Professional Documents

Culture Documents

MVAT Payment Receipt

Uploaded by

Nitin KatreOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MVAT Payment Receipt

Uploaded by

Nitin KatreCopyright:

Available Formats

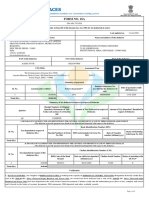

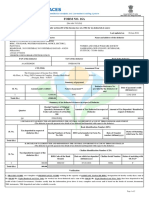

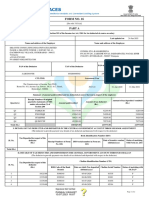

MVAT PAYMENT OTHER THAN WITH RETURN

For the Payer

( See rule 45 ) Chalan in respect of payment made otherwise than with return by a dealer under Maharashtra Value Added Tax.Act 2002 [0040-Sales Tax Receipts under the MVAT Act, 2002 Tax Collection] [For Tax payment through Treasury / Bank ]

1) M.V.A.T. R.C. No, if any 2) C.S.T.R.C.No

FORM 210

Original

3) 4)

Period

From

To

Name and address of the person or dealer on whose behalf money is paid

Payment on account of (a) Sales Tax (b) composition under section 42 (c) Interest under section (d) Penalty under section (e)Composition Money amount for compounding of offence (f) Fine under section 12 (2) or 14(3) (g) Fees payable under rule 73 (h) Amount forfeited Total Rs Amount in Words Crore

Amount ( in figure) Rs

Chalan of tax, penalty and composition money paid to the Treasury/ Sub- Treasury Reserve Bank of India.

Lac

Thousand

Hundred

Tens

Units

Date: ________________________ Signature of Dealer or Depositor Place:._____________________ Designation For Treasury use only.

________________________ ________________________

Received Rs_______________ In words _______________________________________________________ Date of Entry______________ Chalan No____________ Treasury Accountant / Treasury Officer / Agent / Manager.

-1-

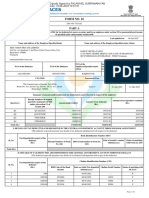

MVAT PAYMENT OTHER THAN WITH RETURN

To be sent to the Sales Tax Officer

( See rule 45 ) Chalan in respect of payment made otherwise than with return by a dealer under Maharashtra Value Added Tax.Act 2002 [0040-Sales Tax Receipts under the MVAT Act, 2002 Tax Collection] [ For Tax payment through Treasury / Bank ]

1) M.V.A.T. R.C. No, if any 2) C.S.T.R.C.No

FORM 210

Duplicate

3) 4)

Period

From

To

Name and address of the person or dealer on whose behalf money is paid

Payment on account of (a) Sales Tax (b) composition under section 42 (c) Interest under section (d) Penalty under section (e)Composition Money amount for compounding of offence (f) Fine under section 12 (2) or 14(3) (g) Fees payable under rule 73 (h) Amount forfeited Total Rs Amount in Words Crore

Amount ( in figure) Rs

Chalan of tax, penalty and composition money paid to the Treasury/ Sub- Treasury Reserve Bank of India.

Lac

Thousand

Hundred

Tens

Units

Date: ________________________ Signature of Dealer or Depositor Place:._____________________ Designation For Treasury use only.

________________________ ________________________

Received Rs_______________ In words _______________________________________________________ Date of Entry______________ Chalan No____________ Treasury Accountant / Treasury Officer / Agent / Manager.

-2-

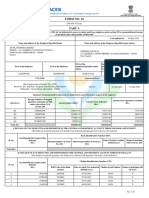

MVAT PAYMENT OTHER THAN WITH RETURN

For the Treasury

( See rule 45 ) Chalan in respect of payment made otherwise than with return by a dealer under Maharashtra Value Added Tax.Act 2002 [0040-Sales Tax Receipts under the MVAT Act, 2002 Tax Collection] [For Tax payment through Treasury / Bank ]

1) M.V.A.T. R.C., if any 2) C.S.T.R.C.No

FORM 210

Triplicate

3) 4)

Period

From

To

Name and address of the person or dealer on whose behalf money is paid

Payment on account of (a) Sales Tax (b) composition under section 42 (c) Interest under section (d) Penalty under section (e)Composition Money amount for compounding of offence (f) Fine under section 12 (2) or 14(3) (g) Fees payable under rule 73 (h) Amount forfeited Total Rs Amount in Words Crore

Amount ( in figure) Rs

Chalan of tax, penalty and composition money paid to the Treasury/ Sub- Treasury Reserve Bank of India.

Lac

Thousand

Hundred

Tens

Units

Date: ________________________ Signature of Dealer or Depositor Place:._____________________ Designation For Treasury use only.

