Professional Documents

Culture Documents

CE - Final Exam - Spring 2006 - Version 4 - With Solutions-1

Uploaded by

Dirit SanghaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CE - Final Exam - Spring 2006 - Version 4 - With Solutions-1

Uploaded by

Dirit SanghaniCopyright:

Available Formats

Ryerson University

CFIN300

Final Exam

Spring 2006

There are 3 hours in this exam.

Version #4

Student Name ________Solution Key_________

(Please Print)

Student Number _________________________________

Notes:

1. This is a closed book exam. You may only have pens, pencils and a calculator at

your desk.

2. A formula sheet is attached to the end of the exam. You may detach the formula

sheet from the exam.

Please fill out the scanner sheet as you go along in the exam. You will not be given extra

time at the end of the exam to fill it out.

3. Select the best possible answer for each multiple-choice question

4. Each of the 50 MC questions is worth 1 mark

Marks: Available

Total 50 _________

There are 18 pages in this exam.

CFIN300: Final Exam: Spring 2006 Version #4

Multiple Choice Questions:

Please answer the 50 multiple choice questions on the scanner sheet provided. Choose the

best answer from the set given for each question. Note, only the scanner sheet will be

marked, and anything written on the test paper will be completely disregarded.

1. At 10:59 A.M., the price of Nexus Corp. stock is $25 on the stock exchange. At 11:00,

Nexus management unexpectedly announces that the firm has just struck oil in

Northern Timbuktu (a good thing). There are no other relevant announcements during

the day. At 11:01, Nexus stock is selling for $28.10. At 12:01, the stock is selling for

$28.00 on the stock exchange. At 4:00 at the close of trading, Nexus stock is still

selling for $28.05. Which of the following statements is most consistent with the above

information?

a) The market is weak form efficient

b) The market is not weak form efficient

c) The market is semi-strong form efficient

d) The market is not semi- strong form efficient

e) The market is strong form efficient

2. You have just gotten a mortgage for $150,000. The interest rate on the mortgage is 6%

per year, compounded semi-annually. If the amortization period is 25 years, and you

are going to make weekly payments what will be the size of each payment?

a) $221.05

b) $590.44

c) $219.27

d) $219.02

e) $302.46

3. In a truly competitive environment in which everyone has the same capabilities, where

there are no barriers to entry, where there are no patent or copyright laws, and where

everyone has equal access to funding, investments

a) Will tend to have a net present value of zero

b) Will tend to have a potential profit of zero

c) Will tend to have a positive net present value

d) Will tend to have a negative net present value

e) None of the Above

2

CFIN300: Final Exam: Spring 2006 Version #4

4. You have been asked to calculate the required rate of return on ABCs common stock.

The stock just paid a dividend of $2. The dividend is expected to increase by 6% per

year in perpetuity. The stocks current price is $10 per share.

a) 27.2%

b) 26.0%

c) 16.6%

d) 16.0%

e) none of the above

5. Given no change in required returns, the value of a share of stock whose dividend is

constant will:

a) increase over time at a rate of r percent

b) decrease over time at a rate of r percent

c) increase over time at a rate equal to the dividend growth rate

d) decrease over time at a rate equal to the dividend growth rate

e) remain unchanged

6. A bond is issued on January 1

st

, 1994. It is a 20-year 5% annual coupon bond with a

$1000 face value. If the price of the bond at issue is greater than $1000,

a) The yield to maturity on the bond will be less than 5%

b) The yield to maturity on the bond will be greater than 5%

c) The yield to maturity on the bond will be 5%

d) We cannot determine from the information provided if the yield to maturity on the

bond will be greater than, less than, or equal to 5%

e) None of the Above

7. Sunk costs

a) Must be incorporated into the capital budgeting calculation, just like any other cash

flow

b) Should not be factored into the capital budgeting calculation

c) Should or should not be factored into the capital budgeting calculation, based on the

type of sunk cost involved

d) Are costs that occur after the start of a capital budgeting project

e) None of the Above

3

CFIN300: Final Exam: Spring 2006 Version #4

8. Risk adverse investors prefer risk for a given level of expected return and

expected return for a given level of risk.

a) More, more

b) More, less

c) Less, more

d) Less, less

e) None of the above.

9. You have been asked to determine the cash flow from the assets for ABC Inc. ABC had

net income of $100. Its interest expense was $20. The companys tax rate was 40%.

