Professional Documents

Culture Documents

Cost Sheet Questions.72124749

Uploaded by

Gayathri SankarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Sheet Questions.72124749

Uploaded by

Gayathri SankarCopyright:

Available Formats

DEEPAK GUPTA CLASSES

98104 88450, 9899221902

COST SHEET

Q1. A Ltd. has a capacity to produce 100,000 units of the product every month. Its work costs at varying levels of production is as under: LEVEL WORK COST (Rs.per unit) 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 400 390 380 370 360 350 340 330 320 310

Its fixed administration expenses amount to Rs.150,000 p.m. and fixed marketing expenses amount to Rs.250,000 p.m. respectively. The variable selling costs amounts to Rs.30 per unit. It can market 100% of its output at Rs.500 per unit provided it incurs the following further expenditure: a) It gives gift items costing Rs.30 per unit of sale, b) It has lucky draw every month giving the first prize of Rs.50,000, 2 nd prize of Rs.25,000, 3rd prize of Rs.10,000 and three consolation prizes of Rs.5,000 each to its customers buying the product. c) It spends Rs.100,000 on refreshments served every month to its customers. d) It sponsors a television programme every week at the cost of Rs.500,000. It can market 30% of its output at Rs.550 per unit without incurring any of the expenses referred above. Prepare cost sheets to compute the amount of profits at 30% and 100% capacity.

S-2, SHIVAM PLAZA, B&E MARKET, DILSHAD GARDEN, DELHI-110095, NEERAJ STUDY CENTER ,C-328, VIVEK VIHAR, DELHI-110095, IDEAL COACHING CENTER, JHEEL CHOWK, DELHI

http://www.deepakguptaclasses.com

DEEPAK GUPTA CLASSES

98104 88450, 9899221902

Q2. ABC Ltd. provides the following information for cookers manufactured during the last year: PARTICULARS Material Direct Wages Power and consumables Lighting of factory Clerical Salaries and Mgmt. Expenses Selling expenses Sales proceeds of factory scrap Plant, repairs, maintenance and depn. AMOUNT(Rs.) 450,000 300,000 60,000 117,500 168,000 27,000 10,000 57,500

The net selling price was Rs.158 per unit and all units were sold. From Ist January of the current year, the selling price was reduced to Rs.150 and it estimated that production could be increased by 50% in the current year due to increased spare capacity. Prepare: a) A cost sheet for the last year. b) A cost sheet for the current year if 15000 units were Produced and sold. The factory overheads are recovered as a percentage of direct wages and office and selling expenses as a percentage of works cost.

Q3. A fire occurred in the factory premises on october31, 2003. The accounting records have been destroyed but some records were kept in another building and they reveal the following for the period september1, 2003 to October 31, 2003: i. ii. iii. Direct material purchased WIP inventory 1.9.2003 Raw material inventory 1.9.2003 Rs.250,000 Rs.40,000 Rs.20,000

S-2, SHIVAM PLAZA, B&E MARKET, DILSHAD GARDEN, DELHI-110095, NEERAJ STUDY CENTER ,C-328, VIVEK VIHAR, DELHI-110095, IDEAL COACHING CENTER, JHEEL CHOWK, DELHI

http://www.deepakguptaclasses.com

DEEPAK GUPTA CLASSES

98104 88450, 9899221902

iv. v. vi. vii. viii. ix. x. Finished goods inventory 1.9.2003 Indirect manufacturing costs Sales revenues Direct Manufacturing labour Prime costs Gross margin percentage Cost of goods available for sale Rs.37,750 40% of conversion costs Rs.750,000 Rs.222,250 Rs.397,750 30% Rs.555,775

The loss is fully covered by insurance so the insurance wants you to Calculate the historical costs of the following inventories: a) Finished goods inventory 31.10.2003. b) Work in Progress 31.10.2003. c) Direct Material inventory 31.10.2003.

Q4. The following data relates to a company for the month of March 2009: i. ii. iii. iv. v. vi. vii. viii. Direct material used Rs.847. Opening stock of finished goods Closing stock of finished goods Rs.94. Direct Labour cost Rs.389. Manufacturing overheads ? ?

Cost of goods produced Rs.18,78. Cost of goods sold ?

Cost of goods available for sale Rs.19,49.