________________________ ________________________

Received Rs_______________ In words _______________________________________________________ Date of Entry______________ Chalan No____________ Treasury Accountant / Treasury Officer / Agent / Manager.

-3-

You might also like

- MVAT Payment Form 210Document3 pagesMVAT Payment Form 210Nilesh AadavNo ratings yet

- FORM 210: For Tax Payment Through Treasury / BankDocument3 pagesFORM 210: For Tax Payment Through Treasury / BankVaibhavJoreNo ratings yet

- VAT ChallanDocument2 pagesVAT Challanrajeshutkur0% (1)

- Challan Vat Form 210Document3 pagesChallan Vat Form 210Rakhi PatilNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- Aaacl4159l Q2 2024-25Document3 pagesAaacl4159l Q2 2024-25vbgrandvizagNo ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- TDS Payment ChallanDocument3 pagesTDS Payment ChallanmejarirajeshNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- ilovepdf_mergedDocument5 pagesilovepdf_mergedsayalibarhate2717No ratings yet

- Gjwpp7325e Q1 2024 25Document3 pagesGjwpp7325e Q1 2024 25Adarsh PandeyNo ratings yet

- 2022-23 TDSDocument6 pages2022-23 TDSMujtabaAliKhanNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToDevasyrucNo ratings yet

- Acfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaDocument3 pagesAcfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaapi-564750164No ratings yet

- Form 405 TDS ReturnDocument5 pagesForm 405 TDS ReturnPravin ShiroleNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Prabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aDocument2 pagesPrabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aankur maheshwariNo ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- TDS CertificateDocument3 pagesTDS Certificatekavita agarwalNo ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- FORM 16 CERTIFICATEDocument8 pagesFORM 16 CERTIFICATENidhish AgrawalNo ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- Form 16A TDS Certificate SummaryDocument2 pagesForm 16A TDS Certificate SummarySOUMYA RANJAN PATRANo ratings yet

- Vaasant G - Resume Seniour LevelDocument3 pagesVaasant G - Resume Seniour LevelanikagiriNo ratings yet

- TDS Certificate SummaryDocument14 pagesTDS Certificate SummaryVaibhav NagoriNo ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- TDS CertificateDocument3 pagesTDS Certificatejfcgfh8fc6No ratings yet

- Form 16 TDS CertificateDocument9 pagesForm 16 TDS CertificateDamodar SurisettyNo ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- ChallanDocument2 pagesChallanrchowdhury_10No ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Cotps9850r Suman Siwa 2023-24Document6 pagesCotps9850r Suman Siwa 2023-24Lakshay DagarNo ratings yet

- VAT Complete Rules 05.02.10Document116 pagesVAT Complete Rules 05.02.10CA Ashish BochiaNo ratings yet

- Nandigam Chandrasekhar Anspc5216h Fy202223 SignedDocument6 pagesNandigam Chandrasekhar Anspc5216h Fy202223 SignedChandrasekhar NandigamNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- FORM16 (Year 2020 - 21)Document11 pagesFORM16 (Year 2020 - 21)Siva RamakrishnaNo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tomukti nath guptaNo ratings yet

- Form 16 ADocument2 pagesForm 16 ANitya NarayananNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Annual.202111684 Form16 - Kaustubh KandharkarDocument8 pagesAnnual.202111684 Form16 - Kaustubh KandharkarKaustubh KandharkarNo ratings yet

- Contingent BillDocument2 pagesContingent Billsantpst20% (5)

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- Section 137 To 146aDocument11 pagesSection 137 To 146aSher DilNo ratings yet

- Kinjal Dixit Rana Dnipr1384g q2 Ay202425 16aDocument3 pagesKinjal Dixit Rana Dnipr1384g q2 Ay202425 16adixitrana303No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPrakash PandeyNo ratings yet

- Form 16A TDS CertificateDocument2 pagesForm 16A TDS CertificatePridex Medical Technologies LLNo ratings yet

- Aaaca4267a Q2 2023-24Document2 pagesAaaca4267a Q2 2023-24amrj27609No ratings yet

- Aaaca4267a Q1 2023-24-1Document2 pagesAaaca4267a Q1 2023-24-1amrj27609No ratings yet

- BalajiGollapalli 3429 F16 2022-23Document10 pagesBalajiGollapalli 3429 F16 2022-23p. r ravichandraNo ratings yet

- TDS Report 27-06-2023Document2 pagesTDS Report 27-06-2023AVDHESH YADAVNo ratings yet

- 0002 Payment Certificate 2010Document3 pages0002 Payment Certificate 2010SreedharanPNNo ratings yet