ABCs capital spending and depreciation was $10. The companys net working capital

for the year did not change.

a) $ 60.00

b) $166.67

c) $120.00

d) $170.00

e) none of the above

10. Assume the anticipated growth rate in dividends is constant for Fly-By-Nite Airlines.

The expected value of the firm's stock at the end of four years (P4) is

I. D5/(r g)

II. P0 * (1 + g)4

III. D0 * (1 + g)/(r g)

a) I only

b) II only

c) I and II only

d) I and III only

e) I, II, and III

11. The risk free rate in the economy is 7%. Stock A has an expected return of 13.5% and

a beta of 1.2. Stock B has an expected return of 10.5% and a beta of 0.8. Suppose that

we know that stock A is fairly priced and the betas of stocks A and B are accurate.

Which of the following regarding stock B is correct?

a) Stock B is also fairly priced

b) The expected return on stock B is too high

c) The expected return on stock A is too high

d) The price of stock B is too high

e) The price of stock A is too high

4

CFIN300: Final Exam: Spring 2006 Version #4

12. You wish to have $200,000 in 20 years time. The bank has offered to set up a special

account that pays 16% per year, compounded quarterly. How much money do you need

to put into the account today to have $200,000 in 20 years?

a) $10,817.58

b) $ 8,676.87

c) $ 9,206.19

d) $10,277.09

e) none of the above

Use the following information to answer the following two questions

You and your spouse have found your dream home in Brandon, Manitoba. The selling

price is $120,000; you will put $20,000 down and obtain a 30-year fixed-rate mortgage at

8.25% compounded semi-annually for the rest.

13. You decide to make monthly payments starting in one month. What will each payment

be?

a) $725.01

b) $741.56

c) $757.76

d) $825.45

e) $901.52

14. How much interest will you pay (in dollars) over the life of the loan? (Assume you

make each of the required 360 payments on time.)

a) $145,583

b) $166,963

c) $170,457

d) $190,457

e) $270,457

15. The advantage of the payback method is its:

a) Time value of money considerations

b) Application of readily available accounting data.

c) Cut-off point.

d) Long-term perspective

e) Simplicity

5

CFIN300: Final Exam: Spring 2006 Version #4

16. You are considering the following projects but have limited funds to invest and cant

take them all. Using the profitability index, rank the projects in the order in which you

would accept them. That is, rank them from best to worst.

Project Initial Investment NPV

A $100,000 $30,000

B 80,000 25,000

C 40,000 17,000

a) A, B, C

b) B, C, A

c) C, A, B

d) C, B, A

e) A, C, B

17. The equipment below is required for your business. Assume each machine will be

replaced as it wears out. The required return is 15%. Ignore taxes.

Machine A Machine B

Initial Cost $200,000 $300,000

Operating Cost / year 15,000 17,500

Life 8 years 10 years

What is the EAC of machine A?

a) -$301,664

b) -$201,676

c) -$48,163

d) -$59,570

e) -$22,437

18. Your parents are saving for their retirement. They have set up a special retirement

account. They have deposited $100 into the account every 4 months for the past 12

years. The effective annual rate of return on the account is 20%. How much money is

in the account at the end of the 12 years? The payments were made at the end of each 4

month period?

a) $ 9,583.63

b) $ 8,919.84

c) $10,184.13

d) $12,633.71

e) $15,132.88

6

CFIN300: Final Exam: Spring 2006 Version #4

19. Twenty years ago your parents set aside $10,000 in a bank account. The account now

has $100,000 in it. What was the effective annual rate of return that the account paid?

a) 10.0%

b) 12.2%

c) 12.6%

d) 13.1%

e) 10.9%

20. Which of the following statements is consistent with the concept of market efficiency?

a) The current price reflects all available relevant information

b) The price reacts very quickly to new information

c) In an efficient market, an investor should expect to make a reasonable risk-adjusted

return

d) None of the Above

e) a), b) and c) are true.

21. Which of the following statements are true?

I If the NPV is positive then the IRR is greater than the discount rate

II If the NPV is negative then the IRR is greater than the discount rate

III If the NPV is zero then the IRR is zero

IV If the NPV is zero then the IRR is equal to the discount rate

a) I only

b) II only

c) IVonly

d) I and IV

e) None of the above

22. DEFs common stock just paid a dividend of $3 per share. You expect the dividend to

increase by 5% per year in perpetuity. If you require a 15% rate of return what is the

price of the stock today?

a) $20.00

b) $21.00

c) $31.50

d) $30.00

e) none of the above

7

CFIN300: Final Exam: Spring 2006 Version #4

23. Suppose investors had to invest 100% of their wealth in one of the following four

stocks which stock would they choose?

