Professional Documents

Culture Documents

Accounting for Receivables Analysis

Uploaded by

So Ka LaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting for Receivables Analysis

Uploaded by

So Ka LaiCopyright:

Available Formats

Chapter 9 Chapter 9

Accounting For Receivables

Financial Accounting, Sixth Edition

Chapter 9-1

Study Objectives Study Objectives

1. 2. 3. 4. 5. 6. 7. 8. 9.

Chapter 9-2

Identify the different types of receivables. Explain how companies recognize accounts receivable. Distinguish between the methods and bases companies use to value accounts receivable. Describe the entries to record the disposition of accounts receivable. Compute the maturity date of and interest on notes receivable. Explain how companies recognize notes receivable. Describe how companies value notes receivable. Describe the entries to record the disposition of notes receivable. Explain the statement presentation and analysis of receivables. (ignore)

Accounting for Receivables Accounting for Receivables

Statement Presentation and Analysis

Presentation Analysis

Types of Receivables

Accounts receivable Notes receivable Other receivables

Accounts Receivable

Recognizing accounts receivable Valuing accounts receivable Disposing of accounts receivable

Notes Receivable

Determining maturity date Computing interest Recognizing notes receivable Valuing notes receivable Disposing of notes receivable

Chapter 9-3

Types of Receivables Types of Receivables

Amounts due from individuals and other companies that are expected to be collected in cash. Amounts owed by customers that result from the sale of goods and services. Accounts Accounts Receivable Receivable

Chapter 9-4

Claims for which formal instruments of credit are issued as proof of debt. Notes Notes Receivable Receivable

Nontrade (interest, loans to officers, advances to employees, and income taxes refundable).

Other Other Receivables Receivables

SO 1 Identify the different types of receivables.

Accounts Receivable Accounts Receivable

Three accounting issues: 1. Recognizing accounts receivable. 2. Valuing accounts receivable. 3. Disposing of accounts receivable. Recognizing Accounts Receivable

For simplicity, inventory and cost of goods sold have been omitted in the following illustration.

Chapter 9-5

SO 1 Identify the different types of receivables.

Recognizing Accounts Receivable Recognizing Accounts Receivable

Illustration: Assume that Jordache Co. on July 1, 2010, sells merchandise on account to Polo Company for $1,000 terms 2/10, n/30. Prepare the journal entry to record this transaction on the books of Jordache Co. Jul. 1 Accounts receivable Sales 1,000 1,000

Chapter 9-6

SO 2 Explain how companies recognize accounts receivable.

Recognizing Accounts Receivable Recognizing Accounts Receivable

Illustration: On July 5, Polo returns merchandise worth $100 to Jordache Co. Jul. 5 Sales returns and allowances Accounts receivable 100 100

Illustration: On July 11, Jordache receives payment from Polo Company for the balance due. Jul. 11 Cash Sales discounts ($900 x .02) Accounts receivable

Chapter 9-7

882 18 900

SO 2 Explain how companies recognize accounts receivable.

Accounts Receivable Accounts Receivable

Valuing Accounts Receivables

Classification Valuation (net realizable value) Uncollectible Accounts Receivable Sales on account raise the possibility of accounts not being collected

Chapter 9-8

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Methods of Accounting for Uncollectible Accounts Direct Write-Off Theoretically undesirable: no matching. receivable not stated at net realizable value. not acceptable for financial reporting.

Allowance Method

Losses are estimated: better matching. receivable stated at net realizable value. required by GAAP.

Chapter 9-9

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

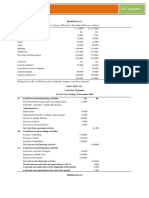

Presentation of Accounts Receivable Presentation of Accounts Receivable

Assets Current Assets: Cash Accounts receivable Less: Allowance for doubtful accounts Inventory Prepaids Total current assets $ 346 500 25 475 812 40 1,673

Chapter 9-10

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Allowance Method for Uncollectible Accounts

1. Companies estimate uncollectible accounts receivable. 2. To record estimated uncollectibles, companies debit Bad Debts Expense and credit Allowance for Doubtful Accounts (a contra-asset account). 3. When companies write off specific uncollectible accounts, they debit Allowance for Doubtful Accounts and credit Accounts Receivable.