Find the missing items. (Ans. Mfg Ov. Rs.642, Op.FG Rs.71, COGS Rs.1,855)

S-2, SHIVAM PLAZA, B&E MARKET, DILSHAD GARDEN, DELHI-110095, NEERAJ STUDY CENTER ,C-328, VIVEK VIHAR, DELHI-110095, IDEAL COACHING CENTER, JHEEL CHOWK, DELHI

http://www.deepakguptaclasses.com

DEEPAK GUPTA CLASSES

98104 88450, 9899221902

Q5. Find out the selling price of an article where costs of production and sales of 100,000 units are as under: Material Labour Overheads Rs.50,000 Rs.40,000 Rs.160,000

The fixed portion of capital employed is Rs.50,000 and the varying portion is 40% of sales turnover. A profit of 8% net on capital employed after payment of taxes @ 40% of the earnings is desired. (Ans. Rs.2.71)

Q6. The following information relates to a company for the half year ending 31st December 2009 is available to you: Purchase of raw material Rent, rates, Insurance of factory Direct wages Carriage inwards Stocks ( 01,july 2009) Raw Material Finished product (1,000 tons) WIP Stocks ( 31,Dec. 2009) Raw Material Finished product (2,000 tons) WIP Sales of finished product Cost of factory supervision Rs.22,240 Rs.32,000 Rs.16,000 Rs.300,000 Rs.8,000 Rs.20,000 Rs.16,000 Rs.4,800 Rs.120,000 Rs.40,000 Rs.100,000 Rs.1,440

S-2, SHIVAM PLAZA, B&E MARKET, DILSHAD GARDEN, DELHI-110095, NEERAJ STUDY CENTER ,C-328, VIVEK VIHAR, DELHI-110095, IDEAL COACHING CENTER, JHEEL CHOWK, DELHI

http://www.deepakguptaclasses.com

DEEPAK GUPTA CLASSES

98104 88450, 9899221902

The advertising discount allowed and selling costs are Rs.1 per ton sold. 16,000 tons of the product were produced during the period. Calculate the total profit and the cost of sales of the product for the period by preparing a cost sheet. (Ans. Rs.45,000 and Rs.255,000) Q7. Nilgiri Ltd. produces fridges and sells each for Rs.20,000 during a year. The DM, DL and OVERHEADS costs are 60%, 20% and 20% respectively of the cost of sales. Next year, the DM costs has increased by 15% and DL costs by 17.5% and so the profit has declined by 50% if the same selling price is maintained. Compute the new selling price to enable the company to maintain the same %age of profit as that earned during the preceding year. (Ans. Old cost Rs.1,600, Old SP Rs.2,000, New cost Rs.1,800, New SP Rs.2,250)

Q8. A factory has received order for two types of alloy sheets weighing 45 tons and 72 tons respectively. 10% of raw materials input is wasted and is sold at 25% of the cost price of raw materials. The cost of raw materials is Rs.800 per ton. The wages for two types of alloy wheels are paid @ Rs.300 and Rs.250 per ton of material input respectively. The cost of moulds for the two types of sheets are Rs.4,000 and Rs.7,500 respectively. If factory overheads are absorbed @ 40% of wages in each case then what is the production cost per ton for each type of alloy sheet. (Ans.Rs.1422.22 and Rs.1,359.72) Q9. A firm has purchased a plant to manufacture a new product, the cost data for which is given below: Estimated annual sales 24,000 units Estimated Costs: Materials Labour Overheads Admn. Expenses Selling expenses Rs.4 per unit Rs.0.60 per unit Rs.24,000 per year Rs.28,800 per year 15% of sales (Ans.Rs.9.20)

Calculate the selling price if profit per unit is Rs.1.02.

Q10. The following information relates to a company:

S-2, SHIVAM PLAZA, B&E MARKET, DILSHAD GARDEN, DELHI-110095, NEERAJ STUDY CENTER ,C-328, VIVEK VIHAR, DELHI-110095, IDEAL COACHING CENTER, JHEEL CHOWK, DELHI

http://www.deepakguptaclasses.com

DEEPAK GUPTA CLASSES

98104 88450, 9899221902

Opening 110,000 70,000 90,000 Closing 95,000 80,000 95,000 Stock Finished goods WIP Raw Material a) Cost of goods produced Rs.684,000. b) Factory cost Rs.654,000. c) Factory overheads Rs.167,000. d) Direct Material consumed Rs.193,000. Calculate: 1) Raw material purchased. 2) Direct labour cost. 3) Cost of goods sold. (Ans. Rs.198,000, Rs.304,000, Rs.699,000)

