Professional Documents

Culture Documents

Instruction To Fill Form St3

Uploaded by

Dhanush GokulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Instruction To Fill Form St3

Uploaded by

Dhanush GokulCopyright:

Available Formats

Instructions to fill the Form ST3

A. General Instructions (i) If there is a change in the address or any other information as provided by the assessee in Form ST-1 or as contained in Form ST-2 (Certificate of Registration issued by the department), it may please be brought to the notice of the jurisdictional Superintendent of Central Excise under an acknowledgement. Please indicate NA against entries which are not applicable. Please indicate nil where the information to be furnished is nil.

(ii) (iii)

B. Information to be furnished in the Form

Column Form 1A 2A 2B. 2C

No.

in

Instructions Fill Y for yes, or N for No. Name should be filled as mentioned in the Form ST-2 (Certificate of Registration issued by the department). STC No. is 15 digits PAN based service tax code No. issued to assessee in the Certificate of Registration or in the Annexure III (prescribed vide circular No. 35/3/2001-ST dated 27.08.2001). Premises code is issued to an assessee under S. No. 5 of the Certificate of Registration (Form ST-2). An assessee to whom premises code has not been issued, may furnish location code as issued to him in the Annexure III (prescribed vide circular No. 35/3/2001-ST dated 27.08.2001). This entry is to be filled separately for each taxable service on which service tax is to be paid by assessee. Name of taxable service and their clause in sub-section (105) of section 65 are as given in the Annexure to these instructions. Sub-clauses from (zzzx) to (zzzzd) to come into effect from a date to be notified after enactment of the Finance Bill, 2007. Fill Y for yes, or N for No. Details of notification is to be furnished in the format NN-YYYY (NN=Notification No. and YYYY=Year of issue). In case abatement is availed under notification No. 1/2006-ST, the relevant S. No. of this notification may be furnished. Fill Y for yes, and N for No. In case of provisional assessment, order No. for provisional assessment, if any, may please be furnished. (i) An assessee liable to pay service tax on quarterly basis may furnish details quarter wise i.e. Apr-Jun, Jul-Sep, Oct-Dec, Jan-Mar. (ii) The service receiver liable to pay service tax should indicate the amount paid by him to service provider.

3. 3A1/3B 3C1 3C2 3D 3E1 & E2 3F (I)

3F(I) (a)(i)

Gross amount received (or paid in case of service receiver) against service provided is the total amount received for towards taxable service on provision of service (including any amount received for continuous service), and (A) it includes,(a) amount received towards exported service, (b) amount received towards exempted service (other than export), and (c) amount received as pure agent, (B) it excludes (a) service tax, (b) education cess ; (c) secondary and higher education cess (d) any amount excludible in terms of rule 6 (2) of the Valuation Rules, 2006

3F(I) (a)(ii)

(Please see the example below.) Gross amount received (or paid in case of service receiver) in advance is the total amount received for the particular taxable service before provision of service, and (A) it includes,(a) amount received towards exported service (b) amount received towards exempted service, (other than export), and (c) amount received as pure agent, (B) it excludes (a) service tax, (b) education cess ; (c) secondary and higher education cess (d) any amount excludible in terms of rule 6 (2) of the Valuation Rules, 2006

3F(I) (b)

(Please see the example below.) (i) The value of consideration received (or paid in case of service receiver), other than money, is to be estimated in equivalent money value. (ii) Money may be understood as defined in section 67 of the Act. (Please see the example below).

3F(I) (c)(ii) 3F(I) (c)(iii) 3F (I) (d) 3F (I) (f) 3F (I) (i) 3F(II)

Exempted service refers to the taxable service which is exempt for the time being under a notification, other than by way of abatement (Please see the example below). Pure Agent may be understood as defined in Explanation 1 to rule 5 of the Service Tax (Determination of Value) Rules, 2006. Abatement refers to the portion of value of taxable service which is exempt in terms of a notification (such as notification No. 1/2006) Service tax rate wise break of value may be furnished Secondary and higher education cess would be applicable to service tax from the date of enactment of Finance Bill 2007. (i) An assessee liable to pay service tax on quarterly basis may furnish details quarter wise i.e. Apr-Jun, Jul-Sep, Oct-Dec, Jan-Mar. (ii) The service receiver liable to pay service tax should indicate the amount billed to him by a service provider.

