Professional Documents

Culture Documents

Questions Financial Accouing 1-Year 1-Sem Mba

Uploaded by

kingmaker9999Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions Financial Accouing 1-Year 1-Sem Mba

Uploaded by

kingmaker9999Copyright:

Available Formats

Profit and Loss Account:

Definition A profit and loss account, also known as an income statement.

Gross profit or loss of a business is ascertained through trading account and net profit is determined by deducting all indirect expenses (business operating expenses) from the gross profit through profit and loss account. Thus profit and loss account starts with the result provided by trading account.

BENEFITS OF PREPARING PROFIT &LOSS ACCOUNT:

The particulars required for the preparation of profit and loss account are available from the trial balance. Only indirect expenses and indirect revenues are considered in it. This account starts from the result of trading account (gross profit or gross loss). Gross profit is shown on the credit side of the profit and loss account and gross loss is shown on the debit side of this account. All indirect expenses are transferred on the debit side of this account and all indirect revenues on credit side. If the total of the credit side exceeds the debit side, the result is "net profit" and if the total of the debit side exceeds the total of the credit side, the result is net loss. As the net profit or net loss of a certain accounting period is determined through profit and loss account, so its heading is: Name of Business Profit and Loss Account for the year ended 31.12.2005

Sequence of Expenses in Profit and Loss Account:

There is no hard and fast rule as to the order in which the items of expenses are shown in profit and loss account. Generally, the items of expenses are shown in the following sequence: These are the expenses with the management of the business e.g. salaries of manager, accountant and office clerks, office rent, office stationary, office electric charges, office telephone etc.

Office and Administration Expenses:

These are the expenses which are directly or indirectly connected with the sale of goods. These expenses vary with the sales i.e. they increase or decrease with the increase or decrease of sale of goods. Examples are advertisements, carriage outward, salesmen's salaries and commission, discount allowed, traveling expenses, bad debts, packaging expenses, warehouse rent etc.

Selling and Distribution Expenses:

Financial and Other Expenses: All other expenses excepting those mentioned above

are considered under this class.

The elements of income are generally divided into four categories: revenues, expenses, gains and losses .

Revenue The amount of money that a company actually receives during a specific period, including discounts and deductions for returned merchandise. Revenue is calculated by multiplying the price at which goods or services are sold by the number of units or amount sold.

Expenses:

In common usage, an expense or expenditure is an outflow of money to another person or group to pay for an item or service, or for a category of costs. For a tenant, rent is an expense. For students or parents, tuition is an expense Gain: In finance, gain is a profit or an increase in value of an investment such as a stock or bond. Gain is calculated by fair market value or the proceeds from the sale of the investment minus the sum of the purchase price and all costs associated with it. If the investment is not converted into cash or another asset, the gain is then called an unrealized gain. Features of Profit and Loss Account:

1. This account is prepared on the last day of an account year in order to 2. 3. 4. 5.

determine the net result of the business. It is second stage of the final accounts. Only indirect expenses and indirect revenues are shown in this account. It starts with the closing balance of the trading account i.e. gross profit or gross loss. All items of revenue concerning current year - whether received in cash or not - and all items of expenses - whether paid in cash or not - are considered in this account. But no item relating to past or next year is included in it.

If credit side exceeds the debit side If debit side exceeds the credit side

= =

Net profit Net loss

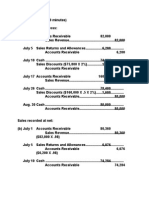

(XYZ co.)Profit and Loss Account for the year ended 31.12.2005

Office and Administration Expenses: Salaries Rent, rates, taxes Selling and Distribution Expenses: Carriage outwards Discount allowed Net profit - transferred to capital A/C $ Gross profit (transferred from 96,000 72,000 $ 312,000

10,000 8,000 126,000 312,000 312,000

Balance Sheet Components - Assets

Total Assets Total assets on the balance sheet are composed of:

