Professional Documents

Culture Documents

Analys Intrprt

Uploaded by

mohit333Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analys Intrprt

Uploaded by

mohit333Copyright:

Available Formats

6.

CRM Interpretation & Analysis

78

BANKS DATA ANALYSIS

6. CRM Interpretation & Analysis 6.1 CRM Analysis for Public Sector Banks and Private Sector Banks

79

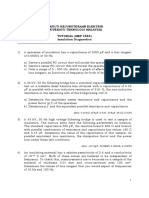

Detail Analysis have been done to understand the relation between various questions put to various staff members of Private and Public Banks. Question set has been divided into different form to have a clear view of individual segment. Question Set Main I with Section A, B, C, D (Refer Annexure 1) was having 45 questions and all questions were discussed with Bank Staff to understand their views on the same. Question Set E with 10 questions were asked to customers to review CRM related to each Bank. Various Factors (26) extracted from various existing researchers and articles related to CRM was summarized and put to respondents to rate each Factor satisfaction. These details are considered in Question Set Main II (Appendix 1) To understand the response of staff on each question Valid Response, Mean, Std. Error, Median, Std. Deviation, and Variance is calculated and shown in the Annexure 2.

Sample size: The number of cases n is the number of numeric entries for the variable that fulfill the selection criterion. In this analysis 91 respondents has given the response from Top Management, Middle Management & Lower Management.127 customers from Public and Private Banks have responded to various questions asked to them. The lowest value and highest value of all observations (range).The lowest value used in the analysis 1 and the highest value is 5 Analyses have been done to understand the basic statistical tools and results Table Shows the results of various questions asked to Staff of Public and Private Banks. Sample size used is the actual responses received from various respondents. In the below table respondent ratio is as mentioned below SBI and PNB 46 respondent, ICICI and HDFC 45 respondent. Total respondent from Staff= 46+45= 91 respondent .Following Section of questions have been analysis A) Perception of Official Respondents on CRM B) Performance review by Official Respondents C) Problem Analysis by Official Respondents D) Importance of CRM by Official Respondents

6. CRM Interpretation & Analysis 6.2 Important Factors Analyzed

80

During the research various factors have been analyzed and documented and same were added in questionnaire set main II (Appendix 1).Same factors were asked to rate by respondents to understand the importance of each. After having responses on 26 factors it was analyzed that 8 factors are more significant and they play important role in Banking Sector. For each factor frequency response is taken from both Public and Private bank respondednts.There Chi Square and p value is calculated to understand the significant factors. Below table show the details. Table No. 6.1

Table No.

:- Analysis of various Factors for Public and Private Banks Type of Bank PUBLIC PRIVATE Percent 0.0 0.0 4.4 35.6 60.0 2.147 0.342

1. Relationship with customer Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied

Percent 0.0 0.0 0.0 34.8 65.2

Chisquare

p-value

Type of Bank PUBLIC 2. Customer Prospecting Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 8.7 28.3 47.8 13.0 2.2 Type of Bank PUBLIC 3. Interactive Management Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 0.0 10.9 52.2 37.0 PRIVATE Percent 0.0 0.0 0.0 44.4 55.6 6.877 0.032 Chisquare p-value PRIVATE Percent 4.4 48.9 33.3 13.3 0.0 5.295 0.258 Chisquare p-value

6. CRM Interpretation & Analysis

81

Type of Bank PUBLIC 4. Empowerment to customers Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 41.3 54.3 4.3 0.0 Type of Bank PUBLIC 5. Understanding customer expectation Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 17.4 52.2 30.4 0.0 0.0 Type of Bank PUBLIC 6. Partnership Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 19.6 60.9 19.6 0.0 0.0 Type of Bank PUBLIC 7. Personalization Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 0.0 6.5 63.0 30.4 PRIVATE Percent 0.0 0.0 8.9 48.9 42.2 1.850 0.396 Chisquare p-value PRIVATE Percent 20.0 51.1 28.9 0.0 0.0 1.207 0.547 Chisquare p-value PRIVATE Percent 4.4 51.1 44.4 0.0 0.0 4.670 0.097 Chisquare p-value PRIVATE Percent 26.7 44.4 28.9 0.0 0.0 17.806 0.000 Chisquare p-value

Type of Bank PUBLIC 8. Presence of Internet facility without risk Highly dissatisfied Percent 0.0 PRIVATE Percent 22.2 Chisquare 14.888 p-value 0.002

6. CRM Interpretation & Analysis

82

39.1 56.5 4.3 0.0 Type of Bank PUBLIC PRIVATE Percent 13.3 53.3 33.3 0.0 0.0 0.104 0.950 Chisquare p-value 46.7 28.9 2.2 0.0

Moderately dissatisfied Neutral Moderately satisfied Highly satisfied

9. Interacting on internet Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied

Percent 13.0 56.5 30.4 0.0 0.0

Type of Bank PUBLIC 10. Speedy Service Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 0.0 10.9 52.2 37.0 PRIVATE Percent 0.0 0.0 4.4 46.7 48.9 2.116 0.347 Chisquare p-value

Type of Bank PUBLIC 11. Speed of ATM and related service Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 6.5 41.3 47.8 4.3 0.0 Type of Bank PUBLIC 12. Staff Cooperation and Behaviour Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 0.0 10.9 56.5 32.6 PRIVATE Percent 0.0 0.0 4.4 46.7 48.9 3.131 0.209 Chisquare p-value PRIVATE Percent 15.6 40.0 42.2 2.2 0.0 2.169 0.538 Chisquare p-value

6. CRM Interpretation & Analysis

83

Type of Bank PUBLIC 13. Loan and related facilities with clear and standard terms and conditions Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 34.8 56.5 8.7 0.0 PRIVATE Percent 20.0 46.7 28.9 4.4 0.0 14.666 0.002 Chisquare p-value

Type of Bank PUBLIC 14. problem solving attitude / specific staff Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 15.2 50.0 30.4 4.3 0.0 Type of Bank PUBLIC 15. Variety of service Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 0.0 10.9 50.0 39.1 PRIVATE Percent 0.0 0.0 0.0 42.2 57.8 6.825 0.033 Chisquare p-value PRIVATE Percent 6.7 57.8 35.6 0.0 0.0 3.906 0.272 Chisquare p-value

Type of Bank PUBLIC 16. Better rate of interest Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 15.2 45.7 37.0 2.2 0.0 Type of Bank PRIVATE Percent 6.7 48.9 40.0 4.4 0.0 1.974 0.578 Chisquare p-value

6. CRM Interpretation & Analysis

84

Chisquare

PUBLIC 17. Online Service , payment and other facility Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 0.0 8.7 56.5 34.8

PRIVATE Percent 0.0 0.0 2.2 31.1 66.7

p-value

9.651

0.008

Type of Bank PUBLIC 18. Home service like delivery of cash Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 17.4 39.1 37.0 6.5 PRIVATE Percent 0.0 26.7 44.4 26.7 2.2 2.757 0.431 Chisquare p-value

Type of Bank PUBLIC 19. Frequency of response Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 39.1 47.8 10.9 2.2 Type of Bank PUBLIC 20. New product and services Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 30.4 50.0 19.6 0.0 Type of Bank PUBLIC 21. Presence Geographically Highly dissatisfied Percent 4.3 PRIVATE Percent 8.9 Chisquare 3.671 p-value 0.452 PRIVATE Percent 0.0 26.7 55.6 17.8 0.0 0.285 0.867 Chisquare p-value PRIVATE Percent 0.0 24.4 55.6 20.0 0.0 4.013 0.260 Chisquare p-value