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToHotel Elegance DelhiNo ratings yet

- Italian Purchase VAT RegisterDocument9 pagesItalian Purchase VAT RegisterArcotsinghNo ratings yet

- Econ 100.1 - Problem Set 5 - AnswerDocument2 pagesEcon 100.1 - Problem Set 5 - AnsweryebbakarlNo ratings yet

- On Monetarism and Libertarianism: The Journal of The Libertarian AllianceDocument5 pagesOn Monetarism and Libertarianism: The Journal of The Libertarian AllianceShahzad AliNo ratings yet

- NufDocument3 pagesNufMinToo KaaLitaNo ratings yet

- French Macroeconomic, Insolvency Update - 011013Document3 pagesFrench Macroeconomic, Insolvency Update - 011013megachameleon1989No ratings yet

- Unicredit CEE Quarterly 4Q2019Document76 pagesUnicredit CEE Quarterly 4Q2019Sorin DinuNo ratings yet

- How To Calculate Custom DutyDocument15 pagesHow To Calculate Custom DutyDr-Koteswara Rao0% (1)

- A Horizontal LMDocument3 pagesA Horizontal LMSalal RindNo ratings yet

- Detailed Syllabus ST Xaviers Kolkata Eco HonsDocument20 pagesDetailed Syllabus ST Xaviers Kolkata Eco HonsSarbartho MukherjeeNo ratings yet

- Cir vs. Toshiba Information Equipment (Phils.), Inc.Document2 pagesCir vs. Toshiba Information Equipment (Phils.), Inc.brendamanganaan100% (2)

- Introduction of The Project: Why Did The Crisis Affect Greece, The Most?Document44 pagesIntroduction of The Project: Why Did The Crisis Affect Greece, The Most?Srishti BodanaNo ratings yet

- Nigeria Withholding Tax GAZETTE 2015Document4 pagesNigeria Withholding Tax GAZETTE 2015ahmad bNo ratings yet

- Fair Trade For All Stiglitz PDFDocument2 pagesFair Trade For All Stiglitz PDFMaryNo ratings yet

- Continue Operations or Shut DownDocument2 pagesContinue Operations or Shut DownDivina Secretario0% (1)

- BCG The Geography of InnovationDocument3 pagesBCG The Geography of Innovation01cunha6186No ratings yet

- Wmata 1-Pager FinalDocument1 pageWmata 1-Pager FinalMarkWarnerNo ratings yet

- 2281 June 2009 P2Document4 pages2281 June 2009 P2fgaushiyaNo ratings yet

- CBP Form 434Document2 pagesCBP Form 434CINTHYANo ratings yet

- Airline Industry Economic Performance ReportDocument6 pagesAirline Industry Economic Performance ReportMae SampangNo ratings yet

- Target of Yolanda Affected Local Government Units (Lgus) Were Based On 25% of Their 2012 CollectionDocument2 pagesTarget of Yolanda Affected Local Government Units (Lgus) Were Based On 25% of Their 2012 CollectionKent Elmann CadalinNo ratings yet

- Thesis Defense PresentationDocument19 pagesThesis Defense PresentationTaufiq Us Samad TonmoyNo ratings yet

- UoB PEAB Sample Exam Paper 2014Document11 pagesUoB PEAB Sample Exam Paper 2014Elliot BeagleyNo ratings yet

- Retirement Nestegg Calculator: You May Need A Nestegg of $3,287,327 To Retire at Age 67Document4 pagesRetirement Nestegg Calculator: You May Need A Nestegg of $3,287,327 To Retire at Age 67fishtaco96No ratings yet

- Money and Banking Mgt-304Document3 pagesMoney and Banking Mgt-304Anonymous 7nY38BNo ratings yet

- Notice: Antidumping: Ball Bearings and Parts Thereof From— ChinaDocument14 pagesNotice: Antidumping: Ball Bearings and Parts Thereof From— ChinaJustia.comNo ratings yet

- Ito Na Talaga Totoo Pramis Teksman Mamatay Man-2Document11 pagesIto Na Talaga Totoo Pramis Teksman Mamatay Man-2ReveRieNo ratings yet

- Css - Profit and Loss AccountDocument7 pagesCss - Profit and Loss AccountramaanejaNo ratings yet

- Lecture Notes - MonetarismDocument5 pagesLecture Notes - MonetarismJomit C PNo ratings yet

- Define Public Policy (5marks)Document1 pageDefine Public Policy (5marks)Syafika Masrom-4FNo ratings yet

- 1 InvoiceDocument1 page1 InvoiceMohit GargNo ratings yet