Professional Documents

Culture Documents

Budgeting Essentials For Students

Uploaded by

Casey FioravanteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgeting Essentials For Students

Uploaded by

Casey FioravanteCopyright:

Available Formats

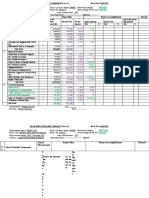

10%30%forSelectedWants: 10%20%forSavings/InvestmentGoals: Emergencyfundinfederallyinsured moneymarketaccount(onemonthsof expenses) Retirementcontributions(IRAs,Roth IRAs,401(k),403(b),etc.

(k),403(b),etc.) Collegesavingsaccounts Paymentsinexcessofmonthly minimumstolowerhighinterestdebt Irregularexpenses(auto,medical, homerepair/maintenance) Spareofthemoment/justbecause Eachindividualcanandshoulddecidehowthey wishtodivideuptheirMonthlyCommittedEx pensesandMonthlySelectedWants.Youmust decidehowtoallocateyouravailablefunds (incomelesstotaldeductions&expensesdue theschoolplusbooks)bypercentagesandthen workoutthedetails.Itisvitallyimportantthat youborrowless,atthelowestpossiblerates Cable/Satellite/Internet Nonessentialfoodpurchases Carpayment&relatedexpenses* Dineout Childcare/Babysitters Personal CellPhone Entertainment/Recreation Presents/Gifts Vacation/Travel Memberships/Subscriptions Other

andbesttermspayingonlyfor"basiceducation andlivingnecessities,"notrunadeficitandhave atleasta$500cushionasanemergencyfund. Thekeytostudentfinancialsuccessandgoal achievementisbeingfinanciallyinformedand responsiblewithanaffordabledebtandmoney managementstrategyinplacewhichprovidesfor simultaneousdebtrepaymentandbuildingfinan cialassetsthroughsavingandinvesting.Main tainingandstrengtheningcreditstatusisalsoa priority. Borrowingtoomuch,whichisfartooeasytodo viafinancialaidandcreditcards,caneasilyturn anexcellentinvestmentlikeyoureducationinto anunmanageableoverleveraged(notenoughin cometomeetdebtpayments)"bad"investment thatwillconsumeexcessiveamountsoffuture incomethatcouldbebetterusedformorepro ductivepurposes. FreeBudgetingToolsareavailableat www.aptaloanconsolidation.com/tools/ YoumayalsocontacttheAPTAEndorsedEduca tionLoanProgramc/oMEDebtSolutionsbyemail atinfo@medebtsolutions.comorvisit www.aptaloanconsolidation.com. BesuretoreferenceAPTA.

APTA

Endorsed Education Loan Program

Budgeting Essentials for Students

Thecontentofthispublicationareproprietaryand areforinformationaluseonlyandaresubjectto changewithoutnotice.TheAPTAEndorsedEdu cationLoanProgram,APTA,EASGroup,LLC/MEDebt Solutionsnortheauthors/editorsassumenore sponsibilityoranyliabilitiesforanyerrors,omis sion,orinaccuracies.

Copyright APTA - Endorsed Education Loan Program and EAS Group, LLC/MEDebt Solutions. October 2008

APTA - Endorsed Education Loan Program Budgeting Essentials for Students

futureliving/lifestyleimplicationsandadjust mentsnecessitatedbyyourborrowing.Be suretoconsideryourgoalsandtimeline,pro jectedfutureincomeandexpensesandbeing suretoincludepayingyourselfsav ing/investing.

and/orthereductionandeliminationofanydebt startingwiththehighestinterestdebt.Studentscan usethefollowingBasicBudgetGoalsBreakdown templateandrecommendationstocreateabudget.

BasicBudgetGoalsBreakdownforStudents

Income/MoneyIn: FinancialAid PersonalCash/Savings/Investments Scholarships AllOtherSources Expenses/MoneyOut: Tuition,feesandrelateddirecteducationcost duetheschoolplusbooks&supplies. Withtheremainingfundsafterpayingtuition, feesandrelateddirecteducationcostduethe schoolallocate: 60%70%forMustHaveCommittedExpenses: Rent/Mortgage InsurancePremiums Utilities Carpayment&relatedexpenses* Basicfoodneeds Taxes(property&other) Studentloanpaymentsthatcannotbe deferred/postponed Childcare Childsupportoralimonypayments Ongoingcontractualobligations(i.e.credit cards,medicalbills)

BudgetingEssentials forStudents

Thefirstandmostimportantstepinbudget ingisthestatementofyourgoals.Whatdo youwishtoaccomplishandwhen.Your budget(moneyin/moneyout)planwillbe mosteffectivewhenformulatedasearlyas possible,evenbeforestartingschool.You wanttoknowacommitmenttoborrowing onlyforyourdirecteducationexpensesand basicminimumstudentlivingcostsothat youareabletokeepasmuchofyourfuture salaryaspossible.Onaregularbasis,atleast twiceayear,preferablyquarterlyandeven bettermonthly,reviewyourbudget.Com pareyouractualincomeandexpenseswith thoseyouhadprojectedandmakenecessary adjustment.Preferablyattheendofthe budgetedschoolyearyouwanttohavesome thingleftoverwith$500foremergenciesor atleastbreakeven.

