Professional Documents

Culture Documents

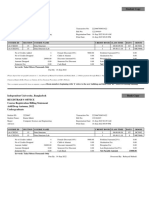

Audit Programme - Sample

Uploaded by

kohmatheOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Programme - Sample

Uploaded by

kohmatheCopyright:

Available Formats

Clients Name:

Client

Prepared by: Reviewed by:

Year/Period End: YPEDate

AUDIT PROGRAMME SALES OBJECTIVES:

To ensure that sales transactions are properly classified, completely and accurately recorded and valid. 1. Completeness (C) All valid transactions are recorded completely. 2. Accuracy (A) Transactions included are accurate as to the amount and other data, and recorded in the proper accounts. 3. Validity (V) Transactions recorded have occurred and pertain to the entity. 4. Existence (E) Verify that the transactions had occurred.

AUDIT PROCEDURES:

No. 1 1.1 Audit Procedures Analytical Procedures Obtain the details of preliminary analytical review report: - Compare this years revenue with last years revenue for their reasonableness. - Compare the increase or decrease of gross profit to see whether its increment or decrement has reasonably affected the net profit margin between the changes of the same year and changes between the current and previous years. - Compare the revenue and cost of sales of the same year to check if the changes are unusual, material and related. - Compare the revenue and cost of sales between the current and previous years to check if the changes are relevant, related, unusual and material. - Compare the amount of expenses that affects the revenue of the same year and between the current and previous years. - Obtain explanation on the material and unusual variances which affect the revenue. Tracing Trace sales order to the sales order listing - Obtain a sales order listing and sales order and agree the amount of sales are fairly stated by ensure the amount in the sales order such -1Obj Initial Date w/p

2 2.1

Auditor

Clients Name:

Client

Prepared by: Reviewed by: Obj Initial Date w/p

Year/Period End: YPEDate No. Audit Procedures as the dates, amount purchased tallied with the sale sorder listing Recalculate the amount of the quantity purchased and the unit cost to ensure the amount is correct Evaluate the amount whether they are agreed and enquire the management for any discrepancies.

2.2

Trace the details of the sales invoice to the sales journal - Make sure the amount of the quantity purchased, amount recorded are all tallied - Ensure all the sales are recorded to the right period Trace the receivables aging report to account receivables ledger - Determine whether the aging results have been reviewed and approved by an independent officer. Look for the initial of the officer and the date the officer signed. - Obtain an explanation for each discrepancies between the account receivable records and account in the general ledgers - Verify whether the customer exist or not for the amounts owed. Trace remittance advice or the receipts such as deposit slips and bank statement to the account balances and receivables listing - Ensure that the amount remitted are same with the amounts in the receivables listing - Review the amount remitted, date of remittance and the customer account name whether they are agreed Trace from the delivery notes to the sales invoice - Trace the details of purchased, quantities and date in the delivery notes the information in the sales invoice. - Ensure there is a valid customer initial by reviewing the customer signature to the initial in approved customer listing to ensure all the sales are acknowledged by the customers so the risk and rewards are transferred - Ensure the sales are properly posted and -2-

A C

2.3

2.4

A C

2.5

Auditor

Clients Name:

Client

Prepared by: Reviewed by: Obj Initial Date w/p

Year/Period End: YPEDate No. Audit Procedures enquire the management for the reason it is not classified as sales. 3 3.1 Vouching Vouch from sales order listing to sales order: - Examine sales order for the responsible officers signature and stamp. - Vouch details to the sales order to ensure the details such as date, sales order number, customer name, amount and other relevant details are exist. - Compare sales order listing details and sales order details to check if the details are tally. Vouch from sales journal to sales invoice: - Examine sales invoice for the responsible officers signature and stamp. - Vouch details to sales invoice to ensure the amount and other details such as date, invoice number, customer name are accurate. - Compare the sales journal and sales invoice to ensure whether the details are tally. Vouch from sales order to customers purchase order: - Ensure whether the customers have place the order. - Examine purchase order for the customers signature and stamp. - Examine details of purchase order such as purchase order number, amount and date whether tally with the sales order.

V E

3.2

V A

3.3

E V A

Note: Disclosure requirements are included in FRS / MASB Disclosure Checklists.

