Professional Documents

Culture Documents

Notes Mar08 - 22.12.09

Uploaded by

Ashish KhantwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes Mar08 - 22.12.09

Uploaded by

Ashish KhantwalCopyright:

Available Formats

Trikha Hospitality & Services Pvt Ltd Schedules forming part of accounts as at March 31,2009 Schedule 8: Notes to accounts

1 Background The company was incorporated during the year under review and is engaged in the business of Hospitality services . 2.Significant Accounting Policies These financial statements have been prepared in accordance with the Accounting Standards as prescribed by the Institute of Chartered Accountants of India and referred to in section 211(3)(c) of the Companies Act 1956, as applicable to the company . Significant accounting policies adopted in the presentation of the accounts are: a. Basis of Accounting These accounts are prepared on the mercantile basis. b. Revenue Recognition Revenue from Food and Beverage Sales is recognised on actual sales . c. Fixed Assets Fixed Assets are stated at their original cost of acquisition / installation less depreciation. All direct expenses attributable to acquisition / installation of assets are capitalized. d. Depreciation / Asset Impairment Depreciation is charged on a pro rata basis on the Written Down Value method at rates prescribed by Schedule XIV of the Companies Act, 1956. e. Retirement benefits No employee of the company was entitled to any retirement benefits . f. Transactions in foreign exchange Transactions in foreign currencies are recorded at the exchange rate prevailing on the date of the transaction. Monetary items denominated in foreign currency and outstanding at the balance sheet date are translated at the exchange rate ruling on that date. Exchange differences on foreign exchange transactions other than those relating to fixed assets are recognised in the Profit & Loss Account. Exchange differences on liability relating to Fixed Assets are capitalized as a part of the asset .

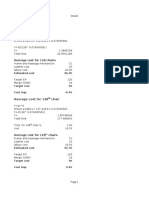

g. Taxes on Income Income tax comprises current tax and deferred tax. Current tax is determined in accordance with the provisions of Income Tax Act, 1961. Advance taxes and provisions for current taxes are presented in the balance sheet after off setting advance taxes paid and income tax provisions. Deferred tax charge or credit is recognised on timing differences being the difference between taxable income and accounting income that originate in one period and are capable of reversal, subject to consideration of prudence, in one or more subsequent periods. Deferred tax assets and liabilities are measured using the tax rates and tax laws that have been enacted or substantively enacted by the balance sheet date. h. Use of estimates The preparation of financial statements in conformity with Generally Accepted Accounting Principles (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent liabilities as at the date of the financial statements and reporting amounts of income and expenses during the year. Examples of such estimates include provision for doubtful debts, future obligations under employee retirement benefit plans, income taxes, foreseeable estimated contract losses and useful life of fixed and intangible assets. Actual results could differ from these estimates. Any revision to accounting estimates is recognised prospectively in the current and future periods. i.Provisions and contingencies A provision is recognised when the Company has a present obligation as a result of a past event, when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and reliable estimate can be made of the amount of the obligation. A contingent liability is recognised where there is a possible obligation or a present obligation that may, but probably will not, require an outflow of resources. 3. Payment to Auditors ( excluding Service tax) Year ended March 31,2009 Rs 15,000 Period ended March 31,2008 Rs 15,000

For Audit Fee

4.Additional Information required to be given pursuant to Part II of Schedule VI of the Companies Act, 1956 Remuneration paid to Directors : Nil (Nil)

Expenditure in Foreign Exchange : Nil (Nil) CIF Value of imports Earnings in Foreign Exchange : Nil (Nil) : Nil(Nil)

5. In the opinion of the Board, current assets, loans and advances have a value not less than the amount at which they are stated.

6. Balances of Sundry Debtors and Creditors are subject to confirmation . 7. Previous year figures may have been provided as this is the first year of company after incorporation. 8.Contingent Liabilities : Nil 9 . Claims against the company not acknowledged as debts : Nil 10.Disclosures as per Micro, Medium and Small Enterprises Development Act, 2006 (MSMED) Pursuant to amendments to Schedule VI to the Companies Act, 1956 vide Notification No. GSR 719 (E) dated 16 November, 2007, the amounts due to Micro and Small Enterprises only to be disclosed as against the earlier disclosure requirement of amounts due to Small Scale Industrial Undertakings Based on the information available with the Company, the balance due to Micro & Small Enterprises as defined under the MSMED Act, 2006 is Rs. Nil and no interest has been paid or is payable under the terms of the MSMED Act, 2006. Further, during the previous year no amounts were payable to small scale undertakings which were outstanding for more than 30 days. 11.As per the information available with the Company, there are no dues outstanding to the Small Scale Industrial Undertakings