6. CRM Interpretation & Analysis

85

13.0 41.3 41.3 0.0 22.2 35.6 31.1 2.2

Moderately dissatisfied Neutral Moderately satisfied Highly satisfied

Type of Bank PUBLIC 22. Quality of Service and Staff Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 6.5 19.6 41.3 32.6 0.0 Type of Bank PUBLIC 23. Well trained and matures Staff to handle errors and critical situations etc Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 0.0 10.9 41.3 47.8 0.0 PRIVATE Percent 4.4 24.4 42.2 26.7 2.2 8.181 0.085 Chisquare p-value PRIVATE Percent 8.9 26.7 33.3 31.1 0.0 1.066 0.785 Chisquare p-value

Type of Bank PUBLIC 24. Better Competitor Offerings Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 15.2 37.0 21.7 13.0 13.0 PRIVATE Percent 31.1 26.7 22.2 13.3 6.7 4.185 0.382 Chisquare p-value

Type of Bank PUBLIC 25. Data protection and privacy of individual details Highly dissatisfied Moderately dissatisfied Neutral Percent 0.0 2.2 34.8 PRIVATE Percent 4.4 4.4 28.9 3.506 0.477 Chisquare p-value

6. CRM Interpretation & Analysis

86

43.5 19.6 35.6 26.7

Moderately satisfied Highly satisfied

Type of Bank PUBLIC 26. 24X7 Telephonic support Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Percent 6.5 21.7 41.3 30.4 0.0 PRIVATE Percent 0.0 13.3 37.8 46.7 2.2 6.501 0.165 Chisquare p-value

Analysis: - After analyzing the various factors considered in research it is observed that following 8 factors are significant as compared to other factors. Interactive Management

Response from various respondents indicates that Bank initiative with customer plays very important role. Comparing Public and Private Banks it is observed that in Public Bank only 37 % of respondents are very Highly Satisfied where as in case of Private Banks it is 55.6 %.Calculating and understanding the Chi Value that is 6.877 and p value 0.032 it shows that this factors is significant and need to be focused by Public Banks Empowerment to customers

Response from various respondents indicates that Empowerment to customers is still have a neutral response .Comparing Public and Private Banks it is observed that in Public Bank customer 54.3 % of respondents are neutral where as in case of Private Banks it is 28.9 %.Calculating and understanding the Chi Value that is 17.806 and p value 0.0 it shows that this factors is significant and need to be focused by both Public Banks and Private banks. Understanding Customer expectation

Response from various respondents indicates that customers from both banks are moderately dissatisfied.Comparing Public and Private Banks it is observed that in Public Bank 52.2 % of respondents are moderately dissatisfied where as in case of Private Banks it is 51.1%.Calculating and understanding the Chi Value that is 4.670 and p value 0.097 it shows that this factors is significant and need to be focused by both banks.

6. CRM Interpretation & Analysis

87

Presence of internet facility without risk

Response from various respondents indicates that though now both Public and Private sector Bank provide this facility but risk factors play still an important concern. Comparing Public and Private Banks it is observed that in Public Bank 56.5 % of respondents are neutral where as in case of Private Banks it is 28.9 %.Calculating and understanding the Chi Value that is 14.888 and p value 0.002 it shows that this factor is significant and need to be focused. Above details shows that respondent from Private Banks feel higher risk while using internet facility from bank as compared to Public bank customers. Loan and related facilities with clear and standard terms and conditions

Response from various respondents indicates that Bank initiative with customer plays very important role. Comparing Public and Private Banks it is observed that in Public Bank only 56.5 % of respondents are neutral where as in case of Private Banks it is 28.9 %.Calculating and understanding the Chi Value that is 14.666 and p value 0.032 it shows that this factor is significant and need to be focused by Private Banks. Though it is easy to get loan in Private Banks but still respondent feel that Public banks terms and conditions are more clear and they follow the same where as in case of Private banks respondent feel that terms and conditions changes fast with subject to market conditions Variety of Services

Response from various respondents indicates that Bank services play important role. Comparing Public and Private Banks it is observed that in Public Bank only 39.1 % of respondents are highly satisfied where as in case of Private Banks it is 57.8 %.Calculating and understanding the Chi Value that is 6.825 and p value 0.033 it shows that this factor is significant and need to be focused by Public Banks. Online service , payment and other services

Response from various respondents indicates that Bank in Public Bank only 34.8 % of respondents are Highly Satisfied where as in case of Private Banks it is 66.7 %.Calculating and understanding the Chi Value that is 9.651 and p value 0.008 it shows that this factor is significant and need to be focused by Public Banks.

Well trained and Mature Staff to handle Errors and critical situations etc

Response from various respondents indicates that in Public Bank have 47.8 % of respondents who are moderately satisfied where as in case of Private Banks it is 26.7 %.Calculating and understanding the Chi Value that is 8.181 and p value 0.085 it shows that this factor is significant and need to be focused by Private Banks. Though Private banks

6. CRM Interpretation & Analysis

88

have more young staff who is well trained as compared to Public banks but respondents still feel that mature staff is present in Public Sector Banks who can handle errors or similar critical situations with there experience.

6. CRM Interpretation & Analysis 6.3 DETAIL ANALYSIS

89

Detail Analysis have been done to understand the relation between various questions put to various staff members of Private and Public Banks. Question set has been divided into different form to have a clear view of individual segment. Question Set Main I was having 45 questions and all questions were discussed with Bank Staff to understand their views on the same. To understand the response of staff on each question table were made with response from different level from Top Management, Middle Management and Lower Management in each Bank. Response was aligned in form of tables and final Total is calculated from the Frequency count against each response. Then Chi Square and p value is calculated using SPSS software as shown below table. Detail analysis of each question is done on Public and Private Bank Respondednts.Public Banks are SBI, PNB and Private Banks are ICICI & HDFC. Annexure 2 Table A2-3 to A2-6 shows details frequency distribution for each bank with different respondents. Annexure 3 shows a collective Frequency distribution of questions in form of total Public banks response and total private bank response Each response was analyzed with graph to understand and conclude the results from the same. Each point is observed and comments are made against the responses which were found significant. 1: - Though we have CRM, I believe that people are not using it adequately.

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 33.3 0.0 33.3 0.0 33.3 100. 0 50.0 50.0 0.0 0.0 0.0 100.0

Middle mgt publi privat c e 5.6 26.7 20.6 31.7 15.6 100. 0 12.7 21.5 22.7 20.4 22.7 100.0

Lower mgt publi privat c e 10.0 45.6 14.4 23.3 6.7 100. 0 9.1 16.7 39.4 25.8 9.1 100.0

Total publi privat c e 10.8 34.7 17.5 24.3 12.8 100. 0 13.0 20.5 29.0 22.0 15.5 100.0

Chisquare value

p valu e

9.71*

0.0 23

6. CRM Interpretation & Analysis

90

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that CRM implementation is still a high concern. Most respondents that is 34.7 % are moderately dissatisfied and in case of Private Banks 20.5% respondents are moderately dissatisfied. Where as highly satisfaction level in Private Banks is 15.5% and in Public Banks it is 12.8 %. So CRM Implementation to full extend in both sectors is very important and need to be focused by individual sectors. 2: - On the whole I am satisfied with CRM here.

