Professional Documents

Culture Documents

Final by Dheeraj

Uploaded by

Prinita DhimanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final by Dheeraj

Uploaded by

Prinita DhimanCopyright:

Available Formats

OneMove Technologies Review and Analysis of Financial Statements 2010

ACC 6050 ACCOUNTING 1-FINANCIAL March 21, 2011 Prinita Dhiman William Ma Leah Bannister Dheeraj Sharma 7678464 7684625 ------ 7670028

For the purpose of this project, we chose to evaluate the financial statements and performance of OneMove Technologies, a publicly traded corporation governed by a Board of Directors out of British Columbia, Canada. Established in 2007, OneMoves proprietary web-based software facilitates efficient communication between all parties involved in the process of buying and selling real estate. 1 What makes the analysis of financial statements interesting is that the nature of business is primarily web-based; therefore the company lacks high levels of inventory and is predominantly service-based. In this paper, ratio analysis has been done with the help of vertical and horizontal analysis of the companys financial statements and by making comparisons of the ratios of current year with the ratios of past years. The ratios of the company have also been compared to the industry ratios attained with the help of SME Benchmarking tool.

Ratio Analysis:

Current Ratio: The current ratio measures the relative amount of current assets to current liabilities and the ability of a company to meet its short-term debt obligations. The higher the current ratio, the greater the short-term solvency is. A recommended current ratio is 2:1, and any ratio below indicates that the entity may face liquidity challenges. Current ratio = current assets/current liabilities Year Current Assets 2008 2009 70,039 409,81 4 0.171 2010 172,811 799,629 0.216 249,65 2 Current Liabilities 218,75 6 Current Ratio 1.141

Based on the ratios, OneMove changes from a position of better solvency to a drastically poor position in 2009, with slight recovery in 2010. This is because of the decrease in current assets resulting from a decrease in cash which reduced to 27.4% and 76.2% in 2009 and 2010 respectively as compared to the

1

http://www.onemovetech.com/default.aspx?id=26

amount in 2008. The reduction in receivables which became 1% and 18.5% in 2009 and 2010 respectively in comparison to the amount in 2008 negatively affected the current ratio. Similarly, a drastic increase in accounts payable and accrued liabilities which rose to 500.6% and 243.3% in 2009 and 2010 respectively as compared to those in 2008 contributed to a poor current ratio. Compared to the industry standard of 1.8, OneMove lags considerably and is well below the bottom quartile ratio of 0.9. The current ratio indicates that OneMove may experience significant difficulties in repaying short-term debts. Quick Ratio: Quick Ratio indicates the extent to which a company can pay its current liabilities without relying on the sale of inventory by comparing quick current assets and current liabilities. Generally, a quick ratio of 1:1 is considered good. Quick ratio = Quick Assets (Cash + cash equivalents + temporary investments receivables)/current assets Year Quick Assets 2008 230,90 2009 53,457 409,81 2010 154,580 799,629

1 Current Liabilities 218,75

6 4 Quick Ratio 1.056 0.130 0.193 Similar to the current ratio, OneMoves quick ratio is good in 2008 but drastically drops in the following two years from 1.056 in 2008 to 0.130 in 2009 and 0.193 in 2010. Because of the nature of the industry, the current ratio and quick ratio are similar considering that inventory is not necessary to sustain the business. Moreover, the quick assets exclude only prepaid expenses which do not show significant reduction and still account for 88.4% in 2009 and 97.2% in 2010 which can be observed from the horizontal analysis of balance sheet. Thus, the quick ratio has dropped mainly due to the same factors responsible for the reduction in current ratio. Debt-to-equity Ratio: Debt-to-equity ratio is a measure of how an entity is financed and indicates the risk being borne by the entity. The higher the ratio, the more debt an entity is using relative to equity.

