Professional Documents

Culture Documents

COL Finance Sample Exam

Uploaded by

medicinenfookiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COL Finance Sample Exam

Uploaded by

medicinenfookiCopyright:

Available Formats

Finance Sample Exam Questions

The Finance Sample Exam will assist in preparing participants in the following events: 1. Accounting 2. Corporate Finance

These test questions were developed by the MBA Research Center. Items have been randomly selected from the MBA Research Center's Test-Item Bank and represent a variety of instructional areas. Performance indicators for these test questions are at the prerequisite, career-sustaining, and specialist levels. A descriptive test key, including question sources and answer rationale, has been provided. Copyright 2012 by MBA Research and Curriculum Center, Columbus, Ohio Each individual test item contained herein is the exclusive property of MBA Research Center. Items are licensed only for use as configured within this exam, in its entirety. Use of individual items for any purpose other than as specifically authorized in writing by MBA Research Center is prohibited.

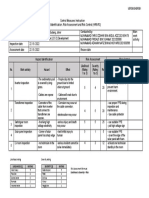

FINANCE EXAM SAMPLE QUESTIONS 1. Which of the following is often cited as the most significant stumbling block in achieving compliance goals within large financial organizations: A. Poor data quality C. Inadequate funding B. Lack of training D. Improper accounting system

2. Clayton recently invested $50,000 in an oil company. The company has agreed to use Clayton's investment strictly for exploration purposes. Rather than writing off $50,000 from its corporate taxes, the company passed the deduction on to Clayton. Clayton can now write off the entire amount of his investment against his taxes. Clayton invested his money in A. offshore companies. C. government bonds. B. flow-through shares. D. derivatives. 3. To accommodate recent regulation changes, a brokerage firm must implement new financial reporting activities. What positive action can the firm take to help its employees adapt to the change? A. Hire additional employees who are knowledgeable about the regulations B. Survey the employees to get their opinions about the regulatory changes C. Revise the firm's vision statement to include the importance of following regulations D. Educate and train the employees about the regulatory changes 4. Which of the following statements regarding financial institutions is true: A. Finance and insurance institutions typically hinder the flow or movement of money through the economy. B. If the flow of money into a financial institution slows down, there is less money available for the institution to lend or invest. C. Financial institutions concentrate the risk that individual savers and investors face among a small number of borrowers. D. Because each financial institution functions independently, the failure of one financial institution has little effect on the others. 5. Analyze the information in the mutual fund table about the AnMl mutual fund. Total Returns Name AnMl NAV 21.52 Net Chg -0.12 YTD %ret +17.7 4Wk %ret +3.5 1 yr NA 3yr-R +22.3A 5yr-R +19.4A 0.00 1.40 Max Init Chrg Exp Ratio

Based on the information provided, what type of mutual fund is the AnMl fund? A. Back-load C. No-load B. Front-load D. Expiring back-load 6. Which of the following can be used to identify the unethical manipulation of records in a financial-information management system: A. Long-term liabilities C. Audit trails B. What-if planning D. Direct checks 7. Which of the following statements regarding accounting and finance is correct: A. Accounting focuses on the past, while finance focuses on the future. B. Accounting is much broader than finance, which focuses on investments. C. Financial managers typically report to the vice president of accounting. D. The finance department focuses on assets, while accountants track liabilities.

FINANCE EXAM SAMPLE QUESTIONS

8. Ingrid must analyze various aspects of the completed project by comparing the results with the objectives. What process is Ingrid likely to use to obtain all of the information for analysis? A. Internal audit C. Team review B. Administrative appraisal D. Productivity evaluation 9. To manage potential risks resulting from unethical conduct, many companies build internal infrastructures that promote and enforce ethical practices. This internal infrastructure is likely to include appropriate audit procedures, a code of conduct, and a __________ policy. A. constituent C. monetary B. credit D. whistleblower 10. Which of the following questions should a business answer in relation to proactive planning: A. When did the local government increase the tax rate for the businesses in the area? B. How could our management team have prevented this breakdown from occurring? C. What changes have been occurring in the marketplace that could affect the business? D. Why did the promotional plan fail to meet the business's annual objectives?

