Professional Documents

Culture Documents

Final Project Accounting)

Uploaded by

Muhammad NadeemOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Project Accounting)

Uploaded by

Muhammad NadeemCopyright:

Available Formats

Financial Ratio Analysis

Subject: Financial Ratio Analysis

Participants Hafiz Muhammad Nadeem (2113202) Adnan Ashraf (2113101) Imran Mushtaq (2113001) ( )

Submitted to: Sir Athar Ikram

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 1

Financial Ratio Analysis

Acknowledgement

First of all we are thankful to Allah who gave us courage to grape this report then we would like to record our heart full thanks to our respected Teacher Mr. Athar Ikram and advisor Mr. Ammar Qasim Jaffari credit Manager at Bank Alfalah & to all Friends of Banking department who helped us in Endeavour of making this report.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 2

Financial Ratio Analysis

Synopsis

Topic: The topic of our research report is to study financial Ratio analysis. Purpose: The purpose of writing this report is to choose the best company for investment between Pakistan Telecommunication (PTCL) and Wateen Telecommunication. Scope: Pakistan Telecommunication (PTCL) and Wateen Telecommunication are telecom services providers in Pakistan both are playing very important role in earning GDP of Pakistan. .

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 3

Financial Ratio Analysis

Executive Summary:

Ratio analysis is one of the techniques of financial analysis to evaluate the financial condition and performance of a business concern. Simply, ratio means the comparison of one figure to other relevant figure or figures. Ratio analysis is an important tool to compare financial performance of different companies. Ratio analysis is widely used to gauge profitability, liquidity, solvency etc. of a company. We have selected telecom sector for project assigned to us by our worthy teacher Mr. Athar Ikram in subject Financial Accounting. M/s PTCL & M/s Wateen Telecom are the two main companies in the telecom sector of Pakistan. We are briefly describing each company before discussing financial statements of respective companies.

About PTCL: PTCL is all set to redefine the established boundaries of the telecommunication market and is shifting the productivity frontier to new heights. Today, for millions of people, PTCL demand instant access to new products and ideas. PTCL is setting free the spirit of innovation. PTCL is going to be customers first choice in the future as well, just as it has been over the past six decades. For clear communication the first choice of business circles is PTCL telephone for local, nationwide and international calling. Today businesses can have 10-100 lines with modern day services to meet their needs. Different options like Caller-ID, call-forwarding, call-waiting, Call Barring etc are on PTCLs board. Business specific services of PTCL include 0800-Toll free number, 0900-Preminum rate services, VPN-Virtual Private Network, Audio Conference Service, Digital Cross Connect (DXX), ISDN (Policy), Tele plus (ISDN/BRI), Digital Phone Facilities/ Modification Charges, UAN, UIN. PTCL has the largest Copper infrastructure spread over every city, town and village of Pakistan with over million installed lines. The network of PTCL has over 6 million PSTN lines installed across Pakistan with more than 3 million working. Furthermore installed capacity of broadband is more than 0.6 million ports spread across 605 cities and towns of the country. PTCL has over 10,400 km fully redundant, fiber optics DWDM backbone network. It connects over 840 cities and towns with 270G bandwidth. PTCL also provides carrier services. As carriers-carrier, PTCL provides the core infrastructure services to the cellular, LDIs, Local Loop operators, ISPs, Call Centers and pay phone operators. PTCL provides all carrier services, right from interconnects and Tele housing to DPLC and IPLC connectivity. Its interconnect services are provided from its 3200 exchange locations that connect carriers networks domestically, in addition to providing IPLC bandwidths to connect internationally through its four international gateways and SEA-ME-WE3 and SEA-ME-WE4 international submarine. Furthermore to provide connectivity to operators in the extreme remote areas of the country, PTCL launched its state of the art satellite service (Skylink). PTCL satellite service (Skylink) is provided using the Intelsat Satellite System, an undisputed leader in satellite communications.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 4

Financial Ratio Analysis

About Wateen Telecom:

Wateen Telecom is a converged communication services provider that fulfills connectivity requirements for organizations and individuals in Pakistan. Wateen Telecom delivers complete solutions for Internet, Voice, Multimedia and Enterprise Solutions that make it the most comprehensive provider for all of Pakistans communication necessities. An Abu Dhabi Group venture, Wateens vision is to take Pakistan into the digital revolution of the 21st Century and to make Pakistan a regional communications hub, connecting the East with the West and Central Asia with the Middle East.

