Professional Documents

Culture Documents

Cement Marketing in India: Challenges & Opportunities: SRM University, Chennai

Uploaded by

Akram JavedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cement Marketing in India: Challenges & Opportunities: SRM University, Chennai

Uploaded by

Akram JavedCopyright:

Available Formats

International Conference on Technology and Business Management

March 26-28. 2012

Cement Marketing in India: Challenges & Opportunities

Anil Kumar Pillai Shanthi Venkatesh anilpills@yahoo.com shan_venky@yahoo.com SRM University, Chennai 1. Introduction

Indias infrastructure will require investment of about USD 1 trillion as per 12th Five Year Plan (2012-17). Economic growth and cement consumption are directly proportional. The factors that could trigger cement sales are infrastructure demand especially for government projects, higher housing demand in rural and semi urban areas. Higher realization and rising dispatches are considered to be conducive for higher profits for the cement industry. All efforts are targeted to grow sales and reach the premium segment in prices. The major challenge faced by the Indian Cement industry are higher raw material prices specially the price of coal, gypsum and flyash. Whenever there is a lackluster demand capacity utilisation in the Indian Cement industry goes down impacting profitability of the firms. Therefore effective marketing for a commodity like cement would ultimately help in scaling up capacity utilisation, increasing dispatches and increasing realization. Cement may be considered to be in the maturity phase of the Product Life Cycle and hence building brand preference is vital. This paper therefore illustrates the fact that a commodity like cement could be marketed effectively. Principles of marketing could be deployed effectively for gaining profits. Creation of differentiation in product or service in cement and its importance by the customers will determine whether the brand can attain premium in price.

2. Indian Cement Industry

An Overview The capacity of the Indian Cement industry as on 31 March 2011 is 234.30 Mn. T. The number of large Plants in India as on 31 March 2011 is 139. In addition to the large plants there are about 365 mini cement plants. Large cement plants, 139 in number, contribute to an installed capacity of 234 million tones per annum while 365 mini plants contribute to an installed capacity of 11.10 million tones per annum (Source: Website of Cement Manufacturers Association www.cmaindia.org). Capacity in the Indian Cement Industry is being added at an accelerated pace. Indias cement manufacturing capacity has already reached 323 million tonnes in the terminal year of the XI plan surpassing the target of 298 million tonnes fixed for the five year period up to March 31, 2012. (Source: Business Line dated January 8th 2012)

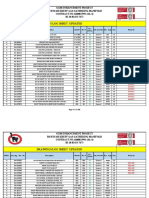

Table 1 Cement Capacity, Production and Consumption (April 2010 March 2011) Region Northern Region Eastern Region Southern Region Western Region Central Region Cement Capacity (Million Tones) 51.56 26.73 94.88 30.52 30.61 Cement Production (Million Tones) 38.14 22.41 59.94 21.70 26.24 Cement Consumption (Million Tones) 27.23 28.07 49.95 31.34 27.38

Source Executive Summary Cement Industry April 2011 CMA (Page 45 -50, 17-18, vii) Table 2 Distribution of Cement: Southern Region Installed Capacity Andhra Pradesh Tamil Nadu Karnataka Kerala 45.56 34.38 14.32 0.62 Production 28.97 20.62 9.77 0.58 Consumption 13.91 18.01 10.84 7.19

TOTAL 94.88 59.94 49.95 Source Executive Summary Cement Industry April 2011 CMA (Page 45 -50, 17-18, vii)

480

International Conference on Technology and Business Management

March 26-28. 2012

Referring to Table 1, we find that Southern region leads in terms of installed capacity, production and consumption of cement. The uneven distribution of cement Plants across various regions is dependent on the availability of Limestone, a key raw material for manufacture of cement. Cement Production and Cement Consumption, in turn are dependent on the demand for cement. The consumption of cement amongst South Indian states as shown in Table 2 during April 2010 March 2011 was the highest in Tamil Nadu. Considering the unequal distribution of cement plants in terms of installed capacity - regionwise and statewise and cement being a bulk commodity, logistics is the key challenge the industry is facing in terms of transportation of cement from the producing areas to the consuming areas. The first priority for a cement manufacturer, would, therefore be to sell most of the cement in areas near the Plant where contribution to profit is high. Even if it is sold in areas away from the Plant prices should be so high that the contribution to profit justifies the sales in far off areas. Few of the major features of the Indian Cement industry are: It involves high capital costs and long gestation periods. Supply of coal power and access to limestone, which are controlled by the government acts as a significant barrier. To tide over the power crisis manufacturers have gone in for captive power plants but volatility of coal prices continues to pose a challenge. Additional capacities introduced in the recent past has further intensified supplies and demand not picking up as expected, the degree of competition has increased. Sales volume is dependent primarily on the dealer network as availability and reach are considered to be the main factors. Product Variety in Cement Production of different varieties of cement for the year 2010 2011 (April 2010 to March 2011) as a percentage to total is as given in Table 3.

