Professional Documents

Culture Documents

Bohemia Q

Uploaded by

Saakshi TiwariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bohemia Q

Uploaded by

Saakshi TiwariCopyright:

Available Formats

Bohemia Industries At the beginning of September, Paul Owen, the new manager of a division of Bohemia Industries received the

August monthly profit statement. He was surprised that the profit had declined from that reported for the previous month. He was expecting an increase in profits because Augusts sales were significantly higher than the sales for July and costs had not increased nor had selling prices declined. The divisional manager asked John Vaughan, the management accountant, if a mistake had occurred since all factors pointed to an increase in profits from July to August. Vaughan assured Owen that the figures were correct. Owen asked for an explanation of why the profit had declined from July to August. Vaughan replied that profits had declined because Augusts production was significantly less than average monthly volume because August was a holiday period when many of the production staff were taking their annual holiday entitlement. The reduction in production staff resulted in production overheads being under-absorbed, and this under-absorption of overheads (known as a volume variance) resulted in additional fixed overheads, compared with July, being assigned as costs within the August profit statement. Owen was sceptical about Vaughans explanation. He pointed out that in the previous company that he had worked for, if sales increased then profits increased, or vice versa, when costs and selling prices remained unchanged. He argued that the August profit statement did not reflect the economic circumstances for July and August. He stated that surely if there is a significant increase in sales this should be reflected in an increase in profits. Vaughan remembered from his accountancy studies an alternative costing system to the current absorption costing system used by the company for accumulating costs for inventory valuation and profit measurement. This alternative system was called variable costing because only variable production costs were assigned to products for inventory valuation and profit measurement and fixed costs were treated as a period cost within the profit statement. Further research by Vaughan indicated that assuming that all other items remained constant variable costing profits were a function of sales volume only whereas with an absorption costing system profits were a function of both production and sales volumes. Vaughan decided to reproduce the profit statements and inventory valuations for July and August using variable costing. These statements using both variable and absorption costing systems are shown in Exhibit 1. Vaughan showed the statements presented in Exhibit 1 to Owen who responded now that is what I expect from an accountancy system to report. I knew that the performance was better in August than July and this is what is reflected in the variable costing profit statement. At our next senior divisional management meeting I am going to propose that we replace the absorption costing system with a variable costing system. Owen proposed at the next senior divisional management meeting that the variable costing system should be adopted. This proposal was also supported by Vaughan who pointed out that it would avoid the need to allocate manufacturing fixed overheads to products. He pointed out that the process was time-consuming and many of these allocations were arbitrary and had the potential to distort the profit margins on individual products. Also because fixed overheads would be separately reported rather than absorbed as a product cost, the variable costing system was preferable for controlling fixed overhead costs. To illustrate the distortion of profit margins Vaughan provided the information shown in Exhibit 2 relating to two of the major products (products A51 and A55) that were produced within the division. Examination of Exhibit 2 indicates that product margins differ depending on whether absorption or variable costing is used. With the former product A51 yields the higher unit margin whereas the latter indicates that Product A55 yields the higher margin. Vaughans boss, the divisional financial director, expressed some concerns about adopting the variable costing system. She pointed out that with the variable costing system that business would be undertaken at margins that exceeded variable costs but that may not provide a sufficient contribution to covering fixed costs or generating sufficient profit. In addition, she drew attention to the fact that external financial accounting required that profit statements and inventory valuations should be based on absorption costing. Therefore it would be necessary to operate both variable and absorption costing systems one for internal profit measurement and the other for external profit measurement. The results reported by the two systems may differ and result in confusion if the systems reported

significant differences in profits. She argued that managers should focus on the same profit measure that financial markets use to evaluate the company. Finally, she drew attention to the fact that although the net profit in August was higher with the variable costing system if the profits for July and August were added together the absorption costing system showed the higher profits. At this point it became apparent that the decision was more complex than originally envisaged. Owen therefore asked the Vaughan and the financial director to produce a report for the next meeting that would identify all of the issues involved relating to using variable or absorption costing for internal reporting. Questions 1. Provide an explanation to the divisional manager why variable and absorption costing systems result in the reporting of different profits using the information shown in Exhibit 1. 2. Comment on the various statements made by each of the managers and their implications for management accounting within the division. 3. Present a report recommending whether variable or absorption costing should be used for internal monthly profit reporting.

