Professional Documents

Culture Documents

Alrpr6574n Itr V

Uploaded by

anon-511097Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alrpr6574n Itr V

Uploaded by

anon-511097Copyright:

Available Formats

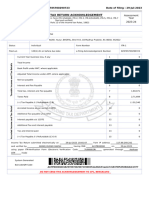

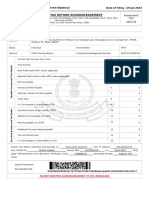

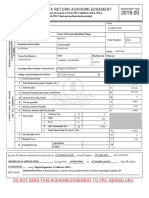

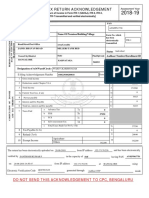

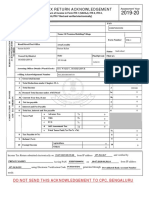

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM

[Where the data of the Return of Income/Fringe Benefits in Form ITR-1, ITR-2, ITR-3,

ITR-V 2008-09

ITR-4, ITR-5, ITR-6 & ITR-8 transmitted electronically without digital signature]

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

PERSONAL INFORMATION AND THE

MD JAMILUR RAHMAN

ALRPR6574N

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village Form No. which

TRANSMISSION

VILL- NALRANGA has been

electronically ITR-4

Road/Street/Post Office Area/Locality transmitted (fill

GAYA the code)

Status (fill the

code) INDL

Town/City/District State Pin

Designation of Assessing Officer

GAYA

BIHAR 823001

NEW ITO WARD 3(1),GAYA

E-filing Acknowledgement Number 48895050081108 Date(DD/MM/YYYY) 08-11-2008

1 Gross total income 1 25739

2 Deductions under Chapter-VI-A 2 0

3 Total Income 3 25740

a Current Year loss, if any 3a 0

COMPUTATION OF INCOME

4 Net tax payable 4 0

AND TAX THEREON

5 Interest payable 5 0

6 Total tax and interest payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 4380

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 4380

8 Tax Payable (6-7d) 8 0

9 Refund (7e-6) 9 4380

10 Value of Fringe Benefits 10

BENEFITS AND TAX THEREON

COMPUTATION OF FRINGE

11 Total fringe benefit tax liability 11

12 Total interest payable 12

13 Total tax and interest payable 13

14 Taxes Paid

a Advance Tax 14a

b Self Assessment Tax 14b

c Total Taxes Paid (14a+14b) 14c

15 Tax Payable (13-14c) 15

16 Refund 16

VERIFICATION

I, MD JAMILUR RHMAN (full name in block letters), son/ daughter of KHALILUR MD RAHMAN

solemnly declare to the best of my of solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules

thereto which have been transmitted electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount

of total income/ fringe benefits and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act,

1961, in respect of income and fringe benefits chargeable to income-tax for the previous year relevant to the assessment year 2008-09. I further declare

that I am making this return in my capacity as authorized signatory and I am also competent to make this return and verify it.

Sign here Date 12-10-2008 Place GAYA

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No

Date

Seal and signature of

receiving official ALRPR6574N448895050081108AB52799FB15F51D4894C168030CBCE1BBA0CA3D1

You might also like

- Mercedes BenzDocument56 pagesMercedes BenzRoland Joldis100% (1)

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBiju DivakaranNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- 829785700290723-Manoj BakshDocument1 page829785700290723-Manoj BakshArchana BakshNo ratings yet

- Rounded Scoodie Bobwilson123 PDFDocument3 pagesRounded Scoodie Bobwilson123 PDFStefania MoldoveanuNo ratings yet

- Change Management in British AirwaysDocument18 pagesChange Management in British AirwaysFauzan Azhary WachidNo ratings yet

- Polyol polyether+NCO Isupur PDFDocument27 pagesPolyol polyether+NCO Isupur PDFswapon kumar shillNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

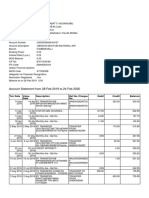

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument43 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancetawhide_islamicNo ratings yet

- SB Account Statement SummaryDocument15 pagesSB Account Statement SummaryMandalabatti noorasabuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurupaappaapNo ratings yet

