Professional Documents

Culture Documents

MACS Mod II

Uploaded by

Prada BiluveOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MACS Mod II

Uploaded by

Prada BiluveCopyright:

Available Formats

Pavan K U

GAT, Bangalore MANAGEMENT ACCOUNTING & CONTROL SYSTEMS MODULE II DETERMINING PRODUCT COSTS

1. ELEMENTS OF PRODUCT COST

Product costing refers to the technique and process of ascertaining the cost of a particular product. It is important for deriving Cost of manufacturing the product Price of the product Cost details of product at different level 2. ELEMENTS OF PRODUCT COST

Material Cost Direct Indirect

Labour cost Direct Indirect

Other expenses Direct Indirect

Overheads

Production OH Administration OH Selling OH Distribution OH

3. ELEMENTS OF PRODUCT COST

Direct Materials are present in the finished product or can be identified in the product. Eg. Cloth in dress making. Direct labour which can be identified or attributed wholly to a particular job, product or process or expended in converting raw materials into finished products, Eg. Labour engaged on the actual production of product or carrying out the necessary operations for converting the raw materials into finished product.

Direct expenses It includes all expenses other than direct material or direct labour, which are specially incurred for a particular product or process. Eg. Excise duty, royalty etc. Indirect materials which do not normally form part of the finished product. Eg. Lubricants, cotton waste etc Indirect labour are the costs which cannot be allocated but can be apportioned to or absorbed by cost units or cost centre. Eg. Supervisors, maintenance workers etc. Indirect expenses other than direct expenses. Eg. Factory rent and rates, insurance, telephone etc.

Pavan K U

GAT, Bangalore

Overheads it is the aggregate of indirect material costs, indirect labour costs, and indirect expenses. This can be grouped as Production or works overheads Administration overheads Selling overheads Distribution overheads 4. DETERMINING PRODUCT COST Product cost can be ascertained by preparing cost sheet.

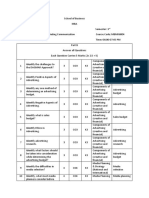

Cost sheet is a document which provides for the assembly of the detailed cost of a cost centre or cost unit. Advantages Provides total and per unit cost figures Helps in cost comparison Facilitates for preparing cost estimates Facilitates cost control Helps in deriving selling price 5. COST SHEET Particulars Total cost (Rs.) Cost Per Unit (Rs.)

Direct materials Direct labour Direct expenses Prime cost Add: works overheads Works/factory cost Add: Administration OH Cost of production/Cost of Add: Selling & Distribution OH Cost of sales

XXX XXX XXX XXXX XXX XXXX XXX goods Sold XXXX XXX XXXX

XX XX XX XXX XX XXX XX XXX XX XXX

6. JOB COSTING

A job refers to a specific contract or work order wherein work is executed as per customers requirements. The output of the job generally consists of one unit or a manageable number of units

Pavan K U

GAT, Bangalore

Examples of job costing are printing press, hardware, ship building, heavy machinery, interior decoration, etc Job costing will be used in the following situations When jobs are executed for different customers according to their specifications When no two jobs are alike in all respects and each job needs special treatment When W-I-P differs from period to period on the basis of the number of jobs in hand at different degrees of completion. 7. PRINCIPLE OF ALLOCATION ABSORPTION & APPORTIONMENT

Cost allocation the term allocation implies relating overheads directly to the various departments. The estimated amount of manufacturing overheads should be allocated to various cost centers or departments. Cost absorption is the allotment of overhead to cost units. Here production department overheads are absorbed over production units. Cost apportionment the allotment of proportion of items of cost to cost centers or department on the basis of benefits received. 8. DISTINCTION BETWEEN ALLOCATION & APPORTIONMENT Allocation of OH It means the allotment of whole items of cost to cost centres or cost units Apportionment of OH It means allotment of proportion of items of cost to cost centres or cost units

It deals with the whole items of cost It deals with only proportion of items of cost Cost is directly allocated to any cost It needs a suitable basis for centre or cost units subdivision of cost by cost centres or cost units Cost is allocated when the cost Cost is apportioned when cost centre uses whole of the benefits of centres use only a proportion of the the expenses. benefits of the whole expenses It is a direct process of allotment It is an indirect process of allotment