3F(II) (j)

Gross amount for which bills/invoices/challans are issued relating to the particular taxable service, in the specified period, whether received or not, includes,(a) amount charged towards exported service;, (b) amount charged towards exempted service ( other than export of service) and (c) amount charged by a pure agent, and excludes,(B) it excludes (a) service tax, (b) education cess ; (c) secondary and higher education cess (d) any amount excludible in terms of rule 6 (2) of the Valuation Rules, 2006 (Please see the example below.)

3F(II) (k)

(i) The value of consideration charged (or paid in case of service receiver), in a form other than money, is to be estimated in equivalent money value. (ii) Money may be understood as defined in section 67 of the Act. Gross amount charged for the exempted service is the amount charged for a taxable service which is exempt for the time being under a notification other than the abatement (Please see the example below).

3F(II) (l)

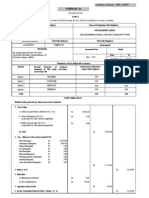

Example: A banking and other financial service (B & FS) providers has following information to furnish in the ST-3 return, for a month namely,-

Head

Amount Billed/invoiced (Rs) (1)

Amount received (It includes amount received for service provided earlier and any amount received as advance) (Rs) (2) 10000 (out of this taxable amount Rs 1000 received for the period July 2004, and Rs 2000 received for the period March 2005, and rest of the amount is for the period July 2006 onwards) 4000 1500 500 900 1200 700 (out of this, Rs 450 pertains to March, 2005)

Gross amount for B & FS ( including export, exempted service and as pure agent)already provided

12000

B C D E F G

Advance for services to be provided later Export of service Pure agent Money equivalent of other consideration received Interest on Financial leasing Bill discounting and overdraft service

3000 2000 250 1000 500

H I J J(i) J (ii)

Service to Government for collection of taxes Service provided in SEZ

200 400

300 600 (out of this, Rs 150 pertains to July, 2004)

B & FS received from a service provider who is outside India and doesnt have establishment in India i.e. this assessee is liable to pay service tax in terms of rule 2(d)(iv) of the ST Rules, 1994 Bill received/Amount paid to such service 1000 (bills 800 ( amount paid to service provider subsequent to receipt of service received in this provider) case) Advance Bills received and advance amount paid 750 500( amount paid to service to such service provider provider)

Notification under which benefit of exemption is available to this assessee are: (i) No. 29/2004-ST w.r.t to bill discounting/overdraft (ii) No. 13/2004-ST w.r.t services provided to Government for collection of taxes (iii) No.4/2004-ST w.r.t services provided in SEZ

Abatement available to assessee : (a) Notif No. 14/2006-ST, abatement equal to 90% of the interest amount on financial leasing service

The entries shall be furnished by this assessee at S. No. 3 in the following manner Separate entries will be made for taxable service provided by the assessee and taxable services received on which assessee is liable to pay service tax in terms of rule 2 (d) (iv) of the ST Rule, 1994, even though, both, the service provided and the service received, on which assessee is liable to pay service tax, are same, i.e., banking and other financial service.

(A) Entries to be furnished for B & FS services provided by the assessee S. No. 3A1(Service provided) 3A2 Information/figures furnished ( as indicated in bold ) Banking & other financial services Tick (i) S. No. 3F (I) (d) 3F (I) (e) Information/figures furnished ( as indicated in bold ) =90% of 1200=1080 =(10000+4000+900)-(1500+1600+500+1080) = 10220 Value (ST payable@ 5%)=Nil Value (ST payable@ 8%)=(1000-150)=850

3B 3C1

zm Y

3F (I) (f)

Value (ST payable@ 10%)=(2000-450)=1550 3C2 (i) 29-2004 (ii) 13-2004 (iii) 4-2004 (iv) 14-2006 NA N 3F (I) (g) =@8% of 850+@10% of 1550+ @ 12% of Value (ST payable@ 12%)=7820 7820=68+155+938=1161 (rounded off)

