Professional Documents

Culture Documents

Asia Pacific Market Briefs

Uploaded by

harsh_tiwari_4Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asia Pacific Market Briefs

Uploaded by

harsh_tiwari_4Copyright:

Available Formats

ASIA PACIFIC MARKETBRIEFS

An oVeRVieW of the AsiA PACifiC offiCe mARket

A CushmAn & WAkefield ReseARCh PubliCAtion

mAY 2011

ASIA PACIFIC MARKETBRIEFS

REGIONAL APAC The Asia Pacific region continued to grow amid an uncertain global Vacancy environment. At the same time, due +1.2% to fast growth coupled with improved Rent labour market conditions and rising +3.6% oil prices, inflation has become a main concern for many countries across the region. Nevertheless, improved economic conditions have translated to rising occupancies in many office markets in the region. Higher rents are observed, with notable increases in Beijing, Hong Kong and Singapore. Investment activity, however, has eased compared to the same period last year. Overall, the economic outlook remains positive, albeit expansion will be slower than in 2010. Occupancies and rents this year and next are expected to remain high.

Y-o-Y change 12-mth outlook

It is expected that the area will become more populated after the completion of residential and retail projects in the next few quarters. PERTH After staying in the negative territory for three years, absorption in Perth picked Vacancy up in 2010. Currently, the vacancy rate is +3.9% at 9.5%. Another 1.5 million square feet Rent (msf ) is expected for delivery in 2011 -3.1% and 2012. If the past average absorption of about 0.7 msf per year is continued, vacancy rate may stabilize. The sales environment seems difficult with no sales above AUD$45 million and few transactions in the AUD$8-AUD$30 million range in the past six months.

Y-o-Y change 12-mth outlook

SYDNEY Sydney rebounded this quarter on an 8.2% vacancy factor, a positive Vacancy result after two and a half years of -3.6% increasing vacancy. As the economic Rent outlook is positive, it is expected that -4.0% leasing activity will increase especially for companies looking to hire more staff and expand to larger premises. With few construction projects in the pipeline, vacancy rate is likely to continue to fall.

Y-o-Y change 12-mth outlook

SELECT COUNTRIES AUSTRALIA BRISBANE Vacancy rate is still high at 9.4% and Brisbane struggled with an oversupply Vacancy of inventory accumulated over the -17.3% past two years. Two natural disasters, Rent a flood and a cyclone, also affected the +3.6% overall economy. However, two large sales closed at the end of 2010 provided a much-needed boost to the office market in Brisbane. There are new projects being announced and tenants may be seeking opportunities to upgrade to newer facilities thus creating some pick up in the absorption.

Y-o-Y change 12-mth outlook

CHINA CHENGDU There is strong leasing interest in Chengdus market largely due to new and Vacancy +24.0% furnished completions of Grade A office buildings. Rental rates have increased and Rent vacancies have declined. Despite positive +18.0% absorption this quarter, with more new supply (about 21.85 msf ) coming on stream, it is expected that the vacancy rate will rise and rental rates will decline slightly.

Y-o-Y change 12-mth outlook

CANBERRA Canberra recorded a vacancy rate of 13.4%. There is continuous supply in Vacancy the coming years until till 2013 and the +4.8% vacancy level is expected to remain high. Rent Thus, some tenants may be looking 0.0% into relocation and upgrading to newer premises. Nevertheless, absorption is likely to continue at average levels if there are no changes in Government policies; the main catalyst for absorption performance in Canberra.

Y-o-Y change 12-mth outlook

BEIJING Increased tenant demand caused rents to rise significantly by 10% compared Vacancy to the previous quarter. This uptrend -62.5% is expected to continue, especially with Rent low supply in core markets through +31.9% 2012. There is 15msf of supply in the pipeline. Of that total, 5.5 msf will be delivered in 2011 and 0.4 msf is already pre-leased. Domestic tenants are accounting for a larger share of the absorption and they have been competing with MNCs for space regardless of higher rents. The tight market in CBD area may result in tenants looking for alternatives in downtown submarkets where choices are abundant and rentals more favourable.