Chapter 9-11

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Recording Estimated Uncollectibles: Assume that Hampson Furniture has credit sales of $1,200,000 in 2010. Of this amount, $200,000 remains uncollected at December 31. The credit manager estimates that $12,000 of these sales will be uncollectible. The adjusting entry to record the estimated uncollectibles is: Dec. 31 Bad debt expense 12,000 12,000

Allowance for doubtful accounts

Chapter 9-12

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Illustration 9-2 Presentation of allowance for doubtful accounts

Chapter 9-13

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Recording the Write-Off of an Uncollectible Account: Assume that the financial vice-president of Hampson Furniture authorizes a write-off of the $500 balance owed by R.A.Ware on March 1, 2011.The entry to record the write-off is: Mar. 1 Allowance for doubtful accounts Accounts receivable 500 500

Illustration 9-3

Chapter 9-14

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Recovery of an Uncollectible Account: Assume that on July 1, R. A. Ware pays the $500 amount that Hampson had written off on March 1.These are the entries: Jul. 1 Accounts receivable Allowance for doubtful accounts Jul. 1 Cash Accounts receivable 500 500 500 500

Chapter 9-15

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage-of-Sales

Illustration: Assume that Gonzalez Company elects to use the percentage-of-sales basis. It concludes that 1% of net credit sales will become uncollectible. If net credit sales for 2010 are $800,000, the adjusting entry is: Dec. 31 Bad debts expense Allowance for doubtful accounts * $800,000 x 1% 8,000 * 8,000

Chapter 9-16

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage-of-Sales

Emphasizes the matching of expenses with revenues. When the company makes the adjusting entry, it disregards the existing balance in Allowance for Doubtful Accounts.

Illustration 9-6

Chapter 9-17

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage-of-Receivables

Illustration 9-7 Aging schedule

Chapter 9-18

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage-of-Receivables

Illustration: If the trial balance shows Allowance for Doubtful Accounts with a credit balance of $528, the company will make the following adjusting entry. Dec. 31 Bad debts expense Allowance for doubtful accounts * $2,228 - 528 1,700 * 1,700

Chapter 9-19

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage-of-Receivables

Illustration 9-8

Occasionally the allowance account will have a debit balance prior to adjustment.

Chapter 9-20

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Bases Used for Allowance Method

Illustration 9-5

Chapter 9-21

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Example Data Credit sales Estimated % of credit sales uncollectible Accounts receivable balance Estimated % of A/R uncollectible Allowance for Doubtful Accounts: Case 1 Case 2

Chapter 9-22

$500,000 1.25% $72,500 8%

$150 (credit balance) $150 (debit balance)

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage of Sales Credit sales Estimated percentage uncollectible Estimated uncollectible $500,000 x $ 1.25% 6,250

=================================================== What should the ending balance be for the allowance account? -- Case 1 and Case 2

Chapter 9-23

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage of Sales Case 1 Actual balance (credit) Estimated uncollectible Ending balance Journal entry: Bad debt expense Allowance for doubtful accounts

Chapter 9-24

Case 2 150 (6,250) (6,100)

(150) (6,250) (6,400)

6,250 6,250

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage of Receivables Accounts receivable Estimated percentage uncollectible Desired balance for allowance $ 72,500 x $ 8% 5,800

=================================================== What should the ending balance be for the allowance account? -- Case 1 and Case 2

Chapter 9-25

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage of Receivables Case 1 Actual balance (credit) Desired balance Adjustment Journal entry Case 1: Bad debt expense Allowance for doubtful accounts

Chapter 9-26

Case 2 150 (5,800) (5,950)

(150) (5,800) (5,650)

5,650 5,650

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Percentage of Receivables Case 1 Actual balance (credit) Desired balance Adjustment Journal entry Case 2: Bad debt expense Allowance for doubtful accounts

Chapter 9-27

Case 2 150 (5,800) (5,950)

(150) (5,800) (5,650)

5,950 5,950

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

When estimating losses using Percentage of Receivables, companies often prepare an aging schedule which classifies customer balances by the length of time they have been unpaid.

Illustration 9-7

Chapter 9-28

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Valuing Accounts Receivable Valuing Accounts Receivable

Summary

Percentage of Sales approach:

Focus on Bad debt expense estimate, any balance in the allowance account is ignored. Method achieves a matching of cost and revenues.

Percentage of Receivables approach:

Accurate valuation of receivables on the balance sheet. Method may also be applied using an aging schedule.

