Professional Documents

Culture Documents

NPO accounting questions

Uploaded by

coonyu1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPO accounting questions

Uploaded by

coonyu1Copyright:

Available Formats

Review questions on NPOs QUESTION ONE (a) The treasurer of the Long Lane FC has prepared a receipts and

payments account, but members have complained about the inadequacy of such an account. She therefore asks an accountant to prepare a trading account for the bar, and an income and expenditure account and a statement of financial position. The treasurer gives the accountant a copy of the receipts and payments account together with information on assets and liabilities at the beginning of the year: Long Lane FC Receipts and payments Account for the year ended 31 December 2006 Receipts Bank balance at 1.1.2006 Subscriptions received for: 2005 (arrears) 2006 . 2007 (in advance) Bar sales Donations received 1,400 14,350 Shs 000 Payments 524 Payment for bar supplies Wages: Grounds man and assistant Barman 19,939 8,624 234 740 1,829 938 2,420 6,210 79,554 Shs 000 38,620

1,200 Bar expenses 61,280 Repairs to stands 800 Ground upkeep Secretary's expenses Transport costs Bank balance at 31.12.2006 79,554

Additional information: 1. The following balances are available: 31.12.2005 31.12.2006 Shs 000 Inventory in the bar-at cost Owing for bar supplies Bar expenses owing Transport costs 4,496 3,294 225 Shs 000 5,558 4,340 336 265

2. The land and football stands were valued at 31 December 2005 at: land: Shs. 40,000,000; football stands Shs 20,000,000; the stands are to be depreciated by 10 per cent per annum. 3. The equipment at 31 December 2005 was valued at Shs. 2,500,000, and is to be depreciated at 20 per cent per annum. 4. Subscriptions owing by members amounted to Shs. 1,400,000 on 31 December 2005, and Shs. 1,750,000 on 31 December 2006.

Required: Bar trading account (7 marks); income and expenditure statement (statement of operations) for the year ended 31 December 2006 (7 marks) and a statement of financial position as at 31 December 2006. (6 marks) QUESTION TWO (a) Explain the fundamental difference(s) between the accounting basis for a non-profit organization and a for-profit organization. (6 marks) (b) The following receipts and payments account was prepared by the treasurer of Wasomaji Members Club for the year ended 31 December 2010: Shs. 000 Shs. 000 January 1 2010: Cash in hand: 10 Grounds man wages 75 Balance as per bank: Purchase of mowing machine 150 Deposit a/c 223 Rent of ground 25 Current a/c 60 Cost of teas 25 December 31 bank interest on 40 deposit a/c 3 Reference books purchased Subscriptions 260 Secretarial expenses 28 Receipts from teas 30 Repairs 50 Contribution to travelling 10 Honoraria to treasurer for 2009 40 Sale of equipment 8 December 31: Balance at bank: Net proceeds from dinner dance 78 Deposit a/c 209 Current a/c 15 Cash in hand 25 682 682

The following additional information is also available: Jan. 1 2010 Shs. 000 Subscriptions due 15 Subscriptions in advance 10 Creditors for secretarial expenses 30 Creditors for repairs 10 Interest on deposit account Estimated value of machinery and equipment 85

Dec. 31 2010 Shs. 000 10 8 25 20 2 175

For the year ended 31 December 2010, the honoraria to the treasurer are to be increased by a total of Shs. 20,000 and the grounds man is to receive a bonus of Shs. 20,000. Overdue subscriptions amounting to Shs. 10,000 were written off. The reference books purchased during the year are to be capitalized as part of the library. The equipment disposed had a book value of Shs. 2,000. Required: (5 marks) (a) Wasomaji Members club statement of affairs as at 1 January 2010. (b) Income and expenditure statement for the year ended 31 December 2010.(12 marks) (c) Statement of financial position as at 31 December 2010. (7 marks) QUESTION THREE The following trial balance was extracted from the books of Scholars Members Club as at 30 September 2000: Sh. 724,800 3,700,000 62,000 1,874,000 284,000 1,450,800 920,000 358,000 108,000 17,000 190,400 54,400 277,000 367,200 495,000 Sh. 5,771,200