Debt-to-equity ratio = Liabilities/ Shareholders equity Year Liabilities Shareholders equity Debt-to-equity ratio 2010 409,814 813,942 0.50 2009 819,270 92,056 8.9 2008 336,907 540,899 0.62

In comparison to 2009, the debt to equity ratio is much less in 2010. In 2009, for every 10 dollars financed, the OneMove had 9 dollars funded through liability, which is an extremely high risk for investors. However, despite the high risk to the investors, in 2010 OneMove effectively attracted a considerable amount of investment from shareholders, and successfully lowered the debt to half the amount of that in 2009. As a result, in 2010 the debt-to-equity showed a big improvement and a much healthier portfolio because OneMove is financed with about half as much debt as equity and it indicates a strong balance sheet. Moreover, as compared to the industry standard of 1.1 OneMove has a better debt to equity ratio in the years 2008 and 2010. Return on equity (ROE) Ratio: Return on equity is a measure of the profitability of an entity and its effectiveness in using the assets provided by the owners to generate net income. Return on equity ratio = (Net income Preferred dividends)/Average common shareholders equity Year 2010 Net income Preferred dividends (253,448) Average common shareholders equity 452,999 Return on equity (55.95%) 2009 (1,046,617) 316,478 (330.71%) 2008 (3,087,820) 2,129,910 (144.97%)

OneMove runs a deficit in all three years listed above. But, as compared to 2008 and 2009, the deficit amount in 2010 is reduced significantly. Compared to 2009, 2010 has a lower loss but higher average common shareholders equity. As a result, in 2010 OneMove has far less loss on equity as compared to 2009, and ROE has improved from (330.71%) to (55.95%). OneMove has not been able to turn the downstream to upstream and is not making profit on investment yet, which still indicates a high risk to investors. However, the industry standard also indicates a negative return on equity which means that this

is due to the nature of the industry, but the debt-to-equity ratio is (55.95%) which is quite far away from the industry standard of (29.60%). Return on Assets: Return on assets is used to assess the performance of an entity in relation to the investment made independent of the method of finance used by the entity. Return on assets = (Net Income+ After-tax interest expense/ Average total assets)*100 Year Net income+After-tax interest expense Average total assets Return on assets 2008 (3,046,630) 3,175,519 (95.9)% 2009 (999,828) 894,566 (111.8)% 2010 (189,708) 1,067,541 (17.8)%

OneMoves return on assets has improved tremendously from (95.9%) to (17.8%). Moreover, the ratio for the year 2010 is very close to the industry standard for upper half 50% of the industry which is (17.6%) and has a little variation from the whole industry standard which is (13.6%). Return on assets can be further broken down into profit margin ratio and asset turnover ratio. Profit Margin Ratio: Profit margin ratio shows the profitability of each dollar of sales. It is a measure of the effectiveness of an entity in controlling its expenses and promoting sales. Profit margin ratio = (Net Income/ Net Sales) * 100 Year Net income Net sales Profit Margin ratio 2008 (3,087,820) 1,637,558 (188.56)% 2009 (1,046,617) 1,513,039 (69.17)% 2010 (253,448) 2,147,597 (11.80)%

OneMove has experienced net loss in all three years but it is a growing company and is engaged in the development of software. However, the net loss is showing a decreasing trend over the years with drastic improvements. The net loss ratio has improved mainly due to decrease in salaries and wages which became 55.7% in 2009 and 63.5% in 2010 of the amount in 2008. In addition, the sales also increased by 31.1% from 2008 to 2010. In 2008, 104.9% of 188.6% was accounted by the loss from discontinued operations. This shows that OneMove is making efforts to cut on the expenses and improve the profits.

Asset Turnover Ratio: Asset turnover ratio is a measure of the sales generated per dollar of assets. Asset Turnover Ratio = Net Sales/ Average total assets Year Net sales Average total assets Return on assets 2008 1,637,558 3,175,519 0.52 2009 1,513,039 894,566 1.69 2010 2,147,597 1,067,541 2.01

The asset turnover ratio is showing an increasing trend because of the increase in sales which grew by 31.1% from 2008 to 2010 as well as due to an increase in the assets which rose by 39.4% from 2008 to 2010. Debtors Turnover Ratio & Average Collection Period: The debtors turnover ratio measures the liquidity of a firm's debts, and shows how rapidly debts are collected. The higher the DTO, the better it is for the organization. The Average Collection period tells us within how many days after a sale, OneMove is able to recover money from its customers. Debtors turnover ratio = Credit sales/ Average debtors Average Collection Period = 365/ Debtor Turnover Ratio Year Sales Average debtors Debtor turnover ratio Average collection period 2008 1,637,558 37,051 44.20 8.26 2009 1,513,039 18,710 80.87 4.51 2010 2,147,597 3,613 594.41 0.61

