Professional Documents

Culture Documents

Trading Coms POWER

Uploaded by

avinashtiwari201745Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trading Coms POWER

Uploaded by

avinashtiwari201745Copyright:

Available Formats

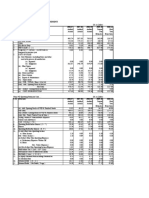

Power companies Comparable companies analysis (INR in millions, except per share data CURRENT SHARE % of 52PRICE Wk High

Company NTPC Reliance Power Tata Power Adani Power REC Mean Median TICKER 0 0 0 0 0 Equity Value EV

LTM Sales 0 0 0 0 0 0 0

0 #DIV/0! 0 0 104.6 75.04% 293416.3 347603.2 104.8 75.04% 248697.7 510464.3 0 #DIV/0! 0 0 0 #DIV/0! 0 0

mar

april

may

2010-2011 june july

aug

sep

oct

nov

jan

feb

mar

april

ENTERPRISE VALUE/ 2008E Sales 2009E Sales LTM EBITDA 2008E EBITDA 2009E EBITDA LTM EBIT 2008E EBIT 2009E EBIT LTM EBITDA Margin

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

dec

jan

feb

may

june

july

aug

sep

oct

nov

dec

PRICE TOTAL LTM Debt/EBIT DA EPS 2008E EPS EPS 2009 LT EPS Growth

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

#DIV/0! #NUM!

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

NTPC

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

NTPC

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

2009 2010 2011 Prior Sub 31/12/2007 -

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

Cuurnt Sub 03/03/08 -

LTM #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE!

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NES : Rpower) Input Page (INR in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketible securities loang term investment

Reliance Power RPOL 31-Mar-11

104.60 75.04% 139.40 68.50 2805.127 293416.28 0.05 73348.33 0.00 19161.45 347603.21 50.70 650.00 18650.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

8.50

162.00

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

Reliance Power RPOL 31-Mar-11

104.60 75.04% 139.40 68.50 2805.127 293416.28 0.05 73348.33 0.00 19161.45 347603.21 50.70 650.00 18650.00

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS

In-the-money shares

Proceeds

Cash Flow Statement

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011

10,236.85 5,828.88 4,407.96 2,427.44 (7,934.67) 9,915.19 2,195.20 7,719.98 115.58 7,604.40

current prior Sub Sub LTM 31/12/2008` 03/03/07 10,236.85 5,828.88 4,407.96 2,427.44 (7,934.67) 9,915.19 2,195.20 7,719.98 115.58 7,604.40 -

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011 19161.45 3471.23 1608.88 24241.56 162595.27 72076.46 258913.28 16417.44 813.13 17230.57 73348.33 90578.90 0.05 168334.33 258913.28 true

2010

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 2805.13 0.00 EBITA #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY

0.00 0.00 0.00

0.30 #DIV/0! #DIV/0!

2805.13 2805.13

0.00 0.00

NFY+1

EPS

10 company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

TATA POWER

104.80 0.77 135.49 80.65 2373.07 248697.74 14142.60 247624.00 0.00 510464.34

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

Sales COGS TATA POWER Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS Adj Sales Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

104.80 0.77 135.49 80.65 2373.07 248697.74 14142.60 247624.00 0.00 510464.34

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011

194508 92858 101649 51650 9736 40264 8684 31580 9756 1223 20601

Current Sub 31/12/2011 18699 9285 9414 856 5721 2837 2000 836 1197 169 (530)

Prior Sub 03/03/10 14362 7220 7142 629 3609 2905 591 2314 763 160 1391

LTM 198844 94924 103921 51877 11848 40195 10093 30102 10190 1232 0 18680 0

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites

2011 22065.9 47878.9 40983.4 110928.20 118093 42280.8 231637.4 502939.40 77276.2 17810.4 95086.60 247624 15050.3 357760.90 14142.6 131035.9 502939.40 -

190823.30 101649.20 97964.90 40263.60 3684.30 1257.40 35321.90 9802.40 45124.30 20601.20 3684.30 1257.40 2836.50 2904.75

Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2836.50

2904.75

2836.50 (529.71)

2904.75 1391.32

2010

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 2373.07 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

0.00 0.00 0.00

0.65 #DIV/0! #DIV/0!

2373.07 2373.07

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE :Misys) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

misys

348.40 0.81 430.00 211.70 366.53 127699.98 0.00 51.00 0.00 56.80 127694.18

1000 option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Tranche 6 Tranche 7

Number of shares 1.40 0.49 1.01 0.76 2.08

Exercise price 2.18 2.41 1.25 1.84 3.03

Tranche 8 Tranche 9 Tranche 10 Total Convertible Securities Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total

5.74

2.40

Amount 100.00

Conversion Price 3.75

100.00

Reported income statement

2009 2010

misys

348.40 0.81 430.00 211.70 366.53 127699.98 0.00 51.00 0.00 56.80 127694.18

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares 2.18 2.41 1.25 1.84 3.03 0.00 0.00

Proceeds 2.18 2.41 1.25 1.84 3.03 0.00 0.00

0.00 0.00 0.00 2.40

0.00 0.00 0.00 2.40

Depriciation and Amortization % sales Capital Expenditure % sales

Conversion Ratio

New Share 26.67

26.67

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011 56.80 134.40 1.00 192.20 14.50 507.00 51.80 765.50 88.80 105.30 33.90 228.00 151.00 56.50 435.50

2010 120.30 285.70 8.20 414.20 30.80 539.90 33.10 1018.00 142.90 166.50 39.60 349.00 119.40 47.90 516.30 149.80

330.00 765.50 true

351.90 1018.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 366.53 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

0.00 0.00 0.00

0.31 #DIV/0! #DIV/0!