Balance at bank current account Accumulated fund 1 October 1999 Land and building at cost Debtors for subscription Furniture and fittings Provision for depreciation of furniture and fittings Subscriptions Lecturers fees Lecturers travel and accommodation expenses Donations Camera and projector repairs Projectors, cameras and audio equipment Depreciation of equipment Rates and water Lighting and heating Rental of rooms

Wages: Caretaker Restaurant Bar staff Purchase of food Stock- bar I October 1999 Bar receipts, Bar purchases Restaurant receipts Loan Deposit account - bank Interest payable Creditors for bar and food

880,000 1,600,000 800,000 1,565,800 473,600 4,032,000 2,842,000 3,642,000 1,600,000 1,000,000 36,000 178,400 17,651,800

17,651,800

Additional information: 1. The bar stock was valued at Sh.642.800 as at 30 September 2000. 2. It is expected that of the debtors for subscriptions, Sh.43.600 will not be collectable. 3. The interest account is net. The loan is at a concessional rate of 4% while I0% has been earned on the deposit account. No changes have taken place all year in the principal sums involved. 4. An invoice for Sh.43.000 of wine had been omitted from the records at the close of the year although the wine had been included in the bar stock valuation. 5. Depreciation for the rear is to be provided as follows: Furniture and fittings Sh. 194.000 Projectors, cameras etc. Sh. 19.000 Required: (a) Bar and restaurant trading account for the year ended 30 September 2000. (6 marks) (b) An income and expenditure account for the year ended 30 September 2000. (8 marks) (c) A statement of financial position as at 30 September 2000. (6 marks)

You might also like

- 01 Income and Expenditure AccountDocument4 pages01 Income and Expenditure AccountPrateek ⎝⏠⏝⏠⎠ Gupta ヅ0% (1)

- Accountancy HOTSDocument47 pagesAccountancy HOTSYash LundiaNo ratings yet

- T323 FA (Students)Document7 pagesT323 FA (Students)Cassandra AnneNo ratings yet

- Financial Accounting Atc 1Document3 pagesFinancial Accounting Atc 1hshing02No ratings yet

- Accounting AnswersDocument5 pagesAccounting AnswersallhomeworktutorsNo ratings yet

- Questions FinanceDocument5 pagesQuestions FinanceallhomeworktutorsNo ratings yet

- Financial Reporting Practice Questions SolvedDocument4 pagesFinancial Reporting Practice Questions SolvedLetsah Bright100% (1)

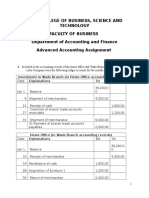

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocument6 pagesHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNo ratings yet

- ICMA Questions Aug 2011Document57 pagesICMA Questions Aug 2011Asadul Hoque100% (1)

- The Following Trial Balance Has Been Prepared by A Trainee Accounting ClerkDocument4 pagesThe Following Trial Balance Has Been Prepared by A Trainee Accounting ClerkRadithNo ratings yet

- Documents Subject Accounts Form4 9PartnershipAccountsDocument16 pagesDocuments Subject Accounts Form4 9PartnershipAccountsCartello008No ratings yet

- 13 Single Entry and Incomplete Records - Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records - Additional ExercisesMei Mei Chan100% (2)

- Financial Accounting QuestionsDocument6 pagesFinancial Accounting QuestionsallhomeworktutorsNo ratings yet

- June Accounting QuestionsDocument6 pagesJune Accounting QuestionsallhomeworktutorsNo ratings yet

- NPODocument3 pagesNPOkanika_mcseNo ratings yet

- THDS Brewery PLC Bank Reconciliation and ProjectsDocument12 pagesTHDS Brewery PLC Bank Reconciliation and ProjectsAliyi BenuraNo ratings yet

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- Blue Print: Accounting: Class XI Weightage Difficulty Level of QuestionsDocument12 pagesBlue Print: Accounting: Class XI Weightage Difficulty Level of Questionssirsa11No ratings yet

