Professional Documents

Culture Documents

IMCase - 01 Harrod

Uploaded by

Jacobi StennisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IMCase - 01 Harrod

Uploaded by

Jacobi StennisCopyright:

Available Formats

1

Harrods Sporting Goods

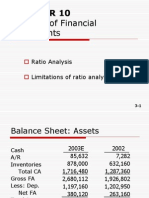

Ratio Analysis

Case 1

Purpose: The case allows the student to examine ratio analysis within the context of a customer-banking arrangement. The firm has a disagreement with the bank over how much it should be paying in relation to prime (no prior knowledge of banking is required for the case). An item of particular interest is the impact of an extraordinary loss on the firms income statement. It has a major effect on the analysis of the company. Industry comparisons also are utilized. Relation to Text: The case should follow Chapter 3. Complexity: The case is moderately complex. It should require 1 to 1 hours.

Solutions

1. Ratios Net income 1. Sales 2a. b. 3a. b. Net income Total assets Net income sales x sales / total assets Net income Stockholders equity Net income / total assets (1 debt / total assets) 2007 4.52 6.09% 4.52 x 1.35 16.04% 6.09% (1 .620) 2008 5.42% 7.23% 5.42% x 1.33 18.55% 7.23% (1 .610) 2009 3.99% 5.71% 3.99% x 1.43 15.02% 5.71% (1 .620)

2. Harrods has suffered a sharp decline in its profit margin, particularly between 2008 and 2009 (5.42% down to 3.99%). Return on assets is also down, but not quite as much due to a slight increase in asset turnover. Return on stockholders equity is also down. 3. 1. 2a. 2b. 3a. 3b. Net income Sales Net income Total assets Net income sales x sales / total assets Net income Stockholders equity Net income / total assets (1 debt / total assets) 2007 4.522 6.09% 4.52 x 1.35 16.04% 6.09% (1 .620) 2008 5.42% 7.23% 5.42% x 1.33 18.55% 7.23% (1 .610) 2009 6.19% 8.85% 6.19% x 1.43 23.30% 8.85% (1 .620)

4. After eliminating the effect of the nonrecurring extraordinary loss, the trend is clearly up over all three years. Particularly impressive is the increase in return on stockholders equity from 16.04% in 2007 to 23.30% in 2009. 5. Harrod has a clear superiority in the profit margin (6.19% vs. 4.51%). This is further enhanced by a more rapid asset turnover (1.43 vs. 1.13) to give an even more superior return on total assets (8.85% vs. 5.1%). Finally, return on stockholders equity greatly benefits from a higher debt ratio (62% vs. 48%) to provide an even larger gap between the firm and the industry (23.30% vs. 9.80%). While debt is not necessarily good, it has hiked up the return on equity to well over twice the industry figure.

3 6. Ratios 4. 6. 7. Sales Receivables Sales Inventory Sales Fixed assets 2009 6.31 4.75 2.77 Industry 5.75 3.01 3.20

Harrods is clearly superior to the industry in receivables turnover (6.31 vs. 5.75) and inventory turnover (4.75 vs. 3.01) and this more than compensates for a lower sales to fixed assets ratio (2.77 vs. 3.20). 7. Becky would appear to have strong grounds for a complaint. It appears that the banker was using unadjusted income statement numbers to arrive at the conclusion that Harrods was on a downward trend in terms of the profitability ratios. Also, using unadjusted data the profit margin was below the industry average. However, the inferior performance was due to an extraordinary, nonrecurring loss. In terms of normal operating performance, the company is clearly on an upward trend and well above the industry averages on all counts. One percent over prime appears to be much more reasonable than 2 percent over prime.

