Professional Documents

Culture Documents

Abbott UnauditedFinancialMar2011

Uploaded by

Ghanshyam AhireOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abbott UnauditedFinancialMar2011

Uploaded by

Ghanshyam AhireCopyright:

Available Formats

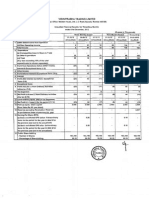

Unaudited Financial results for the quarter ended March 31, 2011

Sr. No Particulars 3 months ended March 31, 2011 3 months ended February 28, 2010 Rupees in Lakhs Previous Period from December 1, 2009 to December 31, 2010 (Audited)

(Unaudited)

(Unaudited)

3 4 5 6 7 8 9 10 11 12 13

14

Net Sales/ Income from Operations a Gross Sales Less: Excise Duty Net Sales b Other Operating Income Expenditure a Decrease/ (Increase) in Stock in Trade and Work-in-Progress b Consumption of Raw Materials c Purchase of Traded Goods d Employees Cost e Depreciation f Other Expenditure g Total Expenditure Profit from Operations before Other Income and Interest (1-2) Other Income Profit before Interest (3+4) Interest Profit before tax Tax Expenses (including current tax, deferred taxation and prior period adjustments for the period ) Net Profit for the period Paid- up Equity Share Capital (Face value of the share Rs. 10) Reserves excluding revaluation reserves (as per last audited balance sheet) Basic and diluted Earnings Per Share for the periods (not annualized) and for the previous period Rs. Public shareholding Number of Shares Percentage of Shareholding Promoters and promoter group shareholding a Pledged/ Encumbered Number of Shares Percentage of Shares (as a % of the total shareholding of promoter and promoter group) Percentage of Shares (as a % of the total share capital of the company) b Non - encumbered Number of Shares Percentage of Shares (as a % of the total shareholding of promoter and promoter group) Percentage of Shares (as a % of the total share capital of the company)

234,92 1,25 233,67 8,61 4,57 9,50 140,60 28,78 2,55 50,13 236,13 6,15 3,08 9,23 1 9,22 3,28 5,94 13,68

202,06 1,23 200,83 5,25 1,08 8,02 124,89 21,60 2,02 31,14 188,75 17,33 1,06 18,39 1 18,38 6,58 11,80 13,68

995,98 6,10 989,88 29,07 (25,08) 44,19 628,20 111,20 11,25 161,93 931,69 87,26 6,93 94,19 4 94,15 33,21 60,94 13,68 291,71 44.56

4.34

8.63

42,47,056 31.06%

42,47,056 31.06%

42,47,056 31.06%

94,28,184 100.00%

94,28,184 100.00%

94,28,184 100.00%

68.94%

68.94%

68.94%

Notes:

1. 2. The results for the quarter ended March 31, 2011 have been reviewed by the Audit Committee, approved by the Board of Directors and subjected to a Limited Review by the auditors of the Company, in compliance with Clause 41 of the Listing Agreement with Bombay Stock Exchange Limited. The members of the Company at their Annual General Meeting held on April 27, 2011, approved a dividend of Rs 17.00 per share on 1,36,75,240 equity shares of Rs 10.00 each value for the period December 1, 2009 to December 31, 2010, amounting to Rs 27,11 Lakhs (including Corporate Dividend Tax). The Company changed its accounting year from year ended November 30 to year ended December 31 from previous financial year onwards. Accordingly, the results for the current quarter are for three months ended March 31, 2011 and the previous quarter are for three months ended February 28, 2010. The results for the current quarter are therefore not comparable with those of the previous quarter. The Shareholders of the Company at the Court Convened meeting held on March 23, 2011 approved the Scheme of Amalgamation of Solvay Pharma India Limited with Abbott India Limited ("Scheme") pursuant to the provisions of Sections 391 to 394 and other applicable provisions of the Companies Act, 1956 and subject to approval of the Honorable High Court of Judicature at Bombay. The swap ratio for the merger is 2:3 i.e. every two shares of Solvay Pharma India Limited will entitle their holder to three shares of Abbott India Limited. Upon receipt of High Court approval, the Scheme would be effective January 1, 2011. .Accordingly the effect of the Scheme will be reflected in the financial results once all the statutory approvals are received. The Company continues to make significant strategic investments for expanding its field force to improve market coverage. The Company also continues to increase advertising and promotion efforts to capture market share and increase brand equity and patient/customer awareness. These initiatives are impacting the near term profitability.

3.

4.

5.

6. 7. 8.

The Company operates in one reportable business segment i.e. Pharmaceuticals and one reportable geographical segment i.e. Within India. There were no Investor Complaints pending at the beginning of the quarter. The Company received 4 complaints from the investors and 3 complaints have been resolved and disposed off during the quarter. There was 1 complaint lying unresolved at the end of the quarter. Figures for the prior period have been regrouped and/or reclassified wherever considered necessary.

