Professional Documents

Culture Documents

Accounting Cheat Sheets

Uploaded by

Greg BealOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Cheat Sheets

Uploaded by

Greg BealCopyright:

Available Formats

10-K Report It reports audited financial statements: Balance Sheet, Income Statement ,Statement of Equity, Statement of Cash Flows

10-Q Report It reports interim unaudited quarterly financial data Revenues, gross profits, income, and earnings per share (EPS) Benefits of disclosure .Good news impact stock prices favorably A reduction in the cost of capital (lower interest rates),Ability to establish superior supplier and customers relationships Costs of disclosure .Comparative Disadvantages disclosed information is scrutinized by competitors Litigation Risk investors may sue firms when expectations are not met, Political costs firms face political & public pressure, which creates political costs (i.e., Oil firms, software, healthcare companies). Snapshot is Balance Sheet. How well org did during a give period? Income statement and statement of cash flows. A= L+E, A-L=E

land, factory buildings, warehouses, office buildings, machinery, motor vehicles, office equipment, etc. (net refers to subtraction of accumulated depreciation, the portion of the assets cost that has been transferred from the balance sheet to the income statement). Long-term investments investments that the company does not intend to sell in the near future (i.e., marketable securities). Intangible and other assets assets without physical substance, (patents, trademarks, franchise rights, goodwill, and other costs the company acquired and provide future benefits). Are borrowed funds used to finance the acquisition of assets. Current liabilities - obligations due within one year. Accounts payableamounts owed to suppliers for goods and services purchased on credit.Accrued liabilities obligations for expenses that have been incurred but not yet paid; examples are accrued wages payable (wages earned but not yet paid). Unearned revenuesobligations created when the company accepts payment in advance for goods or services it will deliver in the future. Short-term notes payableshort-term debt payable to banks or other creditors. Current maturities of long-term debtprincipal portion of long-term debt due in one year.Non-current liabilities - obligations due after one year.Long-term debt - bonds, mortgages.Other long-term debt - pension obligations, taxes. Notable: Pension obligations can run in the billions of dollars. Equity:Capital provided by a firms owners (shareholders) via the purchase of stock or retained earnings. Contributed Capital (cash raised by the issuance of shares)Common stock - par value received from the original sale of common stock to investors.Preferred stock - has fewer ownership rights than common stock. Additional paid-in capital - amounts received from the original sale of stock to investors in addition to the par value of common stock Treasury stock - amount the company paid to reacquire its common stock (a reduction in equity).Earned Capital (reinvestment of profits) Retained earnings - accumulated net income (profit) that has not been distributed to stockholders as dividends.Accumulated other comprehensive income or loss - accumulated changes in equity that is not reported in the income statement Book-value of equity (Book value) - is the value of a firm as determined by GAAP and reported in the books. Book value of equity = Total Assets Total Liabilities Key idea - Book value is reported at historical costs. Market-value of equity (Market value, or Market Cap) - is the value of a firm as determined by investors in capital markets. Calculated as number of common shares outstanding multiply by the per share market price. GAAP recognizes Assets at historical costs and the market attempts to estimate the fair market value of most assets Historical cost is used for most itemsInventory; Property and Equipment; Accounts PayableNet realizable value Accounts receivable GAAP does not recognize lots of intangible assets in the books Internally developed intangible assets (e.g., human capital, brand value, R&D)Off-balance sheet financing (certain leases are not recognize as liabilities) GAAP does not report expected future performance and the market does Capital markets consider expected future revenues and future earnings in determining value Capital market considers the level of competition in which a firm operates in determining value Discontinued operations - Gains or losses from business segments that are being sold or have been sold in the current period. Extraordinary items Gains or losses from events that are both unusual and infrequent (e.g. restructuring charges). Statement of Stockholders Equity: It is a reconciliation of the beginning and ending balances of stockholders equity accounts. Main equity categories are: Contributed capital Retained earnings (and Other Comprehensive Income) Treasury stock Dividends (Cash distributions to Shareholders) Some corporations will NOT report a Statement of Stockholders Equity. If retained earnings are the only account that changed during the year, then the amount of retained earnings is presented in the footnotes. Statement of Cash Flows: Summarizes the sources and uses of cash during a given period; Cash flows from operating activities -Generally, transactions that affect income and that relate to a firms operations (involving changes in current assets and current liabilities)in: collections from customers; dividends received; interest received out: payments to suppliers, employees, tax payments, interest payments Cash flows from investing activities - Generally, cash effects of transactions involving changes in long-term assets in: sales of fixed assets, investment securities; out: purchases of fixed assets (capital expenditures), investments; lending money Cash flows from financing activities - Generally, cash effects of transactions involving changes in long-term liabilities and stockholders equity in: issuance of debt and equity securities out: share repurchases; debt repayments (principal only); dividend payments)

There are two versions of the Trial Balance that must be generated during the closing: Unadjusted Trial Balance lists the ending balance on each account PRIOR to making adjusting entries (or accrual adjustments). Adjusted Trial Balance lists the ending balance on each account AFTER to making adjusting entries (or accrual adjustments).

Accounting income is the change in stockholders equity resulting from business operations Therefore, assuming no other transactions with shareholders AL = E = Net Income What kinds of activities result in income? Selling inventory for more than it was purchased..Cash is received (or a customer promises to pay cash) This is an inflow of net assets ( Equity and Net Income) We give the customer the inventory This is an outflow of net assets ( Equity and Net Income) An income statement summarizes financial performance during a given period. Revenue: increase in net assets from providing goods/services to customers Expense: decrease in net assets from providing goods/services to customers Sales less expenses yield the bottom-line net income amount. Income Statement also includes gains and losses Gain (Loss): increase (decrease) in net assets from peripheral transactions (e.g., sale of production machinery) Net Income = Revenues Expenses + Gains Losses Assets = Liabilities+Shareholders Equity (End).Assets=Liabilities+Contributed Capital+Retained Earnings (End) Assets=Liabilities+Contributed Capital+RE (Beg) + NI Dividends Cash flow is simply the change in cashWe can organize transactions to determine the change in cash due to:Operating Activities, Investing Activities,Financing Activities

Cashbased Accounting a method of accounting that recognizes revenues when cash is received and expenses when cash is disbursed. Accrual Accounting recognizes noncash transactions regardless of not whether we collect or disburse cash. Accrual accounting is driven by two central principles: The revenue recognition principle recognizes revenues when earned even if no cash is received. The matching principle - recognizes expenses in the economic period when the expenses are incurred even if no payment is disbursed