Stock Expected Return Standard Deviation

A 10% 15%

B 5% 12%

C 15% 30%

D 25% 10%

a) Stock A

b) Stock B

c) Stock C

d) Stock D

e) Cant say

24. You borrowed $30,000 to go to school. The bank agreed that you could repay the loan

by making 180 equal monthly payments, starting 12 months from now. If the bank is

charging 8% per year compounded semi-annually, what are your monthly payments?

a) $284.45

b) $305.65

c) $307.65

d) $310.09

e) $334.90

25. You owe $10,000 on your credit card. The card charges interest of 2% per month. If

you make payments of $250 per month, at the beginning of each month, how many

months will it take you to pay off your credit card?

a) 81.3 months

b) 77.5 months

c) 71.7 months

d) 69.2 months

e) 89.4 months

26. Finance Inc had cash flow from the assets last year of $5,000. It paid $1,000 in interest

to its bondholders. It did not make any payments on the principal. It did not issue any

new debt. The company paid $500 in dividends to its common shareholders. What was

the Cash Flow to the Shareholders last year?

a) $3,500

b) $4,000

c) $5,000

d) $ 500

e) $ 0

8

CFIN300: Final Exam: Spring 2006 Version #4

27. You have $1000 of your own money to invest. You borrow a further $1000 from the

bank at a 5% per year compounded annually. You invest the entire $2000 in the market

portfolio which is expected to earn 11% annually. If you cash out your investment

after one year and pay back the bank and the actual market return matches the expected

market return, what percent return will you have made on your original $1000 equity

investment?

a) 5%

b) 11%

c) 14%

d) 17%

e) 22%

28. Which of the following describe(s) a portfolio that plots below the security market line?

a) The security is undervalued

b) The security is providing a return that is higher than expected

c) The security is overvalued

d) The security's beta is too low

e) The security provides a return that exceeds the average return on the market

29. The preferred shares of TX Bank pay a constant dividend of $2.50 per year. A dividend

has just been paid. The required rate of return for the first 3 years is 6% per year

compounded annually and the required return thereafter is 8% per year compounded

annually. What is the current intrinsic value of the shares?

a) $31.25

b) $31.49

c) $32.92

d) $41.67

e) $125.00

30. What is the portfolio beta with 25% in the market portfolio, 25% in an asset with twice

as much risk as the market portfolio and the rest in a risk free asset?

0.50

a) 0.75

b) 1.00

c) 1.25

d) 1.50

31. You expect bond yields to decrease in the near future. You are advising your parents

which of the bonds listed below to purchase. All of the bonds have been issued by the

Government of Canada. Your parents wish to maximize their rate of return.

9

CFIN300: Final Exam: Spring 2006 Version #4

I. A zero coupon bond with 20 years to maturity

II. A zero coupon bond with 10 years to maturity

III. A 20 year coupon bond, with a coupon rate of 10%

IV. A 10 year coupon bond, with a coupon rate of 10%

a) I only

b) II only

c) III only

d) IV only

e) Cant be determined

32. You purchase a 10 year, 1,000 face value bond that has a 6% coupon rate (the coupons

are paid semi-annually). The yield to maturity on the bond is 6% per year compounded

semi-annually. Five years later you decide to sell the bond for $1,050. What is your

average annual rate of return on this investment? Express your answer as a rate per

year compounded semi-annually.

a) 3.00%

b) 3.42%

c) 6.47%

d) 6.86%

e) 7.14%

33. The Really Expensive Bank Inc is offering a special deal. You may borrow $1,000

today and make payments of $20 per week, at the end of each week for the next 2 years

to pay off the loan. What is the effective annual rate of interest is charging you?

a) 0.15%

b) 1.63%

c) 2.31%

d) 65.7%

e) 131.4%

34. The risk-free rate is 4% per year and the market risk premium is 5% per year. The beta

of XYZ Corp common shares is 1.2. Through some independent analysis you think the

return on XYZ over the next year will be 12%. The shares of XYZ are expected to pay

10

CFIN300: Final Exam: Spring 2006 Version #4

a dividend of $5.00 per share next year. You expected the dividends to grow at a

constant rate of 2% for the foreseeable future. Would you consider common shares of

XYZ to be overvalued or under valued relative to the CAPM?

a) Undervalue since you expect a higher return than predicted by the CAPM

b) Undervalued since you expect a lower return than predicted by the CAPM

c) Properly valued since your expectation are in line with the CAPM

d) Overvalued since you expect a higher return than predicted by the CAPM

e) Overvalued since you expect a higher return than predicted by the CAPM

35. DEF Inc will pay a dividend of $1.00 per share tomorrow. This dividend will increase

by 100% the next year, thereafter the dividend will increase by 5% per year in

perpetuity. If investors require a 10% rate of return what is the price of the stock today?

