fixed Assets Investments Cash at Bank Subscription Outstanding Subcriptions received in advance Expenses Outstanding : Stationery Telephone Electricity 5. 1,200 600 1,400 96,000 54,000 3,600 6,000 12,000

64,000 94,000 ? 10,000 20,000 800 400 600 14

X Co. Ltd. Mumbai invoices goods to its Delhi Branch at cost plus 25%. All expenses of the Branch are met by Head Office and cash collected by the branch is set to Head Office. From the following information, prepare Branch Account and Goods sent to Branch A/c in the books of Head Office :

w w w. m o r y as t u d y po i n t . we e b l y.c o m

B.COM (H) 1st Year.5

Branch Stock at invoice price on 1-1-09 Branch Debtors on 1-1-09 Branch Furniture on 1-1-09 Petty Cash on 1-1-09 Salary due for December, 2008 Goods sent to branch during the year (including goods in transit) Goods returned by Branch to Head Office Goods returned by customers to Branch Loss of Goods in transit at I.P. (not insured) Cahs Sales Cash received from customers Goods spoiled at I.P. (normal) Bad Debts Discount allowed Petty expenses incurred by Branch Cheque received from Head Office for : Salaires @ 4000 p.m. Rent Petty Cash Delivery Van Branch Debtors on 31-12-2009 Branch stock on 31-12-2009 Depreciation furniture and delivery van @ 10%. OR (a) Distinguish between Hire Purchase system and Instalment system. 4 (b) A Head Office invocies goods to its branch at 20% less than the list price. The list price is made up by adding 100% to cost price. Goods are sold to customers at list price both by head office and branch. From the following particulars, prepare Trading and Profit & Loss Accounts for the year ended 31st March 2010 to show profit made by Head Office and Branch on Wholesale Basis : Head Office ( ) Opening Stock at Cost (at invoice Price for branch) Purchases Goods sent to Branch at invoice price Sales Expenses PART - B 6. A, B and C shared profit and losses in the ratio of 5 : 3 : 2 respectively. On 31st March, 2009 their Balance Sheet was as follows :

w w w. m o r y as t u d y po i n t . we e b l y.c o m

20,000 25,000 40,000 3,000 4,000 2,00,000 5,000 4,000 10,000 70,000 90,000 4,000 1,000 2,000 2,000

48,000 10,000 3,000 5,000 1,11,000 30,000 ? 14

Branch ( ) 24,000 1,44,000 1,20,000 6,000 10

60,000 6,00,000 9,00,000 1,30,000

B.COM (H) 1st Year.6

Liabilities As Capital A/c Bs Capital A/c Cs Capital A/c Creditors Bank Loan

Assets

22,000 96,000 2,000 80,000 2,00,000

60,000 Furniture 40,000 Stock 20,000 Cash 60,000 Profit & Loss A/c 20,000 2,00,000

The bank had a charge on all the assts. Furniture realised 6,000 and stock was sold for 50,000. Bs private estate realised 12,000. Bs private liabilities were 10,000. C was unable to contribute anything. A paid one-third of what was due from him on his own account. Prepare Realisation Account, Cash Account and Partners Capital Accounts, passing all matters relating to realisation of assets and payment of liabilities through Realisation Account. 14 OR (a) Explain the rule of Garner Vs. Murrary. 4 (b) A, B and C were partners sharing profits and losses in the ratio of 4 : 3 : 1. Their Balance Sheet as on 31st March, 2009 was as follows : Liabilities As Capital A/c Bs Capital A/c Cs Capital A/c Bank Loan (Secured) As Loan

Assets

90,000 30,000 82,500 90,000 2,92,500

1,05,000 Building 45,000 Machinery 75,000 Stock 13,500 Debtors 15,000 2,92,500

They decided to dissolve the business. The assets were realised gradually and the net amounts were distributed immedately as follows : 2009 May 30 July 30 Sept. 30 Nov. 30 Dec. 31

33,000 Expenses paid 25,200 Expenses paid 57,000 Expenses paid 68,000 Expenses paid 1,08,000 Expenses paid

3,000 2,200 4,500 8,000 10,000 10

Show the distribution of cash among partners using maximum possible loss method.

END OF PAPER

w w w. m o r y as t u d y po i n t . we e b l y.c o m

B.COM (H) 1st Year.7

ANSWERS - BCom(1st Year) 2010

1. Objective Type (i) True : In fact all business maintain their books of acccount on accrual basis. It is mandatory for joint stock companies.