Table 3 Types of cement: Production Percentage wise Type of Cement Ordinary Portland Cement (OPC) Portland Pozzolona Cement (PPC) Portland Blast Furnace Slag Cement (PBFS) Sulphate Resistant Cement (SRC) IRS T40 Percentage to Total Production 32.26% 60.79% 6.60% 0.07%

0.24% Source Executive Summary Cement Industry April 2011, CMA (Page 50)

The type of cement that is manufactured in huge quantity is the PPC (Portland Pozzolona Cement) which accounts for about 61% of the total cement manufactured. Evolution of Indian Cement Industry

Table 4 Evolution of Indian Cement Industry Era Era of Dominant Imports Era of Struggle and Survival Era of Price Controls Era of Planning and Controls Era of Partial Decontrol Era of Total Decontrol Year 1914-1924 Remarks about Capacity, Growth, Consumption Cement consumption was around 2 million tones during this period of 10 years; 50 % was through imports. Production in the year 1914 was 10, 000 tonnes and in 1924 production was around 0.26 million tones a year against capacity of half a million tonne. Indigenous production went from 3.66 lakh tones in 1925 to 18.30 lakh tonne in 1941. Imports contributed to less than 7% of total cement consumption during 1924-1942 Production stepped up from 1.8 million tones in 1942 to 3.2 million tones in 1951. Imports dwindled to less than 2 -1/2 % of total consumption Growth in cement capacity but not at requisite pace. Capacity was 29 Mn t in 1981-82 Quantum jump in capacity and production during 1982-88. Cement became surplus from 1987 onwards.

1924-1941 1942-1951 1951-1982 1982-88

March 1989 During the end of FY 2009 capacity rose to 219 Mn tonnes onwards Source Website of Cement Manufacturers Association www.cmaindia.org

481

International Conference on Technology and Business Management

March 26-28. 2012

The table shows the broad changes, the Indian Cement industry has undergone over the years. The development is categorized into six eras. As indicated in Table 4, the industry structure changed over the years. During the year 1914- 24 most of the requirement was met through imports before indigenous production started. Subsequently Government played a major role in Planning & Control. After the industry was decontrolled the capacity grew manifold and by the end of 2009 the annual capacity was around 219 million tonnes. The selling strategy of firms and the buying behavior of customers also saw a major change. Cement from being a pure commodity dependent on price alone is being recognized as a product whose pricing and demand could be varied through various Marketing promotions. Brands started emerging after total decontrol in the year 1989 and certain brands started commanding premium due to quality perceptions. Therefore positioning of cement brands in the customers minds play a vital role.

3. Review of Literature

Referring to cement business, Francois (2007) observes that the name of the game was not differentiation and value proposition but protecting market share without triggering a price war that no one could afford. This reflects the degree of rivalry that is evident in Global Cement Industry. Levitt (1980) suggests that there is no such thing as a commodity and that all goods and services are differentiable. Creating differentiation is possible either in cement or in the services rendered during the supply of cement. Francois (2007) stresses that we no longer need to think of cement as a commodity we can protect prices without compromising sales volumes. Thomas (1982) has identified buying centres as Initiators, Users, Buyers, Gatekeepers, Deciders and Influencers. In a typical construction project decision to procure a brand is not made by a single personnel in a specific function. Hence identification of the roles played by various buying centers of cement and interaction between them should be clearly understood. Onkvisit and Shaw (1988) is of the view that branding when properly executed can be a viable solution to the problem of cut throat competition since brand names can enhance the customer perception of the value of the product. This is applicable in Cement business as there are number of brands in a particular region and the dealer and customer has a choice on preference of the brand. Yankelovich & Meer (2006) points that effective segmentation concentrates on consumer needs, attitudes and behavior which can change quickly rather than on personality traits which usually endures throughout a persons life. This explains one of the reasons as to why in a particular cement market over a period of time there is a change in market leader. Christensen et all (2005) recommends that to build brands that mean something to customers you need to attach them to products that mean something to customers and he suggests that segmenting markets should reflect how customers actually live their lives. Therefore to evaluate ranking of parameters of cement it is essential to involve all those involved in construction activities ranging from Mason, Engineer, Consultant and Owner Kotler (1977) highlights that Sales Executives think in terms of sales volume rather than profit; short run rather than long run; individual customers rather than market segment classes; field work rather than desk work, whereas Marketing Executives thinks in terms of Profit Planning, Long run trends, threats and opportunities, customer type and segment differences; good system for market analysis, planning and control. In a typical firm if achieving sales target and cost control are given undue importance then long term Marketing activities are neglected. Levitt (1983) is of the view that There need be no such thing as a commodity. Levitt (1980) lists and explains the range of possibilities that the product could take and its characteristics. According to him a product could range from Generic, Expected, Augmented to Potential Product. The fundamental, rudimentary, substantive thing is referred to as generic product; Customers minimal purchase conditions like Delivery, Terms, Support efforts, New ideas as the expected product; the augmented product as being the one that may be augmented by things the customer has never thought about; potential product as the one which might be done to attract and hold customers, budget and imagination limiting the possibilities (Levitt 1980). Whats augmented for one customer may be expected by another; whats augmented under one circumstance may be potential in another; part of whats generic in periods of short supply may be expected in periods of oversupply (Levitt 1980). Therefore a buyer who is building a house would behave differently than a Quality Control Engineer of a large infrastructure project although both would be using the same brand. Kevin et al. (2002) has categorized and explained brand differences into the following three types (i) Brand Performance associations depicts ways in which product or service attempts to meet customer functional needs (ii) Brand Imagery associations indicates reliability, durability and serviceability of the brands depicting who uses the brand and under what circumstances (iii) Consumer Insight associations which signifies that if a brand can show consumers it has insights into their problems can then make the case that it is the solution. 482