1. Current Assets - These are assets that may be converted into cash, sold or consumed within a year or less. These usually include: Cash - This is what the company has in cash in the bank. Cash is reported at its market value at the reporting date in the respective currency in which the financials are prepared. (Different cash denominations are converted at the market conversion rate. Marketable securities (short-term investments) - These can be both equity and/or debt securities for which a ready market exist. Furthermore, management expects to sell these investments within one year's time. These short-term investments are reported at their market value. Accounts receivable - This represents the money that is owed to the company for the goods and services it has provided to customers on credit. Every business has customers that will not pay for the products or services the company has provided. Management must estimate which customers are unlikely to pay and create an account called allowance for doubtful accounts.Variations in this account will impact the reported sales on the income statement. Accounts receivable reported on the balance sheet are net of their realizable value (reduced byallowance for doubtful accounts). Notes receivable - This account is similar in nature to accounts receivable but it is supported by more formal agreements such as a "promissory notes" (usually a short term-loan that carries interest). Furthermore, the maturity of notes receivable is generally longer than accounts receivable but less than a year. Notes receivable is reported at its net realizable value (what will be collected). Inventory - This represents raw materials and items that are available for sale or are in the process of being made ready for sale. These items can be valued individually by several different means - at cost or current market value - and collectively by FIFO (first in, first out), LIFO (last in, first out) or average-cost method. Inventory is valued at the lower of the cost or market price to preclude overstating earnings and assets. Prepaid expenses - These are payments that have been made for services that the company expects to receive in the near future. Typical prepaid expenses include rent, insurance premiums and taxes. These expenses are valued at their original cost (historical cost).

2. Long-term assets - These are assets that may not be converted into cash, sold or consumed within a year or less. The heading "Long-Term Assets" is usually not displayed on a company's consolidated balance sheet. However, all items that are not included in current assets are long-term Assets. These are: Investments - These are investments that management does not expect to sell within the year. These investments can include bonds, common stock, long-term notes, investments in tangible fixed assets not currently used in operations (such as land held for speculation) and investments set aside in special funds, such as sinking funds, pension funds and plan-expansion funds. These long-term

investments are reported at their historical cost or market value on the balance sheet. Fixed assets - These are durable physical properties used in operations that have a useful life longer than one year. This includes: Machinery and equipment - This category represents the total machinery, equipment and furniture used in the company's operations. These assets are reported at their historical cost less accumulated depreciation. Buildings (plants) - These are buildings that the company uses for its operations. These assets are depreciated and are reported at historical cost less accumulated depreciation. Land - The land owned by the company on which the company's buildings or plants are sitting on. Land is valued at historical cost and is not depreciable under U.S. GAAP

Total Liabilities Liabilities have the same classifications as assets: current and long-term. 3. Current liabilities - These are debts that are due to be paid within one year or the operating cycle, whichever is longer; further, such obligations will typically involve the use of current assets, the creation of another current liability or the providing of some service. Usually included in this section are: Bank indebtedness - This amount is owed to the bank in the short term, such as a bank line of credit. Accounts payable - This amount is owed to suppliers for products and services that are delivered but not paid for. Wages payable (salaries), rent, tax and utilities - This amount is payable to employees, landlords, government and others. Accrued liabilities (accrued expenses) - These liabilities arise because an expense occurs in a period prior to the related cash payment. This accounting term is usually used as an all-encompassing term that includes customer prepayments, dividends payables and wages payables, among others. Notes payable (short-term loans) - This is an amount that the company owes to a creditor, and it usually carries an interest expense. Unearned revenues (customer prepayments) - These are payments received by customers for products and services the company has not delivered or started to incur any cost for its delivery. Dividends payable - This occurs as a company declares a dividend but has not of yet paid it out to its owners. Current portion of long-term debt - The currently maturing portion of the long-term debt is classified as a current liability. Theoretically, any related premium or discount should also be reclassified as a current liability. Current portion of capital-lease obligation - This is the portion of a long-term capital lease that is due within the next year.

4. Long-term Liabilities - These are obligations that are reasonably expected to be liquidated at some date beyond one year or one operating cycle. Long-term obligations are reported as the present value of all future cash payments. Usually included are: Notes payables - This is an amount the company owes to a creditor, which usually caries an interest expense. Long-term debt (bonds payable) - This is long-term debt net of current portion. Deferred income tax liability - GAAP allows management to use different accounting principles and/or methods for reporting purposes than it uses for corporate tax fillings (IRS). Deferred tax liabilities are taxes due in the future (future cash outflow for taxes payable) on income that has already been recognized for the books. In effect, although the company has already recognized the income on its books, the IRS lets it pay the taxes later (due to the timing difference). If a company's tax expense is greater than its tax payable, then the company has created a future tax liability (the inverse would be accounted for as a deferred tax asset). Pension fund liability - This is a company's obligation to pay its past and current employees' post-retirement benefits; they are expected to materialize when the employees take their retirement (defined-benefit plan). Valued by actuaries and represents the estimated present value of future pension expense, compared to the current value of the pension fund. The pension fund liability represents the additional amount the company will have to contribute to the current pension fund to meet future obligations. Long-term capital-lease obligation - This is a written agreement under which a property owner allows a tenant to use and rent the property for a specified period of. Long-term capital-lease obligations are net of current portion.