To arrive at the cash flows from operating activities, we adjust (add/subtract) net income using the following format:Net income $(Add): Depreciation expense+Adjust for changes in current assets (Subtract): increases in current assets -(Add): decreases in current assets +Adjust for changes in current liabilities(Add): increases in current liabilities +(Subtract): decreases in current liabilities -Cash flows from operating activities $ Firms can report cash flows using the direct or indirect methods. Both methods provide the same ending cash balances. Only difference is the presentation of cash flows from operating activities. The investing and financing sections are the same across methods. Indirect method Computes operating cash flows by adjusting net income for any changes in current assets and current liabilities. By far the most popular: over 90% of U.S. publicly-traded firms use it. Direct method Reports cash flows from operating activities after adding cash receipts (cash sales) and deducting cash disbursements (cash payments for expenses). Cashflow v Income: Net Income does not necessarily equal the amount of net cash flows in a given period. A firm could have reported profits but have poor cash flow or vice versa. Why doesnt Operating Cash Flow = Net Income? Due to Accounting accruals (non-cash transactions are recognized in the books. Revenue is recognized in the I/S but cash has not been collected. Expenses are recognized in the I/S but not been paid. Articulation of the financial statements refers to the relations among various financial statements. They are all closely linked to each other. The balance sheet shows the ending balance of assets, liabilities, equity The income statement shows inflows and outflows of assets Revenues and Expenses The statement of owners equity shows changes in a firms net worth Retained earnings capture changes in equity from income or losses The statement of cash flows shows inflows and outflows of cash Cash Receipts and Cash Payments Record transactions that occur during the fiscal period Purchase Inventory Sell Inventory Pay Bills then..Adjusting Entries - At the end of the fiscal period, make appropriate adjustments for accounts that are misstated. Specifically, we look for the following accrual adjustments:Record any unrecorded expenses (depreciation expense)Adjust prepaid expenses that have declined in value (insurance premiums) Record any unrecorded revenues (earned but not recorded) Adjust unearned revenues if it has been earned during the period. ThenPrepare financial statements Closing Entries (zero out temporary accounts) Starting all over again next period What are Closing Entries? The purpose is to transfer all temporary accounts into retained earnings. At the end of each period (month), Revenues, Expenses, and Dividends are zero out and their ending balances are transferred to retained earnings. After closing entries are performed, all temporary accounts begin the new accounting cycle with a zero balance. (Note that income statement transactions are not automatically updated to retained earnings as shown in the working template used in the book.zero balance.) General entry to close-out temporary accounts: All temporary accounts are reversed Revenues are debited Expenses are credited Dividends are credited How Do We Evaluate Profitability & Overall Financial Performance? Key determinant is the Rate of Return on Investment (ROI) Principal metric used by most firms is Return-on-Equity (ROE) Return-on-Equity (ROE) - Rate of return on invested capital (how much are shareholders earning on their investment). Returnon-Assets (ROA) - measures how effective a firm employed its assets to generate profits. Profit Margins (PM) operating profit a firm earns from each dollar of sales Margins are affected by the level of gross profit (sales cost of sales) Level of operating expenses. A firms ability to control costs. Asset Turnover how productive are a firms assets in generating sales. (a higher ratio is preferable). Note: ROA, Profit margin, and Asset Turnover are affected by several factors outside of management control: Type of industry The business model adopted by a firm The level of competition within an industry Also note Firms with fewer fixed assets achieve higher Asset Turnover, but have lower Profit Margins (e.g., retailers, grocery stores). Common Sizing - refers to expressing individual components of financial statements as a percentage of a single item (in ratio form). It allows comparison among firms of different sizes and across time Horizontal analysis - allow to examine data across time and detect trends or changes in company performance between two or more years. Vertical analysis Allow comparison among firms of different sizes (Walmart vs. Target, General Mills vs. Kellog) Each item in the Income Statement is divided

Accrual accounting is used to prepare all financial statements under U.S. GAAP.Accrual accounting requires estimates and assumptions in the preparation of financial statements. For example: How much depreciation expense should be recorded in a given period? How much to record as an allowance for bad debt expense? How much revenue to recognize on a long-term contract? Many of the estimates would affect reported income and balance sheet accounts (receivables, inventory, PP&E).Because of accrual accounting some firms may report income (profits) even if no cash is received. If the cost is used to purchase a resource that has a future economic benefit (property, prepaid expenses, inventory What happens when the asset is used up? Eventually, assets are expensed when they no longer have any future economic benefits (i.e., prepaid expenses). If the cost creates an immediate economic benefit in current period, the cost must be expensed (wages, supplies, advertising, rent) Assets: Assets are reported at historical costs and not at fair market values (there are some exceptions) To be reported, an asset must: Be owned (or controlled) by the company Must possess expected future economic benefits Be reliably measured (several intangible assets are excluded) Assets are listed in order of liquidity Current assets assets used up or converted into cash within a year (Cash, inventory, accts. receivable) Long-term assets cannot be easily converted to cash within one year (Property, plant & equipment) Cash & cash equivalents currency, bank deposits, and investments with an original maturity of 90 days or less. Marketable securities short-term investments that can be quickly sold to raise cash. Accounts receivable, net amounts due to the company from customers arising from the sale of products on credit (net refers to uncollectible accounts ). Inventory goods purchased or produced for sale to customers. Prepaid expenses costs paid in advance for rent, insurance, advertising or other services. Property, plant and equipment (PPE), Net

by the amount of sales. B/S Items are divided by Total Assets

companys balance sheet shows the advance payment as a liability (called unearned revenue or deferred revenue) because the company is obligated to deliver those products and services.

The percentage-of-completion recognizes revenue by the proportion of costs incurred to date compared with total estimated costs. Used by companies with long-term sales or contract (Defense contractors, aircraft manufacturers, construction firms, consulting) Main idea: Method to estimate revenue is imprecise. Actual costs can vary greatly from what was originally estimated. U.S. GAAP does not distinguish Research costs Vs. Development costs (they are both treated as a combined expense) If R&D activities are developed internally: Costs must be expensed immediately when incurred Exception: internally developed software (US GAAP) If R&D is acquired externally through a merger or acquisition: Costs are capitalizable (recognize at acquisition cost) Amortization finite life: amortize over useful life indefinite life: do not amortize, but test at least annually for impairment U.S. GAAP allows for capitalization of costs related to the development of software once the software achieves commercial feasibility Applies to software developed for sale or lease to external parties Accounting Treatment: Expense costs incurred prior to establishing technological feasibility Technological feasibility: completion of all planning, designing, coding, and testing activities necessary to establish that the product can be produced to meet its design specifications Capitalize costs incurred after technological feasibility is established

Allowance for Uncollectible Accounts - represents an estimate of the amount of credit sales that will not be collected in the future. A provision (or reserve) that firms must establish and adjust periodically based on their estimate of bad debt. A contra-asset account of accounts receivable. It increases with new provisions (additional bad debt) It decreases as debt is written-off the books Also referred as the allowance for bad debt, or allowance for doubtful accounts. Bad Debt Expense represents the expense of uncollectible debt recorded in the income statement. It is directly linked to the allowance for uncollectible accounts. Any increases in the allowance of uncollectible accounts is an increase in Bad Debt Expense by the same amount. (1) Allowance method: estimate amount of uncollectible accounts and recognize as an expense in the same period when estimated. Write-off accounts in the period when they become uncollectible. Note (2) is the Specific Write-off method.

