Professional Documents

Culture Documents

4

Uploaded by

Qing YiluoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4

Uploaded by

Qing YiluoCopyright:

Available Formats

Chapter 4: Activity Based Costing (ABC) Product Costing Product Costing System - method of assigning manufacturing costs to units

produced Product Costs 1. Direct material 2. Direct labor 3. Overhead Assigning overhead costs to units produced Unit level product costing Normal costing - Overhead costs are charged to jobs using a Predetermined (budgeted) overhead rate. Unit level product costing - uses a single cost driver to assign overhead costs, on either a plantwide or departmental level Companies calculate an overhead rate by: 1. budget total overhead costs for year or normal operating cycle 2. determine a cost driver - a measurable activity that all products have in common and is correlated with overhead costs 3. budget the cost driver for the same period of time Predetermined (Budgeted) overhead rate = budgeted total overhead/budgeted total cost driver Overhead costs charged to a job = actual amount of the cost driver used by product X budgeted overhead rate

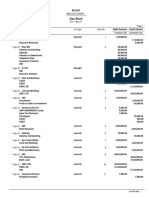

Activity Based Costing ABC was developed in the 1980s. Unit based cost drivers were causing distortions due to product diversity and complexity and direct labor being replaced with automated processes. Key concept underlying ABC: Activities consume the resources of the firm. Products, services, customers, processes, suppliers, etc. consume activities. Steps for Implementing ABC To implement ABC, a company must: 1. Identify the activities necessary to manufacture a product, provide a service, maintain customers, etc.. 2. Determine the budgeted cost of each activity. 3. Determine the cost driver (activity driver) for each activity. 4. Determine an activity rate. 5. Charge products, services, customers, etc. costs based on their consumption of the activity driver for each activity. Manufacturing Example: Cascade Corporation manufactures two products, Product #347 and Product #658. Product #347 has been a standard in the industry for many years. Cascade plans on selling 65,000 units of Product #347 at a price of $145. Product #658 is a recent addition to Cascades product line. Cascade plans to sell 40,000 units at a price of $300. Product #347 requires $80 in direct material and $21 in direct labor per unit. Product #658 requires $140 in direct material and $56 in direct labor per unit. Currently Cascade allocates overhead to products based on direct labor cost. Overhead is budgeted to be $5,472,400 and direct labor costs are budgeted to be $3,605,000. 1. Calculate the Predetermined overhead rate.

2. Calculate the products cost per unit using the plantwide overhead rate:

3.

Calculate the products gross margin per unit with the plantwide overhead rate.

Based on the products gross margins, the sales manager wants to expand the market for Product #658. The controller decides to set up an ABC system to see if the allocated overhead costs are accurate before trying to expanding the market for Product #658. The controller determines that the following activities are used to manufacture the product:

Activity Budgeted Cost Cost Driver Budgeted cost driver Activity rate

Material Procurement Machine Setup

$382,500 $400,000 $45,900 $1,184,000 $3,460,000

Parts

3,825,000 250,000 15,300 2,960,000 865,000

Number of setups Pounds of waste

Hazardous waste disposal Machine Insertion of Part Manual Insertion of Part

Number of parts

Number of parts

1. Determine activity rates.

Activities required per unit of product: Product #347

Parts Machine Insertions of parts Manual Insertions of parts Machine Setups Hazardous waste

Product #658 55 35 20 3 0.35

25 24 1 2 .02 lb.

2. Calculate the products cost per unit using ABC:

3. Calculate the products gross margin per unit using ABC:

Chapter 11: Value Chain Analysis Exploiting Internal Linkages Engineering redesigns Product #658 in order to save costs. In the new design, the number of parts per unit are reduced to 40. Five parts eliminated required machine insertion and 10 required manual insertion. All the machine insertion and manual insertion costs are variable. The material procurement costs consist of $344,250 fixed costs and variable costs are $.01 per part. The fixed costs include 8 purchasing clerks earning $25,000 per year. Each clerk can process 500,000 parts per year. 1. Calculate the total annual cost savings from the new design, assuming they continue to sell 40,000 units per year.