Wateen began its operations in Pakistan in 2007, with the deployment of the largest fiber optic network in the country. Moreover, Wateen is the worlds first company to commercially roll out a WiMAX network on a nationwide scale. Wateen currently services over 250,000 WiMAX subscribers, provides enterprise solutions and data services to over 200 leading organizations and its wired (HFC/GPON) network reaches over 15,000 households in Lahore and Multan. With a new strategic vision and management in place, Wateen has steadily improved its service provision and its corporate structure to adequately reflect its corporate motto and beliefs of Enabling Customer Lifestyles. Wateen is aiming to help shape the education, social and economic development in the country using broadbased internet provision

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 5

Financial Ratio Analysis

Ratio Analysis:

1. Liquidity Ratios:

(i)

CURRENT RATIO Current ratio is a popular financial ratio used to test a companys liquidity by deriving the proportion of current assets available to cover current liabilities.

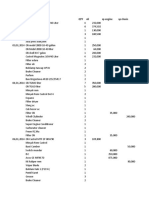

Wateen Telecom Current Ratio = Current Assets Current Liability 8,201,388 24,300,346 0.338 Current Ratio =

PTCL Current Assets Current Liability 45,450,236 30,192,778 1.505

PTCLs liquidity position is far better than wateen. Wateen is facing problems in meeting its current financial obligations as evident from current ratio. On the other hand, PTCL can easily pay off its current liabilities by liquidating its current assets.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 6

Financial Ratio Analysis

Graphical Representation of Current Ratio

Current Ratio

1.600 1.400 1.200 1.000

0.800

0.600 0.400 0.200 0.000 Wateen PTCL

Current Ratio

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 7

Financial Ratio Analysis

(ii) QUICK RATIO

Quick ratio is a liquidity indicator that further refines the current ratio by measuring the amount of the most liquid current assets there are to cover current liability.

Quick Ratio

Wateen Telecom =

PTCL Quick Ratio =

Cash & Equivalents+ Short Term Investments+ Account Receivables Current Liability

Cash & Equivalents+ Short Term Investments+ Account Receivables Current Liability

= =

7,096,237 24,300,346 0.292

= =

30,875,172 30,192,778 1.023

Wateen has very little capacity to meet current liabilities through its most liquid assets. PTCL is again in much better position to meet current liabilities even through more liquid assets. Liquidity ratios clearly indicating better liquidity standings of PTCL whereas Wateen is struggling for liquidity.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 8

Financial Ratio Analysis

Graphical Representation of Quick Ratio:

Quick Ratio

1.200 1.000

0.800 0.600 Quick Ratio 0.400

0.200 0.000 Wateen PTCL

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 9

Financial Ratio Analysis

(iii) Cash Conversion Cycle

The cash conversion cycle (CCC) measures the number of days a company's cash is tied up in the production and sales process of its operations and the benefit it gets from payment terms from its creditors. The shorter this cycle, the more liquid the company's working capital position is. The CCC is also known as the "cash" or "operating" cycle. An often-overlooked metric, the cash conversion cycle is vital for two reasons. First, it's an indicator of the company's efficiency in managing its important working capital assets; second, it provides a clear view of a company's ability to pay off its current liabilities

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 10

Financial Ratio Analysis

Wateen Telecom Cash Conversion Cycle =

Days Inventory Held+ Days A/c Receivables Days A/C Payables

PTCL Cash Conversion Cycle =

Days Inventory Held+ Days A/c Receivables Days A/C Payables

a. Days Inventory Held: Cost of Services per Day = = *Inventory = 6,272,409 365 17,184.68 -

a. Days Inventory Held: Cost of Services per Day = = *Inventory = 38,258,711 365 104,818.40 __ 0____

Days Inventory Outstanding= __ 0____ 17,184.68 = 0 Days b. Days Receivables Revenue per Day= 7,961,103 365 = 21,811.24 = 3,097,982

Days Inventory Outstanding = 104,818.40 = 0 Days b. Days Receivables Revenue per Day = 57,174,527 365 =

156,642.50 Receivables Receivables 10,171,530 =

Days Inventory Outstanding= 3,097,982 21,811.24 = 142 Days c. Days Payables Cost of Services per Day= = Payables = 6,272,409 365 17,184.68 5,922,431 5,922,431 17,184.68 = 345 Days