a) $10.50

b) $41.00

c) $40.00

d) $21.00

e) none of the above

Use the information in the table below to answer the next two questions:

Probability Equity Fund Bond Fund

30% -15% 12%

50% 10% 5%

20% 35% -10%

36. What is the expected return on the equity fund?

a) 10.0%

b) 7.5%

c) 5.9%

d) 7.0%

e) 14%

37. What is the standard deviation of returns for the equity fund?

a) 17.50%

b) 35.24%

c) 422.92%

d) 1268.75%

e) 0%

38. Stock A has an expected return of 10% and a standard deviation of 20%. Stock B has

an expected return of 15% and a standard deviation of 25. The correlation between the

11

CFIN300: Final Exam: Spring 2006 Version #4

two stocks is 0.8. If you invested 25% of your wealth in Stock A and 75% in Stock B

what would be the standard deviation of this portfolio?

a) 23.75%

b) 526.56%

c) 22.50%

d) 22.95%

e) 10.00%

39. A firm has total assets of $2.5 million and spontaneously increasing liabilities of $1

million. The firms total sales for the year just ended were $4 million and the firms

manager expects sales to grow 20% next year. The firm has a net profit margin of 8%

and consistently pays out 40% of its net income as dividends. Using the percentage of

sales method, how much external financing will the firm require in the upcoming year?

a) $69,600

b) $108,000

c) $146,400

d) $200,000

e) $800,000

40. Agency costs refer to:

a) The costs incurred by management in their role as agents of shareholders

b) The costs incurred by the firm when they employ agents (lawyers, accountants,

etc.) to act on behalf of the firm

c) The costs borne by shareholders, created due to the relationship between

management and shareholders

d) The costs incurred by the firm to set up the corporation as an agency.

e) None of the Above

41. What is the present value of $1,000,000 to be received in 3 months if the required

return is 6% per year simple interest?

a) $839,619.28

b) $985,221.67

c) $985,538.36

d) $1,000,000

e) $1,060,000

42. Jamie wants to sell you an investment that will pay $42 every year forever, starting in 4

years. If you require a return of 9% per year compounded annually, what is the most

that you will be willing to pay for this investment?

a) $330.60

b) $360.35

12

CFIN300: Final Exam: Spring 2006 Version #4

c) $428.13

d) $466.67

e) $502.22

43. Ralph A. Horse is making monthly mortgage payments of $1,500. He initially

amortized the mortgage over 25 years. If the interest rate is 8% compounded semi-

annually, what is the outstanding balance after 5 years?

a) $181,081.24

b) $197,826.35

c) $450,000.00

d) $1,396,729.18

e) $1,405,889.20

Use the information in the table below, about the shares of BMO, to answer the next

question:

Asset Expected

Return

Standard

Deviation

Correlations

BMO Risk-Free Rate Market

BMO ?? 15% 1.00 0.00 0.70

Risk-Free Rate 5% 0.0% 1.00 0.00

Market 15% 25% 1.00

44. What is the expected return on BMO stock according to the CAPM?

a) 5.0%

b) 9.2%

c) 12.0%

d) 15.0%

e) 16.7%

45. Which of the following are conditions for using the CCA tax shied formula in capital

budgeting analysis?

I Depreciation must be calculated on a declining basis

II Sunk costs must be included

III Depreciation must be calculated using the straight line method

IV The asset class must remain open

13

CFIN300: Final Exam: Spring 2006 Version #4

a) I and III

b) II and III

c) I and IV

d) I, II and IV

e) None of the Above

46. Which of the following statements is consistent with the concept of market efficiency?

a) If you notice that the price of a stock has risen dramatically in the past hour, you

should definitely buy at that point because somebody else knows something that

you dont about the stock

b) A recent increase in the volume of shares traded on a particular stock is an

important variable to consider when you are deciding whether to buy or sell a stock

c) Management should time their security issuance to coincide with when they believe

their stock is most undervalued

d) None of the Above

e) All of the Above

47. The risk-free rate is 4%. The expected return on the market is 10%. The standard

deviation of the market portfolio is 25%. What is the standard deviation of a portfolio

composed of 30% of the risk-free asset and 70% of the market portfolio?

a) 7%

b) 8.2%

c) 12.5%

d) 17.5%

e) 25.0%

48. Norcam Inc. has just purchased a new Widget machine. The machine cost $6,000,000

and is expected to be used for 10 years. A CCA rate of 30% applies to the new

machine. What is the total dollar amount of CCA for tax purposes that Norcam Inc.