FINANCE EXAM SAMPLE QUESTIONS KEY

1. A Poor data quality. Due to the size and complexity of most large financial organizations, data quality is a challenge. Multiple business units, geographic locations, and product lines create an environment in which it is difficult to properly integrate data to meet compliance requirements while retaining the quality and integrity of that data. Lack of training and inadequate funding can make it difficult to reach compliance goals, but they are not usually cited as the most significant problem in compliance. An improper accounting system is unlikely to be directly related to the achievement of compliance goals. SOURCE: CC:003 SOURCE: Informatica. (2006, November). Data quality, compliance, and risk for financial institutions. Retrieved January 14, 2011, from http://jobfunctions.bnet.com/abstract.aspx?docid=322623&tag=content;col1 2. B Flow-through shares. Flow-through shares are common tax shelters used by taxpayers to reduce their tax burdens. Corporations that issue flow-through shares are typically part of the mining industry. These companies agree to use whatever funds they receive from investors for exploration purposesin other words, to locate new sources of oil, gold, copper, etc. Rather than writing off these funds from their corporate taxes, the companies pass the tax deductions on to their investors, who can write off their entire investments against their taxes. Offshore companies, which are also commonly used as tax shelters, are businesses that are incorporated outside the country. Government bonds are interestbearing certificates issued by the government, which promises to pay bond owners a certain sum at a specified time. Derivatives are financial instruments whose value depends upon the value of other financial instruments (e.g., currencies, securities, commodities, etc.) or a market index. SOURCE: BL:134 SOURCE: Taylor, P.S. (2007, December/January). Everyone's guide to tax shelters. Retrieved February 28, 2011, from http://www.moneysense.ca/2007/01/16/everyones-guide-to-tax-shelters/2/ 3. D Educate and train the employees about the regulatory changes. Businesses must be able to adapt to environmental changes to thrive in the marketplace. External factors, such as regulation changes, may require businesses to change the way they carry out certain processes. These processes can affect the ways in which employees perform their jobs. To help employees adapt to these types of changes, management must communicate with employees. This may involve providing training and education programs to help them understand the changes, so they can effectively transition to a new way of doing things. Surveying employees, revising the firm's vision statement, and hiring additional employees will not help the employees adapt to regulatory changes. SOURCE: EC:107 SOURCE: Kreitner, R., & Kinicki, A. (2004). Organizational behavior (6th ed.) [pp. 673, 675, 690]. New York: The McGraw-Hill Companies.

FINANCE EXAM SAMPLE QUESTIONS

4. B If the flow of money into a financial institution slows down, there is less money available for the institution to lend or invest. Financial institutions act as intermediaries by transferring money from those who have it (savers and investors) to those who need it (borrowers). When a financial institution brings in less money, then it has less money available to lend or invest. Finance and insurance institutions help facilitate the flow or movement of money through the economy from those who have money to those who need money. Financial institutions reduce the risk that individual savers and investors face by spreading their funds out among many borrowers. That way, if a loan or investment goes bad, its impact on individual savers and investors is minimized. Financial institutions are often connected to each other through deposits, investments, and loans that they make to each other. If one financial institution fails, it has the potential to cause a string of other financial institution failures. SOURCE: FI:336 SOURCE: MBA Research and Curriculum Center. (2009). Introduction to finance course guide (pp. 5-19-5-20). Columbus, OH: Author. 5. C No-load. No-load mutual funds do not charge sales commissions or purchase fees. According to the mutual fund provided, the maximum initial charge for purchasing shares of the AnMl mutual fund is $0.00. So, all of an individual's investment would go toward the purchase of shares of AnMl. A front-load mutual fund charges commissions and/or purchase fees when buying shares of the fund. A back-load mutual fund charges fees when an investor sells her/his shares of the fund. An expiring back-load mutual fund also charges fees when an investor sells her/his shares, but at a certain point in time or when the account reaches a certain level, these fees decline or disappear completely. SOURCE: FI:275 SOURCE: Badenhop, S. (2005, October). Investments: How to read the financial page. Retrieved March 1, 2011, from http://www.ca.uky.edu/agc/pubs/fcs5/fcs5439/fcs5439.pdf 6. C Audit trails. Although unethical individuals might erase certain accounts or transactions from their financial-information management system, a record of their erasures would appear in system audit trails. What-if planning involves identifying and considering options for financial decision-making by applying different assumptions to financial data within spreadsheet software. Long-term liabilities are debts that will take longer than a year to pay. A direct check is a method of checking goods in which the goods received are checked directly against the purchase order or the invoice. SOURCE: FM:003 SOURCE: de Jager, P. (2002, September/October). Ethics: Good, evil, and moral duty. Retrieved February 18, 2011, from http://findarticles.com/p/articles/mi_qa3937/is_200209/ai_n9143308/?tag=cont ent;col1