Chapter 9-29

SO 3 Distinguish between the methods and bases companies use to value accounts receivable.

Disposing of Accounts Receivable Disposing of Accounts Receivable

Companies sell receivables for two major reasons.

1. Receivables may be the only reasonable source of cash. 2. Billing and collection are often time-consuming and costly.

Chapter 9-30

SO 4 Describe the entries to record the disposition of accounts receivable.

Disposing of Accounts Receivable Disposing of Accounts Receivable

Sale of Receivables

A factor buys receivables from businesses and then collects the payments directly from the customers.

Chapter 9-31

SO 4 Describe the entries to record the disposition of accounts receivable.

Disposing of Accounts Receivable Disposing of Accounts Receivable

Illustration: Assume that Hendredon Furniture factors $600,000 of receivables to Federal Factors. Federal Factors assesses a service charge of 2% of the amount of receivables sold. The journal entry to record the sale by Hendredon Furniture is as follows. Cash Service charge expense Accounts receivable * ($600,000 x 2% = $12,000)

Chapter 9-32

588,000 12,000 * 600,000

SO 4 Describe the entries to record the disposition of accounts receivable.

Disposing of Accounts Receivable Disposing of Accounts Receivable

Credit Card Sales

Retailer considers credit card sales the same as cash sales. Retailer must pay card issuer a fee of 2 to 4% for processing the transactions. Retailer records in similar manner as checks deposited from cash sale.

Chapter 9-33

SO 4 Describe the entries to record the disposition of accounts receivable.

Disposing of Accounts Receivable Disposing of Accounts Receivable

Illustration: Anita Ferreri purchases $1,000 of compact discs for her restaurant from Karen Kerr Music Co., using her Visa First Bank Card. First Bank charges a service fee of 3%. The entry to record this transaction by Karen Kerr Music is as follows. Cash Service charge expense Sales 970 30 1,000

Chapter 9-34

SO 4 Describe the entries to record the disposition of accounts receivable.

Reading and Assignment Reading and Assignment

Chapter 9 Accounting for Receivables

Read Chapter 9 (pp. 384-398 ) Attempt the following exercises in Chapter 9: Self-study questions 1 to 5 (pp. 408-409) Brief exercises BE9-1 to BE9-7 (pp. 410-411) Exercises E9-1 to E9-8 (pp. 411-413)

Chapter 9-35

Notes Receivable Notes Receivable

Companies may grant credit in exchange for a promissory note. A promissory note is a written promise to pay a specified amount of money on demand or at a definite time. Promissory notes may be used:

1. when individuals and companies lend or borrow money, 2. when amount of transaction and credit period exceed normal limits, or 3. in settlement of accounts receivable.

Chapter 9-36

SO 5 Compute the maturity date of and interest on notes receivable.

Notes Receivable Notes Receivable

To the Payee, the promissory note is a note receivable. To the Maker, the promissory note is a note payable.

Illustration 9-10

Chapter 9-37

SO 5 Compute the maturity date of and interest on notes receivable.

Notes Receivable Notes Receivable

Determining the Maturity Date

Note expressed in terms of Months Days

Computing Interest

Illustration 9-13

Chapter 9-38

SO 5 Compute the maturity date of and interest on notes receivable.

Recognizing Notes Receivable Recognizing Notes Receivable

Illustration: Assuming that Calhoun Company wrote $1,000, two-month, 12% promissory note to settle an open account, Wilma Company makes the following entry for the receipt of the note. Notes receivable Accounts receivable 1,000 1,000

Chapter 9-39

SO 6 Explain how companies recognize notes receivable.

Recognizing Notes Receivable Recognizing Notes Receivable

E9-9 Orosco Supply Co. has the following transactions related to notes receivable during the last 2 months of 2008. Nov. 1 Loaned $15,000 cash to Sally Givens on a 1-year, 10% note. Dec. 11 Sold goods to John Countryman, Inc., receiving a $6,750, 90-day, 8% note. Dec. 16 Received a $4,000, 6-month, 9% note in exchange for Bob Rebers outstanding accounts receivable. Dec. 31 Accrued interest revenue on all notes receivable. Instructions (a) Journalize the transactions for Orosco Supply Co.

Chapter 9-40

SO 6 Explain how companies recognize notes receivable.

