Professional Documents

Culture Documents

Assignment 1

Uploaded by

Nassir CeellaabeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1

Uploaded by

Nassir CeellaabeCopyright:

Available Formats

BWFF2023 FINANCIAL MANAGEMENT II

ASSIGNMENT 1

PART A Following you will find data on RM1,000 par value bond issued by Young Corporation, Thomas Resorts and Entertainment, Inc. at the end of 2011. Assume you are thinking about buying these bonds as of January 2012. Answer the following questions of each of these bonds: 1. Calculate the value of the bonds if your required rates of return are as follows: Young Corp., 6 percent; Thomas Resorts, 9 percent; and Entertainment, Inc., 8 percent:

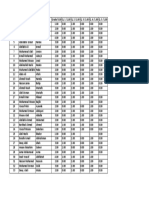

YOUNG CORP. Coupon interest rates Years to maturity 7.8% 10 THOMAS RESORTS 7.5% 17 ENTERTAINMENT, INC. 7.975% 4

2. In December 2011, the bonds were selling for the following amounts: Young Corp. Thomas Resorts Entertainment, Inc. RM1,030 RM973 RM1,035

What were the expected rates of return for each bond? 3. How would the value of the bonds change if i. your required rate of return (r) increases 3 percent. ii. your required rate of return (r) decreases 3 percent. 4. Explain the implications of your answers in questions 1, 2 and 3 as they relate to interest rate risk, premium bonds and discount bonds. [Hints: Relationship between coupon rates, required rates (original percentage, increases 3 %, decreases 3%) and expected rates] 5. Should you buy the bonds? Explain.

WRMAS

BWFF2023 FINANCIAL MANAGEMENT II

PART B In the world of trendsetting fashion, instinct and marketing savvy are prerequisites to success. Christina Cherry had both. During 2011, her national casual-wear company, StylishWare, rocketed to RM300 million in sales after 10 years in business. The companys historical growth was so spectacular that no one could have predicted it. However, securities analysts speculated that StylishWare could not keep up the pace. They warned that competition is fierce in the fashion industry and that the firm might encounter little or no growth in the future. They estimated that stockholders also should expect no growth in future dividends. Contrary to the conservative securities analysts, Christina Cherry felt that the company could maintain a constant annual growth rate in dividends per share of 6% in the future, or possibly 8% for the next 2 years and 6% thereafter. Cherry based her estimates on an established longterm expansion plan into Asian market. Venturing into this market was expected to cause the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently the risk-free rate is 6%. In preparing the long-term financial plan, StylishWares Chief Financial Officer (CFO) has assigned a junior financial analyst, Adam Reis to evaluate the firms current stock price. She has asked Reis to consider the conservative predictions of the securities analysts and the aggressive predictions of the company founder, Christina Cherry. Reis has compiled these 2011 financial data to aid his analysis: Data Earnings per share (EPS) Price per share of common stock Book value of common stock Total common shares outstanding Common stock dividend per share a. What is the firms current book value per share? b. What is the firms current P/E ratio? c. Answer: i. What is the current required return for StylishWare stock? ii. What will be the new required return for StylishWare stock assuming that they expand into Asian market as planned? d. If the securities analysts are correct and there is no growth in future dividends, what will be the value per share of the StylishWare stock? [Note: Use the new required rate in c (ii)] 2011 value RM6.25 RM40.00 RM60,000,000 2,500,000 RM4.00

WRMAS

BWFF2023 FINANCIAL MANAGEMENT II

e. Answer: i. If Christina Cherrys predictions are correct, what will be the value per share of Encore stock if the firm maintains a constant annual 6% growth rate in future dividends? [Note: Use the new required rate in c (ii)] ii. If Christina Cherrys predictions are correct, what will be the value per share of StylishWare stock if the firm maintains a constant annual 8% growth rate in dividends per share over the next 2 years and 6% thereafter? f. Compare the current (2012) price of the stock and the stock values found in parts a, d, and e. Discuss why these values may differ. Which valuation method do you believe most clearly represents the true value of the StylishWare stock? INSTRUCTIONS: 1. Students will work on the assignment collaboratively in groups of Four (4) to Five (5) students. 2. Answer ALL questions. 3. The assignment must be typed on a computer and comply with the following requirements: Font: New Times New Roman Font size: 12 Line spacing: 1.5 4. The dateline for submission of the assignment is on 29 March 2012 (Thursday), before 3:30 pm. Marks will be deducted for project submitted after this date. 5. Plagiarism in all forms is forbidden. Students who submit plagiarized assignment will be penalized.