- CBSE Class 11 Accountancy Question Paper SA 2 2013 PDFDocument6 pagesCBSE Class 11 Accountancy Question Paper SA 2 2013 PDFsivsyadavNo ratings yet

- Control Accounts Practice QuestionsDocument5 pagesControl Accounts Practice Questionsmairaj0897% (36)

- Funds Flow StatementDocument4 pagesFunds Flow Statementsoumya_2688No ratings yet

- IPCC Accounts 31-10-10Document1 pageIPCC Accounts 31-10-10Esukapalli Siva ReddyNo ratings yet

- Soal LatihanDocument15 pagesSoal LatihanRafi FarrasNo ratings yet

- Paper II Financial Accounting IIDocument7 pagesPaper II Financial Accounting IIPoonam JainNo ratings yet

- Accountancy March 2008 EngDocument8 pagesAccountancy March 2008 EngPrasad C M100% (2)

- ACCT5101Pretest PDFDocument18 pagesACCT5101Pretest PDFArah OpalecNo ratings yet

- Hardware Store Financial StatementsDocument9 pagesHardware Store Financial StatementsFarrukhsgNo ratings yet

- Accounts For Non-Trading Concerns Problem: 1Document3 pagesAccounts For Non-Trading Concerns Problem: 1KaliyapersrinivasanNo ratings yet

- Class Exercise: Cash Flow StatementDocument2 pagesClass Exercise: Cash Flow StatementAbhi SinghNo ratings yet

- Cash & Cash EquivalentsDocument4 pagesCash & Cash Equivalentsralphalonzo100% (5)

- Accounting For Non Profit Making OranisationsDocument5 pagesAccounting For Non Profit Making Oranisationsmarkmott39No ratings yet

- BU8101 Sem3 - Group 11Document63 pagesBU8101 Sem3 - Group 11Shweta SridharNo ratings yet

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDocument12 pages2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)

- Rolito DionelaDocument40 pagesRolito DionelaRolito Dionela50% (2)

- Exercise (Final Accounts)Document14 pagesExercise (Final Accounts)Abhishek BansalNo ratings yet

- 2012Document21 pages2012Mohammad Salim HossainNo ratings yet

- Poa May 2001 Paper 2Document10 pagesPoa May 2001 Paper 2Jerilee SoCute WattsNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- Adjust Final Accounts Chapter 8Document11 pagesAdjust Final Accounts Chapter 8Bhavneet SachdevaNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Revision Questions 1Document13 pagesRevision Questions 1Vivian WongNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Mock Midterm Exam - QuestionnaireDocument13 pagesMock Midterm Exam - QuestionnaireMaeNo ratings yet

- Acct 550 Final ExamDocument4 pagesAcct 550 Final ExamAlexis AhiagbeNo ratings yet

- 2010 LCCI Bookkeeping and Accounts Series 3Document8 pages2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- 7110 June 2006Document12 pages7110 June 2006Kristen NallanNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sporting Goods Store Revenues World Summary: Market Values & Financials by CountryFrom EverandSporting Goods Store Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- General-Line Sporting Goods Store Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral-Line Sporting Goods Store Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- ACA Audit and Assurance Professional: Exam Preparation KitFrom EverandACA Audit and Assurance Professional: Exam Preparation KitNo ratings yet

- Intermediate Accounting Dfa I Sem IIDocument1 pageIntermediate Accounting Dfa I Sem IIcoonyu1No ratings yet

- 10 Property IncomeDocument12 pages10 Property Incomecoonyu1No ratings yet

- Portfolio StrategyDocument4 pagesPortfolio Strategycoonyu1No ratings yet

- Risk Return DFADocument19 pagesRisk Return DFAcoonyu1No ratings yet

- NotesDocument68 pagesNotescoonyu1No ratings yet

- Guidelines For Investment Proof SubmissionDocument6 pagesGuidelines For Investment Proof Submissionzaheer KaziNo ratings yet

