Professional Documents

Culture Documents

Reviewer in Auditing

Uploaded by

peboy05Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reviewer in Auditing

Uploaded by

peboy05Copyright:

Available Formats

Chapter 1 Fundamentals of Assurance Services Elements of Assurance Engagements 1.

A three party relationship involving a practitioner(CPA),a responsible party, and intended users 2.An appropriate subject matter 3.Suitable criteria 4.Sufficient appropriate evidence 5.A written assurance Characteristics of Suitable Criteria 1.relevance 2.reliability 3.completeness 4.neutrality 5.understandability Criteria are made available to intended users in the ff. Ways: 1.Publicly 2.inclusion in a clear manner in the presentation of the subject matter information 3.through inclusion in a clear maner in the assurance report. 4.by general understanding

Generalizations abot the reliability of evidence 1.Evidence is more reliable when it is obtained from independent sources outside the entity 2.evidence that is generalized internally is more reliable when the related controls are effective 3.evidence that is obtained directly by th practitioner is more reliable than evidence obtained indirectly or by inference 4.evidence is more reliable when it exists in documentary form 5.evidence provided by original documents is more reliable than evidence provided by photocopies or facsimiles Classifications of assurance According to level of assurance 1.reasonable assurance engagements 2.limited assurance engagements According to Structure 1.Assertion based engagements(attestation) 2.Direct Reporting engagement Assertion based engagements 1.there must be a written assertion being made by one party. 2.there must be agreed upon and objective criteria that can be utilized to assess the accuracy of the assertion 3.the assertion must be amenable to verification of an independent party. 4.the accountant should prepare a written conclusion about the reliability of the assertions

Examples of assertion based engagements 1.an independent audit engagement is one that provides a reasonable(but not absolute)level of assurance that th subject matter(such as Financial statement)is free of material misstatements 2.a review engagement involves a limited investigation of much narrower scope than an audit and undertaken for the purpose of providing limited assurance that the subject matter is presented in accordance with identified suitable criteria Limitations of assurance engagements 1.the use of selective testing 2.the inherent limitations of internal control 3.much of the evidence is conclusive rather than persuasive 4.the use of judgement 5.characteristics of the subject matter Non Assurance Services 1.agreed upon procedures 2.compilation of financial or other information 3.tax services 4.management consulting and other advisory Chapter 2-Audits of Historical financial Information Types of Audit According to subject matter

1.financial statement audit 2.operational audit 3.compliance audit Types of Auditor performing the engagement 1.external audit 2.internal audit 3.government audit Division of Government Audit 1.compliance audit 2.Financial audit 3.performance audit a.economy and efficiency audit b.Effectiveness audit Factors contributing to the existence of information risk 1.Remoteness of information users from information provider 2.potential bias and motives of information provider 3.voluminous data 4.complex exchange transactions

Reducing Information Risk 1.Allow users to verify information 2.user shares information risk with management 3.have the financial statements audited Inherent Limitations of the audit 1.fundamental nature and characteristics of financial reporting and business processes 2.the nature of the audit evidence and procedures 3.the need for the audit to be conducted within a reasonable period of time and at a reasonable cost

Chapter 3:Proffesional Practice of Accounting What is a profession? 1.mastery of a particular intellectual skill,acquired by training and education 2.Adherence by its members to a common code of values and conduct 3.acceptance of a duty to society as a whole

Sectors of accounting practice

1.practice in public accountancy 2.practice in commerce and Industry 3.Practice in education or academe 4.practice in government 5million/10million rule 1.supervising the recording of financial transactions,preparation of financial statement 2.coordinating with the external auditors for the audit of such financial statements 3.other related functions

Practice in Education 1. BLT may be taught by CPAs and Lawyers 2. The position of either the dean or department chairman BSA-must be CPA Regulation of the accounting profession 1. RA9298-Philippine Accountancy Act 2. Standard setting bodies 3. Code of ethics for Cpas 4. Self regulation through a system of quality control 5. Sanctions and penalties against violators

Qualifications of members of PRBOA

1.natural born citizen and resident of the philippines 2.registered CPA with (10)yrs experience in any sectors of accountancy 3.must be of GMC 4.no interest in schools 5.not a director or officer of APO(PICPA) Powers and functions of the BOA 1.prescribe and adopt rules and regulations based on RA9298 2.supervise the registration,licensure and practice of accountancy 3.administer oaths in admistering the provisions of RA9298 4.to adopt an official seal of the board 5.adopt code of ethics Grounds for removal or suspension of the member of BOA 1.neglect of duty or incompetence 2.violation of RA9298 and code of ethics and IRR 3.final judgement of crimes involving moral turpitude 4.manipulation or rigging of the CpA licensure examination results