International Conference on Technology and Business Management

March 26-28. 2012

Garvin (1987) has identified eight critical dimensions of quality that can serve as a framework for strategic analysis Performance, features, Reliability, Conformance, Durability, Serviceability, Aesthetics, Perceived Quality. Quality thus is not confined to performance of cement where surpassing the required parameters of cement is taken as an indicator . Mason and Bequette (1998) states that Perceptions about how products perform on salient attributes is more vital to consumers purchase behavior than actual product attribute performance. Therefore evaluation of quality of cement on the basis of only test results without taking into account the perception of customers may not be effective. Thomas (1982) suggests that the vendors can try to focus the buyers attention on benefits not a part of his or her thinking, to de-emphasize the buyers desire for benefits against which the vendors offering stacks up poorly, to increase the buyers confidence that promised benefits will be realized, try to change what the buyer wants or which class of benefits he or she responds to most strongly. This then is possible if an effective marketing strategy is formulated giving importance to the customers insights collected by the Marketer. Bernett (1969) opines that people characteristics to identify group of consumers with homogeneous purchase behaviors have been notably unsuccessful and recommends Product segmentation. He suggests shifting measurement focus from consumer characteristics to consumer perception of products characteristics of products, both perceived as well as real properties assuming significance. Onkvisit and Shaw (1988) broadly lists the prerequisites before a commodity is transformed into a product a. quality and quantity consistency b.Possibility of a product differentiation c.degree of importance consumers place on the product attributes to be differentiated. Moon (2005) has found that by positioning or repositioning products in unexpected ways companies can change how customers mentally categorize them. Reinartz and Kumar (2002) on ways to make customer loyalty profitable is of the view that different approaches will be more suitable to different businesses depending on customer profile and the complexity of their distribution channels.

4. Challenges & Opportunities in Cement Marketing

Cement is a critical component of the major material used for concrete. Cement is generally considered to be a commodity and as long as its a fine grey powder with ability to set and harden its considered to be sufficient. Therefore there are personnel who believe that there is no scope for differentiation in cement. An analysis of cement business from the perspective of various factors affecting Marketing would help us in identifying opportunities to focus on customer requirements. Distribution of Cement Cement Plants are located close to Limestone deposits. Limestone is the major raw material for manufacture of cement and hence the proximity of Plants to the deposits. To manufacture one tonne of cement about 1.5 tonnes of Limestone is required and therefore it is logical to set up cement Plants near the Limestone deposits than near the Markets. Cement grade Limestone is located in certain areas of the country leading to concentration of Plants in what is normally referred as clusters.