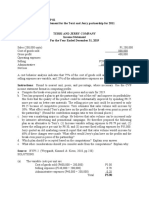

Exhibit 1 Profit statements and inventory valuations for July and August July Absorption Variable costing costing 000s 000s 5,000 5,000 3,000 2,000 2,000 3,000 (10) 2,010 1,600 410 6,300 ___ 3,000 1,200 1,600 200 4,200 August Absorption Variable costing costing 000s 000s 5,500 5,500 3,300 2,200 2,200 3,300 300 1,900 1,600 300 5,700 _____ 3,300 1,200 1,600 500 3,800

Sales revenues Cost of sales at standard cost Standard gross margin Under/(over) absorption of fixed production overheads (volume variance) a Actual gross margin Fixed production overhead Non-manufacturing overheads Profit before taxes Inventory valuations

Note a The remaining variances are insignificant and can be ignored for the case analysis and discussion.

Exhibit 2 Unit profit/contribution margins for products A51 and A55 Absorption costing Product A51 Product A55 500 550 320 385 180 165 Variable costing Product A51 Product A55 500 550 225 240 275 310

Selling price Standard absorption/variable cost Unit profit/contribution margin

You might also like

- Assumptions From The Case StudyDocument4 pagesAssumptions From The Case Studyjoyousmoi100% (1)

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- Overview of absorption and variable costing methodsDocument3 pagesOverview of absorption and variable costing methodsAreeb Baqai100% (1)

- Implementing Beyond Budgeting: Unlocking the Performance PotentialFrom EverandImplementing Beyond Budgeting: Unlocking the Performance PotentialRating: 5 out of 5 stars5/5 (1)

- Ch8 Absorption Variable Costing Income ReportingDocument19 pagesCh8 Absorption Variable Costing Income ReportingIsra' I. SweilehNo ratings yet

- As Hi SHDocument2 pagesAs Hi SHMISHRACOMNo ratings yet

- Variable Costing and Absorption Costing for Inventory ManagementDocument13 pagesVariable Costing and Absorption Costing for Inventory ManagementalliahnahNo ratings yet

- MAS Variable and Absorption CostingDocument11 pagesMAS Variable and Absorption CostingGwyneth TorrefloresNo ratings yet

- Income Effects of Alternative Cost Accumulation SystemsDocument4 pagesIncome Effects of Alternative Cost Accumulation SystemssserwaddaNo ratings yet

- CMA-II-Chapter 1Document20 pagesCMA-II-Chapter 1Yared BitewNo ratings yet

- Bohemia IndustriesDocument13 pagesBohemia Industriesaman100% (1)

- Variable and Absorption CostingDocument5 pagesVariable and Absorption CostingAllan Jay CabreraNo ratings yet

- Absorption (Variable) Costing and Cost-Volume-Profit AnalysisDocument41 pagesAbsorption (Variable) Costing and Cost-Volume-Profit AnalysisPapsie PopsieNo ratings yet

- Chapter 10Document5 pagesChapter 10Ailene QuintoNo ratings yet

- Chapter EightDocument38 pagesChapter EightLauren Campbell100% (4)

- Chapter 13 Variable CostingDocument3 pagesChapter 13 Variable CostingJJ JaumNo ratings yet

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_No ratings yet

- MAS Absorption Costing/Variable Costing Study ObjectivesDocument6 pagesMAS Absorption Costing/Variable Costing Study ObjectivesMarjorie ManuelNo ratings yet

- CMA II CH 1Document22 pagesCMA II CH 1Yared BitewNo ratings yet

- Term Paper: Submitted ToDocument7 pagesTerm Paper: Submitted ToSwagy BoyNo ratings yet

- Issues in Management Accounting Lecture 27 and 28Document7 pagesIssues in Management Accounting Lecture 27 and 28Muqadas JavedNo ratings yet