Principal duties of COA

1.Examine,audit and settle all accounts pertaining to the revenue or receipts and expenditure or uses of government funds 2.central accounting office 3.define the scope of its audit and examination 4.promulgate accounting and auditing rules and regulations 5.submit to the president an annual financial report of the government and reccoment measures to improve there effectiveness and efficiency APO(PICPA) is tasked to meet the ff: 1.it is established to the benefit and welfare of the CPAs 2.membership is open to all CPAs 3.plan to enlist majority of the CPAs within 3 years 4.shall have region all over the philippines;directors should be elected based on the Corporation code 5.shall have a full time career director Education Technical council Powers and duties 1.determine minimum standard curiculum for the study of accountancy 2.establish teaching standards,including the qualifications of the faculty of the school/university 3.monitor the progress of the program;measures attainment of high quality accounting education 4.evaluate periodically the performance of educational institutions Refusal to issue CPA certificates and PRC ID 1.convicted of crimes involving moral turpitude

2.is guilty of immoral or dishonorable conduct 3.unsound mind 4.misrepresentation in the application for the CPA examinations Special and temporary permits for foreigners 1.He is asked for consuultation or specific purpose which the BOA believes is essential to the development of accountancy profession provided that he must only for that purpose only and no other filipino CPA is qualified that purpose. 2.a foreigner engaged to teaching,lecturing which is essential to the development of the accountancy profession provided that he will engage in teaching only 3.his country dopted the reciprocity rule

Fundamental principles 1.integrity 2.objectivity 3.professional competence and due care 4.confidentiality 5.professional behavior

Professional standards 1.PSA

2.PSRE 3.PSAE 4.PSRS

Powers and functions of the PRC-CPE 1.accept,evaluate and approve applications for accreditation of CPE providers 2.accept,evaluate and approve exemptions for taking CPE reqirements 3.monitor the implementations of the CPE providers by their programs,activities and sources 4.assess periodically and upgrade criteria for accreditation of CPE

Penalties and Sactions 1.suspension of CPA certificate 2.Revocation of CPA certificate 3.cancellation of Special or temporary permit 4.payment of fines and/or imprisonment

Chapter 4:setting up and maintaining an accounting practice Quality Review committee Powers and functions 1.conduct quality review on applicants for registration to practice public accountancy and render a report which shall be attached to the application for registration 2.Recommend to the BOA the revocation of the certificate of Registration and the professional identification card of an a)Individual CPA,including any of his/her staff members b)firms,including the sole proprietors and any of his/her employees c)Partnership of CPAs including the partners and staff members thereof who has not observed the quality control measures and who has not compiled with the standards of quality prescribed for the practice of public accountancy Requirements for the practice of public accountancy 1.Registration for accreditation is valid for (3)days and shall be renewed every (3)yrs starting september 30 2.CPAs shall not commence public practice until a valid certificate of registration have been issued for such CPA 3.the applicant for registration shall be accomplished in the form prescribed by the board and duly signed by the applicant CPA. Limitations for Foreign CPA 1.Foreign Cpas are not allowed to practice public accountancy in the phils.(except as provided for by Sec.34-35) 2.OSP and staff thereof cannot practice public accountancy if not qualified to practice

Authentication and Accreditation 1.the BOA shall duly authenticate all applications for registration received in proper form,and after having passed upon such application,shall recommend to the PRC the approval or denial thereof not later than (60) days after the receipt of the aforementioned applications in proper form 2.The PRC upon favorable recommendation of the BOA,issue to the applicant the corresponding Certificate of Registration to practice public accountancy 3.Unless sooner revoked,cancelled or withdrawn,said certificate of Registration shall be valid for (3)yrs and shall be renewable for (3)yrs upon payment of the fees

Training methods for professional CPAs 1.In house training 2.On the job training 3.External training program Hierarchy of personnel in CPA firms 1.Associate-0 to 3yrs 2.Senior Associates-3 to 6yrs 3.Manager-6 to 10yrs

4.Partners-10+

The CPA should not: 1.Make exaggerated claims for services offered,qualifications possessed or experience gained 2.Make disparaging references to usubstantiated comparisons to the work of another

The reasons for not allowing advertisement 1.advertising can lead to undue competition between and among practitioners,and thus may cause a decline in the quality of service 2.advertising would encourage a more commercial approach w/in the profession thus reducing clients trust in CPA and increased the likelihood of Cpas neglecting their ethical duties 3.the cost of advertising would outweigh any savings which might result competition and ultimately be borne by the clients,small firms cannot not matched thhe financial capacity of larger firms