You might also like

- Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesFrom EverandWealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesNo ratings yet

- Analyze Dana Dairy's Financial Performance and Identify Areas for ImprovementDocument13 pagesAnalyze Dana Dairy's Financial Performance and Identify Areas for ImprovementalyNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Martin Manufacturing's 2009 Financial Ratios AnalysisDocument4 pagesMartin Manufacturing's 2009 Financial Ratios AnalysisKhai Eman50% (2)

- Solution Manual For Analysis For Financial Management 12th EditionDocument28 pagesSolution Manual For Analysis For Financial Management 12th Editionmyronholty7qmk100% (16)

- Harrod's Sporting GoodsDocument17 pagesHarrod's Sporting GoodsElisabete PadilhaNo ratings yet

- Module 1 Homework AssignmentDocument3 pagesModule 1 Homework Assignmentlgarman01No ratings yet

- Harrod's Sporting Goods Profit Ratios and Financial Analysis 2004-2006Document5 pagesHarrod's Sporting Goods Profit Ratios and Financial Analysis 2004-2006Bill Butters100% (3)

- Chapter 2 End of Chapter Solutions - EvensDocument4 pagesChapter 2 End of Chapter Solutions - EvensAna StitelyNo ratings yet

- Solution 2Document75 pagesSolution 2Asiful MowlaNo ratings yet

- Solutions Ch06Document4 pagesSolutions Ch06jessicalaurent1999No ratings yet

- Case 03Document9 pagesCase 03Sajieda FuadNo ratings yet

- 2-4 2003 Jun ADocument12 pages2-4 2003 Jun AAjay TakiarNo ratings yet

- T4. How Do You Answer This Ques - GreenwoodDocument11 pagesT4. How Do You Answer This Ques - Greenwood嘉慧No ratings yet

- Bega Cheese FY19-20 Financial Analysis: 11% EBITDA Growth & 384% PAT RiseDocument8 pagesBega Cheese FY19-20 Financial Analysis: 11% EBITDA Growth & 384% PAT RiseHaroon KhanNo ratings yet

- Chapter 3Document73 pagesChapter 3Mark Arceo0% (1)

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- Financial Statements & AnalysisDocument36 pagesFinancial Statements & AnalysisMahiNo ratings yet

- D&G Global Agency Financial AnalysisDocument9 pagesD&G Global Agency Financial AnalysisRitz Tan CadeliñaNo ratings yet

- Tutoria 2 AnswerDocument8 pagesTutoria 2 AnswerDOUMBOUYA SIDIKINo ratings yet

- Liquidity and Profitability Ratios for Adelaide BrightonDocument5 pagesLiquidity and Profitability Ratios for Adelaide BrightonAtul GirhotraNo ratings yet

- Concept Questions: Chapter Twelve The Analysis of Growth and Sustainable EarningsDocument64 pagesConcept Questions: Chapter Twelve The Analysis of Growth and Sustainable EarningsceojiNo ratings yet

- Full Download Solution Manual For Analysis For Financial Management 12th Edition PDF Full ChapterDocument36 pagesFull Download Solution Manual For Analysis For Financial Management 12th Edition PDF Full Chapterbuoyala6sjff100% (15)

- Solution Manual For Analysis For Financial Management 12th EditionDocument21 pagesSolution Manual For Analysis For Financial Management 12th Editionmissitcantaboc6sp100% (42)

- Ratios PDFDocument13 pagesRatios PDFaftab20No ratings yet

- Divisional Performance MeasuresDocument7 pagesDivisional Performance MeasuresNicole TaylorNo ratings yet

- 2024-0222-01 (1)Document8 pages2024-0222-01 (1)Ashutos MohantyNo ratings yet

- Accounts FiguresDocument5 pagesAccounts Figuresamitgupt22kNo ratings yet

- Fin103 LT1 2004-BMHDocument5 pagesFin103 LT1 2004-BMHJARED DARREN ONGNo ratings yet

- DCF Valuation Financial ModelingDocument10 pagesDCF Valuation Financial ModelingHilal MilmoNo ratings yet

- Biotech Group Yen HaDocument6 pagesBiotech Group Yen HaHa JeepNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document10 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- Project 2 Acct400aDocument10 pagesProject 2 Acct400aapi-736250712No ratings yet

- Nguyễn Bảo Ngọc - BAFNIU17016Document3 pagesNguyễn Bảo Ngọc - BAFNIU17016Thu ThuNo ratings yet