Days Inventory Outstanding= 10,171,530 156,642.50 = 65 Days c. Days Payables Cost of Services per Day = = Payables = 38,258,711 365 104,818.40 24,922,197 24,922,197 104,818.40

Days Inventory Outstanding=

Days Inventory Outstanding=

= 238 Days Cash Conversion Cycle = (a+b) c = (0+142) 345 = -203 Cash Conversion Cycle = (a+b) c *Since its a service concern it doesnt hold = (0+65) 238 inventory. = -173 *Since its a service concern it doesnt hold inventory. NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS Page 11

Financial Ratio Analysis

Cash Conversion cycle of PTCL is better than Wateen. Clearly PTCL is recovering receivables in shorter period of time and paying to its creditors with fewer days as compared to Wateen which CCC is not so liquid. The CCC is also exhibiting good liquidity position of PTCL.

2. Profitability Ratios

(i) Gross Profit to Revenue Ratio A telecom service oriented companys cost of services includes salaries, allowances, annual license fee to regulatory authority, repairs & maintenance costs, communication charges etc. This expense is deducted from the company revenue which results in companys first level of profit, or gross profit.

Wateen Telecom Gross Profit to Revenue Ratio = ____ GP_____ Revenue = = 2,043,302 7,961,103 = = 25.66%

PTCL Gross Profit to Revenue Ratio = ____ GP_____ Revenue 18,915,816 57,174,527 33.10%

PTCLs is effective is controlling cost of services which is evident from GP Ratio. GP Ratio is healthy and it is depicting that a good portion of profit is available for admin, selling and general expenses. Wateens GP Margin is lower than PTCL which indicates that its cost of services is high as compared to PTCL and its cushion for selling, admin and other expenses is little as compared to PTCL.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 12

Financial Ratio Analysis

Graphical Representation of Gross Profit Ratio:

Gross Profit

40.000 35.000 30.000 25.000

20.000

15.000 10.000 5.000 0.000 Wateen PTCL

Gross Profit

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 13

Financial Ratio Analysis

(ii) Net Profit to Revenue Ratio

Net Profit Ratio shows the relationship between Net Profit of the concern and its Net Sales. In order to work out overall efficiency of the concern net profit ratio is calculated. This ratio is helpful to determine the operational ability of the concern. While comparing the ratio to previous years ratios, the increment shows the efficiency of the concern.

Wateen Telecom Net Profit to Revenue Ratio = ____ NP_____ Revenue = (2,020,513) 7,961,103 -25.4%

PTCL Net Profit to Revenue Ratio = ____ NP_____ Revenue = 9,294,152 57,174,527 16.26%

PTCL is generating reasonable profitability and NP is in line with industry average. NP is showing PTCLs strong operational ability as figure is good. Figure also suggests that investors are getting reasonable return on their investments. On the other hand, Wateen Telecom is incurring loss and figure is putting question mark on its operational viability.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 14

Financial Ratio Analysis

Graphical Representation of Net Profit Ratio:

Net Profit

20.000

15.000

10.000

5.000

0.000

-5.000

-10.000

Wateen

PTCL

Net Profit

-15.000

-20.000

-25.000

-30.000

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 15

Financial Ratio Analysis

(iii)

Return on Assets

Return on Assets ratio illustrates how well a management is employing the companys total assets to make a profit. The higher the return, the more efficiently management is utilizing its asset base.

Wateen Telecom Return on Assets = ____ NP_____ Total Assets (2,020,513) 29,710,392 -0.068 Return on Assets =

PTCL ____ NP_____ Total Assets 9,294,152 150,767,727 0.062

From the above ratio it has been noted that PTCL is generating small income from utilized assets. This figure should be better. But on the other side, Wateen is incurring loss which is alarming situation. Company management must take corrective measures to better the position.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 16

Financial Ratio Analysis

Graphical Representation of Return on Asset Ratio:

Return on Assets

0.080 0.060 0.040 0.020

0.000 -0.020

-0.040 -0.060 -0.080 Wateen PTCL

Return on Assets

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 17

Financial Ratio Analysis

(iv)

Return on Equity

Return on equity is also known as return on shareholders investment. The ratio establishes relationship between profit available to equity shareholders with equity shareholders funds. Return on Equity judges the profitability from the point of view of equity shareholders. This ratio has great interest to equity shareholders. The return on equity measures the profitability of equity funds invested in the firm. The investors favour the company with higher ROE.

