Professional Documents

Culture Documents

Basic Cost Concepts

Uploaded by

khush_brahmbhatt125Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basic Cost Concepts

Uploaded by

khush_brahmbhatt125Copyright:

Available Formats

BASIC CONCEPTS-COST, COSTING AND COST ACCOUNTING

What is Cost? The term cost indicates the amount of expenditure (actual or notional) incurred on, or attributable to, a specified thing or activity or cost unit. Elements of Cost

Materials Cost

Labour Cost

Other expenses

Direct Material

Indirect Material

Direct Labour

Indirect Labour

Direct Expenses

Indirect Expenses

Overheads

Production or Works O/H

Administrative Or office O/H

Selling O/H

Distribution O/H

Total Cost = Material + Labour + other Expenses Prime Cost = DM + DL + DE Total Cost = Prime Cost + Overheads What is Costing? Costing is the technique and process of ascertaining costs. What is Cost Accounting? Cost accounting is the process of accounting for costs, which begins with recording of income and expenditure or the bases on which they are calculated and ends with the preparation of periodical statements and reports for ascertaining and controlling costs.

Classification of Costs: The important ways of classification of costs are: 1. By Nature or Element: Costs are divided into three categories viz., Material Costs, Labour Costs and Other Expenses. This classification is useful in determining total cost. 2. As Direct and Indirect: Direct costs are those costs that can be identified with or allocated to either cost centre or a cost unit. Costs, which are not direct, are termed as Indirect. For instance, wages of the maintenance department is direct cost of the maintenance deptt., but it is an indirect cost as regards the production departments and production units are concerned. This is because of the fact that the maintenance departments cost is apportioned to different production departments and finally absorbed by the cost units on some realistic basis. 3. By Functions: Cost may be divided into Production Cost, Administration Cost, Selling Cost, Distribution Cost, and R&D Cost. Here, costs are categorized according to the purpose for which they are incurred. 4. By Variability: Under this, costs are divided as per their behavior in relation to changes in volume of production. Costs are classifies as Fixed, Variable and Semi-Variable (or Semi-Fixed). 5. By Controllability: Costs may be Controllable or Uncontrollable. A cost, which may be influenced by a member of an undertaking, is controllable. Controllability of an item of cost will depend upon the area of managerial responsibility and the time factor involved. An expenditure, which is uncontrollable by one individual, may be controllable so far as another individual is concerned. More over, expenditure, which is uncontrollable on a short-term basis, may be controlled on a long term basis. 6. By Normality: Here, costs are categorized as Normal Cost and Abnormal Cost. Normal cost is the cost that is normally incurred at a given level of output in the conditions in which that level of output is normally attained. Abnormal cost is the cost that is not normal. 7. By Time: On the basis of time costs may be categorized as Historical Cost and Predetermined Cost. The cost, which is ascertained after its incurrence is Historical Cost. Predetermined costs are estimated costs. Predetermined cost determined on scientific basis is Standard Cost. 8. For Decision Making: For managerial decision making costs may be sub-divided into Relevant Costs and Irrelevant Costs. Relevant costs are those costs, which are relevant for decision-making. Irrelevant Costs are those, which have no bearing on decision-making. Relevant Costs may be further sub-divided into following categories: Marginal Cost - It is the total variable cost i.e., prime cost plus variable overheads. Differential Cost It is the change in costs due to change in the level of activity or method of production. Differential cost resulting out of such change may be incremental or decremental. Opportunity Cost It is the possible maximum alternative earning that might have been obtained if the productive goods, services or capacity

have been applied to alternative use. For instance, if the owner of a building proposes to use it for a particular project, the likely rent of the building is the opportunity cost, which should be taken into consideration while evaluating the profitability of the project. Replacement Cost It is the cost at which there could be purchase of an asset or material identical to that which is being re4placed or revalued. Imputed Costs These are notional costs appearing in the cost accounts only e.g., notional rent, intt. On capital for which no interest has been paid.

Irrelevant costs are: Sunk Cost It is past cost. Foe e.g., WDV of abandoned plant is a past cost which is irrelevant for decision making. Committed Cost It is the cost that has been committed by the management. Absorbed Fixed Cost Fixed cost which do not change due to increase or decrease in activity is irrelevant for decision making. Statement of Total Cost:

(Assuming no opening and closing stocks of raw material, WIP and finished goods)

Particulars Direct Materials Direct Wages Direct expenses Prime Cost Production Overheads Administration Overheads Cost of Production Selling & Distribution Overheads Total Cost or Cost of Sales

Amount (Rs.) xx xx xx xx xxx xx xx xx xxx

What is Cost Centre? A cost centre is a location, person or item of equipment in respect of which costs may be ascertained and related to cost units for control purposes. The manager of a cost centre is held responsible for control of costs of his cost centre. In a factory, cost centres may be production cost centres or service cost centres. An example of production cost centres can be tablet, capsule, injection and ointment departments in a pharmaceutical factory. Service cost centres render service to production cost centres such as raw material stores, finished goods stores, plant maintenance department, canteen, etc. It may be mentioned that cost centres are the building block of a costing system. What is Cost Unit? A cost unit is a unit of production, service or time in relation to which costs may be ascertained or expressed. Since costing is measuring, the unit of measurement must be

clearly defined and selected before the process of cost finding can be started. The following are the examples of cost units in different industries: Name of Industry Automobile Brickworks Cement Chemicals Furniture Gas Paints Power Shipbuilding Steel Transport Cost Unit Umber Thousand Tonne Litre, Kg, Tonne Number Cubic meter Litre Kwh Number Tonne Tonne-Km Passenger-Km