Advertising and publicity in any medium are acceptable ,provided: 1.it has as its objective the notification to the public 2.it is in good taste 3.it is professionally dignified

4.it avoids frequent repetition of and undue prominence being given to the name of the firm or professional accountant in public practice

The following are not allowed: 1.self laudatory statement 2.Discreding,disparaging or attacking other firms or Cpa practitioner 3.referring to using or citing actual or purported testimonials by third parties 4.publishing and comparing fees with other Cpas or Cpa firms or comparing those services with those provided by another firm or Cpa practitioner 5.giving too much emphasis on competitive differences 6.using words or phrases which are hard to define and even more difficult tosubstantiate objectively 7.publishing services in billboard

A professional accountant may issue to clients or in response to an unsolicited request to a non client: 1.a factual and objectively worded of the services provided 2.a directory settings out names of partners,office addresses and names and addresses of associated firms and correspondents

Basis for the Fees 1.the skill and knowledge required for the type of work involved 2.the level of training and experience of the persons necessarily engaged on the work 3.the time necessarily occupied by each person engaged on the work 4.the degree of responsibility and urgency that the work entails Methods of billing clients 1.Flat or fixed fee basis 2.Actual time charges basis 3.maximum fee basis 4.retainer fee basis

Chapter 5:Quality controls The firm should establish a system of quality control designed to provide it with reasonable assurance that: 1.the firm and its personnel comply with professional standards and regulatory and legal requirements 2.that reports issued by the firm or engagement partners are appropriate in the circumstances

Elements of a system of Quality Control 1.Leadership responsibilities for quality within the firm

2.Ethical requirements 3.Acceptance and continuance of clients relationship and specific engagements 4.human resources 5.Engagement performance 6.monitoring Leadership Responsibilities for quality within the firm 1.perform work that complies withh professional standards and regulatory and legal requirements 2.Issue reports that are appropriate in the circumstances Firms business strategy is subject to overriding requirement Accordingly, 1.the firm assigns management responsibilities so that commercial considerations do not override the quality of work performed 2.the firm s policies and procedures addressing performance evaluation,compensation, and promotion(including incentive systems)with regards to its personnel,are designed to demonstrate the firm s overriding commitment to quality 3.the firm devotes sufficient resources for the development,documentation and support of its quality control policies and procedures Acceptance and continuance procedures 1.Has considered the integrity of the client and does not have information that would lead it to conclude that the client lacks integrity 2.Is competent to perform the engagement and has thecapabilities,time and resources to do so 3.can comply with ethical requirements

Considerations regarding the integrity of clients 1.identity and business reputation of the client s principal owners,key management,related parties and those charged with its governance 2.The nature of the client s operations,including its business practices 3.Information concerning the attitude of the client s principal owners,key management and those charged with its governance towards such matters as aggressive interpretation of accounting standards and the internal control environment 4.Whether the client is aggresively concerned with maintaining the firm s fees as low as possible 5.Indications of an inappropriate limitation in the scope of work 6.Indications that the client might be involved in money laundering or other criminal activities 7.the reasons for the proposed appointment of the firm and non reappointment of the previous firm Considerations regarding firm capabiility,competence,time and resources 1.firm personnel have knowledge of relevant industries or subject matters, and experience with relevant regulatory and reporting requirements;ability to gain the necessary skills and knowledge effectively 2.the firm has sufficient personnel with the necessary capabilities and competence 3.experts are available 4.individuals meeting the criteria and eligibility requirements to perform engagement quality control review are available 5.the firm is able to complete the engagement within the reporting deadline

Policies and procedures on the continuance of the engagement and the client relationship should include consideration of: 1.applicable professional and legal responsibilities,including whether there is a requirement for the firm to report to the person or persons who made the appointment 2.the possibility of withdrawing Policies and procedures on auditor withdrawal 1.discussing with the appropriate level of the client s management and those charged with governance regarding the appropriate action that the firm might take based on the relevant facts and circumstances 2.if its appropriate to withdraw,discuss the witdrawal with the management and those charged with governance and the reason(s) for withdrawal 3.considering whether there is a professional,regulatory or legal requirement to remainin place or for the firm to report the withdrawal 4.documenting signiificant issues,consultations,conclusions and the basis for the conclusions Capabilities and Competence are developed through a variety of methods,including the following: 1.professional education 2.continuing professional development,including training 3.workexperience 4.coaching by more experienced staff Performance evaluation 1.make personnel aware of the firm s expectations regarding performance and ethical principles 2.provides personnel with evaluation of,and counseling on,performance,progress and career development