This shows that within 8.25 days of a sale, OneMove was able to recover its money from customers in 2008; in 2010 that collection length was shortened to within a day. The main reason for such a short period of collection is OneMove mainly works on advance payments. Its a very good sign for OneMove and investors as they do not face the problem of uncollectables: they dont have to put effort in collection of money, calculate time value of money and collection expenses. Also the company would not need loans for operating expenses. Interest Coverage Ratio:

The interest coverage ratio is a measure of the number of times a company could make the interest payments on its debt with its earnings before interest and taxes, also known as EBIT. Lower the interest coverage ratio, higher is the company's debt burden and greater is the possibility of bankruptcy or default. Interest coverage ratio = EBIT/Interest expenses Year Interest expenses EBIT Interest coverage ratio 2008 48,015 (1,530,182) (31.86) 2009 46,789 (845,716) (18.08) 2010 63,740 (191,158) (2.99)

As a general rule of thumb, investors should not own a stock that has an interest coverage ratio under 1.5, and an interest coverage ratio below 1.0 indicates the business is having difficulties generating the cash necessary to pay its interest obligations. As we have seen OneMove has a history of losses and therefore not able to cover its interest expenses. OneMove is trying to reduce it by repayments of loans which is working well to reduce its interest coverage ratio from (31.86) in 2008 to (2.99) in 2010.

Accounting Policies and Recommendations

Note #2 describes, in detail, numerous accounting policies that provide rationale for the financial statements of OneMove, notably including use of estimates, amortization of equipment, revenue recognition, stock based compensation, and conversion from GAAP to IRFS effective on July 1, 2011. We have reviewed the policies and have the following recommendations: Revenue Recognition OneMove recognizes revenue from transaction based fees for the use of its software as well as incidental revenue from providing internet and software based services. OneMove could improve its sales by changing its credit policy. Currently, transaction and service fees are recognized when the transaction is complete or the service has been provided and collection is reasonably assured. While this makes for an average collection period of less than one day, perhaps the company could extend credit to stimulate sales. Cash flow Analysis

In 2010, OneMove is having positive cash from operating activities and cash from investing activities while a negative cash from financing activities. This indicates that the company is using the cash from financing to invest and expand which is the sign of a successful growing entity. The company is having history of making losses. Despite that company is able to generate cash & pay its operating expenses by either raising money or making payment through issue of shares, stock options, warrants or by raising loans. That is not a good sign for the investors as companys share base is increasing and future earning potential is decreasing. Another reason for losses is amortization expenses which are high due to the inclusion of computer software in the companys capital assets which become obsolete very quickly due to which the company has to use high rate of amortization. Salaries and Wages OneMove should increase its margin in salaries and revenues. Currently, OneMove is paying 48% of its revenues as salaries which is very high. In 2008, the company was paying 96% of its revenues as salaries. It would be wise to redirect these funds to long-term investments than to pay so much salary. While it is important to retain high-performing employees, competitive salaries may not be the answer. Further analysis into prevailing labour market salary ranges should be conducted and implemented. Stock-based Compensation OneMove recognized compensation costs for the granting of stock options, agent's options, warrants and direct awards of stock using the fair value method as determined by the Black-Scholes option pricing model which is an industry standard. However, OneMove should reduce its issuing of shares and giving shares as bonuses to employees in the form of stock options or warrants as it increases the share base. This will result in high supply and low demand thus reducing the price of share and interest of investors. Further, there is no logic to give bonuses when the company is experiencing losses. Other performance-based compensation should be considered. Liquidity