Recognizing Notes Receivable Recognizing Notes Receivable

E9-9 Nov. 1 Loaned $15,000 cash to Sally Givens on a 1year, 10% note. Dec. 11 Sold goods to John Countryman, Inc., receiving a $6,750, 90-day, 8% note. Dec. 16 Received a $4,000, 6-month, 9% note in exchange for Bob Rebers outstanding accounts receivable.

Nov. 1

Notes receivable

15,000 15,000 6,750 6,750 4,000 4,000

Cash Dec. 11 Notes receivable Sales Dec. 16 Notes receivable Accounts receivable

Chapter 9-41

SO 6 Explain how companies recognize notes receivable.

Recognizing Notes Receivable Recognizing Notes Receivable

E9-9 Dec. 31 Accrued interest revenue on all notes receivable.

Givens note: Countryman note: Reber note: Amount $ 15,000 6,750 4,000 Rate x 10% x x 8% x x 9% x Time 2 / 12 = 20 / 360 = 15 / 360 = $ 250 30 15 $ 295

Total accrued interest

Dec. 31 Interest receivable Interest revenue

295 295

Chapter 9-42

SO 6 Explain how companies recognize notes receivable.

Notes Receivable Notes Receivable

Valuing Notes Receivable

Like accounts receivable, companies report shortterm notes receivable at their cash (net) realizable value. Estimation of cash realizable value and bad debts expense are done similarly to accounts receivable. Allowance for Doubtful Accounts is used.

Chapter 9-43

SO 7 Describe how companies value notes receivable.

Notes Receivable Notes Receivable

Disposing of Notes Receivable

1. Notes may be held to their maturity date. 2. Maker may default and payee must make an adjustment to the account. 3. Holder speeds up conversion to cash by selling the note receivable.

Chapter 9-44

SO 8 Describe the entries to record the disposition of notes receivable.

Notes Receivable Notes Receivable

Disposing of Notes Receivable

Honor of Notes Receivable A note is honored when its maker pays it in full at its maturity date. Dishonor of Notes Receivable A dishonored note is not paid in full at maturity. Dishonored note receivable is no longer negotiable.

Chapter 9-45

SO 8 Describe the entries to record the disposition of notes receivable.

Notes Receivable Notes Receivable

Honor of Notes Receivables

Illustration: Assume that Betty Co. lends Wayne Higley Inc. $10,000 on June 1, accepting a five-month, 9% interestbearing note. Assuming that Betty Co. presents the note to Wayne Higley Inc. on the maturity date, Betty Co.s entry to record the collection is: Nov. 1 Cash Notes receivable Interest revenue * 10,000 x 9% x 5/12 = 375

Chapter 9-46

10,375 10,000 375 *

SO 8 Describe the entries to record the disposition of notes receivable.

Notes Receivable Notes Receivable

Honor of Notes Receivables

Illustration: If Betty Co. prepares financial statements as of September 30, it must accrue interest. Betty Co. would make an adjusting entry to record 4 months interest. Sept. 30

Interest receivable Interest revenue

* 10,000 x 9% x 4/12 = 300

300

300 *

Chapter 9-47

SO 8 Describe the entries to record the disposition of notes receivable.

Notes Receivable Notes Receivable

Honor of Notes Receivables

Illustration: The entry by Betty Co. to record the honoring of the Wayne Higley Inc. note on November 1 is: Nov. 1 Cash Notes receivable Interest receivable Interest revenue * 10,000 x 9% x 1/12 = 75

Chapter 9-48

10,375 10,000 300 75 *

SO 8 Describe the entries to record the disposition of notes receivable.

Notes Receivable Notes Receivable

Dishonor of Notes Receivables

Illustration: Assume that Wayne Higley Inc. on November 1 indicates that it cannot pay at the present time. If Betty Co. does expect eventual collection, it would make the following entry at the time the note is dishonored (assuming no previous accrual of interest). Nov. 1 Accounts receivable Notes receivable Interest revenue 10,375 10,000 375

Chapter 9-49

SO 8 Describe the entries to record the disposition of notes receivable.

Notes Receivable Notes Receivable

E9-12 On May 2, Kleinsorge Company lends $7,600 to Everhart, Inc., issuing a 6-month, 9% note. At the maturity date, November 2, Everhart indicates that it cannot pay. Instructions (a) Prepare the entry to record the issuance of the note. (b) Prepare the entry to record the dishonor of the note, assuming that Kleinsorge Company expects collection will occur. (c) Prepare the entry to record the dishonor of the note, assuming that Kleinsorge Company does not expect collection in the future.

