Professional Documents

Culture Documents

BS - Is - Oct 11

Uploaded by

luchono1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BS - Is - Oct 11

Uploaded by

luchono1Copyright:

Available Formats

APOLLO FOOD HOLDINGS BERHAD (291471-M) (Incorporated in Malaysia)

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION FOR THE QUARTER ENDED 31 OCTOBER 2011 UNAUDITED AS AT 31/10/2011 RM'000 AUDITED AS AT 30/04/2011 RM'000

ASSETS Non-current assets Property, plant and equipment Leasehold land use rights Investment properties Available-for-sale investments Deferred tax assets

112,295 4,927 14,059 3,220 107 134,608

113,958 5,079 14,165 900 36 134,138

Current assets Inventories Trade and other receivables Tax recoverable Cash and cash equivalents

17,000 27,502 1,278 61,641 107,421 242,029

18,867 24,210 1,205 55,351 99,633 233,771

TOTAL ASSETS EQUITY AND LIABILITIES Equity attributable to owners of the parent Share Capital Reserves attributable to capital Retained profits Total equity Non-current liabilities Retirement benefits obligations Deferred tax

80,000 11,999 123,865 215,864

80,000 12,014 116,464 208,478

1,307 16,642 17,949

1,308 15,894 17,202

Current Liabilities Trade and other payables Retirement benefits obligations Current tax liabilities

7,823 20 373 8,216 26,165 242,029

7,829 67 195 8,091 25,293 233,771

Total liabilities TOTAL EQUITY AND LIABILITIES

Net assets per share (RM)

2.70

2.61

(The Condensed Consolidated Statement of Financial Position should be read in conjunction with the Annual Audited Financial Statements for the year ended 30 April 2011 and the attached accompanying explanatory notes to the interim financial statements)

APOLLO FOOD HOLDINGS BERHAD (291471-M) (Incorporated in Malaysia)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE QUARTER ENDED 31 OCTOBER 2011 (The figures have not been audited) INDIVIDUAL QUARTER CURRENT PRECEDING YEAR YEAR CORRESPONDING QUARTER QUARTER 31/10/2011 31/10/2010 RM'000 RM'000 Revenue Cost of sales Gross profit Other income Operating expenses Finance costs Profit before tax Income tax expense Profit for the period Other comprehensive income Fair value gain on available-for-sale investments Total comprehensive income for the period 85 4,223 21 3,975 56 7,386 88 9,542 45,216 (35,696) 9,520 570 (4,036) 6,054 (1,916) 4,138 37,078 (28,284) 8,794 555 (4,444) 4,905 (951) 3,954 CUMULATIVE QUARTER CURRENT PRECEDING YEAR PERIOD CORRESPONDING TO DATE PERIOD 31/10/2011 31/10/2010 RM'000 RM'000 94,504 (75,851) 18,653 1,066 (9,066) 10,653 (3,323) 7,330 80,595 (60,655) 19,940 933 (9,158) 11,715 (2,261) 9,454

Profit for the period attributable to: Equity holders of the parent Non-controlling interests 4,138 4,138 3,954 3,954 7,330 7,330 9,454 9,454

Total comprehensive income for the period attributable to: Equity holders of the parent Non-controlling interests 4,223 4,223 Earnings per share (sen) (i) Basic (ii) Fully diluted 5.17 5.17 4.94 4.94 9.16 9.16 11.82 11.82 3,975 3,975 7,386 7,386 9,542 9,542

Dividends per share (sen)

20.00

25.00

(The Condensed Consolidated Statement of Comprehensive Income should be read in conjunction with the Annual Audited Financial Statements for the year ended 30 April 2011 and the accompanying explanatory notes attached to the interim financial statements)

APOLLO FOOD HOLDINGS BERHAD (291471-M) (Incorporated in Malaysia)

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE QUARTER ENDED 31 OCTOBER 2011 (The figures have not been audited) Attributable to owners of the parent Non -distributable Distributable Share Capital RM '000 6 months ended 31 October 2011 Balance as at 1 May 2011 Transfer due to realisation of revaluation reserve Total comprehensive income for the period Balance as at 31 October 2011 80,000 4,325 Share Premium RM '000 Revaluation Reserves RM '000 Fair value Reserves RM '000 Retained Profits RM '000 Total RM '000

80,000

4,325

7,450 (71) 7,379

239

116,464 71

208,478 7,386 215,864

56 295

7,330 123,865

6 months ended 31 October 2010 Balance as at 1 May 2010 As previously stated Effect arising from adopting of FRS 117 As restated Effect arising from adopting of FRS 139 80,000 80,000 80,000 Transfer due to realisation of revaluation reserve Total comprehensive income for the period Balance as at 31 October 2010 80,000 4,325 4,325 4,325 4,325 5,454 2,159 7,613 7,613 (90) 7,523 252 252 88 340 113,398 449 113,847 113,847 90 9,454 123,391 203,177 2,608 205,785 252 206,037 9,542 215,579

(The Condensed Consolidated Statement of Changes in Equity should be read in conjunction with the Annual Audited Financial Statements for the year ended 30 April 2011 and the accompanying explanatory notes attached to the interim financial statements)

APOLLO FOOD HOLDINGS BERHAD (291471-M) (Incorporated in Malaysia)