Wateen Telecom Return on Equity = ____ NP_____ Shareholders Equity (2,020,513) 4,209,667 -0.48 Return on Equity =

PTCL ____ NP_____ Shareholders Equity 9,294,152 99,758,711 0.093

PTCL is generating somewhat reasonable return on shareholders equity. Shareholders are getting reasonable return on their investment in PTCL whereas Wateen is not generating return for its shareholders rather incurring loss to their investment. Management has to take revolutionary steps to satisfy its shareholders.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 18

Financial Ratio Analysis

Graphical Representation of Return on Equity Ratio:

Return on Equity

0.120

0.100

0.080

0.060

0.040

0.020

0.000

Return on Equity Wateen PTCL

-0.020

-0.040

-0.060

-0.080

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 19

Financial Ratio Analysis

3. Solvency Ratios (i) Interest Coverage Ratio Interest coverage ratio is used to determine how easily a company can pay interest expense on outstanding debt.

Wateen Telecom Interest Coverage Ratio = ____ EBIT_____ Interest Expense = = 354,608 1,974,257 = = 0.1796 Interest Coverage Ratio =

PTCL ____ EBIT_____ Interest Expense 14,684,358 403,240 36.42

PTCL holds strong financial health and can pay 36 times more than current interest expense through current level of operating profit. Its a healthy sign and shows companys strong financial position. But Wateen is exhibiting other side of the picture and is not able to meet interest expense through its current level of operating profit. The reason may be the high interest expense due to high debt obtained.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 20

Financial Ratio Analysis

Graphical Representation of Interest Coverage Ratio:

Interest Coverage

34.300

4.900

Interest Coverage

0.700

Wateen

PTCL

0.100

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 21

Financial Ratio Analysis

(ii)

Debt Ratio

Debt ratio compares a company total debt to its total assets, which is used to gain a general idea as the amount of leverage being used by a company.

Wateen Telecom Debt Ratio = ____ Total Liabilities_____ Total Assets = 25,500,725 29,710,392 0.858 Debt Ratio =

PTCL ____ Total Liabilities_____ Total Assets = 51,009,016 150,767,727 0.338

PTCLs debt ratio states that it has more assets than its liabilities and company may obtain further debt if needed. Wateen has already been highly leveraged as its debt is on higher side and just getting equal to companys assets which is not a positive trend.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 22

Financial Ratio Analysis

Graphical Representation of Debt Ratio:

Debt Ratio

1.000

0.800

0.600

0.400 0.200

0.000

Debt Ratio

Wateen

PTCL

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 23

Financial Ratio Analysis

(iii)

DEBT to EQUITY RATIO

Debt ratio compares a company total debt to its total assets, which is used to gain a general idea as the amount of leverage being used by a company. A low percentage means that the company is less dependent on leverage. The lower the percentage, the less leverage of a company is using and stronger its equity position.

Wateen Telecom Debt to Equity Ratio = ____ Total Liabilities_____ Shareholders Equity = 25,500,725 4,209,667 6.058

PTCL Debt to Equity Ratio = ____ Total Liabilities_____ Shareholders Equity = 51,009,016 99,758,711 0.511

PTCL is being operated at equity and debt accounts fall 50% of equity. Its the evident of better financial health of the company. Wateen is highly leveraged company and is being run on debt which is negative sign. Its liabilities are 6 times higher than assets which is depicting weak financial health of the company.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 24

Financial Ratio Analysis

Graphical Representation of Debt Equity Ratio:

Debt Equity Ratio

7.000 6.000 5.000 4.000 3.000 2.000 1.000 0.000 Wateen PTCL

Debt Equity Ratio

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 25

Financial Ratio Analysis

Conclusion: It is obvious from above ratio analysis that PTCL is performing well and all financial indicators are showing positive trend. Wateens performance is not up to the mark and financial indicators reflecting negativity in financial health of the company. An investor interested in making investment into some company considers risk and return aspects of that investment. An important tool is ratio analysis of financial statements. Since we are considering only ratios for decision making (although other factors should also be consider e.g. management, market share, stock price, future plans) and on the basis of this result we will invest in PTCL and will not make any investment in Wateen Telecom.