This Years Results - Last Years Results Last Years Results

= Percentage Change

Current Ratio focuses on net working capital Note: A ratio > 1 implies positive working capital (a firm has enough liquidity to meet obligations becoming due within a year). A ratio < 1 indicate that the firm may not be able to meet its debt obligation. However, a ratio that is < 1may NOT always be bad either. Quick Ratio- focus on assets that can be converted to cash quickly Quick Ratio = Cash + Marketable Securities + Acct. Receivales/Current Liabilities Debt-to-Equity Ratio measures the degree to which a firm utilizes debt to acquire assets (proportion of debt in the capital structure) note: A lower ratio is preferable; more solvency & less risk Times Interest Earned (or Debt Service Ratio) measures the relation of interest expense to income or the ability to pay interest. A higher ratio is preferable; less risk of default Dividend Payout Ratio indicates the percentage of earnings returned to stockholders in the form of cash dividends. Note: A higher ratio the better for investors Dividend Yield the percentage of cash dividend return to investors relative to the stock price (equivalent to interest yield). Note: A higher ratio the better for investors EPS represent the amount of earnings attributed to each share of common stock. EPS = Net Income Preferred Stock Dividends/ Common Shares Outstanding If a firm has income (or losses) from discontinued operations, or extraordinary items, the effects on EPS must be disclosed separately. P/E ratio measures the relationship between the earnings of the corporation and the current market price. Investors believe that the P/E ratio is a good indicator of the future earnings power of a company. Firms with high (low) P/E ratios have a stock price that reflects the expectation of higher (lower) future earnings. Price/Earnings to Growth Ratio (PEG ratio) determines stock value while taking into account earnings growth. Big Picture: GAAP gives firms ample latitude as to when to recognize revenues and expenses given that they can choose a set of accounting rules. Firms can accelerate (or deferred) the timing of revenue and expense recognition, to affect reported income. There are managerial incentives to manage earnings upward or downward and we must understand the mechanics behind such actions. Many types of expense and revenue accruals are based on estimates that are subject to managerial discretion. How much depreciation expense should be record in a given period? How much to record as an allowance for bad debt expense? How much revenue to recognize on a long-term contract? Accounting rules are subject to discretion Firms are allowed to choose, and change, assumptions (depreciation rate)Big Baths (firms can accelerate expensing assets in periods of bad times)Key idea: Accruals can be used to manage earnings upward or downward Managers may use expense and revenues accruals to manipulate earnings to meet earnings benchmarks Earnings Management: As the book points out (p.3-12), earnings management is the use of accounting discretion (accruals) to distort reported earnings. Firms may manage earnings upward with income increasing accruals (i.e., accelerating the recognition of revenues)Firms may also engage in earnings management downward and use income-decreasing accruals (accelerating recognition of expenses) Research shows that in bad times, firms may accelerate the recognition of expenses (record write-offs) so they would show less expenses in future periods. This is referred as taking a bath. Research in accounting has identified various reasons why managers manage earnings and mainly this has to do to opportunistic behavior:They want to meet or beat analysts forecasts of earnings to avoid a big drop in their firms stocks.They want to avoid reporting losses (investors penalize firms that incur losses).Accelerate the recognition of revenues to increase stock prices prior to equity offerings.Report higher earnings to receive higher compensation. How do they manage earnings .Revenue is recognized when it is: Earned Delivery of goods has occurred or services have been rendered Realized or realizable There is persuasive evidence of an arrangement for customer payment The price is fixed or determinable Collection is reasonably assured Revenue is recognized at net realizable value (amount of sales the company expects to realize) Sales reported net of sales returns and allowances Discounts Conditions usually met at point of sale, but may also be met earlier (e.g., long-term contracts) Why is revenue recognition important? Revenue is usually the largest number on the subject to management discretion Most accounting fraud cases involve allegations of overstate revenue (misreporting revenues) Deposits or advance payments are not recorded as revenue until the company performs the services owed or delivers the goods. Until then, the

As the allowance for uncollectible accounts is estimated, firms record an amount of bad debt expense equal to the allowance: Dr Bad debt expense XXCrAllowance for uncollectible account XX Income statement effect: bad debt expense reduces net income Balance sheet effect: the allowance reduces the value of gross accounts receivable As specific delinquent accounts are written-off from the books: Dr Allowance for uncollectible account XX Cr Accounts Receivable XX NO effect on the Income Statement, nor the Balance Sheet Gross Receivable Approach - allowance for bad debt is estimated with an aging analysis of receivables that are currently outstanding. Each customers account balance is categorized by the number of days the underlying invoices have remained outstanding. Bad debts percentages are applied to each categorized amounts Sales Revenue Approach - allowance for uncollectible accounts (and bad debt expense) is determined as a percentage of credit sales during the period. Example: a firm had credit sales of $1,000,000 during the period and estimates that 2% will be uncollected. $1,000,000 X .02 = $20,000 Amount of Allowance of Uncollectible Accounts