- 8 (A) - Master BudgetDocument4 pages8 (A) - Master Budgetshan_1299No ratings yet

- Akuntansi Manajemen Absoprtion CostingDocument7 pagesAkuntansi Manajemen Absoprtion CostingMuhammad SyahNo ratings yet

- Cost Accounting AssignmentDocument12 pagesCost Accounting Assignmentridhim khandelwalNo ratings yet

- Assigment 1 AccountDocument7 pagesAssigment 1 AccountMaría Fernanda Cortés GómezNo ratings yet

- Chapter 3 AkmenDocument28 pagesChapter 3 AkmenRomi AlfikriNo ratings yet

- Activity Based Costing Provides Accurate InsightsDocument7 pagesActivity Based Costing Provides Accurate Insightsrachel 1564No ratings yet

- Management Accounting AssignmentDocument21 pagesManagement Accounting AssignmentAadi KaushikNo ratings yet

- Management Accounting AssignmentDocument21 pagesManagement Accounting AssignmentAadi KaushikNo ratings yet

- Manage Accounting Assignment Breakeven AnalysisDocument21 pagesManage Accounting Assignment Breakeven AnalysisAadi KaushikNo ratings yet

- CMA Text SampleDocument35 pagesCMA Text SampleVinoth SairamNo ratings yet

- CA01 VariableCostingFDocument114 pagesCA01 VariableCostingFVenise Balia33% (3)

- Vendmart - TheDocument6 pagesVendmart - TheSagarrajaNo ratings yet

- Section - A 201: (I) Discuss About Accounting PrinciplesDocument7 pagesSection - A 201: (I) Discuss About Accounting PrinciplesPrem KumarNo ratings yet

- Cost Accounting - Week 12-Kode DosenDocument30 pagesCost Accounting - Week 12-Kode Dosenqjcn52f9dvNo ratings yet

- Chapter 15 - Alternative Inventory Valuation MethodsDocument5 pagesChapter 15 - Alternative Inventory Valuation MethodsLemon VeinNo ratings yet

- Managerial Accounting Case StudyDocument19 pagesManagerial Accounting Case StudyAnutaj NagpalNo ratings yet

- What Is Absorption Costing?Document3 pagesWhat Is Absorption Costing?Niño Rey LopezNo ratings yet

- Marginal and Absorption CostingDocument3 pagesMarginal and Absorption CostingsyedzulqarnainhaiderNo ratings yet

- Chap 007Document21 pagesChap 007Brooke CarterNo ratings yet

- Direct Costing Financial Statements: PurposeDocument18 pagesDirect Costing Financial Statements: Purposesadanand_petkar_1No ratings yet

- Karina-Managerial AccountingDocument13 pagesKarina-Managerial AccountingKarinaNo ratings yet

- Absorption CostingDocument4 pagesAbsorption CostingRegine NanitNo ratings yet

- Why companies need cost accounting systemsDocument4 pagesWhy companies need cost accounting systemsWiLliamLoquiroWencesLaoNo ratings yet

- Strategic Cost Management: Absorption vs Variable CostingDocument3 pagesStrategic Cost Management: Absorption vs Variable CostingMarites AmorsoloNo ratings yet

- Absorption Costing Vs Variable CostingDocument2 pagesAbsorption Costing Vs Variable Costingneway gobachew100% (1)

- Direct and Absorpton CostingDocument13 pagesDirect and Absorpton CostingJayson TasarraNo ratings yet

- Chapter 1 Basic Concepts & Product Cost SheetDocument72 pagesChapter 1 Basic Concepts & Product Cost SheetRupee Vs DollarNo ratings yet

- Mas 2605Document6 pagesMas 2605John Philip CastroNo ratings yet

- Home Tasks MBA (2020) - Faisel MohamedDocument5 pagesHome Tasks MBA (2020) - Faisel MohamedFaisel MohamedNo ratings yet

- Assignment V - Managerial Economics Mehul Singh Patel 19FLICDDN01152 Bba - LLB (Hons) Sec BDocument3 pagesAssignment V - Managerial Economics Mehul Singh Patel 19FLICDDN01152 Bba - LLB (Hons) Sec BRiya SinghNo ratings yet