can claim in the first two years of the new machines life? Assume that the half-year

rule applies.

a) $2,430,000

b) $3,400,000

c) $4,200,000

d) $5,000,000

14

CFIN300: Final Exam: Spring 2006 Version #4

e) $6,000,000

49. A company just purchased a new machine. The machine cost $200,000. The CCA rate

is 30%. The tax rate is 40%. The discount rate is 10%. Assuming the machine will

operate for 5 years and will have no salvage value at the end of the 5 years, what is the

present value of the CCA tax shield? Assume the half-year rule applies.

a) $60,000.00

b) $57,272.73

c) $20,000.00

d) $19,090.91

e) $0

50. A company is trying to decide whether it should purchase a new machine. The machine

costs $150,000. The new machine will generate revenues of $100,000 per year. The

variable costs associated with the new machine are $40,000 per year. The machine has

an expected life of 4 years. The tax rate is 0%. The expected salvage value in 4 years is

$50,000. The machine will be depreciated from $150,000 to $50,000, on a straight line

basis over the next 4 years. The discount rate is 15%. What is the NPV associated with

the investment?

a) $47,402.93

b) $19,367.81

c) $49,886.36

d) $182,086.83

e) $150,000.00

Have a great summer!

15

CFIN300: Final Exam: Spring 2006 Version #4

FV = PV (1+NR)

1

]

1

+

R

R

C FV

N

1 ) 1 (

FV = PV (1+R)

N

1

1

1

1

]

1

R

R

C PV

N

) 1 (

1

1

N

R

FV

PV

) 1 ( +

) 1 (

) 1 (

1

1

R

R

R

C PV

N

D

+

1

1

1

1

]

1

R

A

PV

1

Re

) 1 ( R FV FV

gAnn D

+

1 1

1

]

1

+

f

m

m

i

r

) 1 (

1 ) 1 (

R

R

R

C FV

N

D

+

1

]

1

+

1 1

1

]

1

+

m

m

i

EAR

1

1

]

1

,

_

+

+

T

r

g

g r

C

PV

1

1

1

1

q

e EAR

r

D

P

0

g r

D

P

1

0

NPVGO

r

EPS

P +

0

Price Bond

Interest Annual

Yield Current

n

n

r

Face

r

r

C B

) 1 (

) 1 (

1

1

+

+

1

1

1

1

]

1

16

CFIN300: Final Exam: Spring 2006 Version #4

) rate inflation 1 ( ) 1 ( 1 + + + r R

Total Dollar Return (TDR) = Dividend Income +

Capital Gain (Loss)

( )

B

t

B

B E t

P

PC CF

P

P P CF

TDR

+

j

j j

P O R E ) (

) ( ... ) ( ) ( ) (

2 2 1 1 n n P

R E x R E x R E x R E + + +

LU U L U U L L P

x x x x 2

2 2 2 2

+ + Variance of returns [ ]

j

j j

P R E O

2 2

) (

j i j i ij

CORR

,

U L U L U L U U L L P

CORR x x x x

,

2 2 2 2

2 + +

) (

) , (

2

M

M A

A

R

R R COV

[ ]

1

) ( ... ) (

2 2

1 2

+ +

T

R R R R

T

i f M f i

r R E r R E ] ) ( [ ) ( +

outflows cash of lue Present va

inflows cash of lue Present va

Index ity Profitabil

Arbitrage Pricing Theory

[ ]

[ ]

[ ]

f n n

f

f f

R R E

R R E

R R E R R E

+

+

+ +

) ( ...

) (

) ( ) (

2 2

1 1

PV of CCA tax shield

,

_

+

1

]

1

1

]