Y-o-Y change 12-mth outlook

MELBOURNE Compared to the previous quarter where there were a couple of large Vacancy sales for more than AUD$100 million -6.1% and many in the AUD$25-AUD$100 Rent million range, Melbourne witnessed +17.5% fewer sale transactions this quarter. With a wide variety of sectors contributing to the office market, Melbournes vacancy continued to decline from 6.7% to 6.3% this quarter. Consequently, effective rents remained high and are gradually increasing. Of the new construction in the pipeline, almost half is located in the up and coming Docklands precinct.

Y-o-Y change 12-mth outlook

Note: (1) All vacancy and rent changes are quarter-on-quarter basis

ASIA PACIFIC MARKETBRIEFS

SHANGHAI Tenant activity is buoyant in Shanghai. Although a huge amount Vacancy of new supply was added to the market -28.1% this quarter, vacancy rose only slightly from Rent 6.1% in Q4 2010 to 6.9% this quarter. +19.2% Average net effective rents have also risen. Both domestic and foreign companies have also been actively taking up space, with Tomson group purchasing one floor in Shanghai World Financial Center and another domestic company buying up two floors. Going forward, occupier demand is set to strengthen further, with rental rates poised for more growth.

Y-o-Y change 12-mth outlook

CHENNAI Rentals remain relatively stable driven by local demand and lower supply this Vacancy quarter. The upcoming supply would be -19.6% about 5.73 msf, with more distribution in Rent non CBD locations. The lesser supply in +9.1% the CBD location may exert pressure on rentals. Rental escalation is also expected in non CBD locations due to perpetuating demand.

Y-o-Y change 12-mth outlook

HYDERABAD With better overall economy, there was increased demand for space especially from Vacancy the IT/ITes sector looking at expansion -42.3% and accommodating headcount growth. Rent Although 2.1 msf was added to the market -2.1% this quarter, majority of the space was already pre-committed. With buoyant demand and limited Grade A space, landlords and developers have started to revise their rates and it is anticipated that rentals would be on the uptrend.

Y-o-Y change 12-mth outlook

HONG KONG The office market in Hong Kong remained red-hot; with low vacancy rate and high rentals. This is largely due to strong demand from corporate organic growth and new Rent set-ups. Coupled with limited supply at +18.3% only 0.7msf over the next three years, the rental growth is expected to be around 25-30% this year. Facing a tight market, tenants have started looking at other alternatives such as moving back-office departments to lower-rent locations and increasing the seating density. Positive investor interest is also sustained with total sales transactions risen by 6.5% quarter-on-quarter at over 1,000 deals.

Y-o-Y change 12-mth outlook

Vacancy 0.0%

KOLKATA The Kolkata office market saw in general, appreciation in rental values of all Vacancy submarkets except for Rajarhat which +3.0% remained stable due to high vacancy Rent levels. This quarter saw 0.9 msf of supply +10.2% added. Over 40% was pre-committed and the demand came mainly from the IT/ITes sector. The improved absorption will lead to a slight decline in vacancy rates and rentals are expected to be slightly higher across all submarkets.

Y-o-Y change 12-mth outlook

INDONESIA JAKARTA Leasing activity in the first quarter increased, due to firms expanding and the need to Vacancy upgrade existing premises. On the back of -14.6% an improved economy and positive outlook, Rent this trend is set to continue. Higher take-up +3.3% will help to absorb the new supply of about 4.1 msf due for delivery in 2011. Rental rates are projected to remain stable.

Y-o-Y change 12-mth outlook

MUMBAI With uncertainty on the transition from Software Technology Park of India to Vacancy Special Economic Zone, most developers +25.0% remained cautious and refrained from Rent increasing rentals. Nevertheless, demand 0.0% was broad-based this quarter, with transactions not only from IT/ITes but also Logistics, Healthcare and Automobile sectors. The market will witness a large supply in the next few quarters and rentals are expected to remain stable.

