Professional Documents

Culture Documents

VAT 240 Audit Report

Uploaded by

arunupadhyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT 240 Audit Report

Uploaded by

arunupadhyaCopyright:

Available Formats

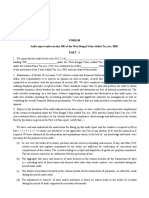

FORM VAT 240 [See rule 34(3)] AUDITED STATEMENT OF ACCOUNTS UNDER SECTION 31(4) OF THE KVAT ACT,

2003 ----------CERTIFICATE Certified that I / we being a Chartered Accountant / Cost Accountant / Tax Practitioner have audited the accounts of 2010-2011 (Name and address of the dealer) BABA MARKETING NO.31/1,EAST CIRCLE, V.V.PURAM, BANGALORE-56004 having registration No. (TIN) 29680738584 for the year ending 31-3-2011 and that subject to my / our observations and comments about non-compliance, short comings and deficiencies in the returns filed by the dealer, as given in the attached report, 1 2 3 4 5 The books of account and other related records and registers maintained by the dealer are sufficient for the verification of the correctness and completeness of the returns filed for the year; The total turnover of sales declared in the returns include all the sales effected during the year; The total turnover of purchases declared in the returns include all the purchases made during the year; The adjustment to turnover of sales and purchases is based on the entries made in the books of account maintained for the year; The deductions from the total turnover including deduction on account of sales returns claimed in the returns are in conformity with the provisions of the law; The classification of goods sold, rate of tax applicable and computation of output tax and net tax payable as shown in the return is correct; The computation of classification of goods purchased, the amount of input tax paid and deductions of input tax credit claimed in the return is correct and in conformity with the provisions of law; The utilization of statutory forms under the KVAT Act ,2003 and the CST Act,1956 is for valid purposes; and Other information given in the returns is correct and complete. Summary of the additional tax liability or additional refund due to the dealer on audit for the year are as follows:Sl. No. 1 2 3 4 5 Particulars Amount as per return (in Rs.) 13,39,176=41 12,20,303=03 -----NIL----------NIL----------NIL----------NIL----------NIL----------NIL-----Correct amount determined on audit (in Rs.) 13,39,176=41 12,20,303=03 -----NIL----------NIL----------NIL----------NIL----------NIL----------NIL-----Difference (in Rs.)

6 7 8 9

Output tax payable under the KVAT Act, 2003 Input tax deduction claimed under Section 10 Ineligible input tax deduction under Section 11 Refund of excess input tax credit claimed in the return Any other item (specify) Tax payable under the CST Act, 1956

-----NIL----------NIL----------NIL----------NIL----------NIL----------NIL----------NIL----------NIL------

The dealer has been advised to file revised returns for the period / month (i) (ii) (iii) pay differential tax liability of Rs NIL and penalty of Rs NIL claim refund of Rs NIL revise the opening / closing balance of input tax credit of Rs with interest of Rs NIL

NIL

Place :Bangalore Date:28/12/2011

Signature : Name : G.SRINIVASA UPADHYA

Membership No: 020690

1 2 3

PART-1 GENERAL INFORMATION Name of the dealer L.RAVINDRA Registration Certificate No. (TIN) 29680738584 (i)Status of the dealer (specify whether PROPRIETOR proprietor, etc.) (ii)If partnership firm, name of all the partners Sl.no Name Trade name and full address of the principal place of business BABA MARKETING NO.31/1,EAST CIRCLE, V.V.PURAM, BANGALORE-560004 Place BANGALORE Pincode 560004

(i)Full address of all additional places of business in the State Sl.no Trade Name Address BABA MARETING GODOWN No.507/2,Out House, Ashwathkatte Road, V.V.Puram, Bangalore BABA MARKETING GODOWN NO.10/5,Narahari Krupa S.B.Road, V.V.Puram