Budgetingasastudentdependentonstudent loansourcesissomewhatdifferentthan budgetingasapracticingphysicaltherapist earningasalary.Studentsdependentupon loansshouldfirstidentifyallsourcesoffunds availabletopayfortheireducation.Next youshoulddeducttuition,feesandrelated directeducationcostduetheinstitutionplus booksfromthecheapestsource.Theremain ingbalanceiswhatyouhavelefttopayforall remainingexpenses.Eachschoolpublishesa schoolbudgetwhichprovidesageneral guidelineforstudentscostofeducationand living.Everystudentmustdecidehowmuchof theirmoneytheywishtospendoneachcost itemsuchashousing,transportationandper sonalexpenses,butunderstandthatverybad

badthingswillhappenthatcaneffectyour financesforthenext2030ormoreyearsif youallowyourexpensestoexceedyouravail abledollars.

Asyoutakeonnewborrowing,estimateand compareyourmonthlypaymentsforalldebt toprojectedpracticeincome.Bydoingsoyou areprepared,informedandunderstandthe Asastudentyourfirstsavvyfinancialmove shouldbetocreativelyreduceyourlivingex pensesby10percentwhichwillbeappliedto

*Carpaymentsandrelatedexpensesisa"MustHave"expense onlyifpublic/alternativetransportationisnotaviable,lower cost,reasonable,safeoption.Otherwise,itisa"SelectedWant." Automobileownershipforthepurposeofstatus,convenienceor perceivedfreedomisnotconsidereda"MustHaveCommitted Expense"forstudents.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Cranial Electrotherapy Stimulator (C.E.S.) Earlobe Stimulator, Pocket-Transportable, 9VDocument1 pageCranial Electrotherapy Stimulator (C.E.S.) Earlobe Stimulator, Pocket-Transportable, 9VemiroNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Presentation - Factors Affecting ClimateDocument16 pagesPresentation - Factors Affecting ClimateAltoverosDihsarlaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Quarterly Progress Report FormatDocument7 pagesQuarterly Progress Report FormatDegnesh AssefaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Week 1 Seismic WavesDocument30 pagesWeek 1 Seismic WavesvriannaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- TS802 - Support StandardDocument68 pagesTS802 - Support StandardCassy AbulenciaNo ratings yet

- Tracheo Esophageal FistulaDocument6 pagesTracheo Esophageal Fistulablast2111No ratings yet

- 2022.08.09 Rickenbacker ComprehensiveDocument180 pages2022.08.09 Rickenbacker ComprehensiveTony WintonNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Community Medicine DissertationDocument7 pagesCommunity Medicine DissertationCollegePaperGhostWriterSterlingHeights100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- API 650 10th Edition ErrataDocument6 pagesAPI 650 10th Edition ErrataJosé Ramón GutierrezNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Kebersihan, Fungsi Sanitasi Dan Drainase - BAHASA INGGRIS - VII - Semester IDocument5 pagesKebersihan, Fungsi Sanitasi Dan Drainase - BAHASA INGGRIS - VII - Semester IRiska AyuNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Basic Operation Electrical - Total - Eng - Prot PDFDocument439 pagesBasic Operation Electrical - Total - Eng - Prot PDFdidik setiawan100% (2)

- 2008 NOHC - JPHDSupplementDocument62 pages2008 NOHC - JPHDSupplementEliza DNNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Data Sheet FC SIDocument2 pagesData Sheet FC SIAndrea AtzeniNo ratings yet

- II092 - Horiz & Vert ULSs With Serial InputsDocument4 pagesII092 - Horiz & Vert ULSs With Serial InputsJibjab7No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Sports MedicineDocument2 pagesSports MedicineShelby HooklynNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Snap Bore Ring PDFDocument8 pagesSnap Bore Ring PDFlaaliNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- UIP ResumeDocument1 pageUIP ResumeannabellauwinezaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Kern County Sues Governor Gavin NewsomDocument3 pagesKern County Sues Governor Gavin NewsomAnthony Wright100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Recommendation On The Acquisation of VitasoyDocument8 pagesRecommendation On The Acquisation of Vitasoyapi-237162505No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Effect of Moisture Content On The Extraction Rate of Coffee Oil From Spent Coffee Grounds Using Norflurane As SolventDocument8 pagesEffect of Moisture Content On The Extraction Rate of Coffee Oil From Spent Coffee Grounds Using Norflurane As SolventMega MustikaningrumNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- W2 - Fundementals of SepDocument36 pagesW2 - Fundementals of Sephairen jegerNo ratings yet

- AQ-101 Arc Flash ProtectionDocument4 pagesAQ-101 Arc Flash ProtectionYvesNo ratings yet

- PowderCoatingResins ProductGuide 0Document20 pagesPowderCoatingResins ProductGuide 0zizitroNo ratings yet

- Updated2021.KEBOS GR11-2KVA 1800W Online Rack Mount UPS DatasheetDocument2 pagesUpdated2021.KEBOS GR11-2KVA 1800W Online Rack Mount UPS DatasheetRicardo HolleroNo ratings yet

- UM-1D User ManualDocument30 pagesUM-1D User ManualAhmedBalaoutaNo ratings yet

- ScienceDocument17 pagesScienceTambong HailyNo ratings yet

- Monitoring AlkesDocument41 pagesMonitoring AlkesEndangMiryaningAstutiNo ratings yet

- Technical Publication: Direction 2296441-100 Revision 06 Ge Medical Systems Lightspeed 3.X - Schematics and BoardsDocument380 pagesTechnical Publication: Direction 2296441-100 Revision 06 Ge Medical Systems Lightspeed 3.X - Schematics and BoardsJairo Manzaneda100% (2)

- Laws and Regulation Related To FoodDocument33 pagesLaws and Regulation Related To FoodDr. Satish JangraNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)