Professional Documents

Culture Documents

350 Fall 2009 Quiz 7 Solution

Uploaded by

Kristy StevensOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

350 Fall 2009 Quiz 7 Solution

Uploaded by

Kristy StevensCopyright:

Available Formats

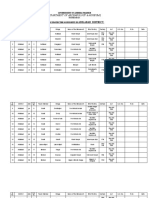

1. ___D____ For 1996, cost of goods available for sale for Jetson Corporation was $1,000,000.

The gross margin was 25% on Sales. Sales for the year were $800,000. What was the amount of ending inventory? a. b. c. d. $0 $200,000 $350,000 $400,000

2. ___C____ On April 15, 1996, a fire destroyed the entire uninsured inventory of Toms Retail Store. The following data are available: Sales, January 1 through April 15 Inventory, January 1 Purchases, January 1 through April 15 Markup on cost The amount of the inventory loss is estimated to be: a. b. c. d. $50,000 $45,000 $42,000 $40,000 $360,000 50,000 280,000 25%

Linkos Corporation has two products in its ending inventory, each accounted for at the lower of cost or market. A profit margin of 40% on selling price is considered normal for each product. Specific data with respect to each product follows: Product #1 Product #2 Historical cost $30.00 $50.00 Replacement cost 35.00 45.00 Estimated selling price 55.00 80.00 3. ___B____ In pricing its ending inventory using the lower of cost or market, what unit values should Linkos use for Product #1? a. b. c. d. $28 $30 $33 $35 Quiz 7 continued over . . . Quiz 7 continued.

4. __C_____ In pricing its ending inventory using the lower of cost or market, what unit values should Linkos use for Product #2? a. b. c. d. $45 $46 $48 $50

5. __A_____ Henke Co. uses the retail inventory method to estimate its inventory for interim statement purposes. Data relating to the computation of the inventory at July 31, 2010, are as follows: Cost Retail Inventory, 2/1/10 $ 200,000 $ 250,000 Purchases 1,000,000 1,575,000 Markups, net 175,000 Sales 1,750,000 Estimated normal shoplifting losses 20,000 Markdowns, net 110,000 Under the lower-of-cost-or-market method, Henke's estimated inventory at July 31, 2010 is a. $72,000. b. $84,000. c. $96,000. d. $120,000. 6. __D_____ At December 31, 2010, the following information was available from Kohl Co.'s accounting records: Cost Retail Inventory, 1/1/10 $147,000 $ 203,000 Purchases 833,000 1,155,000 Additional markups 42,000 Available for sale $980,000 $1,400,000 Sales for the year totaled $1,050,000. Markdowns amounted to $10,000. Under the lower-of-cost-or-market method, Kohl's inventory at December 31, 2010 was a. $294,000. b. $245,000. c. $252,000. d. $238,000.

Quiz 7 continued over . . . Quiz 7 continued.

7. __B_____ Boxer Inc. reported inventory at the beginning of the current year of $360,000 and at the end of the current year of $411,000. If net sales for the current year are $2,214,600 and the corresponding cost of sales totaled $1,879,400, what is the inventory turnover ratio for the current year? a. 5.74. b. 4.88. c. 5.39. d. 4.57.

8. ___C____ East Corporations computation of cost of goods sold is: Beginning inventory Add: Cost of goods purchased Cost of goods available for sale Ending inventory Cost of goods sold The average days to sell inventory for East are a. 56.9 days. b. 63.1 days. c. 66.4 days. d. 75.8 days. 9. ___A____ Lower-of-cost-or-market a. is most conservative if applied to individual items of inventory. b. is most conservative if applied to major categories of inventory. c. is most conservative if applied to the total inventory. d. must be applied to major categories for taxes. 10. __D_____ What is the rationale behind the ceiling when applying the lower-of-costor-market method to inventory? a. Prevents understatement of the inventory value. b. Allows for a normal profit to be earned. c. Allows for items to be valued at replacement cost. d. Prevents overstatement of the value of obsolete or damaged inventories. $ 60,000 405,000 465,000 80,000 $385,000