3D 3E1

=@2% of (155+938)=22 (rounded off) =nil, as this cess will come into effect only after enactment of Finance Bill, 2007 3 E2 NA 3F (II) (j) =(12000+3000)=15000 3F (I) (a)(i) 10000 3F (II)(k) Nil 3F (I) (a)(ii) 4000 3F (II) (l) 2000 3F (I) (b) 900 3F (II) (m) 500+200+400=1100 3F (I) (c)(i) 1500 3F (II) (n) 250 3F (I) (c)(ii) =700+300+600=1600 3F (II) (o) @ 90% of 1000=900 3F (I) (c)(iii) 500 3F (II) (p) =(15000)-(2000+1100+250+900)=10750 In respect of B & FS services received from a service provider who is outside India and doesnt have establishment in India , this assessee is liable to pay service tax in terms of rule 2(d)(iv) of the ST Rules, 1994. On such service separate entries would be made at S. No.3 in the following manner S. No. Information/figures S. No. Information/figures furnished ( as indicated in furnished ( as indicated bold ) in bold ) 3A1(Service received) 3A2 3B 3C1 3C2 3D 3E1 3E2 3F (I) (a)(i) 3F (I) (a)(ii) 3F (I) (b) 3F (I) (c)(i) 3F (I) (c)(ii) 3F (I) (c)(iii) Banking & other financial services Tick (i) ZM N NA NA N NA 800 500 Nil NA Nil Nil 3F (I) (d) 3F (I) (e) Nil 800+500 = 1300 1300 =@12% of 1300= 156 =@2% of 156=3 (rounded off) =nil, as this cess will come into effect only after enactment of Finance Bill, 2007 (1000+750)=1750 Nil Nil NA Nil Nil = 1750

3F (I) (h) 3F (II) (i)

3F (I) (f) 3F (I) (g) 3F (I) (h) 3F (II) (i) 3F (II) (j) 3F (II) (k) 3F (II) (l) 3F (II) (m) 3F (II) (n) 3F (II) (o) 3F (II) (p)

4A (I)(a) (iii)

Rule 6 (3) allows adjustment of such service tax amount which was paid earlier in respect of taxable service not provided wholly or partially by the service provider. Example: A service provider receives an advance of Rs 1000 on which he pays a service tax of Rs 120. However, later on he does not provide this service and refunds the amount to person

4A(I) (a)(iv)

from whom the advance was received. He can in this case adjust the amount of Rs 120 in any of his future liability of service tax. Rule 6 (4A) allows adjustment of such service tax amount paid in preceding months or quarter, which is in excess of the service tax liability for such month or quarter Example: A service provider having centralized registration pays an amount of Rs 1000 as service tax for services provided by him from his five branches. However, on receipt of information from these branches, the service tax liability is computed as Rs 900. In this case he has paid an excess amount of Rs 100 as service tax. He can adjust this excess amount of Rs 100 against service tax liability for succeeding month/quarter..

4A (I) (c) 4A(I) (d) (i) to (vi)

4A(I)(d) (vii) 4A(I)(d) (viii) 4B

Secondary and higher education cess would be applicable to service tax from the date of enactment of Finance Bill 2007. Arrears of revenue includes,(a) amount that was payable earlier but not paid; (b) amount pending recovery on finalization of adjudication or appellate stage, as the case may be; (c) amount pending adjudication or pending in appeals; or (d) amount arising on finalization of provisional assessment etc. Furnish the amount paid in terms of section 73A (Any amount collected in excess of the service tax amount assesses or determined and paid on any taxable service ) Any other amount may be specified. (It may include amount pre-deposit amount as ordered by Commissioner (Appeal) or Appellate Tribunal or Courts). Against source documents, following details may be furnished, For adjustment under rule 6(3), furnish details of earlier return, from where excess amount is derived, in the format YYYY-YY-I/II/Month (YYYY-YY is the financial year and I/II is the half year for which this return pertains, i.e., 2004-05-II /Nov refers to the month Nov in II half yearly return of FY 2004-05). For adjustment under rule 6(4A), furnish details of acknowledgement No. of intimation to Superintendent as required to be furnished in the rules. For arrears, interest and penalty, the source document/period is as follows,(a) in case these are paid suo-moto by the assessee, the period for which such amount is paid may be furnished