S-2, SHIVAM PLAZA, B&E MARKET, DILSHAD GARDEN, DELHI-110095, NEERAJ STUDY CENTER ,C-328, VIVEK VIHAR, DELHI-110095, IDEAL COACHING CENTER, JHEEL CHOWK, DELHI

http://www.deepakguptaclasses.com

DEEPAK GUPTA CLASSES

98104 88450, 9899221902

DIRECT MATERIAL

Q1. Find out the Economic Order Quantity and order schedule for Raw materials and packing materials with the following data given to you: 1. Cost of Ordering : Raw Material Rs.1,000 per order Packing materials 2. Cost of holding inventory : Raw Material Packing materials 3. Production Rate Rs.5,000 per order 1paise per unit per month 5paise per unit per month

: 200,000 units per month

Q2. Calculate the material turnover ratio for the year 1999 from the following details: Particulars Opening Stock Closing Stock Purchases Material X 25,000 15,000 190,000 Material Y 87,500 62,500 125,000

Determine the faster moving material.

S-2, SHIVAM PLAZA, B&E MARKET, DILSHAD GARDEN, DELHI-110095, NEERAJ STUDY CENTER ,C-328, VIVEK VIHAR, DELHI-110095, IDEAL COACHING CENTER, JHEEL CHOWK, DELHI

http://www.deepakguptaclasses.com

You might also like

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsSnehalkumar PatelNo ratings yet

- Problems On Cost SheetDocument4 pagesProblems On Cost SheetAnand Dabasara0% (1)

- CMA AssignmentDocument4 pagesCMA AssignmentniranjanaNo ratings yet

- Management Accounting 21.1.11 QuestionsDocument5 pagesManagement Accounting 21.1.11 QuestionsAmeya TalankiNo ratings yet

- Chapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaDocument14 pagesChapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaAR Ananth Rohith BhatNo ratings yet

- 820001-Cost and Management AccountingDocument4 pages820001-Cost and Management AccountingsuchjazzNo ratings yet

- 4587 - 2179 - 10 - 1486 - 54 - Unit CostingDocument24 pages4587 - 2179 - 10 - 1486 - 54 - Unit CostingApoorv TiwariNo ratings yet

- Cost Accounting Paper-2016Document3 pagesCost Accounting Paper-2016Sharafat Ali100% (1)

- Problem-42: RequiredDocument7 pagesProblem-42: RequiredRADHIKA V HNo ratings yet

- Costing AssignmentDocument15 pagesCosting AssignmentSumit SumanNo ratings yet

- Cost 2014Document3 pagesCost 2014Mozam MushtaqNo ratings yet

- Cagayan State University - AndrewsDocument4 pagesCagayan State University - AndrewsWynie AreolaNo ratings yet

- Ias 2Document4 pagesIas 2SultanNo ratings yet

- Cost Accounting Past Paper 2016 B Com Part 2Document4 pagesCost Accounting Past Paper 2016 B Com Part 2Sana BudhwaniNo ratings yet

- Ac Solve PaperDocument59 pagesAc Solve PaperHaseeb ShadNo ratings yet

- COSTINGDocument182 pagesCOSTINGjahazi2100% (1)

- Effect of Labor Turnover: Question No: 35 (Marks: 3)Document9 pagesEffect of Labor Turnover: Question No: 35 (Marks: 3)Muhammad ZubairNo ratings yet

- Cost Accounting RTP CAP-II June 2016Document31 pagesCost Accounting RTP CAP-II June 2016Artha sarokarNo ratings yet

- Cost AccountingDocument14 pagesCost AccountingAdv Kamran Liaqat50% (2)

- Work Sheet 1Document6 pagesWork Sheet 1Sourabh PatidarNo ratings yet

- Revalidation Test Paper Intermediate Group II: Revised Syllabus 2008Document6 pagesRevalidation Test Paper Intermediate Group II: Revised Syllabus 2008sureka1234No ratings yet

- 68957Document9 pages68957Mehar WaliaNo ratings yet

- CA Assignment QuestionsDocument7 pagesCA Assignment QuestionsShagunNo ratings yet

- Cma Past PapersDocument437 pagesCma Past PapersTooba MaqboolNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsNaveed Mughal AcmaNo ratings yet

- Tutorial 4Document6 pagesTutorial 4FEI FEINo ratings yet

- 36 - Problems On Cost Sheet1Document6 pages36 - Problems On Cost Sheet1Arul JoshNo ratings yet

- Management Accounting AssignmentDocument8 pagesManagement Accounting AssignmentAjay VatsavaiNo ratings yet