FINDINGS:

No. Issues Impacts Recommendations

CONCLUSION:

2006 - 2011 by AXP Solutions Sdn. Bhd. All rights reserved.

Auditor

-3-

You might also like

- 1-Processing Orders and Dispatching GoodsDocument5 pages1-Processing Orders and Dispatching GoodsFaruk H. Irmak100% (1)

- Audit AP TestsDocument3 pagesAudit AP TestsSweet Emme100% (1)

- Chapter 4 - 6 Transaction CyclesDocument8 pagesChapter 4 - 6 Transaction CyclesJessa Mae Banse Limosnero25% (4)

- AUDIT PROCEDURES: 8 STEPSDocument3 pagesAUDIT PROCEDURES: 8 STEPSManish Kumar Sukhija67% (3)

- Chapter FiveDocument14 pagesChapter Fivemubarek oumerNo ratings yet

- Internal Control Questionnaire For SalesDocument1 pageInternal Control Questionnaire For SalesJustine Ann VillegasNo ratings yet

- Audit Program For Liabilities Format in The PhilippinesDocument2 pagesAudit Program For Liabilities Format in The PhilippinesDeloria Delsa100% (1)

- Chapter 1 Auditing and Internal Control PDFDocument21 pagesChapter 1 Auditing and Internal Control PDFDenmarc John AragosNo ratings yet

- Objectives and Phases of Operational AuditsDocument12 pagesObjectives and Phases of Operational AuditsJacqueline Ortega100% (2)

- Audit of InventoryDocument5 pagesAudit of InventoryMa. Hazel Donita DiazNo ratings yet

- CORPORATE PURCHASES AUDITDocument3 pagesCORPORATE PURCHASES AUDITCristina Rosal100% (6)

- Audit Responsibilities and ObjectivesDocument13 pagesAudit Responsibilities and ObjectivesDina Widiyanti67% (3)

- Audit Program Liabilities Against AssetsDocument11 pagesAudit Program Liabilities Against AssetsRoemi Rivera Robedizo100% (3)

- Accounts Dept Audit ChecklistDocument3 pagesAccounts Dept Audit Checklistandruta1978100% (4)

- PPE AuditDocument3 pagesPPE AuditNel HipolitoNo ratings yet

- Planning & Supervising The EngagementDocument13 pagesPlanning & Supervising The EngagementJuris Renier MendozaNo ratings yet

- Substantive Tests of Expenditure Cycle Accounts Substantive TestsDocument3 pagesSubstantive Tests of Expenditure Cycle Accounts Substantive TestsJuvelyn RedutaNo ratings yet

- Audit Report NotesDocument25 pagesAudit Report NotesSafuan Jaafar100% (2)

- Internal Audit ProgramDocument3 pagesInternal Audit ProgramTakogee100% (1)

- Chapter03 - Audit of The Revenue and Collection Cycle - UnlockedDocument13 pagesChapter03 - Audit of The Revenue and Collection Cycle - UnlockedMark Kenneth Chan BalicantaNo ratings yet

- Bank Audit Process and TypesDocument33 pagesBank Audit Process and TypesVivek Tiwari50% (2)

- Audit Program: Property Plant and EquipmentDocument8 pagesAudit Program: Property Plant and EquipmentAqib Sheikh100% (3)

- Revenue Cycle Audit Program Final 140810Document11 pagesRevenue Cycle Audit Program Final 140810Pushkar Deodhar100% (1)

- Audit Revenue Cycle Controls TestsDocument7 pagesAudit Revenue Cycle Controls TestsYoite MiharuNo ratings yet

- ABC Company Audit Program - Receivables Department:: 1) Analytical Procedures-GeneralDocument7 pagesABC Company Audit Program - Receivables Department:: 1) Analytical Procedures-Generalvarghese200779% (14)

- AUDIT PROCEDURES: SUBSTANTIVE TESTING, ANALYTICAL REVIEWS, RELIANCE ON OTHERS (39Document43 pagesAUDIT PROCEDURES: SUBSTANTIVE TESTING, ANALYTICAL REVIEWS, RELIANCE ON OTHERS (39nychan99100% (10)

- 10chap Audit Working PapersDocument10 pages10chap Audit Working PapersZahar Zahur Kaur Bhullar100% (1)