OR Receipt & Payment A/c (Bal. figure) 80,800 Balance Sheet as on 1 Jan. 2009 1,59,600 Balance Sheet as on 31 Dec. 2009 2,48,800 5. P & L A/c (Bal. figure) 49,600 Delhi Branch A/c 4,10,600 Goods sent to Branch A/c 2,01,000 OR Net Profit 3,56,000 6. Net Loss 42,400 Deficiency A/c 5,280 OR Balance and Final Loss As A/c 14,500 Bs A/c 10,875 Cs A/c 3,625

(ii) True : All expenditure paid or incurred before the asset is put to use are capital expenditure. (iii) True : Depreciation is simply with holding or savings of cash. It is not a source of cash. (iv) False : The purpose of receipts and payments account is to show the balance of cash in hand. (v) False : In fact when revenue expenditure are paid in the current year and benefits are to accrue in future, they are allocated to future accounting periods. Thus payment is made in the current year only. 2. Profit and Loss A/c (Addl. Depreciation 5,400 Balance c/d 4,49,250 OR Value of Closing Stock (FIFO) = 15,000 Value of Closting Stock (W.A) = 13,337 Value of closing stock as per LIFO basis under Periodic Sytem No. of unsold units : (100 + 200 + 400 + 300) (100 + 200 + 200) = 1,000 700 = 300 units Value of Stock (LIFO) 100 units @ Rs. 25 200 units @ Rs. 30 2,500 6,000 8,500 3. (b) Net Profit 9,30,000 Net Profit 3,26,300 Balance Sheet 10,91,300 OR Gross Profit 1,09,000 Net Profit 31,000 Balance Sheet 3,14,000 4. Machinery on Hire Purchase A/c 2,88,000 Value of one unsold machine 65,200

w w w. m o r y as t u d y po i n t . we e b l y.c o m

You might also like

- CPA 1 Past Paper 1 - Financial AccountingDocument8 pagesCPA 1 Past Paper 1 - Financial AccountingInnocent Won Aber65% (34)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- TAXATION BAR Q and A A. Domondon PDFDocument102 pagesTAXATION BAR Q and A A. Domondon PDFArvin Balag100% (1)

- Stock Valuation at Ragan EnginesDocument2 pagesStock Valuation at Ragan EnginesNguyen Do Quyen0% (1)

- Paper 1: AccountingDocument30 pagesPaper 1: AccountingSatyajit PandaNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2009Document8 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2009mouryastudypointNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83No ratings yet

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MNo ratings yet

- 106 1648004706 PDFDocument15 pages106 1648004706 PDFMohd AmanullahNo ratings yet

- (Semester Sdteqte) Commerce FLN Tneial Accottnfibg-Il ,,'Document16 pages(Semester Sdteqte) Commerce FLN Tneial Accottnfibg-Il ,,'zingcemNo ratings yet

- Examination Paper-2010Document5 pagesExamination Paper-2010api-248768984No ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- Test Papers: FoundationDocument23 pagesTest Papers: FoundationUmesh TurankarNo ratings yet

- Afa 1 Icmab QuestionsDocument65 pagesAfa 1 Icmab QuestionsKamrul HassanNo ratings yet

- CBSE Class 11 Accountancy Question Paper SA 2 2013 PDFDocument6 pagesCBSE Class 11 Accountancy Question Paper SA 2 2013 PDFsivsyadavNo ratings yet

- P5 Syl2012 InterDocument27 pagesP5 Syl2012 InterViswanathan SrkNo ratings yet

- Advanced Corporate AccountingDocument6 pagesAdvanced Corporate Accountingamensinkai3133No ratings yet

- Assignment Accounting FundamentalsDocument2 pagesAssignment Accounting FundamentalsRajshree DewooNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Document4 pagesLoyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Charles VinothNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- Advance AccDocument8 pagesAdvance AccjayaNo ratings yet

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- Quiz 1Document3 pagesQuiz 1Imthe OneNo ratings yet

- Intermediate Group I Test Papers FOR 2014 DECDocument88 pagesIntermediate Group I Test Papers FOR 2014 DECwaterloveNo ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFsivsyadavNo ratings yet

- Assignment of Fundamental of Accounting IDocument12 pagesAssignment of Fundamental of Accounting IibsaashekaNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsDocument3 pagesAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- 7110 w10 QP 01Document12 pages7110 w10 QP 01mstudy123456No ratings yet

- Intermediate Group I Test PapersDocument57 pagesIntermediate Group I Test Paperssantbaksmishra1261No ratings yet

- 7110 s10 QP 11Document12 pages7110 s10 QP 11mstudy123456No ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Solved Answer Accounts CA IPCC May. 2010Document13 pagesSolved Answer Accounts CA IPCC May. 2010Akash GuptaNo ratings yet

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNo ratings yet

- Mock Test Paper 6Document5 pagesMock Test Paper 6FarrukhsgNo ratings yet

- ch1 8 5eDocument9 pagesch1 8 5eJean Pierre HitimanaNo ratings yet

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document58 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3No ratings yet

- Accountancy - Paper-I - 2012Document3 pagesAccountancy - Paper-I - 2012MaryamQaaziNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- ReceivablesDocument36 pagesReceivablesElla MalitNo ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekeraNo ratings yet