Y-o-Y change 12-mth outlook

INDIA AHMEDABAD Ahmedabad has seen buoyant demand for office space. Rentals are on the rise Vacancy and positive absorption is expected. While +12.5% telecom and banking sectors remained Rent the main drivers, there are gradually more +6.1% enquiries from other sectors such as IT and auto ancillary sector. Vacancy level stands at about 8 -9%.

Y-o-Y change 12-mth outlook

NCR Rentals appreciated across most of the submarkets. This quarter saw new Vacancy completions of 1.05 msf. About 4.7 msf -11.4% is expected in the next two quarters and Rent vacancy rates might be marginally higher. +5.3% In spite of the high level of vacancy and massive under development projects in the pipeline, Gurgaon continues to record rental appreciation as evident for the largest share of demand during the quarter.

Y-o-Y change 12-mth outlook

BANGALORE Persistent demand coupled with conservative supply resulted in rentals on Vacancy the uptrend for Bangalore. Of the 6.5 msf +5.3% additional supply on stream in 2011, 35% Rent is already pre-committed. With positive +12.3% absorption expected for the balance of the year, the vacancy rate is expected to decline.

Y-o-Y change 12-mth outlook

ASIA PACIFIC MARKETBRIEFS

PUNE With availability of new Grade A space, Special Economic Zone spaces and lower Vacancy +1.2% rentals at the suburban and peripheral locations, it has attracted some corporate Rent relocations and expansions. As such, the +7.4% rentals at CBD have decreased by 3%. Pune is expecting about 5.9 msf of supply this year and rentals are likely to be stable and increase steadily over the medium term.

Y-o-Y change 12-mth outlook

SOUTH KOREA SEOUL Overall vacancy rate in Seoul rose to 7.3% from 6.7% last quarter and the rate was more pronounced in CBD where it soared to 11.9% following the completions of Rent several projects. Tenants with 2010-2011 +0.6% expirations took advantage of this situation renewing at same rental rates and combined with generous concession packages such as rent-free periods.

Y-o-Y change 12-mth outlook

Vacancy +67.4%

JAPAN TOKYO Leasing activity remained sluggish and stagnant. Vacancy has also been slowly Vacancy creeping up. With competition to attract +4.5% tenants, there is pressure on rents to Rent decline slightly or remain constant, even -4.6% for buildings in prime locations. Overall, it remains a tenants market. While the earthquake and tsunami in March 2011 has added to its economic woes, it is not expected to overturn the economic situation. There will be a temporary slowdown in the next 1-2 quarters but with reconstruction activity, the overall economy is expected to weather the storm and the outlook remains positive.

Y-o-Y change 12-mth outlook

TAIWAN TAIPEI Leasing activity was active mainly due to the expansion of MNCs and new offices set up by Chinese companies. There are only a few construction deliveries this year and it is Rent expected to see rents rising and a reduction -0.6% in vacancy rate. Investor sentiments, however is marred by the recent hike in interest rate and introduction of Luxury Tax Act, reducing profit margin. Those on the lookout for short-term investments have become less active.

Y-o-Y change 12-mth outlook

Vacancy -9.8%

MALAYSIA KUALA LUMPUR In view of additional supply into the market in the next one to two years, Vacancy rentals are expected to soften. Landlords +25.0% of older buildings are also using this Rent opportunity to do refurbishing and +1.6% alteration works in an attempt to stay competitive while tenants whose leases are due for expiration would be looking for better deals in newer buildings

Y-o-Y change 12-mth outlook

THAILAND BANGKOK The overall office market in Bangkok remained steady with rents unchanged and Vacancy slight increase in vacancy rates. Going forward, +2.3% the economy is expecting growth and coupled Rent with political stability after the elections -1.1% scheduled this year, business sentiments will improve. The outlook is promising and positive absorption is expected.