FINANCE EXAM SAMPLE QUESTIONS

7. A Accounting focuses on the past, while finance focuses on the future. Accountants are responsible for tracking and analyzing financial transactions to determine a client's or business's financial performance. Individuals in finance use the information that accountants prepare to predict and plan for the future. Finance, which focuses on money and capital markets, investments, and financial management, is broader than accounting. Private accountants typically report to a controller who reports to an executive within the finance department, such as the vice president of finance or chief financial officer. Financial managers and accountants focus on both assets and liabilities, not one or the other. SOURCE: FM:005 SOURCE: Dlabay, L.R., & Burrow, J.L. (2008). Business finance (pp. 102-103). SouthWestern Cengage Learning. 8. A Internal audit. An audit is an evaluation of an organization, process, or project. The project manager and team members can determine its successes, strengths, problems, and weaknesses by evaluating all aspects of the project upon completion. The evaluation helps the project team develop a lessons learned document that can be used by teams that execute similar projects for the organization in the future. A comprehensive audit will evaluate many different activities associated with the project, including resource utilization, team productivity and performance, efficiency of processes, and stakeholders' satisfaction, which is done by comparing the objectives with the actual results. SOURCE: OP:159 SOURCE: Row, J.R., & Scudder, R. (2010, May 10). The project deliverables of an internal audit. Retrieved January 6, 2011, from http://www.brighthub.com/office/project-management/articles/70376.aspx 9. D Whistleblower. One way to manage potential risks resulting from unethical conduct is to build an internal infrastructure that promotes and enforces ethical practices and offers incentives to behave ethically. This internal infrastructure typically includes appropriate audit procedures, a code of conduct, a committee to develop the code, training for employees about the code, and a whistleblower policy. A whistleblower policy encourages and enables employees to report unethical behavior or actions without fear of negative repercussions such as demotion or firing. A credit policy is a guideline for a business to follow in controlling the use of payment plans that allow customers to purchase now and pay later. Monetary policy is the government policy that determines the amount of money that will be in circulation and the level of interest rates. Constituent policies are public policies that apply to the government or nation as a whole. Constituent policies include national security, foreign affairs, diplomacy, etc. SOURCE: RM:041 SOURCE: Francis, R. & Armstrong, A. (n.d.). Ethics as a risk management strategy: The Australian experience. Retrieved March 2, 2011, from http://eprints.vu.edu.au/777/1/JBEthicsRisk.pdf

FINANCE EXAM SAMPLE QUESTIONS

10. C What changes have been occurring in the marketplace that could affect the business? Proactive planning focuses on what is going on now and how could it impact the future of the business. Because a primary aspect of proactive planning involves taking advantage of opportunities rather than reacting to problems, the business should consider changes that have been occurring in the marketplace, such as changes in customers' needs, changes in competitors' activities, etc. By analyzing these changes, a business can develop a plan to act on opportunities to their advantage and stop potential threats. The remaining options are reactive questions rather than proactive questions. SOURCE: SM:011 SOURCE: Godfrey, J. (2009, February 4). Proactive vs. reactive. Retrieved March 10, 2011, from http://www.c-peopleinc.com/blog/jeremy-godfrey/proactive-vsreactive