- CA Inter Costing Q MTP 1 May 2024 Castudynotes ComDocument11 pagesCA Inter Costing Q MTP 1 May 2024 Castudynotes ComGaurav kothariNo ratings yet

- Ama Set 28Document5 pagesAma Set 28uroojfatima21299No ratings yet

- Cost Sheet - Pages 16Document16 pagesCost Sheet - Pages 16omikron omNo ratings yet

- Title01 - Job Costing and Batch CostingDocument72 pagesTitle01 - Job Costing and Batch CostingPoonamNo ratings yet

- Exercises For Final ExamDocument5 pagesExercises For Final ExamSivasakti MarimuthuNo ratings yet

- Cost Accounting 2013Document3 pagesCost Accounting 2013GuruKPO0% (1)

- Paper - 4: Cost Accounting and Financial ManagementDocument20 pagesPaper - 4: Cost Accounting and Financial ManagementdhilonjimyNo ratings yet

- As 462Document6 pagesAs 462ziabuttNo ratings yet

- Process Costing Questions Sheet AssignmentDocument12 pagesProcess Costing Questions Sheet Assignmentvanshaj juneja0% (1)

- Cost Accounting: Time Allowed: 3 Hours Marks: 100Document3 pagesCost Accounting: Time Allowed: 3 Hours Marks: 100muhammad sami ullah khanNo ratings yet

- PPCE Que BankDocument2 pagesPPCE Que BanktsrNo ratings yet

- Mid Term (March 2023)Document6 pagesMid Term (March 2023)Nadir IshaqNo ratings yet

- Costing Prob FinalsDocument52 pagesCosting Prob FinalsSiddhesh Khade100% (1)

- Costing QN PaperDocument5 pagesCosting QN PaperAJNo ratings yet

- Caf-03 Cma Artt Mock QP With SolDocument16 pagesCaf-03 Cma Artt Mock QP With Solkulhaq29No ratings yet

- MG T 402 Subjective SolvedDocument8 pagesMG T 402 Subjective SolvedAhsan Khan KhanNo ratings yet

- 4 Af 201 Ca PDFDocument4 pages4 Af 201 Ca PDFSyed Ali GilaniNo ratings yet

- Extra Reading Time: 15 Minutes Writing Time: 03 Hours 05 Minutes Maximum Marks: 100 Roll No.Document5 pagesExtra Reading Time: 15 Minutes Writing Time: 03 Hours 05 Minutes Maximum Marks: 100 Roll No.Ahmed RazaNo ratings yet

- VM Costing ImpDocument22 pagesVM Costing ImpSinsNo ratings yet

- Alagappa University Collaborative Institution B.com (4th Semester) - Internal 1 - Cost and Management AccountingDocument3 pagesAlagappa University Collaborative Institution B.com (4th Semester) - Internal 1 - Cost and Management AccountingSREENAVIN PNo ratings yet

- Topic 2 Cost Concepts and Analysis HandoutsDocument5 pagesTopic 2 Cost Concepts and Analysis HandoutsJohn Kenneth ColarinaNo ratings yet

- Cost Sheet Questions FastrackDocument8 pagesCost Sheet Questions Fastrackdegikoh540No ratings yet

- Budget Numerical PDFDocument5 pagesBudget Numerical PDFDilip BhusalNo ratings yet

- ALl Questions According To TopicsDocument11 pagesALl Questions According To TopicsHassan KhanNo ratings yet

- PAT0084 ExamFinalQDocument6 pagesPAT0084 ExamFinalQJasmine TanNo ratings yet

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- Cma Q. PaperDocument2 pagesCma Q. PaperRobert HensonNo ratings yet

- C&ma RWQDocument5 pagesC&ma RWQPrabhakar RaoNo ratings yet

- Cec Case Study of 20 MarksDocument32 pagesCec Case Study of 20 MarksAjay GohilNo ratings yet

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryFrom EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNo ratings yet

- Takt Time: A Guide to the Very Basic Lean CalculationFrom EverandTakt Time: A Guide to the Very Basic Lean CalculationRating: 5 out of 5 stars5/5 (2)

- Deeds of SaleDocument8 pagesDeeds of SaleRaihanah Sarah Tucaben MacarimpasNo ratings yet

- Unit III - SALES PRE-APPROACH & APPROACHDocument6 pagesUnit III - SALES PRE-APPROACH & APPROACHLance Reyes AguilarNo ratings yet

- Editorial On Role of Emotion in B2B Decision MakingDocument12 pagesEditorial On Role of Emotion in B2B Decision MakingLukaš BeňušNo ratings yet