Figure 1 Distribution of Cement from Plant to the Customer

483

International Conference on Technology and Business Management

March 26-28. 2012

Distributing Cement from the Plants to various areas is a challenge. The normal modes of transport are Railways, Sea and Road. Depending on the distance and quantity of cement to be transported suitable mode of transport is adopted. Say for instance road transport is preferred for shorter distance and transport by railways for longer distance becomes economical. The distribution strategy followed determines the time taken for the cement to reach from the Plant to the consumers with various intermediaries in between. Fig 1 shows the flow chart of distribution of cement to the consumers. Cement is transported in bags of 50 kg or in bulk. As shown in the figure 1 cement is dispatched from the Plant to the dealers outlets from where it is sold to retail customers. Project customers receive cement either in bulk or bags. Companies either directly dispatches cement to the customer or through dealers. The activities that are normally outsourced are the transportation and clearing and forwarding activity. However these outsourced activities needs to be monitored to ensure that cement reaches on time. Clearing and Forwarding of cement is normally followed for cement which is transported through Railways. Road transport is considered to be more reliable than Railways in terms of ensuring timely delivery. However cost considerations is a major criterion depending upon distance. Combinations of one or more of the following strategies are normally followed: The C& F agent (Clearing & Forwarding agent) can also be the dealer for the company The Company may transport cement to their major dealers by road. Most of the dealers who are close to the manufacturing facility normally receive cement by road. Some Companies appoint major dealers / distributors who would sell a huge quantity of cement of a particular brand; who in turn would deliver to the customers in the area. There are Companies who would rather prefer to distribute cement through a large network of small dealers. Distributing cement through a large network of small dealers would ensure that the cement is available in all outlets. Distribution of cement through large dealers would be through an attractive discount scheme. This is to ensure that the dealer do not give much attention to the sales of other brands. Most dealers normally deal with multiple cement brands. The disadvantage of distributing cement through large dealer would be the fact that the negotiation power for discounts /incentives would be shifted to the distributors. Any strain in the relationship between the Company and these major dealers would lead to huge loss of sale. However a large network of small dealers will encourage healthy competition between them. Whether the dealers are large or small it is recommended that Companies follow Pull strategy than Push strategy. Promotional and other marketing activities in a particular region would encourage customers to place enquiries for the brand creating a pull from the customer segment rather than the traditional technique of Push by giving maximum discount to the dealer. Cement Plants normally are situated far off from project locations and customers premises. This could delay supply of cement to customers and high inventory costs. To tide over these problems Companies have started setting up grinding units and Packing units near major Markets. Major infrastructure projects would prefer to have a direct contact with the Company and hence supply would be directly to these major projects from the Plant. There are projects which are supplied through major dealers. The advantage for the project to procure from a major dealer would be attractive credit terms and convenience in the procurement of other building materials. The first and foremost challenge would therefore be to set up a distribution network in line with the objectives of the Company. Distribution strategy followed would in turn determine segmentation, pricing, customer behavior and customer communication decisions. Market Segmentation Segmentation is categorization of buyers into suitable classes so that the Marketing programs are customized and made appropriate to each specific class of buyers. Segmentation could be based on any of the following criteria: Nature of Application of Cement: Cement is used for Large infrastructure projects, Commercial housing project, Residential projects, precast or block making works, Ready Mix Concrete units or for minor repair works Category of Construction Professional: A construction professional could be either a mason, Civil Engineer , Builder or Contractor, Consultant Rural, Semi-urban and Urban Markets: Cement could be sold in villages, suburban areas of cities and within the city limits. 484

International Conference on Technology and Business Management

March 26-28. 2012

Depending on the segmentation strategy customers who are relatively price insensitive, costly to serve or poorly served by competitors can be charged more than those who are really price sensitive, less costly to serve or well served by competitors. Price and Pricing Decisions Cement price is not uniform throughout the country and varies from region to region. Price of cement also depends on the distribution channel whether it is sent directly to the project customer or through the dealers outlets. Segmentation enables the Marketer to different market segments with separate price points rather than serve the entire market with one price point. Amongst the constituent materials of concrete consumers are generally sensitive to change in cement price. When prices of building materials increase there is a strong resentment amongst the constructional professionals when price of cement rise. Predicting change in prices of cement is difficult as supply and demand of cement in a particular region greatly influences price. Input materials that go into the manufacture of cement are mainly controlled by the government and hence there is no scope for negotiation. Continuous supply of power and coal has been a constant challenge. For manufacture of 100 tonnes of cement about 25 tonnes of coal is required. Coal which is normally imported from other countries due to its high calorific value is dependent on rupee depreciaton. Coal prices procured from government through relevant agencies are volatile. Most importantly pricing decisions has to be taken by taking into account the competitors reaction to change in cement price. Quality based on Perceptions Laboratories with necessary accreditation to test cement are few and hence the professionals judge the quality of cement based on the behavior of concrete. However concrete behavior is not entirely dependent on the quality of cement alone. Other factors like quality of other constituent materials, workmanship, after maintenance of concrete etc influence the quality of concrete. Quality perceptions vary with customer segments Masons, Contractors or Builders, Engineers, Consultant, End user, Customer like Individual House Builder. A customer based on his experience may perceive the quality of cement based on colour, setting time of concrete, erratic behavior when admixture is used, occurrence of cracks in concrete etc. Colour of cement is not a parameter in cement test report and there is no specification regarding colour of cement. Setting time of concrete may vary due to change in water content or weather variations, a particular admixture because of varying chemical composition may behave differently with a particular brand of cement. These indirect measures may not be a true indicator of quality of cement. Hence it is very important to understand the various quality perceptions of the customer from a marketing viewpoint. A marketer should not be comparing the product relative to competition but ensure that the product is of high value. A company must adequately empower the customer to achieve value. Or some customers may be unwilling to pay for more information, access or service that is needed. Creation of Differences in Product and Associated Services & Branding of Commodities When a product offers buyers nothing more than its competition the purchase decision tends to focus on price alone. An undifferentiated product does not project the unique value effect and hence works against the seller. One usual route followed by Marketers is to ensure superiority of product as compared to the competition. Understanding of consumer behavior in cement purchase, defined needs, support expected by them to make good concrete and purchase convenience helps in offering differentiated product. Although cement manufacturing in India has adopted the latest available technology, it is important to give priority to problems faced by the construction professionals. Technology alone may not be a clear differentiator. It is very important to recognize that buyers purchase more than just the physical product or service. They buy an entire package including ease of purchase, credit terms, timely delivery, complaint handling that is called the augmented product. Even when it is difficult to differentiate physical product, an augmented product can create differentiation which could be profitable.Superior augmentation of a cement brand, thus, can add substantial value in the eyes of the customer leading them to pay willingly what are often considered price premiums. A single firm could create brands catering to different customer segments based on application and price points. Other special types of cement like SRC could be supplied to niche customers based on requirement. However advantages and disadvantages of multiple brands vs. single brands needs to be recognized. Multiple brands offers benefit customized to various segments, helps in gaining more space in a cement retail counter and single brand helps in focusing a particular segment thus eliminating confusion in the mind of the customer. There are instances of single and multiple brands in the Indian Cement Industry.