3.helps personnel understand that advancement to positions of greater responsibility depends,among other things, upon performance qualit and adherence to ethical principles, and that failure to comply with the firm s policies and procedures may result in disciplinary action

Assignment of engagement teams 1.the identity and role of the engagement partner should be communicated to key members of client management and those charged with governance 2.the engagemrent partner should have the appropriate capabilities 3.the responsibilities of the engagement partner should be clearly defined and communicated to that partner 4.the firm should assign appropriate staff with the necessary capabilities,competence and time to perform engagements in accordance with professional standards annd regulatory and legal requirements, and to enable the firm or engagement partners to issue reports that are appropriate in the circumstances 5.the capabilities and competence are considered when assigning engagement teams,and in determining the level of supervision required

Consideration regarding assignment of Engagement teams 1.an understanding of,and practical experience with,engagements of a similar nature and complexity through appropriate training and participation 2.an understanding of professional standards and regulatory and legal requirements 3.appropriate technical knowledge,including knowledge of relevant information technology 4.knowledge of relevant industries in which the client operates 5.ability to apply professional judgement 6.an understanding of the firm s quality control policies and procedures Supervision and Review 1.tracking the progress of the engagement 2.considering the capabilities and competence of individual members of the engagement team 3.addressing significant issues arising during the engagement,considering their significance and modifying the planned approach appropriately 4.identifying matters for consultation or consideration by more experienced engagement team members

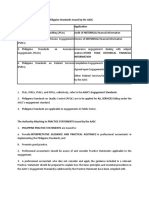

Factors Considered by reviewers of engagement work 1.the work has been performed in accordance with professional standard and regulatory and legal requirements 2.significant matters have been raised for further consideration 3.appropriate consultations have taken place and the resulting conclusions have been documented and impemented 4.there is a need to revise the nature,timing and extent of work performed 5.the work performed supports the conclusions reached and appropriately documented 6.the evidence obtained is sufficient and appropriate to support the report 7.the objectives of the engagement procedures have been achieved Consultation 1.appropriate consultation takes place on difficult or contentious matter 2.sufficient resources are available too enable appropriate consultation to take place 3.the nature and scope of such consultations are documented 4.conclusions resulting from consultations are documented and implemented When is a non audit engagement subject to quality control review? 1.the nature of the engagement,including the extent to which it invoves a matter of public interest 2.the identification of unusual circumstances or risks in an engagement or class of engagements 3.whether laws or regulations require an engagement quality control review

The firm should establish policies and procedures setting out 1.the nature,timing and extent of an engagement quality control review 2.criteria for eligibility of quality engagement control reviewers 3.documentation requirements for an engagement quality control reviewers Matters Considered during an engagement quality control review 1.the engagement team s evaluation of the firm s independence in relation to the specific engagement 2.significant risks identified during the engagement and the responses to those risks 3.judment made,particularly with respect to materiality and significant risks 4.whether appropriate consultation has taken place on matters involving differences of opinion or other difficult or contentious matters,and the conclusions arising fromthose consultations 5.the significance and disposition of corrected and uncorected misstatements identified during the engagement 6.the matters to be communicated to management and those charged with governance and where applicable,other parties such as regulatory parties 7.whether working papers selected for review reflect the work performed in relation to the significant judgements and support the conclusions reached 8.the appropriateness of the report to be issued Objectivity of the engagement quality control reviewer 1.does not participate in the engagement during the period of review 2.does not make decisions for the engagement team 3.is not subject to other considerations that would threaten the reviewer s objectivity

Documentation of the engagement Quality Control review 1.the procedures required by the firm s policies on engagement quality control review have been performed 2.the engagement quality control review has been completed 3.the reviewer is not aware of unresolved matters that would cause the reviewer to believe that the significant judgements the engagement team made and the conclusions they reached were nnot appropriate Maintain the confidentiality,safe custody,integrity,accessibility and retrievability of engagement documentation 1.the firm personnel must observed at all times the confidentiality of information 2.specific laws or regulations may impose additional obligations on the firm s personnel to maintain client confidentiality,particularly where data of a personal nature are concerned 3.accessibility or retrievability of the underlying data that may be compromised if the documentation could be altered,added to or deleted without the firm s knowledge,or if it could be permanently lost or damaged 4.appropriate controls must be designed and implemented for engagement documentation to: a.enable the determination of when and by whom engagement documentation was created,changed or reviewed b.protect the integrity of the information at all stages of the engagement,especially when the information is shared within the engagement team or transmitted to other parties via internet c.prevent unauthorized changes to the engagement documentation d.allow access to the engagement documentation by the engagement team and other authorized parties as necessary to properly discharge their responsibilities

