Professional Documents

Culture Documents

Advance Tax Planning and Fiscal Policy Nov 07

Uploaded by

DRTIMOREOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advance Tax Planning and Fiscal Policy Nov 07

Uploaded by

DRTIMORECopyright:

Available Formats

QUESTION 1 Nii Moi Brown has been in business since 1985. He prepares accounts to 30 th September every year.

Nii Moi has a factory at Suhum; he manufactures traveling bags. The business is good and he wanted to expand it but could not get assistance from the banks. His friend Kwei Kuma who has returned from U. K. after 15 years stay decided to join him as an equal partner. Kwei Kuma introduced additional capital of GH50,000. The residual values of business assets at the end of 30th September, 2002 were as follows: Class 4 = GH1,500 Class 2 = GH25,000

Kwei Kuma joined from 1st October, 2002. They continued to maintain the same accounting date. The following new assets were purchased. (a) (b) (c) 10 new industrial machines costing GH25,000 were purchased on 1st December, 2002 2 delivery vans costing GH10,000 were purchased on 1st July, 2003 New furniture and fittings costing GH5,000 was purchased on 1st September 2003

The following profits were declared: Year to 30th September, 2003 Year to 30th September, 2004 Year to 30th September, 2005 Required: Find the chargeable income of each partner for all years (2003 2005) (20 marks) = = = GH39,300 GH43,640 GH89,652

QUESTION 2 Atta Nyamekye was a prosperous Kwahu businessman based in Accra. He put up several buildings in Adabraka and Asylum Down. On his death, he bequeathed one of his properties to his son-inlaw, Gilly Morgan. The house which was built in 2001 cost GH10,500.

Mr. Morgan rented the property to Sombrello Restaurant in Adabraka with effect from 1st January, 2002. The annual rent was GH12,000 for the first 3 years. At the end of the 3 year expiry period Sombrello Restaurant negotiated and purchased the building for GH50,000. According to the terms of sale, Sombrello agreed to pay 50% of the price, whilst the remaining 50% was used as purchase price of shares in Sombrello Restaurant. In July 2006 Gilly Morgan sold all his shares in the company on the Ghana Stock Exchange. (The company is listed on the Stock Exchange). He made a profit of GH10,000 which he disbursed as follows: (a) (b) (c) (d) (e) (f) Ghana National Trust Fund His wife His mother His friend Joe His driver His Church (Tithe) = = = = = = GH500 GH2,500 GH2,500 GH1,000 GH500 GH1,000

Meanwhile, before he sold the shares he received annual net dividend of GH45. He used the balance of GH2,000 to stake Last Chance Raffle. Luckily he won ten times that amount. Required: Find all tax implications in this case. Give reasons for your decisions. (20 marks)

QUESTION 3 Tax planning, tax avoidance and tax evasion are all geared at minimizing the quantum of tax to be paid or not paying anything at all. Required: Comment on the statement, stating the form and effect of tax planning, tax avoidance and tax evasion. (20 marks)

QUESTION 4 Discuss the principles regarding the assessment of employment income. You may consider the following: (a) (b) When does employment arise? How are other benefits, apart from salaries and wages, but excluding accommodation and transport treated? Which lump sum payments are taxable and which are not? What is the rationale? (20 marks) QUESTION 5 The accounts of Silver and Gold Mining Company Limited for the year ended 30th September, 2003 show the following details: GH Gross Profit B/F Rent Receivable Dividends Less Expenses: Directors Fees Salaries and Wages Repairs and maintenance Subscriptions and donations Utilities Audit Fees Legal Expenses Registration and Licensing Rent Depreciation Traveling and Transport Net Profit GH 3,354,068 80,000 44,000 3,478,068

(c)

16,000 640,000 260,800 48,500 1,420 500 1,100 400 6,300 124,000 39,320 2,339,728 3,478,068

________ 3,478,068

Notes to the Accounts 1. Repairs and Maintenance: This includes, (a) (b) (c) 2. Repairs on a secondhand excavator purchased for use in the business (GH3,200). General repairs of all plant and machinery (GH130,000). Loss on sale of obsolete plant and machinery (GH27,600).

