Professional Documents

Culture Documents

(BNP Paribas) Smile Trading

Uploaded by

Bernard RogierOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(BNP Paribas) Smile Trading

Uploaded by

Bernard RogierCopyright:

Available Formats

www.eqd.bnpparibas.

com This research report has been published in accordance with BNP Paribas

conflict management policy. Disclosures relating to BNP Paribas potential

conflicts of interest are available at https://eqd.bnpparibas.com

Equities & Derivatives Research 28 February 2006

Smile trading

Topic Paper Equity Derivatives Technical Study Europe

We shall never know all the good that a

simple smile can do

1

In this report, we investigate how to make profit from a potential cheap or

dear 90-110% smile. While options strategies such as collar or call ratio are

sensitive to the smile but not necessarily in a linear way, the difference in strike

prices between variance and gamma swaps is linearly related to a change in the

smile. We therefore look how to trade the smile, first in theory by showing how

variance and gamma swaps are impacted by the smile.

Since the gamma swap has a slightly positive delta, we then compare the

costs and benefits of delta-hedging the position. Given the fact that suggested

delta-hedging strategies do not provide a clear delta-neutral position, we argue

that the cost of delta-hedging could overcome its benefit.

Finally, we suggest a simple trading strategy that consists in the following

approach: if the 90-110% smile is 1.5-standard-deviation above (below) its

historical average, we recommend selling (buying) a variance swap and buying

(selling) a gamma swap.

We have backtested the strategy on the -Stoxx 50, the FTSE 100, the CAC

40 and the DAX 30 from January 2001 to January 2006. After transaction costs,

the strategy would have generated 1.21% on average in variance terms for the

-Stoxx 50 index. Depending on the index considered, the strategy would have

performed in 75 to 100% of the cases.

Variance swaps and gamma swaps replication using vanilla options

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

4

5

%

5

0

%

5

5

%

6

0

%

6

5

%

7

0

%

7

5

%

8

0

%

8

5

%

9

0

%

9

5

%

1

0

0

%

1

0

5

%

1

1

0

%

1

1

5

%

1

2

0

%

1

2

5

%

1

3

0

%

1

3

5

%

1

4

0

%

1

4

5

%

1

5

0

%

1

5

5

%

Variance swap Gamma swap

Source BNP Paribas

1

Mother Teresas quote

Nicolas Mougeot

nicolas.mougeot@bnpparibas.com

+33 (0) 1 55 77 53 89

Equity Derivatives Technical Study 28 February 2006

2 Equities & Derivatives Research

The robbed that smiles, steals

something from the thief

William Shakespeare, Othello

In search for hidden assets

There has been recently a search for investing into hidden assets. Hidden

assets include any asset in which it is not possible to invest directly through

listed and standardised products and is comprised among others of volatility,

dividend, correlation and indeed the volatility smile.

The smile refers to the fact that implied volatility in practice varies across

strikes. As the following graph shows, the implied volatility curve usually takes

two shapes:

A smile, when both OTM and ITM volatilities are higher than ATM

volatility. This is often the case for stocks.

A smirk, or skew, when the implied volatility is a decreasing function of

the strike price. This pattern is most often observed for indices.

1-year implied volatility curve for Total and -Stoxx 50 index as of 12

December 2005

0%

5%

10%

15%

20%

25%

30%

35%

40%

4

0

%

5

0

%

6

0

%

7

0

%

8

0

%

9

0

%

1

0

0

%

1

1

0

%

1

2

0

%

1

3

0

%

1

4

0

%

1

5

0

%

1

6

0

%

Strike

1

-

y

e

a

r

i

m

p

l

i

e

d

v

o

l

a

t

i

l

i

t

y

-Stoxx 50 Total

Source BNP Paribas

This is indeed one of the major flaws of the Black & Scholes model which

assumes a constant implied volatility curve. While the enigmatic smile of Mona

Lisa still fails to be deciphered 500 years after it was painted by Leonardo Da

Vinci, several theoretical and practical explanations have been put forward for

the volatility smile:

Leptokurtosis: The Black & Scholes model assumes that stock returns

follow a normal (or Gaussian) distribution. This implies that returns are

evenly and symmetrically distributed on both sides of their mean. In

practice, returns are often found to be leptokurtic, i.e. there is a higher

probability of a large downward movement than a large positive upward

one. Theoretical models using stochastic volatility or distribution with

jumps can create this empirical pattern.