OneMove needs to improve its liquidity position by paying off short term debts. To date, there is no identifiable accounting policy that directs the management of OneMove on the terms of repayment, but possibly the Board of Directors could use the current and quick ratios compared to the industry standard to help determine the need for an accounting policy in this regard. The company manages its liquidity risk by forecasting the future cash flow and anticipating the investing and financing activities. As compared to 2009, the company has increased its amount of cash significantly (2009 - $53,088; 2010 - $147,723) in 2010. As compared to 2009, OneMove has dramatically reduced its current liabilities in 2010 (Please see Liabilities section for details), which leads to a significant improvement in liquidity. Liabilities In 2010, OneMove has effectively reduced the currently liabilities from $799,629 to $409,814 in 2010 with the help of reduction in accounts payable and accrued liabilities and repayment of a short term bridge loan financed in 2009. OneMove has an increased customer deposits from $119,584 to $155,618, however, as OneMove will likely continue its business and offer the services to the customers, customer deposits will likely become revenue eventually. In the previous years (2006-2009), OneMove received $455,201 contributions from Canadas Industrial Research Assistance Program (IRAP). The repayment will begin in Oct 2011 at a rate of 6.25% of gross revenues, payable quarterly until July 2016 (Note 8, CFS 2010). As a result of this, starting from Oct 2011, OneMove will have a repayment expense as to IRAP contributions, which will create a burden to the companys cash flow. Capital Asset and Amortization OneMove uses declining balance method for charging amortization on equipment and straight line method for charging amortization on application software. Management has estimated that useful life of application software is 3 years, and from time to time reviews long tern assets for impairment whenever circumstances suggest that carrying amount is not recoverable. The value of equipment is recorded at cost less accumulated amortization. Amortization is provided for annually at 30% on computer equipment and at 100% on computer software. OneMove could relax its amortization rates to improve net income. If

not possible they should analyze if it is feasible to invest so much money in purchase of intangible assets which will last for 3 years only and is their investment adding value to the organization. For software technology also, the timeline of 3 years could be re-evaluated. Income Taxes In 2008-2010, OneMove paid $0 for income taxes due to loss before income taxes.

Conclusion

Although financial statement analysis is highly useful in understanding the financial statements of a company, it has various limitations. Various challenges are faced while comparison of data with that of the industry data and the competitor companies. While comparing the data with the competitor companies, the use of different accounting methods and policies make it difficult to compare the data. Moreover, while making comparisons with the industry data also there is little or no clarity about the kind of accounting policies used by the companies taken into account for compilation of the industry data, standard account classifications used for the industry averages, and etcetera.Furthermore, while analyzing a company in addition to the ratio analysis and the accounting policy evaluation of the company, various other sources of data should be analyzed. It can be said that company is not doing well as its cumulative losses are increasing every year. It is not able to provide any return to its investors which is one of the reasons that its stocks are currently selling at CAD $0.075 down from a price of CAD $0.15 in 2007 in stock market TSXV. It means that there is a drop of 50% which implies that investors are losing faith in the company. All the ratios show that company is not performing well. They need to increase their customer base which they are doing but more effort is needed. They have to change their compensation as company is giving too much money in bonuses & salaries. APPENDIX:

1. Audited financial statements 2010 of OneMove Technologies 2. Audited financial statements 2009 of OneMove Technologies 10

3. Audited financial statements 2008 of OneMove Technologies

4. Vertical analysis of 2010 income statement of OneMove Technologies 5. Horizontal analysis of 2010 income statement of OneMove Technologies 6. Vertical analysis of 2010 balance sheet of OneMove Technologies 7. Horizontal analysis of 2010 balance sheet of OneMove Technologies

8. SME Benchmarking report

11

4. Vertical Analysis of 2010 Income Statement of OneMove Technologies: Particulars Transaction Fees Other Revenue Total Sales Expenses: Advertising Amortization of equipment Amortization of intangible asset Commission and fees Compensatory shares Consulting fees Corporate/investor communications and filling fees Credit card charges Insurance Interest and financing charges Office and general Professional fees Rent and utilities Stock-based compensation Salaries and wages Telephone Travel Total Expenses Loss before other items Other Items: Other income Uncollectible deposit Foreign exchange gain(loss) Gain on disposal of OneMove UK Loss and comprehensive loss from continuing operations 2010 95 5 100 0.4 4.7 8.5 0 0 6.3 7.1 1.7 2 3 8.8 6 5.7 6.7 46.7 1.8 2.6 111.9 (11.9 ) 0 0 0.1 0 0.1 2009 94.7 5.3 100 0.6 7.5 0 19.6 0 6.6 13.9 0.8 2.6 3.1 9.8 11.1 8.2 12.4 58.1 2.3 2.3 159 (59) 0.2 (9.7) (0.7) 0 (10.2 ) (69.2 ) 0 (69.2 ) 2008 88 12 100 0.7 7.2 0.7 24.5 1.7 3.5 10 0.4 3 2.5 11.1 8.7 7.3 5.1 96.4 2.8 10.9 196.4 (96.4) 3.7 0 (23.5) 32.5 12.7 (83.7) (104.9) (188.6)