9. ACCOUNTING OF OVERHEADS Following are the steps involved in overheads accounting -

Estimation and collection of overheads Cost allocation Cost apportionment Re-apportionment Absorption Treatment of under and over absorption of overheads

Pavan K U

GAT, Bangalore

10.BASES OF APPORTIONMENT OF PRIMARY DISTRIBUTION Basis Floor area Capital values Direct Labour Hr Machine Hrs No of Workers Technical estimate Expenses Lighting, Rent, Depreciation on building, Repairs etc Depreciation on Plant & Machinery, Maintenance of Machinery etc. Remuneration, works mgt etc. Insurance on tools jigs, power etc. Accident, canteen, personnel dept exp, etc Fire prevention, oil and grease

11.SECONDARY DISTRIBUTION Service Dept Personnel Purchasing Receiving Factory office Machine maintenance Engineering Payroll Welfare of employees Internal Transport 12.ABSORPTION OF FACTORY OH Apportionment base No. employees, labour Hrs Cost of materials, No of units, No of orders No of requisitions filled, No of units handled. No of employees Machine Hr, services rendered Machine hrs Total machine/labour hrs No of employees in Dept Weight, value, distance etc.

Absorption rate the rate which is used to charge overhead cost to the product or jobs is known as absorption rate. Various absorption rates are Percentage on Direct Materials

Factory OH

100

Direct Materials

Percentage on direct wages

Factory OH Direct Labour Cost

100

Pavan K U Percentage on prime cost

GAT, Bangalore

Factory OH Prime Cost

100

Labour hour / production hour rate

Factory OH Direct Labour Hrs

Machine hour rate

Factory OH Machine Hrs

13.PROCESS COSTING Process costing is a method of costing which helps the management in the ascertainment of cost of the process, i.e. where raw materials become finished goods in stages or operations and the output of one process becomes the input of the other. Example chemical industries, oil industries etc.

Distinctive features are RM becomes finished goods after under going several operations Costs are added in each process and there is a loss of input in every stage of processing The output of one process becomes the input of other Process accounts are simple ledger accounts and representing inputs on debit and outputs on credit side

14. PROCESS COSTING Special aspects

Normal loss it is an uncontrollable loss incurred due to the nature of materials and method of manufacturing. It is treated as a part of the cost and absorbed on the good units produced Abnormal loss it is a controllable loss, which is more than the normal loss, incurred because of faulty manufacturing process or raw material Abnormal gain if the actual production is more than the expected production or if the actual loss is less than the expected loss, the difference is treated as abnormal gain. 15.ABC COSTING

Activity Based Costing (ABC) is a costing system which focuses on activities performed to produce products.

Pavan K U

GAT, Bangalore

The ABC system, instead of using cost centers, uses activities for accumulating costs. ABC system first accumulates indirect resource costs for each of the activities and then assigns the costs of activities to the product or services or other cost objects.

Resource costs

Activities

Products

16.STAGES OF ABC COSTING

Identify the different activities within the organisation Relate the overheads to the activities Support activities are then spread across the primary activities Determine the activity cost drivers Calculate activity cost driver rate

17.COST POOL & COST DRIVER

Cost pool it means the meaningful grouping of individual costs. Costs are often pooled by departments, by jobs, or by behavior pattern. For example, overhead costs are accumulated by service departments in a factory and then allocated to production departments before multiple departmental overhead rates are developed for product costing purposes.

Cost Driver is any factor or force that causes a change in the cost of an activity. The cost driver may be Resource cost driver is a measure of the quantity of resources consumed by an activity or cost pool. Activity cost driver is a measure of the frequency and intensity of demand, placed on activities by cost objects. 18.ADVANTAGES OF ABC COSTING

More accurate costing of products/services, customers, distribution channels Better understanding overhead

Pavan K U

GAT, Bangalore

Easier to understand for everyone Utilizes unit cost rather than just total cost Integrates well with Six Sigma and other continuous improvement programs Makes visible waste and non-value added Supports performance management and scorecards Enables costing of processes, supply chains, and value streams Activity Based Costing mirrors way work is done Facilitates benchmarking 19.DISADVANTAGES OF ABC COSTING

More time consuming to collect data Cost of buying, implementing and maintaining activity based system

Makes waste visible which some executives and managers don't want their boss to see