- Philippine International Trading Corporation Audit ProgramDocument2 pagesPhilippine International Trading Corporation Audit ProgramNephtali Gonzaga100% (2)

- Audit Accrued Expenses ProgramDocument10 pagesAudit Accrued Expenses ProgramPutu Adi NugrahaNo ratings yet

- Audit Process and Procedures OverviewDocument14 pagesAudit Process and Procedures OverviewZtrick 1234No ratings yet

- Audit of Sale and Collection Cycle!!!Document14 pagesAudit of Sale and Collection Cycle!!!ashiakas82730% (1)

- Audit Program For EquityDocument10 pagesAudit Program For EquityJovelyn Bacit0% (1)

- PSA 230 (RED) "Audit Documentation": (Effectivity Date: December 15, 2009)Document20 pagesPSA 230 (RED) "Audit Documentation": (Effectivity Date: December 15, 2009)Christine NicoleNo ratings yet

- Internal Control QuestionnaireDocument9 pagesInternal Control QuestionnaireEricaNo ratings yet

- Substantive Testing of Cash AssertionsDocument35 pagesSubstantive Testing of Cash AssertionsPamimoomimap Rufila100% (1)

- The Audit of LiabilitiesDocument3 pagesThe Audit of LiabilitiesIftekhar Ifte100% (3)

- Auditing The Expenditure CycleDocument4 pagesAuditing The Expenditure CycleIndri IswardhaniNo ratings yet

- Chapter 5Document22 pagesChapter 5Jenny Lelis100% (1)

- Long Term Debt ProgramDocument10 pagesLong Term Debt ProgramSyarif Muhammad Hikmatyar100% (1)

- Audit Procedure For LIABILITIESDocument2 pagesAudit Procedure For LIABILITIESDana67% (3)

- 1 Audit Program ExpensesDocument14 pages1 Audit Program Expensesmaleenda100% (3)

- Audit Program For Internal Audit of Construction IndustryDocument3 pagesAudit Program For Internal Audit of Construction IndustryMadhavi YetrintalaNo ratings yet

- Audit DocumentationDocument6 pagesAudit Documentationemc2_mcv100% (4)

- Commission On Audit: Republic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesDocument2 pagesCommission On Audit: Republic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesKathrine Cruz100% (1)

- Chapter 8 Controls in The Construction IndustryDocument6 pagesChapter 8 Controls in The Construction IndustryHazraphine LinsoNo ratings yet

- Audit Program For Account ReceivableDocument2 pagesAudit Program For Account ReceivableJustine Ann VillegasNo ratings yet

- Audit Planning MemoDocument5 pagesAudit Planning MemoAdolph AdolfoNo ratings yet

- Sample Audit ProceduresDocument44 pagesSample Audit ProceduresNetra Sharma100% (1)

- PSA 700, 705, 706, 710, 720 ExercisesDocument11 pagesPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungNo ratings yet

- Completing The Audit and Post Audit ResponsibilitiesDocument8 pagesCompleting The Audit and Post Audit ResponsibilitiesJBNo ratings yet

- 2011 11 16 - SMRC - Sales and Marketing - Audit ReportDocument10 pages2011 11 16 - SMRC - Sales and Marketing - Audit ReportNayan GuptaNo ratings yet

- Payroll audit focuses on salaries, wages and terminationsDocument3 pagesPayroll audit focuses on salaries, wages and terminationsallenchi100% (1)

- Audit of Expenditure Cycle TestsDocument19 pagesAudit of Expenditure Cycle Teststankofdoom 4100% (1)

- Audit ProgramDocument16 pagesAudit Programanon_806011137100% (4)

- 33) Substantive Procedures - 14Document4 pages33) Substantive Procedures - 14kasimranjhaNo ratings yet

- Audit ProceduresDocument6 pagesAudit Procedureszxchua3100% (5)

- Audit Sales Receipts Cycle Documents Records TestsDocument45 pagesAudit Sales Receipts Cycle Documents Records Testswhitehorse123100% (2)

- Audit - Sales and ReceivablesDocument6 pagesAudit - Sales and ReceivablesValentina Tan DuNo ratings yet

- 34) Assertions Specific SubstantiveDocument4 pages34) Assertions Specific SubstantivekasimranjhaNo ratings yet