NATIONAL COLLEGE OF BUSINESS ADMINISTRATIO&ECONOMICS

Page 26

You might also like

- Activate Adobe Photoshop CS5 Free Using Serial KeyDocument3 pagesActivate Adobe Photoshop CS5 Free Using Serial KeyLukmanto68% (28)

- Financial Analysis of PTCLDocument47 pagesFinancial Analysis of PTCLIlyas Ahmad Farooqi67% (3)

- Managerial Accouting Final Project - Group 1 - Section B - PELDocument41 pagesManagerial Accouting Final Project - Group 1 - Section B - PELnomanNo ratings yet

- Final Report SCMDocument6 pagesFinal Report SCMvikrambajwa24No ratings yet

- Cadbury PaperDocument14 pagesCadbury PaperBinti Shofiatul JannahNo ratings yet

- PTCL Pakistan's Largest TelecomDocument37 pagesPTCL Pakistan's Largest TelecomaeehaNo ratings yet

- Sap Ewm - Erp Initial SetupDocument3 pagesSap Ewm - Erp Initial SetupVAIBHAV PARAB80% (5)

- 2016 04 1420161336unit3Document8 pages2016 04 1420161336unit3Matías E. PhilippNo ratings yet

- Accounting Final ProjectDocument17 pagesAccounting Final ProjectInnosent IglEsiasNo ratings yet

- CH 4 SolutionDocument14 pagesCH 4 SolutionRody El KhalilNo ratings yet

- The 7 Step Risk Management ProcessDocument41 pagesThe 7 Step Risk Management ProcessThanveer MaNo ratings yet

- Limitation and DelimitationDocument3 pagesLimitation and DelimitationNayab SyedNo ratings yet

- Pest Analysis of TelenorDocument4 pagesPest Analysis of TelenorMuhammad SohaibNo ratings yet

- ESHIP Terminal Exam FA16-EEE-029Document6 pagesESHIP Terminal Exam FA16-EEE-029Rafeh Ali KhanNo ratings yet

- EntrepreneurshipDocument2 pagesEntrepreneurshipDreamtech PressNo ratings yet

- Mobilink's VisionDocument6 pagesMobilink's Visionnidaahmed100% (1)

- ABL Strategic Management Case StudyDocument72 pagesABL Strategic Management Case StudySumAir KhanNo ratings yet

- Telenor M.I.SDocument21 pagesTelenor M.I.Sسعد سعيد100% (1)

- MobilinkDocument35 pagesMobilinkMuhammad SualehNo ratings yet

- 7 P's of Marketing Research Firm-Deepika, Maitri, Mradul@BDocument27 pages7 P's of Marketing Research Firm-Deepika, Maitri, Mradul@BmradulrajNo ratings yet

- Balance Sheet Comparison-AFADocument15 pagesBalance Sheet Comparison-AFAAhsan IshaqNo ratings yet

- Management Semester ProjectDocument22 pagesManagement Semester ProjectMariCh44No ratings yet

- Pakistan's largest cellular provider MobilinkDocument4 pagesPakistan's largest cellular provider MobilinksowabaNo ratings yet

- Final Examination (21355)Document13 pagesFinal Examination (21355)Omifare Foluke Ayo100% (1)

- Ufone Recruitment and Selection ProcessDocument32 pagesUfone Recruitment and Selection ProcessTayyab Dilsahad50% (2)

- BCG and Market ShareDocument3 pagesBCG and Market Sharesuccessor88100% (2)

- Bangla LinkDocument18 pagesBangla LinkjtopuNo ratings yet

- Internationalization Process of Telenor and Future PathsDocument1 pageInternationalization Process of Telenor and Future PathsAlex SaicuNo ratings yet

- Ratio Analysis of National FoodsDocument9 pagesRatio Analysis of National FoodsMujtaba NaqviNo ratings yet

- Shakers Final Report 2Document127 pagesShakers Final Report 2SyedSalmanRahmanNo ratings yet

- MKT_701: IMC Plan for Zong M9 ServiceDocument35 pagesMKT_701: IMC Plan for Zong M9 ServiceHumaRiazNo ratings yet

- Case Study On WAPDADocument9 pagesCase Study On WAPDAChaudhry BabarNo ratings yet

- MISchap 09Document27 pagesMISchap 09Gemini_0804No ratings yet

- A Stratgey and Planing of Organization MobilinkDocument50 pagesA Stratgey and Planing of Organization Mobilinkapi-197598010% (1)