Equity Derivatives Technical Study 28 February 2006

3 Equities & Derivatives Research

Heterogeneous beliefs: by taking into account heterogeneous beliefs

with regard to dividend growth among investors, Buraschi and Jiltskov

show that it can explain the smile.

Correlation risk: in the presence of correlation risk, indexs implied

volatility yields a smile even if stocks have a flat implied volatility curve.

Supply and demand: Insurance companies, through the use of OTM

put or structured products, are often willing to buy downside protection,

which leads to a higher OTM volatility.

How to make you smile in theory

Trading variance swaps vs. gamma swaps can help you capture the volatility

smile as a camera can do with a smile on your face. A variance swap is a

contract, the payoff of which is defined by:

( ) N K Variance off Pay

Var ap Variancesw

* =

and where the variance is defined by:

( ) ( )

=

=

T

i

i i

S S

T

Variance

1

2

1

ln

252

,

Var

K is the strike and N the notional amount

A variance swap therefore provides a simple and cost-efficient way to get a pure

exposure to variance.

The gamma swaps payoff is given by:

( ) N K Gamma off Pay

Gamma swap Gamma

* =

Where

( ) ( )

=

(

=

T

i

i

i i

S

S

S S

T

Gamma

1 0

2

1

ln

252

Gamma

K is the strike and N the notional amount. Gamma swaps are thus

equivalent to variance swaps whose nominal is proportional to the level of the

underlying asset.

By virtue of their payoff and insofar as squared returns

( ) ( )

2

1

ln

i i

S S

are

weighted by the performance of the stock

0

S S

i

, gamma swaps underweight big

downward index move relative to variance swaps. This means that if the

distribution of stock returns is skewed to the left, gamma swaps minimise the

effect of a crash, thereby making it easier for the trader to hedge. In this case,

hedging does not require additional caps, unlike variance swaps which need to

be capped when the underlying asset is a single stock.

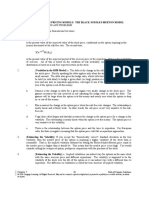

One can further show that variance swaps can be replicated by a static portfolio

of options with a continuum of strike prices and where the each option is

weighted by 1/K

2

. Gamma swaps can be replicated the same way and as its

nominal is proportional to the level of the underlying asset, the gamma swap

can be replicated by static portfolio of options with a continuum of strike prices

where each option is weighted by 1/K. The following graph displays the amount

of options required to replicate the gamma and variance swaps when using the

Derman et al.s discrete hedging approximation

2

.

2

See Volatility Investing Handbook: Variance Swaps and Beyond, September 2005 for a

description of the method

Equity Derivatives Technical Study 28 February 2006

4 Equities & Derivatives Research

Variance swaps and gamma swaps replication weights using vanilla options

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

4

5

%

5

0

%

5

5

%

6

0

%

6

5

%

7

0

%

7

5

%

8

0

%

8

5

%

9

0

%

9

5

%

1

0

0

%

1

0

5

%

1

1

0

%

1

1

5

%

1

2

0

%

1

2

5

%

1

3

0

%

1

3

5

%

1

4

0

%

1

4

5

%

1

5

0

%

1

5

5

%

Variance swap Gamma swap

Source BNP Paribas

The gamma swaps replication therefore requires less expensive OTM option

when compared with that of variance swaps. It further implies that both products

have a different exposure to the smile and that by trading one against the other,

one can get an exposure to the smile. The following graph shows the difference

between variance and gamma swaps strike prices for different levels of smile.

Here we define the smile as the 95%-100% implied volatility spread and we

keep the same average level of volatility. Therefore by increasing the smile, we

steepen the volatility curve.

Variance swap/gamma swap strike prices spread as a function of the smile

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00%

Smile (95%- 100%)

v

a

r

s

w

a

p

-

g

a

m

m

a

s

w

a

p

Source BNP Paribas

As one can see, the relationship between the variance/gamma swap spread

and the smile is increasing and almost linear.