WRMAS

You might also like

- Example 1:: 1.1 Introduction To MatrixDocument32 pagesExample 1:: 1.1 Introduction To Matrixs126178100% (3)

- DropboxDocument3 pagesDropboxmeriemNo ratings yet

- (Chapter 3) Quadratic FunctionDocument17 pages(Chapter 3) Quadratic Functiondenixng100% (3)

- Business Level StrategyDocument38 pagesBusiness Level Strategydjgavli11210100% (1)

- Business Administration Past PapersDocument35 pagesBusiness Administration Past PapersBilal Hussain0% (3)

- Finance: Practice Questions For Cfs & CpaDocument33 pagesFinance: Practice Questions For Cfs & CpaMahtab ChondonNo ratings yet

- Flash Memory Case Study SolutionDocument8 pagesFlash Memory Case Study SolutionRohit Parnerkar57% (7)

- Practice Final Exam Questions399Document17 pagesPractice Final Exam Questions399MrDorakonNo ratings yet

- (Chapter 2) Linear FunctionDocument17 pages(Chapter 2) Linear FunctiondenixngNo ratings yet

- Fm202 Exam Questions 2013Document12 pagesFm202 Exam Questions 2013Grace VersoniNo ratings yet

- README - Andrew KeeneDocument5 pagesREADME - Andrew KeeneInfomesa Training and ConsultingNo ratings yet

- Colgate Vs P&GDocument2 pagesColgate Vs P&Gsakshita palNo ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- Budgeting and Profit Planning CR PDFDocument24 pagesBudgeting and Profit Planning CR PDFLindcelle Jane DalopeNo ratings yet

- 46 Ty Chap2 MCQ PDFDocument18 pages46 Ty Chap2 MCQ PDFMohammed Mansoor50% (2)

- Week8 - Revenue Models SessionDocument28 pagesWeek8 - Revenue Models SessionNassir CeellaabeNo ratings yet

- Week8 - Revenue Models SessionDocument28 pagesWeek8 - Revenue Models SessionNassir CeellaabeNo ratings yet

- Week8 - Revenue Models SessionDocument28 pagesWeek8 - Revenue Models SessionNassir CeellaabeNo ratings yet

- Terminal Value - Perpetuity Growth & Exit Multiple MethodDocument11 pagesTerminal Value - Perpetuity Growth & Exit Multiple MethodFahmi HaritsNo ratings yet

- Customer Journey Mapping: A Walk in Customers' ShoesDocument5 pagesCustomer Journey Mapping: A Walk in Customers' ShoesInnocom100% (7)

- Investment+Planning+Module (1)Document137 pagesInvestment+Planning+Module (1)jayaram_polaris100% (1)

- Question and Answer - 31Document31 pagesQuestion and Answer - 31acc-expertNo ratings yet

- Lean Vs AgileDocument13 pagesLean Vs AgileSukesh shivyaNo ratings yet

- 2 AssignmentDocument14 pages2 AssignmentHira NazNo ratings yet

- MBA507Document10 pagesMBA507pheeyonaNo ratings yet

- Exam 2022 SeptemberDocument11 pagesExam 2022 Septembergio040700No ratings yet

- Valuing Teuer Furniture Using DCF and Multiples MethodsDocument5 pagesValuing Teuer Furniture Using DCF and Multiples MethodsFaria CHNo ratings yet