You might also like

- Financial Statement Analysis CourseworkDocument8 pagesFinancial Statement Analysis Courseworkpqltufajd100% (2)

- TUI UniversityDocument9 pagesTUI UniversityChris NailonNo ratings yet

- Chapter 4 and 5 EssaysDocument10 pagesChapter 4 and 5 EssaysRhedeline LugodNo ratings yet

- Cases in Finance Assignment FinalDocument22 pagesCases in Finance Assignment FinalIbrahimNo ratings yet

- ADL 03 Accounting For Managers V3final PDFDocument22 pagesADL 03 Accounting For Managers V3final PDFgouravNo ratings yet

- ADL 03 Accounting For Managers V3Document21 pagesADL 03 Accounting For Managers V3Amit RaoNo ratings yet

- ACCT3302 Financial Statement Analysis Tutorial 1: Introduction To Financial Statement AnalysisDocument3 pagesACCT3302 Financial Statement Analysis Tutorial 1: Introduction To Financial Statement AnalysisDylan AdrianNo ratings yet

- Contemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaDocument5 pagesContemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaJERRALYN ALVANo ratings yet

- Term Paper of Financial ManagementDocument6 pagesTerm Paper of Financial Managementafmzmxkayjyoso100% (1)

- Tybms, 563, Chinmay Joshi - If ProjectDocument11 pagesTybms, 563, Chinmay Joshi - If ProjectVivek sharmaNo ratings yet

- Thesis On Sources of FinanceDocument4 pagesThesis On Sources of Financeleslylockwoodpasadena100% (2)

- 03 LasherIM Ch03Document47 pages03 LasherIM Ch03Sana Khan100% (1)

- Bryan T. Lluisma Fin 3 BSA-4 TTH 5:00-6:30PM Prelim ExamDocument4 pagesBryan T. Lluisma Fin 3 BSA-4 TTH 5:00-6:30PM Prelim ExamBryan LluismaNo ratings yet

- Module 1 Financial Accounting For MBAs - 6th EditionDocument15 pagesModule 1 Financial Accounting For MBAs - 6th EditionjoshNo ratings yet

- Prelim ModuleDocument5 pagesPrelim ModuleJenefer GwmpesawNo ratings yet

- Financing A New Venture Trough and Initial Public Offering (IPO)Document32 pagesFinancing A New Venture Trough and Initial Public Offering (IPO)Manthan LalanNo ratings yet

- CH 01Document29 pagesCH 01Xinni XuNo ratings yet

- Financial Management Economics For Finance 1679035282Document135 pagesFinancial Management Economics For Finance 1679035282Alaka BelkudeNo ratings yet

- Tutorial 6 SolutionsDocument4 pagesTutorial 6 Solutionsmerita homasiNo ratings yet

- ACC 111 Assessment 2 - Project: Adam MuhammadDocument7 pagesACC 111 Assessment 2 - Project: Adam Muhammadmuhammad raqibNo ratings yet

- Term Paper Topics For Financial ManagementDocument5 pagesTerm Paper Topics For Financial Managementc5r0qjcf100% (1)

- Capital Budgeting TechniquesDocument97 pagesCapital Budgeting TechniquesPriyanshu Singh0% (1)

- CH 01Document57 pagesCH 01junjjangieNo ratings yet

- Case 25 NotesDocument5 pagesCase 25 NotesRohit AggarwalNo ratings yet

- Reporting Standards Impact Company AssetsDocument8 pagesReporting Standards Impact Company AssetsAqsa ButtNo ratings yet

- Capital BudgetingDocument17 pagesCapital BudgetingKristine HeizelleNo ratings yet

- Chapter 3Document26 pagesChapter 3Siddhesh TamhanekarNo ratings yet

- 03 LasherIM Ch03Document47 pages03 LasherIM Ch03Maryam Bano100% (5)

- Dire-Dawa University Institute of Technology: Construction Technology and Management Chair Course Code: byDocument34 pagesDire-Dawa University Institute of Technology: Construction Technology and Management Chair Course Code: bySemNo ratings yet

- 04 - Dfin404 - Insurance and Risk ManagementDocument10 pages04 - Dfin404 - Insurance and Risk ManagementHari KNo ratings yet