How to make you smile From theory to practice

The previous graph could be somewhat misleading. If one wants to buy the

smile, he would simply need to buy a variance swap and sell a gamma swap. In

practice, however, the situation is as usual different. While the

Equity Derivatives Technical Study 28 February 2006

5 Equities & Derivatives Research

variance/gamma swap spread payoff is indeed a function of the smile, the smile

is not the only factor affecting its payoff:

Spot price: while the variance swaps payoff is invariant with the

underlying asset price, the gamma swap is slightly delta-positive as its

payoff is a function of the spot price.

Smile structure: The sensitivity of the variance/gamma swap spread to

the smile is almost linear in theory. However, as shown in the previous

section, the smile is not a linear function of strike prices. The smile

structure itself - and in particular its wings - could thus affect the

sensitivity of the variance/gamma swap spread to the smile.

In order to study the relationship between the variance/gamma swap spread

and the smile, we have simulated 1-year variance and gamma swaps strike

prices using the Derman et al.s methodology from January 2001 to January

2006 for the major European indices. When needed, the dividend yield is

calculated by taking the historical dividend yield and the bond yield is

approximated by the 1-year swap rate in the relevant currency.

The smile & the variance/gamma swap strike price spread

The following graphs display the 90%-110% smile as well as the

variance/gamma swap strike price spread for the -Stoxx 50, FTSE 100, CAC

40 and DAX 30 indices.

The two series are as expected strongly and positively correlated but it is worth

bearing in mind that the correlation is not stationary. The full sample correlation

ranges between 13.60% for the DAX 30 to 47.50% for the FTSE 100 but is

much higher if we consider sub samples. This is explained by a de-correlation

between the smile and the variance gamma spread between April 2003 and

January 2004, i.e. during the strong equity market recovery. For all indices, the

smile started to bounce back from very low level while the variance-gamma

swap spread declined as gamma swaps prices were pricing a rise in the equity

market.

Correlation between 90%110% smile and variance/gamma strike price

spread (1-year)

-Stoxx 50 FTSE 100 DAX 30 CAC 40

Jan. 01 - Jan. 05 15.89% 37.48% 14.91% 34.72%

Jan. 01 - Sep. 03 55.90% 78.90% 53.39% 79.47%

Oct. 03 - Jan. 05 72.57% 78.52% 55.39% 69.01%

Source BNP Paribas

A strong but not stationary correlation

Variance swaps/gamma swaps spread

and the 90%-110% smile (1-year)

FTSE 100

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

Jan-01 Jul-01 Jan-02 Jul-02 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

var - gamma 90% - 110% smile

-STOXX 50

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

Jan-01 Jul-01 Jan-02 Jul-02 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

var - gamma 90% - 110% smile

DAX 30

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

Jan-01 Jul-01 Jan-02 Jul-02 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06

3.00%

4.00%

5.00%

6.00%

var - gamma 90% - 110% smile

CAC 40

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

Jan-01 Jul-01 Jan-02 Jul-02 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06

2.00%

3.00%

4.00%

5.00%

6.00%

var - gamma 90% - 110% smile

Source BNP Paribas

Equity Derivatives Technical Study 28 February 2006

6 Equities & Derivatives Research

To delta-hedge or not to delta hedge? That is the question

In theory, one should delta-hedge its gamma swap in order to immunise against

changes in the underlying share price. As the gamma swaps payoff should be

slightly delta positive, investors/traders should take a negative position in the

underlying asset or its futures.

The question is however less trivial in practice. First, the indexs variance and its

performance are strongly negatively correlated. When markets decline, volatility

usually rises. Variance and Gamma swaps realised payoffs are thus in reality

negatively correlated to the underlying assets performance. Therefore, since

delta-hedging the gamma swap would imply taking a negative position in the

underlying asset, it would increase the negative sensitivity of the gamma swap

to the underlying assets performance.

Correlation between 1-year indexs performance and 1-year

variance and gamma swaps realised payoffs

-Stoxx 50 FTSE 100 DAX 30 CAC 40

variance swap -79.29% -80.80% -70.23% -78.39%

gamma swap -71.44% -76.06% -56.11% -70.29%

Source BNP Paribas

What about the strike prices? Variance and gamma swaps strike prices are

defined as a portfolio of option with a continuum of strike prices. These options

are weighted by (1/K)

2

and 1/K in the case of the variance and gamma swaps

respectively. Since options prices are usually determined by arbitrage models,

they should be independent of investors expectations about the underlying

assets expected returns.

Correlation between 1-year indexs performance and 1-year

variance and gamma swaps strike prices lagged 1 year

-Stoxx 50 FTSE 100 DAX 30 CAC 40

variance swap 15.59% 1.00% 35.79% 16.46%

gamma swap 11.54% -3.80% 32.86% 11.54%

Source BNP Paribas

But, in fact, what matters is not the delta of each strategy but the delta of the

variance/gamma spread. There exists several ways to delta-hedge the gamma

swap. If we neglect interest rate, dividend, repo rate and if we assume a

constant volatility, one can show that in order to get a delta-neutral gamma

swap, one needs to hold:

T

t T

S

0

2

shares at time t.

The P&L of such a delta-hedge strategy is at time T equal to:

( )

| |

0

0

2

1

0

1

0

2

S

S S

S S

T

t T

S

T

i

i i

=

(

=

+

The following table shows the correlation between the 1-year indexs

performance and:

The variance/gammas payoff i.e.:

( ) ( )

=

(

(

|

|

.

|

\

|

252

1 0

2

1

1 ln

i

i

i i

S

S

S S

The variance/gammas strike price spread: K

Var

-K

Gamma

Equity Derivatives Technical Study 28 February 2006

7 Equities & Derivatives Research

The P&L, i.e. the difference between the payoff and the strike price

spread

The delta-hedged P&L, i.e. the P&L plus the aforementioned delta-

hedging strategy

Correlation between 1-year indexs performance and variance/gamma

spreads

-Stoxx 50 FTSE 100 DAX 30 CAC 40

var-gamma's payoffs -89.25% -88.42% -87.48% -88.73%

var-gamma's strike prices 42.00% 33.89% 52.71% 44.90%

P&L (payoffs-strike prices) -89.31% -85.84% -88.76% -89.01%

P&L + delta-hedge -71.88% -62.87% -66.52% -68.73%

Source BNP Paribas

Delta-hedging the position allows for reducing the correlation of the P&L with

the performance of the index by 20% an average. However, as the correlation

remains very high and negative, the benefit of delta-hedging may be

overweighted by its operational and financial costs.

Equity Derivatives Technical Study 28 February 2006

8 Equities & Derivatives Research

A simple smile trading strategy

While a pure smile trade may be difficult to set up, trading variance swaps

against gamma swaps can be optimised with respect to the smile level. We

therefore suggest a straightforward trading strategy to profit from very cheap or

dear smiles. If the 90-110% smile is 1.5-standard deviation above (below) its

historical average, we recommend selling (buying) a variance swap and buying

(selling) a gamma swap. This fairly simple standard-deviation signal has been

profitably used in cash pairs trading for years actually

3

.

We perform this strategy on four different European indices, namely the -Stoxx

50, the FTSE 100, the CAC 40 and the DAX 30 using 1-year variance and

gamma swaps. Results from the backtest are reported in the following table,

assuming a 50bps bid-ask on each swap.

First, a systematic long-short strategy would have poorly performed. Buying a

variance swap or a gamma swap and selling the other would have resulting in a

performance on average either negative or barely positive.

Applying the 1.5 standard-deviation screen on the smile strongly improves the

performance of the strategy. For the FTSE 100 for example, being long a 1-year

variance swap and short a 1-year gamma swap would have generated 1.25% in

variance terms. Both strategies have performed positively in at least 75% of the

case whatever the considered European index.

The number of potential trades lies between 2 to 12% of the days in our sample.

This could be increased by relaxing the filter, i.e. by considering for example

cases where the 90-110% smile is one standard-deviation away from its mean

instead of 1.5. This would yield a potential trade in around 18% of the cases or

one every six trading days but this would be accompanied by an increase of the

potential loss, without necessarily a subsequent rise in the potential

performance.

Statistics on the smile trading strategy January 2001 January 2006

-Stoxx 50 FTSE 100 CAC 40 DAX 30

Long variance short gamma average 1.21% 1.25% 0.43% 0.96%

minimum -2.29% 0.56% -1.93% -2.90%

maximum 5.05% 1.80% 1.13% 1.88%

percentage of positive performance 76% 100% 86% 87%

percentage of occurrence 4% 2% 5% 6%

systematic long-short average 0.08% -0.26% -0.02% 0.35%

Short variance long gamma average 0.52% 0.32% 0.46% 0.60%

minimum 0.31% 0.13% 0.29% 0.41%

maximum 0.74% 0.95% 0.67% 0.84%

percentage of positive performance 100% 100% 100% 100%

percentage of occurrence 12% 12% 14% 12%

systematic long-short average -0.59% -0.17% -0.48% -0.89%

Source BNP Paribas

3

See for example Pairs trading: performance of a relative value arbitrage rule , by Gatev,

Goetzmann and Rouwenhorst, forthcoming in the Review of Financial Studies.

Equity Derivatives Technical Study 28 February 2006

9 Equities & Derivatives Research

In accordance with US regulations, the analyst(s) named in this report certifies that 1) all of the views expressed herein accurately reflect the

personal views of the analyst(s) with regard to any and all of the content, securities and issuers and 2) no part of the compensation of the

analyst(s) was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst(s) in this report.

It is a BNP Paribas policy that analysts are prohibited from trading in any of the stocks in the sector that they cover.

THIS PUBLICATION IS NOT INTENDED FOR PRIVATE CUSTOMERS AS DEFINED IN THE FSA RULES AND SHOULD NOT BE PASSED

ON TO ANY SUCH PERSON.

The material in this report was produced by a BNP Paribas Group Company. It will have been approved for publication and distribution in the

United Kingdom by BNP Paribas London Branch, a branch of BNP Paribas SA whose head office is in Paris, France. BNP Paribas London

Branch is regulated by the Financial Services Authority ("FSA") for the conduct of its designated investment business in the United Kingdom.

BNP Paribas SA, a limited company, is registered as a bank with the Comit des Etablissements de Crdit et des Entreprises

dInvestissement (CECEI) and is regulated by the Autorit des Marchs Financiers (AMF) for the conduct of its designated investment

business in France. BNP Paribas Securities Corp. in the United States accepts responsibility for the contents of this report in circumstances

where the report has been distributed by BNP Paribas Securities Corp. direct to U.S. recipients.

The information and opinions contained in this report have been obtained from public sources believed to be reliable, but no representation or

warranty, express or implied, is made that such information is accurate or complete and it should not be relied upon as such. Information and

opinions contained in the report are published for the assistance of recipients, but are not to be relied upon as authoritative or taken in

substitution for the exercise of judgement by any recipient, and are subject to change without notice. This report is not, and should not be

construed as, an offer document or an offer or solicitation to buy or sell any investments. Any reference to past performance should not be

taken as an indication of future performance. No BNP Paribas Group Company accepts any liability whatsoever for any direct or consequential

loss arising from any use of material contained in this report. This report is confidential and is submitted to selected recipients only. It may not

be reproduced (in whole or in part) to any other person. A BNP Paribas Group Company and/or persons connected with it may effect or have

effected a transaction for their own account in the investments referred to in the material contained in this report or any related investment

before the material is published to any BNP Paribas Group Company's customers. On the date of this report a BNP Paribas Group Company,

persons connected with it and their respective directors and/or representatives and/or employees may have a long or short position in any of

the investments mentioned in this report and may purchase and/or sell the investments at any time in the open market or otherwise, in each

case either as principal or as agent. Additionally, a BNP Paribas Group Company within the previous twelve months may have acted as an

investment banker or may have provided significant advice or investment services to the companies or in relation to the investment(s)

mentioned in this report.

This report is prepared for professional investors and is not intended for Private Customers and should not be passed on to any such persons.

For the purpose of distribution in the United States this report is only intended for persons which can be defined as 'Major Institutional Investors'

under U.S. regulations. Any U.S. person receiving this report and wishing to effect a transaction in any security discussed herein, must do so

through a U.S. registered broker dealer. BNP Paribas Securities Corp. is a U.S. registered broker dealer.

By accepting this document you agree to be bound by the foregoing limitations.

BNP Paribas (2004). All rights reserved.

BNP Paribas is incorporated in France with Limited Liability.

Registered Office 16 boulevard des Italiens, 75009 Paris.

BNP Paribas London Branch, 10 Harewood Avenue, London NW1 6AA is authorised by CECEI

& AMF and the Financial Services Authority, and is regulated by the Financial Services

Authority for the conduct of its investment business in the United Kingdom.

BNP Paribas London Branch is registered in England and Wales under No. FC13447.

Registered Office: 10 Harewood Avenue, London NW1 6AA.

Tel: +44 (0)20 7595 2000 Fax: +44 (0)20 7595 2555 www.bnpparibas.com

You might also like

- Trading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4From EverandTrading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4Rating: 4 out of 5 stars4/5 (1)

- Option Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3From EverandOption Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3No ratings yet

- Asset Swaps to Z-spreads: An Introduction to Swaps, Present Values, and Z-SpreadsDocument20 pagesAsset Swaps to Z-spreads: An Introduction to Swaps, Present Values, and Z-SpreadsAudrey Lim100% (1)

- (Merrill Lynch) Credit Derivatives Handbook 2006 - Volume 2Document196 pages(Merrill Lynch) Credit Derivatives Handbook 2006 - Volume 2tndiemhangNo ratings yet

- AQR - Chasing Your Own Tail RiskDocument9 pagesAQR - Chasing Your Own Tail RiskTimothy IsgroNo ratings yet

- (Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsDocument14 pages(Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsJonathan Ching100% (1)

- Trading Fixed Income and FX in Emerging Markets: A Practitioner's GuideFrom EverandTrading Fixed Income and FX in Emerging Markets: A Practitioner's GuideNo ratings yet

- CH 21 Hull OFOD9 TH EditionDocument40 pagesCH 21 Hull OFOD9 TH Editionseanwu95No ratings yet

- Lecture Notes in Financial EconomicsDocument586 pagesLecture Notes in Financial EconomicsDinesh Kumar100% (1)

- A Look at DurationDocument45 pagesA Look at Durationjames.kwokNo ratings yet

- Dispersion Trade Option CorrelationDocument27 pagesDispersion Trade Option Correlationmaf2014100% (2)

- Derivatives Strategy: Factors Behind Single Stock VolatilityDocument10 pagesDerivatives Strategy: Factors Behind Single Stock Volatilityhc87No ratings yet

- Skew GuideDocument18 pagesSkew Guidezippolo100% (2)

- Interest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsDocument14 pagesInterest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsReema RatheeNo ratings yet

- Signal Processing 20101110Document36 pagesSignal Processing 20101110smysona100% (2)

- JP Morgan Fixed Income Correlation Trading Using SwaptionsDocument7 pagesJP Morgan Fixed Income Correlation Trading Using Swaptionscoolacl100% (2)

- (Ebook) Goldman Sachs-Fixed Income ResearchDocument44 pages(Ebook) Goldman Sachs-Fixed Income Researchepicurien91100% (2)

- Ribeiro Volatility 2012Document16 pagesRibeiro Volatility 2012pbecker126100% (2)

- Optimal Delta Hedging For OptionsDocument11 pagesOptimal Delta Hedging For OptionsSandeep LimbasiyaNo ratings yet

- A&J Questions Bank For SOA Exam MFE/ CAS Exam 3FDocument24 pagesA&J Questions Bank For SOA Exam MFE/ CAS Exam 3Fanjstudymanual100% (1)

- (BNP Paribas) Volatility Investing HandbookDocument43 pages(BNP Paribas) Volatility Investing Handbooktv1s100% (3)

- Nomura US Vol AnalyticsDocument26 pagesNomura US Vol Analyticshlviethung100% (2)

- The Art of The Variance SwapDocument5 pagesThe Art of The Variance SwapMatt Wall100% (1)

- JPM Volatility Swap PrimerDocument28 pagesJPM Volatility Swap Primermark100% (2)

- Introduction To Conditional Variance SwapsDocument2 pagesIntroduction To Conditional Variance SwapstsoutsounisNo ratings yet

- Which Free Lunch Would You Like Today, Sir?: Delta Hedging, Volatility Arbitrage and Optimal PortfoliosDocument104 pagesWhich Free Lunch Would You Like Today, Sir?: Delta Hedging, Volatility Arbitrage and Optimal PortfolioskabindingNo ratings yet

- Volatility - A New Return Driver PDFDocument16 pagesVolatility - A New Return Driver PDFrlprisNo ratings yet

- Dispersion Trading: Many ApplicationsDocument6 pagesDispersion Trading: Many Applicationsjulienmessias2100% (2)

- Introduction To DerivativesDocument430 pagesIntroduction To DerivativesKunal MehtaNo ratings yet

- Dispersion Trading and Volatility Gamma RiskDocument10 pagesDispersion Trading and Volatility Gamma RiskHenry Chow100% (2)

- CDocument16 pagesC7610216922No ratings yet

- Hedging of Autocallabe - FinalDocument27 pagesHedging of Autocallabe - FinalVicol Dan100% (8)

- Dispersion TradesDocument41 pagesDispersion TradesLameune100% (1)

- 2006 Loeys, J., Exploiting Cross-Market MomentumDocument16 pages2006 Loeys, J., Exploiting Cross-Market MomentumArthur FournierNo ratings yet

- Trading the Volatility SkewDocument11 pagesTrading the Volatility Skewhc87No ratings yet

- Fixed Income Relative Value Analysis: A Practitioners Guide to the Theory, Tools, and TradesFrom EverandFixed Income Relative Value Analysis: A Practitioners Guide to the Theory, Tools, and TradesNo ratings yet

- Understanding Duration and Volatility: Salomon Brothers IncDocument32 pagesUnderstanding Duration and Volatility: Salomon Brothers IncoristhedogNo ratings yet

- Equity Derivatives OverviewDocument22 pagesEquity Derivatives Overviewthava477cegNo ratings yet

- Handbook of Fixed-Income SecuritiesFrom EverandHandbook of Fixed-Income SecuritiesPietro VeronesiRating: 4 out of 5 stars4/5 (12)

- YieldBook MBS Volatility Skew and Valuation of MTG (2005)Document25 pagesYieldBook MBS Volatility Skew and Valuation of MTG (2005)fengn100% (1)

- Auto Call 1Document24 pagesAuto Call 1Jérémy HERMANTNo ratings yet

- Convexity and VolatilityDocument20 pagesConvexity and Volatilitydegas981100% (2)

- (Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueDocument12 pages(Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-Valuecoolacl0% (2)

- (Dresdner Klein Wort, Bossu) Introduction To Volatility Trading and Variance SwapsDocument56 pages(Dresdner Klein Wort, Bossu) Introduction To Volatility Trading and Variance Swapstwilgaal100% (1)

- Credit Suisse - Sell SX5E SkewDocument3 pagesCredit Suisse - Sell SX5E SkewZhenhuan SongNo ratings yet

- Uncertainty and Style Dynamics: Portfolios Under ConstructionDocument27 pagesUncertainty and Style Dynamics: Portfolios Under ConstructionRaphael100% (1)

- JP Morgan - Trading Credit Curves 2Document37 pagesJP Morgan - Trading Credit Curves 2PeterNo ratings yet

- The High Frequency Game Changer: How Automated Trading Strategies Have Revolutionized the MarketsFrom EverandThe High Frequency Game Changer: How Automated Trading Strategies Have Revolutionized the MarketsNo ratings yet

- Advanced Portfolio Management: A Quant's Guide for Fundamental InvestorsFrom EverandAdvanced Portfolio Management: A Quant's Guide for Fundamental InvestorsNo ratings yet

- Mathematics of Financial Derivatives: An IntroductionDocument15 pagesMathematics of Financial Derivatives: An IntroductionVinh PhanNo ratings yet

- SkewDocument34 pagesSkewnblanc88100% (4)

- Barclays Special Report Market Neutral Variance Swap VIX Futures StrategiesDocument23 pagesBarclays Special Report Market Neutral Variance Swap VIX Futures Strategiesicefarmcapital100% (1)

- Yield Curve Modeling and Forecasting: The Dynamic Nelson-Siegel ApproachFrom EverandYield Curve Modeling and Forecasting: The Dynamic Nelson-Siegel ApproachRating: 4 out of 5 stars4/5 (2)

- Dispersion - A Guide For The CluelessDocument6 pagesDispersion - A Guide For The CluelessCreditTraderNo ratings yet

- DBG 020911 94525Document48 pagesDBG 020911 94525experquisite100% (1)

- European Fixed Income Markets: Money, Bond, and Interest Rate DerivativesFrom EverandEuropean Fixed Income Markets: Money, Bond, and Interest Rate DerivativesJonathan A. BattenNo ratings yet