- Sample Exam #1Document6 pagesSample Exam #1btseng01No ratings yet

- Tutorial Questions FinDocument16 pagesTutorial Questions FinNhu Nguyen HoangNo ratings yet

- Exercise Chap 4 QDocument3 pagesExercise Chap 4 QFaiz Ridhwan0% (1)

- FIN2001 Exam - 2021feb - FormoodleDocument7 pagesFIN2001 Exam - 2021feb - Formoodletanren010727No ratings yet

- MAN 321 Corporate Finance Final Examination: Fall 2001Document8 pagesMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginNo ratings yet

- Corporate Finance ReExamDocument5 pagesCorporate Finance ReExamNAITIK SHAHNo ratings yet

- Financial Economics 1: Calculating Intrinsic Stock ValuesDocument19 pagesFinancial Economics 1: Calculating Intrinsic Stock ValuesMattia CampigottoNo ratings yet

- Đề 1Document2 pagesĐề 1Anh TrầnNo ratings yet

- The Big Sho (R) T: TalkofthetownDocument4 pagesThe Big Sho (R) T: Talkofthetownashu soniNo ratings yet

- International Financial Management V1Document13 pagesInternational Financial Management V1solvedcareNo ratings yet

- 820003Document3 pages820003Minaz VhoraNo ratings yet

- BBS 3rd Year Foundation of Financial Systems Model QuestionDocument8 pagesBBS 3rd Year Foundation of Financial Systems Model QuestionNirajan SilwalNo ratings yet

- Problems and Questions - 3Document6 pagesProblems and Questions - 3mashta04No ratings yet

- SFM Exam Capsule Question Part New Syllabus 1Document74 pagesSFM Exam Capsule Question Part New Syllabus 1shankar k.c.100% (1)

- Project Appraisal Assignment2Document9 pagesProject Appraisal Assignment2Shashi Bhushan SonbhadraNo ratings yet

- STR 581 Capstone Final Exam All Part 1-2-3Document7 pagesSTR 581 Capstone Final Exam All Part 1-2-3johnNo ratings yet

- 5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920Document6 pages5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920ahmerNo ratings yet

- Financial Markets & Institution - Set-2Document4 pagesFinancial Markets & Institution - Set-2DarshanNo ratings yet

- Time-Bound Home Exam-2020: Purbanchal UniversityDocument2 pagesTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlNo ratings yet

- Assignment - FinalDocument5 pagesAssignment - FinalapoorvkrNo ratings yet

- BST PQDocument11 pagesBST PQSakshi MauryaNo ratings yet

- PP 12 Bssiness Studies 2024Document24 pagesPP 12 Bssiness Studies 2024sourabhkumarrai7No ratings yet

- Class 12 BST - PQDocument23 pagesClass 12 BST - PQvishishti sharmaNo ratings yet

- GTU Exam - Financial Management QuestionsDocument3 pagesGTU Exam - Financial Management QuestionsMRRYNIMAVATNo ratings yet

- NMIMS Dec PGDBM Assignments - 9967480770Document6 pagesNMIMS Dec PGDBM Assignments - 9967480770Ca-cs Acma-mba PradeepNo ratings yet

- MAF653-Test 1 MCQ MAY 2022 QuestionDocument9 pagesMAF653-Test 1 MCQ MAY 2022 QuestionAyunieazahaNo ratings yet

- FM AssignmentDocument3 pagesFM Assignmentjeaner2008No ratings yet

- Dividend Discount Models ExplainedDocument16 pagesDividend Discount Models ExplainedPro TenNo ratings yet

- Finance Pq1Document33 pagesFinance Pq1pakhok3No ratings yet

- Corporate FinanceDocument4 pagesCorporate FinancejosemusiNo ratings yet

- Case Study Before UTS LD21-20221028051637Document5 pagesCase Study Before UTS LD21-20221028051637Abbas MayhessaNo ratings yet

- 2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013Document9 pages2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013theatresonicNo ratings yet

- Financial Management-1Document6 pagesFinancial Management-1chelseaNo ratings yet

