Professional Documents

Culture Documents

Commercial Banks Funding and Lending

Uploaded by

Heri LimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commercial Banks Funding and Lending

Uploaded by

Heri LimCopyright:

Available Formats

Chapter 2 Commercial banks 1.

You are travelling to work by train when a student seated next to you notices that you work for a bank. She asks you what a bank is, why we have banks and what they do? In your own words, respond to her questions. A bank is essentially a financial institution that acts as a payment agent for customers by providing a wide range of financial services including the acquisition and provision of funds. They are the largest group of financial institutions within a financial system and hence central to facilitating the flow of funds between savers and borrowers. Because of the wide range of services that they provide, most businesses, individuals and governments consider them indispensable. 2. Banks have always been the dominant institutions within the financial system, but their relative importance has fluctuated due, in part, to changes in the regulatory environment in which they operate. Analyse and discuss this statement. Commercial banks are the main financial institutions operating in all major international financial systems, accounting for the largest share of the assets of all financial institutions. However, their dominance has a direct correlation with the level of financial system regulation that is evident within a nation-state. For example, prior to the mid-1980s there was a high level of bank regulation in most major economies that constrained the development of commercial banks. This high level of regulation led to a wide range of new financial institutions evolving in competition with the commercial banks, hence diminishing the dominance of the banks. These days, however, due to the deregulation of the commercial banks, the banking sector has grown so much that the nominal value of their off-balance-sheet transactions exceeds their balance-sheet assets. 3. Within the context of a commercial bank funding its balance sheet, explain asset management and liability management. Provide an example of how a bank uses liability management when determining the structure of its balance sheet. Which form of management is predominantly used by banks today? Asset management is basically where a bank restricts the growth in its lending to match the available deposit base, this often resulted in a bank running out of funds for lending towards the end of the month expecting customers would try to obtain a loan again. Liability management is instead of controlling the amount of funds available for lending, the bank seeks out other avenues/funding sources (liabilities) in order to ensure that they have sufficient funds available to meet loan demand and other commitments. If loan demand increases, banks simply enter the capital markets and borrow the necessary funds. Banks like other firms look to expand their financial services activities and hence aggressively compete for the funds necessary to support their loan programs. This has resulted, following the deregulation of financial markets in the movement from asset management to liability management as the predominant form of management.

4. A customer has approached a commercial bank seeking to invest funds for a period of six months. The customer is considering lodging the funds in a term deposit or, alternatively, purchasing a negotiable certificate of deposit. (a) Explain each of these investment products to the customer. Term Deposits are funds lodged in an account for a predetermined period and at a specified fixed interest rate. A Certificate of Deposit is a short-term discount security issued by a bank; face value repayable at maturity. (b) Why might the CD be a more appropriate investment choice? A CD would be the more appropriate investment choice, as the customer is only looking to invest his/her money for six months. Though the bank may offer a term deposit to suit him/her, CDs are much more flexible. If the CD has a maturity of longer than six months, it can be reissued into the deeply liquid secondary money markets whenever the customer chooses. 5. The ANZ Banking Group announced today that it has raised USD500 million through the issue of debt instruments into the international capital markets. Why might the bank borrow such a large amount of foreign currency liabilities? The deregulation of the financial system opened up enormous opportunities for banks to expand their activities and fund their loan demands through international money-market and capital-market sources. The fact that it is easier to raise larger amounts of debt in the international capital markets and often at lower net costs, meant the removal of constraints on the activities in the foreign exchange market, the floating of the exchange rate and the removal of most restrictions on capital flows in the international markets, made it extremely attractive as it allowed banks to diversify their funding base and raise foreign currency liabilities. Many of the banks major corporate clients have become more internationalised and have increased their demand for financial services denominated in currencies of their commercial hence deriving the banks demand for foreign currency liabilities. 6. Commercial banks are the principal providers of loan finance to the household sector. Identify five different types of loan finance that a bank offers to individuals. Briefly explain the nature and purpose of each of these types of loans. Housing Finance - the provision of long-term funds to enable the purchase of residential property. The bank registers a mortgage over the property as security for the loan, such that it will tank possession of the house and sell it should the borrowers fail to meet their housing loan commitments. Investment Property Finance - funding that enables a borrower to purchase property to rent or lease to a third party. Again, the bank will take a registered mortgage over the property as security for the loan. Fixed-term Loan - a loan provided for a predetermined period; use to purchase specified goods or services. The bank will require some form of security to support the loan. Credit Card - a card facility that provides access to funds through electronic distribution