BANGALORE

560004

7 8

9 10 11 12 13

14 15

(ii)Full address of all additional places of business outside the State Sl.no Trade Name Address Place Pincode NIL NIL NIL NIL Address of any branch or unit in the State having a different registration number (TIN) Sl.no Trade Name Address Place Pincode NIL NIL NIL NIL Nature of business (specify whether Reseller manufacturer, reseller, works contractor, etc.) Description of 10 major goods sold Sl.no Commodity Name Soaps, Soap Powder, Mop Stic, Mop RF, Toilet Deodrants, Room Freshner, Brushes, Cleaning Powder, Harpic, Lizol, Colin, Dettol, Paper Napkin, Tissue Roll, Garbage Bag, Plastic Goods, Acid Whether opted for composition or not NO Whether permitted under special accounting scheme NO or not Whether availing incentive as a new industrial NO unit(specify whether exemption/deferment) Whether registered under the KTEG Act, 1979 and NO enrolled / registered under the KTPTC & E Act, 1976 Books of account maintained THE BOOKS OF ACCOUNTS ARE COMPUTERISED AND THE GENERATED ARE SALES REGISTER, PURCHASE REGISTER, CASH BOOK, BANK BOOK SUNDRY CREDITORS & DEBTORS, & JOURNAL REGISTER. List of books of account examined ALL THE BOOKS MENTIONED ABOVE HAVE BEEN EXAMINED Method of valuation of opening and closing stocks COST OR MARKET PRICE WELL

1 2

PART 2 PARTICULARS OF TURNOVERS, DEDUCTIONS AND PAYMENT OF TAX Total and taxable turnovers 1,65,82,043=51 Deductions claimed under the KVAT Act, 2003 (specify in respect of each deduction its nature and whether, it is in order and supported by prescribed documents) Details of taxable sales within the State Sl.no Description of goods Soaps, Soap Powder, Mop Stic, Mop RF, Toilet Deodorants, Room Freshner, Brushes, Cleaning Powder, Harpic, Lizol, Colin Dettol, Paper Napkin, Tissue Roll, Garbage Bag, Plastic Goods, Acid Details of purchases Total value of purchases and receipts: and receipts Imports Inter-state purchase Inter-state stock transfer Purchases from registered dealers within the State Purchases from un-registered dealers within the State Details of input tax paid on purchases Sl.no 1 Description of goods

1,25,51,100=10

Less: Exemption, Auto & Transportation & VAT Coll 26,24,889=00+ 66,878=00 +13,39,176=41 Total 40,30,943=41 Taxable Turnover 83,71,948=75 Rate of tax 13.5% Tax payable 11,30,213=86

41,79,151=35

5%

2,08,962=55

1,38,64,662=99 NIL 17,74765=00 NIL 1,20,89,897=99 -----NIL-----Rateof tax Tax paid

TaxableTurnover

Soaps, Soap Powder, Mop Stic, Mop RF, Toilet Deodorants, 75,77,350=34 13.5% 10,22,963=30 Room Freshener, Brushes, Cleaning Powder, Harpic, Lizol, Colin 2 Dettol, Paper Napkin, Tissue Roll, Garbage Bag, Plastic 39,16,888=65 5% 1,97,339=73 Goods, Acid 6 Details of input tax paid on purchases eligible for deduction(give details of capital goods separately and specify whether calculated on the basis of partial rebating formula) Sl.no Description of goods NCG/CG Taxable Turnover Rate of tax Tax paid Partial Rebate 7 Details of input tax paid on purchases ineligible for deduction(give details of capital goods and special rebate separately and specify whether calculated on the basis of partial rebating formula) Sl.no Description of goods NCG/CG Taxable Turnover Rate of tax Tax paid Partial Rebate --NIL---NIL---NIL---NIL---NIL---NIL-8 Details of input tax deduction claimed on purchases relating to inter-State sales and export sales(give details of capital goods and special rebate separately and specify whether calculated on the basis of partial rebating formula) Sl.no Description of goods NCG/CG Taxable Turnover Rate of tax Tax paid Partial Rebate --NIL---NIL---NIL---NIL---NIL---NIL-9 Details of un-adjusted excess input tax credit carried over from the previous year and to the next year previous current