- Sir Dave's Classroom Quiz Bee Number 3 QuestionsDocument13 pagesSir Dave's Classroom Quiz Bee Number 3 QuestionsKenzel lawasNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- Department AccountsDocument9 pagesDepartment Accountssridhartks100% (1)

- Account - 2Document6 pagesAccount - 2kakajumaNo ratings yet

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- Bcom 2 Sem Financial Accounting 2 21103179 Dec 2021Document5 pagesBcom 2 Sem Financial Accounting 2 21103179 Dec 2021Akhil AbrahamNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2011Document6 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2011mouryastudypointNo ratings yet

- Delhi 2011Document4 pagesDelhi 2011mouryastudypointNo ratings yet

- Delhi 2011Document4 pagesDelhi 2011mouryastudypointNo ratings yet

- Delhi 2011Document4 pagesDelhi 2011mouryastudypointNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2011Document6 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2011mouryastudypointNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Document7 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointNo ratings yet

- Course Learning Assignment - 2 ACC 550Document6 pagesCourse Learning Assignment - 2 ACC 550Hasan All Banna SarkerNo ratings yet

- What To Trade, When To Trade Intermarket AnalysisDocument56 pagesWhat To Trade, When To Trade Intermarket AnalysisconsxavierNo ratings yet

- International Journal of Current Business and Social Sciences - IJCBSS Vol.1, Issue 2, 2014Document23 pagesInternational Journal of Current Business and Social Sciences - IJCBSS Vol.1, Issue 2, 2014Yasmine MagdiNo ratings yet

- Stock Statement Format 1Document6 pagesStock Statement Format 1gokulanNo ratings yet

- Project Report of Share KhanDocument117 pagesProject Report of Share KhanbowsmikaNo ratings yet

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Cost of Capital This OneDocument9 pagesCost of Capital This OneAmandeep Singh MankuNo ratings yet

- 01 StockMarketCharting Case Study v4 0 UIUX Phase1Document13 pages01 StockMarketCharting Case Study v4 0 UIUX Phase1DIVRITNo ratings yet

- Question On Bond ValuationDocument3 pagesQuestion On Bond ValuationHarsh RajNo ratings yet

- Duration 2 Hours Max Marks 70Document25 pagesDuration 2 Hours Max Marks 70AgANo ratings yet

- Schroder Dana Istimewa: Fund FactsheetDocument1 pageSchroder Dana Istimewa: Fund FactsheetbtishidbNo ratings yet

- Poor Track Record of ShareholdersDocument8 pagesPoor Track Record of ShareholdersPrerna GuptaNo ratings yet

- Appointment & Remuneration of Managerial Personnel (Sec 196 To Sec 205)Document24 pagesAppointment & Remuneration of Managerial Personnel (Sec 196 To Sec 205)naga jaganNo ratings yet

- Corporate New Venture UnitsDocument3 pagesCorporate New Venture UnitsSaad Rehman100% (3)

- 05 - Chapter IIDocument51 pages05 - Chapter IISALMAN K 2ndNo ratings yet

- Chap 012Document80 pagesChap 012ALEXANDRANICOLE OCTAVIANO100% (1)

- ISI - Cable & Satellite Initiations - Oct 2011Document139 pagesISI - Cable & Satellite Initiations - Oct 2011brettpevenNo ratings yet

- Semantic MapDocument1 pageSemantic MapMarian Kaye OrlanesNo ratings yet

- Capital Srtructure and LeverageDocument56 pagesCapital Srtructure and LeverageDaniel Hunks100% (1)

- Income TaxDocument84 pagesIncome TaxA Jalaludeen100% (1)

- Investing - Notes On The Intelligent Asset Allocator PDFDocument3 pagesInvesting - Notes On The Intelligent Asset Allocator PDFCA_KenNo ratings yet

- BKM CH 04 Answers 561987b22037eDocument9 pagesBKM CH 04 Answers 561987b22037eLiaquat Ali KhanNo ratings yet

- Factors Determining Capital StructureDocument2 pagesFactors Determining Capital StructureMostafizul HaqueNo ratings yet

- HWRK Grading Criteria HWRK 1 Ch. 2 - 2017Document5 pagesHWRK Grading Criteria HWRK 1 Ch. 2 - 2017Moulee DattaNo ratings yet

- Chapter 5 Bonds and Stock ValuationDocument16 pagesChapter 5 Bonds and Stock ValuationEstores Ronie M.No ratings yet

- Corporation Law Divina LMTDocument595 pagesCorporation Law Divina LMTjoliwanagNo ratings yet

- Merchant BankingDocument70 pagesMerchant BankingyakshNo ratings yet

- CORPO 3rd ExamDocument51 pagesCORPO 3rd ExamHarry PotterNo ratings yet