- FM Tutorial 1 - Cost of CapitalDocument5 pagesFM Tutorial 1 - Cost of CapitalAaron OforiNo ratings yet

- 2003 DecemberDocument7 pages2003 DecemberSherif AwadNo ratings yet

- Case - Assessing Martin Manufacturing's Current Financial PositionDocument3 pagesCase - Assessing Martin Manufacturing's Current Financial PositionM B Hossain Raju100% (4)

- Answer Mini CaseDocument11 pagesAnswer Mini CaseJohan Yaacob100% (3)

- Chap 3 SolutionsDocument70 pagesChap 3 SolutionsHoàng Huy80% (10)

- q3 13 Earnings ReleaseDocument13 pagesq3 13 Earnings ReleaseCicero PaulaNo ratings yet

- Analyzing Financial Ratios of a CompanyDocument35 pagesAnalyzing Financial Ratios of a Companyfrasatiqbal100% (1)

- KrispyDocument3 pagesKrispywilliamjone100% (1)

- Practice of Ratio Analysis, InterpretationDocument4 pagesPractice of Ratio Analysis, InterpretationZarish AzharNo ratings yet

- 2019 Analysis SAC Version 2 SolutionDocument6 pages2019 Analysis SAC Version 2 SolutionLachlan McFarlandNo ratings yet

- Financial Ratio Analysis ReportDocument8 pagesFinancial Ratio Analysis ReportJeff AtuaNo ratings yet

- 2-4 2006 Dec ADocument13 pages2-4 2006 Dec AAjay Takiar50% (2)

- Research Sample - IREDocument7 pagesResearch Sample - IREIndepResearchNo ratings yet

- Financial Ratios - XLSX 1Document11 pagesFinancial Ratios - XLSX 1minhhoai.evelynNo ratings yet

- Tugas Finance Bab3Document4 pagesTugas Finance Bab3Praisy KoruaNo ratings yet

- A1 Basic Financial Statement Analysis Q8Document3 pagesA1 Basic Financial Statement Analysis Q8bernard cruzNo ratings yet

- Analysis of Liquidity, Turnover and Profitability RatiosDocument9 pagesAnalysis of Liquidity, Turnover and Profitability RatiosvivekchittoriaNo ratings yet

- 3Q2013earningsCall11 7Document32 pages3Q2013earningsCall11 7sabah8800No ratings yet

- Financial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosDocument15 pagesFinancial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosdjmondieNo ratings yet

- FinanceDocument31 pagesFinanceMythili MuthappaNo ratings yet

- 5ffb Ims03Document32 pages5ffb Ims03Azadeh AkbariNo ratings yet

- GMACCase (Feb2007)Document5 pagesGMACCase (Feb2007)norcaldbnNo ratings yet

- Financial Ratio Analysis of Heartland IncDocument8 pagesFinancial Ratio Analysis of Heartland IncARCHIT KUMARNo ratings yet

- American Vanguard Corporation (Security AnaylisisDocument18 pagesAmerican Vanguard Corporation (Security AnaylisisMehmet SahinNo ratings yet

- 10k activity - wk mnDocument9 pages10k activity - wk mnapi-737334124No ratings yet

- READING 10 Industry and Company AnalysisDocument26 pagesREADING 10 Industry and Company AnalysisDandyNo ratings yet

- Hershey's $112M ERP Project Derails Halloween SalesDocument2 pagesHershey's $112M ERP Project Derails Halloween SalesJacobi StennisNo ratings yet

- Blaming ERPDocument4 pagesBlaming ERPJacobi StennisNo ratings yet

- Gary Stennis BUS242L Weekly Task ReportDocument2 pagesGary Stennis BUS242L Weekly Task ReportJacobi StennisNo ratings yet

- Walmart Vs TargetDocument3 pagesWalmart Vs TargetJacobi StennisNo ratings yet

- Eureka MckoyDocument1 pageEureka MckoyJacobi StennisNo ratings yet

- Stennis BUS227 U1 Review-AssignmentDocument7 pagesStennis BUS227 U1 Review-AssignmentJacobi StennisNo ratings yet