Supplier Costing Purchasing managers are typically rewarded based on the purchase price they are able to negotiate (material price variance). However, important characteristics of suppliers such as quality and reliability of the product and delivery performance are not captured in the purchase price. Companies can use ABC to determine how much issues such poor product quality or supplier unreliability are costing them and thus, calculate the total cost of a supplier. Example XYZ Company has 2 suppliers, Murray Inc. and Plata Inc., for 2 component parts, Part A1 and Part B2, used in the manufacture of tools. You are given the following information: Murray Part A1 Unit purchase price Units purchased Failed units $20 80,000 1,600 Murray Part B2 $52 40,000 380 40 Plata Part A1 $24 10,000 10 0 Plata Part B2 $56 10,000 10 0

Late shipments 60

The cost of repairing 2,000 failed units is expected to be $800,000. The cost of the 100 late shipments is expected to be $200,000. 1. Calculate activity rates for repairs and late shipments.

2.

Calculate the total unit purchasing cost for each component for each supplier

Customer Profitability Example: Jackson Company, a warehouse distributor of construction material, has two major customers, Accent Construction and Barton Construction. Sales Revenue and Cost of Goods Sold is given below: Accent Construction Sales $500,000 Cost of Goods Sold $300,000 Gross Margin $200,000 Barton Construction $700,000 $450,000 $250,000

Jackson Companys selling and administrative costs total $400,000 and consist of the costs to enter an order, to pick an order from the warehouse, to deliver the order and general administration. Jackson Companys budgeted activity costs and drivers are below: Activity Cost Driver Activity Cost Cost driver per activity Entering order Number of orders $45,000 500 entered Picking an order $120,000 Number of items picked 20,000 Delivering order $85,000 Number of deliveries 850 made Performing Order Value $150,000 $1,500,000 general administration

1.

Calculate activity rates.

Activities uses by Accent and Barton are as follows: Accent Number of orders 150 Number of items 7,000 Number of deliveries 150 Order value $500,000

Barton 250 9,000 400 $700,000

2. Allocate activity costs to Accent and Barton:

3. Determine Customer Profitability Analysis:

4.

Analyse results:

Homework 1. Bell Inc. is considering redesigning one of its products. You are given the following information. a. The current design requires 100 machine setups per year. The new design would only require 80 machine setups per year. Fixed machine setup costs consist of employee wages. Two employees, earning $50,000 per year, are required for every 50 setups. Variable machine setup costs are $100 per setup. b. The current design requires 50,000 component parts be purchased per year. The new design would decrease the component parts to 40,000 per year. Fixed purchasing costs are a step fixed cost. $5,000 in fixed costs are incurred for every 10,000 component parts purchased (i.e., if 10,000 components are purchased total fixed costs are $5,000; if 20,000 components are purchased, total fixed costs are $10,000; etc.). Variable purchasing costs are $2 per component purchased. c. The inspection costs depend upon the number of component parts in a product. All inspection costs are fixed and are a step fixed cost. $2,000 in fixed costs are incurred for every 5,000 component parts inspected. Calculate the total annual cost savings from the new design.