For and on behalf of the board

July 22, 2009

Director

Director

You might also like

- Language 1Document3 pagesLanguage 1Ashish KhantwalNo ratings yet

- The Present Day 1Document2 pagesThe Present Day 1Ashish KhantwalNo ratings yet

- Justice Iredell Gave Expression To An Apology Preceding His Dissent, Which Practice Has Been FollowedDocument1 pageJustice Iredell Gave Expression To An Apology Preceding His Dissent, Which Practice Has Been FollowedAshish KhantwalNo ratings yet

- DU LLB 2017 Question PaperDocument17 pagesDU LLB 2017 Question PaperAshish KhantwalNo ratings yet

- The Mah. Municipal Corporation Act (H-4062)Document439 pagesThe Mah. Municipal Corporation Act (H-4062)csakhare82No ratings yet

- The Mah. Municipal Corporation Act (H-4062)Document439 pagesThe Mah. Municipal Corporation Act (H-4062)csakhare82No ratings yet

- Filing User ManualDocument47 pagesFiling User ManualAshish KhantwalNo ratings yet

- Common Induction Moot, 2017, Campus Law Centre: Before The Hon'ble High Court, Central ProvinceDocument16 pagesCommon Induction Moot, 2017, Campus Law Centre: Before The Hon'ble High Court, Central ProvinceAshish KhantwalNo ratings yet

- Participant Under StressDocument5 pagesParticipant Under StressAshish KhantwalNo ratings yet

- Beginning Running Program 3CDocument15 pagesBeginning Running Program 3CAshish KhantwalNo ratings yet

- Character, Medical Certificate - 2Document3 pagesCharacter, Medical Certificate - 2ChitiBujiNo ratings yet

- Discssion Neo Pi RDocument2 pagesDiscssion Neo Pi RAshish KhantwalNo ratings yet

- Group Comparison Research: Causal-Comparative (Ex Post Facto) ResearchDocument18 pagesGroup Comparison Research: Causal-Comparative (Ex Post Facto) ResearchSiti SakinahNo ratings yet

- Advertisement - 1 For Judiciary Exam HaryanaDocument6 pagesAdvertisement - 1 For Judiciary Exam HaryanaAshish KhantwalNo ratings yet

- Du Mark SheetDocument2 pagesDu Mark SheetAshish KhantwalNo ratings yet

- Mean Age and Gender FrequensiesDocument1 pageMean Age and Gender FrequensiesAshish KhantwalNo ratings yet

- Career Academy PDFDocument1 pageCareer Academy PDFAshish KhantwalNo ratings yet

- PatriDocument1 pagePatriAshish KhantwalNo ratings yet

- Paper I English A282Document10 pagesPaper I English A282Ashish KhantwalNo ratings yet

- How To Study and Learn A DisciplineDocument11 pagesHow To Study and Learn A DisciplineAshish Khantwal58% (12)

- Sorry ScribdDocument1 pageSorry ScribdAshish KhantwalNo ratings yet

- Property Tax Delhi 2014-15Document1 pageProperty Tax Delhi 2014-15Ashish KhantwalNo ratings yet

- Water Bill ApplicationDocument1 pageWater Bill ApplicationAshish KhantwalNo ratings yet

- Letter To Jal Board OfficerDocument1 pageLetter To Jal Board OfficerAshish KhantwalNo ratings yet

- Hip Flexor WorksheetDocument1 pageHip Flexor WorksheetAshish KhantwalNo ratings yet

- sbm1 4 12 30 9Document3 pagessbm1 4 12 30 9Ashish KhantwalNo ratings yet

- Sorry Scribdreally SorryDocument1 pageSorry Scribdreally SorryAshish KhantwalNo ratings yet

- Sorry ScribdDocument1 pageSorry ScribdAshish KhantwalNo ratings yet

- DJBBillDocument2 pagesDJBBillAshish KhantwalNo ratings yet

- Property Tax Delhi 2014-15Document1 pageProperty Tax Delhi 2014-15Ashish KhantwalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Final Draft - Banana ChipsDocument34 pagesFinal Draft - Banana ChipsAubrey Delgado74% (35)