- Mobilink Management ReportDocument76 pagesMobilink Management Reportibrahim_ghaznaviNo ratings yet

- Report On Information System of Muslim Commercial BankDocument20 pagesReport On Information System of Muslim Commercial Bankannieriaz63% (8)

- IDLC Finance Limited: Assignment (Research Report)Document29 pagesIDLC Finance Limited: Assignment (Research Report)Nishat ShimaNo ratings yet

- Retailer Satisfaction of Vodafone: Marketing Research Report ONDocument70 pagesRetailer Satisfaction of Vodafone: Marketing Research Report ONAnil Kumar SinghNo ratings yet

- Telenor Group History and OperationsDocument8 pagesTelenor Group History and OperationsZohaib Ahmed JamilNo ratings yet

- Pso Marketing Research ReporDocument62 pagesPso Marketing Research ReporMuhammad ShahnawazNo ratings yet

- History of VideoconDocument4 pagesHistory of Videoconsameeruddin ahmed100% (1)

- Mobilink's HRM PracticesDocument39 pagesMobilink's HRM PracticesAdnan Akram100% (1)

- Star TopologyDocument12 pagesStar TopologyChandrakant PatilNo ratings yet

- Financial Statement Analysis of Bank Al Falah and Habib Bank LimitedDocument47 pagesFinancial Statement Analysis of Bank Al Falah and Habib Bank Limitedammar123No ratings yet

- MKT 501 - Group 3 - Mini Assignment - Holistic Marketing - ACI LimitedDocument8 pagesMKT 501 - Group 3 - Mini Assignment - Holistic Marketing - ACI LimitedMd. Rafsan Jany (223052005)No ratings yet

- Assignment On Mercantile Bank Limited, Dhaka, Bangladesh.Document6 pagesAssignment On Mercantile Bank Limited, Dhaka, Bangladesh.নিশীথিনী কুহুরানীNo ratings yet

- IE2001Document8 pagesIE2001eyaacobNo ratings yet

- Strategic Management Analysis of UfoneDocument27 pagesStrategic Management Analysis of Ufonemalikhaseb86No ratings yet

- PDF Internship Report LcwuDocument125 pagesPDF Internship Report LcwuKashif IftikharNo ratings yet

- A Comparative Study On Investment Pattern...Document9 pagesA Comparative Study On Investment Pattern...cpmrNo ratings yet

- Banglalink As A Value ChainDocument5 pagesBanglalink As A Value ChainNazir Ahmed ZihadNo ratings yet

- Best Way & Lucky Cement Case StudyDocument16 pagesBest Way & Lucky Cement Case StudyArisha BaigNo ratings yet

- Strategic Management Report on Wateen TelecomDocument12 pagesStrategic Management Report on Wateen TelecomSana JavaidNo ratings yet

- Telenor Vision and Organizational StructureDocument23 pagesTelenor Vision and Organizational StructureUzair ShahNo ratings yet

- Infosys Supply ChainDocument11 pagesInfosys Supply ChainAmit BharNo ratings yet

- Project report on SWOT analysis of Pepsi CoDocument29 pagesProject report on SWOT analysis of Pepsi CoRitika KhuranaNo ratings yet

- Internship Report On UBLDocument75 pagesInternship Report On UBLBashir Ahmad0% (2)

- Banglalink's CRM Practices and Customer SatisfactionDocument43 pagesBanglalink's CRM Practices and Customer SatisfactionSharif Mahmud100% (2)

- NSU Admission Test: MGT 314 Section: 06 Submitted To: Shaila Jahan Mona (JMS)Document11 pagesNSU Admission Test: MGT 314 Section: 06 Submitted To: Shaila Jahan Mona (JMS)inna tasneemNo ratings yet

- PTCL ProjectDocument28 pagesPTCL ProjectFahad RazaNo ratings yet

- Board of Directors Corporate Information Directors' Report: Pakistan Telecommunication Company LimitedDocument26 pagesBoard of Directors Corporate Information Directors' Report: Pakistan Telecommunication Company LimitedTahir ArfiNo ratings yet

- PTCL NOC ensures fault-resilient networkDocument19 pagesPTCL NOC ensures fault-resilient networkusmanaminchNo ratings yet