1

+

+

+

n

n

k k d

dT S

k

k

k d

CdT

) 1 (

1

) ( 1

5 . 0 1

) (

Current Ratio = Current Assets Total Asset = Sales

Current Liabilities Turnover Total Assets

Quick Ratio = Current Assets Inventory ROA = Net Income

Current Liabilities Total Assets

Inventory Turnover = COGS ROE = Net Income

Inventory Total Equity

Cash Ratio = Cash P/E Ratio = Price/common share

Current Liabilities EPS

Receivables = Sales Dividend Payout = DPS

Turnover Accounts Receivable Ratio EPS

D/E Ratio = Total Debt Dividend Payout = Cash Dividends

Total Equity Ratio Net Income

Total Debt Ratio = Total Debt Market to Book Price / Common share

Total Assets Ratio = Book value of equity

Equity multiplier = Total Assets Profit = Net Income

Total Equity Margin Sales

17

CFIN300: Final Exam: Spring 2006 Version #4

Net Working = Net Working Capital Interval Measure = Current Assets

Capital-Total Asset Total Assets Average Daily

Operating Costs

Long Term Debt = Long Term Debt Cash Coverage = EBIT + Depreciation

Ratio Total Equity + LT Debt Ratio Interest

Days Sales in = 365 Days Days Sales in = 365 Days

Receivables Receivables Turnover Inventory Inventory Turnover

Internal Growth = ROA x R Sustainable = ROE x R

Rate 1 ROA x R Growth Rate 1 ROE x R

Sustainable = p(S/A)(1+D/E) x R

Growth Rate 1 p(S/A)(1+D/E) x R

NWC = Sales Fixed Asset = Sales

Turnover NWC Turnover Net Fixed Assets

Times Interest = EBIT CF from Assets =

Operating CF Cap Ex Additions to NWC

Operating CF = EBIT + Deprec Tax

=Sales Costs Taxes

= (Sales Costs) x (1 Tc) + Deprec x Tc

Cap Ex = End Gross FA Beg Gross FA

Cap Ex = End Net FA Beg Net FA + Deprec

Add to NWC = End NWC Beg NWC

CF to Debtholders = Interest Net New Debt

CF to Shareholders = Divs Net New Equity

CF from Assets = CF to Debtholders + CF to

Shareholders

Earned Interest Charges

18

You might also like

- Freedom of Redemption ProcessDocument161 pagesFreedom of Redemption ProcessRedfieldHasArrived100% (8)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Exam II Version BDocument12 pagesExam II Version B조서현No ratings yet

- Policy On Loan Classification and ProvisioningDocument9 pagesPolicy On Loan Classification and Provisioningmsa_1302100% (3)

- PRACTICE FINAL EXAM KEYDocument8 pagesPRACTICE FINAL EXAM KEYrahulgattooNo ratings yet

- BUSI 2504 Practice Final ExamDocument8 pagesBUSI 2504 Practice Final ExamKnochenkuhNo ratings yet

- DocDocument6 pagesDoctai nguyenNo ratings yet

- CMA 2013 SampleEntranceExam Revised May 15 2013Document77 pagesCMA 2013 SampleEntranceExam Revised May 15 2013Yeoh MaeNo ratings yet

- TVM Practice Questions Fall 2018Document4 pagesTVM Practice Questions Fall 2018ZarakKhanNo ratings yet

- CMS Questions Answered: Credit, Transactions, and Account InformationDocument45 pagesCMS Questions Answered: Credit, Transactions, and Account InformationSoumava BasuNo ratings yet

- CH3 Derivatives PPDocument61 pagesCH3 Derivatives PPvincenzo21010No ratings yet

- Audit of Cash and Cash EquivalentsDocument10 pagesAudit of Cash and Cash EquivalentsDebs FanogaNo ratings yet

- UPAS L/C: An Innovative Payment Scheme For International TradeDocument2 pagesUPAS L/C: An Innovative Payment Scheme For International TradesomsemNo ratings yet

- BUS 306 Exam 1 - Spring 2011 (B) - Solution by MateevDocument10 pagesBUS 306 Exam 1 - Spring 2011 (B) - Solution by Mateevabhilash5384No ratings yet

- Spring03 Final SolutionDocument14 pagesSpring03 Final SolutionrgrtNo ratings yet

- Ch. 13 Leverage and Capital Structure AnswersDocument23 pagesCh. 13 Leverage and Capital Structure Answersbetl89% (27)

- Midterm F08 With SolutionsDocument11 pagesMidterm F08 With SolutionsSupri awasthiNo ratings yet

- 3530 SU23 Final Exam - Type X - Questions (Post)Document13 pages3530 SU23 Final Exam - Type X - Questions (Post)combatapple25No ratings yet

- The Following Questions Are Worth 3 Points Each. Provide The Single Best ResponseDocument9 pagesThe Following Questions Are Worth 3 Points Each. Provide The Single Best ResponsePaul Anthony AspuriaNo ratings yet

- Manitoba University Finance Exam Multiple Choice QuestionsDocument15 pagesManitoba University Finance Exam Multiple Choice Questionsupload55No ratings yet

- Blank ExamsDocument9 pagesBlank ExamsAndros MafraugarteNo ratings yet

- PART 1 - Post As Word or Excel Attachment - Total 5 PointsDocument7 pagesPART 1 - Post As Word or Excel Attachment - Total 5 PointsmulNo ratings yet