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 0.0 0.0 50.0 0.0 50.0 100. 0 0.0 100. 0 100.0

Middle mgt publi privat c e 10.0 8.8 47.2 43.1 32.2 21.5 0.0 17.7 10.6 100. 0 8.8 100.0

Lower mgt publi privat c e 20.0 43.9 38.9 20.2 13.3 20.2 15.6 15.7 12.2 100. 0 0.0 100.0

Total publi privat c e 13.1 24.0 39.0 31.0 21.5 22.5 8.4 18.0 17.9 100. 0 4.5 100.0

Chisquare value

p valu e

10.650

0.32

6. CRM Interpretation & Analysis

91

3: - I feel secure and happy with CRM in the bank so far.

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 33.3 0.0 33.3 0.0 0.0 100.0 0.0 0.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 26.1 20.4 31.7 22.7 15.6 21.5 16.1 21.5 10.6 13.8 100. 0 100.0

Lower mgt publi privat c e 21.1 19.2 40.0 27.3 21.1 11.1 12.2 31.3 5.6 11.1 100. 0 100.0

Total publi privat c e 23.9 19.0 36.7 23.5 17.1 20.5 13.1 25.0 9.1 12.0 100. 0 100.0

Chisquare value

p valu e

5.820*

0.05

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that respondents are still not happy with CRM implementation. Most respondents that is 36.7 % are moderately dissatisfied and in case of Private Banks 23.5%

6. CRM Interpretation & Analysis

92

respondents are moderately dissatisfied. Where as highly satisfaction level in Private Banks is 12.0% and in Public Banks it is 9.1 %. So CRM Implementation to full extend in both sectors is very important and need to be focused by individual sectors.

4: -CRM needs to be improved in Bank. p va lu e 0. 44 0

Top Mgt Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total publi c 0.0 33.3 0.0 33.3 33.3 100. 0 privat e 0.0 0.0 50.0 50.0 0.0 100.0

Middle mgt publi c 10.0 5.6 26.1 31.7 26.7 100. 0 privat e 3.8 3.8 44.2 30.4 17.7 100.0

Lower mgt publi c 11.1 15.6 33.3 26.7 13.3 100. 0 privat e 10.1 25.8 14.6 20.2 29.3 100.0

Total publi c 8.8 13.1 27.9 28.7 21.5 100. 0 privat e 6.5 13.5 31.5 26.5 22.0 100.0

Chisquare value

6.840

5:-I think, additional inputs are needed. p va lu e 0. 34

Top Mgt Satisfaction level Highly dissatisfied Moderately dissatisfied publi c 0.0 0.0 privat e 50.0 0.0

Middle mgt publi c 0.0 5.0 privat e 0.0 7.7

Lower mgt publi c 21.1 23.3 privat e 0.0 20.2

Total publi c 10.8 13.1 privat e 2.0 13.0

Chisquare value 12.300

6. CRM Interpretation & Analysis

93

0.0 50.0 0.0 100.0 31.7 31.7 31.7 100. 0 31.5 31.5 29.2 100.0 10.0 27.8 17.8 100. 0 43.9 24.7 11.1 100.0 21.5 30.3 24.3 100. 0 35.5 29.5 20.0 100.0

Neutral Moderately satisfied Highly satisfied Total

33.3 33.3 33.3 100. 0

6: -CRM leads to improved performance in Bank

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 33.3 50.0 33.3 0.0 0.0 50.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 5.6 8.8 16.1 21.5 41.7 30.4 26.7 21.5 10.0 17.7 100. 0 100.0

Lower mgt publi privat c e 0.0 10.1 21.1 14.6 33.3 24.7 32.2 30.3 13.3 20.2 100. 0 100.0

Total publi privat c e 2.4 9.0 19.9 20.0 36.7 26.5 26.7 26.5 14.4 18.0 100. 0 100.0

Chisquare value

p valu e

4.360

0.72

6. CRM Interpretation & Analysis

94

7:-In Bank business is primarily based on relations.

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 0.0 33.3 0.0 33.3 100.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 5.0 7.7 21.1 26.5 31.7 35.4 21.1 8.8 21.1 21.5 100. 0 100.0

Lower mgt publi privat c e 6.7 19.2 13.3 19.2 27.8 15.7 40.0 35.9 12.2 10.1 100. 0 100.0

Total publi privat c e 6.0 12.5 16.8 22.0 30.3 25.0 29.4 25.0 17.5 15.5 100. 0 100.0

Chisquare value

p valu e

5.300

0.60

8: -Do you think better work will be done, if CRM is made better.

6. CRM Interpretation & Analysis

95

Middle mgt publi privat c e 0.0 7.7 16.7 13.8 26.7 39.2 36.1 22.7 20.6 16.5 100. 0 100.0 Lower mgt publi privat c e 6.7 0.0 17.8 13.6 32.2 11.1 33.3 55.1 10.0 20.2 100. 0 100.0 Total publi privat c e 4.0 4.0 15.9 13.0 29.0 27.0 31.9 38.5 19.1 17.5 100. 0 100.0 Chisquare value p valu e

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 0.0 33.3 50.0 0.0 50.0 66.7 0.0 100. 0 100.0

7.670

0.33

9: -Do you think time has come to make use of CRM extensively in Banks.

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 0.0 0.0 50.0 66.7 50.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 5.0 3.8 5.0 25.4 26.7 20.0 36.7 33.1 26.7 17.7 100. 0 100.0

Lower mgt publi privat c e 3.3 14.6 27.8 14.6 38.9 38.4 21.1 26.8 8.9 5.6 100. 0 100.0

Total publi privat c e 4.0 8.5 16.8 19.5 30.7 29.0 30.7 31.5 17.9 11.5 100. 0 100.0

Chisquare value

p valu e

7.380

0.42

6. CRM Interpretation & Analysis

96

10: -CRM is very important in service organization like Banks.

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 0.0 66.7 100.0 33.3 0.0 0.0 0.0 100. 0 100.0

Middle mgt publi privat c e 0.0 3.8 16.1 21.5 42.2 11.5 31.1 40.4 10.6 22.7 100. 0 100.0

Lower mgt publi privat c e 0.0 4.5 0.0 19.2 21.1 41.4 48.9 19.2 30.0 15.7 100. 0 100.0

Total publi privat c e 0.0 4.0 6.8 19.5 33.0 29.0 40.7 29.0 19.5 18.5 100. 0 100.0

Chisquare value

p valu e

5.750

0.44

11: -CRM is going to improve the business in Banks.

6. CRM Interpretation & Analysis

97

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 33.3 0.0 0.0 0.0 0.0 50.0 33.3 50.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 5.6 0.0 10.6 21.5 10.0 26.5 47.2 20.4 26.7 31.5 100. 0 100.0

Lower mgt publi privat c e 6.7 14.6 30.0 10.1 42.2 30.3 12.2 30.3 8.9 14.6 100. 0 100.0

Total publi privat c e 8.8 6.5 19.5 15.5 25.5 29.5 28.3 26.0 17.9 22.5 100. 0 100.0

Chisquare value

p valu e

7.790

0.40

12: -CRM is better than any other management system.