(11.8 ) Loss and comprehensive loss from discontinued operations 0 Loss and comprehensive loss for the year (11.8 )

12

5. Horizontal Analysis of 2010 Income Statement of OneMove Technologies: Particulars Transaction Fees Other Revenue Total Sales 2010 141. 5 54.7 131. 2009 99.3 41.3 92.4 2008 100 100 100 13

1 Expenses: Advertising Amortization of equipment Amortization of intangible asset Commission and fees Compensatory shares Consulting fees Corporate/investor communications and filling fees Credit card charges Insurance Interest and financing charges Office and general Professional fees Rent and utilities Stock-based compensation Salaries and wages Telephone Travel Total Expenses Loss before other items Other Items: Other income Uncollectible deposit Foreign exchange gain(loss) Gain on disposal of OneMove UK 90.4 85.2 1694 0 0 238. 2 93.3 520. 3 87.1 154. 7 103. 2 90.2 102. 1 173. 1 63.5 84.2 31.3 74.7 16.2 0 N/A 0.4 0 0.7 82 96.1 0 73.9 0 177.4 128.7 169.3 81.7 113.6 81.1 118.3 103.9 227.2 55.7 74.3 19.3 74.8 56.6 5 N/A 2.6 0 (74.2 ) 76.3 0 33.9 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100 100

Loss and comprehensive loss from continuing operations 18.5 Loss and comprehensive loss from discontinued operations 0 Loss and comprehensive loss for the year 8.2

14

6. Vertical Analysis of 2010 Balance Sheet of OneMove Technologies: Particulars Assets Current Cash Receivables Prepaid Expenses Total Current Assets Advances Equipment Intangible Assets Long term deposits Total Assets Liabilities and Shareholders Equity Current Accounts Payable and accrued liabilities Customer deposits Deferred revenue Current portion of capital lease obligations Loans payable Total Current Liabilities Capital lease obligations Total Liabilities Shareholders equity Capital stock Contributed surplus Share subscriptions received Share subscriptions receivable Deficit Total Shareholders Equity Total liabilities and shareholders equity 2010 2009 2008

12.1 0.6 1.5 14.1 3 20 60.3 2.5 100

5.8 0 1.8 7.7 4.3 25.9 58.2 3.9 100

22.1 4.2 2.1 28.4 0 38.4 0 33.1 100

18.8 12.7 0 2 0 33.5 0 33.5 1475.1 296.9 0 (3.7) (1701.9 ) 66.5 100

51.9 13.1 3.3 10.3 9.1 87.7 2.2 89.9

10.8 0 3.4 10.7 0 24.9 13.5 38.4

1892.2 1900.1 380.7 373.8 0 12.2 (5.3) 0 (2257.5 ) (2224.5) 10.1 61.6 100 100

15

7. Horizontal Analysis of 2010 Balance Sheet of OneMove Technologies: Particulars Assets Current Cash Receivables Prepaid Expenses Total Current Assets Advances Equipment Intangible Assets Long term deposits Total Assets Liabilities and Shareholders Equity Current Accounts Payable and accrued liabilities Customer deposits Deferred revenue Current portion of capital lease obligations Loans payable Total Current Liabilities Capital lease obligations Total Liabilities Shareholders equity Capital stock 2010 2009 2008