Chapter 9-50

SO 8 Describe the entries to record the disposition of notes receivable.

Notes Receivable Notes Receivable

E9-13 (a) Prepare the entry to record the issuance of the note. (b) Prepare the entry to record the dishonor of the note, assuming that Kleinsorge Company expects collection will occur.

(a) (b)

Notes receivable Cash

7,600 7,600

Interest = $7,600 x 9% x 6/12 = $342

Accounts receivable Notes receivable Interest revenue

Chapter 9-51

7,942 7,600 342

SO 8 Describe the entries to record the disposition of notes receivable.

Notes Receivable Notes Receivable

E9-13 (c) Prepare the entry to record the dishonor of the note, assuming that Kleinsorge Company does not expect collection in the future.

(c)

Allowance for doubtful accounts Notes receivable

7,600 7,600

When there is no hope of collection, the note holder would write off the face value of the note. No interest revenue would be recorded because collection will not occur.

Chapter 9-52

SO 8 Describe the entries to record the disposition of notes receivable.

Statement Presentation and Analysis Statement Presentation and Analysis

Presentation

Identify in the balance sheet or in the notes, each major type of receivable. B/S Report short-term receivables as current assets. Report both gross amount of receivables and allowance for doubtful account. Report bad debts expense and service charge expense as selling expenses. Report interest revenue under Other revenues and gains.

SO 9 Explain the statement presentation and analysis of receivables.

I/S

Chapter 9-53

Reading and Assignment Reading and Assignment

Chapter 9 Accounting for Receivables

Read Chapter 9 (pp. 384 - 403, 406 - 407 ) Attempt the following exercises in Chapter 9: Self-study questions 1 to 10 (pp. 408-409) Brief exercises BE9-1 to BE9-10 (pp. 410-411) Exercises E9-1 to E9-11 (pp. 411-413) Problems P9-6A* (p. 416)

Chapter 9-54

Chapter 9 Accounting for Receivables Chapter 9 Accounting for Receivables

10-minute Quiz 1. Receivables are classified as accounts, notes, or other. True False 2. Financing charges added to a customers credit card balance with a retailer are recorded as a debit to Accounts Receivable and a credit to Interest Revenue. True False 3. The allowance method for uncollectible accounts violates the matching principle. True False 4. An aging schedule shows a required balance in Allowance for Doubtful Accounts of $8,600. If there is a credit balance in the allowance account of $2,000 prior to adjustment, the adjustment amount is Chapter $6,600. True False 9-55

Chapter 9 Accounting for Receivables Chapter 9 Accounting for Receivables

10-minute Quiz 5. Sale of receivables to a factor may result in a debit to Service Charge Expense at the time of sale. True False 6. The maturity date of a 60-day note dated December 1 is January 31. True False 7. The interest due at maturity on a two-month, 8%, $800 note is computed by: $800 x .08 x 2/12. True False 8. The maturity value of a $5,000 note is $5,300. If $180 of the interest has been accrued prior to maturity, the entry to record the honoring of the note at maturity should include a credit to Interest Chapter Revenue for $120. True False 9-56

Chapter 9 Accounting for Receivables Chapter 9 Accounting for Receivables

10-minute Quiz 9. The principal amount of a 9%, 3-year, note receivable is $300,000 and is dated January 1, 2008. The interest revenue to be recognized on December 31, 2008, is $9,000. True False 10. Short-term receivables are reported in the balance sheet immediately below cash. True False

Chapter 9-57

Chapter 9 Accounting for Receivables Chapter 9 Accounting for Receivables

Multiple Choice 1. The sale of merchandise by a company on its own credit card may result in a a. debit to Service Charge Expense. b. debit to Interest Expense. c. credit to Interest Revenue. d. credit to Cash. 2. A company has net credit sales of $600,000 for the year and it estimates that uncollectible accounts will be 2% of sales. If Allowance for Doubtful Accounts has a credit balance of $1,000 prior to adjustment, its balance after adjustment will be a credit of a. $12,000. b. $13,000. c. $11,000. Chapter 9-58 d. some other amount.

