Professional Documents

Culture Documents

Long Term Construction

Uploaded by

JohnAllenMarillaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Long Term Construction

Uploaded by

JohnAllenMarillaCopyright:

Available Formats

Long Term construction On January 2, 2008, JGG Builders Corp.

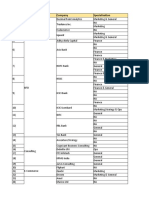

of Ilocos enters into a contract to construct a building for P 40,000,000. During the construction period many change orders are made to the original contract. All of the changes were accepted by both the customer and the contractor. The following schedule summarizes the change orders in 2008: Cost Incurred In 2008 8,000,000 50,000 300,000 125,000 Estimated Costs to Complete 28,000,000 50,000 50,000 300,000 Contract Price 40,000,000 125,000 600,000 100,000

Basic Contract Change order # 1 Change order # 2 Change order # 3 Change order # 4

Under the percentage of completion method, what is the gross profit to be recognized on December 31, 2008 (Rounded to the nearest peso)? a. P 907,828 b. P 888,889 c. P 909,063 d. P 970,830

In 2006, Builders agreed to construct a commercial building at a price of P 1,000,000. South Builders uses the percentage of completion method of recognizing revenue on long term construction projects. The data relating to the projects from 2006-2008 are as follows: 2006 280,000 520,000 150,000 120,000 2007 320,000 200,000 400,000 320,000 2008 185,000 1,000,000 940,000

Cost Incurred each year Estimated Cost o complete Billings Date Collection of billings date

What is the amount of gross profit to be recognized in 2007? a. 80,000 b. 78,500 c. 85,000 d. 90,000 Using the above information, what is the balance of construction projects net contract billings account of south builders December 31, 2007 balance sheet? a. 350,000 b. 300,000 c. 550,000 d. 380,000 Using the above information, assuming the company uses the zero profit method of recognizing revenue from the project, what is the balance of the construction in progress account net of contract billings as of December 31, 2007? a. 200,000 b. 250,000 c. 350,000 d. 300,000 North Construction Company uses the percentage of completion method of recognition gross profit on long term construction contracts. The company started work on the two contracts during 2007. Data relating to the two contracts are given below: Contracts price P 1, 800,000 1, 350,000 Actual cost 12/31/2007 P 450,000 262,500 estimated cost to complete P 450,000 487,500

Contract 1 Contract 2

In 2008, contrast 3 was started for a contract prize of P 2, 700,000. As of December 31, 2008, the following data are available: Actual cost 1/1/07-12/31/08 840,000 540,000 540,000 Estimated Cost to Complete 210,000 360,000 960,000

Contract 1 Contract 2 Contract 3

How much income is to be recognized in 2008? a. 1,302,000 b. 432,000 c. 642,000 d. 270,000 Using the information above, what is the balance of the construction in progress account as of December 31, 2008? a. 3,222,000 b. 3,942,000 c. 1,920,000 d. 2,562,000

On July 1, 2006, summer construction Corporation contracted to build an office building for JG Inc., Inc. for a total price of 975,000. Data relating to the project from 2006-2008 are as follows: 2006 75,000 675,000 150,000 2007 600,000 400,000 550,000 2008 1,050,000 275,000

Contract Cost Estimated Cost to complete Billings to JG Inc.

Summer construction corp uses the zero profit method. What is the balance of the construction in progress account net of billings at December 31, 20007? a. P 125,000 due to JG Inc b. P 125,000 due from JG Inc c. P 25,000 due from JG Inc d. P 25,000 due to JG Inc Assuming the use of the Percentage of Construction method, how much is the gross profit (loss) to be recognized in 2007? a. (47,500) b. 47,500 c. (22,500) d. 22,500

West Construction company recognized gross profit of P 31,500 on its long term project what has accumulated costs of P61,250. To finish the project, the company estimates that it has to incur additional cost of P122,500. Billings ,made were 40% of the contract price. What is the balance of the CIP net of billings? a. 18500 liability b. 18,550 asset c. 50,050 asset d. 50,050 liability Marlboro Construction company, Inc. entered into a construction contract in 2007 that called for a contract price of P 9,600,000. At the beginning of 2008, a change order increased the initial contract price by 480,000. The company uses the percentages of completion method. The following data is available: 2007 2008 Cost incurred to date 4,920,000 8,640,000 Estimated cost to complete 4,920,000 2,160,000 What is the gross profit or loss should Marlboro company recognize in 2007 and 2008

a. b.