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 33.3 0.0 33.3 100.0 0.0 0.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 15.0 10.0 21.7 21.5 26.7 17.7 26.1 30.4 10.6 20.4 100. 0 100.0

Lower mgt publi privat c e 0.0 18.2 24.4 20.2 33.3 29.3 32.2 15.7 10.0 16.7 100. 0 100.0

Total publi privat c e 6.0 13.0 24.3 20.0 30.7 26.5 26.3 22.5 12.8 18.0 100. 0 100.0

Chisquare value

p valu e

7.760

0.36

6. CRM Interpretation & Analysis

98

13: -Customers will increase with CRM

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 66.7 0.0 0.0 50.0 33.3 0.0 0.0 50.0 0.0 0.0 100. 0 100.0

Middle mgt publi privat c e 5.0 13.8 36.1 25.4 16.1 39.2 26.7 12.7 16.1 8.8 100. 0 100.0

Lower mgt publi privat c e 8.9 18.2 23.3 21.2 27.8 15.7 27.8 24.7 12.2 20.2 100. 0 100.0

Total publi privat c e 11.1 15.0 25.9 24.5 23.9 27.0 25.9 20.0 13.1 13.5 100. 0 100.0

Chisquare value

p valu e

8.200

0.32

6. CRM Interpretation & Analysis

99

14: -Have you managed customers according to CRM?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 50.0 33.3 0.0 0.0 50.0 66.7 0.0 100. 0 100.0

Middle mgt publi privat c e 5.0 0.0 16.7 12.7 21.1 44.2 36.1 26.5 21.1 16.5 100. 0 100.0

Lower mgt publi privat c e 3.3 14.6 6.7 21.2 26.7 14.6 44.4 39.4 18.9 10.1 100. 0 100.0

Total publi privat c e 4.0 6.5 11.1 18.0 24.3 29.0 36.7 33.5 23.9 13.0 100. 0 100.0

Chisquare value

p valu e

7.300

0.41

15:-Have you implemented CRM guidelines?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 33.3 0.0 33.3 50.0 33.3 0.0 0.0 50.0 100. 0 100.0

Middle mgt publi privat c e 10.0 0.0 26.1 13.8 27.2 25.4 26.1 44.2 10.6 16.5 100. 0 100.0

Lower mgt publi privat c e 3.3 0.0 17.8 0.0 36.7 30.3 30.0 40.4 12.2 29.3 100. 0 100.0

Total publi privat c e 6.0 0.0 21.9 7.0 33.0 29.0 28.3 40.5 10.8 23.5 100. 0 100.0

Chisquare value

p valu e

3.29*

0.05

6. CRM Interpretation & Analysis

100

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that respondents fell that customers are not managed as per CRM Policy Most respondents that is 33 % are neutral . Employees feel once policy framed then there is no issue but if any thing not defined in policy that is not followed .In case of Private Banks 33.5% respondents are moderately satisfied. Where as highly satisfaction level in Private Banks is 23.5% and in Public Banks it is 10.8 %. 16:-Have you evaluated CRM?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 33.3 50.0 33.3 0.0 33.3 0.0 0.0 50.0 0.0 0.0 100. 0 100.0

Middle mgt publi privat c e 10.6 3.8 25.6 5.0 36.7 26.5 10.6 38.1 16.7 26.5 100. 0 100.0

Lower mgt publi privat c e 5.6 4.5 12.2 24.7 20.0 21.2 38.9 30.3 23.3 19.2 100. 0 100.0

Total publi privat c e 9.1 6.0 19.1 13.5 29.5 23.0 23.9 35.5 18.3 22.0 100. 0 100.0

Chisquare value

p valu e

7.670

0.37 0

6. CRM Interpretation & Analysis

101

17:-Are your CRM practices customers oriented?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 33.3 0.0 0.0 0.0 66.7 50.0 0.0 50.0 100. 0 100.0

Middle mgt publi privat c e 0.0 0.0 10.0 0.0 26.7 21.5 37.2 56.9 26.1 21.5 100. 0 100.0

Lower mgt publi privat c e 6.7 0.0 23.3 0.0 38.9 30.3 22.2 30.3 8.9 39.4 100. 0 100.0

Total publi privat c e 4.0 0.0 17.5 0.0 30.7 24.5 32.7 44.5 15.1 31.0 100. 0 100.0

Chisquare value

p valu e

4.730*

0.04

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that respondents fell that customers are not as per customer orientation Most respondents that is 30.7 % are moderately dissatisfied. In case of Private Banks 44.5%

6. CRM Interpretation & Analysis

102

respondents are moderately satisfied. Where as highly satisfaction level in Private Banks is 31.0% and in Public Banks it is only 15.1 %.So CRM Practices need to be modified in case of Public Sector where as in case of Private Banks it need some alignment only. 18:-Have redesigned jobs according to the requirement of CRM?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 33.3 0.0 33.3 50.0 0.0 50.0 0.0 0.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 0.0 0.0 10.6 18.8 37.2 29.2 31.1 35.4 21.1 16.5 100. 0 100.0

Lower mgt publi privat c e 5.6 11.1 11.1 21.2 24.4 29.3 43.3 28.3 15.6 10.1 100. 0 100.0

Total publi privat c e 4.8 5.0 11.5 21.0 28.3 30.5 35.9 30.5 19.5 13.0 100. 0 100.0

Chisquare value

p valu e

6.110

0.47

19: -Have you improved customer handling?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 66.7 0.0 0.0 100.0 33.3 0.0 0.0 0.0 100. 0 100.0

Middle mgt publi privat c e 0.0 3.8 5.6 23.8 37.2 21.5 41.7 29.2 15.6 21.5 100. 0 100.0

Lower mgt publi privat c e 17.8 5.6 12.2 19.2 15.6 24.7 27.8 40.4 26.7 10.1 100. 0 100.0

Total publi privat c e 8.8 4.5 13.5 20.5 23.9 26.5 34.3 33.0 19.5 15.5 100. 0 100.0

Chisquare value

p valu e

7.010

0.47

6. CRM Interpretation & Analysis

103

20: -Have you improved relations with the customers?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 33.3 0.0 0.0 0.0 66.7 50.0 0.0 50.0 100. 0 100.0

Middle mgt publi privat c e 0.0 0.0 11.1 5.0 42.8 30.4 36.1 43.1 10.0 21.5 100. 0 100.0

Lower mgt publi privat c e 8.9 0.0 12.2 5.6 24.4 25.8 33.3 35.9 21.1 32.8 100. 0 100.0

Total publi privat c e 4.4 0.0 13.5 5.0 30.7 27.0 36.7 40.0 14.8 28.0 100. 0 100.0

Chisquare value

p valu e

4.920

0.51

6. CRM Interpretation & Analysis

104

21: -Have you prepared your people to work in CRM environment?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 0.0 0.0 50.0 66.7 50.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 10.6 21.5 10.6 13.8 15.6 30.4 31.7 21.5 31.7 12.7 100. 0 100.0

Lower mgt publi privat c e 17.8 10.1 21.1 14.6 27.8 21.2 18.9 29.3 14.4 24.7 100. 0 100.0

Total publi privat c e 13.1 15.5 15.1 13.5 21.1 27.0 28.3 26.5 22.3 17.5 100. 0 100.0

Chisquare value

p valu e

4.750

0.68

6. CRM Interpretation & Analysis

105

22: -Have you benchmarked your organization performance with best practices of other banks?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 33.3 0.0 33.3 0.0 33.3 0.0 0.0 100.0 100. 0 100.0

Middle mgt publi privat c e 5.6 12.7 15.0 17.7 21.1 29.2 31.7 22.7 26.7 17.7 100. 0 100.0

Lower mgt publi privat c e 12.2 0.0 8.9 24.7 18.9 25.8 38.9 49.5 21.1 0.0 100. 0 100.0

Total publi privat c e 8.8 6.5 12.8 20.0 21.5 26.5 35.0 33.5 21.9 13.5 100. 0 100.0