485

International Conference on Technology and Business Management

March 26-28. 2012

Integrated Marketing Communication in Cement A company needs to inform the buyers and persuade them to perceive a brand favorably. To devise effective Marketing promotions it is necessary to understand customer perceptions especially those of Engineers who are considered to be the major influencers in cement buying behavior. Advertising projects the value a customer could enjoy if he buys the brand. The message communicated is the main parameter in advertising. Advertising could create awareness and hence attracts new users. Common Marketing Communication for cement are Wall Painting, hoardings, print and TV advertisements, promotional meetings. Wall paintings of various cement brands jostle for space in most of the places. The message that should be conveyed through these Marketing Communications should be integrated and convey uniform message .Other avenues of promotion includes participation in building material exhibition, Association meetings, Demonstrations, Concrete demonstrations, formation of clubs for specific customer segments. Generation of queries through the usage of web /internet is very less and could be implemented especially for the construction professionals like Engineers, Contractors and Consultants. Cement firms by virtue of being members of Cement and Concrete associations would help in building a professional image. This would help in establishing a rapport with the end customers and also keep abreast of market and technological developments in the cement and construction industry. Cement and construction firms by virtue of being the member of the same association could create a forum where discussions on various problems in concrete helps in arriving at solutions.

5. Conclusion

The success of a firm in the Indian Cement industry is dependant on the degree of integration between various functions of Marketing Distribution, Pricing, Segmentation, Differentiation and Integrated Communication Program. The above Marketing concepts relating to cement is dependent on the strategy followed by the firm and the status of the industry which could be listed as follows: Whether expansion of the Company was through greenfield projects or mergers & acquisitions Whether the Company has fragmented capacities across the country or is a strong regional player Whether the industry is on the boom bust cycle of supply demand Whether the Company is a cement company or diversified to various areas Whether other business of the Company complements the cement business for instance steel, construction, Ready Mix Concrete.

6. Scope for Further Research

The authors are of the view that a detailed study on customers perceptions of cement would help in formulation of effective Marketing strategy for a cement company. Understanding of the consumer behavior, segmentation on the basis of appropriate criteria helps in positioning of cement brands. Any marketing activity with customer at the center would contribute to the firms profitability. Research on various marketing efforts to enhance branding of commodities like cement would help companies in the industry. Further work needs to be done on the identification of right kind of Marketing Communication for the target segment.

7. References

1. 2. Business Line dated January 8, 2012. Christensen. M. Clayton; Cook, Scott and Hall, Teddy (2005), Marketing Malpractice The Cause and the Cure Harvard Business Review, December 2005. 3. Executive Summary Cement Industry CMA, April 2011 pp 45-50, 17-18, vii. 4. Francois. M. Jacques (2007), Even Commodities have Customers, Harvard Business Review, May 2007. 5. Garvin. A. David (1987), Competing on the eight dimensions of Quality, Harvard Business Review, Nov- Dec 1987. 6. http://www.equitymaster.com/research-it/sector-info/cement/cement-inputs.html browsed on 15th February 2012. 7. http://www.indianinfrastructuresummit.com/overview.htm browsed on February 11, 2012. 8. Kotler, Phlip (1977), From Sales Obsession to Marketing Effectiveness, Harvard Business Review, Nov-Dec 1977. 9. Levitt, Theodore (1980), Marketing Success through differentiation of anything, Harvard Business Review, Jan Feb 1980. 10. Levitt Tedd (1983), The Marketing Imagination. 486

International Conference on Technology and Business Management

March 26-28. 2012

11. Mason Kevin and Bequette Joyce (1998), Product experience and consumer product attribute inference accuracy, Journal of Consumer Marketing, Vol 15, No 4 pp 343 357. 12. Moon Youngme (2005), Break free from the Product Life Cycle, Harvard Business Review, May 2005 pp88-94. 13. Onkvisit, Sak and Shaw J. John (1988), The international dimension of branding: Strategic Considerations and decisions, International Marketing Review, pp 22, 23, 24. 14. Reinartz, Werner and Kumar. V (2002), The Mismanagement of Customer Loyalty, Harvard Business Review, July 2002 pp 86-94. 15. Thomas. V. Bonoma (1982), Major Sales: Who Really Does the Buying?, Harvard Business Review, May June 1982. 16. Yankelovich, Daniel and Meer, David, Rediscovering Market Segmentation Harvard Business Review, February 2006. 17. www.cmaindia.org