For and on behalf of the Board,

Mr Vivek Mohan Managing Director Mumbai: Date: April 27, 2011

You might also like

- Q3 Results 201112Document3 pagesQ3 Results 201112Bishwajeet Pratap SinghNo ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- Pakistan Synthetics Limited Condensed Interim Balance Sheet AnalysisDocument8 pagesPakistan Synthetics Limited Condensed Interim Balance Sheet AnalysismohammadtalhaNo ratings yet

- Ashok Leyland Limited Regd. Office:1 Sardar Patel Road, Guindy, Chennai - 600 032Document2 pagesAshok Leyland Limited Regd. Office:1 Sardar Patel Road, Guindy, Chennai - 600 032Kumaresh SalemNo ratings yet

- Avt Naturals (Qtly 2011 03 31) PDFDocument1 pageAvt Naturals (Qtly 2011 03 31) PDFKarl_23No ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- Subject - Analysis of Financial Statements. Topic-Project On Analysis of Financial Statements of "ITC LTD". Submitted To - Prof C.A Sanjay KatiraDocument46 pagesSubject - Analysis of Financial Statements. Topic-Project On Analysis of Financial Statements of "ITC LTD". Submitted To - Prof C.A Sanjay KatiraSabah MemonNo ratings yet

- Alok - Performance Report - q4 2010-11Document24 pagesAlok - Performance Report - q4 2010-11Krishna VaniaNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- PI Industries Q1FY12 Result 1-August-11Document6 pagesPI Industries Q1FY12 Result 1-August-11equityanalystinvestorNo ratings yet

- BATA INDIA 1Q FY2011 Earnings ReportDocument1 pageBATA INDIA 1Q FY2011 Earnings ReportSagar KadamNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- Ultratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Document7 pagesUltratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Anushree Harshaj GoelNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- IFCI Q3 FY10 financial resultsDocument3 pagesIFCI Q3 FY10 financial resultsnitin2khNo ratings yet

- Financial Statement Analysis of United Motors Lanka PLCDocument37 pagesFinancial Statement Analysis of United Motors Lanka PLCPuwanachandran KaniegahNo ratings yet

- HUL's cost sheet analysisDocument12 pagesHUL's cost sheet analysisoswalpNo ratings yet

- Consolidated AFR 31mar2011Document1 pageConsolidated AFR 31mar20115vipulsNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Document18 pagesTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauNo ratings yet

- BHL Fin Res 2011 12 q1 MillionDocument2 pagesBHL Fin Res 2011 12 q1 Millionacrule07No ratings yet

- BHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Document3 pagesBHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Shubham TrivediNo ratings yet

- 1Q FY2011 Performance ReportDocument24 pages1Q FY2011 Performance ReportMohnish KatreNo ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- Summary of Consolidated Financial Results For The Year Ended March 31, 2014 (U.S. GAAP)Document34 pagesSummary of Consolidated Financial Results For The Year Ended March 31, 2014 (U.S. GAAP)pathanfor786No ratings yet

- Case Study - ACI and Marico BDDocument9 pagesCase Study - ACI and Marico BDsadekjakeNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Britannia Industries Q2 FY2012 Financial ResultsDocument2 pagesBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434No ratings yet

- Manac-1: Group Assignment BM 2013-15 Section ADocument12 pagesManac-1: Group Assignment BM 2013-15 Section AKaran ChhabraNo ratings yet

- HCL Tech - Event Update - Axis Direct - 05042016 - 05!04!2016 - 13Document5 pagesHCL Tech - Event Update - Axis Direct - 05042016 - 05!04!2016 - 13gowtam_raviNo ratings yet

- Sebi MillionsDocument2 pagesSebi MillionsNitish GargNo ratings yet

- 2010 11 Full Year Consolidated Financial ResultsDocument4 pages2010 11 Full Year Consolidated Financial ResultsManita PokhrelNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- NFL Results March 2010Document3 pagesNFL Results March 2010Siddharth ReddyNo ratings yet

- Ajooni BiotechDocument21 pagesAjooni BiotechSunny RaoNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- FY2011 ResultsDocument1 pageFY2011 ResultsSantosh VaishyaNo ratings yet

- Segment Results PDFDocument1 pageSegment Results PDFhkm_gmat4849No ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Rationale of Mergers & Acquisitions: Assignment 1Document6 pagesRationale of Mergers & Acquisitions: Assignment 1mujtabaansariNo ratings yet

- GSK Annual Report 2010Document48 pagesGSK Annual Report 2010Anish KumarNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Document1 pagePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaNo ratings yet

- Signed LGE FY16 Q1 English Report Separate PDFDocument62 pagesSigned LGE FY16 Q1 English Report Separate PDFvinodNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- ACCA p4 2007 Dec QuestionDocument13 pagesACCA p4 2007 Dec QuestiondhaneshwareeNo ratings yet

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Document4 pagesMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750No ratings yet

- NFL Annual Report 2011-2012Document108 pagesNFL Annual Report 2011-2012prabhjotbhangalNo ratings yet