- Finance Strategy PDFDocument8 pagesFinance Strategy PDFShahzaib AslamNo ratings yet

- Solution Manual For Financial Accounting in An Economic Context 10th Edition Pratt PetersDocument6 pagesSolution Manual For Financial Accounting in An Economic Context 10th Edition Pratt PetersEdna Steward100% (43)

- Readings - Introduction To Financial ManagementDocument35 pagesReadings - Introduction To Financial ManagementAnish AdhikariNo ratings yet

- VCE Summer Internship Program 2021: Name Email-ID Smart Task No. Project TopicDocument3 pagesVCE Summer Internship Program 2021: Name Email-ID Smart Task No. Project TopicShazmeenNo ratings yet

- FIN 004_Comprehensive Quiz_with Answers and SolutionsDocument49 pagesFIN 004_Comprehensive Quiz_with Answers and SolutionsJovelyn UbodNo ratings yet

- An Evaluation of Capital Structure and Profitability of Business OrganizationDocument16 pagesAn Evaluation of Capital Structure and Profitability of Business OrganizationPushpa Barua0% (1)

- Project BudgetDocument13 pagesProject BudgetnehaNo ratings yet

- Chapter 1-solutionsDocument55 pagesChapter 1-solutionstongthanhthao265No ratings yet

- FM 1 MaterialDocument17 pagesFM 1 MaterialSwati SachdevaNo ratings yet

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Important Theory Q&aDocument13 pagesImportant Theory Q&amohsin razaNo ratings yet

- Chapter 1 Test QuestionsDocument3 pagesChapter 1 Test QuestionsRocel NavajaNo ratings yet

- Manage Finances Bsbfim 601 Chiradet Thepwong 14497: ASSESSMENT 3 (Online Assessment) - Research and QuestioningDocument11 pagesManage Finances Bsbfim 601 Chiradet Thepwong 14497: ASSESSMENT 3 (Online Assessment) - Research and Questioningnatty60% (5)

- Financial Ratio Analysis ThesisDocument8 pagesFinancial Ratio Analysis Thesismichellebojorqueznorwalk100% (1)

- Business Finance Assignment..1Document10 pagesBusiness Finance Assignment..1Mohsin IqbalNo ratings yet

- Formalities For Setting Up A Small Business EnterpriseDocument8 pagesFormalities For Setting Up A Small Business EnterpriseMisba Khan0% (1)

- Chapter 12 Financial Management and Financial Objectives: Answer 1Document9 pagesChapter 12 Financial Management and Financial Objectives: Answer 1PmNo ratings yet

- Investment Markets and Principles PADocument17 pagesInvestment Markets and Principles PAnguyenphuonganh07102002No ratings yet

- BUSN 2nd Edition Kelly Solutions Manual 1Document3 pagesBUSN 2nd Edition Kelly Solutions Manual 1sandra100% (33)

- Financial Management Dissertation ExamplesDocument4 pagesFinancial Management Dissertation ExamplesBuyCollegePaperOnlineAtlanta100% (1)

- Sample Thesis Financial AnalysisDocument5 pagesSample Thesis Financial AnalysisTye Rausch100% (2)

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- JHA for Checking, Testing and Troubleshooting LoopsDocument6 pagesJHA for Checking, Testing and Troubleshooting LoopsChinedu AchilikeNo ratings yet

- Integrated Reporting ChecklistDocument7 pagesIntegrated Reporting Checklistvilan flucyNo ratings yet

- Qi240 Manual EngDocument268 pagesQi240 Manual Englandago100% (1)

- WGU - c176 - Terms and DefinitionsDocument15 pagesWGU - c176 - Terms and DefinitionsdrthtaterNo ratings yet

- Solution Manual Fundamentals of Investments 3rd Edition by Gordon J. Alexander SLP1137Document10 pagesSolution Manual Fundamentals of Investments 3rd Edition by Gordon J. Alexander SLP1137Thar Adelei50% (2)