Subscriptions and Donations: (a) Scholarship awards to needy but brilliant children from the area of operations (GH10,000). (b) (c) KVIP facility for townsfolk (GH15,000). Donation towards the celebration of Sasako festival of the people of the area (GH2,000). Christmas gifts to the chief and his elders (GH1,500).

(d) 3.

Legal Expenses This was in defence of a charge of assault levelled against a security officer of the company.

4.

Travelling and Transport (a) (b) Overseas travelling expenses for Kofi Adjetey, the Chief Accountant and his family while attending a seminar on mining operations in South Africa (GH13,800). Passage expenses for John Dean, an expatriate, on termination of his employment. (GH5,520)

5.

Capital allowance for the year amounted to GH278,928 and unutilized capital allowance brought forward also amounted to GH40,000. Loss brought forward was GH210,000.

6.

Required: Determine the year of assessment and compute the chargeable income. (20 marks)

SOLUTION: ADVANCE TAXATION PLANNING AND FISCAL POLICY, NOV 2007 QUESTION 1 CAPITAL ALLOWANCES 2003 1/10/02 30/9/03 Residue b/d Additions Total C.A. Residue c/f 2004 1/10/03 - 30/9/04 Residue b/d C.A. Residue c/f 2005 1/10/04 - 30/9/05 Residue b/d C.A. Class 2 (30%) 250,000,000 350,000,000 600,000,000 180,000,000 420,000,000 Class 4 (20%) Total 15,000,000 50,000,000 65,000,000 13,000,000 193,000,000 52,000,000

420,000,000 126,000,000 294,000,000

52,000,000 10,400,000 41,600,000

136,400,000

294,000,000 88,200,000 205,800,000 ASSESSMENTS

41,600,000 8,320,000 33,280,000

96,520,000

2003 1/10/02 - 30/9/03 Income Less CA CI Each Partners Share 2004 1/10/03 - 30/9/04 Income Less CA CI Each Partners Share 2005 1/10/04 - 30/9/05 Income Less CA CI Each Partners Share = = = = = = = = = = = =

393,000,000 193,000,000 200,000,000 100,000,000 GH10,000 436,400,000 136,400,000 300,000,000 150,000,000 GH15,000 896,520,000 96,520,000 800,000,000 400,000,000 GH40,000 5

QUESTION 2 1. 2. 3. The building was inherited under a Will. There is therefore no Gift Tax applicable. The rent of 120,000,000 a year is subject to rent tax for the three years at the rate of 10% a year. The sale of the building will result in Capital Gains Tax as follows: Realised sun Cost Base Capital Gain Tax @ 10% 4. 5. = = = = 500,000,000 Nil 500,000,000 50,000,000

Sale of shares on Ghana Stock Exchange is exempt from Capital Gains Tax for the time being. The disbursement of the profit of 100,000,000 will result in Gift Tax in some cases. (a) (b) (c) (d) (e) (f) G.N.T.F Tithe to church Gift to wife Gift to mother Gift to friend, Joe Gift to driver = = = = = = No Tax (Exempt) No Tax (Exempt) No Tax (Exempt) No Tax (Exempt) No Tax (Exempt) No Tax (Exempt)

6.

Win on Last Chance Raffle is not taxable. It is a game of change.

QUESTION 3 1. Tax Planning The main essence of tax planning is to take advantage of all available tax incentives to pay just the minimum amount of tax due. As the name implies it should be a well thought out plan giving due consideration to the whole spectrum of the tax laws and the economy generally. It should start from the point of selecting the type of business to be undertaken. It should be noted that nothing illegal or nothing that does not make business sense is included in the plan. Some considerations to be made are:i. ii. iii. iv. how much capital is available? what type of venture is to be undertaken? what are the tax incentives, reliefs, exemptions etc available? is it going to be a sole-proprietorship, partnership or limited liability company?