76.2 27.4 18.5 1 97.2 88.4 69.2 28.1 N/A N/A 72.6 69.9 N/A N/A 10.5 12.2 139. 103. 4 8

100 100 100 100 100 100 100 100 100

243. 500. 3 6 N/A N/A 0 100 25.8 99.6 N/A N/A 187. 365. 3 5 0 16.6 121. 243. 6 2

100 100 100 100 100 100 100 100 100 100 100 100 100 100 100

108. 103. 2 4 110. 105. Contributed surplus 7 7 Share subscriptions received 0 0 Share subscriptions receivable N/A N/A 106. 105. Deficit 7 4 150. Total Shareholders Equity 5 17 139. 103. Total liabilities and shareholders equity 4 8

16

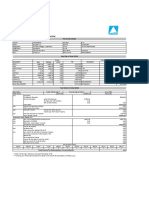

8. SME Benchmarking Report:

17

Industry Canada | Industrie Canada Government of Canada | Gouvernement du Canada Whole Industr y (Reliab ility) Number of Businesses Revenue Range: Low Value ($ 000) High Value ($ 000) REVENUES AND EXPENSES Total revenue Sales of goods and services All other revenues Cost of sales (direct expenses) Wages and benefits Purchases, materials and sub-contracts Opening Inventory Closing inventory Operating expenses (indirect expenses) Labour and commissions Amortization and depletion Repairs and maintenance Utilities and telephone/telecommunic ation Rent Interest and bank charges Professional and business fees Advertising and promotion Delivery, shipping and warehouse expenses Insurance Other expenses Total expenses Net profit/loss BALANCE SHEET Total assets Total current assets Accounts receivable Closing inventory Other current assets Net fixed assets 125 30 5000 (percen tage of revenu e) 100.00 96.90 3.10 17.00 4.90 13.50 1.70 3.10 93.50 35.40 4.40 0.60 3.30 4.90 0.30 7.10 12.00 0.10 0.60 24.90 110.50 -10.50 (thousa nds of dollars) 329.50 158.80 48.40 11.80 98.60 67.40 30 171 171 5000 30 88 88 171 171 424 424 5000 Lower Half (50%) Upper Half (50%) Botto m Quarti le (25%) Lower Middle (25%) Upper Middle (25%) Top Quarti le (25%) Percent of Busine sses Reporti ng

100.00 94.20 5.80 8.90 3.10 7.20 0.40 1.80 92.40 28.60 5.50 1.30 6.30 4.50 1.30 10.50 8.30 0.30 0.60 25.10 101.30 -1.30

100.00 97.20 2.80 18.00 5.10 14.30 1.90 3.30 93.70 36.20 4.30 0.50 2.90 4.90 0.10 6.60 12.40 0.10 0.60 24.90 111.60 -11.60

100.00 97.30 2.70 10.30 5.20 5.10 0.90 0.90 76.30 22.30 4.90 1.60 6.00 5.30 0.00 11.90 4.30 0.30 0.20 19.40 86.50 13.50

100.00 92.90 7.10 8.30 2.10 8.20 0.20 2.20 99.40 31.40 5.80 1.20 6.50 4.20 1.90 9.80 10.10 0.20 0.70 27.60 107.70 -7.70

100.00 95.80 4.20 23.20 2.30 20.90 0.10 0.10 79.00 28.80 1.90 0.60 3.60 6.00 0.20 11.40 4.00 0.00 1.60 20.80 102.30 -2.30

100.00 97.50 2.50 16.70 5.70 12.70 2.30 4.00 97.10 38.00 4.80 0.50 2.80 4.70 0.10 5.50 14.40 0.10 0.30 25.90 113.80 -13.80

100.00 99.20 43.20 44.00 17.60 43.20 11.20 12.80 100.00 75.20 85.60 35.20 89.60 65.60 59.20 90.40 78.40 14.40 37.60 97.60 100.00 100.00

149.80 56.60 7.20 1.40 47.90 57.10

509.20 261.10 89.70 22.10 149.20 77.80

59.60 26.60 2.20 0.30 24.10 20.30

240.00 86.50 12.20 2.50 71.80 93.80

337.70 114.50 30.10 0.00 84.40 33.00

680.70 407.70 149.40 44.30 214.10 122.60

18

Source: http://www.ic.gc.ca/eic/site/pp-pp.nsf/eng/home

19

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LIC policy renewal receiptDocument1 pageLIC policy renewal receiptNitin GuptaNo ratings yet