2007 (240,000) (240,000)

2008 (720,000) (480,000)

c. d.

2007 240,000 240,000

2008 (960,000) (720,000)

East Builders works on a 70 million contract in 2008 to construct a shopping mall for SM inc. During 2008, East Builders uses the percentage of completion method of revenue recognition. At December 31, 2008, the account balances are Construction in progress Accounts Receivable Contract Billings Estimated cost to complete 24.55 million 2.4 million 12.0 million 31.85 million

How much is the actual cost incurred in 2008? a. 24.5 million b. 49 million c. 7.5 million d. 17.150 million

From BAYSA Exercise 7-1 In 2006, Durabuilt Engineering entered into an agreement to construct an office building at a contract price of P 50,000,000. Construction data were as follows: 2006 2007 2008 Construction Cost P 7,500,000 P 27,000,000 P 6,300,000 Estimated Cost to complete 30,000,000 8,625,000 Progress Billings 8,000,000 36,000,000 6,000,000 Collection from clients 5, 500,000 33,000,000 11,500,000 Instruction 1. Determine the revenue, cost of revenue and gross profit to be recognized in 2006,20007,20008 using the percentage of completion method and the cost to cost method of estimating the percentage of work completed. 2. Prepare necessary journal entries to record construction activities for each year, including the recognized revenue, cost of revenue and gross profit. 3. For 2007, show how the details related to this construction ciontract would be disclosed on the balance sheet and in the income statement.

2006 P50,000,000 P 7,500,000 30,000,000 37,500,000 P12,500,000 20% To Date P10,000,000 7,500,000 P 2,500,000 P40,000,000 34,500,000 P 5,500,000 P50,000,000 40,800,000 P 9,200,000 2007 P50,000,000 P34,500,000 8,625,000 P43,125,000 P 6,875,000 80% Recognized in prior year/s P10,000,000 7,500,000 P 2,500,000 P40,000,000 34,500,000 P 5,500,000 2008 P50,000,000 P40,800,000 __________ P40,800,000 P 9,200,000 100% To be recognized this year P10,000,000 7,500,000 P 2,500,000 P30,000,000 27,000,000 P 3,000,000 P10,000,000 6,300,000 P 3,700,000

Contract price Cost incurred to date Est. cost to complete Total estimated cost Total estimated gross profit Percentage of completion

2006 - Recognized revenue Cost of revenue Gross profit 2007 - Recognized revenue Cost of revenue Gross profit 2008 - Recognized revenue Cost of revenue Gross profit

a. Construction in progress Cash, Materials, etc.

2006 7,500,000 7,500,000

2007 27,000,000 27,000,000 36,000,000

2008 6,300,000 6,300,000 6,000,000

b. Accounts Receivable 8,000,000 Progress Billings on Const. Contracts

8,000,000

36,000,000

6,000,000

c. Cash Accounts Receivable d. Cost of LTCC Construction in Progress Revenue from LTCC

5,500,000 5,500,000 7,500,000 2,500,000 10,000,000

33,000,000 33,000,000 27,000,000 3,000,000 30,000,000

11,500,000 11,500,000 6,300,000 3,700,000 10,000,000

e. Progress Billings on

Construction Contracts Construction In Progress 50,000,000 50,000,000

Statement of Financial Position Current Assets: Accounts Receivable Current Liabilities: Progress Billings on Construction Contracts Less Construction in Progress

P5,500,000

P44,000,000 40,000,000

P4,000,000

New Dimension Construction Company bagan operations January 1, 2003: During the year , the company entered into a contract with centurion Company to construct a manufacturing facility. At that time, new dimension estimated that it would take five years to complete the facility at a total cost of P 18,000,000. The total contract price for construction of the facility is P 25,000,000. During the year, the company incurred P 4,400,000 in construction cost related to the construction project. The estimated cost to complete is P 15,600,000. Centurion was billed and paid 30% of the contract price subject to a 10% retention fee. Determine the amount of gross profit for the year ended December 31, 2003. Determine the balance of AR, CIP, Progress Billings on Construction contracts ANSWER 1. Contract price Total estimated cost: Cost incurred to date P 4,400,000 Estimated cost to complete 15,600,000 Total estimated gross profit Percentage of completion ( P 400,000/20,000,000) Gross profit to be recognized in 2008 2. Accounts Receivable Construction in Progress Progress Billings on Construction Contracts P25,000,000