Y-o-Y change 12-mth outlook

PHILIPPINES MANILA Leasing activity in Manila remained relatively unchanged. So far, rents are Vacancy stable but are expected to pick up, +9.6% especially with better overall economy Rent and no significant construction 0.0% completions this year. Investor sentiments have also improved, albeit more cautious in the light of various macroeconomic events that have happened

Y-o-Y change 12-mth outlook

VIETNAM HANOI Hanois Grade A office space has seen rents decreasing while Grade B rents remained Vacancy stable. Likewise, vacancy rate for Grade A 0.0% has increased while the rate for Grade B Rent has reduced slightly. More projects will be +6.0% completed this year and this will further put a pressure on the overall vacancy rate. Landlords are expected to offer more incentives packages and abatements on rents in a bid to retain existing tenants and attract new ones.

Y-o-Y change 12-mth outlook

SINGAPORE Prime office leasing remained active, albeit at a slower pace compared to 2010. Vacancy Overall, prime rents have increased -45.3% another 5% from year end and thus, Rent it remains a landlords market where +28.3% overall availability of prime office space is limited. Investor interest was upheld as evidenced by deals closed this quarter including Capital Square achieving a record selling price of $2,300 per square foot. The outlook remains positive and rentals are expected to continue to increase.

Y-o-Y change 12-mth outlook

HO CHI MINH CITY There will be significant construction completions in 2011 and 2012, adding Vacancy pressure on the vacancy rate. Vacancy stands +31.3% at 21% for Grade A space and it is likely Rent to remain elevated over the next few years. -18.0% Rentals are observed to be stable with leasing activity relatively active. Positive absorption is anticipated if the overall economy continues to recover and grow.

Y-o-Y change 12-mth outlook

ASIA PACIFIC MARKETBRIEFS

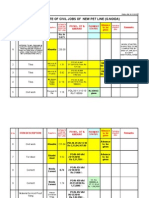

1Q 2011 siGnifiCAnt neW leAse tRAnsACtions Country/City China-Chengdu building sichuan investment building submarket nanyanxian senayan Rajarhat Cbd hinjewadi tenant sichuan development holdings Co. banking Cognizant mckinsey,Rejuskorea, hanhwa e&C Cognizant square feet 355,209 322,917 270,000 261,294 250,000

Table: 1

indonesia - Jakarta sentral senayan iii india- kolkata korea-seoul india-Pune unitech infospace Center 1 dlf Akruti

Source: Cushman & Wakefield Research

1Q 2011 siGnifiCAnt neW sAle tRAnsACtions Country/City Japan-tokyo singapore singapore building otemachi PAl Capital square 16 Collyer Quay submarket Chiyoda (Cbd) Raffles Place Raffles Place Cbd Cbd buyer mitsui fudosan ntuC income ntuC income Commonwealth Reit/ macarthurCook Property eureka funds management/ ARiA square feet 300,565 386,525 279,560 313,865 161,501 Purchase Price (usd$) 876,600,000 705,439,013 524,516,521 206,716,849 86,123,394

Australia-sydney 310-322 Pitt sq Australia-sydney 55 Clarence st

Source: Cushman & Wakefield Research

Table: 2

1Q 2011 siGnifiCAnt ConstRuCtion ComPletions Country/ City China-shanghai india-mumbai China-shanghai india-nCR China-Chengdu building CitiC shipyard-Phase i boomerang-Phase 2 submarket lujiazui Andheri major tenant n/A n/A n/A tCs sichaun development holdings square feet Completion date 2,071,039 1,180,000 848,324 750,000 742,709 1Q11 1Q11 1Q11 1Q11 1Q11

PingAn international finance Center lujiazui Asf insignia sichuan investment building Gurgaon nanyanxian

Source: Cushman & Wakefield Research Table: 3

1Q 2011 siGnifiCAnt PRoJeCts undeR ConstRuCtion Country/ City Japan-tokyo india-nCR China-beijing korea-seoul singapore Plan landmark Cyber Park Guoson Center 101 Pine Avenue Asia square tower 1 building submarket Chiyoda (Cbd) Gurgaon east 2nd Ring Road Cbd marina bay major tenant banking n/A n/A n/A Citi Group square feet 1,517,711 1,500,000 1,442,363 1,399,232 1,300,000 Completion date 2Q12 3Q11 4Q11 4Q11 2Q11