Examples of control over engagement documentations 1.the use of password to restrict the access to electronic engagement documentation to authorize users 2.appropriate back up routines 3.proceduress for properly distributing engagement documentation 4.procedures for restricting access to and enabling proper distribution and confidential storage of,hardcopy engagement document Original documentation 1.generate scanned copies that reflect the entire content of the original paper documentation,including manual signatures,cross references and annotations 2.integrate the scanned copies into the engagement files 3.enable the scanned copies to be retrieved and printed as necessary Procedures that the firm adopts for retention of engagement documentation include those that: 1.Enable the retrieval of,and access to, the engagement documentation during the retention period, particularly in the case of electronic documentation since the underlying technology may be upgraded or changed over time 2.provide,where necessary, a record of changes made to engagement documentation after the engagement files have been completed 3.enable authorized external parties to access and review specific engagement documentation for quality control or other purposes The purpose of monitoring and compliance with quality control policies and procedures is to provide an evaluation of: 1.adherence to professional standards and regulatory and legal requirements 2.whether the quality control system has been appropriately designed and effectively implemented 3.whether the firm s quality control policies and procedures have been engagement partners are appropriate in the circumstance

Consideration and evaluation of the system of quality control includes matters such as the following: 1.analysis of a.new developments in professionalstandards and regulatory and legal requirements b.written confirmation of compliance with policies and procedures on independence c.continuing professional development d.decisions related to acceptance and continuance of client relationships and specific engagements 2.determination of corrective actions to be taken and improvements to be made in the system 3.communication to appropriate firm personnel of weaknesses identified in the system in the system 4.follow up appropriate firm personnel so that necessary modifications are promptly made to the quality control policies and procedures

Factors to consider in determining the manner an timing of selection of individual engagements for inspection 1.the size of the firm* 2.the number and geographical location of offices 3.the results of previous monitoring procedures 4.the degree of authority both personnel and offices* 5.the nature and complexity of the firms practice and organization* 6.the risk associated with the firm s clients and specific engagements *criterias for documentation

Complains and allegations 1.complains and allegations that the work performed by the firm fails to comply withprofessional standards and regulatory and legal requirements 2.allegations of non compliance with the firm s system of quality control

PSA 220-audits of historical financial information The engagement team should: 1.implement quallity control procedures that are applicable to the audit engagement 2.provide the firm with relevant information to enable the functioning of that part of the firm s system of quality control realting to independence 3.are entitled to rely on the firm s system In complying to independence requirements,the engagement team should: 1.obtain relevant information ffrom the firm and network firms to identify and evaluate circumstances and relationships that create threats to independence 2.evaluate information on identified breaches of the firm s independence policies and procedures to determine whether they create a threat to independence for the audit engagement 3.take appropriate action to eliminate such threats or reduce to the accpetable low level by applying safeguards 4.document conclusions on independence and any relevant discussions with the firm that support these conclusions

Acceptance and continuance of clients relationship include considering: 1.the integrity of the principal owners,management and those charged with governance 2.whether the engagement tem is competent to perform the audit engagement and has the necessary time and resources 3.whether the firm and the engagement team can comply with ethical requirements Integrity of the client 1.obtain and review available FS regarding the prospective client,such as annual reports,interim financial statements and income tax returns 2.inquiry of third parties as to any information regarding the prospective clients and its management and principals which may have a bearing on evaluating the prospective client 3.communicate with the predecessor auditor 4.consider circumstances which would cause the firm to regard the engagement as one requiring special attention or presenting unusual risk Engagement partner informs the engagement team of: 1.their responsibilities 2.the nature of the entity s business 3.risk related issues 4.problems that may arise 5.the detailed approach to the performance of the engagement

Supervision and Review 1.tracking the progress of the audit engagement 2.cosidering the capabilities and competence of individual members of the engagement team 3.addressing significant issues 4.identifyinf matters for consultation Reviewer considers whether(when a senior staff member review the work perform by less experienced) 1.the work has been performed in accordance with professional standards and regulatory and legal requirements 2.significant matters hav been raised for further consideration 3.appropriate consultation have taken place and the resulting conclusion have been documented and implmented 4.there is a nee to revise the nature,timing and extent of work performed 5.the work performed supports the conclusion reached and is appropriately documented 6.the evidence obtained is sufficient and appropriate to support the auditor s report 7.the objective of the engagement procedures have been achieved