--NIL--

-----NIL----------NIL-----Total and taxable turnovers under the CST Act, 1956 Total Turnovers Taxable turnovers -----NIL----------NIL-----11 Deductions claimed (specify in respect of each deduction its nature, whether it is in order and supported by prescribed documents) -----NIL-----12 Details of taxable sales Sl.no Description of goods Taxable Turnover Rate of tax Tax payable -----NIL----------NIL----------NIL----------NIL-----13 If the dealer has opted for composition indicate the type of composition scheme opted and details of the composition amount paid, its rate and the basis Composition Type -----NIL-----Composition Rate -----NIL-----10

14

Composition Amount Details of returns filed

-----NIL------

Month Due Date Date of Filling Tax Paid Date of Payment of Tax PenaltyLevied Interest Paid April 20/05/2010 20/05/2010 4975=00 20/05/2010 -----NIL----------NIL-----May 21/06/2010 21/06/2010 -----NIL----------NIL----------NIL----------NIL-----June 20/07/2010 20/07/2010 11364=00 20/07/2010 -----NIL----------NIL-----July 20/08/2010 20/08/2010 10013=00 20/08/2010 -----NIL----------NIL-----August 20/09/2010 20/09/2010 -----NIL----------NIL----------NIL----------NIL-----September 20/10/2010 20/10/2010 13952=00 13/01/2011 1395=00 523=00 October 20/11/2010 18/11/2010 19949=00 18/11/2010 -----NIL----------NIL-----November 20/12/2010 20/12/2010 30059=00 20/12/2010 -----NIL----------NIL-----December 20/01/2011 20/01/2011 -----NIL----------NIL----------NIL----------NIL-----January 20/02/2011 19/02/2011 217=00 19/02/2011 -----NIL----------NIL-----February 20/03/2011 19/03/2011 22688=00 19/03/2011 -----NIL----------NIL-----March 20/04/2011 20/04/2011 8455=00 20/04/2011 -----NIL----------NIL-----15 Details of inspection of the business premises / books of account of the dealer by departmental authorities on inspection / visit Date of Visit/ Designation of the Additional Tax Penalty CF levied/Collected inspection officer -----NIL----------NIL----------NIL----------NIL----------NIL-----Note: Trading account in respect of each class of goods and manufacturing account in respect of each class of goods (whether taxable or not) along with accounting ratios on sales and other non-sale transactions has to be furnished separately. Wherever the Profit and Loss Account and Balance Sheet contain the details of transactions made outside the State, then the details relating to transactions within the State shall be suitably computed and declared separately. PART 3 PARTICULARS OF DECLARATIONS AND CERTIFICATES Total Amount NIL NIL NIL Amount recovered NIL NIL NIL No. of forms filed NIL NIL NIL Balance NIL NIL NIL

1 2 3

Details of sales as commission agent (VAT 140) Details of purchases as commission agent (VAT 145) Details of tax deducted at source from the amounts payable to the dealer (VAT 156/158/161) (i)Stock of declarations / certificates / delivery notes under the KVAT Act, 2003. Opening Stock Forms obtained during the year from CTD Forms utilized during the year Loss, if any Closing Balance (ii)Details of any misuse of forms

VAT 140 NIL NIL NIL NIL NIL NIL Form C

VAT 145 NIL NIL NIL NIL NIL NIL Form EI

VAT 156 NIL NIL NIL NIL NIL NIL Form EII

VAT 158 NIL NIL NIL NIL NIL NIL

VAT 161 NIL NIL NIL NIL NIL NIL Form F

VAT 505 NIL NIL NIL NIL NIL NIL Form H

(1)Stock of declarations / under the CST Act, 1956.

certificates

Opening Stock Forms obtained during the year from CTD Forms utilized during the year Loss, if any Closing Balance (2) Details of any misuse of C forms

NIL NIL NIL NIL NIL Number

NIL NIL

NIL NIL

NIL NIL NIL NIL NIL Nature of misuse NIL

NIL NIL NIL NIL NIL

NIL NIL NIL NIL NIL NIL Amount of purchase involved NIL

NIL

The above audit report enclosed to my / our certificate is true and correct.