cash flow statement :

The statement of cash flows tells you how much cash went into and out of a company during a specific time frame such as a quarter or a year. You may wonder why there's a need for such a statement because it sounds very similar to the income statement, which shows how much revenue came in and how many expenses went out. The difference lies in a complex concept called accrual accounting. Accrual accounting requires companies to record revenues and expenses when transactions occur, not when cash is exchanged. While that explanation seems simple enough, it's a big mess in practice, and the statement of cash flows helps investors sort it out. The statement of cash flows is very important to investors because it shows how much actual cash a company has generated. The income statement, on the other hand, often includes noncash revenues or expenses, which the statement of cash flows excludes.

One of the most important traits you should seek in a potential investment is the firm's ability to generate cash. Many companies have shown profits on the income statement but stumbled later because of insufficient cash flows. A good look at the statement of cash flows for those companies may have warned investors that rocky times were ahead. The Three Elements of the Statement of Cash Flows Because companies can generate and use cash in several different ways, the statement of cash flows is separated into three sections: cash flows from operating activities, from investing activities, and from financing activities. The cash flows from operating activities section shows how much cash the company generated from its core business, as opposed to peripheral activities such as investing or borrowing. Investors should look closely at how much cash a firm generates from its operating activities because it paints the best picture of how well the business is producing cash that will ultimately benefit shareholders. The cash flows from investing activities section shows the amount of cash firms spent on investments. Investments are usually classified as either capital expenditures--money spent on items such as new equipment or anything else needed to keep the business running--or monetary investments such as the purchase or sale of money market funds. The cash flows from financing activities section includes any activities involved in transactions with the company's owners or debtors. For example, cash proceeds from new debt, or dividends paid to investors would be found in this section.

You might also like

- The ProDocument39 pagesThe Profisho abukeNo ratings yet

- Financial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)Document7 pagesFinancial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)yashwini2827No ratings yet

- Profit and Loss AccountDocument5 pagesProfit and Loss AccountLanston PintoNo ratings yet

- Professional Practices Lecture 18Document40 pagesProfessional Practices Lecture 18Talha Chaudhary100% (1)

- Accounting Terms: DirectionDocument5 pagesAccounting Terms: Directionkthesmart4No ratings yet

- FABM 2 Lecture NotesDocument4 pagesFABM 2 Lecture NotesLucky MimNo ratings yet

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- Basics of AccountingDocument16 pagesBasics of Accountingmule mulugetaNo ratings yet

- Apuntes AccountingDocument35 pagesApuntes AccountingPatricia Barquin DelgadoNo ratings yet

- Accounting - Week 2Document5 pagesAccounting - Week 2junkmail4akhNo ratings yet

- Afm Research AssignmentDocument13 pagesAfm Research AssignmentNISHANo ratings yet

- FINANCIAL STATEMENT For PrintDocument4 pagesFINANCIAL STATEMENT For PrintGkgolam KibriaNo ratings yet

- Accounting Review Material 2018Document10 pagesAccounting Review Material 2018Alex ComelingNo ratings yet

- Ch.3, Understanding Financial Statements and Cash FlowsDocument13 pagesCh.3, Understanding Financial Statements and Cash Flowsمحمد اسامہ فیاضNo ratings yet

- Income Statement Revenues - Expenses Net IncomeDocument4 pagesIncome Statement Revenues - Expenses Net IncomeTanishaq bindalNo ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsJonabed PobadoraNo ratings yet

- Unit I - Accounting EquationDocument6 pagesUnit I - Accounting EquationAnime LoverNo ratings yet

- Fabm 2 Reviewer Statement of Financial Position (SFP)Document3 pagesFabm 2 Reviewer Statement of Financial Position (SFP)Bealou CastillonNo ratings yet