Restructuring expenses are reported as a separate expense item in the income statement (may also be disclosed as a footnote). Restructuring expenses typically consists of three components: Employee severance or relocation costs Asset writedowns Other (i.e., contract termination costs, legal expenses, etc.) Accounting Standard: A company is required to have a formal restructuring plan that is approved by its board of directors before any restructuring charges are accrued. A company must identify the relevant employees and notify them of its restructuring plan. Restructuring expenses are accrued (recognized) in the income statement as an expense (and as a liability) in the period when a firm announces its restructuring plan.Example: Pfizer announces $2,523 million in restructuring costs in year 2007: Dr Employee termination costs $2,034 Asset impairments 260 Cr Restructuring Liability$2,294 Firms must disclose in its footnotes each subsequent year the original amount of the liability (accrual), how much of that liability is settled in the current period (such as employee payments), how much of the original liability has been reversed because of cost overestimation. Restructuring charges are typically abuse by managers as a way to improve future income (its an earnings management tool).Firms tend to overestimate the amount of restructuring charges in periods in which income is depressed. Management controls the timing of recognition of restructuring charges. Big Bath recognizing restructuring costs when income is already depressed, or if a firm is already incurring a big loss. Restructuring charges are overestimated. Management opportunistically increases Asset impairments Two categories of items are presented after below-the-line (after income from continuing operations): Discontinued operations - Net income (loss) from business segments that have been or will be sold, and any gains (losses) on net assets related to those segments sold in the current period. Extraordinary items - Gains or losses from events that are both unusual and infrequent. Both must be reported in the Income Statement Net of Tax. GAAP requires disclosure of EPS in the Income Statement in two ways: Basic EPS Dilutive EPS (after adjusting for the effects stock options and convertible bonds) If a firm has income (or losses) from discontinued operations, or extraordinary items, the effects on EPS must be disclosed separately. Pro-forma income is income from operations that excludes:Restructuring expenses Research and Development expenses Goodwill expenses (amortization of goodwill) Employee stock-options compensation expenses Main purpose is to exclude transitory (one-time) items; proponents argue that it enhances year-to-year comparability of income. Examples of Pro-forma income: EBIT (earning before interest and taxes) EBITDA (earnings before interest, taxes, depreciation, and amortization)

Shifting income from future periods into the current period: Management deliberately underestimates the allowance and reports lower bad debt expense to improve current period net income (i.e. raise profits).Why would a firm want to shift income from future periods into the current period (i.e., report higher profits)? What are the incentives? income pressures can cause managers to bend (or even break) the rules (textbook p. 6-9) Shifting income from the current period into the future periods: Management overestimates the allowance and reports higher bad debt expense to show lower income in the current period (i.e. lower profits).Can you think of any reasons as to why a firm may want to shift income from the current period to future periods and report lower profit.

A/R Turnover measures the number of times that receivables have been collected during the period. A higher ratio means that receivables are being collected more quickly. A/R Turnover = __Credit Sales___ or ___Sales____/Average Gross A/R Average Gross A/R Note: Most companies do not disclose amount of Credit Sales. The numerator Net Credit Sales is replaced with Sales when credit sales are not available. Some firms may also use Average Net Account Receivables in the denominator (we will use gross receivables as opposed to net receivables) Note higher ratio is preferable.

For many firms, credit sales are an important part of their operations and receivables a major component of working capital. There is inherent risk in holding receivables since some customers will not pay. GAAP requires firms to report A/R at the amount a firm expects to collect from customers (Net Realizable Value). Net Realizable Value = Accounts Receivable - Allowance for Uncollectible Accounts Key idea: firms must estimate the amount of uncollectible accounts periodically

Average collection period the average period of time (in days) it takes to collect a receivable. A lower ratio means that receivables are being collected faster. Average

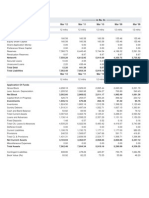

Collection Period = 365 Days , A/R Turnover Note:Some analysts may use 360 days in the denominator (well use 365 days) Cyscos Average Collection Period: 365 days 9.3 = 39 days NOTE LOWER RATIO IS PREFERRABLE. Answer 1 Southwests main assets are comprised of property and equipment. Specifically, the balance sheet shows a gross value of planes and $ $2,122 million of ground equipment, before deducting accumulated depreciation. Collectively, fixed assets show a net book value after deducting accumulated depreciation of $10,578 million. This represents 95% of long --term assets Note he gets the # by going to the balance sheet and taking the figure for assets less allowance for depreciation and adding other assets to it. This is where the 11,184 is coming from. ($10,578 =$11,184) and 68.4% of total assets ($10,578 =$ 15,463). The asset structure seems appropriate for an airline company. Airlines must invest heavily in fixed operating assets (planes, ground equipment) to be able to compete effectively. Airlines are capital intensive in that they need physical infrastructure to generate revenues. Thus, the asset structure is pretty consistent with their business model. 2. Short--term assets are equivalent to current assets: $4,279 million Long--term assets: $11,184 million (Includes $606 of other assets) $4,279 / $11,184 = .3826 Short--term assets = 38.3% Long--term assets = 61.7% All of this information was created from the balance sheet. Refer to the Statement of Cash Flows. It generated $1,561 million in cash flows from operating activities, * under net cash provided by operating activities. which represent cash flows generated from its core earnings resulting from its main business of flying passengers. With regards to investing activities, it had a net cash outflow of ($1,265) , which was caused primarily by investing $5,624 million in short --term investments. It uses the indirect method to compute cash flows from operating activities. We can infer this because cash flows from operating activities is obtained by adjusting net income for non--cash items (i.e., depreciation) and changes in working capital accounts (accts receivables). # 3 Did SW pay dividends in 2010. If so what is the payout. What is div yield. Assume avg price of $9. Refer to the Statement of Stockholders Equity. By looking at the adjustment to retained earnings (column 3), it shows that it paid $13 million in cash dividends. Alternatively, you can also refer to the Financing section in the Statement of Cash Flows. Dividend payout represents the amount of after--tax earnings that Southwest distributes to shareholders of common stock. Calculated as follows: dividends paid = net income $13 million / $459 million (net income from cash flows) =.0283 = 2.83% -- southwest is distributing 2.8% of its after tax earnings and reinvesting 97.2% to its business for future growth. Dividend yield equivalent to interest yield, or an interest return. Calculated as follows: dividends per share =stock price $0.018 / $9.00 = .002 = .20% -- Southwests investors are earning about 1/5 of a percent in dividends returns relative to the stock price. #4. Was SW profitable in 2010. Did it show improvements in profitablilty. Southwest was profitable in 2010. It earned after--tax income of $459 (net income from cash flows) million and had net operating earnings of $988 million (operating income.. from statement of income). However, as we discussed in class, we should also look at other measure of profitability, such as ROE and ROA to make more definite conclusion about their level of profits. To evaluate whether there is an improvement in earnings we must calculate the growth in earnings across the years. From 2009 to 2010, Net Income grew by 364% [($459- $99)/$99=3.636=364%]. Likewise, we can see that from 2008 to 2009, net income decreased by 44% [$99-$178)/$178 = --0.44 = 44%]. Thus. Clearly, this shows that profits increased substantially in 2010 relative to the previous to years. What caused such improvement? To further assess this we need to calculate the growth in operating revenues and operating expenses across the years and also evaluate revenues and expenses on a common--size basis (divide each item by total revenues). 2010 2009 Revenue growth 16.1% --6.2% Operating expenses growth 9.2% --4.6% Net income growth 364% --44% Revenue growth (2010): ($11,489 (passenger operating revenve) divided by previous year -- $9,892)/$9,892 =.1614 = 16.1% Revenue growth (2009): ($9,892 -- $10,542)/$10,542 = -0.0616 = --6.2% Operating Expenses growth (from income statement) (2010): ($11,116 -- $10,088)/$11,116 = 0.0924 = 9.2% Operating Expenses growth (from income statement) (2009): ($10,088 -- $10,574)/$10,574 = -0.0459 = --4.6% Based on these figures, we can conclude that the growth in net income of 364% was mainly driven by a 16.1% growth in revenues. Although, operating expenses also grew during this period by 9.2% and affected the bottom line(profits), the increased in revenues offset the rise in costs by a greater margin in relative terms. If we evaluate Southwests individual expenses, we can conclude that the rise in costs is mainly attributed to a rise in fuel and oil expenses from 2009 to 2010 of $576 million. This represents a rise of 18.9% in 2010. This can be further confirms with common--size figures. In 2009, fuel and oil expenses represented 30.2% of total operating expenses and in 2010 32.6% of total operating expenses. That said, other than other fees and other rentals, the rest of the operating expenses do not show a large rise from 2009 to 2010 (You may want to perform common--size analysis for these expenses as well). Common--size analysis for fuel and oil expenses 2010: $3,620/$11,116 = 32.6% 2009: $3,044/$10,088 = 30.2% 2008: $3,713/$10,574 = 35.1% Problem 2 (Whole Foods / Kroger) #1 Return on Assets = Net income / Average total assets Whole Foods = $115 / $3,297 = 3.5% Kroger = $1,181 / $21,757 = 5.4% Return on equity = Net income / Average stockholders equity Whole Foods: = 115 / $1,482 = 7.8% Kroger = $1,181 / $4,919 = 24% ROA measures the return in profits for each dollars invested in assets. In this case, Whole Foods earns about 3.5% (about 3.5 cents per dollar) for every dollar in assets and Kroger 5.4% (5.4 cents per dollar). ROE measures the return on invested capital. For every dollar that shareholders have invested in Whole Foods, the firm is returning 7.8% in profits and Kroger is returning 24%.

