Professional Documents

Culture Documents

Partnership Law

Uploaded by

TanXeel A. RiazOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Law

Uploaded by

TanXeel A. RiazCopyright:

Available Formats

PARTNERSHIP LAW

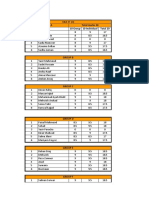

Definitions Act of a firm, Business, Prescribed, and Third Party. Partnership Relation between persons agree to share the profit or loss Partners Firm No of partner 2 but not more than 20 in Ordinary business Not more than 10 in case of banking company Features/Essentials of Partnership Agreement Number of partners Business Profit motive Conduct of business Unlimited liability Investment Transfer of share Types of Partnership Partnership at will Particular Partnership Partnership for a fixed time

Registration of Partnership Firm Name of Firm Principal Place of business of the firm Name of sub office Nature of Business Duration of Firm Name/Address/other Particulars of the partners Date of Joining of each Partner of the firm Process Signature and Verification of prescribed form Prescribed fee and submission of form Entry of Registration Change in the form Partnership Agreement Name of Firm, Nature of business, Location, List of Partners, Duration of Partnership, Date of Commencement, Total Capital, Ratio of Profit, Amount of Drawing, Amount of Salary, Division of work, Head Office and Branches, Bank, Audit of account, Rules of admission and Withdrawal, Right and duty of Each Partner, Arbitration, Witnesses. Advantages Legal advantages Can file suit Protection of Rights Protection of Property Protection to Creditors General Advantages Govt. Facilities Public Confidence/ Reputation Credit Facilities Legal Protection

Rights and Liabilities of The Partners Duties of the partner Perform the True Services - Compensation for loss Sincere and careful - Work without Remuneration Work for Best Advantages - Distribution of loss Provide all types of Information - Keep Secrecy Undue Advantages - Return the Profit to firm Rights of Partner Right of Consultation Receive of Profit Participation in the Management Inspection of Accounts Right of Compensation - Right to Exercise Powers Introduction of New Partner Continuation Retirement- Liability of incoming partner Liability of Retiring / Deceased Partner Minor As A Partner Rights of Minor Share in the Business Have access to inspect the account Option to become Partner Become Major Liabilities Minor Share is liable not personally Give a notice to public when attaining age of majority After attaining majority he may be liable Partnership becoming Illegal Alien enemy Amendment of Act License withdrawn

Partnership distinguish from Private Company Control under partnership act 1932 Control under companies ordinance 1984 Maximum member 20--Maximum member 50 Two classes of member ordinary partner limited liability partner One class share holder with limited liability Audit no restriction Audit is compulsory Meeting no compulsion Must be held May change the business by mutual consent Mention in the memo of association except the sanction of the court Not required to submit the document to registrar Article of association and memo of association must be submitted Partnership vs. Co-Ownership Agreement is not essential arisen by operation of law Must have agreement Minor can become regular Co-Owner Restriction for minor to become a regular partner No limit for members

Not more than 20 Co-Owner can transfer his share Cant Co-Owner is not an agent of another Co-Owner Partner is the agent of other partner A Co-Owner can demand division of property Partner cant but only share of profit Partnership vs Company Control under partnership act 1932 Control under Companies Ordinance 1984 Restriction for transferring of shares No restrictions Maximum number 20 No limit No subscription of shares and debentures Subscription of shares and debentures As same as private company Implied Authority of Partnership Draw cheques in the name of firm Adjust and settle the accounts

Enter into all contracts Engager servants and agents Recover debts Sell the goods Purchase the goods Restrictions Open a bank account on his own name Withdraw a suit Admit any liability in a suit Acquire immovable property Transfer immovable property In Emergency Can do everything Dissolution of Partnership Ways of dissolution 1-Dissolution by agreement with the consent of all partners 2-Compulsory dissolution By the insolvency of partners By business becoming illegal 3-Contingent dissolution Completion of venture Expiry of time

Death of partner Retirement of partner 4-Dissolution by partner 5-Dissolution by court Breach of contract Unsound mind Incapacity of partner Misconduct of partner Transfer of interest Rights and obligations of partners after dissolution of partnership Public notice Notice to the registrar Publish in the newspaper Partner cant be assume as an agent after dissolution Partner will not bind the firm or another partner Exception Partner dies Partner retired Reconstitution of firm Introduction of a new partner Retirement of a partner Death of a partner Transfer of share