systems. They typically have high interest rates on used credit, and a range of transaction and other fees might also apply. Personal Overdraft Facility - allows an individual to put a nominated account into debt from time to time up to an agreed limit. The bank expects that the overdraft will be brought back into credit when the individual receives income. 7. ABC Limited plans to purchase injection moulding equipment to manufacture its new range of plastics products. The company approaches its bank to obtain a term loan. Identify and discuss important issues that the company and the bank will need to negotiate in relation to the term loan. Term loans are provided for a predetermined period; usually for a known purpose. The issues which the bank and the company will need to negotiate include the interest rate whether it will be a fixed interest rate or a variable rate. Generally, a fixed-rate loan will be renegotiated or reset after a specified period. The repayment schedule, ie, the frequency of loan repayments and the form of repayment need to be discussed as well. The bank will also require some form of security attached to the loan so if the borrower defaults on loan repayments, the lender will exercise the security and take possession of the pledged assets in order to recover the amount owing on the loan. 8. Banks invest in financial securities that they hold in their securities portfolio. A proportion of these securities may be government securities. Government securities are regarded as essentially risk-free and therefore pay a low rate of return. Why then do banks invest in this type of security? Banks invest in government securities because government securities: are an investment vehicle for surplus funds that a bank is holding in anticipation of future lending are a primary source of liquidity for a bank in that these securities can be easily sold in the secondary markets and converted into cash as needed augment bank earnings by providing income streams and potential capital gains whereas holding cash does not produce income represent collateral that can be used as security to support the bank's own borrowings may be used with a repurchase agreement with the central bank in order to raise cleared funds for payments system settlements improve the quality of the balance sheet by creating a group of assets with lower risk attributes enable a bank to manage the maturity structure of its balance sheet in that the bank can purchase securities with a range of maturities and associated cash flows allow a bank to manage its interest rate sensitivity by quickly restructuring its securities portfolio, by purchasing or selling securities with fixed or variable interest rate payments

9. The off-balance-sheet business of banks has expanded significantly and, in

notional dollar terms, now represents around six times the value of balance-sheet assets. (a) Define what is meant by the off-balance-sheet business of banks. Off-balance-sheet business of banks is the business undertaken that by nature is not recorded as assets or liabilities on the banks balance sheets. These off-balance-sheet transactions represent an major source of income for banks and are imperative in the financial life of businesses and governments. (b) Identify the four main categories of off-balance-sheet business and use an example to explain each of them. Direct credit substitutes are a guarantee to support a clients financial obligations. This could be a stand-by letter of credit, which is an undertaking by the bank to make payment to a specified third party if the banks client fails to meet its financial commitment to that party. Trade- and performance-related items are similar to direct credit substitutes in which the bank acts as a guarantor to support a clients non-financial contractual obligations. This can include trade-related undertakings or agreements to provide goods or services. For example a documentary letter of credit, is where the bank substitutes its credit rating for that of its client, and on behalf of its client the bank authorises payment to a named party against delivery by that party of a shipment of goods. Commitments involve the bank in an undertaking to advance funds to a client, to underwrite debt and equity issues or to purchase assets at some future date. Repurchase agreements are an example of a commitment in which the bank sells assets such as government securities on the understanding that they will repurchase them again at a specified date. Foreign exchange contracts, interest rate contracts and other market-rate-related contracts involve the use of derivative products (futures, options, swaps, forward contracts.) to facilitate hedging against the effects of movements in exchange rates, interest rates, equity prices and commodity prices. Forward exchange contracts are where the bank contracts to buy or sell at a future date a specified amount of foreign currency at an exchange rate that is set today, ie reducing the level of risk in case of exchange rate fluctuations that may occur in the future. 10. Nation-state bank regulators impose minimum capital adequacy standards on commercial banks. (a) Briefly explain the main functions of capital. Capital has a number of important functions, including: It is the source of equity funds for a corporation It provides the equity funding base that enables growth in a business It is a source of profits It is necessary in order to write-off periodic abnormal business losses (b) What is the minimum capital requirement under the Basel II capital accord?