Chisquare value

p valu e

7.990

0.42

6. CRM Interpretation & Analysis

106

23: -Have you driven out the fear?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 0.0 66.7 50.0 0.0 50.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 5.6 5.0 16.7 5.0 26.1 18.8 31.1 54.6 20.6 16.5 100. 0 100.0

Lower mgt publi privat c e 0.0 0.0 5.6 0.0 21.1 33.8 45.6 31.3 27.8 34.8 100. 0 100.0

Total publi privat c e 2.4 2.5 9.5 2.5 26.3 26.5 36.3 44.5 25.5 24.0 100. 0 100.0

Chisquare value

p valu e

5.490

0.55

24: -Have you adopted an organization culture with shared version, values and analysis?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 50.0 33.3 0.0 33.3 0.0 0.0 50.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 5.6 0.0 11.1 8.8 31.1 8.8 31.1 55.8 21.1 26.5 100. 0 100.0

Lower mgt publi privat c e 8.9 0.0 6.7 5.6 37.8 49.5 36.7 25.8 10.0 19.2 100. 0 100.0

Total publi privat c e 6.8 2.5 11.1 7.0 33.0 26.5 31.9 42.0 17.1 22.0 100. 0 100.0

Chisquare value

p valu e

10.840

0.30

6. CRM Interpretation & Analysis

107

25: -Has organization taken transformation initiative?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 33.3 0.0 0.0 100.0 33.3 0.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 5.6 7.7 5.0 18.8 26.7 24.2 41.7 27.7 21.1 21.5 100. 0 100.0

Lower mgt publi privat c e 12.2 11.1 10.0 33.8 27.8 15.7 32.2 33.8 17.8 5.6 100. 0 100.0

Total publi privat c e 8.8 9.0 10.4 24.5 25.9 24.0 35.0 29.0 19.9 13.5 100. 0 100.0

Chisquare value

p valu e

8.450

0.35

6. CRM Interpretation & Analysis

108

26: - Have you evaluated management skills?

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 33.3 50.0 33.3 0.0 0.0 0.0 33.3 50.0 100. 0 100.0

Middle mgt publi privat c e 5.6 5.0 11.1 5.0 16.1 21.5 31.7 50.8 35.6 17.7 100. 0 100.0

Lower mgt publi privat c e 0.0 0.0 0.0 0.0 27.8 34.8 54.4 35.9 17.8 29.3 100. 0 100.0

Total publi privat c e 2.4 2.5 7.1 5.0 23.9 26.5 41.0 42.0 25.5 24.0 100. 0 100.0

Chisquare value

p valu e

7.380

0.25

6. CRM Interpretation & Analysis 27: -Do you feel motivated with CRM polices?

109

Satisfaction level Highly dissatisfied Moderately dissatisfied Neutral Moderately satisfied Highly satisfied Total

Top Mgt publi privat c e 0.0 0.0 0.0 0.0 100. 0 0.0 0.0 50.0 0.0 50.0 100. 0 100.0

Middle mgt publi privat c e 5.6 5.0 5.6 13.8 26.1 42.2 20.6 100. 0 31.5 49.6 0.0 100.0

Lower mgt publi privat c e 5.6 0.0 6.7 5.6 33.3 36.7 17.8 100. 0 24.7 21.2 48.5 100.0

Total publi privat c e 4.8 2.5 6.4 9.5 35.0 36.7 17.1 100. 0 27.0 37.0 24.0 100.0

Chisquare value

p valu e

8.520

0.35

28:-Identifying potential. Y/N Top Mgt publi privat c e 66.7 0.0 33.3 100.0 100. 0 100.0 Middle mgt publi privat c e 47.8 49.2 52.2 50.8 100. 0 100.0 Lower mgt publi privat c e 30.0 35.9 70.0 64.1 100. 0 100.0 Total publi privat c e 39.8 41.0 60.2 59.0 100. 0 100.0 Chisquare value 1.06

Satisfaction level No Yes Total

p value 0.53

6. CRM Interpretation & Analysis

110

29:-Identify training needs. Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 0.0 0.0 100. 0 100.0 100. 0 100.0

Middle mgt publi privat c e 53.3 50.4 46.7 100. 0 49.6 100.0

Lower mgt publi privat c e 37.8 56.1 62.2 100. 0 43.9 100.0

Total publi privat c e 43.0 50.5 57.0 100. 0 49.5 100.0

Chisquare value

p valu e

2.37

0.38

6. CRM Interpretation & Analysis

111

30: -Generating data for key skills. Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 66.7 50.0 33.3 50.0 100. 0 100.0

Middle mgt publi privat c e 57.8 64.6 42.2 35.4 100. 0 100.0

Lower mgt publi privat c e 44.4 35.9 55.6 64.1 100. 0 100.0

Total publi privat c e 50.6 51.0 49.4 49.0 100. 0 100.0

Chisquare value 2.13

p valu e 0.42

31:-I feel CRM is just a formality Y/N Top Mgt publi privat c e 33.3 50.0 66.7 50.0 100. 0 100.0 Middle mgt publi privat c e 47.2 33.1 52.8 66.9 100. 0 100.0 Lower mgt publi privat c e 35.6 47.5 64.4 52.5 100. 0 100.0 Total publi privat c e 39.4 40.0 60.6 60.0 100. 0 100.0 Chisquare value 1.07

Satisfaction level No Yes Total

p value 0.58

6. CRM Interpretation & Analysis

112

32:-I feel parameters used in our present CRM are relevant. Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 33.3 50.0 66.7 50.0 100. 0 100.0

Middle mgt publi privat c e 52.2 43.1 47.8 56.9 100. 0 100.0

Lower mgt publi privat c e 38.9 43.9 61.1 56.1 100. 0 100.0

Total publi privat c e 43.4 43.5 56.6 56.5 100. 0 100.0

Chisquare value 0.91

p value 0.6

6. CRM Interpretation & Analysis

113

33.I feel business is better with CRM rather then without Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 33.3 50.0 66.7 50.0 100. 0 100.0

Middle mgt publi privat c e 46.7 53.1 53.3 46.9 100. 0 100.0

Lower mgt publi privat c e 36.7 44.9 63.3 55.1 100. 0 100.0

Total publi privat c e 40.7 49.5 59.3 50.5 100. 0 100.0

Chisquare value 0.78

p valu e 0.63

34:-Inflexibility to change. Y/N

6. CRM Interpretation & Analysis

114

Satisfaction level No Yes Total

Top Mgt publi privat c e 100. 0 0.0 0.0 100.0 100. 0 100.0

Middle mgt publi privat c e 32.2 67.8 100. 0 30.4 69.6 100.0

Lower mgt publi privat c e 35.6 64.4 100. 0 59.6 40.4 100.0

Total publi privat c e 38.2 61.8 100. 0 42.0 58.0 100.0

Chisquare value

p valu e

2.19

0.36

35:-Insupportable technology Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 0.0 100.0 100. 0 0.0 100. 0 100.0

Middle mgt publi privat c e 37.2 31.9 62.8 100. 0 68.1 100.0

Lower mgt publi privat c e 47.8 44.9 52.2 100. 0 55.1 100.0

Total publi privat c e 39.4 41.0 60.6 100. 0 59.0 100.0

Chisquare value

p valu e

2.34

0.37

6. CRM Interpretation & Analysis

115

36: -Delayed responsiveness across the organization Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 66.7 100.0 33.3 0.0 100. 0 100.0