20,000,000 P 5,000,000 22% P 1,100,000

(P25,000,000 x 30% x 10%) P 750,000 (P4,400,000 + P1,100,000) P5,500,000 (P25,000,000 x 30%) P7,500,000

You were engaged to AUDIT the books of accounts of MMN contractors which had a 3 year construction contract in 2003 for P9,000,000. MMN uses the percentage of completion method for financial statement purposes recognized for each year is based on the ration of cost incurred to total estimate cost to complete the contract. Data on this contract follows: Accounts receivable-construction contract billings P 300,000 Construction in Progress P 937,500 Less: Account Billed 843,750 10% retention 93,750 Net Income recognized in 2003 ( before tax) 150,000 MMN Contractors maintain a separate bank account for each construction contract. Bank deposits to this contract amounted to P 500,000. 1. How much cash collected on the contract was not yet deposited at December 31, 2003? a. 43,750 b. 1,137,500 c. 193,750 d. 287,500 2. What was the estimated total income before tax on this contract? c. 1,440,000 a. 450,000 b. 840,000

d. 287,500

Answer Key Total amount billed Less Balance of accounts receivable Total collections Amount deposited Cash collected not yet deposited P150,000 937,500/9,000,000 P843,750 300,000 P543,750 500,000 P 43,750 P1,440,000

On September 14, 2003, NNO Contractors, Inc. won the bid for the construction of a 1,000 room hotel for hoteliers, Inc. on the reclamation area for 1.2 billion. On the terms of payment, parties agreed on the following: One percent mobilization fee (deductible for the final bill) payable within fifteen days after signing the contract; Retention of 10% on all billings, payable with the final bill after the acceptance of entire completed project; and Progress billings on construction within seven days from the date of acceptance By the end of 2003, the company presented one progress billings for 10% completion by hoteliers inc. evaluated and accepted on decmebr 28, 2003 for payment on January. The company used percentage of completion method of accounting. In the year 2003 NNO contractors Inc. received a fee of a. 9.8 million b. 10.8 million c. 12 million ANSWER: C

d. 1.2 million

Mobilization fee (P1.2B x 1%)

P 1.2M

Collections on billings (1.2B x 10% x 90%) Total fee received by NNO

10.8M P12.0M

You might also like

- Long Term Construction ContractsDocument16 pagesLong Term Construction ContractsLorena Joy Aggabao100% (3)

- Construction ProblemsDocument31 pagesConstruction ProblemsCatherine Joy VasayaNo ratings yet

- LTCC Master TestbankDocument8 pagesLTCC Master TestbankPrankyJelly0% (1)

- Long-Term Construction QuizDocument4 pagesLong-Term Construction QuizCattleyaNo ratings yet

- Construction ContractsDocument9 pagesConstruction ContractsShiela Dimaun100% (3)

- Group 3: Quizzer On Installment SalesDocument33 pagesGroup 3: Quizzer On Installment SalesKate Alvarez100% (2)

- Prac 1 - First Preboard - P2 65th NewDocument12 pagesPrac 1 - First Preboard - P2 65th NewArianne Llorente100% (1)

- Franchise AccountingDocument20 pagesFranchise AccountingJerichoPedragosa60% (5)

- Corp Liq MoodleDocument32 pagesCorp Liq MoodleAJ100% (2)

- Afar 2Document7 pagesAfar 2Diana Faye CaduadaNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesMarianne LanuzaNo ratings yet

- Franchise AccountingDocument5 pagesFranchise Accountingnephtalie92% (12)

- 1 60Document23 pages1 60Joshua Gabrielle B. GalidoNo ratings yet

- Chapter 08 DayagDocument24 pagesChapter 08 DayagEureka Fernandez67% (6)