- Hydro Skimming Margins Vs Cracking MarginsDocument78 pagesHydro Skimming Margins Vs Cracking MarginsWon Jang100% (1)

- Local Budget Memorandum No. 75 PDFDocument21 pagesLocal Budget Memorandum No. 75 PDFArnold ImbisanNo ratings yet

- 2021.10.06 Boq Facade Civil Works at b10 - 20211129Document24 pages2021.10.06 Boq Facade Civil Works at b10 - 20211129Irul HimawanNo ratings yet

- 00 2 Physical Science - Zchs MainDocument4 pages00 2 Physical Science - Zchs MainPRC BoardNo ratings yet

- Safety Breach NoticeDocument3 pagesSafety Breach NoticeMohamed HadjkacemNo ratings yet

- Biju Patnaik University of Technology MCA SyllabusDocument18 pagesBiju Patnaik University of Technology MCA SyllabusAshutosh MahapatraNo ratings yet

- Grasshopper VB Scripting Primer IntroductionDocument28 pagesGrasshopper VB Scripting Primer Introductionfagus67No ratings yet

- Lotader: Ethylene - Acrylic Ester - Maleic Anhydride TerpolymerDocument2 pagesLotader: Ethylene - Acrylic Ester - Maleic Anhydride TerpolymerLe MinhNo ratings yet

- Smartviewer 4.9.6: User ManualDocument71 pagesSmartviewer 4.9.6: User ManualPaginas Web AdministrablesNo ratings yet

- Ilo MLCDocument66 pagesIlo MLCcarmenNo ratings yet

- Resume Assignment v5 - Ps 4963 - Cloninger Ps t00111877Document1 pageResume Assignment v5 - Ps 4963 - Cloninger Ps t00111877api-666151731No ratings yet

- Mazda2 Brochure August 2009Document36 pagesMazda2 Brochure August 2009Shamsul Zahuri JohariNo ratings yet

- Parliamentary Procedure in The Conduct of Business MeetingDocument14 pagesParliamentary Procedure in The Conduct of Business MeetingEstephanie SalvadorNo ratings yet

- Prop. Solution For India Asset and Tax DepreciationDocument8 pagesProp. Solution For India Asset and Tax DepreciationJit Ghosh100% (1)

- Lec4 WWW Cs Sjtu Edu CNDocument134 pagesLec4 WWW Cs Sjtu Edu CNAUSTIN ALTONNo ratings yet

- Tools and Techniques For Implementing Integrated Performance Management Systems PDFDocument36 pagesTools and Techniques For Implementing Integrated Performance Management Systems PDFDobu KolobingoNo ratings yet

- Doctrine of Repugnancy ExplainedDocument13 pagesDoctrine of Repugnancy ExplainedAmita SinwarNo ratings yet

- Minimize audit risk with pre-engagement activitiesDocument2 pagesMinimize audit risk with pre-engagement activitiesAnonymityNo ratings yet

- Ruskin Bond's Haunting Stories CollectionDocument5 pagesRuskin Bond's Haunting Stories CollectionGopal DeyNo ratings yet

- 1 ST QTR MSlight 2023Document28 pages1 ST QTR MSlight 2023Reynald TayagNo ratings yet

- Barbara S. Hutchinson, Antoinette Paris-Greider Using The Agricultural, Environmental, and Food Literature Books in Library and Information Science 2002Document491 pagesBarbara S. Hutchinson, Antoinette Paris-Greider Using The Agricultural, Environmental, and Food Literature Books in Library and Information Science 2002Paramitha TikaNo ratings yet

- China Identity Verification (FANTASY TECH)Document265 pagesChina Identity Verification (FANTASY TECH)Kamal Uddin100% (1)

- International Capital Structure and Cost of CapitalDocument20 pagesInternational Capital Structure and Cost of CapitalQuoc AnhNo ratings yet

- Sreeja.T: SR Hadoop DeveloperDocument7 pagesSreeja.T: SR Hadoop DeveloperAnonymous Kf8Nw5TmzGNo ratings yet

- Terms and conditions for FLAC 3D licensingDocument2 pagesTerms and conditions for FLAC 3D licensingseif17No ratings yet

- Topic: Fea For Fatigue Life Assessment of Valve Component Subjected To Internal Pressure Loading. (Through Software)Document27 pagesTopic: Fea For Fatigue Life Assessment of Valve Component Subjected To Internal Pressure Loading. (Through Software)tallat0316557No ratings yet

- 3 Zones in 3 Weeks. Devops With Terraform, Ansible and PackerDocument24 pages3 Zones in 3 Weeks. Devops With Terraform, Ansible and Packermano555No ratings yet

- 2 C Program StructureDocument13 pages2 C Program StructurePargi anshuNo ratings yet

- 3 Human Resource ManagementDocument10 pages3 Human Resource ManagementRonaldNo ratings yet

- Calculus Early Transcendentals 10th Edition Anton Solutions ManualDocument35 pagesCalculus Early Transcendentals 10th Edition Anton Solutions Manualcrenate.bakshish.7ca96100% (16)