Middle mgt publi privat c e 37.2 30.4 62.8 69.6 100. 0 100.0

Lower mgt publi privat c e 36.7 42.9 63.3 57.1 100. 0 100.0

Total publi privat c e 39.4 39.0 60.6 61.0 100. 0 100.0

Chisquare value 1.9

p valu e 0.41

37: -losses faced by the organization Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 33.3 0.0 66.7 100.0 100. 0 100.0

Middle mgt publi privat c e 46.1 41.9 53.9 58.1 100. 0 100.0

Lower mgt publi privat c e 26.7 30.3 73.3 69.7 100. 0 100.0

Total publi privat c e 34.3 35.0 65.7 65.0 100. 0 100.0

Chisquare value 2.37

p valu e 0.49

6. CRM Interpretation & Analysis

116

38: -Ready to face competition. Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 33.3 50.0 66.7 50.0 100. 0 100.0

Middle mgt publi privat c e 47.2 43.1 52.8 56.9 100. 0 100.0

Lower mgt publi privat c e 34.4 15.7 65.6 84.3 100. 0 100.0

Total publi privat c e 40.7 31.0 59.3 69.0 100. 0 100.0

Chisquare value 2.04*

p valu e 0.05

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that respondents fell that they are ready for competition Most respondents that is 59.3 % states YES ..In case of Private Banks 69.5% respondents says YES. So here is the major significance in highly satisfaction level in both sectors. Employees in private sector feel that customers expectations from private banks are very high so need 100% accuracy to retain them. Public banks feel they are ready and slowly and slowly improving to face competition.

6. CRM Interpretation & Analysis 39: -Underutilization of resources. Y/N

117

Satisfaction level No Yes Total

Top Mgt publi privat c e 66.7 0.0 33.3 100.0 100. 0 100.0

Middle mgt publi privat c e 31.1 54.2 68.9 45.8 100. 0 100.0

Lower mgt publi privat c e 37.8 39.4 62.2 60.6 100. 100.0

Total publi privat c e 35.4 45.0 64.6 55.0 100. 100.0

Chisquare value 2.11*

p value 0.034

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that respondents fell that they have resources and there is an improvement on date but still 64.6 % says YES. Employees feel they have started rotational job but still results are to be achieved as compared to private banks .In case of Private Banks 55% respondents stated YES .Employees in private sector feel that customers expectation from private banks are very high so need 100% accuracy to retain them.

40:-Improved performance Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 33.3 50.0 66.7 50.0 100. 0 100.0

Middle mgt publi privat c e 46.7 31.5 53.3 68.5 100. 0 100.0

Lower mgt publi privat c e 51.1 29.3 48.9 70.7 100. 0 100.0

Total publi privat c e 47.4 31.0 52.6 69.0 100. 0 100.0

Chisquare value 1.33*

p valu e 0.04

6. CRM Interpretation & Analysis

118

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that respondents fell that there is an improvement as compared to last financial year Most respondents says YES that is 52.6 % .In case of Private Banks 69% respondents say YES on improved performance . 41: -As a status symbol Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 33.3 0.0 66.7 100.0 100. 0 100.0

Middle mgt publi privat c e 31.7 31.9 68.3 68.1 100. 0 100.0

Lower mgt publi privat c e 44.4 43.9 55.6 56.1 100. 0 100.0

Total publi privat c e 37.4 36.0 62.6 64.0 100. 0 100.0

Chisquare value 1.02

p valu e 0.6

42: -Satisfied customer Y/N

6. CRM Interpretation & Analysis

119

Middle mgt publi privat c e 21.1 48.1 78.9 51.9 100. 0 100.0 Lower mgt publi privat c e 42.2 43.9 57.8 56.1 100. 0 100.0 Total publi privat c e 32.7 46.5 67.3 53.5 100. 0 100.0 Chisquare value 1.26* p valu e 0.04

Satisfaction level No Yes Total

Top Mgt publi privat c e 33.3 50.0 66.7 50.0 100. 0 100.0

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that respondents fell that customers are satisfied .Most respondents that is 67.3 % says YES. Employees feel that they have limited customers and public sector has improved a lot in terms of last impression. In terms of ATM networks they have largest as compared to private sector. In case of Private Banks 53.5% respondents says YES. Employees in private sector feel that customers expectation from private banks are very high so need 100% accuracy to retain them. 43: -More Business Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 66.7 0.0 33.3 100.0 100. 0 100.0

Middle mgt publi privat c e 46.7 32.7 53.3 67.3 100. 100.0

Lower mgt publi privat c e 52.2 19.2 47.8 80.8 100. 100.0

Total publi privat c e 51.4 25.0 48.6 75.0 100. 100.0

Chisquare value 1.42*

p valu e 0.05

6. CRM Interpretation & Analysis

120

From the table and graph it is analyzed that results are significant in this case. In case of Public Banks it is observed that respondents fell that in present scenario private Banks are getting more business as compared to Public sector .Only 48.6 % respondents feel that they are having better business opportunity as compared to private sector .In case of Private Banks 75% respondents say YES .Private sector is more confident on business growth as compared to public sector. 44: -Is it results in satisfaction level of customer? Y/N

Satisfaction level No Yes Total

Top Mgt publi privat c e 33.3 0.0 66.7 100.0 100. 0 100.0

Middle mgt publi privat c e 32.2 49.2 67.8 50.8 100. 0 100.0

Lower mgt publi privat c e 51.1 40.4 48.9 59.6 100. 0 100.0

Total publi privat c e 41.8 43.0 58.2 57.0 100. 0 100.0

Chisquare value 1.12

p valu e 0.54

6. CRM Interpretation & Analysis

121

45: -Do customers give references to other people of your Bank? Y/N Top Mgt publi privat c e 33.3 50.0 66.7 50.0 100. 0 100.0 Middle mgt publi privat c e 46.7 53.1 53.3 46.9 100. 0 100.0 Lower mgt publi privat c e 36.7 44.9 63.3 55.1 100. 0 100.0 Total publi privat c e 40.7 49.5 59.3 50.5 100. 0 100.0 Chisquare value 0.78 p valu e 0.63

Satisfaction level No Yes Total

6. CRM Interpretation & Analysis

122

A Paired Sample Correlation Analysis is applied for customer review. It is applied on questions.50 respondents were considered in case of each bank Section E no 1 to 10 (Refer Appendix 1). Detail Correlation tables are attached in Appendix 4 .From these table of Correlation details were analyzed. To analyze the response from various respondent data was converted to Correlation Table for each sector that is Public Sector Bank and Private Sector Bank. In each case questions were asked to 100 respondents. Final response received in case of Public Sector Banks is N=62 and in case of Private sector Banks N=67 and total N=127. Three different Correlations were run. First for Public Sector, Second for Private Sector and Third for Total. Refer Appendix 4. From Final Total Correlation table above it was found that in three cases, response is significant or highly significant. Those case have been analyze below

Are you Satisfied with the problem solving Attitude of bank Public Banks Correlation (Refer Table Correlation Public Banks) N=62 Are you Satisfied with the bank ( 1= Yes , 0 = No ) Private Banks Correlation ( Refer Table Correlation Public Banks ) N=65

Correlation (Refer Table Correlation Total )

N=127

0.242

0.131

0.186

Analyzing the details it is observed that these questions are positive correlated with each other .When most of the respondents were asked about there satisfaction level it is observed they have mix response and most of them have correlated the same with Problem solving attitude of the bank. It seems that if banks will solve customer problem efficiently they will feel satisfied. In case of Public Banks it is observed that Correlation is 0.242 and in case of Private Banks it is 0.131. But when total respondents were taken Total Correlation value is 0.186