Table: 4

Source: Cushman & Wakefield Research

ASIA PACIFIC MARKETBRIEFS

1Q 2011 RentAl RAtes

loCAl CuRRenCY (psf per month)

in usd (psf per year)

ClAss A GRoss RentAl RAtes

in euRo (psm per year)

ClAss AGRoss RentAl RAtes

CountRY

CitY

ClAss A GRoss RentAl RAte

Q-o-Q ChAnGe in Rent

Y-o-Y ChAnGe in Rent

Australia Australia Australia Australia Australia China China China China india india india india india india india india indonesia Japan korea malaysia Philippines singapore thailand Vietnam Vietnam

brisbane Canberra melbourne sydney Perth beijing Chengdu shanghai hong kong Ahmedabad bangalore Chennai hyderabad kolkata mumbai nCR Pune Jakarta tokyo seoul kuala lumpur manila singapore bangkok ho Chi minh City hanoi

4.73 3.18 4.72 6.21 4.88 303.60 152.30 355.84 66.48 35.00 82.00 60.00 47.00 108.00 300.00 256.00 58.00 187,813.00 20,743.63 25,724.49 6.25 619.91 9.65 594.96 70,000.00 73,220.00

-0.56% nA 0.00% -4.03% 0.00% 10.18% 8.63% 3.40% 8.00% 2.94% 2.50% 0.00% 0.00% 4.85% 0.00% 2.40% -3.33% 1.30% -1.67% -1.36% 0.50% 0.00% 6.00% -0.32% 7.70% 7.00%

3.65% nA 17.48% -4.03% -3.08% 31.86% 17.97% 19.19% 18.30% 6.06% 12.33% 9.09% -2.08% 10.20% 0.00% 5.35% 7.41% 3.30% -4.57% 0.58% 1.60% 0.00% 28.30% -1.11% -18.00% 6.00%

55.16 37.08 55.02 72.34 56.82 51.61 25.89 60.49 102.41 9.46 22.16 16.22 12.70 29.19 81.08 69.19 15.68 24.05 85.53 26.17 24.74 16.04 89.76 21.97 40.20 42.00

445.21 299.03 444.09 583.88 458.65 391.62 196.45 459.00 776.69 71.37 167.21 122.35 95.84 220.22 611.73 522.01 118.27 182.24 640.33 198.58 187.82 120.84 696.27 166.13 304.57 318.21

Source: Cushman & Wakefield Research Table: 5

ASIA PACIFIC MARKETBRIEFS

1Q 2011 VACAnCY RAtes

Singapore Hong Kong Melbourne Beijing Shanghai Seoul Sydney Ahmedabad Tokyo Brisbane Manila Perth Bangkok Hanoi NCR Jakarta Hyderabad Kuala Bangalore Chennai Mumbai Ho Chi Kolkata Pune Chengdu

3.5%

5.7% OVERALL VACANCY 6.2% 6.3% 6.9% 7.7% 8.1% 9.0% 9.2% 9.3% 9.4% 9.4% 10.0% 12.0% 12.4% 14.0% 15.0% 15.0% 15.8% 19.3% 20.0% 21.0% 23.7% 25.3%

29.4%

Source: Cushman & Wakefield Research Figure: 1

PRoJeCts undeR ConstRuCtion in AsiA PACifiC

Vietnam 4.7% Singapore 1.8% Thailand 0.5% Australia 2.7% Philippines 1.6% Malaysia 4.8% Korea 10.1% Japan 4.9% Indonesia 2.1% India 42.0% China 24.8%

total construction = 229.5 million square

Source: Cushman & Wakefield Research Figure: 2

ASIA PACIFIC MARKETBRIEFS

Cushman & Wakefields Asia Pacific Research Group utilizes research data material, statistics and sources to create leading micro and macro economic market reports and publications about the Asia Pacific region. through the delivery of timely, accurate, high-quality research reports on the leading trends, markets around the world and business issues of the day, we aim to assist our clients in making property decisions that meet their objectives and enhance their competitive position. for all research related queries, please contact Sigrid Zialcita Managing Director, Research, Asia Pacific email: sigrid.zialcita@ap.cushwake.com Address: 3 Church street #09-03 samsung hub singapore 049483 65 6535 3232 Joanne Lee Manager, Research, Asia Pacific email: joanne.lee@ap.cushwake.com Address: 3 Church street #09-03 samsung hub singapore 049483 65 6535 3232