- Perbandingan Sistem Pemerintahan Dalam Hal Pemilihan Kepala Negara Di Indonesia Dan SingapuraDocument9 pagesPerbandingan Sistem Pemerintahan Dalam Hal Pemilihan Kepala Negara Di Indonesia Dan SingapuraRendy SuryaNo ratings yet

- How To Make Pcbat Home PDFDocument15 pagesHow To Make Pcbat Home PDFamareshwarNo ratings yet

- Synopsis: A Study On Customer Satisfaction AT Nerolac Paints LTD., KadapaDocument5 pagesSynopsis: A Study On Customer Satisfaction AT Nerolac Paints LTD., KadapaAnu GraphicsNo ratings yet

- Nuxeo Platform 5.6 UserGuideDocument255 pagesNuxeo Platform 5.6 UserGuidePatrick McCourtNo ratings yet

- Admission Checklist (Pre-) Master September 2021Document7 pagesAdmission Checklist (Pre-) Master September 2021Máté HirschNo ratings yet

- Article. 415 - 422Document142 pagesArticle. 415 - 422Anisah AquilaNo ratings yet

- ABN AMRO Holding N.V. 2009 Annual ReportDocument243 pagesABN AMRO Holding N.V. 2009 Annual ReportF.N. HeinsiusNo ratings yet

- Rust Experimental v2017 DevBlog 179 x64 #KnightsTableDocument2 pagesRust Experimental v2017 DevBlog 179 x64 #KnightsTableIngrutinNo ratings yet

- Hilti X-HVB SpecsDocument4 pagesHilti X-HVB SpecsvjekosimNo ratings yet

- Etp ListDocument33 pagesEtp ListMohamed MostafaNo ratings yet

- ITIL - Release and Deployment Roles and Resps PDFDocument3 pagesITIL - Release and Deployment Roles and Resps PDFAju N G100% (1)

- Macdonald v. National City Bank of New YorkDocument6 pagesMacdonald v. National City Bank of New YorkSecret SecretNo ratings yet

- 59 - 1006 - CTP-Final - 20200718 PDFDocument11 pages59 - 1006 - CTP-Final - 20200718 PDFshubh.icai0090No ratings yet

- Product Catalog: Ductless Mini-Splits, Light Commercial and Multi-Zone SystemsDocument72 pagesProduct Catalog: Ductless Mini-Splits, Light Commercial and Multi-Zone SystemsFernando ChaddadNo ratings yet

- Verificare Bujii IncandescenteDocument1 pageVerificare Bujii IncandescentemihaimartonNo ratings yet

- Siyaram S AR 18-19 With Notice CompressedDocument128 pagesSiyaram S AR 18-19 With Notice Compressedkhushboo rajputNo ratings yet

- Fleck 3150 Downflow: Service ManualDocument40 pagesFleck 3150 Downflow: Service ManualLund2016No ratings yet

- Draft of The English Literature ProjectDocument9 pagesDraft of The English Literature ProjectHarshika Verma100% (1)

- Nexus Undercarriage Cross Reference GuideDocument185 pagesNexus Undercarriage Cross Reference GuideRomanNo ratings yet

- 702190-Free PowerPoint Template AmazonDocument1 page702190-Free PowerPoint Template AmazonnazNo ratings yet

- 1 N 2Document327 pages1 N 2Muhammad MunifNo ratings yet

- Modulus of Subgrade Reaction KsDocument1 pageModulus of Subgrade Reaction KsmohamedabdelalNo ratings yet

- Forecasting AssignmentDocument1 pageForecasting AssignmentVarun Singh100% (1)

- Factory Hygiene ProcedureDocument5 pagesFactory Hygiene ProcedureGsr MurthyNo ratings yet

- Factors Affecting Employee Turnover and Job Satisfaction A Case Study of Amari Hotels and Resorts Boondarig Ronra and Assoc. Prof. Manat ChaisawatDocument26 pagesFactors Affecting Employee Turnover and Job Satisfaction A Case Study of Amari Hotels and Resorts Boondarig Ronra and Assoc. Prof. Manat ChaisawathumeragillNo ratings yet

- Method StatementDocument11 pagesMethod StatementMohammad Fazal Khan100% (1)

- A. Readings/ Discussions Health and Safety Procedures in Wellness MassageDocument5 pagesA. Readings/ Discussions Health and Safety Procedures in Wellness MassageGrace CaluzaNo ratings yet