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW FOR THE QUARTER ENDED 31 OCTOBER 2011 (The figures have not been audited) 6 months ended 31 October 2011 2010 RM'000 RM'000 Cash flows from operating activities Profit before tax Adjustment for non cash-flow items Non-cash items Non-operating items Operating profit before changes in working capital Net change in current assets Net change in current liabilities Cash flows generated from operations Income tax paid Income tax refunded Net cash flow generated from operating activities Cash flows from investing activities Rental received Dividends received Proceeds from disposal of property, plant and equipment Proceeds from disposal of available-for-sale investments Purchase of available-for-sale investments Purchase of leasehold land use rights Purchase of property, plant and equipment Net cash used in investing activities Net Change in Cash and Cash Equivalents Effect of changes in exchange rate Cash & Cash Equivalents at beginning of period Cash & Cash Equivalents at end of period

10,653 4,345 (865) 14,133 (742) (54) 13,337 (2,540) 10,797

11,715 5,155 (805) 16,065 (8,409) 36 7,692 (2,549) 2,078 7,221

157 5 (2,264) (2,599) (4,701) 6,096 194 55,351 61,641

164 5 7 231 (1,050) (2,643) (3,286) 3,935 (384) 62,504 66,055

(The Condensed Consolidated Statement of Cash Flow should be read in conjunction with the Annual Audited Financial Statements for the year ended 30 April 2011 and the accompanying explanatory notes attached to the interim financial statements)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Belgian Ale by Pierre Rajotte (1992)Document182 pagesBelgian Ale by Pierre Rajotte (1992)Ricardo Gonzalez50% (2)

- Sap Fico GlossaryDocument12 pagesSap Fico Glossaryjohnsonkkuriakose100% (1)

- The Feasibility of Establishing A Tax and Accounting Firm in Digos CityDocument2 pagesThe Feasibility of Establishing A Tax and Accounting Firm in Digos Citylorren4jeanNo ratings yet

- MGMT611 Managing Littlefield TechDocument4 pagesMGMT611 Managing Littlefield Techqiyang84No ratings yet

- Petronas Swot AnalysisDocument2 pagesPetronas Swot AnalysisAfiqah Yusoff70% (10)

- Advanced Accounting Test Bank Questions Chapter 8Document19 pagesAdvanced Accounting Test Bank Questions Chapter 8Ahmed Al EkamNo ratings yet

- Time Value of MoneyDocument18 pagesTime Value of MoneyJunaid SubhaniNo ratings yet

- Air Asia - Flying High With Low Cost HopesDocument3 pagesAir Asia - Flying High With Low Cost HopesSheng Wei Yeo0% (1)

- Personal Assignment Fraud Audit ReviewDocument8 pagesPersonal Assignment Fraud Audit ReviewNimas KartikaNo ratings yet

- Pocket ClothierDocument30 pagesPocket ClothierBhisma SuryamanggalaNo ratings yet

- World Leasing GuideDocument5 pagesWorld Leasing GuideLudmila DumbravaNo ratings yet

- Keto Diet PlanDocument5 pagesKeto Diet PlanSouharda MukherjeeNo ratings yet

- EU Languages Day QUIZ2Document2 pagesEU Languages Day QUIZ2Emily2008No ratings yet

- Bermuda SWOT, Trade & EconomyDocument6 pagesBermuda SWOT, Trade & EconomysreekarNo ratings yet

- 13-0389 Bus Times 157Document7 pages13-0389 Bus Times 157Luis DíazNo ratings yet

- Answers To Second Midterm Summer 2011Document11 pagesAnswers To Second Midterm Summer 2011ds3057No ratings yet

- Business Development Manager Research in Chicago IL Resume Christine HorwitzDocument2 pagesBusiness Development Manager Research in Chicago IL Resume Christine HorwitzChristineHorwitzNo ratings yet

- Chapter 11 Appendix Transfer Pricing in The Integrated Firm: ExercisesDocument7 pagesChapter 11 Appendix Transfer Pricing in The Integrated Firm: ExerciseschrsolvegNo ratings yet

- WWW EconomicsdiscussionDocument12 pagesWWW EconomicsdiscussionMorrison Omokiniovo Jessa SnrNo ratings yet

- Production Possibility Frontier ("PPF")Document6 pagesProduction Possibility Frontier ("PPF")New1122No ratings yet

- Setup QUAL2E Win 2000 PDFDocument3 pagesSetup QUAL2E Win 2000 PDFSitole S SiswantoNo ratings yet

- Managing Account PortfoliosDocument14 pagesManaging Account PortfoliosDiarra LionelNo ratings yet

- A Preliminary Feasibility Study About High-Speed Rail in CanadaDocument16 pagesA Preliminary Feasibility Study About High-Speed Rail in CanadamaxlentiNo ratings yet

- Receivables Management's Effect on ProfitabilityDocument12 pagesReceivables Management's Effect on ProfitabilityRhona BasongNo ratings yet

- Carlin e Soskice (2005)Document38 pagesCarlin e Soskice (2005)Henrique PavanNo ratings yet

- Statistic SolutionsDocument53 pagesStatistic SolutionsRahmati Rahmatullah100% (2)

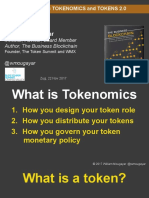

- William Mougayar: Designing Tokenomics and Tokens 2.0Document16 pagesWilliam Mougayar: Designing Tokenomics and Tokens 2.0rammohan thirupasurNo ratings yet

- IGCT PresentationDocument14 pagesIGCT PresentationNinAd Pund100% (2)

- GST Functional BOE Flow Phase2Document48 pagesGST Functional BOE Flow Phase2Krishanu Banerjee89% (9)

- El Al.Document41 pagesEl Al.Chapter 11 DocketsNo ratings yet