- Chapter 2Document11 pagesChapter 2Earl Jose PanoyNo ratings yet

- Lecture 2 and 3 Revision Notes Balance Sheet What Is It?Document4 pagesLecture 2 and 3 Revision Notes Balance Sheet What Is It?Anisah HabibNo ratings yet

- 5 Main Elements of Financial StatementsDocument8 pages5 Main Elements of Financial StatementsMuhammad Nazmuddin100% (1)

- Elements of Financial StatementsDocument3 pagesElements of Financial StatementsMargNo ratings yet

- Account DefinationsDocument7 pagesAccount DefinationsManasa GuduruNo ratings yet

- What Are The Parties Interested in Accounting?Document7 pagesWhat Are The Parties Interested in Accounting?Mohammad Zahirul IslamNo ratings yet

- Types of Major AccountsDocument43 pagesTypes of Major AccountsMaeshien Posiquit AboNo ratings yet

- 2 Elements of AccountingDocument4 pages2 Elements of Accountingapi-299265916No ratings yet

- Test of Whether Something Is An Asset IsDocument9 pagesTest of Whether Something Is An Asset IsMehrose AhmedNo ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- Understanding The Balance Sheet ItemsDocument3 pagesUnderstanding The Balance Sheet ItemsSuresh KadamNo ratings yet

- Banking Vs ManufaturingDocument16 pagesBanking Vs ManufaturingShoaib AslamNo ratings yet

- Social AccountingDocument28 pagesSocial Accountingfeiyuqing_276100% (1)

- Stock Analysis Week 4: Quantitative Analysis: Balance SheetDocument7 pagesStock Analysis Week 4: Quantitative Analysis: Balance SheetSushil1998No ratings yet

- Chapter 3Document12 pagesChapter 3spambryan888No ratings yet

- Account ElementsDocument8 pagesAccount ElementsMae AroganteNo ratings yet

- FABM 1 - Contextualized LAS - Week 4Document7 pagesFABM 1 - Contextualized LAS - Week 4Sheila Marie Ann Magcalas-GaluraNo ratings yet

- 02 Handout 1Document6 pages02 Handout 1Stacy Anne LucidoNo ratings yet

- Financial Statements of Sole ProprietorshipDocument39 pagesFinancial Statements of Sole ProprietorshipVishal Tanwar100% (1)

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- Accounting NotesDocument3 pagesAccounting NotesMir TowfiqNo ratings yet

- Managerial ACGT: Key for business decisionsDocument4 pagesManagerial ACGT: Key for business decisionsmperenNo ratings yet

- Financial StatementDocument16 pagesFinancial StatementCuracho100% (1)

- Financial Statements ExplainedDocument12 pagesFinancial Statements ExplainedRosda DhangNo ratings yet

- Exam NotesDocument7 pagesExam NotesAmit VadiNo ratings yet

- AssetsDocument7 pagesAssetsarchie demesaNo ratings yet

- Balance Sheet AccountsDocument6 pagesBalance Sheet AccountsRashmi Ranjan BeheraNo ratings yet

- Major Account TitleDocument63 pagesMajor Account TitleElla RamosNo ratings yet

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- Ans.Q1) Accounting Is The Process of Recording Financial Transactions Pertaining To ADocument8 pagesAns.Q1) Accounting Is The Process of Recording Financial Transactions Pertaining To ALavina AgarwalNo ratings yet

- Crest 2015fd AppraisalDocument22 pagesCrest 2015fd Appraisalcountryhomes03No ratings yet

- Financial ManagementDocument32 pagesFinancial ManagementAirah Gale A. DalugduganNo ratings yet

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- The Chart of Accounts Is Normally Arranged or Grouped by The Major Types of AccountsDocument7 pagesThe Chart of Accounts Is Normally Arranged or Grouped by The Major Types of AccountsNeekita DhakneNo ratings yet

- Notes CanniiDocument53 pagesNotes Canniicaro.colcerasaNo ratings yet

- Accounting Principles Lecture-3Document5 pagesAccounting Principles Lecture-3shivani chhipaNo ratings yet