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- CostDocument161 pagesCostMae Namoc67% (6)

- Government AccountingDocument131 pagesGovernment AccountingAngelo Andro SuanNo ratings yet

- Chapter 3 - Organizational EthicsDocument17 pagesChapter 3 - Organizational EthicsNguyễn Quốc HưngNo ratings yet

- Enterprise Performance Management - MCQDocument20 pagesEnterprise Performance Management - MCQSabina Saldanha72% (18)

- Basics - Financial Accounting, TheDocument401 pagesBasics - Financial Accounting, Theramon studiesNo ratings yet

- Quiz 8 Adjusting EntriesDocument4 pagesQuiz 8 Adjusting EntriesJazzy Mercado33% (3)

- 1.operation Research.Document18 pages1.operation Research.Sharath KannanNo ratings yet

- Wipro Technologies Limited giant IT services corporationDocument2 pagesWipro Technologies Limited giant IT services corporationPrada BiluveNo ratings yet

- Balanced Scorecar1 2Document3 pagesBalanced Scorecar1 2Prada BiluveNo ratings yet

- SynopsisDocument3 pagesSynopsisPrada BiluveNo ratings yet

- TABLE 3-11 An Example External Factor Evaluation Matrix For UST, IncDocument4 pagesTABLE 3-11 An Example External Factor Evaluation Matrix For UST, IncArnold NitinNo ratings yet

- P2 RevisionDocument16 pagesP2 RevisionfirefxyNo ratings yet

- Toshiba PDFDocument2 pagesToshiba PDFAgung M.MNo ratings yet

- Ebm 3Document38 pagesEbm 3Mehak AsimNo ratings yet

- AmSpa Financials 150222Document59 pagesAmSpa Financials 150222Amelia SmithNo ratings yet

- Valuation of Ashok Leyland Fiev ReportDocument31 pagesValuation of Ashok Leyland Fiev ReportVishalRathoreNo ratings yet

- MM MaggieDocument22 pagesMM MaggieCommerce StudentNo ratings yet

- TechniumDocument14 pagesTechniumPeter ParkerNo ratings yet

- Chapter One: Cost Management and StrategyDocument29 pagesChapter One: Cost Management and StrategySupergiant EternalsNo ratings yet

- MM Lectures CompleteDocument518 pagesMM Lectures CompleteVarunNo ratings yet

- Show Me the Shoppers Growth In and Out of the BoxDocument12 pagesShow Me the Shoppers Growth In and Out of the BoxRamses LandaverdeNo ratings yet

- Marketing Strategy Internship ReportDocument37 pagesMarketing Strategy Internship ReportA H LabuNo ratings yet

- Pandora's Freemium Model SuccessDocument3 pagesPandora's Freemium Model SuccessAbdullah RamayNo ratings yet

- Diana Cool Fresh Case StudyDocument41 pagesDiana Cool Fresh Case StudyDung VũNo ratings yet

- Loreal Master ThesisDocument6 pagesLoreal Master ThesisMonique Anderson100% (2)

- Arpit Sharma - Resume MPDocument2 pagesArpit Sharma - Resume MParpit sharmaNo ratings yet

- Lafarge Surma CementDocument2 pagesLafarge Surma CementNur AlahiNo ratings yet

- Designing Services and Products for OperationsDocument206 pagesDesigning Services and Products for OperationsTIZITAW MASRESHANo ratings yet

- Integration APDocument9 pagesIntegration AProcaholicnepsNo ratings yet

- Cash Flows Cheat SheetDocument13 pagesCash Flows Cheat SheetSumeet RanuNo ratings yet

- Budgeting: A Group PresentationDocument43 pagesBudgeting: A Group PresentationSaud Khan WazirNo ratings yet

- A Conceptual Model of Customer Behavioral IntentioDocument6 pagesA Conceptual Model of Customer Behavioral IntentioHannah Marie NadumaNo ratings yet

- Factors Influencing Global Marketing Policy of ColgateDocument8 pagesFactors Influencing Global Marketing Policy of Colgatesayam siddiquegmail.comNo ratings yet

- Final Question Paper For CAT-2 Part B & CDocument4 pagesFinal Question Paper For CAT-2 Part B & CShailendra SrivastavaNo ratings yet