6. CRM Interpretation & Analysis

123

Will you refer other to this bank Private Banks Correlation (Refer Table Correlation Public Banks ) N=65

Public Banks Correlation (Refer Table Correlation Public Banks) N=62 Will you again come in future Here ( 1= Yes , 0 = No )

Correlation (Refer Table Correlation Total )

N=127

0.275*

-0.233

-0.248

Seeing the table generated by SPSS software it is observed the value is highly significant .Analyzing the details it is observed that these questions are negatively correlated with each other as per table .When most of the respondents were asked that you will again come in future then customers response shows negative correlation of the same to give reference of banks to others. It is observed that Respondent due to convince of reach will again come to bank but is negative correlated to refer the same to others. C Do you think this bank is better than other bank Public Banks Correlation (Refer Table Correlation Public Banks) N=62 Are you satisfied with problem solving attitude to bank ( 1= Yes , 0 = No )

Private Banks Correlation (Refer Table Correlation Public Banks ) N=65

Correlation (Refer Table Correlation Total )

N=127

-0.098

-0.0281

-0.192

Seeing the Total Correlation Table generated by SPSS Software the value is Significant. Analyzing the details it is observed that these questions are negatively correlated with each other but of significance. Respondent response shows that against the problem solving attitude they

6. CRM Interpretation & Analysis

124

still feel that problems can be handled in much better and efficient way They feel many other banks solve the problem in better way.

You might also like

- Service Quality Analysis of SBIDocument38 pagesService Quality Analysis of SBIAkhil BhatiaNo ratings yet

- A Report On Customer Satisfaction On Technological Services of Private Commercial BanksDocument169 pagesA Report On Customer Satisfaction On Technological Services of Private Commercial BanksdrriyaaNo ratings yet

- Blueprint of Banking SectorDocument33 pagesBlueprint of Banking SectorShrish Agrawal89% (9)

- Chapter 4: Results and AnalysisDocument62 pagesChapter 4: Results and AnalysisChance SecondNo ratings yet

- Presentation1 Customer SatisfactionDocument22 pagesPresentation1 Customer SatisfactionAnjali Angel100% (2)

- Internship Report Depositor Buying Behavior An Analysis On Social Investment Bank Limited Principal Branch at AssignmentBasketDocument53 pagesInternship Report Depositor Buying Behavior An Analysis On Social Investment Bank Limited Principal Branch at AssignmentBasketBadrul Alam100% (1)

- Study of Customer Perception Towards Banking SectorDocument6 pagesStudy of Customer Perception Towards Banking SectorTUSHAR RATHINo ratings yet

- AppendixDocument47 pagesAppendixsowmiNo ratings yet

- Customer Satisfaction Level in Online Banking: Group MembersDocument7 pagesCustomer Satisfaction Level in Online Banking: Group Membersaashir chNo ratings yet

- Copy BookDocument18 pagesCopy Bookarafat chowdhuryNo ratings yet

- Group 11Document15 pagesGroup 11Deepanshu GuptaNo ratings yet

- Customer Relationship Management in Banking Sector-A Case Study of PNBDocument27 pagesCustomer Relationship Management in Banking Sector-A Case Study of PNBmanicoolgal4uNo ratings yet

- Mihret Dereje Fin Resrch 1 - CommentedDocument35 pagesMihret Dereje Fin Resrch 1 - Commentedfikru terfaNo ratings yet

- Data Analysis & InterpretationDocument11 pagesData Analysis & InterpretationAbdussalam KhanNo ratings yet

- Less Than 1 Year Less Than 2 Year More Than 2 YearDocument10 pagesLess Than 1 Year Less Than 2 Year More Than 2 YearkoolmanojsainiNo ratings yet

- Applying The Servqual Method in BanksDocument6 pagesApplying The Servqual Method in BanksJyotiSinghNo ratings yet

- Chapter-4 (Research Methodology)Document48 pagesChapter-4 (Research Methodology)ankit161019893980No ratings yet

- Customer Satisfaction IN Banking ServicesDocument10 pagesCustomer Satisfaction IN Banking ServicesSaurabh AgarwalNo ratings yet

- Naseer Prroject ReportDocument116 pagesNaseer Prroject ReportnehaNo ratings yet

- A Report On: A Study of Customer Satisfaction From Services Provided by Axis BankDocument26 pagesA Report On: A Study of Customer Satisfaction From Services Provided by Axis BankShani Saini0% (1)

- Title of The Research Comparative Analysis of Current Account of AXIS Bank With HDFC Bank in Mirzapur City"Document14 pagesTitle of The Research Comparative Analysis of Current Account of AXIS Bank With HDFC Bank in Mirzapur City"Ayushi AgrawalNo ratings yet

- FYP ReportDocument90 pagesFYP Reportyasir224100% (2)

- Addis ProposalDocument22 pagesAddis Proposaldenekew lesemiNo ratings yet

- The Excelence Customer Service Plays An Important Role To Maximise The Sales A Case Study On M&S Brent Cross BranchDocument111 pagesThe Excelence Customer Service Plays An Important Role To Maximise The Sales A Case Study On M&S Brent Cross Branchhrrana126No ratings yet

- HDFC Twoweeler LoanDocument93 pagesHDFC Twoweeler Loanashish100% (22)

- A Study On The Effectiveness of Service Provided To Customers of Bank (Iob, Indian Bank, Karur Vysya Bank, Sbi, City Union Bank)Document6 pagesA Study On The Effectiveness of Service Provided To Customers of Bank (Iob, Indian Bank, Karur Vysya Bank, Sbi, City Union Bank)santoshNo ratings yet

- Summer Project Report: End To End Improvement in Turn Around Time in Two-Wheelers Loan'Document93 pagesSummer Project Report: End To End Improvement in Turn Around Time in Two-Wheelers Loan'rahul gargNo ratings yet

- 1implications of Banking Services On Customer Loyalty 2003Document24 pages1implications of Banking Services On Customer Loyalty 2003Kunal Bhatt AmetaNo ratings yet

- Lean for Service Organizations and Offices: A Holistic Approach for Achieving Operational Excellence and ImprovementsFrom EverandLean for Service Organizations and Offices: A Holistic Approach for Achieving Operational Excellence and ImprovementsNo ratings yet

- HDFC BankDocument98 pagesHDFC BankAjay SethiNo ratings yet

- Servicequalityof Canara BankDocument49 pagesServicequalityof Canara BankRichard Lawrence50% (4)

- Finding of The StudyDocument22 pagesFinding of The StudyAkshat UpadhyayNo ratings yet

- Plagiarism Checker X Originality Report: Similarity Found: 20%Document33 pagesPlagiarism Checker X Originality Report: Similarity Found: 20%ShuvorehmanNo ratings yet

- Customers Satisfaction Towards Banking Services: Offered by Uco Bank in MoradabadDocument18 pagesCustomers Satisfaction Towards Banking Services: Offered by Uco Bank in MoradabadAditya KumarNo ratings yet

- Business Analytics Report: "The Factors Affect To Customers' Satisfaction of Techcombank Banking Services"Document8 pagesBusiness Analytics Report: "The Factors Affect To Customers' Satisfaction of Techcombank Banking Services"SơnNo ratings yet

- Customer Satisfaction in E-CommerceDocument66 pagesCustomer Satisfaction in E-CommerceAndrei Nebunoiu100% (1)

- Grand Project ReportDocument127 pagesGrand Project ReportVinay VinayNo ratings yet