Chapter 9 Accounting for Receivables Chapter 9 Accounting for Receivables

Multiple Choice 3. Under the allowance method, the entry to write-off an uncollectible account results in a debit to a. Bad Debts Expense and a credit to Accounts Receivable. b. Bad Debts Expense and a credit to Allowance for Doubtful Accounts. c. Allowance for Doubtful Accounts and a credit to Bad Debts Expense. d. Allowance for Doubtful Accounts and a credit to Accounts Receivable.

Chapter 9-59

Chapter 9 Accounting for Receivables Chapter 9 Accounting for Receivables

Multiple Choice

4. A company sells $400,000 of accounts receivable to a factor for cash less a 2% service charge. The entry to record the sale should not include a a. debit to Interest Expense for $8,000. b. debit to Cash for $392,000. c. debit to Service Charge Expense for $8,000. d. credit to Accounts Receivable for $400,000. 5. When an interest-bearing note is dishonored at maturity and ultimate collection is expected, the entry for the dishonoring, assuming no previous accrual of interest should include a. a debit to Allowance for Doubtful Accounts. b. only a credit to Notes Receivable. c. a credit to Notes Receivable and Interest Revenue. d. a credit to Notes Receivable and Interest Receivable. Chapter

9-60

You might also like

- CH 09Document48 pagesCH 09indahmuliasariNo ratings yet

- ch08 PPTDocument52 pagesch08 PPTDatboy BookNo ratings yet

- Accounting For Receivables: Accounting Principles, Ninth EditionDocument43 pagesAccounting For Receivables: Accounting Principles, Ninth EditionNuttakan MeesukNo ratings yet

- Accounting Principle Kieso 8e - Ch09Document47 pagesAccounting Principle Kieso 8e - Ch09Sania M. JayantiNo ratings yet

- Weygandt Accounting Principles 10e PowerPoint Ch09Document66 pagesWeygandt Accounting Principles 10e PowerPoint Ch09billy93No ratings yet

- CH 08Document54 pagesCH 08Chang Chan ChongNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument62 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAhmed El Khateeb100% (1)

- Chapter Five - Accounting For - ReceivablesDocument60 pagesChapter Five - Accounting For - ReceivablesOrnet StudioNo ratings yet

- ch08 Accounting For ReceivablesDocument75 pagesch08 Accounting For ReceivablesNisrina Ardyanti100% (1)

- By: Tewodros EndaleDocument68 pagesBy: Tewodros Endalesamuel asratNo ratings yet

- Lecture 08 - ReceivablesDocument54 pagesLecture 08 - Receivablescesene3863No ratings yet

- Chapter 9Document45 pagesChapter 9mziabdNo ratings yet

- Reporting and Analyzing ReceivablesDocument72 pagesReporting and Analyzing ReceivablesRishabh JainNo ratings yet

- CH 08Document75 pagesCH 08Surabaya Lindungi 2021No ratings yet

- Ch01 Accounting IIDocument68 pagesCh01 Accounting IIbesedegefub9131No ratings yet

- CH 08Document68 pagesCH 08nastassya ruhukailNo ratings yet

- Accounting For Receivables: Learning ObjectivesDocument44 pagesAccounting For Receivables: Learning ObjectivesIsyraf Hatim Mohd TamizamNo ratings yet

- Accounting for Receivables PreviewDocument29 pagesAccounting for Receivables PreviewwtfNo ratings yet

- CH 09Document27 pagesCH 09Imtiaz PiasNo ratings yet

- Slide ACC101 Chapter 8 Accounting For ReceivablesDocument51 pagesSlide ACC101 Chapter 8 Accounting For ReceivablesSriyanti IsimaNo ratings yet

- Chapter 4 Intermediate AccountingDocument5 pagesChapter 4 Intermediate Accountingmohamad ali osmanNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument83 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegesma pgriNo ratings yet

- CH 09Document30 pagesCH 09XS3 GamingNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument66 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegeقتيبة الجدايةNo ratings yet

- Intermediate Accounting IFRS Edition Chapter 07 Cash and ReceivablesDocument109 pagesIntermediate Accounting IFRS Edition Chapter 07 Cash and ReceivablesAnnisayuniarz100% (4)

- IFA Chapter 3Document97 pagesIFA Chapter 3kqk07829No ratings yet

- 02 Peng Ak 2 - v0 0 - PiutangDocument13 pages02 Peng Ak 2 - v0 0 - PiutangJihan Ulfah TsariNo ratings yet