- Exercise Session 1Document8 pagesExercise Session 1EdoardoMarangonNo ratings yet

- FINANCIAL STATEMENT GROUP 2Document4 pagesFINANCIAL STATEMENT GROUP 2Fitri Choerunisa0% (1)

- Seminar Questions Set IVDocument4 pagesSeminar Questions Set IVfanuel kijojiNo ratings yet

- HW Assignment 3Document6 pagesHW Assignment 3Jeremiah Faulkner0% (1)

- ANSWER KEY Discounted Cash Flow MethodDocument10 pagesANSWER KEY Discounted Cash Flow MethodDanna VargasNo ratings yet

- Group - Assignment Best To UsedDocument3 pagesGroup - Assignment Best To UsedNour FaizahNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2En Yu HoNo ratings yet

- Assignment May2011 ADocument6 pagesAssignment May2011 AZyn Wann HoNo ratings yet

- Actuarial Society of India: ExaminationsDocument6 pagesActuarial Society of India: ExaminationsRewa ShankarNo ratings yet

- UntitledDocument13 pagesUntitledJocelyn GiselleNo ratings yet

- Finance: Practice QuestionsDocument33 pagesFinance: Practice QuestionsMahtab Chondon100% (1)

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaNo ratings yet

- Mefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Document202 pagesMefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Srilekha KadiyalaNo ratings yet

- Project Guidelines FS 2022Document3 pagesProject Guidelines FS 2022Rahul UoNo ratings yet

- Advanced Financial Management Mock Examination December 2018Document6 pagesAdvanced Financial Management Mock Examination December 2018David LeeNo ratings yet

- Absent Fresh Students 2020Document14 pagesAbsent Fresh Students 2020Nassir CeellaabeNo ratings yet

- Academic Weekly Report SEMESTER 5Document4 pagesAcademic Weekly Report SEMESTER 5Nassir CeellaabeNo ratings yet

- ASSIGNMENTDocument2 pagesASSIGNMENTNassir CeellaabeNo ratings yet

- Business Model and Idea CanvassesDocument9 pagesBusiness Model and Idea CanvassesNassir CeellaabeNo ratings yet

- 2018 Innovate Accelerator Program: Final Shortlisted StartupsDocument1 page2018 Innovate Accelerator Program: Final Shortlisted StartupsNassir CeellaabeNo ratings yet

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDocument55 pagesIntermediate Accounting: Prepared by University of California, Santa BarbaraAbdirahmanNo ratings yet

- Intermediate Accounting-IMorning A-Chapter 3 Quiz 3-GradesDocument1 pageIntermediate Accounting-IMorning A-Chapter 3 Quiz 3-GradesNassir CeellaabeNo ratings yet

- Build Revenue Model GuideDocument26 pagesBuild Revenue Model GuideNassir CeellaabeNo ratings yet

- Build Revenue Model GuideDocument26 pagesBuild Revenue Model GuideNassir CeellaabeNo ratings yet

- Knowledge Template 16x9Document5 pagesKnowledge Template 16x9Nassir CeellaabeNo ratings yet

- Business Model Idea Canvases PPT - NBDocument9 pagesBusiness Model Idea Canvases PPT - NBNassir CeellaabeNo ratings yet

- Knowledge Template 16x9Document5 pagesKnowledge Template 16x9Nassir CeellaabeNo ratings yet

- CIPMAWB15 Solutions 2Document72 pagesCIPMAWB15 Solutions 2Nassir CeellaabeNo ratings yet

- MA Summary of ChangesDocument1 pageMA Summary of ChangesNassir CeellaabeNo ratings yet

- Management Accounting: Updated January 2018 Valid For Exams in 2018Document14 pagesManagement Accounting: Updated January 2018 Valid For Exams in 2018Nassir CeellaabeNo ratings yet

- (Chapter 4) Exponential & Logarithmic FunctionDocument20 pages(Chapter 4) Exponential & Logarithmic FunctiondenixngNo ratings yet