- Strategic ManagementDocument42 pagesStrategic ManagementElvira CuadraNo ratings yet

- Kelompok 6 Chapter 6Document11 pagesKelompok 6 Chapter 6leoni pannaNo ratings yet

- Ch9 Raiborn SMDocument34 pagesCh9 Raiborn SMMendelle Murry100% (1)

- Absorption Costing and Varibale CostingDocument6 pagesAbsorption Costing and Varibale Costinghoney beeNo ratings yet

- Advantages of The Contribution ApproachDocument1 pageAdvantages of The Contribution Approachravi20288No ratings yet

- Difference between variable and absorption costingDocument8 pagesDifference between variable and absorption costingJc QuismundoNo ratings yet

- Accounting and FinanceDocument4 pagesAccounting and FinanceMuhammad WaqasNo ratings yet

- Suggested Solution:: 1. Prepare A Variable Costing Income Statement and An Absorption Costing Income StatementDocument4 pagesSuggested Solution:: 1. Prepare A Variable Costing Income Statement and An Absorption Costing Income Statement詹鎮豪No ratings yet

- Summer Trainee PolicyDocument4 pagesSummer Trainee PolicySaakshi TiwariNo ratings yet

- Ganesh Stuti for Protection and BlessingsDocument2 pagesGanesh Stuti for Protection and BlessingsSaakshi TiwariNo ratings yet

- Hinter Hunt MelangeDocument7 pagesHinter Hunt MelangeSaakshi TiwariNo ratings yet

- Grant Proposal Sample5Document13 pagesGrant Proposal Sample5Saakshi TiwariNo ratings yet

- 6754 Srm1 SmokingDocument4 pages6754 Srm1 SmokingSaakshi TiwariNo ratings yet

- 2008 1 GhergheDocument41 pages2008 1 GhergheSaakshi TiwariNo ratings yet

- Chapter 6 ParcorDocument10 pagesChapter 6 Parcornikki syNo ratings yet

- Financial Forecast Template ExcelDocument43 pagesFinancial Forecast Template ExcelPro Resources100% (1)

- Managerial Analysis: CVP 01 Break-EvenDocument4 pagesManagerial Analysis: CVP 01 Break-EvenGrace SimonNo ratings yet

- Consolidated financial statementsDocument3 pagesConsolidated financial statementsFarrell DmNo ratings yet

- Fin. Anal RafaelDocument6 pagesFin. Anal RafaelMarjonNo ratings yet

- 10 Acct 1abDocument16 pages10 Acct 1abJerric Cristobal100% (1)

- The Working Capital CycleDocument5 pagesThe Working Capital Cycleormeco sodNo ratings yet

- Cash To Accrual ProblemsDocument10 pagesCash To Accrual ProblemsAmethystNo ratings yet

- AFARDocument41 pagesAFARAlican, JerhamelNo ratings yet

- GDP by Income Approach ExplainedDocument15 pagesGDP by Income Approach ExplainedPreetiNo ratings yet

- Merchandising ReviewerDocument23 pagesMerchandising ReviewerCatherine LegaspiNo ratings yet

- FABV - PresentationDocument12 pagesFABV - PresentationPuneet MalhotraNo ratings yet

- Quiz CH 9 - 10Document2 pagesQuiz CH 9 - 10Niswatun NabilaNo ratings yet

- Chapter 10 - Accounting (Financial Statements) - 1-1Document8 pagesChapter 10 - Accounting (Financial Statements) - 1-1Sonali AnandNo ratings yet

- Sales 24344504 q3Document3 pagesSales 24344504 q3Vedantam GuptaNo ratings yet

- UNISA E-TUTOR'S GUIDE ON ADJUSTMENTS AND CLOSING PROCEDURESDocument30 pagesUNISA E-TUTOR'S GUIDE ON ADJUSTMENTS AND CLOSING PROCEDURESMichelle Foord100% (2)

- A Summer Training Project Report On Working Capital ManagementDocument65 pagesA Summer Training Project Report On Working Capital ManagementNeeraj Verma67% (3)