AUSTRALIA David Woolford Managing Director email: david.Woolford@ap.cushwake.com Address: level 1, 60 Castlereagh street sydney, Australia nsW 2000 612 9223 4888 CHINA Andy Zhang Managing Director email: Andy.Zhang@ap.cushwake.com Address: 6f, tower 1, China Central Place no. 81 Jianguolu, Chaoyang district beijing, China 100025 86 10 5921 0808 HONG KONG John Siu Executive Director email: John.siu@ap.cushwake.com Address: 6th floor, henley building 5 Queens Road Central hong kong, China 852 2956 3888 INDIA Anurag Mathur Managing Director email: Anurag.mathur@ap.cushwake.com Address: 14th floor, tower C, building 8 dlf Cyber City Gurgaon, india haryana-122002 91 124 4695555 INDONESIA David Cheadle Managing Director email: david.Cheadle@ap.cushwake.com Address: Jakarta stock exchange building tower 2, 15th floor Jl. Jend. sudirman kav. 52-53, Jakarta 12190 62 21 2550 9500

JAPAN Todd Olson Executive Managing Director email: todd.olson@ap.cushwake.com Address: sanno Park tower 13f 2-11-1 nagatacho Chiyoda-ku, tokyo, Japan 100-6113 813 3596-7070 MALAYSIA YY Lau CEO email: yylau@yypropertysolutions.com Address: lot 3A-1, level 4, Wisma W1m 7 Jalan Abang haji openg taman tun dr ismail kuala lumpur, malaysia 60000 603 7728 8116 PHILIPPINES Jose Marie Cuervo CEO email: josemari_cuervo@cuervo.com.ph Address: 5th f s&l building 101 esteban st. cor. dela Rosa st. legaspi Village, makati City 1229, Philippines 632 750 6610 SINGAPORE Toby Dodd Executive Director email: toby.dodd@ap.cushwake.com Address: 3 Church street #09-03 samsung hub, singapore 049483 65 6535 3232 SOUTH KOREA Richard Hwang Managing Director email: Richard.hwang@ap.cushwake.com Address: 5/f korea computer building 21 sogong-dong, Jung-gu seoul, south korea 100-070 822 3188 322

TAIWAN Michael Tseng President email: mktseng@repro.com.tw Address: RePro international inc. 13f-2, no. 89, songRen Road exchange square one taipei, taiwan 886 2 2758 6000 THAILAND Teerawit Limthongsakul Director email: teerawit@nexus.co.th Address: 31st fi., bangkok insurance building / Y.W.C.A. 25 south sathorn Road, thungmahamek, sathorn bangkok 10120, thailand 02 286 8899 VIETNAM Hang Dang Managing Director email: hang.dang@ap.cushwake.com Address: level 3, Pathfinder building 52 dong du, district 1 ho Chi minh City,Vietnam 84 8 2914 707

2011 Cushman & Wakefield All Rights Reserved

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Adidas MKTG Industry Analysis (India)Document12 pagesAdidas MKTG Industry Analysis (India)Anuj100% (13)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- World Trade ReportDocument256 pagesWorld Trade ReportYasir Hussain KhokharNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Small Is BeautifulDocument12 pagesSmall Is Beautifulharsh_tiwari_4No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Civil StatusDocument2 pagesCivil Statusharsh_tiwari_4No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Business LeaderDocument14 pagesBusiness Leaderharsh_tiwari_4No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Job Order CostingDocument39 pagesJob Order CostingCharisse Ahnne Toslolado100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- PFE PfizerDocument12 pagesPFE PfizerArthur HoNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- FinalDocument26 pagesFinalBilal HamidNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- BASE Textiles LimitedDocument76 pagesBASE Textiles LimitedPushpa BaruaNo ratings yet