You might also like

- BT - Cat35fr005 - Field Report LaafDocument21 pagesBT - Cat35fr005 - Field Report LaafFabianoBorg100% (2)

- English 7 WorkbookDocument87 pagesEnglish 7 WorkbookEiman Mounir100% (1)

- Petition For The Issuance of A New Owner's Duplicate TCTDocument4 pagesPetition For The Issuance of A New Owner's Duplicate TCTNikel TanNo ratings yet

- Math PracticeDocument3 pagesMath Practiceakmal_07No ratings yet

- Merged Capstone QuestionsDocument36 pagesMerged Capstone QuestionsIsha Mahajan83% (6)

- Tip-Top Cleaning Supply budget and cash collection analysisDocument39 pagesTip-Top Cleaning Supply budget and cash collection analysisNguyễn Vũ Linh NgọcNo ratings yet

- Budgeting and Variance Analysis QuestionsDocument13 pagesBudgeting and Variance Analysis QuestionsAli Rizwan100% (1)

- Advacc 2 Chapter 1 ProblemsDocument5 pagesAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- Rural Houses of The North of Ireland - Alan GaileyDocument6 pagesRural Houses of The North of Ireland - Alan Gaileyaljr_2801No ratings yet

- Value Investing: From Graham to Buffett and BeyondFrom EverandValue Investing: From Graham to Buffett and BeyondRating: 4 out of 5 stars4/5 (24)

- MA 1 Final ExamDocument10 pagesMA 1 Final ExamSheena Calderon50% (2)

- 001 Sap Gts 7.2 Delta 1Document68 pages001 Sap Gts 7.2 Delta 1snd31No ratings yet

- GUBAnt BanwnaDocument36 pagesGUBAnt BanwnaMarc Philip100% (1)

- A Exam SampleDocument20 pagesA Exam Sampledanchinh100% (1)

- Winter ParkDocument7 pagesWinter Parksadafkhan210% (1)

- RavsolovetichikyomhaatzmautDocument61 pagesRavsolovetichikyomhaatzmautHirshel TzigNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Quiz B Inventory Valuation Marks 05: Q: Choose The Best Answer For Each of The Following QuestionsDocument2 pagesQuiz B Inventory Valuation Marks 05: Q: Choose The Best Answer For Each of The Following QuestionsArjun LalwaniNo ratings yet

- Activity 2: COST ACCOUNTING AND COST CONTROL (Select The Letter of The Best Answer)Document8 pagesActivity 2: COST ACCOUNTING AND COST CONTROL (Select The Letter of The Best Answer)kakimog738No ratings yet

- ACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionDocument14 pagesACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionXiaoying XuNo ratings yet

- ACC 577 Quiz Week 2Document11 pagesACC 577 Quiz Week 2MaryNo ratings yet

- Test Chapter 8 Principles Sample TestDocument9 pagesTest Chapter 8 Principles Sample TestJacob WagenknechtNo ratings yet

- 3311 CH 8 REVIEWDocument5 pages3311 CH 8 REVIEWVernon Dwanye LewisNo ratings yet

- Study Guide For Mgr. Exam 2Document10 pagesStudy Guide For Mgr. Exam 2Skirmante ZalysNo ratings yet

- ACC 301 CH 9 NO AnswersDocument6 pagesACC 301 CH 9 NO AnswersCarl Angelo0% (1)

- Confram QuizDocument8 pagesConfram QuizCelestine MariNo ratings yet

- Adoption of variable costing for managerial decision makingDocument6 pagesAdoption of variable costing for managerial decision makingFabian NonesNo ratings yet

- Câu 32 Trong Hình Tao Gửi Sai Nên Ai Làm Phần Đó Nhớ Sửa LạiDocument11 pagesCâu 32 Trong Hình Tao Gửi Sai Nên Ai Làm Phần Đó Nhớ Sửa LạiNhu Le ThaoNo ratings yet

- Sampleexam 2 BDocument13 pagesSampleexam 2 Btrs1234No ratings yet

- Multiple Choice Answer On The Scantron Provided ONLYDocument10 pagesMultiple Choice Answer On The Scantron Provided ONLYGiovana Marie Balasquide100% (1)