- MULTIPLE CHOICE QUESTIONSDocument6 pagesMULTIPLE CHOICE QUESTIONSDenise ChenNo ratings yet

- Fin 455 Fall 2017 FinalDocument10 pagesFin 455 Fall 2017 FinaldasfNo ratings yet

- CFIN 601 Corporate Finance AssignmentDocument13 pagesCFIN 601 Corporate Finance AssignmentNasir ShaikhNo ratings yet

- MBA507Document10 pagesMBA507pheeyonaNo ratings yet

- Practice questions for corporate finance examDocument8 pagesPractice questions for corporate finance examSadi0% (1)

- FIN1FOF Practice Exam QuestionsDocument7 pagesFIN1FOF Practice Exam QuestionsNăm Trần TrọngNo ratings yet

- FFL SMU Finance For Law .Sample Exam With SolutionDocument7 pagesFFL SMU Finance For Law .Sample Exam With SolutionAaron Goh100% (1)

- Winter 2010 Midterm With SolutionsDocument11 pagesWinter 2010 Midterm With Solutionsupload55No ratings yet

- CF Mid Term - Revision Set 3Document10 pagesCF Mid Term - Revision Set 3linhngo.31221020350No ratings yet

- BBA Finance Exam Ch 4-6 PV, YTM, BondsDocument6 pagesBBA Finance Exam Ch 4-6 PV, YTM, BondsAdrtyNo ratings yet

- Managerial Finance (BUS 718A)Document5 pagesManagerial Finance (BUS 718A)Kwaku Frimpong GyauNo ratings yet

- 2489Document23 pages2489Mai PhạmNo ratings yet

- Fall 203Document6 pagesFall 203mehdiNo ratings yet

- Exam 3 Review and Sample ProblemsDocument14 pagesExam 3 Review and Sample ProblemsCindy MaNo ratings yet

- Managerial Finance (NCC 5060) Sample Exemption ExamDocument9 pagesManagerial Finance (NCC 5060) Sample Exemption ExamStevent WongsoNo ratings yet

- The Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 ExaminationDocument8 pagesThe Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 Examination李敏浩No ratings yet

- 1.1 Bayne Chap 1Document7 pages1.1 Bayne Chap 1Jennifer PradoNo ratings yet

- Multiple Choice Questions on Finance TopicsDocument12 pagesMultiple Choice Questions on Finance TopicsHamid UllahNo ratings yet

- Calculating Bond Values and Stock PricesDocument8 pagesCalculating Bond Values and Stock Pricesjangrapa100% (1)

- Finance 300 Exam ReviewDocument9 pagesFinance 300 Exam ReviewAnaliza ArrofoNo ratings yet

- Important Student Exam InstructionsDocument13 pagesImportant Student Exam InstructionsCarl-Henry FrancoisNo ratings yet

- Managerial Final ExampleDocument8 pagesManagerial Final ExamplemgiraldovNo ratings yet

- 33 Comm 308 Final Exam (Summer 1 2018)Document16 pages33 Comm 308 Final Exam (Summer 1 2018)Carl-Henry FrancoisNo ratings yet

- CF Self Assess QuestionsDocument6 pagesCF Self Assess QuestionsLeo Danes100% (1)

- Mid-Term Examination: University of Economics and Law - Vietnam National University - HCMCDocument7 pagesMid-Term Examination: University of Economics and Law - Vietnam National University - HCMCNgân Võ Trần TuyếtNo ratings yet

- Common Stocks Valuation Practice Questions Chapters 10-15Document18 pagesCommon Stocks Valuation Practice Questions Chapters 10-15prashantgargindia_93No ratings yet

- FINA 200 Sample Final ExamDocument19 pagesFINA 200 Sample Final ExamHC1990No ratings yet

- Final ExamDocument7 pagesFinal ExamOnat PNo ratings yet

- FIN350 in Class Work No. 1 First Name - Last NameDocument8 pagesFIN350 in Class Work No. 1 First Name - Last Nameh1ph9pNo ratings yet

- FM II Quiz - 1Document13 pagesFM II Quiz - 1Abhishek BaralNo ratings yet

- Prior Exam 3Document9 pagesPrior Exam 3Brian WangNo ratings yet

- 12 Comm 308 Final Exam (Winter 2012) SolutionsDocument18 pages12 Comm 308 Final Exam (Winter 2012) SolutionsAfafe ElNo ratings yet

- TRUE/FALSE AND MULTIPLE CHOICE FINANCE QUESTIONSDocument6 pagesTRUE/FALSE AND MULTIPLE CHOICE FINANCE QUESTIONSf100% (1)