When the business is finally selected and established, there will be need for:i. ii. iii. iv. good record keeping, a thorough grasp or knowledge of the tax laws so as to be able to take full advantage of tax incentives available for the business, a sound commercial judgement is also necessary in decision making submission of returns and tax payments on due dates will obviate the imposition of penalties. Tax planning is therefore essential in putting the business on a sound footing right from commencement and keeping it on track whilst taking advantage of all reliefs and incentives to pay just the right amount due. 2. Tax Avoidance Tax avoidance is synonymous to tax planning in the sense that it also takes advantage of the provisions of the tax laws to pay the minimum of tax. Secondly, it does not involve itself in any thing illegal. Tax avoidance schemes operate by finding loopholes in the tax laws and using them to pay the minimum of tax or not paying anything at all. It therefore requires a comprehensive knowledge of the tax laws to determine what exemptions, reliefs and other incentives are avoidable to take advantage of them.

3.

Tax Evasion Tax evasion, unlike tax planning and tax avoidance is illegal. It involves a deliberate act of: i. ii. iii. iv. Failure to declare and under declarations; Submitting false statements and returns; Keeping one set of books containing false entries for the revenue authorities and another with the actual business operations for himself; and Any other fraudulent act or means of deliberately dodging or minimizing payment of tax on ones income.

It is a crime against the state and therefore any person who aids or abets is also guilty and punishable under the tax laws.

QUESTION 4

a)

Employment arises when there is a contract of service. In other words when a master servant relationship has been established between two parties. The employer engages the services of the employee for an agreed amount under certain conditions. The employer can dismiss the employee when he does not meet the terms of the contract; alternatively, the employee can sue the employer if he also fails to meet his part of the bargain. The employer provides the tools for the work and in some cases, but not always, directs the employee as to how the work should be done. At the end of the day, the employer reaps all profits or bears all losses. The employee is just entitled to his wages.

b)

Benefits attached to the office of employment are called perquisites. If they form part of the conditions of service, they are taxable. Sometimes, they are not specifically spelt out but over the years have become customary or traditional; such benefits are taxable. Some examples are the following i. Imprests: Some grades of officers are given some allowances for the entertainment of guest or clients. If such amounts are accountable then they are tax exempt; otherwise they are taxable.

ii.

Some companies give their products for free or at reduced price to their employees. Such packages are benefits in kind and must be assessed at the market value; that is what the receiver will get on selling the item. In some cases employees negotiate for tax-free salaries. In which case the employer bears the tax element. This is not accepted for tax purposes, and the Tax Authorities have a mechanism to work out the gross amount and levy the appropriate tax. Other benefits such as payment of school fees or other liabilities of the employee are assessed by the employee. If there is a scholarship for children of the employee which is available to all on competitive bases, then such benefits are not assessable to tax.

iii.

iv.

v.

Quite often employees are given loans for various purposes. Strictly speaking such loans should attract interest at the prevailing bank rate as it is a benefit and must be assessed to tax. This also applies to company shares which are sold to employees at reduced rates.

Lamp sum payment Certain lump sums are exempt from tax e.g. pension, severance pay, gratuities under Act 592. Normally the conditions of service will provide a clue as to whether the lump sum is taxable or not. If the payment can be as a result of services rendered (except those exempt) then it is taxable. Compensation in lieu of notice is taxable, whereas compensation paid for loss of office is not taxable. Long service awards, generally are taxable because it is as a result of services rendered. However if it is for exceptional performance or a testimonial which is out of the blues, then it is tax exempt.