- Chapter 1 Extra-Credit AssignmentDocument16 pagesChapter 1 Extra-Credit AssignmentShipra SinghNo ratings yet

- Managerial Accounting Practice Problems2 PDFDocument9 pagesManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- Chapter 7Document46 pagesChapter 7Awrangzeb AwrangNo ratings yet

- MAS 03 CVP AnalysisDocument4 pagesMAS 03 CVP AnalysisJoelyn Grace MontajesNo ratings yet

- ACCT 201 Principles of Financial Accounting Practice Exam - Chapter 5 Reporting & Analyzing Inventories Dr. Fred BarbeeDocument22 pagesACCT 201 Principles of Financial Accounting Practice Exam - Chapter 5 Reporting & Analyzing Inventories Dr. Fred BarbeetamiratNo ratings yet

- Fill in The Blanks by Using The Words or Phrases Given BelowDocument8 pagesFill in The Blanks by Using The Words or Phrases Given BelowhokageNo ratings yet

- Final ExamDocument12 pagesFinal ExamKang JoonNo ratings yet

- At 3Document8 pagesAt 3Ley EsguerraNo ratings yet

- Wiley - Practice Exam 2 With SolutionsDocument11 pagesWiley - Practice Exam 2 With SolutionsIvan BliminseNo ratings yet

- Achievement Test QuestionsDocument3 pagesAchievement Test QuestionsglamfactorsalonspaNo ratings yet

- Part 1 - Decision MakingDocument174 pagesPart 1 - Decision Makingkodaikart786No ratings yet

- Exercises Chapter 4 Cost Behavior and AnalysisDocument7 pagesExercises Chapter 4 Cost Behavior and AnalysishanaNo ratings yet

- 2010-06-23 203304 Financialaccounting 2Document6 pages2010-06-23 203304 Financialaccounting 2pi!No ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAnne BacolodNo ratings yet

- ACC 304 Week 2 Homework - Chapter 9Document6 pagesACC 304 Week 2 Homework - Chapter 9LereeNo ratings yet

- Achievement Test 3: Chapters 5-6 Managerial AccountingDocument8 pagesAchievement Test 3: Chapters 5-6 Managerial AccountingJoshua GibsonNo ratings yet

- MGRL Practice 2 ModDocument20 pagesMGRL Practice 2 ModAnn Kristine TrinidadNo ratings yet

- POA1-Assignment - Chapter 6 - Q SentDocument6 pagesPOA1-Assignment - Chapter 6 - Q SentYusniagita EkadityaNo ratings yet

- Trắc NghiệmDocument50 pagesTrắc NghiệmNGÂN CAO NGUYỄN HOÀNNo ratings yet

- Intermediate Accounting Practice HandoutsDocument8 pagesIntermediate Accounting Practice HandoutspolxrixNo ratings yet

- Inventory SolutionDocument5 pagesInventory Solution465jgbgcvfNo ratings yet

- Accounting Textbook Solutions - 69Document19 pagesAccounting Textbook Solutions - 69acc-expertNo ratings yet

- Strategic Cost MidtermDocument15 pagesStrategic Cost MidtermhsjhsNo ratings yet

- Inventories QuestionnaireDocument9 pagesInventories QuestionnaireKristine JavierNo ratings yet

- How Inventories Affect Financial StatementsDocument9 pagesHow Inventories Affect Financial StatementsKristine JavierNo ratings yet

- ReviewerDocument2 pagesReviewerKristine De JoyaNo ratings yet

- Final Exam Autumn 2011 v1Document38 pagesFinal Exam Autumn 2011 v1peter kongNo ratings yet

- Intacc Q2Document4 pagesIntacc Q2Juliana Reign RuedaNo ratings yet

- Chap 4 - ActivitiesDocument3 pagesChap 4 - Activities31211022392No ratings yet

- TIP Relevant Costing Ex TipDocument10 pagesTIP Relevant Costing Ex TipmaurNo ratings yet