487

You might also like

- Roll No 8 (PGDM - Comm) - Value Chain Analysis - Ultra Tech CementsDocument8 pagesRoll No 8 (PGDM - Comm) - Value Chain Analysis - Ultra Tech CementsanuragmahendraNo ratings yet

- LNT Vs Grasim Full DossierDocument108 pagesLNT Vs Grasim Full Dossierbiswajit0% (1)

- Xerox Management Failed To See The Opportunities Afforded by Many of The Innovations at ParcDocument2 pagesXerox Management Failed To See The Opportunities Afforded by Many of The Innovations at Parcambrosialnectar50% (2)

- Cement Industry and M&A PDFDocument5 pagesCement Industry and M&A PDFSourin SauNo ratings yet

- Cement Industry in IndiaDocument19 pagesCement Industry in IndiaShobhit Chandak100% (14)

- Brand Position of Various Cement BrandsDocument92 pagesBrand Position of Various Cement Brandsvineet228767% (6)

- Project Report On Cement IndustryDocument21 pagesProject Report On Cement Industryhafiz346No ratings yet

- Swot Analysis of Ultratech Cement LimitedDocument23 pagesSwot Analysis of Ultratech Cement Limitedtarunnayak11100% (3)

- Market Structure of Indian Cement IndustryDocument7 pagesMarket Structure of Indian Cement IndustryKhushboo Rani100% (2)

- 162-Cement Industry in IndiaDocument33 pages162-Cement Industry in Indiapiyushbhatia10_28338100% (2)

- Cause & EffectDocument5 pagesCause & EffectKit Champ50% (2)

- Malabar Cements Internship Report Malabar Cements Internship ReportDocument79 pagesMalabar Cements Internship Report Malabar Cements Internship ReportrajeevreddyaNo ratings yet

- Overview of Indian Cement Industry 2010Document17 pagesOverview of Indian Cement Industry 2010shubhav1988100% (2)

- Cement TransportationDocument12 pagesCement Transportationdebasish2000No ratings yet

- UltraTech Cement Fundamental Report with Financial AnalysisDocument6 pagesUltraTech Cement Fundamental Report with Financial AnalysisMohd HussainNo ratings yet

- Project Report On CciDocument62 pagesProject Report On CciShilank Sharma100% (2)

- Synopsis of Mba Project Acc CementDocument6 pagesSynopsis of Mba Project Acc CementAman Aggarwal100% (1)

- Acc Cement Copy ProjectDocument33 pagesAcc Cement Copy ProjectVrushabh ShelkarNo ratings yet

- Introduction:-: Mission & VisionDocument10 pagesIntroduction:-: Mission & Visionzalaks100% (5)

- UltratechDocument15 pagesUltratechHardik KinhikarNo ratings yet

- UltraTech Cement's Strategic Growth Under Aditya Birla GroupDocument17 pagesUltraTech Cement's Strategic Growth Under Aditya Birla GroupShanky JainNo ratings yet

- Strategic Management of AMBUJA CEMENT LTDDocument210 pagesStrategic Management of AMBUJA CEMENT LTDpankaj_tari918268100% (2)

- Cement InternshipDocument54 pagesCement InternshipGaurav SarnotNo ratings yet

- Cement Industry AnalysisDocument30 pagesCement Industry Analysissameerghiya50% (2)

- SWOT, PESTLE and Porter's Five Forces AnalysisDocument4 pagesSWOT, PESTLE and Porter's Five Forces AnalysisAhsan ShakirNo ratings yet

- Synopss Orignal of Ambuja CementDocument25 pagesSynopss Orignal of Ambuja CementLovely Garima JainNo ratings yet

- Company Profile - UltraTechDocument49 pagesCompany Profile - UltraTechlnm sidhiNo ratings yet

- Project On DG Khan CementDocument26 pagesProject On DG Khan CementQaim MaharNo ratings yet

- Roshan Jain (Summer Training Project Report)Document31 pagesRoshan Jain (Summer Training Project Report)roshmyc50% (4)

- UltratechDocument93 pagesUltratechlokesh_045No ratings yet

- Tata CementDocument70 pagesTata Cementramansuthar100% (2)

- Market Structure in Indian Cement IndustryDocument7 pagesMarket Structure in Indian Cement IndustryrajyalakshmiNo ratings yet

- Acc CementDocument60 pagesAcc Cementsahib21No ratings yet

- Report On Cement IndustryDocument33 pagesReport On Cement Industrykanu vij67% (9)

- Binani Cement Research ReportDocument11 pagesBinani Cement Research ReportRinkesh25No ratings yet

- Ultratech CementDocument65 pagesUltratech CementSonam Borana0% (1)