Under the Basel II capital accord, the prudential standard requires an institution, at a minimum, to maintain a risk-based capital ratio of 8.00 per cent at all times. At least half of the risk-based capital ratio must take the form of Tier 1 capital. The remainder of the capital requirement may be held as Tier 2 (upper and lower) capital. Where considered appropriate, a regulator may require an institution to maintain a minimum capital ration above 8.00 per cent. (c) Identify and define the different types of acceptable capital under the Basel II capital accord. Provide an example of each type of capital. Tier 1 (core capital) consists of the highest quality capital elements which fully satisfy all the essential capital characteristics [e.g. paid-up ordinary shares] i. They provide a permanent and unrestricted commitment of funds ii. They are freely available to absorb losses iii. They do not impose any unavoidable servicing charge against earnings iv. They rank behind the claims of depositors and other creditors in the event of windingup Upper Tier 2 capital consists of elements that are essentially permanent in nature, including some hybrid capital instruments which have the characteristics of both equity and debt. [e.g. perpetual subordinated debt approved by the regulator] Lower Tier 2 capital consists of instruments that are not permanent that is, dated or limited life instruments. [e.g. term subordinated debt approved by the regulator]

You might also like

- MGT411-Latest Solved MCQS by MeDocument62 pagesMGT411-Latest Solved MCQS by MeWaqas SherwaniNo ratings yet

- Asset Backed SecuritiesDocument179 pagesAsset Backed SecuritiesShivani NidhiNo ratings yet

- Treasury Management AssignmentDocument28 pagesTreasury Management AssignmentThanh LexNo ratings yet

- Needham Bit Coin ReportDocument31 pagesNeedham Bit Coin ReportAlex100% (1)

- 2015-11-02 PDF JP Morgan Special Report - Proposed FRTB Ruling Endangers Securitized Products MarketsDocument10 pages2015-11-02 PDF JP Morgan Special Report - Proposed FRTB Ruling Endangers Securitized Products MarketsDivya Krishna BirthrayNo ratings yet

- 4 6032630305691534636 PDFDocument254 pages4 6032630305691534636 PDFDennisNo ratings yet

- Foreign Exchange Risk ManagementDocument12 pagesForeign Exchange Risk ManagementDinesh KumarNo ratings yet

- ANZ Chattel MortgageDocument10 pagesANZ Chattel Mortgagelovekimsohyun89No ratings yet

- Government Influence On Exchange Rate in BangladeshDocument22 pagesGovernment Influence On Exchange Rate in BangladeshOmar50% (2)

- Financial Market in Pakistan: Financial Markets and Their Roles: Commercial BanksDocument5 pagesFinancial Market in Pakistan: Financial Markets and Their Roles: Commercial BanksAnamMalikNo ratings yet

- Accenture Banking Retail LendingDocument16 pagesAccenture Banking Retail LendingRaunak MotwaniNo ratings yet

- Economic Order Quantity ModelsDocument7 pagesEconomic Order Quantity ModelsP Singh KarkiNo ratings yet

- Leman BrothersDocument7 pagesLeman Brothersblueeagle477952No ratings yet

- What Is Financial RiskDocument9 pagesWhat Is Financial RiskDeboit BhattacharjeeNo ratings yet

- Chapter 11 - Computation of Taxable Income and TaxDocument22 pagesChapter 11 - Computation of Taxable Income and TaxMichelle Tan100% (1)

- MF0007 Treasury Management MQPDocument11 pagesMF0007 Treasury Management MQPNikhil Rana0% (1)

- NettingDocument17 pagesNettingAnshulGupta100% (1)

- Microproject On Hotel Management SystemDocument13 pagesMicroproject On Hotel Management SystemYuvraj DeshmukhNo ratings yet

- Financial Management QuestionsDocument3 pagesFinancial Management Questionsjagdish002No ratings yet

- Evolution and Function of MoneyDocument14 pagesEvolution and Function of MoneyGhulam HasnainNo ratings yet

- Securities and MarketsDocument51 pagesSecurities and MarketsBilal JavedNo ratings yet

- Concepts of Value and ReturnDocument38 pagesConcepts of Value and ReturnVaishnav KumarNo ratings yet

- Treasury Management AssignmentDocument4 pagesTreasury Management AssignmentJed Bentillo100% (1)

- The Development of Asset Securitisation in MalaysiaDocument14 pagesThe Development of Asset Securitisation in MalaysiaAK FleurNo ratings yet