- Service and Maintenance Manual: Models 600A 600AJDocument342 pagesService and Maintenance Manual: Models 600A 600AJHari Hara SuthanNo ratings yet

- Clark DietrichDocument110 pagesClark Dietrichikirby77No ratings yet

- India: Kerala Sustainable Urban Development Project (KSUDP)Document28 pagesIndia: Kerala Sustainable Urban Development Project (KSUDP)ADBGADNo ratings yet

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- Biology Mapping GuideDocument28 pagesBiology Mapping GuideGazar100% (1)

- Math5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1Document19 pagesMath5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1ronaldNo ratings yet

- Resume Template & Cover Letter Bu YoDocument4 pagesResume Template & Cover Letter Bu YoRifqi MuttaqinNo ratings yet

- The Ultimate Advanced Family PDFDocument39 pagesThe Ultimate Advanced Family PDFWandersonNo ratings yet

- Artist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheDocument2 pagesArtist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheUy YuiNo ratings yet

- Software Requirements Specification: Chaitanya Bharathi Institute of TechnologyDocument20 pagesSoftware Requirements Specification: Chaitanya Bharathi Institute of TechnologyHima Bindhu BusireddyNo ratings yet

- 20 Ua412s en 2.0 V1.16 EagDocument122 pages20 Ua412s en 2.0 V1.16 Eagxie samNo ratings yet

- ASMOPS 2016 - International Invitation PHILIPPINEDocument4 pagesASMOPS 2016 - International Invitation PHILIPPINEMl Phil0% (3)

- Last Clean ExceptionDocument24 pagesLast Clean Exceptionbeom choiNo ratings yet

- ServiceDocument47 pagesServiceMarko KoširNo ratings yet

- August 03 2017 Recalls Mls (Ascpi)Document6 pagesAugust 03 2017 Recalls Mls (Ascpi)Joanna Carel Lopez100% (3)

- RACI Matrix: Phase 1 - Initiaton/Set UpDocument3 pagesRACI Matrix: Phase 1 - Initiaton/Set UpHarshpreet BhatiaNo ratings yet

- HenyaDocument6 pagesHenyaKunnithi Sameunjai100% (1)

- Top Malls in Chennai CityDocument8 pagesTop Malls in Chennai CityNavin ChandarNo ratings yet

- PLC Networking with Profibus and TCP/IP for Industrial ControlDocument12 pagesPLC Networking with Profibus and TCP/IP for Industrial Controltolasa lamessaNo ratings yet

- Us Virgin Island WWWWDocument166 pagesUs Virgin Island WWWWErickvannNo ratings yet

- Difference Between Mark Up and MarginDocument2 pagesDifference Between Mark Up and MarginIan VinoyaNo ratings yet

- John Titor TIME MACHINEDocument21 pagesJohn Titor TIME MACHINEKevin Carey100% (1)

- Catalogoclevite PDFDocument6 pagesCatalogoclevite PDFDomingo YañezNo ratings yet

- Portfolio Artifact Entry Form - Ostp Standard 3Document1 pagePortfolio Artifact Entry Form - Ostp Standard 3api-253007574No ratings yet

- Algorithms For Image Processing and Computer Vision: J.R. ParkerDocument8 pagesAlgorithms For Image Processing and Computer Vision: J.R. ParkerJiaqian NingNo ratings yet

- Borello-Bolted Steel Slip-Critical Connections With Fillers I. PerformanceDocument10 pagesBorello-Bolted Steel Slip-Critical Connections With Fillers I. PerformanceaykutNo ratings yet

- MID TERM Question Paper SETTLEMENT PLANNING - SEC CDocument1 pageMID TERM Question Paper SETTLEMENT PLANNING - SEC CSHASHWAT GUPTANo ratings yet

- всё необходимое для изучения английского языкаDocument9 pagesвсё необходимое для изучения английского языкаNikita Chernyak100% (1)

- Progressive Myoclonic Epilepsies - Practical Neurology 2015. MalekDocument8 pagesProgressive Myoclonic Epilepsies - Practical Neurology 2015. MalekchintanNo ratings yet

- Yellowstone Food WebDocument4 pagesYellowstone Food WebAmsyidi AsmidaNo ratings yet