- CementDocument8 pagesCementppppNo ratings yet

- Indian Cement Industry-Plant Case StudyDocument5 pagesIndian Cement Industry-Plant Case StudyBhaskar (भास्कर) Agate (आगटे)No ratings yet

- Advertising and Sales Promotion at Acc CemenDocument92 pagesAdvertising and Sales Promotion at Acc CemenshaikameermalikNo ratings yet

- Fauji CementDocument3 pagesFauji CementHaroon RashidNo ratings yet

- Automotive Tyre Manufacturers' Association (ATMA)Document21 pagesAutomotive Tyre Manufacturers' Association (ATMA)flower87No ratings yet

- A Look Into The Indian Cement Industry PresentationDocument27 pagesA Look Into The Indian Cement Industry PresentationsumitkumareceNo ratings yet

- SCM of UltratechDocument29 pagesSCM of UltratechDisha GanatraNo ratings yet

- Fdocuments - in - Summer Project On Dalmia CementDocument98 pagesFdocuments - in - Summer Project On Dalmia CementGaurav KumarNo ratings yet

- Real Estate and Construction Chemical MarketDocument13 pagesReal Estate and Construction Chemical Marketaseem krishnaNo ratings yet

- Sarashtra Cement Ranavav-1Document89 pagesSarashtra Cement Ranavav-1sanjay50% (2)

- UltraTech Cement Group Project CE-VDocument27 pagesUltraTech Cement Group Project CE-VAniruddh Singh ThakurNo ratings yet

- Summer Training Report ON Acc Cement Pvt. LTD.: SESSION (2017-2018) Career Point University Hamirpur (Himachal Pradesh)Document15 pagesSummer Training Report ON Acc Cement Pvt. LTD.: SESSION (2017-2018) Career Point University Hamirpur (Himachal Pradesh)lucasNo ratings yet

- Wonder CementDocument11 pagesWonder CementVINIT SAXENANo ratings yet

- Porters Five Force Analysis of Ceat TyresDocument4 pagesPorters Five Force Analysis of Ceat TyresSaguna DatarNo ratings yet

- Ultratech Cement LTD - SAPM AssignmentDocument25 pagesUltratech Cement LTD - SAPM AssignmentTushar PatilNo ratings yet

- Cement Industry AnalysisDocument18 pagesCement Industry AnalysisAbhik Tushar DasNo ratings yet

- Roll No 8 PGDM Comm Value Chain Analysis Ultra Tech CementsDocument8 pagesRoll No 8 PGDM Comm Value Chain Analysis Ultra Tech CementsAkashNo ratings yet

- LGB SY AV PerformanceoftheIndianCementIndustry TheCompetitiveLandscapeDocument34 pagesLGB SY AV PerformanceoftheIndianCementIndustry TheCompetitiveLandscapeNulu Gopi chandNo ratings yet

- 08 - Chapter 1 PDFDocument36 pages08 - Chapter 1 PDFAkash RastogiNo ratings yet

- Indian Cement IndustryDocument27 pagesIndian Cement IndustrySubhamay Biswas100% (1)

- Zuaricem Study Competition AnalysisDocument62 pagesZuaricem Study Competition Analysisbalki123No ratings yet

- ChettinadDocument52 pagesChettinadVinodh KumarNo ratings yet

- Performance of The Indian Cement Industry: The Competitive LandscapeDocument35 pagesPerformance of The Indian Cement Industry: The Competitive LandscapeRohan AgrawalNo ratings yet

- Indian Cement IndustryDocument73 pagesIndian Cement Industryamit_kumaryad71% (7)

- Analysis of The Indian Cement IndustryDocument74 pagesAnalysis of The Indian Cement IndustryAnurag AgrawalNo ratings yet

- Price Fluctuation 2Document5 pagesPrice Fluctuation 2IAEME PublicationNo ratings yet

- Akram Javed Report 2014Document12 pagesAkram Javed Report 2014Akram JavedNo ratings yet

- ArielDocument51 pagesArielAkram JavedNo ratings yet

- Measuring Customer SatisfactionDocument4 pagesMeasuring Customer SatisfactionAkram JavedNo ratings yet

- Customer SatisfactionDocument4 pagesCustomer SatisfactionAkram Javed100% (1)

- Akram Javed ProjectDocument88 pagesAkram Javed ProjectAkram JavedNo ratings yet

- Ashutosh ParmarDocument97 pagesAshutosh ParmarAshutosh ParmarNo ratings yet

- Evaluating Marketing Strategy For Reliance My Gold PlanDocument65 pagesEvaluating Marketing Strategy For Reliance My Gold PlanAkram JavedNo ratings yet

- Measuring Customer Satisfaction and Loyalty ModelsDocument5 pagesMeasuring Customer Satisfaction and Loyalty ModelsAkram Javed100% (1)

- Ebay UrlDocument1 pageEbay UrlAkram JavedNo ratings yet

- Cement IndustryDocument41 pagesCement IndustryReshmi Kadungoth K100% (1)