- Adjusting Journal Entries for Dec 31, 2020Document11 pagesAdjusting Journal Entries for Dec 31, 2020Dianna Rose MenorNo ratings yet

- Construction 09-2017-26 Sector HiddenDocument40 pagesConstruction 09-2017-26 Sector Hiddenajml39No ratings yet

- Financial Accounting and Reporting Analysis-Term 1: Godrej Consumer Products LimitedDocument6 pagesFinancial Accounting and Reporting Analysis-Term 1: Godrej Consumer Products LimitedNamit BaserNo ratings yet

- Chapter 4 End of The Period Adjustments Final ModuleDocument75 pagesChapter 4 End of The Period Adjustments Final ModuleRian Hanz AlbercaNo ratings yet

- Interim Financial Reporting: Click To Edit Master Subtitle StyleDocument64 pagesInterim Financial Reporting: Click To Edit Master Subtitle StyleMariel Angeli Chan100% (1)

- Pengantar AkuntansiDocument2 pagesPengantar AkuntansiYohana NataliaNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of Teachersroukaiya_peerkhanNo ratings yet

- Sorsogon State University module analyzes financial statementsDocument11 pagesSorsogon State University module analyzes financial statementserickson hernanNo ratings yet

- Page 206: EX. 4.3:: Problem Solving: Chapter 4Document3 pagesPage 206: EX. 4.3:: Problem Solving: Chapter 4Rebecca AntoniosNo ratings yet

- Chapter 1 Problems HDocument14 pagesChapter 1 Problems Hbalaji RNo ratings yet

- Cost-Volume-Profit and Breakeven AnalysisDocument36 pagesCost-Volume-Profit and Breakeven AnalysisJosartNo ratings yet

- Deliverable 14 - Statutory Financial Statements Redachem Industries Maghreb V08042022Document3 pagesDeliverable 14 - Statutory Financial Statements Redachem Industries Maghreb V08042022Loubna MikouNo ratings yet

- Topic 7 OF ACCONTINGDocument11 pagesTopic 7 OF ACCONTINGCharlesNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0No ratings yet

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (11)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- Impact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeFrom EverandImpact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeRating: 5 out of 5 stars5/5 (8)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- Systems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessFrom EverandSystems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessRating: 4.5 out of 5 stars4.5/5 (80)

- Sales Pitch: How to Craft a Story to Stand Out and WinFrom EverandSales Pitch: How to Craft a Story to Stand Out and WinRating: 5 out of 5 stars5/5 (1)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- Lean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdFrom EverandLean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdRating: 4.5 out of 5 stars4.5/5 (17)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantFrom EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantRating: 4 out of 5 stars4/5 (387)

- Small Business For Dummies: 5th EditionFrom EverandSmall Business For Dummies: 5th EditionRating: 4.5 out of 5 stars4.5/5 (10)

- HBR's 10 Must Reads 2023: The Definitive Management Ideas of the Year from Harvard Business Review (with bonus article "Persuading the Unpersuadable" By Adam Grant)From EverandHBR's 10 Must Reads 2023: The Definitive Management Ideas of the Year from Harvard Business Review (with bonus article "Persuading the Unpersuadable" By Adam Grant)Rating: 3.5 out of 5 stars3.5/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Strategy Legacy: How to Future-Proof a Business and Leave Your MarkFrom EverandThe Strategy Legacy: How to Future-Proof a Business and Leave Your MarkNo ratings yet

- HBR's 10 Must Reads on Business Model InnovationFrom EverandHBR's 10 Must Reads on Business Model InnovationRating: 4.5 out of 5 stars4.5/5 (12)

- Amp It Up: Leading for Hypergrowth by Raising Expectations, Increasing Urgency, and Elevating IntensityFrom EverandAmp It Up: Leading for Hypergrowth by Raising Expectations, Increasing Urgency, and Elevating IntensityRating: 5 out of 5 stars5/5 (50)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- HBR Guide to Setting Your StrategyFrom EverandHBR Guide to Setting Your StrategyRating: 4.5 out of 5 stars4.5/5 (18)