Consultation,the engagement partner should: 1.be responsible for the engagement team undertaking appropriate consultation on difficult and contentious matter a.the issue on which consltation was sought b.the results of the consultation 2.be satisfied that members of the engagement team have undertaken appropriate consultation during the course of the engagement 3.be satisfied that the nature and scope such consultations are documented and agreed with the party consulted 4.determine that conclusions resulting from consultations have been implemented Engagement Quality control review FS of Listed Entities The engagement partner should: 1.determine that an engagement quality control reviewer has been appointed 2.discuss significant matter arising during the audit engagement 3.not issue the auditor s report until the completion of the engagement quality control review

An engagement qality control review must consider the following: 1.the engagement team s evaluatiom of the firm s independence in relation to the specific audit engagement 2.significant risk identified during the engagement and responses to those risk 3.judgement made particularly to materiality and sigificant risk 4.whether consultation has taken place on matters involving differences of opinion 5.significance and disposition of corrected and uncorrected misstatements identified during the audit 6.the matters to be communicated to management and those charged with governance 7.whether audit documentation selected for review reflected work performed in relation to the significant judgements and supports the conclusion reached 8.the appropriateness of the auditor s report to be issued Monitoring The engagement partners considers: 1.whether deficiencies noted in that information may affect the audit engagement 2.whether the measures the firm took rectify the situation are sufficient in the context of that audit

Chapter6:code of Ethics for Cpas Fundamental Principles 1.Integrity 2.Objectivity 3.Professional Competence and due care 4.confidentiality 5.Professional behavior Safeguards 1.safeguards created by professional,legislation or regulation 2.safeguards in the work environment Threats to Independence 1.self interest threat 2.self review threat 3.advocacy threat 4.familiarity threat 5.intimidation threat

Safeguards created by profession,legslation or regulators 1.educational,training and experience requirements 2.continuing professional developments 3.corporate governance regulations 4.professional standards 5.professional or regulatory monitoring and disciplinary procedures 6.external review by a legally empowered third party Safeguards tha t increase the likelihood of identifying or deterring unethical behavior 1.effective,well publicized complaints systems operated by the employing organization,the profession or a regulator, which enable colleagues,employers and members of the public to draw attention to unprofessional or unethical behavior. 2.an explicitly stated duty to report breaches of ethical requirements Ethical Conflict resolution 1.relevant facts 2.ethical issues involved 3.fundamental principles related to the matter in question 4.established internal procedures 5.alternative courses of actions PART B:Professional accountant in public practice

You might also like

- Group Reporting RubricsDocument1 pageGroup Reporting RubricsDonald Bose Mandac90% (68)

- Substantive Procedures AA ACCADocument18 pagesSubstantive Procedures AA ACCAizdihar global50% (2)

- CPAR Auditing TheoryDocument62 pagesCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- Standards, Laws, and RegulationDocument35 pagesStandards, Laws, and RegulationKezNo ratings yet

- HeheDocument17 pagesHehen56xdmnmmxNo ratings yet

- AT Lecture 2 Professional Practice of Accounting - (1SAY2021)Document7 pagesAT Lecture 2 Professional Practice of Accounting - (1SAY2021)Jan Mouie LucidoNo ratings yet

- FEU Mkti - at Lecture 2 Professional Practice of AccountingDocument10 pagesFEU Mkti - at Lecture 2 Professional Practice of AccountingmarkNo ratings yet

- AI 2 Part 6 QADocument39 pagesAI 2 Part 6 QAJobby JaranillaNo ratings yet

- Code of Ethics For Proffessional AccountantsDocument5 pagesCode of Ethics For Proffessional AccountantsKristel JuliaNo ratings yet

- New 27456Document60 pagesNew 27456Lovely Jane Raut CabiltoNo ratings yet

- MODULE 2 The Professional Practice of AccountingDocument21 pagesMODULE 2 The Professional Practice of AccountingMary Grace Dela CruzNo ratings yet

- Audit and Assurance ReportDocument4 pagesAudit and Assurance ReportLovely Jane Raut CabiltoNo ratings yet

- Auditing Theory: (1 Point)Document9 pagesAuditing Theory: (1 Point)Kyla de SilvaNo ratings yet

- Auditing TheoryDocument63 pagesAuditing TheoryJohn Laurence LoplopNo ratings yet

- Module 3 - The Professional StandardsDocument8 pagesModule 3 - The Professional StandardsMAG MAGNo ratings yet

- Ac19 Module 4 - DGCDocument19 pagesAc19 Module 4 - DGCMaricar PinedaNo ratings yet