Analysis (you should provide a thorough discussion of your results (hint: bring example discussed in class, or your own thoughts of a given firm or industry) Kroger appears to be more profitable ROA and ROE are both higher. This is surprising because Whole Foods is a premium grocery store and accordingly should exhibit a higher ROA (not necessarily a higher ROE though because this is greatly affected by how well a firm is being managed). Why do we observe this? This is a similar pattern to what we saw during our class discussion of Walmart. If you recall, Walmart posted a significant rise in sales in 2008 due to the recent economic downturn, which in turn increased substantially Walmarts ROA in 2008. In this case, it appears that Kroger benefited from the recent economic downturn as well that began in 2007. On the other hand, the recession affected adversely Whole Foods. More specifically, it is causing high--end food buyers to substitute some purchases for more mainstream groceries such as those sold at Kroger. #2 Profit margin = Net income / Sales Whole Foods = $115 / $7,954 = 1.4% Kroger = $1,181 / $70,235 =1.7% Asset turnover = Sales / Average assets Whole Foods = $7,954 / $3,297 = 2.4 Kroger = $70,235 / $21,757 = 3.2 Kroger has a higher return on assets because its profit margin is higher and its turnover is higher. Thus, Kroger is more profitable and more efficient. However, the decomposition reveals some results that are contrary to expectations and not consistent with each grocer business model. To illustrate, you should examine how each grocer competes. Whole Food makes its money by selling higher--end grocery items. It caters to well off customers who are willing to pay a premium for its groceries. As a result, it commands higher prices. This should be reflected in higher margins. Kroger does the opposite and cannot command as higher margins; it makes most of its money on volume. Thus, Kroger should have lower margins. However, in this particular situation, the economic downturn has caused the opposite. In the case of Kroger, although sales have increased, net income has probably increased in greater proportion to sales (more favorable pricing, or lower cost of sales). This, in turn, has led to greater profit margins than Whole Foods. Given the decomposition results, we can see that grocers typically have very low Profit Margins and make their money through volume (larger sales), which in turn raises asset productivity or asset turnover. As we discussed in class, there is usually a trade--off between having high (or low) profit margins and low (or high) asset productivity. Although profit margins and asset turnover are largely affected by a firms business model, it is also influenced by the type of products a company sells, the nature of the industry in which a firm operates, and how mature the industry is. For example, in capital-intensive industries such as manufacturing, firms would hold a large asset base. As a result, they carry a low asset turnover but typically have higher profit margins. On the other hand, grocers (as well as retailers, wholesales, information technology firms, etc.) hold fewer fixed assets and maintain higher asset turnover. However, due to greater competition they maintain lower profit margins. Problem 3 solution (Oracle) Answer 1 2008: $5,127 million + $303 million = $5,430 million 2007: $4,074 million + $306 million = $4,380 million Note: the 303 comes from the side of trade recivables on the problem it says net allowances. This is where its coming from. Answer 2 2008: $5,430 million / $47,268 million =11.5% 2007: $4,380 million / $34,572 million =12.7% The company is holding a smaller proportion of its total assets as accounts receivable despite the fact that the dollar amount of receivables actually increased in 2008. Answer 3 2008: $303 million / $5,430 million = 5.6% 2007: $306 million / $4,380 million = 7.0% The company has reduced both the dollar amount and the relative size of the allowance. As discussed in class, this could be a potential red flag that a firm is using the reserve to manage earnings. However, in this case, this does not proved to be the case (see answer below). Oracle has improved the quality of the receivables from 2007 to 2008. Notice that receivables as a percentage of total assets had decreased and the amount of the reserve has not increased either. This is especially impressive given that the economy weakened in 2008. To prove further that receivables management has improved you can also calculate the Receivables Turnover (note: no information is provided for gross receivables for year 2006 to calculate the average for 2007, but you could still use 2007 figures). For 2008 A/R turnover 4.13 and for 2007 is 4.11 (use gross 2007 receivables in the denominator as opposed to the average). Essay question solution Question 1-- solution Managers must estimate the allowance for doubtful accounts on the financial statements. Thus, to a large extent, the amount and timing of the allowances are at the discretion of management. Though a companys auditors must approve the reasonableness of the allowance from uncollectible accounts, they do not possess the inside knowledge of management and are therefore at an information disadvantage in determining the accuracy of allowance estimates. As a result, management can use the estimates to shift income from one year to another. If management underestimates the provision, expense is reduced in the current year, which increases current income. In the future when write--offs do occur which had not been accounted for earlier, the future provision must be increased, thus reducing income in that future period. Hence, income has been shifted from the future into the current period. On the other hand, if management overestimates the bad debt provision income is shifted from the current year to future periods since more bad debt expense is recognized in the current period.Why do managers do this? As said, one reason is that they seek to meet certain earnings targets that managers might not otherwise meet. We discussed several motives (or incentives) for meeting earnings targets. Chief among them is to prevent a large drop in the price of a firm stock for not meeting earnings expectations (for example, we saw how Google stock price dropped 8% in one day for not meeting earnings by just a few cents). Other motives relate to management compensation. Usually, part of their compensation is tied to meeting earnings targets. Also, managers want to avoid defaulting on other obligations. On the other hand, companies may overestimate the provision for bad debt in order to create what is referred as a cookie jar reserve to use current income to offset tougher times in the future. Or, companies may opt to take a big bath by using an overestimated allowance for uncollected accounts. If you recall, we refer to this as throwing everything into the kitchen zinc as refer to expenses. This reserve can, then, be used to increase future earnings. Carr Sheet: Financial Statements: (1) Balance Sheet: A = L + E. Point in time. Permanent account because it carries over: year edning balance = year beginning balance; (2) Income Sheet: Period of Time. Net Income (profit to owners for a period of time) = Revenue - Expenses. Gross Profit (gross margin) = revenue -Cost of Goods Sold. Revenue - COGS = Net Income (or loss); (3) Statement of Cashflow: sources and uses of cash from Operating, investing, and financing activities over a period of time. Profitability is reflected from positive operating income; (4) Statement of Equity: Reports on changes in the accounts that makeup equity: contributed captial, earned capital (retained earnings). amounts of capital accounts (contributed vs. reinvestment of profits)