- SCM Assignment 2Document9 pagesSCM Assignment 2SebaanNo ratings yet

- Conell - Business Plan - Vancouver Luxury Hotel Residences - 2009 - StaigerDocument76 pagesConell - Business Plan - Vancouver Luxury Hotel Residences - 2009 - StaigeraschalewNo ratings yet

- The Inbound Marketing Sales Playbookv5-1Document51 pagesThe Inbound Marketing Sales Playbookv5-1rahulartiNo ratings yet

- Module 6 EMDocument18 pagesModule 6 EMCJ MamaclayNo ratings yet

- CoffeeVille Business Plan PDFDocument37 pagesCoffeeVille Business Plan PDFAnirbit GhoshNo ratings yet

- Unit 2: Sales Rebates Through Settlement Management: Gain Experience With SAP S/4HANA - LogisticsDocument17 pagesUnit 2: Sales Rebates Through Settlement Management: Gain Experience With SAP S/4HANA - Logisticszulfiqar26No ratings yet

- The Problem and Its SettingDocument25 pagesThe Problem and Its SettingMia Siong CatubigNo ratings yet

- The Influence of Advertising On Consumer Brand Preference: Journal of Social SciencesDocument9 pagesThe Influence of Advertising On Consumer Brand Preference: Journal of Social SciencesRahulKrishnanNo ratings yet

- A-Consulting Case - Group 10 FinalDocument12 pagesA-Consulting Case - Group 10 FinalMayur Dadia100% (1)

- Business Proposal - RV1Document13 pagesBusiness Proposal - RV1Poppy irawan arif100% (1)

- The Relationship Marketing Process A Conceptualization and Application PDFDocument14 pagesThe Relationship Marketing Process A Conceptualization and Application PDFkoreanguyNo ratings yet

- Entrepreneurship 101 NotesDocument5 pagesEntrepreneurship 101 NotesMaricel Sanchez - CostillasNo ratings yet

- Medical Coding SpecialistDocument3 pagesMedical Coding Specialistapi-789518410% (1)

- AjoobaDocument12 pagesAjoobaammara tanveerNo ratings yet

- MGT301 Online Quiz MCQs With Solution MEGA File 200 Pages PDFDocument180 pagesMGT301 Online Quiz MCQs With Solution MEGA File 200 Pages PDFhk dhamanNo ratings yet

- Ch-1 Consumer Behavior: Its Origins and Strategic ApplicationsDocument19 pagesCh-1 Consumer Behavior: Its Origins and Strategic ApplicationsNasir HossenNo ratings yet

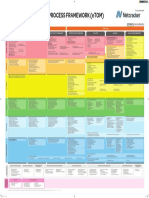

- Business Process Framework (Etom) : Frameworx Release 16.5Document1 pageBusiness Process Framework (Etom) : Frameworx Release 16.5mattiaNo ratings yet

- International Journal of Bank Marketing: Article InformationDocument20 pagesInternational Journal of Bank Marketing: Article InformationpadmavathiNo ratings yet

- Role of Merchandiser in Garment IndustryDocument12 pagesRole of Merchandiser in Garment IndustryBhuva_janaNo ratings yet

- 1.0 Company Background 1.1 Pegasus Reef Beach Hotel: Figure 01: Org. Structure Source: Org. Internal SourceDocument9 pages1.0 Company Background 1.1 Pegasus Reef Beach Hotel: Figure 01: Org. Structure Source: Org. Internal SourceHaneen JosephNo ratings yet

- VP Director Human Resources in Atlanta GA Resume Valeria RobertsDocument3 pagesVP Director Human Resources in Atlanta GA Resume Valeria RobertsValeriaRobertsNo ratings yet

- CS3 Local Final Paper - September 2020Document24 pagesCS3 Local Final Paper - September 2020Kavindu Mihiranga100% (1)

- Divya ProjectDocument82 pagesDivya ProjectAnonymous kK5O7WFZ5No ratings yet

- Harsh PDFDocument10 pagesHarsh PDFsanketmehtaNo ratings yet

- Model Question Paper MBADocument7 pagesModel Question Paper MBAraopandit2001No ratings yet

- Final Assignment Spring 2021Document9 pagesFinal Assignment Spring 2021Samiha SadiaNo ratings yet

- National Account Manager in Philadelphia PA Resume Bruce CliftonDocument2 pagesNational Account Manager in Philadelphia PA Resume Bruce CliftonBruceCliftonNo ratings yet