- Payment of Bonus Act 1965Document11 pagesPayment of Bonus Act 1965KNOWLEDGE CREATORS100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Module 1 - Recording Business TransactionDocument11 pagesModule 1 - Recording Business Transactionem fabi100% (1)

- Adjustment of Contract SumDocument8 pagesAdjustment of Contract SumNor Aniza100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Comparative Analysis Between Tesco and Sainsbury'sDocument53 pagesComparative Analysis Between Tesco and Sainsbury'sJahid Hasan100% (4)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Aligning Corporate and Financial StrategyDocument46 pagesAligning Corporate and Financial StrategyDr-Mohammed FaridNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- PowerscreenDocument4 pagesPowerscreenMJ Cobb50% (2)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Application of Marginal Costing Technique in Fixation of Selling PriceDocument2 pagesApplication of Marginal Costing Technique in Fixation of Selling PriceRajesh GuptaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Final Account of Sole Trading ConcernDocument7 pagesFinal Account of Sole Trading ConcernAMIN BUHARI ABDUL KHADER50% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Internship ReportDocument48 pagesInternship ReportIftekhar Abid FahimNo ratings yet

- Practice QuestionsDocument5 pagesPractice Questionsnks_5No ratings yet

- Summary Multiple Steps Income Statements & ExercisesDocument19 pagesSummary Multiple Steps Income Statements & ExercisesrayNo ratings yet

- Chapter 16 Notes - Complex Financial InstrumentsDocument13 pagesChapter 16 Notes - Complex Financial InstrumentsAli Nath0% (2)

- Liquidity and Financial Performance A Correlational Analysis of Quoted Non Financial Firms in GhanaDocument11 pagesLiquidity and Financial Performance A Correlational Analysis of Quoted Non Financial Firms in GhanaEditor IJTSRDNo ratings yet

- Magadh University BBM 2ND YEAR QUESTIONSDocument13 pagesMagadh University BBM 2ND YEAR QUESTIONSSuryansh SinghNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Project On Analysis of Ulips in IndiaDocument78 pagesA Project On Analysis of Ulips in IndiaNadeem NadduNo ratings yet

- TVM-Time Value of Money ConceptsDocument45 pagesTVM-Time Value of Money ConceptsHisham MohammedNo ratings yet

- Final Ready SampleDocument15 pagesFinal Ready SampleachsamirksNo ratings yet

- Assessment Task 2 - Workbook SP53 2020Document16 pagesAssessment Task 2 - Workbook SP53 2020Minh Y VoNo ratings yet

- Project Report On Divya Bhaskar Ahmedabad (By Yogesh)Document41 pagesProject Report On Divya Bhaskar Ahmedabad (By Yogesh)yogesh079492% (12)

- WWW Uscis Gov-Sites-Default-Files-Files-Form-I-864Document9 pagesWWW Uscis Gov-Sites-Default-Files-Files-Form-I-864api-269468511No ratings yet

- Philex Mining Corp Vs CIRDocument2 pagesPhilex Mining Corp Vs CIRWilliam Christian Dela Cruz100% (2)

- Paystub TjmaxxDocument1 pagePaystub Tjmaxxyishii258000No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Accounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Document12 pagesAccounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Badiuz FaruquiNo ratings yet

- Full Prepayment Trial Calculation (Company)Document1 pageFull Prepayment Trial Calculation (Company)muripande pandeNo ratings yet

- Note On Ground Water Fee in OrissaDocument7 pagesNote On Ground Water Fee in Orissaapu_biswasNo ratings yet

- Trends and Issues in India's Evolving Tax PolicyDocument68 pagesTrends and Issues in India's Evolving Tax Policy9892830073No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)