Place :Bangalore Date: 28/12/2011

Signature : Name : G.SRINIVASA UPADHYA

ANNEXURE TO CERTIFICATE IN FORM VAT 240 DATED . U/S 31(4) OF THE KVAT ACT, 2003. Name of the Dealer : BABA MARKETING On verification of the Books of account .related records and register maintained by the dealer and the information given to us for the period from 1-4-2010 to 31-3-2011 1.SALES REGISTER 2.PURCHASE REGISTER 3.CASH BOOK 4.BANK BOOK 5 SUNDRY CREDITORS 6.SUNDRY DEBTORS 7.JOURNAL REGISTER 8 9

You might also like

- Tnvat Form WW Fy 15-16Document30 pagesTnvat Form WW Fy 15-16samaadhuNo ratings yet

- New VAT Audit FormatDocument12 pagesNew VAT Audit FormatparulshinyNo ratings yet

- Form Vat 240 Audited Statement of Accounts Under Section 31 (4) OF THE KVAT ACT, 2003 - CertificateDocument5 pagesForm Vat 240 Audited Statement of Accounts Under Section 31 (4) OF THE KVAT ACT, 2003 - Certificatecharan srNo ratings yet

- FORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1Document26 pagesFORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1S Kumar SharmaNo ratings yet

- Audit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryDocument24 pagesAudit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryrockyrrNo ratings yet

- FORM 202: Popular EnterpriseDocument4 pagesFORM 202: Popular Enterprisesam3461No ratings yet

- RMCF 10-Q 20110831Document22 pagesRMCF 10-Q 20110831mtn3077No ratings yet

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDocument4 pagesComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- Audit Report Form 88Document12 pagesAudit Report Form 88TarifNo ratings yet

- Details of VAT Form 240Document23 pagesDetails of VAT Form 240yoga_tptNo ratings yet

- Bir Ruling 044-10Document4 pagesBir Ruling 044-10Jason CertezaNo ratings yet

- CST Form 1Document6 pagesCST Form 1Sarath Disha80% (5)

- Upvat Xxvi-A Department of Commercial Taxes, Government of Uttar PradeshDocument6 pagesUpvat Xxvi-A Department of Commercial Taxes, Government of Uttar PradeshShreya AgarwalNo ratings yet

- Saark Associates Report For InternshipDocument13 pagesSaark Associates Report For InternshippratikNo ratings yet

- Form Xxiv-A: 6A Taxpayer's PAN (Permanent Account Number)Document3 pagesForm Xxiv-A: 6A Taxpayer's PAN (Permanent Account Number)Jayant SharmaNo ratings yet

- 2011 Annual Stat ReportDocument19 pages2011 Annual Stat ReportRob PortNo ratings yet

- Bir Atp MemoDocument10 pagesBir Atp Memobge5No ratings yet

- Rs 22,510 Rs 743 367 Rs.36,748: TotalDocument2 pagesRs 22,510 Rs 743 367 Rs.36,748: Totalasad khokharNo ratings yet

- 2015 Annual ReportDocument19 pages2015 Annual ReportRob PortNo ratings yet

- Audit Check Sheet GuideDocument17 pagesAudit Check Sheet GuideJayant JoshiNo ratings yet

- 2006 BIR-RMC ContentsDocument22 pages2006 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- Financial Statements - WPIDocument24 pagesFinancial Statements - WPIeuwillaNo ratings yet

- DuoyuanGlobalWaterInc AR2009Document130 pagesDuoyuanGlobalWaterInc AR2009Timothy ChklovskiNo ratings yet

- GPHC Half Year ResultsDocument28 pagesGPHC Half Year ResultsArmi MontillaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Document9 pagesGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresNo ratings yet

- Department of Commercial Taxes, Government of Uttar Pradesh: Upvat - XxivDocument11 pagesDepartment of Commercial Taxes, Government of Uttar Pradesh: Upvat - Xxivpradeepji392No ratings yet

- Transmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument2 pagesTransmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueLayne Kendee100% (2)

- Select Applicable Sheets Below by Choosing Y/N and Click On ApplyDocument69 pagesSelect Applicable Sheets Below by Choosing Y/N and Click On ApplysreetomapaulNo ratings yet