QUESTION 5 YEAR OF ASSESSMENT - 2003 Net profit as per a/cs Less: Rent receivable Dividends Add Back Depreciation Repairs and Maintenance Subs. and Donations Legal Expenses Travelling and Transport Less: Loss B/f Adjusted Profit Less: Capital Allowance B/f Capital (Current) Chargeable Income (Mining) Add Rent Income Gross 30% std. Allowance Total Chargeable Income 80,000 24,000 56,000 1,916,000 40,000 278,928 318,928 1,860,000 124,000 30,800 3,500 1,100 13,800 173,200 2,388,928 210,000 2,178,928 80,000 44,000 124,000 2,215,728 2,339,728

10

You might also like

- Introduction To Financial Accounting - Horngren 10-34, 9edition.Document2 pagesIntroduction To Financial Accounting - Horngren 10-34, 9edition.ashish_kumar_881167% (3)

- Auditing Hand OutDocument157 pagesAuditing Hand OutMOREGHNo ratings yet

- Cima F1 May 2013Document20 pagesCima F1 May 2013MHasankuNo ratings yet

- NOCLAR FAQs for SAICA MembersDocument17 pagesNOCLAR FAQs for SAICA MembersKarlo Jude AcideraNo ratings yet

- Chapter 24 - AnswerDocument12 pagesChapter 24 - AnswerAgentSkySkyNo ratings yet

- Chap 8Document62 pagesChap 8Daniel Sineus100% (1)

- Apple Inc. - Dupont Analysis For Class-1 - Group - 11Document24 pagesApple Inc. - Dupont Analysis For Class-1 - Group - 11Anurag SharmaNo ratings yet

- Accounting RTPDocument40 pagesAccounting RTPMayur KundarNo ratings yet

- R Woods Trading and Balance Sheet AccountsDocument2 pagesR Woods Trading and Balance Sheet AccountsMurari NayuduNo ratings yet

- Riahi-Belkaoui 2004 PDFDocument14 pagesRiahi-Belkaoui 2004 PDFNisa Ul HusnaNo ratings yet

- ACG 4803 Exam 3 Study GuideDocument11 pagesACG 4803 Exam 3 Study GuideMinh NguyễnNo ratings yet

- Multiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019Document8 pagesMultiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019jad NasserNo ratings yet

- Solution Manual For Advanced Accounting by DayagDocument9 pagesSolution Manual For Advanced Accounting by DayagArnel Felices EspanolaNo ratings yet

- Advance Cost AccountingDocument37 pagesAdvance Cost Accountingashish_20kNo ratings yet

- Financial Accounting Libby 8th Edition Chapter 1 Q&AsDocument162 pagesFinancial Accounting Libby 8th Edition Chapter 1 Q&AsBrandon SNo ratings yet

- Segment AnalysisDocument53 pagesSegment AnalysisamanNo ratings yet

- Format of Cash Flow Statement as per SEBIDocument3 pagesFormat of Cash Flow Statement as per SEBIMoses Fernandes100% (1)

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 13 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document19 pagesChapter 13 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Foreign Portfolio Investment (FPI)Document26 pagesForeign Portfolio Investment (FPI)Alok ShuklaNo ratings yet

- TAX4862 TL106 - 2019 Slides 1 Per PGDocument108 pagesTAX4862 TL106 - 2019 Slides 1 Per PGMagda100% (1)

- Ratio Analysis Using The DuPont ModelDocument10 pagesRatio Analysis Using The DuPont ModelDharini Raje SisodiaNo ratings yet

- UntitledDocument21 pagesUntitleddhirajpironNo ratings yet

- Solution Review QuestionsDocument41 pagesSolution Review Questionsying huiNo ratings yet

- FINMAN TB Chapter13 Capital Structure and LeverageDocument32 pagesFINMAN TB Chapter13 Capital Structure and Leveragechin mohammadNo ratings yet

- FSAV3eModules 5-8Document26 pagesFSAV3eModules 5-8bobdoleNo ratings yet

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Strategy Framework for Organizational SuccessDocument11 pagesStrategy Framework for Organizational SuccessKhaja ZakiuddinNo ratings yet