4C 5B

if paid consequent to a show cause notice (SCN) or order, the source document is relevant SCN No/Demand Notice No., Order In Original No. or Order in Appeal No or any other order , etc.,. In case service tax liability is not discharged in full, during the period of return, the details of short payment may be indicated against this S. No. (i) The terms inputs, capital goods, input services and input service distributor may be understood as defined in the CENVAT Credit Rules, 2004; (ii) Against S. No. 5B (I) (b) (iii), furnish the details of credit availed on input services received directly by the assessee. In other words, this figure would not include the service tax credit received from input service distributor (i.e., office of manufacturer or output service provider, which receives invoices towards

(b)

purchases of input services and issues invoices//bills /challans for distribution of such credit, in terms of the CENVAT Rules, 2004). Credit received from input service distributor has to be shown separately against S. No. 5B (I) (b) (iv). (iii) Against S. No. 5B (I) (b) (iv), furnish the details of service tax credit as received from input service distributor.

Above instructions for S. No. 5B (I) (b) (iii), S. No. 5B (I) (b) (iv), will mutatis mutandis apply to S. No. 5B (II) (b) (iii), S. No. 5B (II) (b) (iv) for furnishing details of credit taken of education cess and secondary and higher education cess. This information has to be furnished only by an input service distributor.

(iv)

Annexure to Instructions Sub-clause No. (under clause (105) of section 65) Name of taxable service Stock broking Telephone connection Radio Paging General Insurance Advertising agency Courier Consulting Engineer Custom House Agent Steamer Agent Clearing and Forwarding Man Power Recruitment and Supply agency Air Travel Agent Mandap Keeper Sub-clause No. (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) Name of taxable service Internet Caf Management, maintenance or repair Technical testing and analysis Technical inspection and certification Forex exchange broking by a broker other than those covered in zm above Port other than those covered in zn above Airport Services Air Transport of Goods service Business Exhibition Service Goods Transport by Road Construction of commercial complex Intellectual Property Service Opinion Poll Service Subclause No. (zzf) (zzg) (zzh) (zzi) (zzk) (zzl) (zzm) (zzn) (zzo) (zzp) (zzq) (zzr) (zzs)

Tour Operator Rent- a- Cab operator Architect Interior Decorator Management Consultant Chartered Accountant Cost Accountant Company Secretary Real Estate Agent/Consultant Security Agency Credit Rating agency Market Research agency Underwriter Scientific and technical consultancy Photography Convention services Leased circuits Telegraph Telex Facsimile (FAX) On-line information and database access and/ or retrieval Video tape production Sound recording Broadcasting Insurance auxiliary (General Insurance) Banking and other financial

(n) (o) (p) (q) (r) (s) (t) (u) (v) (w) (x) (y) (z) (za) (zb) (zc) (zd) (ze) (zf) (zg) (zh) (zi) (zj) (zk) (zl) (zm)

Outdoor Catering Service Television and Radio Programme Production Survey and Exploration of Minerals Pandal and Shamiana Travel Agent Forward Contract Brokerage Transport through Pipeline Site preparation Dredging Survey and map making Cleaning service Clubs and associations service Packaging service Mailing list compilation and mailing Residential complex construction Registrar service to an issue Share transfer agent Automated teller machine operation , management, maintenance Recovery agents Sale of space for advertisement Sponsorship International air travel Containerized rail transport Business support service Auction service Public relation management

(zzt) (zzu) (zzv) (zzw) (zzx) (zzy) (zzz) (zzza) (zzzb) (zzzc) (zzzd) (zzze) (zzzf) (zzzg) (zzzh) (zzzi) (zzzj) (zzzk) (zzzl) (zzzm) (zzzn) (zzzo) (zzzp) (zzzq) (zzzr) (zzzs)

Port services Authorised automobile repair and maintenance Beauty parlour Cargo handling Cable Operators Dry cleaning Event Management Fashion designer Health Club and Fitness Centres Life Insurance Insurance auxiliary service (life insurance)

(zn) (zo) (zq) (zr) (zs) (zt) (zu) (zv) (zw) (zx) (zy)