Procedure of linking Cost with Cost Centre and Cost Units: The main stages involved in linking process are 1. Cost Classification Discussed above 2. Cost Allocation and Apportionment Cost allocation is the allotment of whole items of costs to cost centre or cost units. Cost apportionment is the allotment of proportion of item of cost to cost centre or cost units. E.g., wages of powerhouse workers can be wholly charged to powerhouse service department. On the other head rent charges should be distributed to different department on the basis of effective area of each department. 3. Overhead Absorption Overhead absorption is the procedure involved in the allotment of total cost of a cost centre to the products or services on a suitable basis. METHODS OF COSTING: Different methods of cost finding are used because businesses vary in their nature, methods of production, types of products/services they render and the unit of cost used. The various methods of costing are discussed below: 1. JOB COSTING: this method is applied where the items of prime cost are traceable to specific jobs or orders, as shipbuilding, machinery repair, furniture construction, etc. Here each job is separately identified and prime cost and overhead is charged to it. 2. BATCH COSTING: A batch of similar products is regarded as one job, and the cost of this complete batch is collected. This method is applicable to factories, which produce in convenient economical batches, e.g., biscuits, drug formulations, etc. 3. CONTRACT COSTING: In building construction industry, a contract is treated as a whole job and is costed in total. Contract costing is used where the job is big and spread over the long periods of time.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nyloflex ACE Nyloflex ACE Digital: Sets The Standard in High Quality Flexo PrintingDocument2 pagesNyloflex ACE Nyloflex ACE Digital: Sets The Standard in High Quality Flexo PrintingIoan-Alexandru CsinádyNo ratings yet

- VODOR压力表资料 PDFDocument2 pagesVODOR压力表资料 PDFliu zhao liu zhaoNo ratings yet

- PS 1Document2 pagesPS 1Kelvin CulajaráNo ratings yet

- IGCSE COMMERCE Chapter 6.1 PDFDocument4 pagesIGCSE COMMERCE Chapter 6.1 PDFTahmid RaihanNo ratings yet

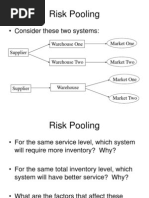

- Risk PoolingDocument11 pagesRisk PoolingAshok100% (1)

- Hygienic Design of Food Industry EquipmentDocument10 pagesHygienic Design of Food Industry EquipmentBồ Công AnhNo ratings yet

- PTS 60.3005 - Waste ManagementDocument58 pagesPTS 60.3005 - Waste ManagementNorisham Mohamed Ali50% (2)

- Design For ManufacturingDocument43 pagesDesign For ManufacturingKesava PrasadNo ratings yet

- Recycling GuideDocument2 pagesRecycling GuideRachel SadonNo ratings yet

- 60mm Pavers Compressive Strength Profile (Mar-Apr 2017)Document3 pages60mm Pavers Compressive Strength Profile (Mar-Apr 2017)Frank MtetwaNo ratings yet

- ASME Section II Part A - Ferrous Material SpecificationsDocument8 pagesASME Section II Part A - Ferrous Material SpecificationsGato Sesa100% (1)

- ERP For Printing and PackagingDocument8 pagesERP For Printing and PackagingSuryanarayana TataNo ratings yet

- Karakuri - PremDocument3 pagesKarakuri - PremRicky MarkNo ratings yet

- Topic 14 Papermaking Pressing TextDocument21 pagesTopic 14 Papermaking Pressing Textronaldsacs100% (1)

- Coal Handling System GuideDocument8 pagesCoal Handling System GuidePrasanna kumar subudhiNo ratings yet

- B5514Document3 pagesB5514Raghu RamNo ratings yet

- Problem Transport ModeDocument4 pagesProblem Transport ModeDrinkwell AccountsNo ratings yet

- P 1-11 Storm Drainage PDFDocument11 pagesP 1-11 Storm Drainage PDFMahmoud GwailyNo ratings yet

- Api Q1Document4 pagesApi Q1Sandra Sanders33% (3)

- Anodizingpresentation 091024090524 Phpapp01Document21 pagesAnodizingpresentation 091024090524 Phpapp01sonchemenNo ratings yet

- Adhesives Plexus Ma830Document2 pagesAdhesives Plexus Ma830Vinaya Almane DattathreyaNo ratings yet

- An Overview of How To Execute EPCCDocument17 pagesAn Overview of How To Execute EPCCZAB236100% (2)

- Electronic PackagingDocument54 pagesElectronic PackagingAdelle Lyn Carlos100% (1)

- Tech GuideDocument102 pagesTech GuideParashuram ChauhanNo ratings yet

- CV Mohd - Ijaz Aramco Vid ApprovedDocument3 pagesCV Mohd - Ijaz Aramco Vid ApprovedShahbaz KhanNo ratings yet

- Daftar PustakaDocument3 pagesDaftar PustakaFikrah IslamiNo ratings yet

- HDPE Pipe InformationDocument24 pagesHDPE Pipe InformationTylerNo ratings yet

- Acom86 - 1+2 Engineering Properties of Duplex SS (2205, 2307) PDFDocument24 pagesAcom86 - 1+2 Engineering Properties of Duplex SS (2205, 2307) PDFpipedown456No ratings yet

- Senior Production Engineer Sample ResumeDocument3 pagesSenior Production Engineer Sample Resumelexsaugust50% (2)

- Experienced mechanical engineer and procurement leaderDocument2 pagesExperienced mechanical engineer and procurement leaderJose Kiko RomeroNo ratings yet