- Preparing simple consolidated financialsDocument10 pagesPreparing simple consolidated financialstapia4yeabuNo ratings yet

- Introduction To Accounting Concepts and PracticeDocument122 pagesIntroduction To Accounting Concepts and Practicedonutchuu100% (1)

- Foreign Currency Transaction Notes (Ias 21) (2021)Document43 pagesForeign Currency Transaction Notes (Ias 21) (2021)Elago IilongaNo ratings yet

- Chapter 23 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document29 pagesChapter 23 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- CH 05Document4 pagesCH 05vivienNo ratings yet

- FinAcc Vol. 3 Chap3 ProblemsDocument26 pagesFinAcc Vol. 3 Chap3 ProblemsGelynne Arceo33% (3)

- IveyMBA Permanent Employment Report PDFDocument10 pagesIveyMBA Permanent Employment Report PDFUmesh T NNo ratings yet

- Financial Reporting: Business Combinations and Group AccountingDocument17 pagesFinancial Reporting: Business Combinations and Group Accountingrajkrishna03No ratings yet

- Exam 1 - Sample Exam SolutionsDocument7 pagesExam 1 - Sample Exam SolutionsArnulfo ArmamentoNo ratings yet

- Nestle Strategic Plan Final Project 4M1 Group. (Major - Marekting)Document50 pagesNestle Strategic Plan Final Project 4M1 Group. (Major - Marekting)mohaNo ratings yet

- Auditing Groupppt WorkDocument19 pagesAuditing Groupppt WorkSafdar HaiderNo ratings yet

- Introduction To The Consolidation Process: Learning Objectives - Coverage by QuestionDocument21 pagesIntroduction To The Consolidation Process: Learning Objectives - Coverage by QuestionJay BrockNo ratings yet

- Acca P7Document48 pagesAcca P7Kool SamuelNo ratings yet

- ACC 1110 Introductory Managerial Accounting Practice Final ExamDocument24 pagesACC 1110 Introductory Managerial Accounting Practice Final ExamMariela CNo ratings yet

- The Hershey Company: Financial Statement Analysis AnalysisDocument19 pagesThe Hershey Company: Financial Statement Analysis AnalysisNikhil Singh100% (1)

- Chapter 15 - Consolidation: Controlled Entities: Review QuestionsDocument13 pagesChapter 15 - Consolidation: Controlled Entities: Review QuestionsShek Kwun Hei100% (1)

- Accounting EquationDocument11 pagesAccounting EquationNacelle SayaNo ratings yet

- f1 Answers Nov14Document14 pagesf1 Answers Nov14Atif Rehman100% (1)

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- F9 JUNE 17 Mock QuestionsDocument23 pagesF9 JUNE 17 Mock QuestionsottieNo ratings yet

- 2011 E2Document81 pages2011 E2Rehman MuzaffarNo ratings yet

- Revised IFRS 16 Lease Math 1, 2Document8 pagesRevised IFRS 16 Lease Math 1, 2Feruz Sha Rakin100% (1)

- Audit Postulates ExplainedDocument1 pageAudit Postulates ExplainedPhebieon MukwenhaNo ratings yet

- Social Impact Bond CaseDocument21 pagesSocial Impact Bond CaseTest123No ratings yet

- Financial planning case study for property developerDocument25 pagesFinancial planning case study for property developerJesse Rielle CarasNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- FAQDocument3 pagesFAQFaisal MohammedNo ratings yet

- Examination About Investment 6Document2 pagesExamination About Investment 6BLACKPINKLisaRoseJisooJennieNo ratings yet

- Capital Budgeting FM2 AnswersDocument17 pagesCapital Budgeting FM2 AnswersMaria Anne Genette Bañez89% (28)

- Tc-Ab Client Presentation 2020g1Document22 pagesTc-Ab Client Presentation 2020g1api-457482687No ratings yet