- Wharton Case Preparation Toolkit: Industry PrimerDocument25 pagesWharton Case Preparation Toolkit: Industry PrimerBailu Xu100% (1)

- A400MDocument29 pagesA400MHikari Nazuha100% (1)

- Understand Risky ShiftDocument26 pagesUnderstand Risky ShiftSreekumar GopalakrishnanNo ratings yet

- Corporate Governance: Suggested Answers and Examiner's CommentsDocument25 pagesCorporate Governance: Suggested Answers and Examiner's CommentsDaniel DakaNo ratings yet

- Project Risk Management: Muhammad Kamran Khalid, PMP, Six Sigma Black BeltDocument24 pagesProject Risk Management: Muhammad Kamran Khalid, PMP, Six Sigma Black BeltcelestinawarbekNo ratings yet

- Fleet Strategy - ACS Power TransformersDocument96 pagesFleet Strategy - ACS Power TransformersManojNo ratings yet

- Design Spaces For Analytical MethodsDocument11 pagesDesign Spaces For Analytical Methodsiabureid7460No ratings yet

- Craft Personal Entrepreneurial StrategyDocument66 pagesCraft Personal Entrepreneurial StrategySj Grant60% (5)

- 4) SOP On Hazard Identification & Risk AssessmentDocument6 pages4) SOP On Hazard Identification & Risk AssessmentsivaNo ratings yet

- AACONAPPS1 Reviews Audit Risk Model and Risk-Based ApproachDocument15 pagesAACONAPPS1 Reviews Audit Risk Model and Risk-Based ApproachClarisse Angela PostreNo ratings yet

- Singapore Property & REITs Focus: Developers' Valuations Too Cheap to IgnoreDocument310 pagesSingapore Property & REITs Focus: Developers' Valuations Too Cheap to Ignoremonami.sankarsanNo ratings yet

- UEFSB Control Measures Instruction (HIRARC) LSS2Document1 pageUEFSB Control Measures Instruction (HIRARC) LSS2Faris DiharNo ratings yet

- USSS NTAC Enhancing School Safety Guide 7.11.18Document32 pagesUSSS NTAC Enhancing School Safety Guide 7.11.18Ed Praetorian100% (1)

- EnerSys Global Leader in Industrial BatteriesDocument32 pagesEnerSys Global Leader in Industrial BatteriesAshredNo ratings yet

- Lifting EquipmentDocument24 pagesLifting EquipmentIwan HerawanNo ratings yet

- Food Processing Equipment Design and Cleanability: FLAIR-FLOW Technical Manual 377A/00Document35 pagesFood Processing Equipment Design and Cleanability: FLAIR-FLOW Technical Manual 377A/00Bhavesh100% (1)

- Liccue00 00Document40 pagesLiccue00 00John Fredy Palacio G.No ratings yet

- SEB's Commodities Monthly: Crude Oil Back On The Radar ScreenDocument20 pagesSEB's Commodities Monthly: Crude Oil Back On The Radar ScreenSEB GroupNo ratings yet

- Bias, Confounding and Effect Modification in EpidemiologyDocument10 pagesBias, Confounding and Effect Modification in EpidemiologyCSilva16No ratings yet

- Child Protection Standards in Ontario 2007Document86 pagesChild Protection Standards in Ontario 2007rob mitchellNo ratings yet

- Word of Mouth A Literature ReviewDocument10 pagesWord of Mouth A Literature ReviewCarlo Angelo S. BanateNo ratings yet

- Exploring Disaster Risk Reduction in The Built EnvironmentDocument16 pagesExploring Disaster Risk Reduction in The Built EnvironmentPotter Kai FongNo ratings yet

- WEF Global Risks Report 2019Document114 pagesWEF Global Risks Report 2019Jesus100% (1)

- FSAP Risks - Controls PKG Materials May 2009 PDFDocument14 pagesFSAP Risks - Controls PKG Materials May 2009 PDFramcatNo ratings yet

- Unit 5: Security: LO3 Review Mechanisms To Control Organisational ITDocument18 pagesUnit 5: Security: LO3 Review Mechanisms To Control Organisational ITBob LongNo ratings yet