- F8 Notes Acca NotesDocument10 pagesF8 Notes Acca NotesSehaj Mago100% (1)

- AT 02 Intro To AuditingDocument5 pagesAT 02 Intro To AuditingPrincess Mary Joy LadagaNo ratings yet

- Ra 9298Document7 pagesRa 9298Monica Allarrey BalacaniaNo ratings yet

- Edited Chapter IIDocument8 pagesEdited Chapter IISeid KassawNo ratings yet

- Auditing Theory Cpa ReviewDocument53 pagesAuditing Theory Cpa ReviewIvy Michelle Habagat100% (1)

- Auditing Theory ChallengeDocument15 pagesAuditing Theory ChallengeAiko E. LaraNo ratings yet

- 04 - Peer Review and Quality ReviewDocument18 pages04 - Peer Review and Quality ReviewRavi RothiNo ratings yet

- Chapter 2 Auditing PDFDocument9 pagesChapter 2 Auditing PDFMulugeta BerihunNo ratings yet

- Lanaban Aud5-EvaluationDocument3 pagesLanaban Aud5-EvaluationAireyNo ratings yet

- Auditing and Investigation Acc 412Document7 pagesAuditing and Investigation Acc 412saidsulaiman2095No ratings yet

- CASE1Document141 pagesCASE1Mikaela CorderoNo ratings yet

- Adverse Opinions, Which States That The Financial Statement Do Not Present Fairly, in Conformity inDocument3 pagesAdverse Opinions, Which States That The Financial Statement Do Not Present Fairly, in Conformity inbcruelaNo ratings yet

- CH 3 6Document15 pagesCH 3 6Gizachew MayebetNo ratings yet

- Audit Assignment Case 3Document11 pagesAudit Assignment Case 3Yee HooiNo ratings yet

- Auditing Midterm Notes and QuizzesDocument91 pagesAuditing Midterm Notes and QuizzesAnonymous dKdGmsT1dNo ratings yet

- Espinoza, Audit Quiz 1Document5 pagesEspinoza, Audit Quiz 1Daenielle EspinozaNo ratings yet

- Chapter 4 (Salosagcol)Document4 pagesChapter 4 (Salosagcol)Lauren Obrien100% (1)

- Study Guide - PrelimDocument3 pagesStudy Guide - PrelimGellie Vale T. ManagbanagNo ratings yet

- 03.2 Handbook of The International Code of Ethics For Professional AccountantsDocument92 pages03.2 Handbook of The International Code of Ethics For Professional AccountantsnuggsNo ratings yet

- Auditing Theory Summary NotesDocument63 pagesAuditing Theory Summary NotesChandria FordNo ratings yet

- AuditmidtermsDocument26 pagesAuditmidtermsLana sereneNo ratings yet

- QUIZDocument18 pagesQUIZJefNo ratings yet

- The Auditing ProfessionDocument10 pagesThe Auditing Professionmqondisi nkabindeNo ratings yet

- Module #03 - The Professional Practice of AccountingDocument6 pagesModule #03 - The Professional Practice of AccountingRhesus UrbanoNo ratings yet

- 15 Code of Ethics For Professional Accountants in The PhilippinesDocument11 pages15 Code of Ethics For Professional Accountants in The PhilippinesDia Mae GenerosoNo ratings yet

- Aud339 Audit Planning Part 1Document25 pagesAud339 Audit Planning Part 1Nur IzzahNo ratings yet

- 1503158448846auditing Standards Full SummaryDocument11 pages1503158448846auditing Standards Full SummaryTushar GuptaNo ratings yet

- Materials Comprehensive AUd Theory NotesDocument25 pagesMaterials Comprehensive AUd Theory Notesjethro carlobosNo ratings yet

- CDA AccreditationDocument11 pagesCDA AccreditationAndres Lorenzo III50% (2)

- PSADocument17 pagesPSAMichelle de Guzman100% (1)

- Aud Spec 101Document19 pagesAud Spec 101Yanyan GuadillaNo ratings yet

- Apd 2 NotesDocument3 pagesApd 2 NotesHelios HexNo ratings yet

- Auditing Principle 1 - ch2Document18 pagesAuditing Principle 1 - ch2Sabaa ifNo ratings yet

- Chapter Two: The Auditing ProfessionDocument10 pagesChapter Two: The Auditing ProfessionNigussie BerhanuNo ratings yet

- Audit Planning Lecture 6 NewDocument24 pagesAudit Planning Lecture 6 Newpadjetey00No ratings yet