Ship management Internet telephony Ship Cruise tour Credit/debit/charged card Telecommunication service Mining of mineral, oil or gas Renting of immovable property Works contract Management of investment under unit linked insurance business (ULIP) scheme Stock exchange services Services provided by a recognized/registered association (commodity exchanges) for transaction in goods or forward contracts. Processing and clearing house services in relation to processing, clearing and settlement of transactions in securities, goods or forward contracts Supply of tangible goods services

(zzzt) (zzzu) (zzzv) (zzzw) (zzzx) (zzzy) (zzzz) (zzzza) (zzzzf) (zzzzg) (zzzzh)

Rail travel agent

(zz)

(zzzzi)

Storage and warehousing Business auxiliary Commercial coaching or training Erection, commissioning or installation Franchise service

(zza) (zzb) (zzc) (zzd) (zze)

(zzzzj)

You might also like

- ST RKBDocument14 pagesST RKBanon-849760No ratings yet

- Service Tax Return 3in Excel Format-1Document8 pagesService Tax Return 3in Excel Format-1priyaradhiNo ratings yet

- ST 3 Revised For 2nd QuarterDocument16 pagesST 3 Revised For 2nd QuarterSam SmartNo ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- (Please See The Instruction Carefully Before Filling The Form) (ORIGINAL / REVISED RETURN (Strike Whichever Is NOT Applicable) ) Financial YearDocument10 pages(Please See The Instruction Carefully Before Filling The Form) (ORIGINAL / REVISED RETURN (Strike Whichever Is NOT Applicable) ) Financial Yearharjeet54No ratings yet

- Stform 3Document17 pagesStform 3Ramesh SawantNo ratings yet

- ServiceTaxobjective QuestionsDocument14 pagesServiceTaxobjective QuestionsJitendra VernekarNo ratings yet

- ST-3 FORMDocument12 pagesST-3 FORMAvijit BanerjeeNo ratings yet

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- TaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsDocument5 pagesTaxMarvel - Modifications in Form GSTR 3B and New Disclosure RequirementsAmit AgrawalNo ratings yet

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaNo ratings yet

- Service Tax Procedures: HapterDocument25 pagesService Tax Procedures: HaptertimirkantaNo ratings yet

- Form ST-3 (Return Under Section 70 of The Finance Act, 1994)Document9 pagesForm ST-3 (Return Under Section 70 of The Finance Act, 1994)Samir SalunkheNo ratings yet

- Office of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002Document11 pagesOffice of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002pmNo ratings yet

- Amendments in Service TaxDocument15 pagesAmendments in Service TaxShankar NarayananNo ratings yet

- Form Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Document1 pageForm Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Krishan ChanderNo ratings yet

- Form 16 TDS SummaryDocument4 pagesForm 16 TDS SummarySushma Kaza DuggarajuNo ratings yet

- VT & PT - Latest Revenue IssuancesDocument19 pagesVT & PT - Latest Revenue Issuancesapplemae.mostalesNo ratings yet

- Examples On Taxable Services A To L (Chapter 59)Document6 pagesExamples On Taxable Services A To L (Chapter 59)kapilchandanNo ratings yet

- Bundled Service ValuationDocument7 pagesBundled Service ValuationSushant SaxenaNo ratings yet

- Payments To Non-ResidentsDocument8 pagesPayments To Non-Residentssmyns.bwNo ratings yet

- Brief Facts of The Case: 2.1Document11 pagesBrief Facts of The Case: 2.1Gaurav SinghNo ratings yet

- Service Tax Notification No.07/2014 Dated 11th July, 2014Document3 pagesService Tax Notification No.07/2014 Dated 11th July, 2014stephin k jNo ratings yet

- YYC July NewsletterDocument11 pagesYYC July NewsletterCatherine ChuaNo ratings yet

- Notificaiton 5Document3 pagesNotificaiton 5Parmeet NainNo ratings yet

- Taxation (Nov. 2007)Document17 pagesTaxation (Nov. 2007)P VenkatesanNo ratings yet

- KPMG - Change in Tax Audit ReportDocument5 pagesKPMG - Change in Tax Audit ReportDhananjay KulkarniNo ratings yet

- Tax Audit Clauses PDFDocument13 pagesTax Audit Clauses PDFSunil KumarNo ratings yet