- CCRC Benchmarks and 2009 Medians-BB&T-Jan 2010Document8 pagesCCRC Benchmarks and 2009 Medians-BB&T-Jan 2010api-26406608No ratings yet

- Carnival Cruises SWOTDocument2 pagesCarnival Cruises SWOTGendis FreyonaNo ratings yet

- L12 Problem On Profitability Measures For Profit CenterDocument8 pagesL12 Problem On Profitability Measures For Profit Centerapi-3820619No ratings yet

- For HODDocument94 pagesFor HODVinu VaviNo ratings yet

- Learning Curve: Average Cost For 128 ChairsDocument5 pagesLearning Curve: Average Cost For 128 ChairsFarman ShaikhNo ratings yet

- Problem 7 39Document3 pagesProblem 7 39ninjai_thelittleninjaNo ratings yet

- 203 Principles of Taxation LawDocument182 pages203 Principles of Taxation Lawbhatt.net.in100% (5)

- Gam Chap 3Document9 pagesGam Chap 3Johanna VidadNo ratings yet

- Accounts of Non Trading OrganisationDocument13 pagesAccounts of Non Trading OrganisationMahesh Kumar100% (2)

- Problem SolvingDocument32 pagesProblem SolvingJoanna Paula MagadiaNo ratings yet

- ACN 305, Course Outline, Su'17Document12 pagesACN 305, Course Outline, Su'17Wasif HossainNo ratings yet

- 20 Air Canada vs. Commissioner of Internal RevenueDocument30 pages20 Air Canada vs. Commissioner of Internal Revenueshlm bNo ratings yet

- SEO Analysis of Sears Holding CompanyDocument11 pagesSEO Analysis of Sears Holding CompanyHelplineNo ratings yet

- Tiger Analytics: Case Study: FF IncDocument22 pagesTiger Analytics: Case Study: FF IncRohit Kumar PandeyNo ratings yet

- Accounting Principles: Second Canadian EditionDocument38 pagesAccounting Principles: Second Canadian EditionErik Lorenz PalomaresNo ratings yet

- Solution Manual For Cornerstones of Financial and Managerial Accounting 2nd Edition by RichDocument57 pagesSolution Manual For Cornerstones of Financial and Managerial Accounting 2nd Edition by RichEric Badanguio100% (31)

- Aneil GroupDocument40 pagesAneil GroupRyan X RoseNo ratings yet

- Financial Ratios Analysis & Comparing Financial Performance of Two Pharmaceuticals Companies - (Cipla and Lupin)Document10 pagesFinancial Ratios Analysis & Comparing Financial Performance of Two Pharmaceuticals Companies - (Cipla and Lupin)nithiyaashriNo ratings yet

- MIC Electronics LTD+Document3 pagesMIC Electronics LTD+dhirajjNo ratings yet

- Jaiib Tricks To Remember Accounting StandardsDocument3 pagesJaiib Tricks To Remember Accounting Standardshrocking1No ratings yet

- A. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 MillionDocument11 pagesA. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 Millionralphalonzo100% (1)

- Data Import Template BLDocument94 pagesData Import Template BLdavender kumarNo ratings yet

- Contemporary AccountingDocument22 pagesContemporary AccountingRadhakrishna Mishra50% (2)

- Webster University 2011-2012 Audited Financial StatementsDocument36 pagesWebster University 2011-2012 Audited Financial StatementsWebsterJournalNo ratings yet

- Marginal Costing vs Absorption Costing Profit ReconciliationDocument4 pagesMarginal Costing vs Absorption Costing Profit ReconciliationFareha Riaz100% (2)

- Master POA Sample Book PDFDocument20 pagesMaster POA Sample Book PDFwjpodjoaspodjadNo ratings yet

- Kaushik Jain - 30 ProjectDocument45 pagesKaushik Jain - 30 ProjectKAUSHIK JAINNo ratings yet

- Accounting: Marketing Academic Year 2021-2022, 1st SemesterDocument212 pagesAccounting: Marketing Academic Year 2021-2022, 1st SemesterVali CaciulanNo ratings yet

- IAS 21 Foreign SubsidiaryDocument14 pagesIAS 21 Foreign SubsidiaryRoqayya FayyazNo ratings yet