How are the four FS linked? (a) The IS and BS are linked via retained earnings (Beginning Retained Earnings + NI (or loss) - Dividends =Ending Retained Earnings) on SSE. (b) Retained Earnings, contributed capital, and other equity balances appear on SSE and BS. SoCF is linked to IS as NI is a component of operating cash flow. SoCF is linked to the BS as the change in BS cash reflects net cash inflow/outflows for a period of time. Add/diss add to Owner Financing? A: No interest, no dividend, owe nothing to nobody, no risk of default. DA: More people have control in decesion making. Investors expect a dividend at some point. Add/diss add to non-owner financing large cash flow. Just have to pay interest, control, no dividend. DA: debt, risk of default. Book Value v. Market Value: BV = outstanding share x market price. MV reports assets at historical value, goodwill, brand recgonition, intellectual property, human capital = intangible assets (BS estimation). Permanent accounts: represent balance sheet accounts; referred as permanaent because they carry over from one period to the next. Nomonial (temp) account, represent revenues and expenses; temporary because they have to be closed out at the end of each period. Cash Accounting: cash is paid or received before expenses/revenues are recognized (prepaid expenses and Unearned revenues) Accruals Accounting: is non-cash transactions, such as the recognition of revenues when earned, or recording expenses when incurred (even if no payment is made) Accured expense, Accured Revenues. Under accural accounting there is more liberty in reporting. Generally, report when title has passed or the amount has been realized. Issues: MGMT discretion, P-steak. Percentage change (growth ratios)= (this year's result- last year result)/ Last year's results = % Change Common Sixing-expresses individual components of financial statements as percentage of single item--comparison. Horizontal analysis--examine data across time and detect trends or changes in company performance 2 or more years. Verticalcompares different size firms. What is earnings management? Use of accounting discretion (accruals) to distort reported earnings. "Big Bath" up and down. Low NI and High NI to achieve personal incentives (meeto or beat analysts forecasts, avoid reporting losses, accelerate recog. Of revenues, higher pay). Revenue Recognize Criteria (PER GAPP). Earned (delivery of goods) title passes; its' realizable (persuasive evidence of customer payment (A/R); FASB Revenue recognition policy may differ to SEC Criteria. Unearned Revenue: No performance = liability. Percentage of completion: liability to recognized. Profitable? Look at NI and a firm's operating income. NI includes transitory or nonrecurring intem; lookat profits form core operating activities. Look at ROE and ROA and solvenc/Liquidtyy ratios. Also look at income shifts in profitability from period to period and which factors (expenses or revenues, or both led t othe change. Profitability Ratio--Measure the ability to generate income. ROI = Profits / Level of Investment or ROE, which is how much shareholders' earn on their investment. The ROE derived from operating activities is measured with ROA. ROA measures how effective a firm employed its assets to genterate profits (a higher ration is always preferable). ROA shows effective management by generating capital off of assets and not by financing. Disaggregation of ROA: Profit Margin and Asset Turnover. How you are making return on asset. Great PM, AT, or both. Shows that firm stay true to business model, e.g., walmart, target, cost co. HI PM= low AT. High AT= low PM. PM: is operating profit a firm earns from each dollar of sales. Margines are affected by gross profit (sales- cost of sales), level of operating expenses, firm's ability to control costs. AT (will be a number): how productive are a firm's assets in generating sales (a higher ratio is preferable). Average total asset = last year plus this year's total asset divided by 2. ROA can help answer: was the company profitable, can it pay its debts, is it staying true to its business model. Firms with high proportion of long-term fixed assets have lower AT but may have higher PM (oil, tobacco, hotels). Firms with fewer fixed assets achieve higher AT, but have lower Profit margins (food, wholesale, retail). Liquidity Ratios is a measure of a firm's ability to meet its short-term debt. Current ration focuses on net working capital. Greather than 1 implies positivie working capital (liquidity to meet obligains due within a year). Less than 1 indicate that firm cannot meet obligations due within one year . . .not bad--walmart. Quick ration: is a narrower scope of quick ration. Retail-inventory selling would be debt if less than 1. Manufacturing should be over or close to 1. Solvency Rations: Ability to meet its long-term debt obligations, interest and principal. Debt-to-equity: measures the degree to which a firm utilized debt to acquire assets. A lower ratio is preferable; more solvency & less risk. Also shows that you are positively utilizing owner financing. Time Interest Earned: Measuresthe relation of interest expense t oincome or the abilit to pay interest. A higher ration is preferable; less risk of default. Times Interest Earned (cash basis): measures the ability to pay interest using cash flows as opposed to earnings. A higher ratio is preferable; less risk of repayment. Sotckholders Ration: measures the degree of returns and cash payouts to investors. Dividend Payout Ratio: indicatesthe percentage of earnings returned to stockholders in the form of cash dividends. A higher ration is better for investors. Dividend Yield: The percentage of cash dividend return to invesotrs relative to the stock price (equivalent to interest yield). A higher ratio the better for investors. Earnings per share: represent the amount of earnings attributed to each share of common stock. Firm has income (or losses) from discontinued operations, or extraordianary items, the effects on EPS must be disclosed separately. P/E ratio: measures the relationshp between the earnings of the corporation and the current market price. e.g., walmart = 52/4.7 = 11.06 (selling at 11 times its current earnings. P/E is a good indicator of the future earning power of a company. High P/E = high stock to reflect high future earnings . . . same for low. Established firms have lower P/E ratio becasue there is less room to grow in a mature market. Price/Earnings to Growth Ratio: determines stock value while taking into account earnings growth. Accounting for R &D: GAPP R & D-not on any statement until technoligically feasible, then on IS. Not on BS because it is not an asset w/a future economic value. Exception: software or externally acquired. Recording R & D can justify a lower NI and it will eventually become an asset. Restructuring Expenses: Reported as a separate expense item in the IS or foot note. Recognized as an expense in the IS at the date of announcemnt. The stock will probably go up because there will be better management . . ".trimming the fat." Abused by managers to improve future income, overestimate amount of restructuring charges, management controls timing of recognition. Transitory Items: Discontinued operations: NI (loss) from business segmentsthat have been or will be sold. Extraordinary items: gains or losses from events that are both unusal and infrequent. Both must be reported in the IS net of tax. Impact of Bad Debt on FS: IS: Income will change by the amount of bad debt expense based on the estimate of the bad debt allowance. BS: A higher bad debt expense results in a higher allowance for uncollectible accounts, which reduces assets (A/R). A higher bad debt expense reduces NI, which reduces retained earnings.