- Basic Accounting Terms: Name-Ritumbra Chilwal CLASS - 11 Subject - AccountancyDocument66 pagesBasic Accounting Terms: Name-Ritumbra Chilwal CLASS - 11 Subject - AccountancyAashray BehlNo ratings yet

- Chapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRDocument14 pagesChapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRSaket_srv2100% (1)

- Accounting BasicsDocument13 pagesAccounting BasicskameshpatilNo ratings yet

- Unit 1: Balance SheetDocument8 pagesUnit 1: Balance SheetthejeshwarNo ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- Junior Philippine Accounting Midterms ReviewDocument5 pagesJunior Philippine Accounting Midterms ReviewezraelydanNo ratings yet

- Previous Questions and Answers Plus Two AccountancyDocument47 pagesPrevious Questions and Answers Plus Two AccountancyPushppa KumaryNo ratings yet

- CA Inter Accounting Revision NotesDocument106 pagesCA Inter Accounting Revision NoteskalyanikamineniNo ratings yet

- BAFS F.4 NotesDocument265 pagesBAFS F.4 NotesJacob Odgon100% (3)

- Full Download Entrepreneurial Finance 6th Edition Leach Solutions ManualDocument35 pagesFull Download Entrepreneurial Finance 6th Edition Leach Solutions Manualcoctilesoldnyg2rr100% (28)

- Coca Cola Mini CaseDocument1 pageCoca Cola Mini CaseDania Sekar WuryandariNo ratings yet

- CH07 SolutionsDocument13 pagesCH07 Solutionsasflkhaf2No ratings yet

- CA Final - FR Faster Batch - Consolidation Additional QuestionsDocument8 pagesCA Final - FR Faster Batch - Consolidation Additional QuestionsRonaldo GOmesNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- E. Patrick Assignment 1.4Document3 pagesE. Patrick Assignment 1.4Alex83% (6)

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Document36 pagesSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNo ratings yet

- MCQs - RatiosDocument9 pagesMCQs - RatiosLalitNo ratings yet

- Xlookup ExercisesDocument59 pagesXlookup ExercisesSamNo ratings yet

- This Study Resource Was: Universiti Teknologi Mara Final ExaminationDocument8 pagesThis Study Resource Was: Universiti Teknologi Mara Final ExaminationFara husnaNo ratings yet

- Handout Bus Com 2302Document6 pagesHandout Bus Com 2302Cylevri TomimboNo ratings yet

- Template - QE - Advance AccountingDocument18 pagesTemplate - QE - Advance AccountingJykx SiaoNo ratings yet

- Solution For The Analysis and Use of Financial Statements White G ch03Document48 pagesSolution For The Analysis and Use of Financial Statements White G ch03twinkle goyalNo ratings yet

- Week 4 5 Ulob - Working Capital ManagementDocument7 pagesWeek 4 5 Ulob - Working Capital ManagementKezzi Ervin UngayNo ratings yet

- USJR FAR Quizbowl BlankDocument8 pagesUSJR FAR Quizbowl BlankSarah BalisacanNo ratings yet

- Investor Presentation - Q1 FY17 (Company Update)Document67 pagesInvestor Presentation - Q1 FY17 (Company Update)Shyam SunderNo ratings yet

- Accounting Cycle Self Test QuestionsDocument6 pagesAccounting Cycle Self Test QuestionsFahad MushtaqNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- Conceptual Framework: Objective of Financial ReportingDocument47 pagesConceptual Framework: Objective of Financial Reporting버니 모지코No ratings yet

- Acc Paper Class 11Document16 pagesAcc Paper Class 11Varsha AswaniNo ratings yet

- Account TitlesDocument8 pagesAccount TitleskdjasldkajNo ratings yet

- Financial Ratios Topic (MFP 1) PDFDocument9 pagesFinancial Ratios Topic (MFP 1) PDFsrinivasa annamayyaNo ratings yet

- Determine COGS and ending inventory using FIFO, LIFO, average costDocument19 pagesDetermine COGS and ending inventory using FIFO, LIFO, average costTrung Kiên NguyễnNo ratings yet

- Ch1 4e - Acc in Action 2021Document50 pagesCh1 4e - Acc in Action 2021K59 Vu Thi Thu HienNo ratings yet

- FAR 610 Group Project 2 Advanced AccountingDocument10 pagesFAR 610 Group Project 2 Advanced Accountingafrina aziziNo ratings yet