- Engineering EconomyDocument87 pagesEngineering EconomyAbhishek KumarNo ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- Advance Auditing TechniquesDocument29 pagesAdvance Auditing TechniquesFaizan Ch75% (8)

- Earnings Management NotesDocument7 pagesEarnings Management NoteslciimNo ratings yet

- Torres Vs CA - DigestDocument2 pagesTorres Vs CA - Digest001noone75% (4)

- Report On Dutch Bangla Bank & Ratio AnalysisDocument32 pagesReport On Dutch Bangla Bank & Ratio Analysisolidurrahman33% (3)

- Case 5 Chrysler ExamDocument6 pagesCase 5 Chrysler ExamFami FamzNo ratings yet

- CareersLit Project Topics Master ListDocument178 pagesCareersLit Project Topics Master Listshreekumar_scdlNo ratings yet

- Chapter 14Document5 pagesChapter 14RahimahBawaiNo ratings yet

- Liquor Store Business Plan ExampleDocument37 pagesLiquor Store Business Plan ExampleDaniel AberaNo ratings yet

- Acct 221 Final Exam - The Latest Version - UmucDocument8 pagesAcct 221 Final Exam - The Latest Version - UmucOmarNiemczyk100% (1)

- GE1451 NotesDocument18 pagesGE1451 NotessathishNo ratings yet

- Gatchalian vs. Collector 67 Phil 666Document5 pagesGatchalian vs. Collector 67 Phil 666FranzMordenoNo ratings yet

- ZVZCFGDG DFG Aadfagf FVZXCV./KJHFKHF KGJ.J: The Corporate Form of Organization Characteristics of CorporationsDocument2 pagesZVZCFGDG DFG Aadfagf FVZXCV./KJHFKHF KGJ.J: The Corporate Form of Organization Characteristics of CorporationsbeachsnowNo ratings yet

- Additional ProblemsDocument21 pagesAdditional Problemsdarshan jain0% (1)

- Modified Pag-Ibig Ii Enrollment FormDocument1 pageModified Pag-Ibig Ii Enrollment FormSarah jane LopezNo ratings yet

- Tan, Ma. Cecilia ADocument20 pagesTan, Ma. Cecilia ACecilia TanNo ratings yet

- Accounting Provides Solid Foundation for Business DecisionsDocument4 pagesAccounting Provides Solid Foundation for Business DecisionsMargeNo ratings yet

- Resume NaveenDocument2 pagesResume NaveenVinaySinghNo ratings yet

- Citibank, N.A.: Company ProfileDocument21 pagesCitibank, N.A.: Company ProfileGirish GholapNo ratings yet

- Profit or Ioss Pre and Post IncorporationDocument22 pagesProfit or Ioss Pre and Post IncorporationRanjana TrivediNo ratings yet

- Value Guide Dec 08 - SSKIDocument57 pagesValue Guide Dec 08 - SSKIIndrajeet PaNo ratings yet

- Management & Financial AccountingDocument390 pagesManagement & Financial AccountingParveen KumarNo ratings yet

- Manac Quiz 2 With AnswersDocument2 pagesManac Quiz 2 With AnswersHanabusa Kawaii IdouNo ratings yet

- Nachi Company ProfileDocument28 pagesNachi Company ProfilepibearingNo ratings yet

- Accounting Errors That Affect Trial BalanceDocument5 pagesAccounting Errors That Affect Trial BalanceTimore FrancisNo ratings yet

- Dy Peh, And/Or Victory Rubber Manufacturing, Petitioner, vs. Collector of Internal Revenue, RespondentDocument3 pagesDy Peh, And/Or Victory Rubber Manufacturing, Petitioner, vs. Collector of Internal Revenue, RespondentMacNo ratings yet

- What Is The Accounting Cycle?: Financial Statements BookkeeperDocument4 pagesWhat Is The Accounting Cycle?: Financial Statements Bookkeepermarissa casareno almueteNo ratings yet

- Tugas GSLC Corp Finance Session 17 & 18Document8 pagesTugas GSLC Corp Finance Session 17 & 18Javier Noel Claudio100% (1)