- SEBI Role and FunctionsDocument28 pagesSEBI Role and FunctionsAnurag Singh100% (4)

- C.A IPCC Ratio AnalysisDocument6 pagesC.A IPCC Ratio AnalysisAkash Gupta100% (2)

- Primary Role of Company AuditorDocument5 pagesPrimary Role of Company AuditorAshutosh GoelNo ratings yet

- Investment BankingDocument15 pagesInvestment BankingRahul singhNo ratings yet

- Chapter 06Document25 pagesChapter 06Farjana Hossain DharaNo ratings yet

- Capital MarketDocument15 pagesCapital Marketरजनीश कुमारNo ratings yet

- Financial Markets and Resource MobilizationDocument13 pagesFinancial Markets and Resource MobilizationFred Raphael Ilomo100% (3)

- Money Mkt.Document9 pagesMoney Mkt.Kajal ChaudharyNo ratings yet

- Financial Markets and Institutionschap 2Document8 pagesFinancial Markets and Institutionschap 2Ini IchiiiNo ratings yet

- Introduction To Financial MarketDocument30 pagesIntroduction To Financial Marketmaria evangelistaNo ratings yet

- Money and Banking: Chapter - 8Document36 pagesMoney and Banking: Chapter - 8Nihar NanyamNo ratings yet

- International Financial MarketDocument36 pagesInternational Financial MarketSmitaNo ratings yet

- Alibaba ProductsDocument4 pagesAlibaba ProductsYash SurekaNo ratings yet

- Understanding Multiple Deposit Creation and The Money SupplyDocument36 pagesUnderstanding Multiple Deposit Creation and The Money SupplyJames EstradaNo ratings yet

- Chapter 11 The Money MarketsDocument8 pagesChapter 11 The Money Marketslasha KachkachishviliNo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Banking Quiz on Assets, Liabilities, Basel Accords & MoreDocument5 pagesBanking Quiz on Assets, Liabilities, Basel Accords & Morenatasha100% (1)

- ICWAI Dividend Policy-Financial Management & International Finance Study Material DownloadDocument35 pagesICWAI Dividend Policy-Financial Management & International Finance Study Material DownloadsuccessgurusNo ratings yet

- Financial Management Assignment 1Document12 pagesFinancial Management Assignment 1parvathy ShanmughanNo ratings yet

- Chap 006Document14 pagesChap 006Adi SusiloNo ratings yet

- Solutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 8Document4 pagesSolutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 8Ahmed El KhateebNo ratings yet

- New Edited Cash ManagementDocument59 pagesNew Edited Cash Managementdominic wurdaNo ratings yet

- Analyzing Developing Country Debt Using the Basic Transfer MechanismDocument5 pagesAnalyzing Developing Country Debt Using the Basic Transfer MechanismJade Marie FerrolinoNo ratings yet

- Settlement SystemsDocument6 pagesSettlement SystemsRachana PatilNo ratings yet

- BTR Functions Draft 6-1-15Document16 pagesBTR Functions Draft 6-1-15Hanna PentiñoNo ratings yet

- Chapter 6 Review QuestionsDocument3 pagesChapter 6 Review Questionsapi-242667057100% (1)

- Factoring & ForfaitingDocument2 pagesFactoring & ForfaitingYashNo ratings yet

- FIN 413 - Midterm #2 SolutionsDocument6 pagesFIN 413 - Midterm #2 SolutionsWesley CheungNo ratings yet

- Raising Capital: A Survey of Non-Bank Sources of CapitalDocument34 pagesRaising Capital: A Survey of Non-Bank Sources of CapitalRoy Joshua100% (1)

- 1 Financial MarketDocument35 pages1 Financial MarketSachinGoelNo ratings yet

- Core Risks in BankingDocument9 pagesCore Risks in BankingVenkatsubramanian R IyerNo ratings yet

- Sources of international financing and analysisDocument6 pagesSources of international financing and analysisSabha Pathy100% (2)

- FIN204 AnswersDocument9 pagesFIN204 Answerssiddhant jainNo ratings yet

- Leon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3Document3 pagesLeon County Sheriff'S Office Daily Booking Report 4-Jan-2022 Page 1 of 3WCTV Digital TeamNo ratings yet

- Presidential Commission On Good Government v. GutierrezDocument12 pagesPresidential Commission On Good Government v. GutierrezJanine OlivaNo ratings yet