- Chapter FourDocument16 pagesChapter FourGebrekiros ArayaNo ratings yet

- Chapter 1 and 2Document56 pagesChapter 1 and 2Snn News TubeNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCFrom EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- International Trade SyllabusDocument2 pagesInternational Trade SyllabusFlashNo ratings yet

- A Study On Measuring of E-Shopping at Flipkart: Chapter-1Document49 pagesA Study On Measuring of E-Shopping at Flipkart: Chapter-1MohanNo ratings yet

- Advertising 9 Managing Creativity in Advertising and IBPDocument13 pagesAdvertising 9 Managing Creativity in Advertising and IBPOphelia Sapphire DagdagNo ratings yet

- Final Superintendent Recommendation 2023Document30 pagesFinal Superintendent Recommendation 2023ABC Action NewsNo ratings yet

- Evidence Law Reading ListDocument9 pagesEvidence Law Reading ListaronyuNo ratings yet

- Question Bank: Student Check-Ins: 80 Questions Across Well-Being, SEL Skills, Relationships, and Classroom FeedbackDocument15 pagesQuestion Bank: Student Check-Ins: 80 Questions Across Well-Being, SEL Skills, Relationships, and Classroom FeedbackTemporary 241No ratings yet

- Cengage LearningDocument12 pagesCengage LearningerikomarNo ratings yet

- A Crash Course in Media LiteracyDocument4 pagesA Crash Course in Media LiteracyAkan D YazganNo ratings yet

- Daniel B. Pe A Memorial College Foundation, Inc. Tabaco CityDocument3 pagesDaniel B. Pe A Memorial College Foundation, Inc. Tabaco CityAngelica CaldeoNo ratings yet

- Request To Defer Admission For International Applicants: ImportantDocument1 pageRequest To Defer Admission For International Applicants: Importantharsh rewariNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument16 pagesCambridge International General Certificate of Secondary EducationAhmed ZeeshanNo ratings yet

- Consultative Approach Communication SkillsDocument4 pagesConsultative Approach Communication SkillsSadieDollGlonekNo ratings yet

- Notification AAI Manager Junior ExecutiveDocument8 pagesNotification AAI Manager Junior ExecutivesreenuNo ratings yet

- Contract Basis For Its Panchkula Unit and Project SitesDocument8 pagesContract Basis For Its Panchkula Unit and Project SitesEr Vinay SinghNo ratings yet

- "Full Coverage": Laws of Indices: (Edexcel GCSE June2008-2F Q15b)Document13 pages"Full Coverage": Laws of Indices: (Edexcel GCSE June2008-2F Q15b)Yee MeiNo ratings yet

- Conclusion and RecommendationsDocument3 pagesConclusion and Recommendationsstore_2043370333% (3)

- A Proposed Program To Prevent Violence Against Women (Vaw) in Selected Barangays of Batangas CityDocument16 pagesA Proposed Program To Prevent Violence Against Women (Vaw) in Selected Barangays of Batangas CityMarimarjnhioNo ratings yet

- General Education From PRCDocument40 pagesGeneral Education From PRCMarife Dela CruzNo ratings yet

- IELTS Listening Test 1Document4 pagesIELTS Listening Test 1chelseholicNo ratings yet

- Oral DefenseDocument23 pagesOral DefenseShanna Basallo AlentonNo ratings yet

- A Lesson Plan in GrammarDocument4 pagesA Lesson Plan in GrammarJhoel VillafuerteNo ratings yet

- The Impact of Integrating Social Media in Students Academic Performance During Distance LearningDocument22 pagesThe Impact of Integrating Social Media in Students Academic Performance During Distance LearningGoddessOfBeauty AphroditeNo ratings yet

- 2 - Basic Assessment in TrainingDocument32 pages2 - Basic Assessment in TrainingDevan MollyNo ratings yet

- Karachi, From The Prism of Urban Design: February 2021Document14 pagesKarachi, From The Prism of Urban Design: February 2021SAMRAH IQBALNo ratings yet

- GA Classic Qualification SpecificationDocument10 pagesGA Classic Qualification SpecificationThomasNo ratings yet

- Best Practices (Sraes)Document19 pagesBest Practices (Sraes)encarNo ratings yet

- Ba7101 - PomDocument7 pagesBa7101 - PomanglrNo ratings yet

- Curriculum Dualism AssignmentDocument7 pagesCurriculum Dualism AssignmentMuhammad Mohsin AltafNo ratings yet

- Arturo Leon CV May 20 2014Document27 pagesArturo Leon CV May 20 2014Guillermo Yucra Santa CruzNo ratings yet