You might also like

- CHAPTER 19-4 Rules and Regulations Governing The Investment Policies and Procedures of The State Board of AdministrationDocument4 pagesCHAPTER 19-4 Rules and Regulations Governing The Investment Policies and Procedures of The State Board of AdministrationQing YiluoNo ratings yet

- MGT 326 HW1 Bond Yield Curve AnalysisDocument3 pagesMGT 326 HW1 Bond Yield Curve AnalysisQing YiluoNo ratings yet

- Arens14e Ch07Document43 pagesArens14e Ch07Qing YiluoNo ratings yet

- Financial Accounting TEMA 1Document43 pagesFinancial Accounting TEMA 1adriamg95No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Newspapers Are Transforming Not Disappearing: iMAT Conference 2006Document1 pageNewspapers Are Transforming Not Disappearing: iMAT Conference 2006Justin ReedNo ratings yet

- PCC Module 3Document3 pagesPCC Module 3Aries MatibagNo ratings yet

- MEDICINE INVENTORY MANAGEMENT SYSTEM (MIMSDocument3 pagesMEDICINE INVENTORY MANAGEMENT SYSTEM (MIMSChris ValduezaNo ratings yet

- Sales Funnel Strategies PDFDocument41 pagesSales Funnel Strategies PDFgeyles100% (4)

- AccountingDocument4 pagesAccountinganca9004No ratings yet

- Essential Links for Marketing, Finance & TechDocument3 pagesEssential Links for Marketing, Finance & TechsouranilsenNo ratings yet

- Cola CaseDocument40 pagesCola Case01dynamic100% (1)

- G.O. 361-I&prDocument3 pagesG.O. 361-I&prBalu Mahendra SusarlaNo ratings yet

- Pepsi Cola Brand ArchitectureDocument13 pagesPepsi Cola Brand ArchitectureAyrushNo ratings yet

- Business Economics Book TrOWJ916T5Document340 pagesBusiness Economics Book TrOWJ916T5aartimum9275100% (2)

- Using DITA With Share Point - Frequently Asked QuestionsDocument6 pagesUsing DITA With Share Point - Frequently Asked QuestionsJohn MelendezNo ratings yet

- Maximize Google Ads Results With a Low BudgetDocument3 pagesMaximize Google Ads Results With a Low BudgetErick Javier FlorezNo ratings yet

- Example LocDocument7 pagesExample LocGraha Teknologi MandiriNo ratings yet

- Day Book 2Document2 pagesDay Book 2The ShiningNo ratings yet

- Synopsis DhananjayDocument15 pagesSynopsis DhananjayDevendra DhruwNo ratings yet

- Analysis of Task EnvironmentDocument6 pagesAnalysis of Task EnvironmentRiju Joshi100% (1)

- Workmen's Compensation Act 1923 (HR)Document18 pagesWorkmen's Compensation Act 1923 (HR)Rahul AcharyaNo ratings yet

- Sbi Code of ConductDocument5 pagesSbi Code of ConductNaved Shaikh0% (1)

- Install GuideDocument122 pagesInstall GuideJulio Miguel CTNo ratings yet

- Computation of Tax On LLPS and Critical Appraisal.Document14 pagesComputation of Tax On LLPS and Critical Appraisal.LAW MANTRANo ratings yet

- Jurnal Yaa TSMDocument12 pagesJurnal Yaa TSMhd capitalNo ratings yet

- (NAK) Northern Dynasty Presentation 2017-06-05Document39 pages(NAK) Northern Dynasty Presentation 2017-06-05Ken Storey100% (1)

- HCC Industries CaseDocument3 pagesHCC Industries CaseelNo ratings yet

- Process Costing Breakdown/TITLEDocument76 pagesProcess Costing Breakdown/TITLEAnas4253No ratings yet

- Raza Building StoneDocument9 pagesRaza Building Stoneami makhechaNo ratings yet

- Uab AugimitaDocument1 pageUab Augimitaozel tekstilNo ratings yet

- Basma Rice Mills PVTDocument3 pagesBasma Rice Mills PVTAmna SaadatNo ratings yet

- SupermarketsDocument20 pagesSupermarketsVikram Sean RoseNo ratings yet

- 90-Day PlannerDocument8 pages90-Day PlannerNikken, Inc.No ratings yet

- Esp Sales Executive Needs AnalysisDocument4 pagesEsp Sales Executive Needs AnalysisChitra Dwi Rahmasari100% (1)