- Nen Si Modi CPP PT 12345Document50 pagesNen Si Modi CPP PT 12345vivekjain007No ratings yet

- Developing A Strategic Plan For Brac Bank Ltd. For 2020. - PPTDocument40 pagesDeveloping A Strategic Plan For Brac Bank Ltd. For 2020. - PPTOmayerNo ratings yet

- Internship ReportDocument13 pagesInternship ReportSuraksha Koirala50% (6)

- Choose Right Measures For Right StrategyDocument3 pagesChoose Right Measures For Right StrategyCristian LunguNo ratings yet

- Abraham Research FinishedDocument51 pagesAbraham Research FinishedBarnababas BeyeneNo ratings yet

- Mastering Metrics 38460063Document21 pagesMastering Metrics 38460063jerome100% (27)

- Summer Internship Report On HNW Scoping and Market Survey: (Chartered Accountants)Document35 pagesSummer Internship Report On HNW Scoping and Market Survey: (Chartered Accountants)gajendraNo ratings yet

- Declaration: Customer Satisfaction After The Computerization of Banking Services" in Partial Fulfillment ofDocument47 pagesDeclaration: Customer Satisfaction After The Computerization of Banking Services" in Partial Fulfillment ofKaranPuriNo ratings yet

- Afrin Akter RumiDocument109 pagesAfrin Akter RumiSunny RekhiNo ratings yet

- Copy Book 1Document20 pagesCopy Book 1arafat chowdhuryNo ratings yet

- Study of Customer Satisfication On HDFC Bank: Project Work Report OnDocument11 pagesStudy of Customer Satisfication On HDFC Bank: Project Work Report OnXtremeInfosoftAlwarNo ratings yet

- Dissertation Report - Anuradha RathoreDocument44 pagesDissertation Report - Anuradha RathorejigyasaNo ratings yet

- Measuring What Matters: Our Net Promoter ProgramDocument34 pagesMeasuring What Matters: Our Net Promoter ProgramMegan ShepherdNo ratings yet

- Sarah Khurshid ReportDocument65 pagesSarah Khurshid ReportVaibhav ManoharanNo ratings yet

- Research Paper On Customer Satisfaction of Southeast Bank Ltd.Document17 pagesResearch Paper On Customer Satisfaction of Southeast Bank Ltd.monjurshajib67% (3)

- Golam Morshed HasanDocument112 pagesGolam Morshed HasankhandakeralihossainNo ratings yet

- Presented By:: Anil Mouraya Maryann D'souza Neha Dalvi Sukhada Manjrekar Dharmishtha Akshada DesaiDocument30 pagesPresented By:: Anil Mouraya Maryann D'souza Neha Dalvi Sukhada Manjrekar Dharmishtha Akshada Desaianilmourya5No ratings yet

- E BankingDocument29 pagesE Bankingprince rajNo ratings yet

- Banks Customer Satisfaction in Kuwait PDFDocument77 pagesBanks Customer Satisfaction in Kuwait PDFpavlov2No ratings yet

- Rachel Mitchell Task 1Document1,003 pagesRachel Mitchell Task 1nazmul HasanNo ratings yet

- Cognizant Company FAQDocument4 pagesCognizant Company FAQManojChowdary100% (1)

- Microeconomics Theory and Applications 12th Edition Browning Solutions ManualDocument5 pagesMicroeconomics Theory and Applications 12th Edition Browning Solutions Manualhauesperanzad0ybz100% (26)

- Trabajo Final CERVEZA OLMECADocument46 pagesTrabajo Final CERVEZA OLMECAramon nemeNo ratings yet

- 48 - 1997 SummerDocument42 pages48 - 1997 SummerLinda ZwaneNo ratings yet

- Tran Date Value Date Tran Particular Credit Debit BalanceDocument96 pagesTran Date Value Date Tran Particular Credit Debit BalanceGenji MaNo ratings yet

- Web Bearing and Buck1ling To BS en 1993Document3 pagesWeb Bearing and Buck1ling To BS en 1993antoninoNo ratings yet

- 5.1 - FMCSDocument19 pages5.1 - FMCSJon100% (1)

- Abhijit Auditorium Elective Sem 09Document3 pagesAbhijit Auditorium Elective Sem 09Abhijit Kumar AroraNo ratings yet

- 7779 19506 1 PBDocument24 pages7779 19506 1 PBAyessa FerrerNo ratings yet

- PRANIR ProfileDocument14 pagesPRANIR ProfileManish VadanereNo ratings yet

- Fadm Project 5 ReportDocument4 pagesFadm Project 5 ReportVimal AgrawalNo ratings yet

- DL5/DL6 With CBD6S: User ManualDocument32 pagesDL5/DL6 With CBD6S: User ManualMeOminGNo ratings yet

- Direct Marketing CRM and Interactive MarketingDocument37 pagesDirect Marketing CRM and Interactive MarketingSanjana KalanniNo ratings yet

- Notes in Train Law PDFDocument11 pagesNotes in Train Law PDFJanica Lobas100% (1)

- Misca 367 of 2008Document5 pagesMisca 367 of 2008Kabelo TsehareNo ratings yet

- Synergy Elektrik (PVT.) LTD PDFDocument3 pagesSynergy Elektrik (PVT.) LTD PDFMuhammad KashifNo ratings yet

- Human Resource Information Systems 2nd Edition Kavanagh Test BankDocument27 pagesHuman Resource Information Systems 2nd Edition Kavanagh Test BankteresamckenzieafvoNo ratings yet

- MSSQL and Devops DumpsDocument5 pagesMSSQL and Devops DumpsRishav GuptaNo ratings yet

- Name - Hiral Baid Class - 12 C Subject - Commerce Project 1 - Swot Analysis and Consumer ProtectionDocument21 pagesName - Hiral Baid Class - 12 C Subject - Commerce Project 1 - Swot Analysis and Consumer Protectionhiral baidNo ratings yet

- Australian Car Mechanic - June 2016Document76 pagesAustralian Car Mechanic - June 2016Mohammad Faraz AkhterNo ratings yet

- Tutorial MEP1553 - Insulation DiagnosticsDocument4 pagesTutorial MEP1553 - Insulation DiagnosticsSharin Bin Ab GhaniNo ratings yet

- Dy DX: NPTEL Course Developer For Fluid Mechanics Dr. Niranjan Sahoo Module 04 Lecture 33 IIT-GuwahatiDocument7 pagesDy DX: NPTEL Course Developer For Fluid Mechanics Dr. Niranjan Sahoo Module 04 Lecture 33 IIT-GuwahatilawanNo ratings yet

- Program 7Document6 pagesProgram 7Khushi GuptaNo ratings yet

- Renderoc LA55Document2 pagesRenderoc LA55Mansoor AliNo ratings yet

- Status Of: Philippine ForestsDocument11 pagesStatus Of: Philippine ForestsAivy Rose VillarbaNo ratings yet

- 3471A Renault EspaceDocument116 pages3471A Renault EspaceThe TrollNo ratings yet

- Digest of Agrarian From DAR WebsiteDocument261 pagesDigest of Agrarian From DAR WebsiteHuzzain PangcogaNo ratings yet

- PCB Design PCB Design: Dr. P. C. PandeyDocument13 pagesPCB Design PCB Design: Dr. P. C. PandeyengshimaaNo ratings yet

- Nogales V Capitol Medical CenterDocument2 pagesNogales V Capitol Medical CenterGraceNo ratings yet