- Gary Stennis. ConclusionDocument3 pagesGary Stennis. ConclusionJacobi StennisNo ratings yet

- Accounting For Managerial DecisionsDocument2 pagesAccounting For Managerial DecisionsvineethkmenonNo ratings yet

- Bondor Steel PDFDocument63 pagesBondor Steel PDFriad riduNo ratings yet

- Delhivery ReportDocument15 pagesDelhivery ReportUdit Narayan KosareNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument4 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Vietnam's Leading Pangasius ProducerDocument20 pagesVietnam's Leading Pangasius ProducerANo ratings yet

- Saleem Provided Following Trial Balance On December 31, 2015Document17 pagesSaleem Provided Following Trial Balance On December 31, 2015S Jawad Ul HasanNo ratings yet

- Client Assistance ScheduleDocument9 pagesClient Assistance SchedulesefanitNo ratings yet

- Format Sopl and SofpDocument3 pagesFormat Sopl and SofpMuhammad Faaiz IzzeawanNo ratings yet

- CHapter 4 COnsolidated After Date of AcquisitionDocument53 pagesCHapter 4 COnsolidated After Date of AcquisitionAchmad RizalNo ratings yet

- IFRS 10 Consolidation RRDocument43 pagesIFRS 10 Consolidation RRYared HussenNo ratings yet

- SFL Final Prospectus-CompressedDocument434 pagesSFL Final Prospectus-Compressedsethirupal20013837No ratings yet

- Oxy 2006 10KDocument138 pagesOxy 2006 10Kbmichaud758No ratings yet

- Krakatau Steel A Study Cases Financial M PDFDocument8 pagesKrakatau Steel A Study Cases Financial M PDFZulkifli SaidNo ratings yet

- BST 2024 Paper 2Document9 pagesBST 2024 Paper 2sd8543326No ratings yet

- DVM Enterprises Financial Statements AnalysisDocument6 pagesDVM Enterprises Financial Statements AnalysisNicole AlexandraNo ratings yet

- Calculating Book Value, Earnings per ShareDocument61 pagesCalculating Book Value, Earnings per ShareDennis L. Udani75% (4)

- Ifrs, Basd Financial Stetmt Analysis Ch2Document14 pagesIfrs, Basd Financial Stetmt Analysis Ch2Slemon YiheyisNo ratings yet

- DividendsDocument3 pagesDividendsjano_art2125% (8)

- TM 7 AklDocument6 pagesTM 7 AklSyam NrNo ratings yet

- Sapm - Fifth (5) Sem BBIDocument156 pagesSapm - Fifth (5) Sem BBIRasesh ShahNo ratings yet

- Team Executive SummaryDocument5 pagesTeam Executive Summaryapi-490169824No ratings yet

- IAS7Document16 pagesIAS7Fitri Putri AndiniNo ratings yet

- FINANCIAL STATEMENT ANALYSIS - Practice Set PDFDocument4 pagesFINANCIAL STATEMENT ANALYSIS - Practice Set PDFDwight Manikan EchagueNo ratings yet

- Capital StructureDocument16 pagesCapital Structureanushri100% (1)

- Asset Based FinancingDocument64 pagesAsset Based FinancingChintan Shah100% (1)

- Advanced Financial Reporting - Class NotesDocument321 pagesAdvanced Financial Reporting - Class NotesJohn Kimiri Njoroge50% (2)

- BTN Billingual 31 Des 2018 ReleasedDocument246 pagesBTN Billingual 31 Des 2018 Releasedsusi sitohangNo ratings yet

- Fincial Statement AnalysisDocument41 pagesFincial Statement AnalysisAziz MoizNo ratings yet

- NCERT Class 11 Accountancy Book (Part II)Document124 pagesNCERT Class 11 Accountancy Book (Part II)Jidu M DivakaranNo ratings yet

- Contemporary Strategy Analysis Ch2 Study QuestionsDocument3 pagesContemporary Strategy Analysis Ch2 Study QuestionsBeta Acc100% (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungFrom EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungRating: 4 out of 5 stars4/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet