Professional Documents

Culture Documents

Pooling and Purchase - Accounting Methods

Uploaded by

Nirav GosarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pooling and Purchase - Accounting Methods

Uploaded by

Nirav GosarCopyright:

Available Formats

Goodwill on the Balance Sheet Investing Lesson 3 - Analyzing a Balance Sheet http://beginnersinvest.about.com/od/analyzingabalancesheet/a/goodwill-on-thebalance-sheet.

htm In the accounting sense, Goodwill can be thought of as a "premium" for buying a business. When one company buys another, the amount it pays is called the purchase price. Accountants take the purchase price and subtract it by a company'sbook value. The difference is called Goodwill. For decades, when a company bought another company, it could use one of two accounting methods: pooling of interest or purchase. When the pooling of interest method is used, thebalance sheets of the two businesses are combined and no goodwill is created. When the purchase method is used, the acquiring company will put the premium they paid for the other company on their balance sheet under the "Goodwill" category. Accounting rules require the goodwill be amortized over the course of 40 years. An Example of Balance Sheet Goodwill What does that mean? Let's use McDonald's and Wendy's as an example since most people are familiar with them. McDonald's Earnings: $1,977,300,000 Shares Outstanding: 1.29 Billion (You don't need McDonald's other information for this example) Wendy's Book Value: $1,082,424,000 Book Value per Share: $10.3482 Shares Outstanding: 104.6 Million Earnings: $169,648,000 Say McDonald's decided to buy all of Wendy's stock using the purchase method. Wendy's has a book value of $10.3482 per share, yet is trading at $32 per share. If McDonald's were to pay the current market price, they would spend a total of $3,347,200,000 (104.6 million shares x $36 per share). To keep this example simple, we are going to assume the shareholders of Wendy's approved the merger for cash. McDonald's would mail a check to the Wendy's shareholders, paying them $32 for each share they owned. Since the book value of Wendy's is only $1,082,424,000, and McDonald's paid $3,347,200,000, McDonald's paid a premium of $2,264,776,000. This is going to go onto their balance sheet as Goodwill. It is required to be amortized against earnings for up to 40 years. This means that each year, 1/40 of the goodwill amount must

be subtracted from McDonald's earnings so that by the 40th year, there is no goodwill left on the balance sheet. Now that McDonald's and Wendy's are one company, their earnings will be combined. Assuming next year's results were identical, the company would earn $2,146,948,000, or $1.66 per share1. Remember that goodwill must be amortized, meaning 1/40 the amount must be deducted from next year's earnings. McDonald's must deduct $56,619,400 from earnings next year as a charge against goodwill2. Now, McDonald's can only report earnings of $2,090,328,600, or $1.62 per share (compared to the $1.66 they would have been able to report before the goodwill charge). Goodwill reduced earnings by 4 per share. If the pooling of interest method had been used, no goodwill would have been created, and McDonald's would have reported EPS (earnings per share) of $1.66. Meaning that depending on how the accounting was handled, the exact same transaction could have two vastly different impacts on earnings per share. Goodwill on the Balance Sheet Receives New Accounting Rules It is no wonder that managements, in order to avoid this reduction in reportable earnings, frequently opted to use the pooling of interest method when they complete a merger. Since no goodwill is created, over-eager managers are able to pay outrageous prices for acquisitions with little or no accountability on the balance sheet. Since it makes no sense to have two different ways for accounting for a merger, the FASB (the folks in charge of coming up with these accounting rules) decided they should eliminate the pooling of interest method and force all transactions to be done via the purchase method. Executives and politicians claimed this will significantly reduce the number of mergers since the new standards would cause reportable earnings to drop as soon as a company had completed an acquisition. As a concession, the FASB will no longer require goodwill to be written off unless the assets became impaired (which means it becomes clear that the goodwill isn't worth what the company paid for it). Pay careful attention to the mergers a company has made in the past few years. Once you are able to value a business, you will want to look at recent acquisitions to determine if they were too expensive. If you find this to be the case, you will probably want to avoid the stock (why would you want to invest in a company that was throwing your money around?). Notes: 1.) Since McDonald's purchased Wendy's, the two companies' profits will be combined. $1,977,300,000 + $169,648,000 = $2,146,948,000. To get the earnings per share, you would simply divide it by the number of shares outstanding (1.29 billion). We're assuming McDonald's bought Wendy's for cash. If stock had been used, the number of shares would change, but for simplicity sake, we are going to assume this not to be the case. 2.) Take the premium $2,264,776,000 and divide it by 40 years = this is the charge against earnings each year 3.) Companies

purchased before 1970 are not required to be amortized off the balance sheet. They can stay there forever.

The Battle Over Merger Accounting Graziadio Business Review Proposed pooling ban unlikely to halt activity. http://gbr.pepperdine.edu/2010/08/the-battle-over-merger-accounting/ Maybe youve never taken an accounting class, or maybe you took one years ago and dont remember much. However, if your firm is in the acquisition mode, one issue in accounting should be of interest to you. This issue is whether or not pooling of interests accounting should be allowed, and it is creating a firestorm in the merger and acquisition arena arena. In essence, when two firms combine, there are two methods that can be used to account for the combined value of the firm. They are the purchase method and the pooling of interests method. In most cases, they yield radically different outcomes with pooling resulting in a much better looking income statement for years to come. Yet, the Financial Accounting Standards Board (FASB), the primary accounting rulemaking body in the U.S., has preliminarily decided to eliminate this method by the end of the year. Should you be concerned? More importantly, if you are thinking of acquiring another company or are in the market to be acquired, should you be trying to wrap it up by the end of this year? If you take literally some of the comments reported recently in the business press, it would surely seem that you should be. For example, in a report entitled Valuing the New Economy: How New Accounting Standards will Inhibit Economically Sound Mergers and Hinder the Efficiency and Innovation of U.S. Business, Merrill Lynch states that the (purchase) accounting method itself would prove an obstacle to a merger that both parties want to consummate. As a result, the wave of consolidations that has enhanced productivity, encouraged innovation, and stimulated dynamism in the U.S. economy may notably decline. In a report titled entitled The Furor Over Purchase/Pooling, Daniel Donoghue and others with the investment banking firm U.S. Bancorp Piper Jaffray make the following alarming statement right after summarizing the proposed new rules: These changes could potentially have a chilling impact on the mergers and acquisitions market. Yet listen to the very next, virtually contradictory, statement: The new rules have no real economic consequences since corporate cash flows are not impacted. In other words, the proposed new rules dont change cash flows one iota.

So, how can such toothless rules that do not affect real value possibly have a chilling impact on the M&A marketplace? The authors provide a partial answer to this question when they write, The proposed accounting only affects reported earnings (emphasis added). Therein lies the real issue: Is the market fooled by cosmetic accounting differences? To help you separate the wheat from the chaff and provide evidence to answer this question for yourself (and for your company if youre feeling the urge to merge), this article will first provide a simple example to illustrate the financial statement differences between the two methods so you can see what the big deal is all about. Then, a brief summary of research findings on this issue will be presented, some of which are fairly startling. Finally, there is a prediction about the final outcome of this battle that may help you decide whether or not you need to be concerned. The Two Methods of Merger Accounting In the simplest of terms, the issue can be illustrated by the following scenario. If two companies merge, each one having only one asset, say a truck, the combined balance sheet would consist of two trucks and the combined income statement would consist of the total combined revenues. The controversial issue is: What value should be used for the two trucks? Should they be combined using their existing recorded values? Or should both be restated to their current market value? Or should the truck of the company being acquired be restated to the price actually paid by the acquiring company? Current rules say that if the merger is a pooling, the assets are combined at their book values. If one company is purchasing the other company, the purchased asset is recorded at its purchase price. There are actually twelve rules, all of which must be met, that determine if the new company can use the pooling method of accounting. The main rule is that stock must be used for the payment instead of cash. The implication is that there is a continuity of ownership and that nothing has really changed for the two companies. In other words, if the company being acquired is given stock in the acquiring company, the two ownership groups have simply combined to own a larger basket of assets. There is no sale and there are no tax implications. If cash is used, however, the owners of the acquired company are viewed as having sold the assets so that they have a taxable gain (or loss), and the buyer records the assets at the price paid for them. A more helpful example would be as follows: Company A pays $650 in stock to acquire Company B. The book value of Company B is $50, composed of $150 in assets minus $100 in liabilities. The $600 excess over book value is allocable $100 to undervalued plant, property and equipment and $500 to goodwill due largely to

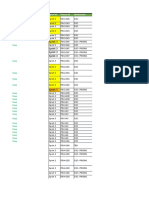

intellectual property. If the combination is treated as a pooling, the combined balance sheet and income statement look as follows: Balance Sheet A Current Assets PP&E Intangibles Total Current Liabilities Long Term Liabilities Stockholders Equity Total Income Statement A Revenues Expenses 1000 -400 B 600 -200 A+B Pooling 1600 -600 700 100 200 400 700 150 50 50 50 150 850 150 250 450 850 200 500 B 100 50 A+B Pooling 300 550

Net Income 600 400 1000 If, however, the combination is treated as a purchase, the combined financial statements will look as follows (pooling totals shaded for comparison): Balance Sheet A Current Assets PP&E Intangibles Total Current Liabilities Long term Liabilities Stockholders Equity Total 700 150 85 1450 400 50 45 +600 1050 700 150 85 100 200 50 50 15 25 200 500 B A+B Purchase A+B Purchase 300 +100 +500 650 500 1450 150 250

Pooling Adjustments 100 30 50 55

Income Statement A Revenues Expenses Net Income Extra Depreciation (10 year life) Amortization of goodwill (20 year life) Net Income after extra depreciation and amortization of B A+B Purchase A+B Purchase 1600 -600 1000 -10 -25 965

Pooling Adjustments 1000 600 1600 -400 -200 -600 600 400 1000

goodwill Note that the balance sheet looks stronger under the purchase method due to a higher asset base. The income statement looks worse, however, due to the extra depreciation and amortization of goodwill. In many of todays mega mergers, the income statement differences are far greater because goodwill can comprise 8090% of the purchase price resulting in huge amortization charges that can even cause the combined entity to report operating losses for years to come. To put the difference between the two methods into the simplest terms, the previously cited Merrill Lynch report states it this way: The premium paid for the intangible goods the goodwill is never recorded (in a pooling). Yet, if you think about it, this is an amazing statement that actually highlights the fatal flaw of the pooling method The premium paid is never recorded. Although financial accounting may be deficient in myriad ways, there is no other instance in which it is proper and legal to avoid recognizing a payment for something especially something that can run into the billions of dollars. Research Findings A question that has been directed to the FASB is whether an acquisition paid for with stock is fundamentally different from an acquisition paid for with cash. The FASB has been asked to consider this. Harvey Golub, chairman and CEO of American Express, put it this way in a recent article in theWall Street Journal: a merger with stock isnt the same as a purchase for cash. Different business combinations require different accounting treatment. One company buying another for cash is decidedly different than an exchange of stock, which consolidates the ownership of the two entities. The problem with this argument is two-fold. First, in negotiating the exchange ratio of the stocks, the current market value of both companies stock, and not book value, is the primary determinant of the ratio. In a very real sense, the acquiring firm estimates what the target firm is worth in total, divides that by the acquiring firms current share price to determine the number of shares to be offered, and

then breaks that down into a share-for-share ratio. In other words, a companys stock is a negotiable type of currency just one step away from cash. Second, the continuity of interests only lasts for a moment in time. In fact, there may be a large number of shares trading hands all the way up to the date of the formal exchange. Moreover, most shareholders in the target firm receiving shares of the acquiring firm are free to sell them immediately after receiving the shares. A more convincing argument, however, is what has occurred in the marketplace. In an article published in the Journal of Finance, Tim Loughran and Arnand Vijh examine benefits accruing to target shareholders in the five-year period after the combination. Those that received cash and immediately invested that cash into the acquirers stock realized substantial returns by holding that stock for five years. In contrast, target shareholders who received stock in the acquiring company and held that for five years realized essentially no gain as any premium received at the time of the acquisition tended to dissipate. These results are consistent with the popular theory that a firm issues stock when insiders believe the stock is overvalued. Adding fuel to the pooling fire, consider the results from two other streams of research. First, there have been about ten academic studies using different methodologies and time periods that have consistently demonstrated that, in spite of the higher reported earnings, the stock performance is not better for pooling method firms after the combination. In fact, two studies, including one by this author, found that the stock of firms that used the purchase method performed significantly better than that of firms using the pooling method. In other words, the market is not fooled by the higher cosmetic earnings reported by pooling method firms, and it appears to reward firms using the more conservative purchase method. Yet, in spite of these consistent research results, some firms are willing to pay extra to be able to pool. One example is the well-documented 1991 AT&T-NCR pooling method merger. A conservative estimate is that AT&T paid $50 million to be able to pool but, depending on how stock price changes during the negotiation period are interpreted, the additional cost may have been as high as $500 million for a merger that was ultimately disastrous. Two additional academic studies examined large samples of pooling method mergers and found that, in general, not only does the likelihood of using the pooling method increase with the size of the potential goodwill to be recorded, but the premiums paid for similar sized target firms are higher if the pooling method is used.

Where Do We Go From Here? The Financial Accounting Standards Board held public hearings on the proposed new rules in February, 2000. Not only did they hear the same sky is falling arguments described earlier, but not a single person who testified was able to present a workable alternative to the FASBs proposed new rules. Even if convincing evidence had been presented indicating that the new rules would have a significant negative impact, the FASBs mandate is to advocate rules that present the economic reality of a transaction and not to be swayed by the potential economic consequences of those rules. Adding to the FASBs resolve on this issue is the fact that most major industrialized countries do not allow poolings or allow them only in very rare circumstances. Only Canada has rules similar to ours, and they are also proposing to eliminate poolings. All of this has not stopped those who want to maintain the availability of pooling from urging members of Congress to pressure the FASB into not changing the rules. However, it appears likely that the FASB will stick to its guns and eliminate poolings by the end of this year. What the business press has not reported is that the elimination of pooling does not eliminate the possibility of using stock to acquire another firm. Stock exchanges will still be possible they even can still be tax-free but companies wont be able to use the pooling method of combining both firms at book value. In other words, mergers that make economic sense will continue to make economic sense. Due to the growing size of goodwill, more and more firms are highlighting either earnings before goodwill amortization (as the FASBs proposed rules require) or cash earnings since goodwill amortization is not tax deductible in most cases. So, firms need not stifle the urge to merge. Instead, they must redouble efforts to identify firms that fit strategically with their growth plans, and use cash or stock whichever makes the most sense in a particular situation. Although Mr. Golub made several questionable statements in his WSJ article, he clearly get one thing right at the end when he writes, Several recent studies show that the market does not give higher valuations to companies that combine via pooling rather than purchase accounting. The market doesnt seem to care which accounting method merging companies use.

Pooling vs. Purchase http://www.stoel.com/showarticle.aspx?Show=3243 The difference between the pooling and purchase accounting methods is straightforward. Under the pooling method, a cooperative records the assets of an acquired company at the book value of the assets on the acquired company's balance sheet at the time of the merger. Under the purchase method, a cooperative must record the assets of an acquired company at the fair market value of the assets at the time of the transaction. Pooling and purchase accounting methods lead to different accounting results whenever the fair market value of assets deviates from book value. The fair market value of assets is often different than book value because book value is simply the original cost of an asset less any accumulated depreciation. To the extent that fair market value deviates from an asset's original cost and accumulated depreciation, book value and fair market value will be different; this difference can be significant, particularly for assets that were acquired long ago or where accelerated depreciation was applied to the assets. One might question why the Financial Accounting Standards Board ("FASB") would bother mandating a change from pooling to purchase accounting. After all, the change only affects the accounting of a transaction and not the transaction's underlying economic substance. The change can be seen as an effort to make financial statements and disclosures reflect, to the extent possible, current market values, which arguably increases the value of the financial statements to those who use and evaluate them, and adds to the comparability of one company's statements with another company's financial statements. Another possible reason for the change is to reduce the use of deceptive accounting practices. In the past, companies could (and have) used pooling accounting to artificially inflate earnings. This is done by purchasing a company whose assets are booked at values far below fair market value. After the acquisition, the acquirer sells the assets and records income on the sales thus artificially improving the appearance of the business. We do not suggest deceptive accounting is an issue within the cooperative community. On the other hand, and driven also by its desire to conform accounting

standards in the United States with international accounting standards, because FASB had previously eliminated the use of pooling for the rest of the business community, FASB then determined that co-ops (and other mutual organizations) were not sufficiently unique to justify the continued use of the pooling method for co-ops. Parenthetically, the co-op community made a determined effort to persuade FASB to allow cooperatives to continue using the pooling method. While we expect that you may be surprised and perhaps troubled by the application of the purchase method to mergers of cooperatives and other mutual organizations, we think you should know that numerous organizations and trade associations fully aired the coop community's concerns to FASB. M&A Methods and Their Impact on Financial Statements 1. Purchase method Book entry is by cost of acquisition and fair value of acquired net assets. The difference occurring between the two is recognized as goodwill or negative goodwill. Also, if the acquisition was paid for in cash, then the cost of acquisition is the purchase price paid; if it is paid with issued securities, then the cost of acquisition is the fair value of the issued securities. The above goodwill must be amortized in accordance with regulations, and must undergo regular testing for asset impairment. If impairment occurs, it must be recognized as a loss which may not be reversed. 2. Pooling of interest method The vantage point of the pooling of interest method is from the start of the merger, so the surviving company enters the book value of the dissolved company in its accounts. When merging under the pooling of interest method, the dissolved company may adopt different accounting principles to account for assets or liabilities generally similar to those of the surviving company. If the different accounting principles are better suited to the dissolved company, then it is appropriate to adjust account entries so that they are in keeping with generally similar accounting principles after the merger.

You might also like

- Solution Manual For M Finance 4th Edition Marcia Cornett Troy Adair John NofsingerDocument36 pagesSolution Manual For M Finance 4th Edition Marcia Cornett Troy Adair John Nofsingerjuristvesicantg7egkNo ratings yet

- Creative AccountingDocument8 pagesCreative Accountingpriteshvadera18791No ratings yet

- One plus one makes three: The key principle behind M&ADocument5 pagesOne plus one makes three: The key principle behind M&Apratikj_36No ratings yet

- DissertationDocument25 pagesDissertationKanak Rai0% (1)

- Solution Manual 16Document69 pagesSolution Manual 16KiranNo ratings yet

- Paying Back Your ShareholdersDocument7 pagesPaying Back Your Shareholdersnopri dwi rizkiNo ratings yet

- Accounting Concepts and Principles ExplainedDocument27 pagesAccounting Concepts and Principles ExplainedRaisa Yuliana FitranieNo ratings yet

- Short Writeup On Dividend Payout DecisionDocument5 pagesShort Writeup On Dividend Payout DecisionNksNo ratings yet

- Finance KeyDocument37 pagesFinance KeyTrần Lan AnhNo ratings yet

- TFM SlidesDocument34 pagesTFM SlidesSiraj AhmedNo ratings yet

- Chapter 2 Accounting Concepts and Principles PDFDocument12 pagesChapter 2 Accounting Concepts and Principles PDFAnonymous F9lLWExNNo ratings yet

- Merger and Acqusition-Sm ProjectDocument10 pagesMerger and Acqusition-Sm ProjectparthNo ratings yet

- Bva 3Document7 pagesBva 3najaneNo ratings yet

- ACCOUNTING ENTITY ASSUMPTION explainedDocument8 pagesACCOUNTING ENTITY ASSUMPTION explainedJonalyn abesNo ratings yet

- Advance Finance NotesDocument28 pagesAdvance Finance NotesKalash JainNo ratings yet

- Mergers Final ProDocument34 pagesMergers Final ProShoumi MahapatraNo ratings yet

- Tax Chapter 5 Answer KeyDocument63 pagesTax Chapter 5 Answer Keyawby04No ratings yet

- Questions DuresDocument25 pagesQuestions DuresAnna-Maria Müller-SchmidtNo ratings yet

- Because They're Worth ItDocument4 pagesBecause They're Worth Itcatalin_noagheaNo ratings yet

- Lecture # 8: (Chapter 02) Conflicts of Interests: Shareholders Versus Managers - The Agency' Problem The ProblemDocument7 pagesLecture # 8: (Chapter 02) Conflicts of Interests: Shareholders Versus Managers - The Agency' Problem The ProblemMuhammad Shafiq GulNo ratings yet

- Accounts ReceivableDocument9 pagesAccounts ReceivableTrang LeNo ratings yet

- Dividend Policy of Indian Corporate FirmsDocument19 pagesDividend Policy of Indian Corporate FirmsRoads Sub Division-I,PuriNo ratings yet

- Problems Cash Flow AnalysisDocument18 pagesProblems Cash Flow Analysisleilo4kaNo ratings yet

- Dividend Policy Maximizing Shareholder ValueDocument8 pagesDividend Policy Maximizing Shareholder ValuefajarNo ratings yet

- 20mm Finance BasicsDocument19 pages20mm Finance BasicsMart2943No ratings yet

- MBA FPX5010 Andre Tyra Assesment 2Document5 pagesMBA FPX5010 Andre Tyra Assesment 2danielNo ratings yet

- Name: Class: Semester: Roll No.: Enrollment No.: Subject:: Vartika Srivastava Mba (HR)Document13 pagesName: Class: Semester: Roll No.: Enrollment No.: Subject:: Vartika Srivastava Mba (HR)Ceegi Singh SrivastavaNo ratings yet

- Student Name: Roll No. Date: TitleDocument2 pagesStudent Name: Roll No. Date: TitlewaratNo ratings yet

- Financial Management Introduction Lecture#1Document12 pagesFinancial Management Introduction Lecture#1Rameez Ramzan AliNo ratings yet

- M&A: Introduction: Mergers and Acquisitions: DefinitionDocument15 pagesM&A: Introduction: Mergers and Acquisitions: DefinitionUmesh ChaubeyNo ratings yet

- Merger and AcquisitionDocument13 pagesMerger and AcquisitionBlue LovingNo ratings yet

- M & ADocument14 pagesM & ASurjya ChatterjeeNo ratings yet

- Creative Accounting Case Study: XeroxDocument5 pagesCreative Accounting Case Study: Xeroxsahanvit100% (1)

- Cashflow.comDocument40 pagesCashflow.comad9292No ratings yet

- Chapter 1Document25 pagesChapter 1ragi malikNo ratings yet

- Types of Mergers: Vertical MergerDocument6 pagesTypes of Mergers: Vertical MergerCheruv SoniyaNo ratings yet

- Cash Flow Framework Reveals Differences Between Old and New Economy CompaniesDocument42 pagesCash Flow Framework Reveals Differences Between Old and New Economy Companiespjs15No ratings yet

- Retained EarningsDocument17 pagesRetained EarningsAngieNo ratings yet

- M&A ValuationDocument7 pagesM&A ValuationmithunsworldNo ratings yet

- Business Valuations PDFDocument5 pagesBusiness Valuations PDFAyan NoorNo ratings yet

- Mergers and Acquisitions in IndiaDocument6 pagesMergers and Acquisitions in Indiasandesh bhagatNo ratings yet

- Accounting ConventionsDocument16 pagesAccounting ConventionsDishank Baid100% (1)

- Taxation Merger and AcquisitionDocument55 pagesTaxation Merger and AcquisitionRajesh ChavanNo ratings yet

- Merger &acquisitionDocument150 pagesMerger &acquisitionMadhvendra BhardwajNo ratings yet

- Chap 014Document36 pagesChap 014Hemali MehtaNo ratings yet

- Distributions To Owners: Bonuses, Dividends, and RepurchasesDocument30 pagesDistributions To Owners: Bonuses, Dividends, and Repurchasesshaikh shahrukhNo ratings yet

- Running Head: BUSINESS REPORT 1Document36 pagesRunning Head: BUSINESS REPORT 1John AjopeNo ratings yet

- Dividend Policy: Answers To Concept Review QuestionsDocument6 pagesDividend Policy: Answers To Concept Review Questionsmeselu workuNo ratings yet

- Slides 7 To 11Document63 pagesSlides 7 To 11aliNo ratings yet

- Background On DividendsDocument3 pagesBackground On DividendsGustafaGovachefMotivati0% (1)

- Signature AssignmentDocument5 pagesSignature AssignmentAishwarya KalimireddyNo ratings yet

- Corporate Finance 11th Edition Ross Solutions ManualDocument13 pagesCorporate Finance 11th Edition Ross Solutions Manualstrickfacile.viza7100% (36)

- Valuation of Goodwilles Problems SolutionDocument39 pagesValuation of Goodwilles Problems SolutionchandreshNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Balance Sheet Management: Squeezing Extra Profits and Cash from Your BusinessFrom EverandBalance Sheet Management: Squeezing Extra Profits and Cash from Your BusinessNo ratings yet

- The Mechanics of Law Firm Profitability: People, Process, and TechnologyFrom EverandThe Mechanics of Law Firm Profitability: People, Process, and TechnologyNo ratings yet

- NDF FX FowardsDocument5 pagesNDF FX FowardsNirav GosarNo ratings yet

- Google AnswersDocument2 pagesGoogle AnswersNirav GosarNo ratings yet

- Important QuestionsDocument17 pagesImportant QuestionsNirav GosarNo ratings yet

- Effective CommunicationDocument64 pagesEffective CommunicationsamjaiNo ratings yet

- CDBM WorkbookDocument58 pagesCDBM WorkbookGourav SahaNo ratings yet

- Design For Manufacture and Assembly: Why Use DFMA?Document12 pagesDesign For Manufacture and Assembly: Why Use DFMA?pradheepkNo ratings yet

- Tesla Motors January 2014 Investor PresentationDocument33 pagesTesla Motors January 2014 Investor PresentationotteromNo ratings yet

- Chapter 14 Titman 1SlidePages Cost of CapitalDocument54 pagesChapter 14 Titman 1SlidePages Cost of Capitallor nandezNo ratings yet

- Mama Mboga Sheds Lwandanyi PDF CombDocument95 pagesMama Mboga Sheds Lwandanyi PDF CombMISIKO JOHNNo ratings yet

- Sprint 3 Process Tracking ReportDocument32 pagesSprint 3 Process Tracking ReportPratik MandlikNo ratings yet

- How To Manage Inventory FIFO LIFO AVCO Small Business Guides Xero (.SRT)Document5 pagesHow To Manage Inventory FIFO LIFO AVCO Small Business Guides Xero (.SRT)Nurainin AnsarNo ratings yet

- Marketing CommunicationDocument14 pagesMarketing Communicationarjunmba119624No ratings yet

- Kohinoor: KBS KhandalaDocument15 pagesKohinoor: KBS KhandalaRitesh RawalNo ratings yet

- Swaps Session - Derivatives Risk ManagementDocument19 pagesSwaps Session - Derivatives Risk ManagementUtsav ThakkarNo ratings yet

- Assignment 2 - HS201 - QuestionsDocument3 pagesAssignment 2 - HS201 - QuestionsMayankNo ratings yet

- Manufacturing Plant Cash FlowDocument9 pagesManufacturing Plant Cash FlowKuralay TilegenNo ratings yet

- Electro Smelting of IlmeniteDocument14 pagesElectro Smelting of IlmeniteRavi KiranNo ratings yet

- ME Ebay Case Study Notes by Renu & AvaniDocument4 pagesME Ebay Case Study Notes by Renu & AvaniNawazish KhanNo ratings yet

- Seminar 1: Introduction To Operations, Operations Strategy Soh Yu Hong JonathanDocument2 pagesSeminar 1: Introduction To Operations, Operations Strategy Soh Yu Hong JonathanJonathan Soh Yu HongNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument24 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Jyothy Fabricare Services Ltd.Document25 pagesJyothy Fabricare Services Ltd.Lini Susan John100% (2)

- Worksheet No 1 Bond Pricing - 2016Document2 pagesWorksheet No 1 Bond Pricing - 2016z_k_j_vNo ratings yet

- Commodity Money: Money Derived from CommoditiesDocument5 pagesCommodity Money: Money Derived from Commoditieshasan jamiNo ratings yet

- 2 Inventory Cost Flow Intermediate Accounting ReviewerDocument3 pages2 Inventory Cost Flow Intermediate Accounting ReviewerDalia ElarabyNo ratings yet

- Pak Steel MillDocument31 pagesPak Steel Millwasiq Ahmed0% (1)

- Books On Retail MGTDocument5 pagesBooks On Retail MGTssyashu6685No ratings yet

- Exercises + Answers - The Cost of CapitalDocument6 pagesExercises + Answers - The Cost of CapitalWong Yong Sheng Wong100% (1)

- ECONOMY 700 MCQs With Explanatory Notes PDFDocument234 pagesECONOMY 700 MCQs With Explanatory Notes PDFvarunNo ratings yet

- Value Engineering 67319A Sample PagesDocument10 pagesValue Engineering 67319A Sample Pagesaboahmedah8No ratings yet

- 0220 Baiynd PDFDocument21 pages0220 Baiynd PDFqmbutvxe100% (2)

- Chapter 10 ATW 108 USM Tutorial SlidesDocument18 pagesChapter 10 ATW 108 USM Tutorial Slidesraye brahmNo ratings yet

- Promotional Strategies Followed in Retail SectorDocument34 pagesPromotional Strategies Followed in Retail SectorKamalKishoreMittalNo ratings yet

- A Price Transmission Testing FrameworkDocument4 pagesA Price Transmission Testing FrameworkYaronBabaNo ratings yet

- Asset and Equity VolatilitiesDocument40 pagesAsset and Equity Volatilitiescorporateboy36596No ratings yet

- Option C Target Contract - WatermeyerDocument7 pagesOption C Target Contract - WatermeyerCamilo RamirezNo ratings yet

- CFAP 04 BFD PracticeKitDocument441 pagesCFAP 04 BFD PracticeKitSajid Ali100% (4)