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 2 NibDocument1 page2 NibTanXeel A. RiazNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Boliver Oil CompanyDocument12 pagesBoliver Oil Companyayub_balticNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Productivity of Cement Industry of PakistanDocument37 pagesProductivity of Cement Industry of Pakistansyed usman wazir100% (9)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- BRDocument20 pagesBRTanXeel A. RiazNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Fauji CementDocument13 pagesFauji CementM Gj Kothari ⎝⏠⏝⏠⎠No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Result Presentation First MBA 1 BCDocument4 pagesResult Presentation First MBA 1 BCTanXeel A. RiazNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Digest of Manila Memorial Park Cemetery, Inc. v. Linsangan (G.R. No. 151319)Document2 pagesDigest of Manila Memorial Park Cemetery, Inc. v. Linsangan (G.R. No. 151319)Rafael PangilinanNo ratings yet

- The Standard - 2014-07-31Document80 pagesThe Standard - 2014-07-31jorina807100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Gateforum Test SeriesDocument7 pagesGateforum Test SeriesRam RameshNo ratings yet

- Employees Compensation Act, 1923Document39 pagesEmployees Compensation Act, 1923sayam jarialNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Rental AgreementDocument3 pagesRental AgreementArun KumarNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Persons & Family Relations Digested Cases PrelimDocument26 pagesPersons & Family Relations Digested Cases PrelimVikki AmorioNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Constitutional Law AssignmentDocument6 pagesConstitutional Law AssignmentKaran KapoorNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Assignment 2 Ashutosh 163Document4 pagesAssignment 2 Ashutosh 163ashutosh srivastavaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Leviste vs. CaDocument15 pagesLeviste vs. CaRocky MagcamitNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- MNLU HandbookDocument36 pagesMNLU HandbookAnonymous fC8bz6BNo ratings yet

- CD - 1.laguna Estate v. CADocument2 pagesCD - 1.laguna Estate v. CAMykaNo ratings yet

- #8 Tapay V Bancolo 2013Document2 pages#8 Tapay V Bancolo 2013robynneklopezNo ratings yet

- AR.A.S.P.V.P.V. Automobiles Private Limited: Tax InvoiceDocument4 pagesAR.A.S.P.V.P.V. Automobiles Private Limited: Tax InvoicePratheesh .P100% (1)

- The AstraDocument3 pagesThe Astradassi99No ratings yet

- Kedudukan Hukum Hipotek Kapal Laut Dalam Hukum Jaminan Dan Penetapan Hipotek Kapal Laut Sebagai Jaminan Perikatan Syukri Hidayatullah, S.H., M.HDocument7 pagesKedudukan Hukum Hipotek Kapal Laut Dalam Hukum Jaminan Dan Penetapan Hipotek Kapal Laut Sebagai Jaminan Perikatan Syukri Hidayatullah, S.H., M.HDani PraswanaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Commonwealth of Massachusetts 18 MISC 000327: Fikia Option One Mortgage Corp.Document6 pagesCommonwealth of Massachusetts 18 MISC 000327: Fikia Option One Mortgage Corp.RussinatorNo ratings yet

- Violation of Probation Terms and ConditionsDocument1 pageViolation of Probation Terms and ConditionsDrewz BarNo ratings yet

- Corporations RightsDocument3 pagesCorporations RightsAnthony AnthonyNo ratings yet

- Scanvinsky v. Sac County ComplaintDocument8 pagesScanvinsky v. Sac County ComplaintScottNo ratings yet

- Legal Rights ExplainedDocument23 pagesLegal Rights ExplainedUsman AsifNo ratings yet

- Portland Police Association Final OfferDocument15 pagesPortland Police Association Final OfferKGW NewsNo ratings yet

- Omnibus Sworn StatementDocument2 pagesOmnibus Sworn StatementPICE CALBAYOG CHAPTERNo ratings yet

- Listed Grievances in Censure Resolution For State Rep. Chris Paddie by Harrison Co. GOPDocument2 pagesListed Grievances in Censure Resolution For State Rep. Chris Paddie by Harrison Co. GOPJeramy Kitchen100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Echo 2000 Commercial Corporation v Obrero PilipinoDocument2 pagesEcho 2000 Commercial Corporation v Obrero PilipinoAngela Louise SabaoanNo ratings yet

- CJ Critical Thinking - Gun Control 1Document9 pagesCJ Critical Thinking - Gun Control 1api-510706791No ratings yet

- PT & T v. LaguesmaDocument2 pagesPT & T v. Laguesmadiv_macNo ratings yet

- People vs. Quinto Jr. Decision CarnappingDocument4 pagesPeople vs. Quinto Jr. Decision Carnappinghermione_granger10No ratings yet

- Civil Complaint in Banko Brown ShootingDocument17 pagesCivil Complaint in Banko Brown ShootingMissionLocalNo ratings yet

- Personal Selling StrategiesDocument56 pagesPersonal Selling StrategiesJoshua Monang ParulianNo ratings yet

- Filed: Patrick FisherDocument3 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)