- Managerial accounting problemsDocument9 pagesManagerial accounting problemsMohitNo ratings yet

- Soal Mojakoe Akuntansi Manajemen UTS Genap 2019 2020Document6 pagesSoal Mojakoe Akuntansi Manajemen UTS Genap 2019 2020Adi NugrohoNo ratings yet

- Week 2 managerial accounting tutorial questionsDocument4 pagesWeek 2 managerial accounting tutorial questionsMANPREETNo ratings yet

- Quiz in ELEC 01 (Inventory Estimation)Document3 pagesQuiz in ELEC 01 (Inventory Estimation)djanine cardinalesNo ratings yet

- Calculate Degree of Operating Leverage & Break-Even Point for ECG CompanyDocument2 pagesCalculate Degree of Operating Leverage & Break-Even Point for ECG CompanyUMAIR AFZALNo ratings yet

- DocxDocument11 pagesDocx?????No ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Harga MethanolDocument1 pageHarga MethanolYuli NugraheniNo ratings yet

- MBC and SAP Safe Management Measures, Caa 2020-05-28Document9 pagesMBC and SAP Safe Management Measures, Caa 2020-05-28Axel KruseNo ratings yet

- Harnessing The Heat Beneath Our Feet GE - Feb 22 224Document1 pageHarnessing The Heat Beneath Our Feet GE - Feb 22 224ShhhhhhhhyeahNo ratings yet

- Hargrave, Cyrus Lead 2014 "Baad Team": Late-Breaking BCSP NotesDocument1 pageHargrave, Cyrus Lead 2014 "Baad Team": Late-Breaking BCSP NotesEric MooreNo ratings yet

- Grade 7 - RatioDocument5 pagesGrade 7 - RatioHâu NguyenNo ratings yet

- Winchel RM Stanley MDocument13 pagesWinchel RM Stanley MMariola AlamoNo ratings yet

- Career Lesson Plan Cheat SheetDocument2 pagesCareer Lesson Plan Cheat Sheetapi-278760277No ratings yet

- Silent Night (2015) ProgramDocument88 pagesSilent Night (2015) ProgramLyric Opera of Kansas CityNo ratings yet

- 8 deadly sins of investing: Overlooking fundamentals, myopic vision, ignoring portfolioDocument4 pages8 deadly sins of investing: Overlooking fundamentals, myopic vision, ignoring portfolionvin4yNo ratings yet

- Audit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaDocument15 pagesAudit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaIdorenyin Okon100% (1)

- Taste of IndiaDocument8 pagesTaste of IndiaDiki RasaptaNo ratings yet

- Operational Auditing Internal Control ProcessesDocument18 pagesOperational Auditing Internal Control ProcessesKlaryz D. MirandillaNo ratings yet

- Expedite Unclaimed Cargo AuctionsDocument4 pagesExpedite Unclaimed Cargo AuctionsDinesh ChakravartyNo ratings yet

- Application For Treaty Purposes: (Relief From Philippine Income Tax On Dividends)Document2 pagesApplication For Treaty Purposes: (Relief From Philippine Income Tax On Dividends)Nepean Philippines IncNo ratings yet

- MPRC - OGSE100 FY2020 Report - 0Document48 pagesMPRC - OGSE100 FY2020 Report - 0adamNo ratings yet

- Boltanski Thevenot Los Usos Sociales Del CuerpoDocument52 pagesBoltanski Thevenot Los Usos Sociales Del CuerpoAngélica VeraNo ratings yet

- ASAP Current Approved Therapists MDocument10 pagesASAP Current Approved Therapists MdelygomNo ratings yet

- Protected Monument ListDocument65 pagesProtected Monument ListJose PerezNo ratings yet

- Debate Motions SparringDocument45 pagesDebate Motions SparringJayden Christian BudimanNo ratings yet

- Power Plant Cooling IBDocument11 pagesPower Plant Cooling IBSujeet GhorpadeNo ratings yet

- The Ancient CeltsDocument2 pagesThe Ancient CeltsArieh Ibn GabaiNo ratings yet