- Tax RTPDocument40 pagesTax RTPlalaNo ratings yet

- GSTR-9 ArticleDocument8 pagesGSTR-9 Articlecihoni1143No ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- Income Tax (Deduction For Expenses in Relation To Secretarial Fee and Tax Filing Fee) Rules 2014 (P.U. (A) 336-2014)Document1 pageIncome Tax (Deduction For Expenses in Relation To Secretarial Fee and Tax Filing Fee) Rules 2014 (P.U. (A) 336-2014)Teh Chu LeongNo ratings yet

- Supply Under GST, Time & Value of Supply SolutionDocument2 pagesSupply Under GST, Time & Value of Supply SolutionAman RayNo ratings yet

- "Form St-3: (Please See The Instructions Carefully Before Filling The Form)Document8 pages"Form St-3: (Please See The Instructions Carefully Before Filling The Form)lbajaj_3No ratings yet

- GSTR 9 9C FY 22 23 DUE 31st December 2023 1694345252Document7 pagesGSTR 9 9C FY 22 23 DUE 31st December 2023 1694345252RajatNo ratings yet

- Form 16 Salary CertificateDocument5 pagesForm 16 Salary CertificateAshok PuttaparthyNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument3 pagesFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiNo ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document6 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270No ratings yet

- Amendments - 23rd August, 2011Document52 pagesAmendments - 23rd August, 2011Vipul MallickNo ratings yet

- Filing Requirements NotesDocument42 pagesFiling Requirements NotesAllanNo ratings yet

- Taxation concepts and calculationsDocument34 pagesTaxation concepts and calculationsMeet GargNo ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document7 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiNo ratings yet

- Site Info ClearanceDocument9 pagesSite Info ClearanceAnuppur Amlai RangeNo ratings yet

- GST 31.03.17 Itc Rules PDFDocument9 pagesGST 31.03.17 Itc Rules PDFParthibanNo ratings yet

- Arrears Relief Calculator For W.B.govt Employees 2Document4 pagesArrears Relief Calculator For W.B.govt Employees 2Rana BiswasNo ratings yet

- Instructions For Filling Out FORM ITR 3Document231 pagesInstructions For Filling Out FORM ITR 3Samantha JNo ratings yet

- Income Tax 2017 Edazdb1013Document50 pagesIncome Tax 2017 Edazdb1013Pradeep PatilNo ratings yet

- IDT Corrigendum For Nov 22 ExamsDocument8 pagesIDT Corrigendum For Nov 22 Examspreeti sinhaNo ratings yet

- Advisory On GSTR-2B Dated 02.04.2021Document6 pagesAdvisory On GSTR-2B Dated 02.04.2021V RawalNo ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- What Is Tax Deducted at SourceDocument6 pagesWhat Is Tax Deducted at SourcejdonNo ratings yet

- ExnotestDocument4 pagesExnotestaNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- TPT RoadDocument13 pagesTPT RoadLakhan PatidarNo ratings yet

- Explanation:-For The Purposes of This Sub-Rule, The ExpressionsDocument5 pagesExplanation:-For The Purposes of This Sub-Rule, The ExpressionsRakesh BenganiNo ratings yet

- Notification No. 33/2012 - Service TaxDocument5 pagesNotification No. 33/2012 - Service TaxMahaveer DhelariyaNo ratings yet

- Direct Tax Laws Suggested AnswersDocument17 pagesDirect Tax Laws Suggested Answersmknatoo1963No ratings yet

- 2017 Accoutns Paper PracticalDocument4 pages2017 Accoutns Paper PracticalHmingsangliana HauhnarNo ratings yet

- Agenda Item 2 (2) - ITC RulesDocument9 pagesAgenda Item 2 (2) - ITC Rulesfintech ConsultancyNo ratings yet

- Rights Remidies and Procedures Under Il Law PDFDocument68 pagesRights Remidies and Procedures Under Il Law PDFEdward FederNo ratings yet

- INSTRUCTION OF VOWS IndexDocument8 pagesINSTRUCTION OF VOWS Indexmurji20035353No ratings yet

- 3GPP TS 33.401Document176 pages3GPP TS 33.401nvilochanNo ratings yet

- Let-It-Snow.-Ho-Ho-Ho Worksheet // Lesson PlanDocument21 pagesLet-It-Snow.-Ho-Ho-Ho Worksheet // Lesson PlanМария НифонтоваNo ratings yet