Income Shifting. A firm may increase current period income by deliberately underestimating the allowance of uncollectible accounts and bad debt expense. E.g., Bad debt underestimated--lower bad debt expensed--lower total operating expenses-higher reported NI. A firm may want to report lower income in the current period and deliberately overestimate the allowance for bad debt in the current period. Bad debt overestimated--higher bad debt expense--higher total operating expenses--lower reported NI. CH 6 Notes. GAPP requires estimate dollar of uncollectible accounts. Bad debts expense; effect is lower NI. How to asses adequacy of bad debt allowance? Compare gross A/R to competitors. Economic environemnt changed, less write-offs, improved is credit collection. Income Shifting: Management controls amount and timing. To report lower bad debt now to increae current income is borrowing income from future periods. Acccounts Receivable Turnover: how many times receivables have turned (been collected. Asset turnover is an important financial performance measure used by managers for internal goals and outside evaluation of the company. Hight performing firms must be effective (control margins and operating expenses) and efficient (most of of its assets). An increase in receivables ties up cash. Slow-turning carries the risk of loss.

You might also like

- Accounting Cheat SheetDocument7 pagesAccounting Cheat Sheetopty100% (14)

- CheatSheet (Finance)Document1 pageCheatSheet (Finance)Guan Yu Lim100% (3)

- Accounting Cheat SheetDocument2 pagesAccounting Cheat Sheetanoushes1100% (2)

- Financial Statements Demystified: A Self-Teaching Guide: A Self-teaching GuideFrom EverandFinancial Statements Demystified: A Self-Teaching Guide: A Self-teaching GuideRating: 3 out of 5 stars3/5 (1)

- Federal Income Tax Outline Formula6Document2 pagesFederal Income Tax Outline Formula6Greg Beal100% (1)

- Dividend Discount and Residual Income Models ExplainedDocument2 pagesDividend Discount and Residual Income Models ExplainedMohammad DaulehNo ratings yet

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetZee Drake100% (5)

- Classification of AccountsDocument3 pagesClassification of AccountsSaurav Aradhana100% (1)

- Ratios Used in Analysis of Financial StatementsDocument2 pagesRatios Used in Analysis of Financial StatementsMary100% (4)

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- ACCT 101 Cheat SheetDocument1 pageACCT 101 Cheat SheetAndrea NingNo ratings yet

- Cheat Sheet Final - FMVDocument3 pagesCheat Sheet Final - FMVhanifakih100% (2)

- Inbm 110 - Accounts Study Sheet: Chapter 1 & 2Document5 pagesInbm 110 - Accounts Study Sheet: Chapter 1 & 2Laura TaiNo ratings yet

- Kelly's Finance Cheat Sheet V6Document2 pagesKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- Account ClassificationDocument2 pagesAccount ClassificationMary96% (23)

- Cheat Sheet Exam 1Document1 pageCheat Sheet Exam 1Shashi Gavini Keil100% (2)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetToby Arriaga100% (2)

- Target Costing & Variance AnalysisDocument1 pageTarget Costing & Variance AnalysispinkrocketNo ratings yet

- Asset Accounts With Normal BalancesDocument2 pagesAsset Accounts With Normal BalancesMary100% (2)

- Secured Transactions - ZinnickerDocument97 pagesSecured Transactions - ZinnickerGreg BealNo ratings yet

- 5 Components COSO Framework ExplainedDocument6 pages5 Components COSO Framework ExplainedGabrielNo ratings yet

- ACC1002X Cheat Sheet 2Document1 pageACC1002X Cheat Sheet 2jieboNo ratings yet

- Basics Accounting PrinciplesDocument22 pagesBasics Accounting PrincipleshsaherwanNo ratings yet

- CheatDocument1 pageCheatIshmo KueedNo ratings yet

- Cheat Sheet For AccountingDocument4 pagesCheat Sheet For AccountingshihuiNo ratings yet

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat Sheetazulceleste0_0100% (1)

- Cheat Sheet For Financial AccountingDocument1 pageCheat Sheet For Financial Accountingmikewu101No ratings yet

- Basic Everyday Journal EntriesDocument2 pagesBasic Everyday Journal EntriesMary73% (15)

- Basics of AccountingDocument20 pagesBasics of AccountingvirtualNo ratings yet

- Class of AccountsDocument5 pagesClass of AccountssalynnaNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Financial Accounting: Tools For Business Decision-Making, Third Canadian EditionDocument6 pagesFinancial Accounting: Tools For Business Decision-Making, Third Canadian Editionapi-19743565100% (1)