366.53 366.53

0.00 0.00

company A (NYSE : MSFT) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketable securities loang term investment

MICROSOFT CORPORATION MSFT

31.08 94.32% 32.95 23.65 8483.00 263651.64 0.00 11927.00 0.00 57403.00 218175.64

5876.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

93.00

23.16

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

MICROSOFT CORPORATION MSFT

31.08 94.32% 32.95 23.65 8483.00 263651.64 0.00 11927.00 0.00 57403.00 218175.64

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

5876.00

In-the-money shares 0.00 0.00 0.00 0.00 0.00 93.00

Proceeds 0.00 0.00 0.00 0.00 0.00 93.00

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 31/03/ 2011 69943.00 (15577.00) 54366.00 (18162.00) (8133.00) 28071.00 28071.00 (4921.00)

Prior Sub 30/09/2010 16195.00 (3139.00) 13056.00 (3744.00) (2082.00) 7230.00 7230.00 (1820.00)

Cuurnt Sub 30/09/2011 17372.00 (3777.00) 13595.00 (4063.00) (2226.00) 7306.00 7306.00 (1568.00)

LTM 71120.00 (16215.00) 54905.00 (18481.00) (8277.00) 28147.00 0.00 28147.00 (4669.00) 0.00 0.00 23478.00 40.00%

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites

23150.00 40.00%

8,490

5410.00 40.00%

5738.00 40.00%

2.73 69943.00 69943.00 28071.00 (910.00) 27161.00 38.83% 2766.00 29927.00 42.79% 23150.00 (910.00) (546.00) 22604.00 16195.00 16195.00 7230.00 (114.00) 7116.00 43.94% 694.00 7810.00 48.22% 5410.00 (114.00) (68.40) 5341.60 17372.00 17372.00 7306.00 (103.00) 7203.00 41.46% 726.00 7929.00 45.64% 5738.00 (103.00) (61.80) 5676.20 71120.00 71120.00 28147.00 0.00 (899.00) 27248.00 36.36% 2798.00 30046.00 40.21% 23478.00 (899.00) (539.40) 22938.60

Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2766.00 0.04

694.00 0.04

726.00 0.04

2798.00 0.04

2011 57403.00 10153.00 7715.00 75271.00 8033.00 13563.00 10548.00 107415.00 3719.00 2388.00 19436.00 25543.00 11927.00 10554.00 48024.00

2010

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 8483.00 0.00 EBITA 3.07 7.26 8.01 11.40 NFY

0.00

0.00

0.00

0.32 0.39 0.21

0.00

0.17 0.40 0.44

59391.00 107415.00 true 0.00 true

8483.00 8483.00

0.00 0.00

NFY+1

EPS

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######

Balance sheet data Cash and cash equivalent Account recivable Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill and intangible assets Other assets Total assets Account paybles Accrued liabilites other current liabilites Total current liabilites Total Debt Other Loang-Term Liabilites Total Liabilites Non controlling Interest Preferred Stock Shareholder's Equity Total Liabilites and Equity Balance check

2011

2010

0.00

0.00

0.00

0.00

0.00 true

Trading Multiples LTM EV/Sales Mertric EV/EBITDA Mertric EV/EBIT Mertric P/E Mertric LTM Return on Investment Ratios Return on Invested Capital Return on Equity Return on Assets Implied Annual Dividend Per share LTM Credit Statistics Debt/ Total Capitalization Total debt /EBITDA Net Debt/ EBITDA EBITDA/ Interest expenses (EBITDA-capex)/Interest Expenses EBIT/Interest Expenses Growth Rates Sales Historical 1-year 2-year CAGR Estimated 1-Year 2-year CAGR Long-Term 0.00 0.00 EBITA EPS #DIV/0! #DIV/0! #DIV/0! #DIV/0! NFY NFY+1

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

0.00 0.00

0.00 0.00

company A (NYSE : AES) Input Page ($ in millions, expecte per share data) General information Company Name Trcker Fiscal Year Ending Moody,s Corporate Rating S&P Corporate Rating Predicted Beta Marginal Tax Rate Selected Market Data Current Price % of 52-Week High Price 52- Week high Price 52- Week Low Price Dividend per share (MRQ) Fully Diluted shares Outstanding Market cap Add: minority interest Add: Total Debt Add: Preferred Stock Less: Cash and Cash Equivalents Enterprise Value Adjestment pension deficit loan term marketiblw securities loang term investment

#DIV/0!

0.00 0.00 0.00 0.00 0.00

option /warrents Tranche Tranche 1 Tranche 2 Tranche 3 Tranche 4 Tranche 5 Total

Number of shares

Exercise price

Convertible Securities Amount Issue 1 Issue 2 Issue 3 Issue 4 Issue 5 Total Conversion Price

Reported income statement

2009 2010

#DIV/0!

Sales COGS Gross Profit SG&A Other Expences/income EBIT Interest expenses Pre tax income Income tax Non controlling interest Preferred dividends Net income Effective tax rate Weighted average diluted share Diluted EPS

0.00 0.00 0.00 0.00 0.00

Reported Gross Profit Non recurring items in COGS Adj Gross Profit Reported EBIT Non-recurring Items in COGS Other Non-recurring Items Adjusted EBIT % margin Depreciation & Amortization Adjusted EBITDA % margin Reported Net Income Non-recurring Items in COGS Other Non-recurring Items Non-operating Non-rec. Items Tax Adjustment Adjested Net Profit Adjested Diluted EPS Cash Flow Statement

In-the-money shares

Proceeds

Conversion Ratio

New Share

Depriciation and Amortization % sales Capital Expenditure % sales

2011 Prior Sub 31/12/2007 -

Cuurnt Sub 03/03/08 -

LTM ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### ####### #######