- Long-Term Construction ContractsDocument12 pagesLong-Term Construction Contractsblackphoenix303No ratings yet

- Installment Sales Reviewer. Problems and Solutions.Document43 pagesInstallment Sales Reviewer. Problems and Solutions.Kate Alvarez91% (22)

- Consignment & FranchiseDocument9 pagesConsignment & FranchiseHeinie Joy Paule100% (1)

- KsadsadsDocument3 pagesKsadsadsKenneth Bryan Tegerero Tegio0% (1)

- BAFINAR - SW 1 ConsignmentDocument3 pagesBAFINAR - SW 1 ConsignmentRoy Mitz Aggabao Bautista V100% (1)

- Construction Contracts Prac 2 2020 PDFDocument27 pagesConstruction Contracts Prac 2 2020 PDFSharmaineMiranda100% (1)

- Franchise AccountingDocument8 pagesFranchise AccountingJayhan Palmones100% (1)

- Multiple Choices QuestionsDocument10 pagesMultiple Choices QuestionsChristopher Price0% (1)

- Long-Term Construction Contracts and FranchisingDocument16 pagesLong-Term Construction Contracts and FranchisingAlexis SosingNo ratings yet

- Quiz 2 Consignment ProblemsDocument2 pagesQuiz 2 Consignment ProblemsElla Turato100% (1)

- Installment Sales - PunzalanDocument33 pagesInstallment Sales - PunzalanAcoOh Sii MHarian Sagum100% (5)

- Strictly no erasures allowedDocument12 pagesStrictly no erasures allowedErwin Labayog MedinaNo ratings yet

- Franchise Revenue RecognitionDocument5 pagesFranchise Revenue RecognitionErwin Labayog MedinaNo ratings yet

- Calculate Branch Inventory Cost and Profits for Home Office MarkupsDocument6 pagesCalculate Branch Inventory Cost and Profits for Home Office Markupsangela arcedoNo ratings yet

- Araullo University Advanced Financial Accounting & ReportingDocument7 pagesAraullo University Advanced Financial Accounting & ReportingDarelle Hannah MarquezNo ratings yet

- Consolidated Problems TestbankDocument6 pagesConsolidated Problems TestbankIvy Salise0% (1)

- Problems Chapter 6-10Document15 pagesProblems Chapter 6-10u got no jams0% (1)

- P2 Branch Accounting M2020Document6 pagesP2 Branch Accounting M2020Charla SuanNo ratings yet

- Installment Sales Multiple QuestionsDocument36 pagesInstallment Sales Multiple QuestionsTrixie CapisosNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- Advanced Accounting 2-DayagDocument472 pagesAdvanced Accounting 2-DayagNazee Mohammad IsaNo ratings yet

- RESA 1st PBDocument9 pagesRESA 1st PBRay Mond0% (1)

- Discussions About Contracts With Customer Other IssuesDocument14 pagesDiscussions About Contracts With Customer Other Issuestrisha0% (1)

- ch18 PDFDocument44 pagesch18 PDFerylpaez67% (9)

- HOBADocument4 pagesHOBAHannah YnciertoNo ratings yet

- Franchise Accounting PDFDocument2 pagesFranchise Accounting PDFLouise Anciano100% (2)

- C Par First Pre Board 2008 ADocument17 pagesC Par First Pre Board 2008 AJaylord Pido100% (1)

- Advanced Accounting Quiz 8 Installment Sales Part 1 of 2Document2 pagesAdvanced Accounting Quiz 8 Installment Sales Part 1 of 2Michelle de Guzman90% (10)

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Home Office and Branch Accounting ProblemsDocument6 pagesHome Office and Branch Accounting ProblemsMary Dale Joie Bocala100% (1)

- Sales agency net income and cost of sales calculationDocument27 pagesSales agency net income and cost of sales calculationKandiz89% (9)

- Final AFSTDocument7 pagesFinal AFSTCatherine ValdezNo ratings yet

- Selecting Appropriate Construction Contract Accounting MethodDocument11 pagesSelecting Appropriate Construction Contract Accounting MethodKayla SheltonNo ratings yet