- Sample TrustDocument8 pagesSample TrustGreg BealNo ratings yet

- Bookkeeping Checklist - Rayvat AccountingDocument1 pageBookkeeping Checklist - Rayvat AccountingRayvat AccountingNo ratings yet

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Microeconomics Formulas & ConceptsDocument20 pagesMicroeconomics Formulas & Conceptsgavka100% (1)

- Cheat Sheet - AccountingDocument2 pagesCheat Sheet - AccountingJeffery KaoNo ratings yet

- Ultimate Accounting Guide SheetDocument1 pageUltimate Accounting Guide SheetMD. Monzurul Karim Shanchay67% (6)

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsMary100% (4)

- Adjusting Journal EntriesDocument1 pageAdjusting Journal EntriesMary100% (3)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetHectorNo ratings yet

- Accounting Acquaintance: An Introduction to Accounting: Theory and PracticeFrom EverandAccounting Acquaintance: An Introduction to Accounting: Theory and PracticeNo ratings yet

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Instant Software RichesDocument22 pagesInstant Software RichesGene JohnsonNo ratings yet

- SAP HANA ControllingDocument52 pagesSAP HANA ControllingJuan Diego González100% (1)

- Closing Journal EntriesDocument1 pageClosing Journal EntriesMary91% (11)

- Journal Entries For Long Lived AssetsDocument2 pagesJournal Entries For Long Lived AssetsMary100% (20)

- BVA CheatsheetDocument3 pagesBVA CheatsheetMina ChangNo ratings yet

- Key financial reporting explainedDocument11 pagesKey financial reporting explainedhemanth727100% (1)

- Assignment 2Document8 pagesAssignment 2Anonymous qbVaMYIIZ100% (4)

- Week 5 - Business FinanceDocument3 pagesWeek 5 - Business FinanceAries Gonzales Caragan100% (2)

- Midterm Cheat SheetDocument4 pagesMidterm Cheat SheetvikasNo ratings yet

- Financial Performance Analysis of Force MotorsDocument89 pagesFinancial Performance Analysis of Force Motorsshaaiily100% (2)

- Accounting Cheat Sheet FinalsDocument5 pagesAccounting Cheat Sheet FinalsRahel CharikarNo ratings yet

- Gross Pay CalculationsDocument2 pagesGross Pay CalculationsMary100% (3)

- Marketing Final Exam NotesDocument4 pagesMarketing Final Exam NotesGreg BealNo ratings yet

- Session 12 - Week 2Document14 pagesSession 12 - Week 2Greg BealNo ratings yet

- Lincoln's Notes on Law LecturesDocument42 pagesLincoln's Notes on Law LecturesGreg BealNo ratings yet

- U.S. v. Angela Johnson, 354 F. Supp. 2d. 939 (N.D. Iowa 2005)Document3 pagesU.S. v. Angela Johnson, 354 F. Supp. 2d. 939 (N.D. Iowa 2005)Greg BealNo ratings yet

- 2010 Tech Grade RangesDocument1 page2010 Tech Grade RangesGreg BealNo ratings yet

- Tax RemediesDocument19 pagesTax RemediesRocky MarcianoNo ratings yet

- Economics Chapter 4-9Document51 pagesEconomics Chapter 4-9Warwick PangilinanNo ratings yet

- Managing A Quarry in Nigeria - A Case StudyDocument20 pagesManaging A Quarry in Nigeria - A Case Studysfsdffeds100% (3)

- FP Report 2012Document180 pagesFP Report 2012CY LiuNo ratings yet

- Developing Customer Satisfaction - Value, and LoyaltyDocument17 pagesDeveloping Customer Satisfaction - Value, and LoyaltyDeepak AhujaNo ratings yet

- A985329123 - 19289 - 15 - 2017 - Profit & Loss Set 1Document4 pagesA985329123 - 19289 - 15 - 2017 - Profit & Loss Set 1Avinash SinghNo ratings yet

- ZTBL ProjectDocument41 pagesZTBL Projectshahab_8585100% (1)

- Balance Sheet and P&L of CiplaDocument2 pagesBalance Sheet and P&L of CiplaPratik AhluwaliaNo ratings yet

- Translation of Financial StatementsDocument3 pagesTranslation of Financial StatementsjroflcopterNo ratings yet

- Hard & Soft HRDocument17 pagesHard & Soft HRIfeanyi MbahNo ratings yet

- Unethical Accounting Practices Not Only Cause Instability in The MarketDocument12 pagesUnethical Accounting Practices Not Only Cause Instability in The MarketGada AbdulcaderNo ratings yet

- ADANI PowerDocument6 pagesADANI Powerkitrak89No ratings yet

- Day in The Life of A School CanteenDocument16 pagesDay in The Life of A School Canteenclaire juarezNo ratings yet

- 16 - Analysis of Pomelo VC in Ben Tre Province-EnGDocument28 pages16 - Analysis of Pomelo VC in Ben Tre Province-EnGViet Suu NguyenNo ratings yet

- VIVEKANANDHA EDUCATIONAL INSTITUTIONS VERBAL ABILITY TESTDocument5 pagesVIVEKANANDHA EDUCATIONAL INSTITUTIONS VERBAL ABILITY TESTmagisrajNo ratings yet

- Thesis November Week 4Document4 pagesThesis November Week 4api-278033882No ratings yet

- Financial Analysis On Tesco 2012Document25 pagesFinancial Analysis On Tesco 2012AbigailLim SieEngNo ratings yet

- Square Pharmaceuticals LTDDocument32 pagesSquare Pharmaceuticals LTDMohiuddin6950% (2)

- Guide Financial Analysis Cultural SectorDocument25 pagesGuide Financial Analysis Cultural Sectorzulejunior87100% (1)

- ACIIA July NewsletterDocument14 pagesACIIA July NewsletterAdedeji AjadiNo ratings yet

- Natureview Farm Case Revenue Growth StrategyDocument3 pagesNatureview Farm Case Revenue Growth StrategyRachit PradhanNo ratings yet

- "Automobile Maintenance Workstation (Amw) " Business Development PlanDocument54 pages"Automobile Maintenance Workstation (Amw) " Business Development PlankalisuryNo ratings yet

- Arithmetic RevisionDocument4 pagesArithmetic RevisionSushobhan SanyalNo ratings yet

- Finance: What Is Finance? MeaningDocument4 pagesFinance: What Is Finance? MeaningnadiaabrarNo ratings yet