- Bill Overview: Jlb9Hznfdskgxfivcivc Ykpfivba5Kywibxmvc4Ewpcaxgaf 7FDocument5 pagesBill Overview: Jlb9Hznfdskgxfivcivc Ykpfivba5Kywibxmvc4Ewpcaxgaf 7FEric LauNo ratings yet

- Spring Easy ReadingDocument1 pageSpring Easy ReadingАміна БондарNo ratings yet

- Joe Guaracino Superseding InformationDocument7 pagesJoe Guaracino Superseding InformationThe Straw BuyerNo ratings yet

- Understanding Atheism Relationship Betwe PDFDocument195 pagesUnderstanding Atheism Relationship Betwe PDFAily SangcapNo ratings yet

- Commerce F2 SampleDocument30 pagesCommerce F2 SampleMalcolm CharidzaNo ratings yet

- Complete List From Karmayog Art and CultureDocument160 pagesComplete List From Karmayog Art and CultureShashank JainNo ratings yet

- Note 13 - Grievance & DisciplineDocument3 pagesNote 13 - Grievance & DisciplineVishesh MehtaNo ratings yet

- MMDA Case StudyDocument7 pagesMMDA Case StudySendirly Liz S MetranNo ratings yet

- Stamp Duty On Transfer or Transmission of Shares Securities Statewise in IndiaDocument5 pagesStamp Duty On Transfer or Transmission of Shares Securities Statewise in IndiaAnchal RaiNo ratings yet

- Reseach Paper On The Topic The Causes Behind The Failure of Pakistan RailwaysDocument34 pagesReseach Paper On The Topic The Causes Behind The Failure of Pakistan Railwaysbureaucrat31567% (3)

- Origins of The American Civil WarDocument61 pagesOrigins of The American Civil WarHHprofiel202No ratings yet

- Freelancing Success: 101 Questions AnsweredDocument52 pagesFreelancing Success: 101 Questions AnsweredsdsdsdNo ratings yet

- Cover Letter To EquifaxDocument4 pagesCover Letter To Equifaxf5dgrnzh100% (2)

- Agirm Agn 4500210653 Itp 001 02 Kas3 Iso Seawater Strainer Forward Sea ChestDocument6 pagesAgirm Agn 4500210653 Itp 001 02 Kas3 Iso Seawater Strainer Forward Sea ChestRJS TUTORIALNo ratings yet

- JSS 3 Sos 1ST Term ExamDocument11 pagesJSS 3 Sos 1ST Term ExamAmaraNo ratings yet

- Cisco CCW Configuration User GuideDocument102 pagesCisco CCW Configuration User GuideRoger RicciNo ratings yet

- John Snow's pioneering epidemiology links Broad Street pump to cholera outbreakDocument4 pagesJohn Snow's pioneering epidemiology links Broad Street pump to cholera outbreakAngellaNo ratings yet

- Amruth SchemeDocument3 pagesAmruth SchemeMycentral InfoNo ratings yet

- Modern Approaches To Comparative Politics, Nature of Comparative PoliticsDocument32 pagesModern Approaches To Comparative Politics, Nature of Comparative PoliticsGamer JiNo ratings yet

- Radio Content AnalysisDocument42 pagesRadio Content Analysispbalbaboco100% (2)

- Combining MCC & IOSDocument11 pagesCombining MCC & IOSMargarethe GatdulaNo ratings yet

- IELTS Writing Topics from 2020-2022Document154 pagesIELTS Writing Topics from 2020-2022TRAN AN KHANHNo ratings yet

- Journal and Ledger Entries for Accounting TransactionsDocument58 pagesJournal and Ledger Entries for Accounting TransactionskrishanptfmsNo ratings yet

- en 1 A Different ManDocument31 pagesen 1 A Different ManVera Lucía Wurst GiustiNo ratings yet

- National Aluminium Co Quotation for ToolsDocument2 pagesNational Aluminium Co Quotation for ToolsVishal KumarNo ratings yet

- Domestic Abuse and Bullying StatisticsDocument8 pagesDomestic Abuse and Bullying Statisticsijohn1972100% (1)