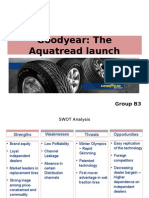

- GoodyearDocument10 pagesGoodyearMiteshwar SinghNo ratings yet

- How To Assess Nonprofit Financial PeformanceDocument84 pagesHow To Assess Nonprofit Financial PeformanceRay Brooks100% (1)

- Perbandingan Kinerja Keuangan Perusahaan Manufaktur Menggunakan Analisis Rasio KeuanganDocument22 pagesPerbandingan Kinerja Keuangan Perusahaan Manufaktur Menggunakan Analisis Rasio KeuanganIrma Retno DewiNo ratings yet

- MNC Nep PresentationDocument53 pagesMNC Nep PresentationSaajan RathodNo ratings yet

- Trilateral CommissionDocument8 pagesTrilateral Commissionmary engNo ratings yet

- 1213 PDFDocument23 pages1213 PDFnamasralNo ratings yet

- National Institute of Fashion Technology Chennai finance assignmentDocument7 pagesNational Institute of Fashion Technology Chennai finance assignmentSamridhi AgrawalNo ratings yet

- CBSE Class12 98 Entreprenureship Set 4 IOP-COMPTT Exam Question Paper 2017 (All India Scheme)Document8 pagesCBSE Class12 98 Entreprenureship Set 4 IOP-COMPTT Exam Question Paper 2017 (All India Scheme)Heisn BurgNo ratings yet

- ADSF Bankruptcy FilingDocument207 pagesADSF Bankruptcy FilingHannah ColtonNo ratings yet

- Wellness Report by PWCDocument64 pagesWellness Report by PWCPranav Santurkar100% (1)

- Adani Enterprises AustraliaDocument21 pagesAdani Enterprises AustraliaSandeep PatilNo ratings yet

- Property Investment Strategies: Cap Rates, DCF, and Leasing TrendsDocument26 pagesProperty Investment Strategies: Cap Rates, DCF, and Leasing TrendsVaishnavi HallikarNo ratings yet

- Questions Case StudyDocument4 pagesQuestions Case StudyKrupa VoraNo ratings yet

- 4 - Sensitivity AnalysisDocument6 pages4 - Sensitivity AnalysismarcusforteNo ratings yet

- Chapter 8 - Receivables Lecture Notes - StudentsDocument43 pagesChapter 8 - Receivables Lecture Notes - StudentsKy Anh NguyễnNo ratings yet

- Poornatha - AboutDocument3 pagesPoornatha - AboutPoornathaNo ratings yet

- Shinhan Bank Circular Dated 22 June 2009Document348 pagesShinhan Bank Circular Dated 22 June 2009eureka8No ratings yet

- Role of Banking in International BusinessDocument15 pagesRole of Banking in International Businesstheaaj100% (2)

- Final Project of Working CapitalDocument118 pagesFinal Project of Working CapitalVishal Keshri0% (1)

- FIXED INCOME SECURITIES AND DEBT MARKETS Chapter 5 ANSWERSDocument14 pagesFIXED INCOME SECURITIES AND DEBT MARKETS Chapter 5 ANSWERSShilpika ShettyNo ratings yet

- Soal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)Document2 pagesSoal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)SECRET MENUNo ratings yet

- Sustainable TourismDocument30 pagesSustainable Tourismravindrahawk100% (1)

- HR PRacticeDocument2 pagesHR PRacticeAjay SinghNo ratings yet

- Project AppraisalDocument62 pagesProject Appraisalsagarlakra100% (1)

- Documents - Ienergizer Admission Document 27 8 101 PDFDocument120 pagesDocuments - Ienergizer Admission Document 27 8 101 PDFShubham ChahalNo ratings yet

- Adjusting Journal EntriesDocument11 pagesAdjusting Journal EntriesKatrina RomasantaNo ratings yet