- Sales Tax Special Withholding Rules 2010Document9 pagesSales Tax Special Withholding Rules 2010Shayan Ahmad QureshiNo ratings yet

- GST - GOODS & Service Tax What Is GSTDocument4 pagesGST - GOODS & Service Tax What Is GSTsubbiah kailasamNo ratings yet

- Audit Report GuideDocument88 pagesAudit Report GuidenuudmNo ratings yet

- BIR Form 1702 Annual Income Tax Return GuideDocument6 pagesBIR Form 1702 Annual Income Tax Return GuideMary Monique Llacuna Lagan100% (1)

- California Tax Information For City and County OfficialsDocument83 pagesCalifornia Tax Information For City and County Officialswmartin46No ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- Treehouse Food SincDocument50 pagesTreehouse Food SincSwisskelly1No ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- The Goodyear Tire & Rubber Company: FORM 10-QDocument62 pagesThe Goodyear Tire & Rubber Company: FORM 10-Qavinashtiwari201745No ratings yet

- Kanya KarungalDocument13 pagesKanya KarungalramNo ratings yet

- Requirements For Summary List of Sales and PurchasesDocument2 pagesRequirements For Summary List of Sales and PurchasesMary Joy Villanueva100% (2)

- Fiscal Documents Annex 1 (FINAL)Document10 pagesFiscal Documents Annex 1 (FINAL)danielNo ratings yet

- Internal Revenue Service: Third Party Communication: None Date of Communication: Not ApplicableDocument6 pagesInternal Revenue Service: Third Party Communication: None Date of Communication: Not Applicableivan_mitev9979No ratings yet

- Mvat f231Document5 pagesMvat f231pgotaphoeNo ratings yet

- VAT Booklet for FY 2012-13 by Dhirubhai Shah & CoDocument20 pagesVAT Booklet for FY 2012-13 by Dhirubhai Shah & Coankur2706No ratings yet

- Rmo 1981Document228 pagesRmo 1981Mary graceNo ratings yet

- 28689ipcc ST Vol1 cp7 PDFDocument0 pages28689ipcc ST Vol1 cp7 PDFGautam PradhanNo ratings yet

- 231 - CST User GuideDocument82 pages231 - CST User GuideMandarNo ratings yet

- Form RT-II: Qua Rterly Statement Under Section 24 of The Bihar Value Added Tax Act, 2005Document7 pagesForm RT-II: Qua Rterly Statement Under Section 24 of The Bihar Value Added Tax Act, 2005abhaysrNo ratings yet

- State Sales and Use Tax ReturnDocument2 pagesState Sales and Use Tax ReturnRick JordanNo ratings yet

- Form 704Document704 pagesForm 704Dhananjay KulkarniNo ratings yet

- Vat AnnexuresDocument11 pagesVat AnnexuresRanga ThiyagarajNo ratings yet

- Rmo 3-2009Document29 pagesRmo 3-2009sheena100% (2)

- 43677RMO 3-2009 - Suspension GroundsDocument29 pages43677RMO 3-2009 - Suspension GroundsAnonymous OyhbxcjNo ratings yet

- Checklist For KVATDocument15 pagesChecklist For KVATcharan srNo ratings yet

- Statement On Page 20Document57 pagesStatement On Page 20WXYZ-TV Channel 7 DetroitNo ratings yet

- Sales Tax Special Procedure (Withholding) Rules, PDFDocument6 pagesSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasNo ratings yet

- Bir Reqts FsDocument2 pagesBir Reqts Fsopep77No ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- 4Document2 pages4asad khokharNo ratings yet

- Footwear Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandFootwear Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Ch12 Segment Reporting and DecentralizationDocument84 pagesCh12 Segment Reporting and DecentralizationMaricar CachilaNo ratings yet

- Audit Under Fiscal Laws GST AuditDocument4 pagesAudit Under Fiscal Laws GST AuditRanjit BhogesaraNo ratings yet

- Re Teh D.o.o.: Academic VersionDocument13 pagesRe Teh D.o.o.: Academic VersionVito MartiniNo ratings yet