- Cipfa WB4Document43 pagesCipfa WB4Nassir CeellaabeNo ratings yet

- The Role and Scope of Management AccountingDocument16 pagesThe Role and Scope of Management AccountingNassir CeellaabeNo ratings yet

- Find break-even points for 3 firms with cost and revenue equationsDocument1 pageFind break-even points for 3 firms with cost and revenue equationsNassir CeellaabeNo ratings yet

- Mid Term Business Mathimatics For A, B, C, D, EDocument4 pagesMid Term Business Mathimatics For A, B, C, D, ENassir CeellaabeNo ratings yet

- (Chapter 1) Intruction To FunctionDocument16 pages(Chapter 1) Intruction To FunctiondenixngNo ratings yet

- Find the domain and range of function g(xDocument5 pagesFind the domain and range of function g(xNassir CeellaabeNo ratings yet

- (123doc) - Chapter-35Document5 pages(123doc) - Chapter-35Pháp NguyễnNo ratings yet

- InvoiceDocument1 pageInvoicemanojkmorwal07No ratings yet

- Unit IDocument19 pagesUnit IlakshmiNo ratings yet

- Chapter 4Document58 pagesChapter 4Anh Võ TừNo ratings yet

- The-New-Financial-Accounting-System-In-Algeria - The-Horizons-And-The-ChallengesDocument10 pagesThe-New-Financial-Accounting-System-In-Algeria - The-Horizons-And-The-ChallengesMadoui LNo ratings yet

- McCarthyFaderHardie ValuingSubscriptionBusinesses JM2017Document21 pagesMcCarthyFaderHardie ValuingSubscriptionBusinesses JM2017Christian VermehrenNo ratings yet

- Nasecore vs. Erc. MeralcoDocument25 pagesNasecore vs. Erc. Meralcoanimusiago100% (1)

- Microeconomics: Slides: N. Gregory Mankiw's Chapter 4: Thomson South-WesternDocument63 pagesMicroeconomics: Slides: N. Gregory Mankiw's Chapter 4: Thomson South-Westernm ameen100% (1)

- Environmental Economics 2nd Edition, Charles Kolstad: Share This ToDocument1 pageEnvironmental Economics 2nd Edition, Charles Kolstad: Share This ToEzioNo ratings yet

- My Watchlist - Value ResearchDocument1 pageMy Watchlist - Value ResearchpksNo ratings yet

- Exercises Part6Document14 pagesExercises Part6Inder Mohan0% (1)

- CRM FinalDocument54 pagesCRM FinalPrashant GuptaNo ratings yet

- Ladoo PropertyDocument24 pagesLadoo PropertyShreyaNo ratings yet

- Protective Put StrategyDocument3 pagesProtective Put StrategydanNo ratings yet

- Coursework-1 2013 Mba 680Document5 pagesCoursework-1 2013 Mba 680CarlosNo ratings yet

- Midterm Exam - Attempt ReviewDocument6 pagesMidterm Exam - Attempt ReviewMahmoud AliNo ratings yet

- GR Apwgraph AnswersDocument7 pagesGR Apwgraph AnswersEzra Denise Lubong Ramel73% (15)

- Mba III Semester SyllabusDocument24 pagesMba III Semester SyllabusAditya RajNo ratings yet

- Case Analysis OnDocument7 pagesCase Analysis OnEileen EnriquezNo ratings yet

- The Impact of Digital Media and Technology On The Marketing MixDocument40 pagesThe Impact of Digital Media and Technology On The Marketing MixFatin IzzatiNo ratings yet

- FXDocument119 pagesFXyahooshuvajoyNo ratings yet

- EVA Approach: Calculation of Economic Value Added (EVA)Document4 pagesEVA Approach: Calculation of Economic Value Added (EVA)Lakshmi BaiNo ratings yet

- Institutional Clients Group | General Industrials & Financial SponsorsDocument2 pagesInstitutional Clients Group | General Industrials & Financial SponsorsShilpi KumariNo ratings yet