- Relative Value Single Stock VolatilityDocument12 pagesRelative Value Single Stock VolatilityTze Shao100% (2)

- Practical Portfolio Performance Measurement and AttributionFrom EverandPractical Portfolio Performance Measurement and AttributionRating: 3.5 out of 5 stars3.5/5 (2)

- Trading the Fixed Income, Inflation and Credit Markets: A Relative Value GuideFrom EverandTrading the Fixed Income, Inflation and Credit Markets: A Relative Value GuideNo ratings yet

- Moody KMV Explained UT Berlin Tetereva - 05042012 PDFDocument32 pagesMoody KMV Explained UT Berlin Tetereva - 05042012 PDFKapil AgrawalNo ratings yet

- SPS Commerce IncDocument6 pagesSPS Commerce IncRishi SinghNo ratings yet

- Calibration of A Jump Di FussionDocument28 pagesCalibration of A Jump Di Fussionmirando93No ratings yet

- Buehler Stoch Prop DividendsDocument21 pagesBuehler Stoch Prop DividendserererehgjdsassdfNo ratings yet

- Eric Benhamou - Pricing Convexity Adjustment With Wiener Chaos PDFDocument22 pagesEric Benhamou - Pricing Convexity Adjustment With Wiener Chaos PDFChun Ming Jeffy TamNo ratings yet

- Chapter 22Document40 pagesChapter 22bayu0% (1)

- ACross Functional Model ProposalDocument19 pagesACross Functional Model ProposalFRASETYO ANGGA SAPUTRA ARNADINo ratings yet

- T13 Option PricingDocument2 pagesT13 Option PricingElizabethNo ratings yet

- Black-Scholes ProjectDocument16 pagesBlack-Scholes ProjectJeff LeeNo ratings yet

- Stochastic Calculus II Exercise Sheet 11: Prof. D. Filipovi C, E. HapnesDocument2 pagesStochastic Calculus II Exercise Sheet 11: Prof. D. Filipovi C, E. HapnesDIANo ratings yet

- 380.760: Corporate Finance: Definitions of OptionsDocument19 pages380.760: Corporate Finance: Definitions of Optionsssregens82No ratings yet

- Jovanovic Slobodan - Hedging Commodities - A Practical Guide To Hedging Strategies With Futures and Options - 2014, Harriman House - Libgen - LiDocument809 pagesJovanovic Slobodan - Hedging Commodities - A Practical Guide To Hedging Strategies With Futures and Options - 2014, Harriman House - Libgen - LiazertyNo ratings yet

- Chap 016Document59 pagesChap 016anilmeherNo ratings yet

- PDFDocument22 pagesPDFnylibr100% (1)

- ) N (D Xe: Chapter 5: Option Pricing Models: The Black-Scholes-Merton ModelDocument9 pages) N (D Xe: Chapter 5: Option Pricing Models: The Black-Scholes-Merton ModelTami DoanNo ratings yet

- Local VolatilityDocument87 pagesLocal VolatilityClaudio Cuevas PazosNo ratings yet

- Binomial Model Faq2Document3 pagesBinomial Model Faq2ericting123No ratings yet

- Option Pricing Model: © Kaji DahalDocument75 pagesOption Pricing Model: © Kaji DahalAnkit AgarwalNo ratings yet

- Asymptotics For The Laplace Transform of The Time Inte - 2023 - Operations ReseaDocument7 pagesAsymptotics For The Laplace Transform of The Time Inte - 2023 - Operations Reseapepito perezNo ratings yet

- A Simple Binomial Model: - A Stock Price Is Currently $20 - in Three Months It Will Be Either $22 or $18Document55 pagesA Simple Binomial Model: - A Stock Price Is Currently $20 - in Three Months It Will Be Either $22 or $18nasrullohNo ratings yet

- Maximizing Corporate Profits Under RiskDocument21 pagesMaximizing Corporate Profits Under RiskrcouchNo ratings yet

- Finance 261 - Cheat SheetDocument2 pagesFinance 261 - Cheat SheetstevenNo ratings yet

- Valuation and Dynamic Replication of Contingent Claims in The Framework of The Beliefs-Preferences Gauge SymmetryDocument10 pagesValuation and Dynamic Replication of Contingent Claims in The Framework of The Beliefs-Preferences Gauge SymmetrygatitahanyouNo ratings yet