- Vision For Nation Finacial ManualDocument66 pagesVision For Nation Finacial Manualvision generationNo ratings yet

- शिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiDocument4 pagesशिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiAshish ChNo ratings yet

- Accounting in ActionDocument51 pagesAccounting in Actionlove D infintyNo ratings yet

- Professional Curriculum VitaeDocument17 pagesProfessional Curriculum VitaeAnonymous zeqDcNJuHNo ratings yet

- DT Nov 2022 PaperDocument26 pagesDT Nov 2022 PaperPoonam Sunil Lalwani LalwaniNo ratings yet

- XPRS Xpress Annual Report 2011 - From A Ripple in Singapore, To A Wave in AsiaDocument30 pagesXPRS Xpress Annual Report 2011 - From A Ripple in Singapore, To A Wave in AsiaWeR1 Consultants Pte LtdNo ratings yet

- CRU Computer Rental: Case StudyDocument5 pagesCRU Computer Rental: Case StudyVijay KoushalNo ratings yet

- Group 2 - FS Analysis, Planning, Forecasting 20240217 - UpdatedDocument30 pagesGroup 2 - FS Analysis, Planning, Forecasting 20240217 - Updateddias khairunnisaNo ratings yet

- Solutions To Recommended Questions - Chapter 1Document16 pagesSolutions To Recommended Questions - Chapter 1David Terran TangNo ratings yet

- PFRS SummaryDocument20 pagesPFRS Summaryrena chavezNo ratings yet

- Air Canada v. Commissioner of Internal Revenue, G.R. 169507, January, 11 201Document25 pagesAir Canada v. Commissioner of Internal Revenue, G.R. 169507, January, 11 201Paul SarangayaNo ratings yet

- Negative Cash Flow ExplainedDocument2 pagesNegative Cash Flow ExplainedDindin Oromedlav LoricaNo ratings yet

- Timothy Monroe Opened A Law Office On January 1 2017 PDFDocument1 pageTimothy Monroe Opened A Law Office On January 1 2017 PDFAhsan KhanNo ratings yet

- Nepal Budget Highlights 2078Document36 pagesNepal Budget Highlights 2078shankarNo ratings yet

- TOT3 ReturnDocument14 pagesTOT3 Returnmerciefedherico_4977No ratings yet

- APEA 2023 Brochure (General)Document10 pagesAPEA 2023 Brochure (General)Aaron CorneliusNo ratings yet

- Week 004 Module 4 - Travel IntermediariesDocument3 pagesWeek 004 Module 4 - Travel IntermediariesMavNo ratings yet

- Akun-Akun Queen ToysDocument4 pagesAkun-Akun Queen ToysAnggita Kharisma MaharaniNo ratings yet

- Assignment 1 Answers - Preparing Income StatementsDocument9 pagesAssignment 1 Answers - Preparing Income Statementsvarun022084No ratings yet

- 2014 Dse Bafs 2a MSDocument8 pages2014 Dse Bafs 2a MSryanNo ratings yet

- EdSource: Proposition 30 - Proposition 38 ComparisonsDocument8 pagesEdSource: Proposition 30 - Proposition 38 Comparisonsk12newsnetworkNo ratings yet

- SAP B1 questions on accounts, payments, and configurationDocument28 pagesSAP B1 questions on accounts, payments, and configurationLina Melina100% (1)

- Current Financial Condition of Squash FilletDocument9 pagesCurrent Financial Condition of Squash FilletNicole Bianca Asuncion CorralesNo ratings yet

- Recognition of Construction Contract Revenue Based On PSAK 34 at PT Tunggal Jaya RayaDocument8 pagesRecognition of Construction Contract Revenue Based On PSAK 34 at PT Tunggal Jaya RayamegakadirNo ratings yet

- Unit Deficit Financing: 14.0 ObjectivesDocument12 pagesUnit Deficit Financing: 14.0 ObjectivesSiddharth DixitNo ratings yet

- Unit - Iii Profit Prior To IncorporationDocument33 pagesUnit - Iii Profit Prior To IncorporationShah RukhNo ratings yet

- Canara BankDocument18 pagesCanara Bankmithun mohanNo ratings yet