- Cocolife Cancellation LetterDocument1 pageCocolife Cancellation LetterIanRoseAcelajadoAderes50% (2)

- Bad Debts, Doubtful Debts and Provision For Doubtful Debts-NotesDocument1 pageBad Debts, Doubtful Debts and Provision For Doubtful Debts-Notescutipig0% (1)

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Document2 pagesChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNo ratings yet

- Chapter 17 Audit of Cash Balances: Auditing, 14e (Arens)Document22 pagesChapter 17 Audit of Cash Balances: Auditing, 14e (Arens)boerd77No ratings yet

- Module No. 2 Week 2 Acctg. For Business CombinationDocument3 pagesModule No. 2 Week 2 Acctg. For Business CombinationJayaAntolinAyusteNo ratings yet

- Hertz Vehicle Financing II, 9.30.2015 PDFDocument339 pagesHertz Vehicle Financing II, 9.30.2015 PDFaweinerNo ratings yet

- Accounting For Managers Chapter 5 ReviewDocument42 pagesAccounting For Managers Chapter 5 ReviewHerbert B. Bañas IVNo ratings yet

- Philconsa Vs Enriquez: FactsDocument2 pagesPhilconsa Vs Enriquez: FactsvictorNo ratings yet

- Palileo V CosioDocument3 pagesPalileo V CosioRvic CivrNo ratings yet

- Application of E-Commerce in BankingDocument14 pagesApplication of E-Commerce in Bankingswetanim86% (7)

- Polycab Final ReportDocument97 pagesPolycab Final ReportAnjali PandeNo ratings yet

- Governmental and Not-For-profit Accounting 5th Chapter 2 SolutionDocument28 pagesGovernmental and Not-For-profit Accounting 5th Chapter 2 SolutionCathy Gu75% (8)

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- Book Keeping and Accounts Past Paper Series 2 2014Document12 pagesBook Keeping and Accounts Past Paper Series 2 2014cheah_chinNo ratings yet

- Special and technical Knowledge 25% Day 1 CoverageDocument2 pagesSpecial and technical Knowledge 25% Day 1 CoverageJoshua ArmestoNo ratings yet

- Government of India memorandum on tax assistant recruitment preferencesDocument2 pagesGovernment of India memorandum on tax assistant recruitment preferencespranjali shindeNo ratings yet

- FBDC VS CirDocument13 pagesFBDC VS CirRene ValentosNo ratings yet

- Contract For LoveDocument4 pagesContract For Lovelindy6614444No ratings yet

- Philippines: Senate Bill No. 1896 - Universal Health Care ActDocument51 pagesPhilippines: Senate Bill No. 1896 - Universal Health Care ActAlbert Domingo100% (3)

- FinancialLiteracy QuestionnaireDocument4 pagesFinancialLiteracy QuestionnaireRupesh PatekarNo ratings yet

- Form5 PTDocument2 pagesForm5 PTShilpa KapoorNo ratings yet

- Notice of Dispute and Demand for ValidationDocument6 pagesNotice of Dispute and Demand for ValidationNat Williams97% (29)

- Financial Advice in The Midst of Crisis - by John Francis Lee Hok, MD, MBA PDFDocument10 pagesFinancial Advice in The Midst of Crisis - by John Francis Lee Hok, MD, MBA PDFElaine June FielNo ratings yet

- CV Loan AgreementDocument17 pagesCV Loan AgreementankitNo ratings yet

- Fundamentals of Accounting Business and Management 2: Last Name Given Name M.I. Grade & Section Score DateDocument3 pagesFundamentals of Accounting Business and Management 2: Last Name Given Name M.I. Grade & Section Score DateCherann agumboy100% (1)

- MOA-Car Sale With Assumption (For Scribd)Document3 pagesMOA-Car Sale With Assumption (For Scribd)Danya T. Reyes66% (67)

- Worldcom ScandalDocument3 pagesWorldcom ScandalMark Jayson Gonzaga CerezoNo ratings yet

- Cummins Case Study by Application of Six SigmaDocument4 pagesCummins Case Study by Application of Six Sigmananno guptaNo ratings yet

- PT Saraswati Griya Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Saraswati Griya Lestari TBK.: Summary of Financial StatementMaradewiNo ratings yet