- Printed by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pagePrinted by SYSUSER: Dial Toll Free 1912 For Bill & Supply ComplaintsGopal KaushikNo ratings yet

- Non Circumvention Non Disclosure Agreement (TERENCE) SGDocument7 pagesNon Circumvention Non Disclosure Agreement (TERENCE) SGLin ChrisNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- Unit 1 - Gear Manufacturing ProcessDocument54 pagesUnit 1 - Gear Manufacturing ProcessAkash DivateNo ratings yet

- Quater 1Document3 pagesQuater 1सर्व ब्राह्मण समाज संगठनNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Review your bank statement onlineDocument3 pagesReview your bank statement onlineSam BabuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahesh JadhavNo ratings yet

- ITR Form AY 21-22Document96 pagesITR Form AY 21-22Anurag Kumar ReloadedNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- PDF 441907670270322Document1 pagePDF 441907670270322shryeasNo ratings yet

- PrintApplication PDFDocument1 pagePrintApplication PDFAmbarish BadigerNo ratings yet

- AccountStatement 3988538125 Jul25 134513Document8 pagesAccountStatement 3988538125 Jul25 134513ANURAGNo ratings yet

- Indian Income Tax Return Acknowledgement FormDocument1 pageIndian Income Tax Return Acknowledgement FormRahulMahajanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearPrateeksha SharmaNo ratings yet

- RPT CPSPM 6816030 21848Document8 pagesRPT CPSPM 6816030 21848Poornima AcharyaNo ratings yet

- RPT CPSPM 12321640 25753 PDFDocument6 pagesRPT CPSPM 12321640 25753 PDFsandeep pinnintiNo ratings yet

- ITR-1 Filing AcknowledgementDocument1 pageITR-1 Filing AcknowledgementRavi KumarNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementNANDAN SALESNo ratings yet

- Manage savings account balance onlineDocument4 pagesManage savings account balance onlineMahesh Kumar K BNo ratings yet

- Aman Verma Bank StatementDocument4 pagesAman Verma Bank StatementAman VermaNo ratings yet

- DLP in Health 4Document15 pagesDLP in Health 4Nina Claire Bustamante100% (1)

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKrishna KumarNo ratings yet

- PDFDocument33 pagesPDFSriram KrishnanNo ratings yet

- Ack 137988180310723Document1 pageAck 137988180310723Lakesh kumar padhyNo ratings yet

- Account StatementDocument5 pagesAccount StatementBhagyavanti BNo ratings yet

- Ashok S R 2021-22 AckDocument1 pageAshok S R 2021-22 AckSHIFAZ SULAIMANNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAmit SharmaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBalajiNo ratings yet

- Statement of Account: State Bank of IndiaDocument7 pagesStatement of Account: State Bank of Indiavishal sahaneNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurujasvir singhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagesamaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearshyam krishnaNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Tax Return Summary for Mr. Bidhan MukherjeeDocument6 pagesTax Return Summary for Mr. Bidhan MukherjeeBIDHANNo ratings yet

- Bank Pass BookDocument3 pagesBank Pass Booksvignesh singhNo ratings yet

- PDFDocument12 pagesPDFDyna JoseNo ratings yet

- '400072'-Vijay ChavanDocument1 page'400072'-Vijay ChavanrdrupnawarNo ratings yet

- Itr-3 IsrarDocument42 pagesItr-3 IsrarNEELAM SHARMANo ratings yet

- Statement - XXXX XXXX 0166 - 16jan2024 - 11 - 44Document4 pagesStatement - XXXX XXXX 0166 - 16jan2024 - 11 - 44Praveen SainiNo ratings yet

- High School 10th Marksheet - Rohit SagarDocument1 pageHigh School 10th Marksheet - Rohit SagarRohit SagarNo ratings yet

- Renewal Premium ReceiptDocument1 pageRenewal Premium ReceiptRakesh KumarNo ratings yet

- Detailed bank statement for Mahendran PDocument3 pagesDetailed bank statement for Mahendran Pkarthick rajuNo ratings yet

- Procap Financial Services Pvt. LTDDocument9 pagesProcap Financial Services Pvt. LTDDekrouf SysNo ratings yet