- Re-Engineering Today's Advertising Agency For TomorrowDocument9 pagesRe-Engineering Today's Advertising Agency For TomorrowAkram JavedNo ratings yet

- SBIDocument2 pagesSBIAkram JavedNo ratings yet

- Sir SyedDocument1 pageSir SyedAkram JavedNo ratings yet

- Choosing An Agency 1007Document3 pagesChoosing An Agency 1007Akram JavedNo ratings yet

- Tesla v. Xpeng's Cao ComplaintDocument14 pagesTesla v. Xpeng's Cao ComplaintmashablescribdNo ratings yet

- AD 302: Tightening of Ordinary Bolts: Sci Advisory DeskDocument2 pagesAD 302: Tightening of Ordinary Bolts: Sci Advisory DeskLightninWolf32No ratings yet

- ISA RP60.3 Human Engineering For Control CentersDocument22 pagesISA RP60.3 Human Engineering For Control CentersDaniel Arrieta DarrásNo ratings yet

- CASE03-ABC-MfgDocument2 pagesCASE03-ABC-MfgLaura Catalina PerezNo ratings yet

- Ge Inlet Air CoolingDocument4 pagesGe Inlet Air Coolinggeorge gabriel100% (1)

- Vicat Apparatus Setting Time and Consistency of Cement: StandardsDocument1 pageVicat Apparatus Setting Time and Consistency of Cement: StandardsSciencetes PlusNo ratings yet

- Multi-Entity Work Process Dor: Attachment B (Sample)Document2 pagesMulti-Entity Work Process Dor: Attachment B (Sample)Gordon LongforganNo ratings yet

- IRender NXT For SketchUp Rendering - RenderPlusDocument6 pagesIRender NXT For SketchUp Rendering - RenderPlusRender PlusNo ratings yet

- Electronic Payment Systems Security and Protocols ExplainedDocument36 pagesElectronic Payment Systems Security and Protocols ExplainedPaksmilerNo ratings yet

- Richa Industries Wins First Rail Over Bridge Project For Railways (Company Update)Document2 pagesRicha Industries Wins First Rail Over Bridge Project For Railways (Company Update)Shyam SunderNo ratings yet

- Presentation ON Rural Marketing Mix: Presented By: Aradhana Bhopte Ravneet KaurDocument23 pagesPresentation ON Rural Marketing Mix: Presented By: Aradhana Bhopte Ravneet KaurRavneet Kaur100% (1)

- Steel Industry Hand Safety ToolsDocument24 pagesSteel Industry Hand Safety ToolsTaherNo ratings yet

- Industrial Training: Muhammad Amiruddin Bin Hassan 161382895 Ry44 - Integrated Electronic Alps Electric (M) SDN BHDDocument17 pagesIndustrial Training: Muhammad Amiruddin Bin Hassan 161382895 Ry44 - Integrated Electronic Alps Electric (M) SDN BHDAmiruddin HassanNo ratings yet

- CV Summary for Network EngineerDocument2 pagesCV Summary for Network EngineerManisha PatilNo ratings yet

- GGM Enhancement Project Drawings Log Sheet UpdatedDocument198 pagesGGM Enhancement Project Drawings Log Sheet UpdatedJohn BuntalesNo ratings yet

- Grading Spun Yarns For Appearance: Standard Test Method ForDocument5 pagesGrading Spun Yarns For Appearance: Standard Test Method ForShaker Qaidi100% (1)

- D9 MG GensetDocument4 pagesD9 MG GensetAji HandokoNo ratings yet

- Bajaj PULSUR 220 DTS - OkokDocument75 pagesBajaj PULSUR 220 DTS - OkokSubramanya DgNo ratings yet

- Assam & Nagaland 1Document218 pagesAssam & Nagaland 1Ahmer KhanNo ratings yet

- 03 Sheet Metal FormingDocument38 pages03 Sheet Metal FormingPanNo ratings yet

- Bleriot XIDocument8 pagesBleriot XIAlejandro M. Bianchi100% (1)

- Standard Costing and The Balance ScorecardDocument76 pagesStandard Costing and The Balance ScorecardSaifurKomolNo ratings yet

- Technical ManualDocument36 pagesTechnical Manualneeshakothari31No ratings yet

- Brochure Al Osais International Holding CompanyDocument4 pagesBrochure Al Osais International Holding CompanyhafezasadNo ratings yet

- Flipkart's Big Billion Day Sale IT FailuresDocument21 pagesFlipkart's Big Billion Day Sale IT FailuresManisha KumariNo ratings yet

- Developer Feasibility StudyDocument9 pagesDeveloper Feasibility Studysam dorilloNo ratings yet

- Bartec Headed Bars Qualification File and References 2017.09.08Document35 pagesBartec Headed Bars Qualification File and References 2017.09.08Andres Hermoso MeijideNo ratings yet

- Borehole Imaging Tools PDFDocument4 pagesBorehole Imaging Tools PDFshahbazmirzaNo ratings yet