- TOR Custom Clearance in Ethiopia SCIDocument12 pagesTOR Custom Clearance in Ethiopia SCIDaniel GemechuNo ratings yet

- ISPS Code Awareness TrainingDocument57 pagesISPS Code Awareness Trainingdiegocely700615100% (1)

- Twelve Reasons To Understand 1 Corinthians 7:21-23 As A Call To Gain Freedom Philip B. Payne © 2009Document10 pagesTwelve Reasons To Understand 1 Corinthians 7:21-23 As A Call To Gain Freedom Philip B. Payne © 2009NinthCircleOfHellNo ratings yet

- ST TuesDocument34 pagesST Tuesdoug smitherNo ratings yet

- Assigned Cases SpreadsheetDocument13 pagesAssigned Cases SpreadsheetJulius David UbaldeNo ratings yet

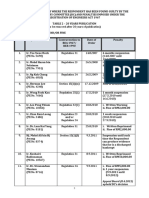

- 2019 Fusion For Energy Financial RegulationDocument60 pages2019 Fusion For Energy Financial Regulationale tof4eNo ratings yet

- Riverscape Fact SheetDocument5 pagesRiverscape Fact SheetSharmaine FalcisNo ratings yet

- The People in The Trees: Also by Hanya YanagiharaDocument5 pagesThe People in The Trees: Also by Hanya YanagiharaMirNo ratings yet

- Bill of Supply For Electricity: Tariff Category:Domestic (Residential)Document2 pagesBill of Supply For Electricity: Tariff Category:Domestic (Residential)Praveen OjhaNo ratings yet

- Kings and ChroniclesDocument18 pagesKings and ChroniclesRamita Udayashankar83% (6)

- Ethics of UtilitarianismDocument26 pagesEthics of UtilitarianismAngelene MangubatNo ratings yet

- Analysis of Freedom of Trade and Commerce in India Under The Indian ConstitutionDocument19 pagesAnalysis of Freedom of Trade and Commerce in India Under The Indian ConstitutionHari DuttNo ratings yet

- Court of Appeals Upholds Dismissal of Forcible Entry CaseDocument6 pagesCourt of Appeals Upholds Dismissal of Forcible Entry CaseJoseph Dimalanta DajayNo ratings yet

- Metro Manila Development Authority v. Viron Transportation Co., Inc., G.R. No. 170656Document2 pagesMetro Manila Development Authority v. Viron Transportation Co., Inc., G.R. No. 170656catrina lobatonNo ratings yet

- LIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDocument1 pageLIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDarrenNo ratings yet

- Safety Residential WarrantyDocument1 pageSafety Residential WarrantyJanan AhmadNo ratings yet

- Doe V Doe Trevi LawsuitDocument30 pagesDoe V Doe Trevi LawsuitSaintNo ratings yet

- 17Mb221 Industrial Relations and Labour LawsDocument2 pages17Mb221 Industrial Relations and Labour LawsshubhamNo ratings yet

- Meredith WhitneyDocument13 pagesMeredith WhitneyFortuneNo ratings yet

- Sing To The Dawn 2Document4 pagesSing To The Dawn 2Nur Nabilah80% (5)

- (RBI) OdtDocument2 pages(RBI) OdtSheethal HGNo ratings yet

- Role of Jamaat Islami in Shaping Pakistan PoliticsDocument15 pagesRole of Jamaat Islami in Shaping Pakistan PoliticsEmranRanjhaNo ratings yet

- NC LiabilitiesDocument12 pagesNC LiabilitiesErin LumogdangNo ratings yet

- SAP ACH ConfigurationDocument49 pagesSAP ACH ConfigurationMohammadGhouse100% (4)

- Ownership Dispute Over Corporation's RecordsDocument2 pagesOwnership Dispute Over Corporation's RecordsFrancisco Ashley AcedilloNo ratings yet

- MOA Establishes 50-Hectare Model Agroforestry FarmDocument8 pagesMOA Establishes 50-Hectare Model Agroforestry FarmENRO NRRGNo ratings yet

- Written ComplianceDocument2 pagesWritten ComplianceKriselle Joy ManaloNo ratings yet

- People VS Hon. Bienvenido TanDocument3 pagesPeople VS Hon. Bienvenido Tanjoy dayagNo ratings yet