- Accounting for Receivables Accounts Receivable PptDocument18 pagesAccounting for Receivables Accounts Receivable Pptlocomotingkenya.co.keNo ratings yet

- Pengantar Akuntansi Ii: Piutang Dagang (Account Receivable)Document52 pagesPengantar Akuntansi Ii: Piutang Dagang (Account Receivable)Vivi IndiraNo ratings yet

- ACCT 201: Reporting and Analyzing ReceivablesDocument23 pagesACCT 201: Reporting and Analyzing ReceivablesDuygu YılmazNo ratings yet

- Accounting For Receivables: Learning ObjectivesDocument68 pagesAccounting For Receivables: Learning ObjectivesDeeb. DeebNo ratings yet

- Financial AccountingDocument66 pagesFinancial AccountingFaisal SaleemNo ratings yet

- ACC 255 08 OutlineDocument9 pagesACC 255 08 Outlineadi zilbrshtiinNo ratings yet

- Chapter 3-Cash&ReceivablesDocument22 pagesChapter 3-Cash&ReceivablesDr. Mohammad Noor Alam100% (1)

- Chapter 8Document3 pagesChapter 8ßòrñã Îrãñî MôtlãghNo ratings yet

- Chapter 7: Receivables: Principles of AccountingDocument50 pagesChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- 2100 Solutions - CH8Document58 pages2100 Solutions - CH8ds hhNo ratings yet

- Welcomeback: Workshop SixDocument55 pagesWelcomeback: Workshop SixLeah StonesNo ratings yet

- CH 07Document99 pagesCH 07homeboimartinNo ratings yet

- Accounting Principles 12th Edition Weygandt Solutions ManualDocument16 pagesAccounting Principles 12th Edition Weygandt Solutions Manualmalabarhumane088100% (27)

- Accounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFDocument37 pagesAccounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (10)

- ch05 ReceivablesDocument51 pagesch05 ReceivableszedingelNo ratings yet

- Financial Accounting, 4eDocument47 pagesFinancial Accounting, 4eEka Aliyah FauziNo ratings yet

- StudyGuideChap08 PDFDocument27 pagesStudyGuideChap08 PDFNarjes DehkordiNo ratings yet

- Ch11 - Current Liabilities and Payroll AccountingDocument52 pagesCh11 - Current Liabilities and Payroll AccountingPrincess Trisha Joy Uy100% (1)

- Chapter 9 - Accounting For 9 ReceivablesDocument4 pagesChapter 9 - Accounting For 9 ReceivablesMộc TràNo ratings yet

- Acc CH 4Document15 pagesAcc CH 4Bicaaqaa M. AbdiisaaNo ratings yet

- Accounting Lecture V HandoutsDocument34 pagesAccounting Lecture V HandoutsКамилла МолдалиеваNo ratings yet

- Accounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonDocument6 pagesAccounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonbikilahussenNo ratings yet

- Chapter 9 SolutionsDocument75 pagesChapter 9 SolutionsLy VõNo ratings yet

- Adjustments to Accounts ExplainedDocument12 pagesAdjustments to Accounts ExplainedSinoNo ratings yet

- Chapter 8Document2 pagesChapter 8Bellla AgustinaNo ratings yet

- REVIEW AND PRACTICE Chapter 8 Accounting For ReceivablesDocument3 pagesREVIEW AND PRACTICE Chapter 8 Accounting For Receivablesukandi rukmanaNo ratings yet

- Acc CH 4Document16 pagesAcc CH 4Tajudin Abba RagooNo ratings yet

- Accounting For Receivables: Learning ObjectivesDocument66 pagesAccounting For Receivables: Learning ObjectivesSamar BarakehNo ratings yet

- Notes 08Document11 pagesNotes 08FantayNo ratings yet

- CH 07Document109 pagesCH 07Bayoe AjipNo ratings yet

- Introduction To Accounting 2 Current LiabilitiesDocument13 pagesIntroduction To Accounting 2 Current LiabilitiesRhea Mae AmitNo ratings yet

- SBA Loan Product MatrixDocument1 pageSBA Loan Product Matrixed_nycNo ratings yet

- DAYAG Advac SolutionChapter6Document18 pagesDAYAG Advac SolutionChapter6Lawrence Lamban100% (5)

- Fabm 2-5Document24 pagesFabm 2-5Andrei Bana100% (2)