- REVENUE RECOGNITION LONG TERM CONSTRUCTIONDocument4 pagesREVENUE RECOGNITION LONG TERM CONSTRUCTIONCee Gee BeeNo ratings yet

- Long Term Construction Quiz PDF FreeDocument4 pagesLong Term Construction Quiz PDF FreeMichael Brian TorresNo ratings yet

- Practical Accounting 2 ReviewDocument42 pagesPractical Accounting 2 ReviewJason BautistaNo ratings yet

- Long Term Construction ContractsDocument4 pagesLong Term Construction ContractsAnalynNo ratings yet

- Solving Construction Problems Step-by-StepDocument6 pagesSolving Construction Problems Step-by-StepAlexNo ratings yet

- Construction ContractsDocument4 pagesConstruction ContractsAnjelica MarcoNo ratings yet

- Review 2Document3 pagesReview 2Tracy LeeNo ratings yet

- Construction IllustrationDocument54 pagesConstruction IllustrationCatherine Joy Vasaya100% (3)

- LTCC - ExamDocument5 pagesLTCC - ExamLouise Anciano100% (1)

- LTCC Exam PDF FreeDocument5 pagesLTCC Exam PDF FreeMichael Brian TorresNo ratings yet

- Construction Contracts GuideDocument3 pagesConstruction Contracts GuideJamie RamosNo ratings yet

- 5 LT CONSTRUCTION CONTRACT HandoutDocument2 pages5 LT CONSTRUCTION CONTRACT HandoutDJAN IHIAZEL DELA CUADRANo ratings yet

- Incometax Pang Pist Sa ScribdDocument9 pagesIncometax Pang Pist Sa ScribdJohnAllenMarillaNo ratings yet

- Exam - SHE, RE & Share Based CompensationDocument4 pagesExam - SHE, RE & Share Based CompensationJohnAllenMarilla100% (2)

- Business Combination MaterialsDocument6 pagesBusiness Combination MaterialsJohnAllenMarillaNo ratings yet

- Exam-First YearDocument4 pagesExam-First YearJohnAllenMarillaNo ratings yet

- Exam 2nd Year Without ANSWERDocument7 pagesExam 2nd Year Without ANSWERJohnAllenMarillaNo ratings yet

- Assement Exam-Dysas 1st Quarter-P1Document5 pagesAssement Exam-Dysas 1st Quarter-P1JohnAllenMarillaNo ratings yet

- Exam QuizbowlersDocument7 pagesExam QuizbowlersJohnAllenMarillaNo ratings yet

- Answer Key - First YearDocument10 pagesAnswer Key - First YearJohnAllenMarillaNo ratings yet

- PertDocument17 pagesPertJohnAllenMarillaNo ratings yet

- Accounting Students Exam GAAP and Financial ReportingDocument7 pagesAccounting Students Exam GAAP and Financial ReportingJohnAllenMarillaNo ratings yet

- Vat On Sale of ServicesDocument55 pagesVat On Sale of ServicesJohnAllenMarilla67% (3)

- Vat On Sale of Services and Use orDocument53 pagesVat On Sale of Services and Use orJohnAllenMarillaNo ratings yet

- Final Najud Xa (2007)Document38 pagesFinal Najud Xa (2007)JohnAllenMarillaNo ratings yet

- Vat On Sale of ServicesDocument55 pagesVat On Sale of ServicesJohnAllenMarilla67% (3)

- Badilles Dormitel: A Term Paper Presented To The University of Mindanao Bolton, Davao CityDocument26 pagesBadilles Dormitel: A Term Paper Presented To The University of Mindanao Bolton, Davao CityJohnAllenMarillaNo ratings yet

- Financial Analysis May Be Used To Test TheDocument8 pagesFinancial Analysis May Be Used To Test TheJohnAllenMarilla100% (1)

- Accounting Students Exam GAAP and Financial ReportingDocument7 pagesAccounting Students Exam GAAP and Financial ReportingJohnAllenMarillaNo ratings yet

- ABMAK Profile - August 2014Document5 pagesABMAK Profile - August 2014Bbaale AdvocatesNo ratings yet

- TAX2 ReyesDocument9 pagesTAX2 ReyesClaire BarrettoNo ratings yet

- Paper Accountingandcultureandmarket Zarzeski 1996.Document20 pagesPaper Accountingandcultureandmarket Zarzeski 1996.SorayaNo ratings yet