- I Pledge That I Will Work On The Examination Without Collaborating With Any Other Individuals. SignatureDocument7 pagesI Pledge That I Will Work On The Examination Without Collaborating With Any Other Individuals. SignaturesameraNo ratings yet

- Second Examination - Finance 3320 - Spring 2011 (Moore)Document9 pagesSecond Examination - Finance 3320 - Spring 2011 (Moore)Randall McVayNo ratings yet

- Economics Homework HelpDocument25 pagesEconomics Homework HelpLucas MillerNo ratings yet

- Stock ValuationDocument6 pagesStock ValuationrinaawahyuniNo ratings yet

- Solution Key To Problem Set 3Document8 pagesSolution Key To Problem Set 3Ayush RaiNo ratings yet

- Af208 2015 MSTDocument15 pagesAf208 2015 MSTPaul Sau HutaNo ratings yet

- Sheet 1 Time Value of MoneyDocument5 pagesSheet 1 Time Value of MoneyAhmed RagabNo ratings yet

- CF Revision Set 1Document10 pagesCF Revision Set 1Thảo My PhanNo ratings yet

- CH 21 Accounting For LeasesDocument87 pagesCH 21 Accounting For LeasesSamiHadadNo ratings yet

- Case 15-1 (Private Fitness, LCC)Document12 pagesCase 15-1 (Private Fitness, LCC)janella manaliliNo ratings yet

- Lending Risk MitigationDocument33 pagesLending Risk MitigationdhwaniNo ratings yet

- 3 - FINREP - EBA ITS - v2.8Document34 pages3 - FINREP - EBA ITS - v2.8Miguel Angel OrtizNo ratings yet

- Future Nest KollurDocument29 pagesFuture Nest KollurBrajesh Kumar AnupamNo ratings yet

- Financial Analysis of Britannia and DaburDocument8 pagesFinancial Analysis of Britannia and DaburBiplab MondalNo ratings yet

- Centeral BankDocument34 pagesCenteral Banksamfisher0528No ratings yet

- End of StatementDocument1 pageEnd of Statementbrazil server0No ratings yet

- The Era of Management Report on Biti's CompanyDocument20 pagesThe Era of Management Report on Biti's CompanyViet HungNo ratings yet

- OVERVIEW OF THE CURRENT ECONOMIES - PicardalDocument44 pagesOVERVIEW OF THE CURRENT ECONOMIES - PicardalShanna Marie De LeonNo ratings yet

- Recording and Accounting For Leases Through Oracle EBS R12: Case StudyDocument13 pagesRecording and Accounting For Leases Through Oracle EBS R12: Case StudyThiru vengadamsudNo ratings yet

- Cash Flow AssumptionDocument3 pagesCash Flow AssumptionEsperas KevinNo ratings yet

- Due Amount: We're ListeningDocument2 pagesDue Amount: We're ListeningmustafazahmedNo ratings yet

- LN-Session 2-Chapter 3-How Securities Are TradedDocument72 pagesLN-Session 2-Chapter 3-How Securities Are Tradedchaudhari vishalNo ratings yet

- Argonauts of The Western Pacific-BDocument56 pagesArgonauts of The Western Pacific-BNidhi Arora KumarNo ratings yet

- Book ListDocument10 pagesBook Listdj1284No ratings yet

- PayslipDocument1 pagePayslipvando19081943No ratings yet

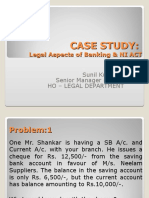

- Case Study Legal Aspects & NI ActDocument23 pagesCase Study Legal Aspects & NI Actvarun_bathula100% (1)

- CGTMSE - Scheme Document CGS I - Updated As On March 31, 2022 PDFDocument26 pagesCGTMSE - Scheme Document CGS I - Updated As On March 31, 2022 PDFkarthik kvNo ratings yet

- International Finance - MG760-144 Week 4 - Chapter 5 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolDocument5 pagesInternational Finance - MG760-144 Week 4 - Chapter 5 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolKiran100% (1)

- Technical Perspective STP : StradivariDocument10 pagesTechnical Perspective STP : StradivariUwe TruppelNo ratings yet

- Teaching PowerPoint Slides - Chapter 16Document36 pagesTeaching PowerPoint Slides - Chapter 16Seo ChangBinNo ratings yet

- RHM Accounting SOP AdminstrationDocument52 pagesRHM Accounting SOP AdminstrationGianna AngelaNo ratings yet