- Basic Accounting 1Document33 pagesBasic Accounting 1Tejas BapnaNo ratings yet

- Dawood Islamic BankDocument57 pagesDawood Islamic BankMimi ZamanNo ratings yet

- Financial Statements of Tata Steel - 2018Document69 pagesFinancial Statements of Tata Steel - 2018Samaksh VermaNo ratings yet

- 2nd Quarter Financial Report 2019Document94 pages2nd Quarter Financial Report 2019Vika OktarinaNo ratings yet

- Revised Standard Chart of Accounts For Cooperatives: Account Code Account TitleDocument36 pagesRevised Standard Chart of Accounts For Cooperatives: Account Code Account TitleAireyNo ratings yet

- Peran Audit Atas Kas Dan Setara Kas Pada PT. Murni Gas Raya SamarindaDocument5 pagesPeran Audit Atas Kas Dan Setara Kas Pada PT. Murni Gas Raya SamarindaAn WismoNo ratings yet

- ACCA Dec 2011 F7 Mock PaperDocument10 pagesACCA Dec 2011 F7 Mock PaperCharles AdontengNo ratings yet

- FINAL FABM2 Handouts #3.pdf  Version 1Document12 pagesFINAL FABM2 Handouts #3.pdf  Version 1Kristy Veyna BautistaNo ratings yet

- Introductory Financial Accounting For Business 1St Edition Edmonds Test Bank Full Chapter PDFDocument67 pagesIntroductory Financial Accounting For Business 1St Edition Edmonds Test Bank Full Chapter PDFmrissaancun100% (6)

- Starbucks Corporation (SBUX) Balance SheetDocument2 pagesStarbucks Corporation (SBUX) Balance Sheetstevan joeNo ratings yet

- Auditing Problem For Shareholder's EquityDocument14 pagesAuditing Problem For Shareholder's Equityblack hudieNo ratings yet

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav179% (29)

- Management Accounting Final ExamDocument4 pagesManagement Accounting Final Examacctg2012No ratings yet

- Q8Document4 pagesQ8Sundaramani Saran100% (1)

- Ventura, Mary Mickaella R. - p.49 - Statement of Financial PositionDocument5 pagesVentura, Mary Mickaella R. - p.49 - Statement of Financial PositionMary VenturaNo ratings yet

- Quiz - Chapter 1 - Current Liabilities - 2021Document3 pagesQuiz - Chapter 1 - Current Liabilities - 2021Jennifer RelosoNo ratings yet

- ACC501 Quiz 1Document10 pagesACC501 Quiz 1Sayyed Muhammad Aftab ZaidiNo ratings yet

- AC5021 2015-16 Resit Exam Questions ASPDocument8 pagesAC5021 2015-16 Resit Exam Questions ASPyinlengNo ratings yet

- Finance Accounting Financial Statement Analysis ViewDocument31 pagesFinance Accounting Financial Statement Analysis ViewEdgar Lapa100% (4)

- Chap005 (Modified)Document63 pagesChap005 (Modified)Kate LiNo ratings yet

- FinanceDocument22 pagesFinanceromit.jaink1No ratings yet

- They Use That Information To Make Important Decisions.: Chapter 1: Accouting and The Business Environment Page 1 of 91Document91 pagesThey Use That Information To Make Important Decisions.: Chapter 1: Accouting and The Business Environment Page 1 of 91Joshe Dela Cruz100% (1)

- Horizontal Analysis: Income Statement Analysis InterpretationsDocument2 pagesHorizontal Analysis: Income Statement Analysis InterpretationsShanzay JuttNo ratings yet

- ACCT 117 Chapter 1 Tutorial ClassDocument47 pagesACCT 117 Chapter 1 Tutorial Classhazem 00No ratings yet

- FABM 2 Module 1 Review of Basic Accounting PDFDocument8 pagesFABM 2 Module 1 Review of Basic Accounting PDFJOHN PAUL LAGAO100% (3)

- Dr. Mohammed Anam Akhtar Lecturer Accounting & FinanceDocument55 pagesDr. Mohammed Anam Akhtar Lecturer Accounting & FinanceAfra ShaikhNo ratings yet

- Foundations in Accountancy FFA/ACCA FDocument45 pagesFoundations in Accountancy FFA/ACCA FTuyết Anh ĐồngNo ratings yet