- Folio 7775960443 AllMonthsDocument2 pagesFolio 7775960443 AllMonthsPravin AwalkondeNo ratings yet

- Bank statement summary for Rayudu PeyyalaDocument12 pagesBank statement summary for Rayudu PeyyalaDr V SaptagiriNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Xen Operation DPHNo ratings yet

- Bhavini Jogi AC Statment 2Document1 pageBhavini Jogi AC Statment 2Ravi PurohitNo ratings yet

- 1571988702732Document33 pages1571988702732LS GUPTANo ratings yet

- 2014-15 Form 16Document4 pages2014-15 Form 16om shanker soniNo ratings yet

- Account - STMT Jan To CurrentDocument10 pagesAccount - STMT Jan To Currentarunghodke12No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDattatraya JoshiNo ratings yet

- Statement Oct 20 Rama KrishnaDocument3 pagesStatement Oct 20 Rama KrishnaPhaniNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusumitNo ratings yet

- تاااتتاااDocument14 pagesتاااتتاااMegdam Sameeh TarawnehNo ratings yet

- всё необходимое для изучения английского языкаDocument9 pagesвсё необходимое для изучения английского языкаNikita Chernyak100% (1)

- India Today 11-02-2019 PDFDocument85 pagesIndia Today 11-02-2019 PDFGNo ratings yet

- Clark DietrichDocument110 pagesClark Dietrichikirby77No ratings yet

- Radio Frequency Transmitter Type 1: System OperationDocument2 pagesRadio Frequency Transmitter Type 1: System OperationAnonymous qjoKrp0oNo ratings yet

- Accomplishment Report 2021-2022Document45 pagesAccomplishment Report 2021-2022Emmanuel Ivan GarganeraNo ratings yet

- Ancient Greek Divination by Birthmarks and MolesDocument8 pagesAncient Greek Divination by Birthmarks and MolessheaniNo ratings yet

- Unit-1: Introduction: Question BankDocument12 pagesUnit-1: Introduction: Question BankAmit BharadwajNo ratings yet

- ERP Complete Cycle of ERP From Order To DispatchDocument316 pagesERP Complete Cycle of ERP From Order To DispatchgynxNo ratings yet

- Attributes and DialogsDocument29 pagesAttributes and DialogsErdenegombo MunkhbaatarNo ratings yet

- JurnalDocument9 pagesJurnalClarisa Noveria Erika PutriNo ratings yet

- Passenger E-Ticket: Booking DetailsDocument1 pagePassenger E-Ticket: Booking Detailsvarun.agarwalNo ratings yet

- Memo Roll Out Workplace and Monitoring Apps Monitoring Apps 1Document6 pagesMemo Roll Out Workplace and Monitoring Apps Monitoring Apps 1MigaeaNo ratings yet

- Java development user guide eclipse tutorialDocument322 pagesJava development user guide eclipse tutorialVivek ParmarNo ratings yet

- AATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsDocument3 pagesAATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsAdrian CNo ratings yet

- #### # ## E232 0010 Qba - 0Document9 pages#### # ## E232 0010 Qba - 0MARCONo ratings yet

- Controle de Abastecimento e ManutençãoDocument409 pagesControle de Abastecimento e ManutençãoHAROLDO LAGE VIEIRANo ratings yet

- Manual Analizador Fluoruro HachDocument92 pagesManual Analizador Fluoruro HachAitor de IsusiNo ratings yet

- Bluetooth TutorialDocument349 pagesBluetooth Tutorialjohn bougsNo ratings yet

- Towards A Human Resource Development Ontology Combining Competence Management and Technology-Enhanced Workplace LearningDocument21 pagesTowards A Human Resource Development Ontology Combining Competence Management and Technology-Enhanced Workplace LearningTommy SiddiqNo ratings yet

- House Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Document4 pagesHouse Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Raphael Eyitayor TyNo ratings yet

- Guiding Childrens Social Development and Learning 8th Edition Kostelnik Test BankDocument16 pagesGuiding Childrens Social Development and Learning 8th Edition Kostelnik Test Bankoglepogy5kobgk100% (29)

- 4 Wheel ThunderDocument9 pages4 Wheel ThunderOlga Lucia Zapata SavaresseNo ratings yet