- HR Functions of IDLC Securities LimitedDocument48 pagesHR Functions of IDLC Securities LimitedAsif Rajian Khan AponNo ratings yet

- Supreme Court: Aitken and Deselms For Appellant. Hartigan and Welch For AppelleeDocument15 pagesSupreme Court: Aitken and Deselms For Appellant. Hartigan and Welch For AppelleeRobert Paul A MorenoNo ratings yet

- Mark Scheme January 2009: GCE Accounting (8011-9011)Document17 pagesMark Scheme January 2009: GCE Accounting (8011-9011)Dark Knight GamerNo ratings yet

- ROLLNO-20DM011 Where Were The Board and Its Independent Directors?Document4 pagesROLLNO-20DM011 Where Were The Board and Its Independent Directors?saswat mohantyNo ratings yet

- Top 20 Sno Domain Companies SpecialisationsDocument4 pagesTop 20 Sno Domain Companies SpecialisationsUjjwalPratapSinghNo ratings yet

- CostofCollegeQuizTEKS812G 1Document4 pagesCostofCollegeQuizTEKS812G 1Hannah KellyNo ratings yet

- RESEARCH PAPER EditedDocument34 pagesRESEARCH PAPER EditedJericho ArinesNo ratings yet

- World BankDocument25 pagesWorld Bankjais_ash1985No ratings yet

- Consolidated Financial Statements ProblemsDocument6 pagesConsolidated Financial Statements ProblemsBhosx KimNo ratings yet

- Week 5 Workshop Solutions - Short-Term Debt MarketsDocument3 pagesWeek 5 Workshop Solutions - Short-Term Debt MarketsMengdi ZhangNo ratings yet

- TDU Belt System White BlueDocument3 pagesTDU Belt System White BlueIvan Olmo ForniesNo ratings yet

- Trading Indicators by Bill Williams - Forex Indicators GuideDocument2 pagesTrading Indicators by Bill Williams - Forex Indicators Guideenghoss77No ratings yet

- Letter of TransmittalDocument4 pagesLetter of TransmittalTasmia SwarnaNo ratings yet

- Telgi scam mastermind ran operations from prison using mobile phonesDocument8 pagesTelgi scam mastermind ran operations from prison using mobile phonesPlacement CellNo ratings yet

- West Coast Paper MillsDocument72 pagesWest Coast Paper Millsvinodkumar_vicky100% (2)

- Fintech and The Transformation of The Financial IndustryDocument9 pagesFintech and The Transformation of The Financial Industryrealgirl14No ratings yet

- Vouched For Top Adviser 2020Document20 pagesVouched For Top Adviser 2020DhawalChandanNo ratings yet

- Solutions To Module 3-1 Accounts Receivable ExercisesDocument4 pagesSolutions To Module 3-1 Accounts Receivable ExercisesAndrea Joy PekNo ratings yet

- Annual General Meeting Agenda: Income Tax Exemption and Sporting ClubsDocument2 pagesAnnual General Meeting Agenda: Income Tax Exemption and Sporting ClubsStacey-Ann SteeleNo ratings yet

- 20.09.2022 Cause List C - IIDocument5 pages20.09.2022 Cause List C - IIpedro perezNo ratings yet

- Ligasure Vessel Sealing Generator Service ManualDocument164 pagesLigasure Vessel Sealing Generator Service Manualamson-baluNo ratings yet

- India's 1991 Economic Crisis and ReformsDocument17 pagesIndia's 1991 Economic Crisis and ReformsRohan PatilNo ratings yet

- Financial Internal AuditDocument508 pagesFinancial Internal Auditbalu2301100% (1)

- F1 Notes 1Document21 pagesF1 Notes 1rameshmbaNo ratings yet

- Public Investment FundDocument7 pagesPublic Investment FundSanvi KguNo ratings yet

- PHP Ilt KW KDocument5 pagesPHP Ilt KW Kfred607No ratings yet

- Distressed Commercial Mortgage Loan Workout Analysis and FormsDocument217 pagesDistressed Commercial Mortgage Loan Workout Analysis and Formsmateo165No ratings yet